07 August 2023 Morning Session Analysis

Greenback plunged amid US jobs growth deteriorated.

The dollar index, which was traded against a basket of six major currencies, lost its ground of gains as the latest job data showed sign of loosening in July. Last month, the U.S. economy experienced a lower-than-anticipated increase in jobs. However, there were positive signs in the labor market, including solid wage gains and a decrease in the unemployment rate to 3.5%, indicating that the job market remained tight. According to the Labor Department’s survey of households, nonfarm payrolls experienced a growth of 187,000 jobs, falling short of the 200,000 jobs forecasted by economists in Reuters’ survey. The revisions for job growth in May and June showed a slowdown in labor demand, in response to the significant rate hikes implemented by the Federal Reserve. The jobs number, which was softer than expected, had immediate impacts on the financial markets. It halted the surge in Treasury yields that had been happening throughout the week and put a stop to the recent climb of the dollar. Going forward, the investors will eye on the upcoming inflation data in order to gauge the further direction of the dollar index. A surprise jump in inflation may urge the Fed to implement another round of rate hike in the next meeting. As of writing, the dollar index edged down -0.02% to 102.00.

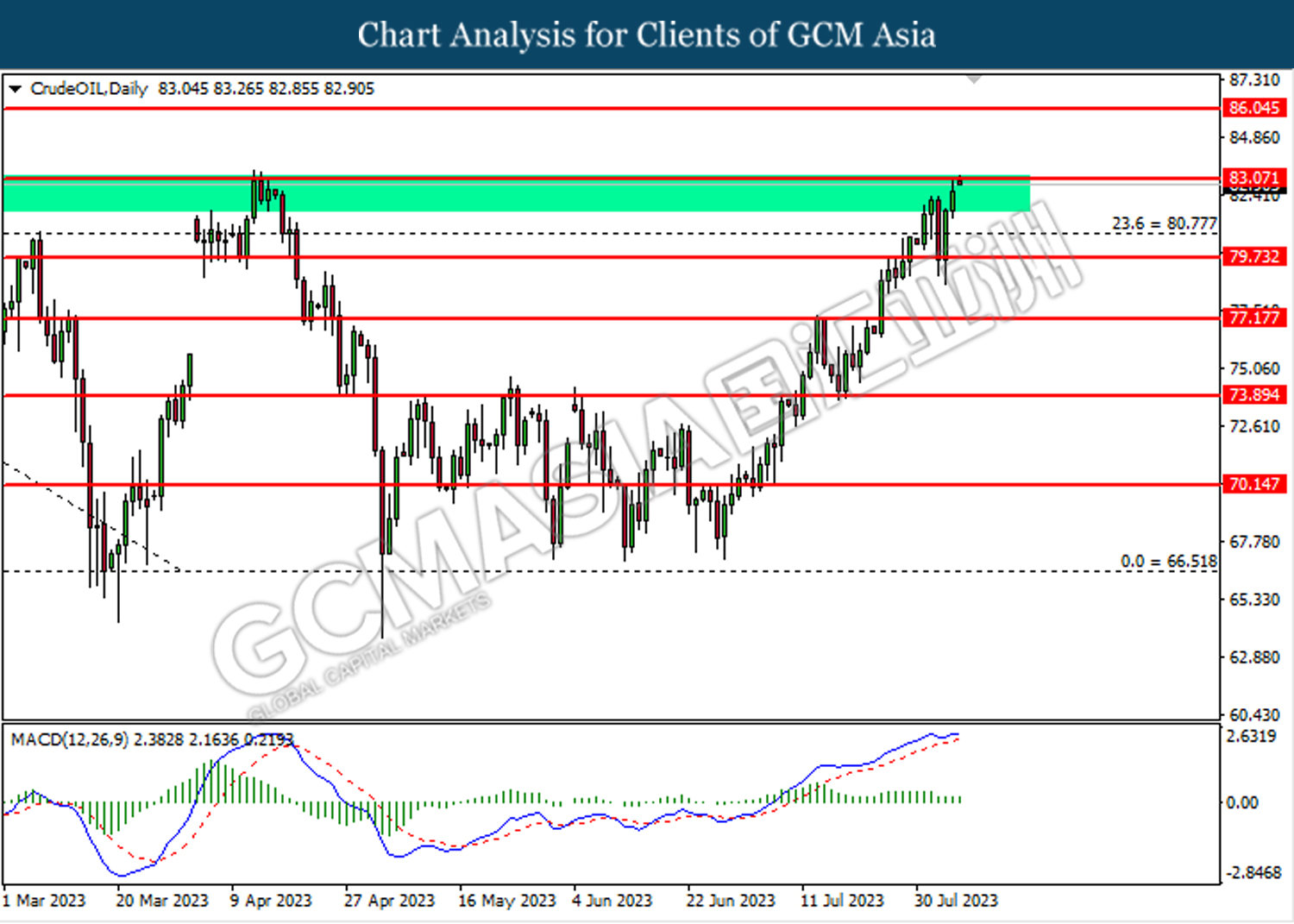

In the commodities market, crude oil prices were up by 1.10% to $82.65 per barrel as the US dollar eased further following the announcement of NFP data, which prompted the investors to rush into the oil market. Besides, gold prices surged by 0.07% to $1944.25 per troy ounce amid the weakness of dollar index.

Today’s Holiday Market Close

Time Market Event

All Day CAD Civic Holiday

Today’s Highlight Events

Time Market Event

20:15 USD FOMC Member Harker Speaks

20:30 USD FOMC Member Bowman Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

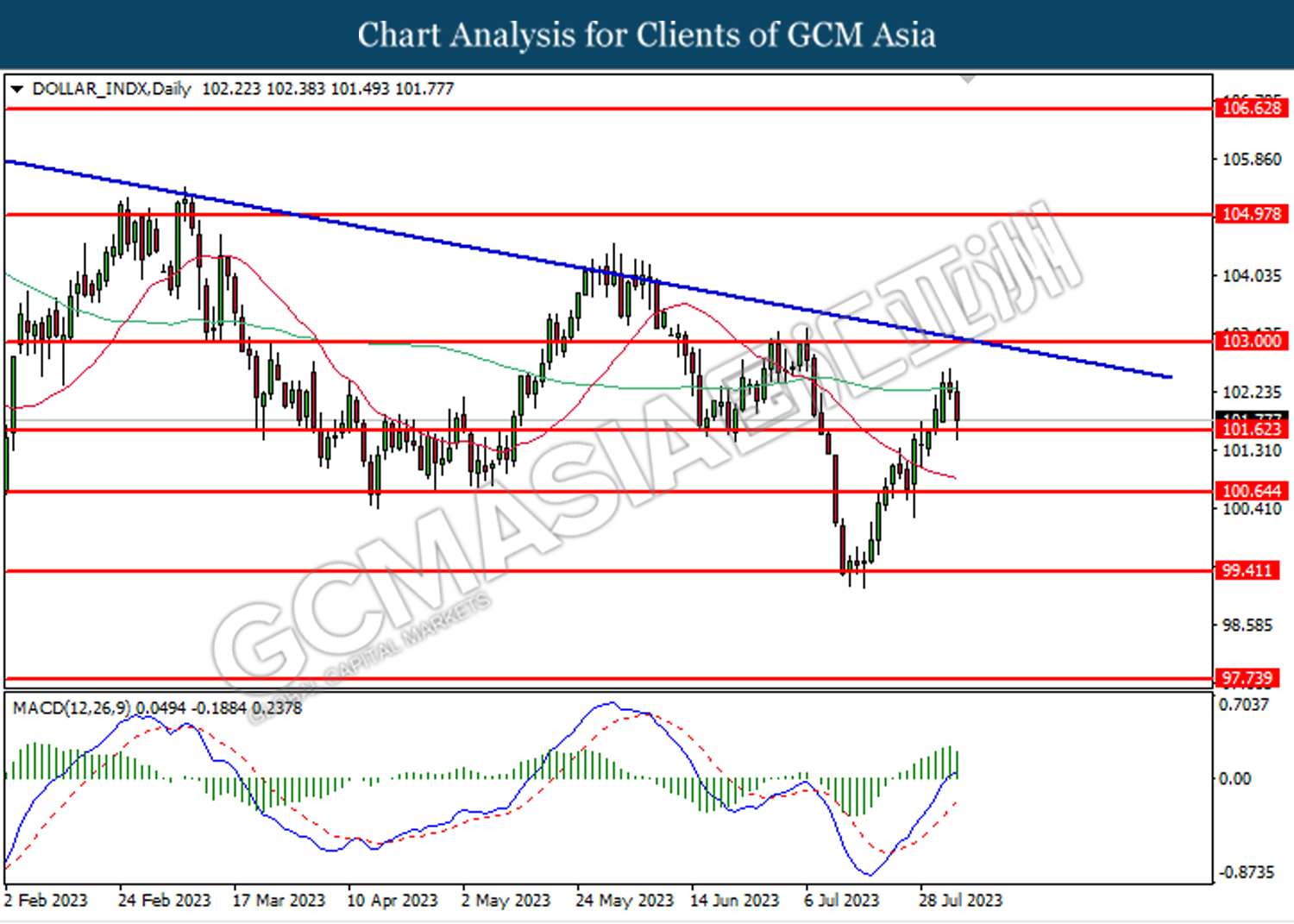

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 101.65. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.00, 105.00

Support level: 101.65, 100.65

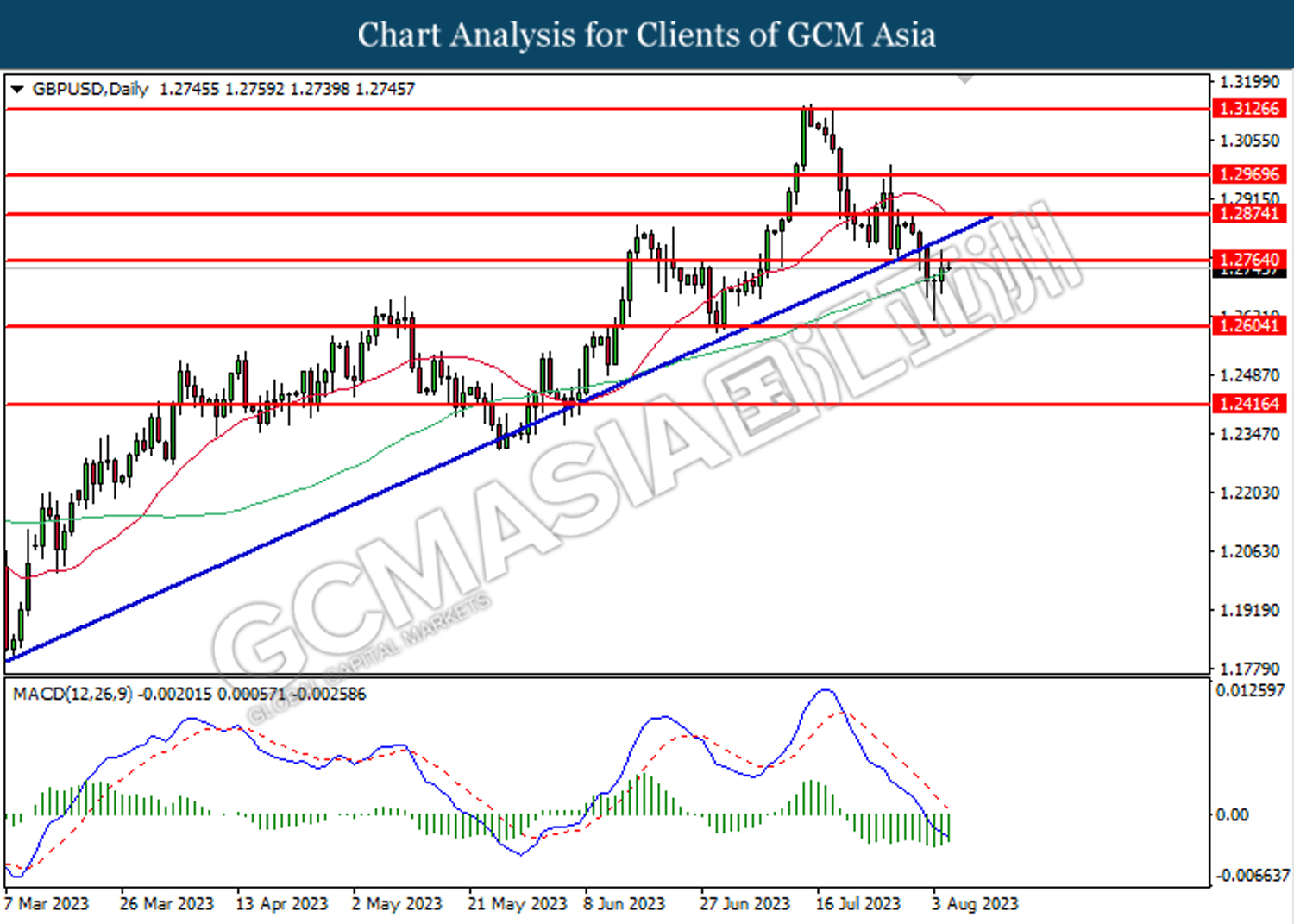

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2765. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2765, 1.2875

Support level: 1.2605, 1.2415

EURUSD, Daily: EURUSD was traded higher following the prior rebound near the support level at 1.0960. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.1065.

Resistance level: 1.1065, 1.1155

Support level: 1.0960, 1.0850

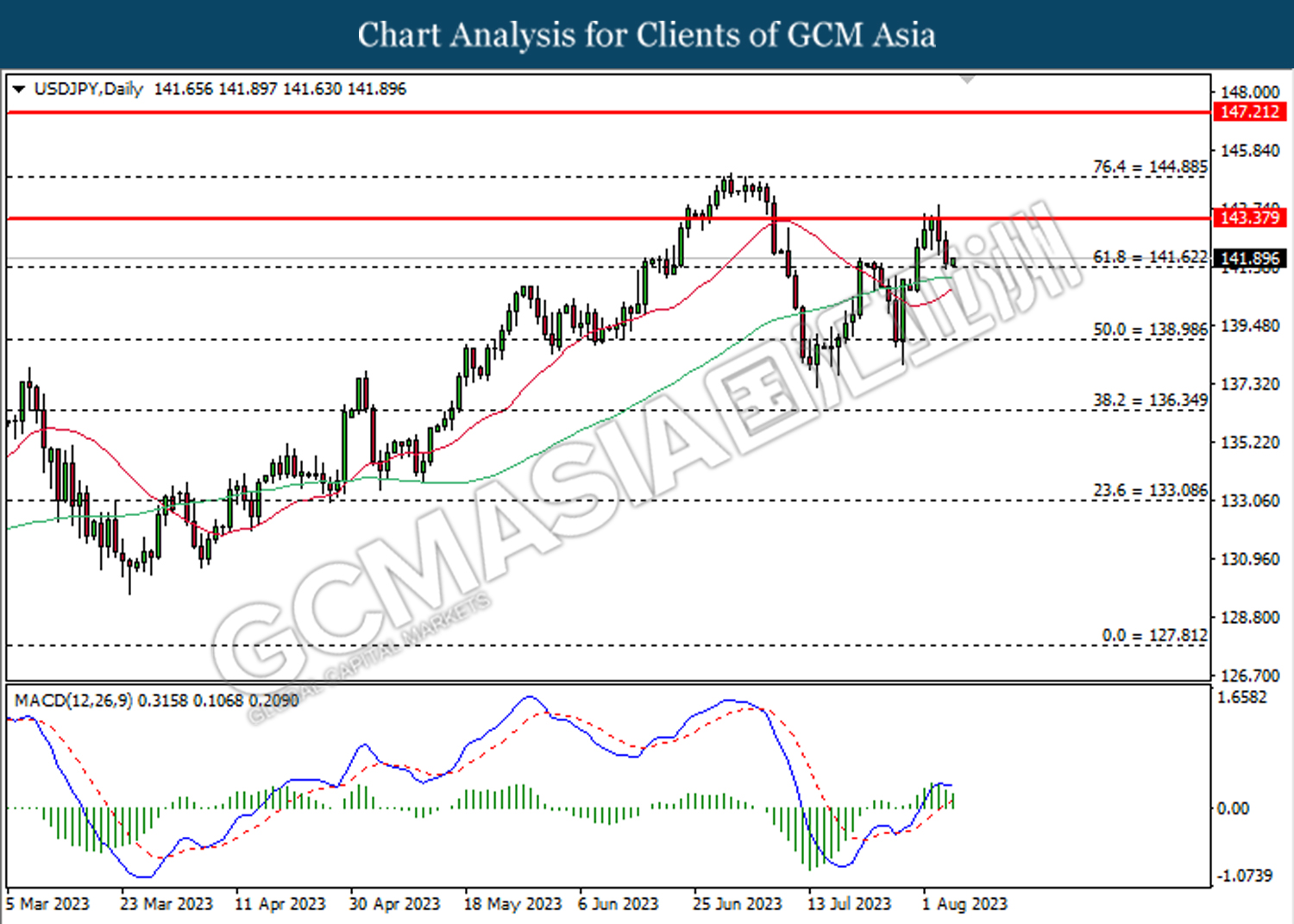

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 141.60. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 143.40, 144.90

Support level: 141.60, 139.00

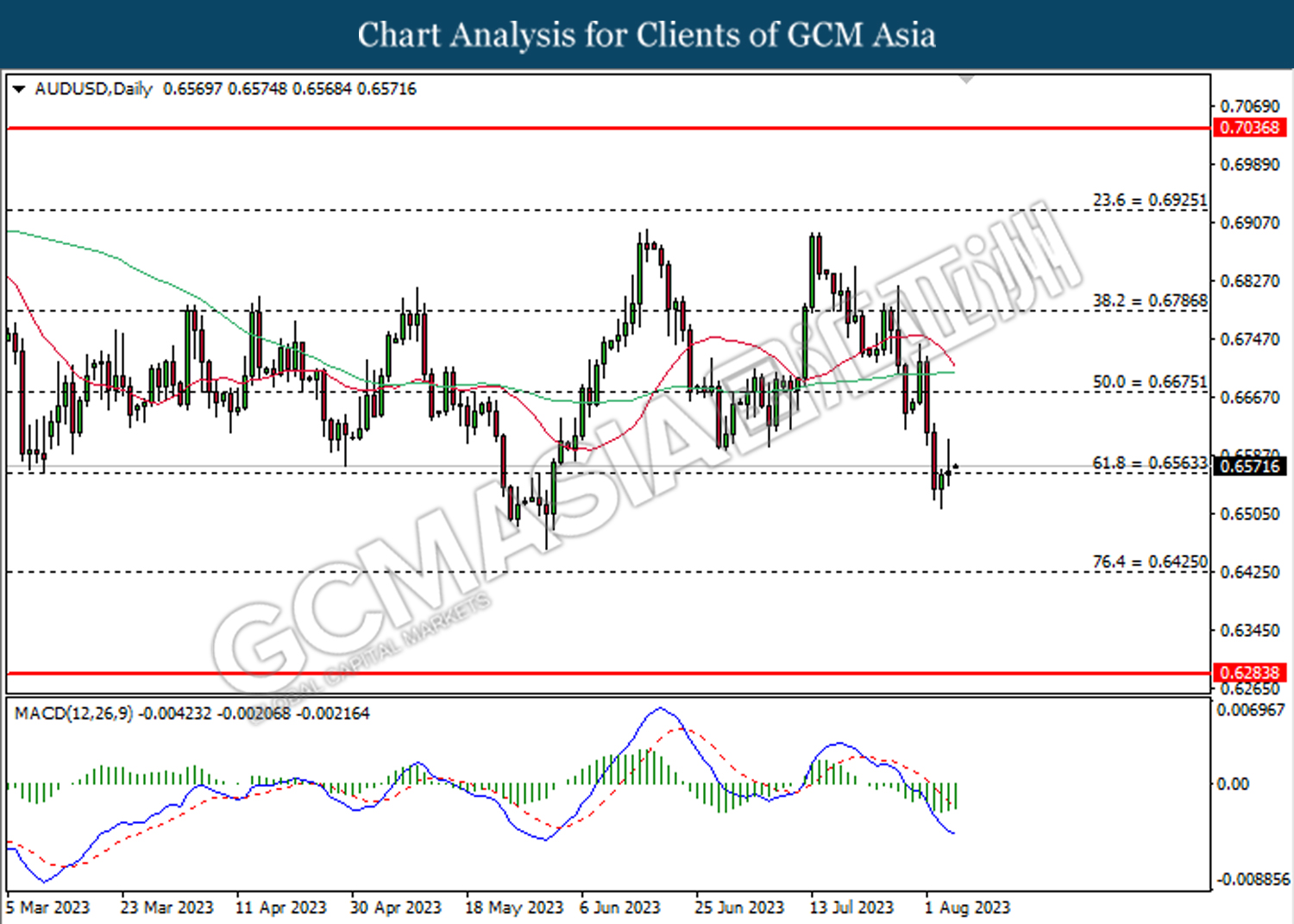

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the support level at 0.6565. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6675.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

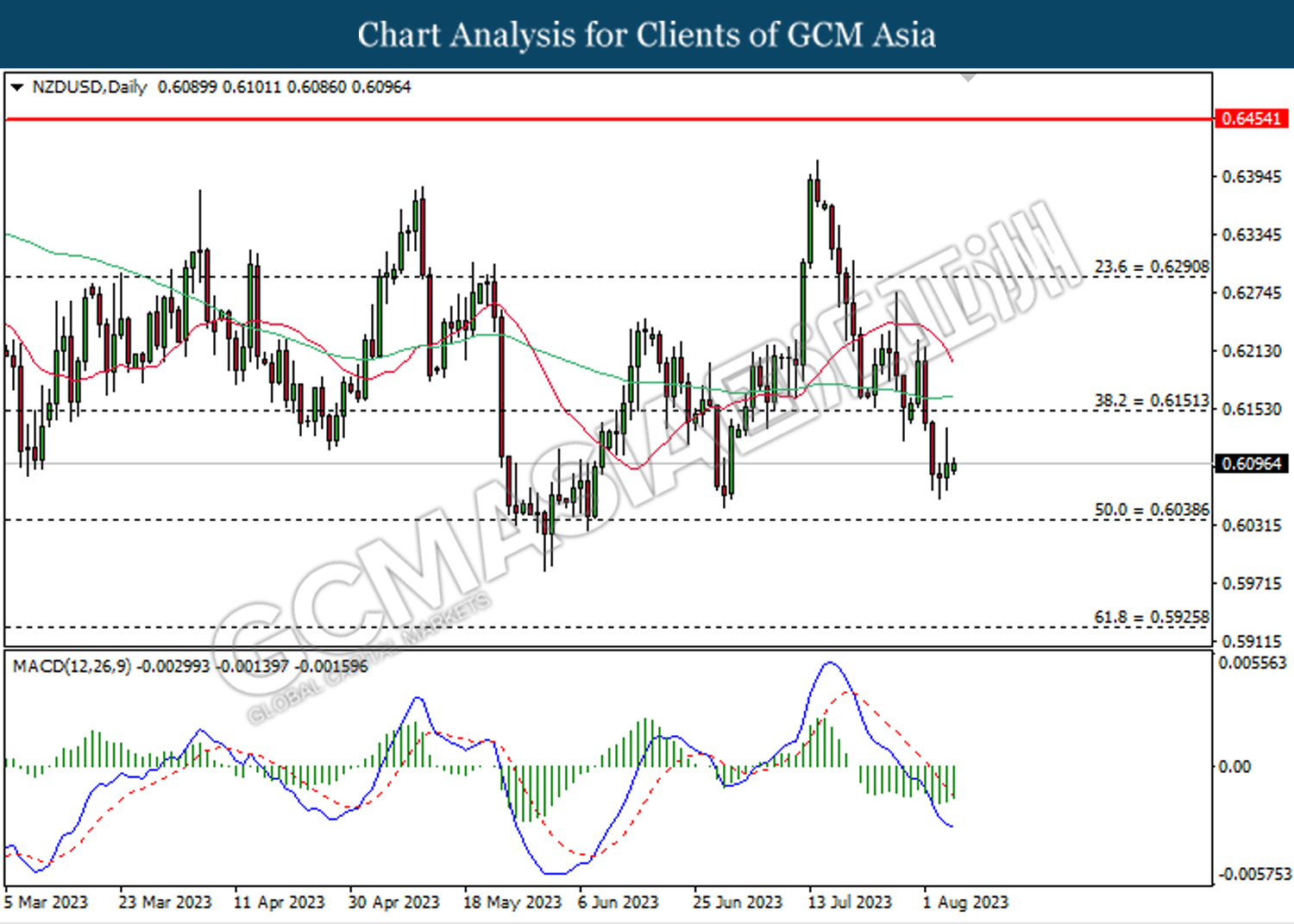

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6150.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

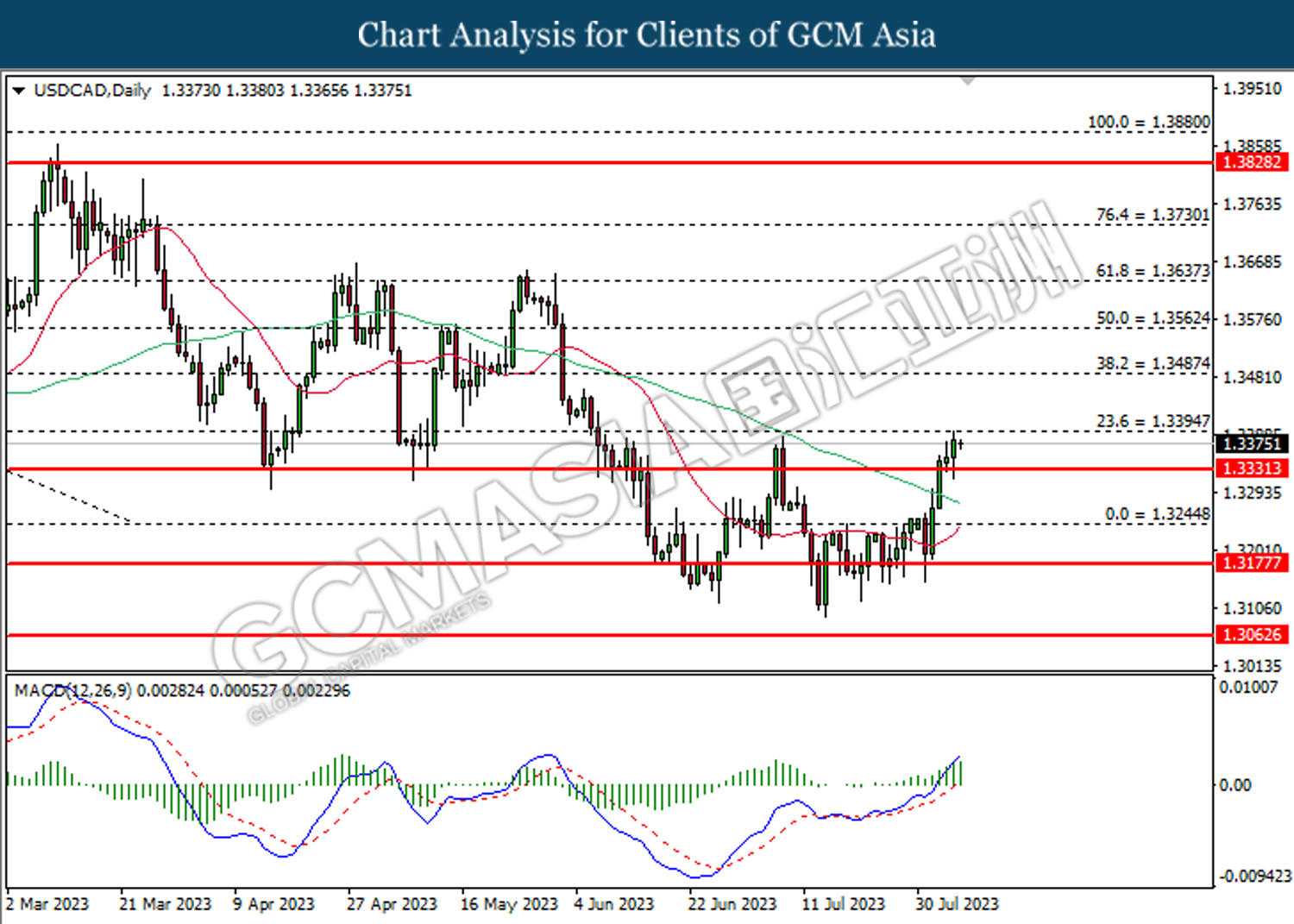

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3330. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3395.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

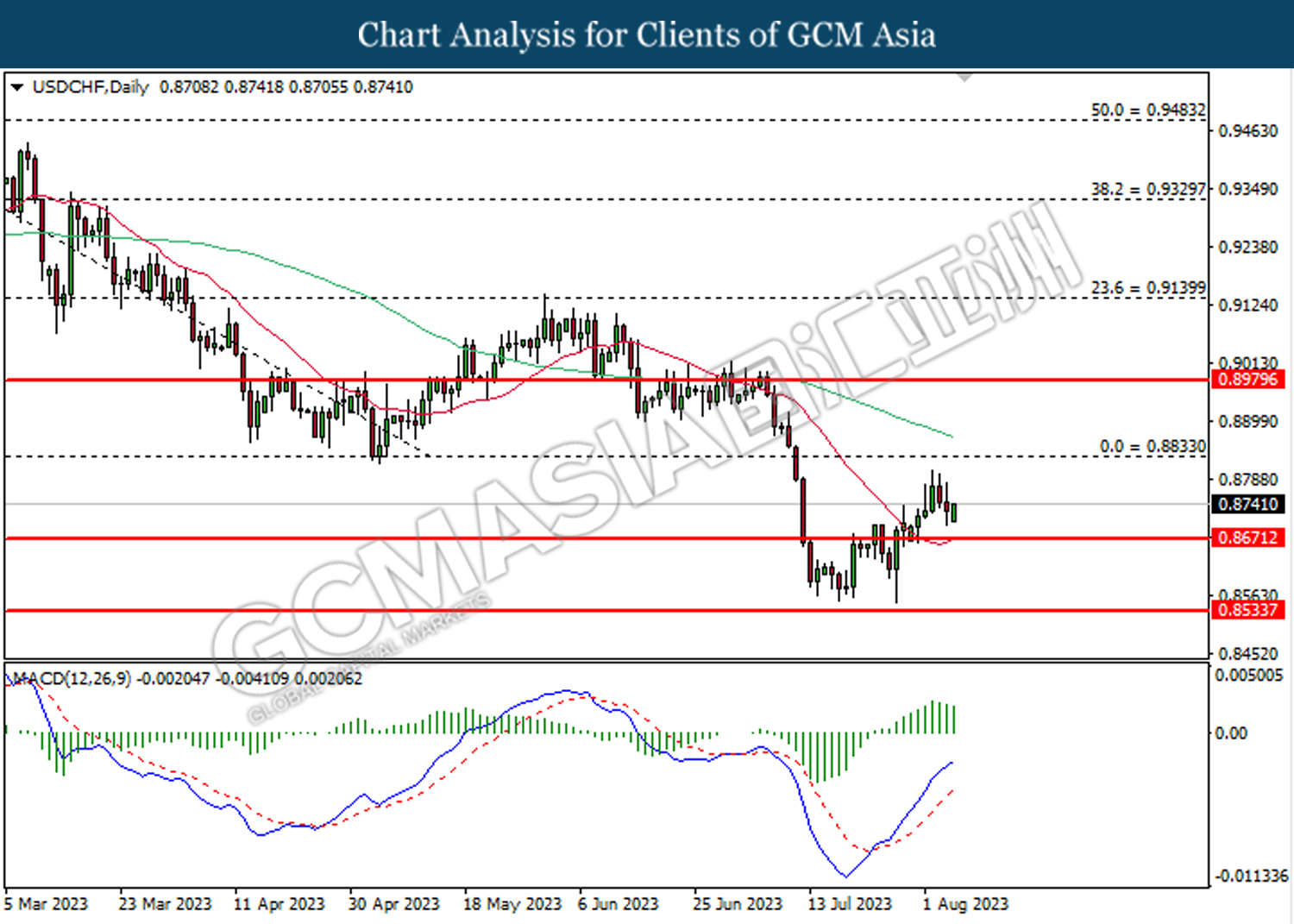

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8670. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.8835.

Resistance level: 0.8835, 0.8980

Support level: 0.8670, 0.8535

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 83.05. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 83.05, 86.05

Support level: 80.75, 79.75

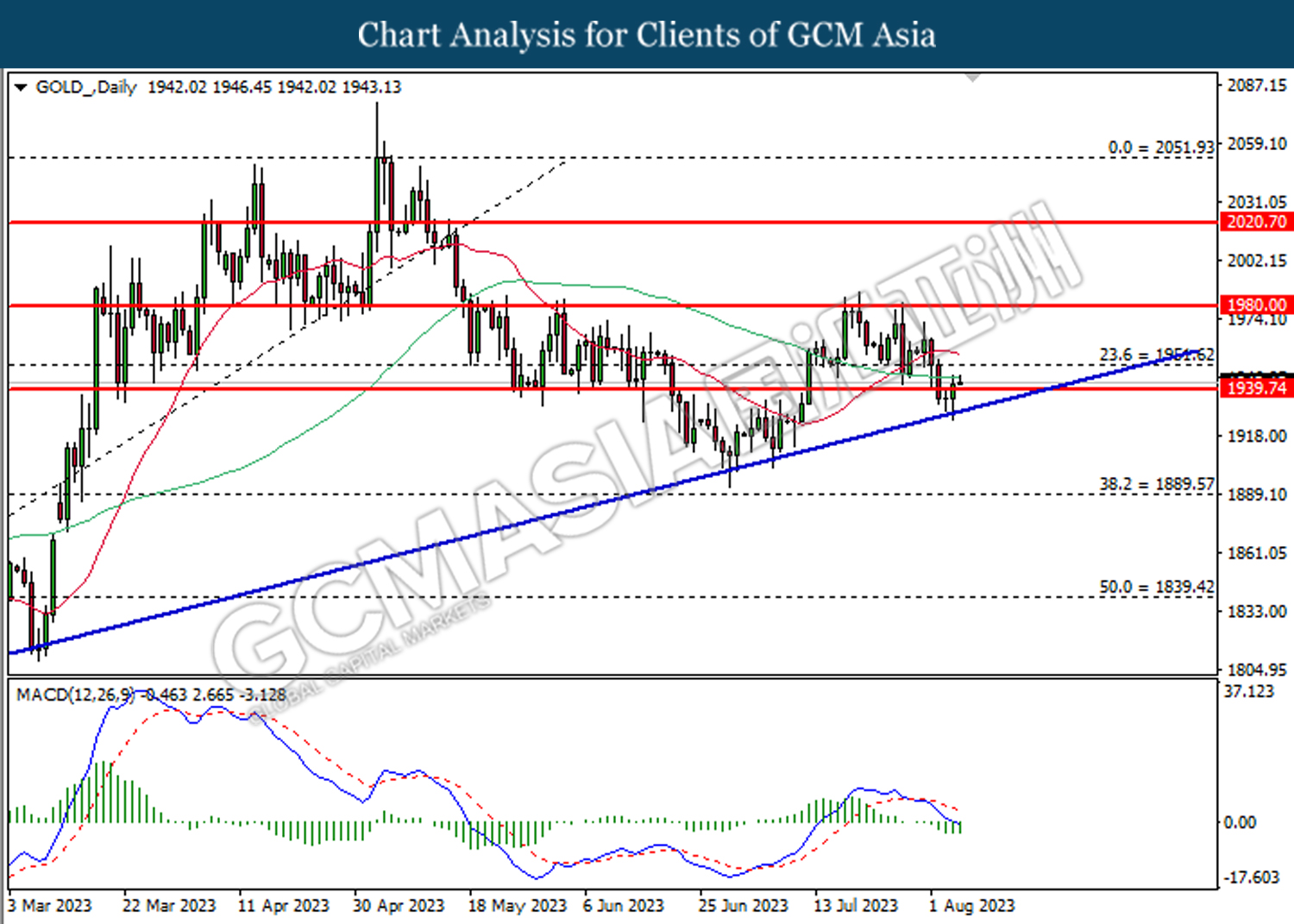

GOLD_, Daily: Gold price was traded higher following the prior breakout above the previous resistance level at 1939.75. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1951.60.

Resistance level: 1951.60, 1980.00

Support level: 1939.75, 1889.55