7 September 2020 Afternoon Session Analysis

Pound slumped amid Brexit uncertainty.

Pound Sterling extend its losses against the US Dollar amid the US Dollar strengthened over the backdrop of the string of positive US jobs data on last week while the uncertainty with regards of the post-Brexit deals continue to weigh on the Pound Sterling. According to Reuters, the UK Prime Minister Boris Johnson claimed that the UK government has set a deadline on 15th October to strike a free-trade deal with European Union, and if both parties are still unable to reach an agreement, the UK would trade with the European Union on WTO rules from next year onwards. In fact, the UK Brexit negotiator David Frost said that UK was not scared of a no-deal Brexit at the end of the year, which heightening the tensions between the UK and EU. Nonetheless, UK and EU would resume the talks again in London on Tuesday. Hence, investors would continue to scrutinize the development of the Brexit talk on Tuesday in order to receive further trading signal. As of writing, GBP/USD depreciated by 0.30% to 1.3241.

In the commodities market, the crude oil price appreciated by 0.91% to $39.28 per barrel as of writing amid technical correction from the biggest weekly fall on last week. The oil market edged lower last week amid spiking numbers of the coronavirus and easing oil production cuts from the OPEC and its allies including Russia had continue to weigh on the crude oil price. On the other hand, the gold price depreciated by 0.01% to $1937.10 per troy ounces amid upbeats jobs data from the United States on last week, which spurring risk-on sentiment in the FX market.

Today’s Holiday Market Close

Time Market Event

All Day USD Labor Day

All Day CAD Labor Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

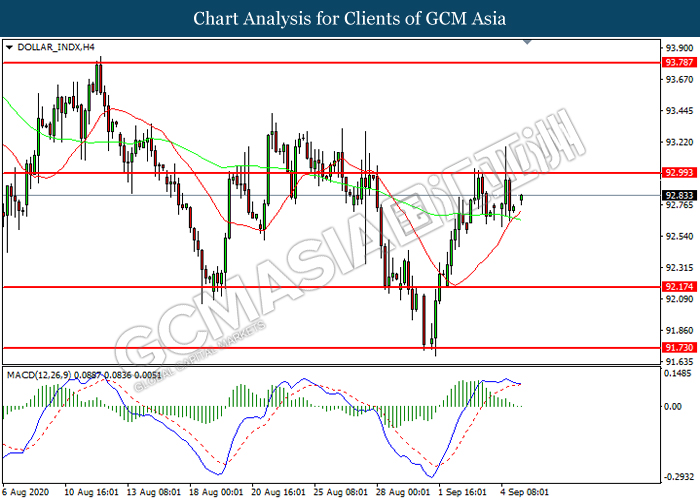

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level at 93.00. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses toward support level at 92.15.

Resistance level: 93.00, 93.80

Support level: 92.15, 91.75

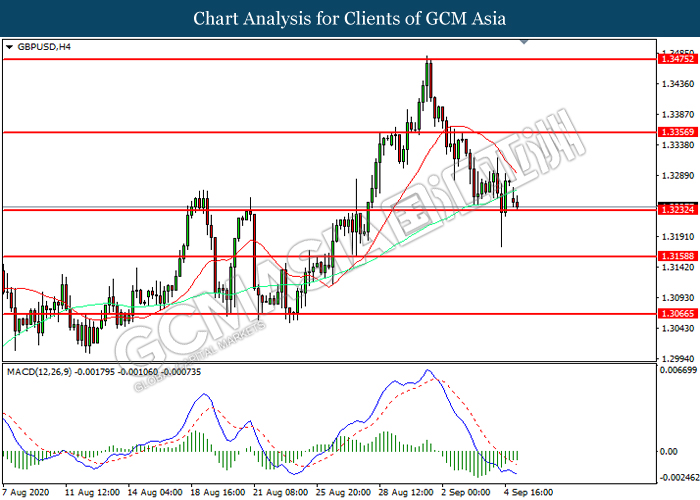

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.3230. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3355, 1.3475

Support level: 1.3230, 1.3160

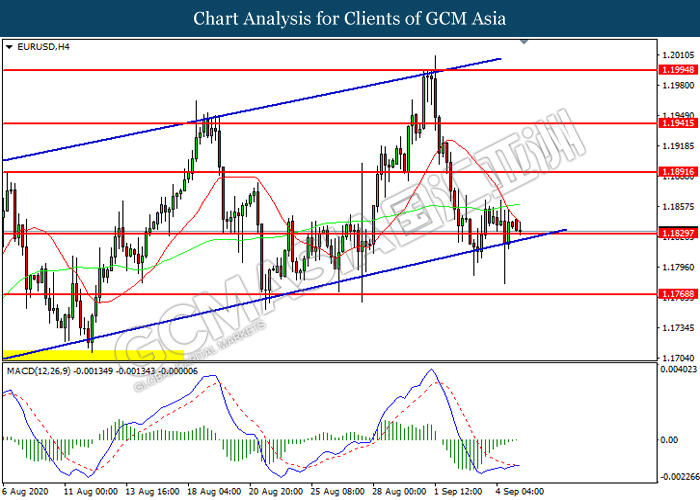

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1830. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1890, 1.1940

Support level: 1.1830, 1.1770

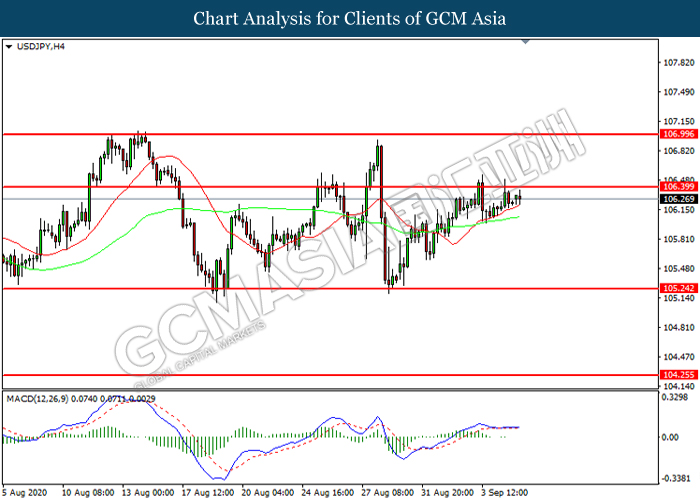

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 106.40. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 106.40, 107.00

Support level: 105.25, 104.25

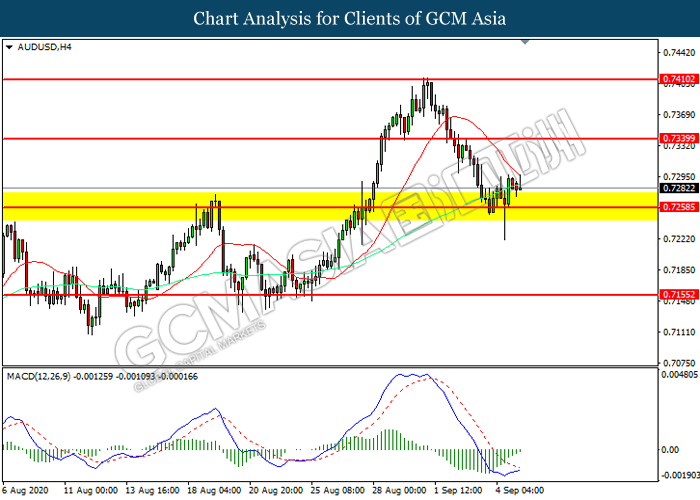

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7260. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.7340.

Resistance level: 0.7340, 0.7410

Support level: 0.7260, 0.7155

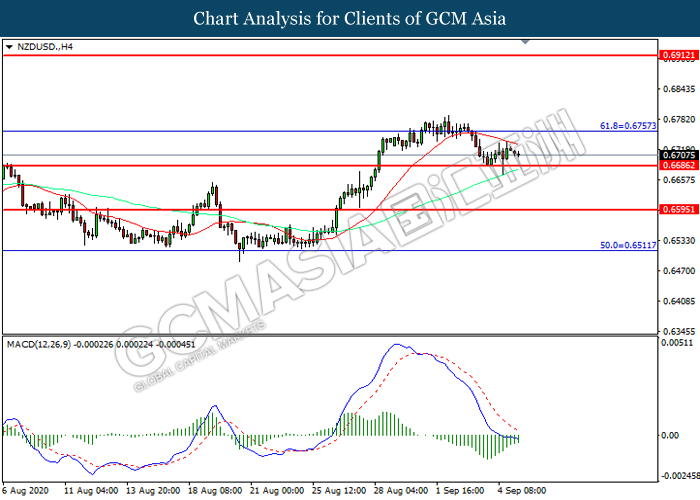

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level at 0.6685. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.6755.

Resistance level: 0.6755, 0.6910

Support level: 0.6685, 0.6595

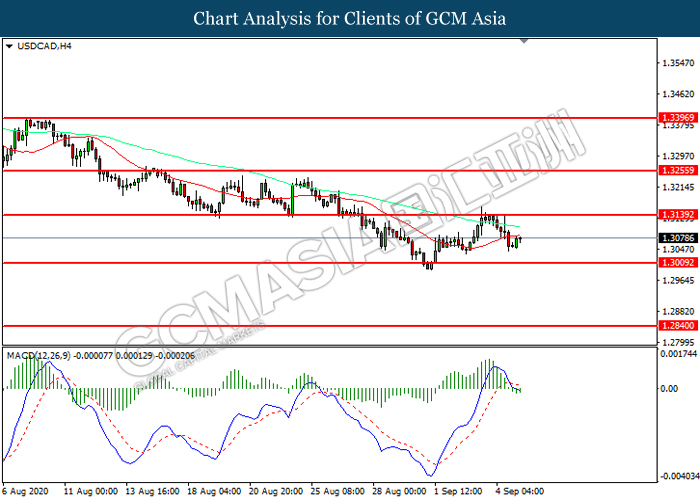

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level at 1.3140. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3010.

Resistance level: 1.3140, 1.3255

Support level: 1.3010, 1.2840

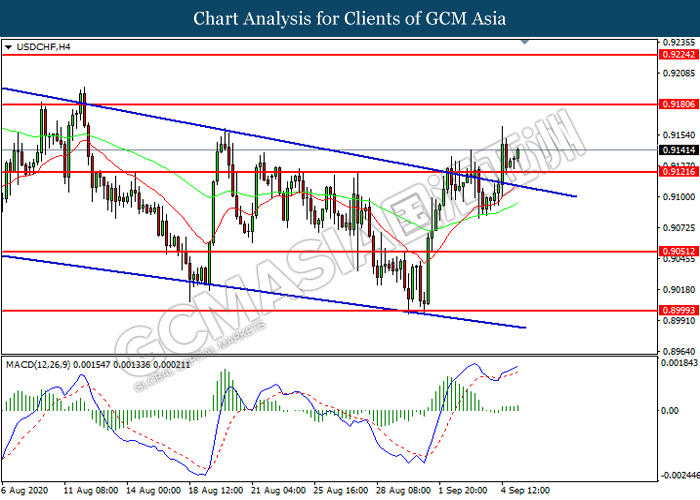

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level at 0.9120. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.9180.

Resistance level: 0.9180, 0.9225

Support level: 0.9120, 0.9050

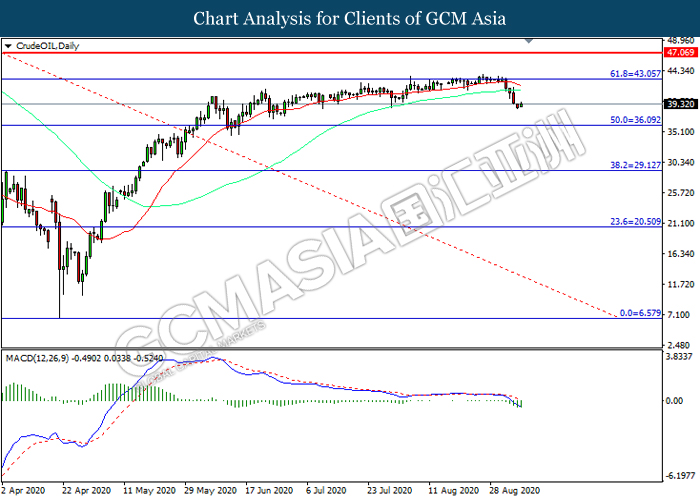

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 43.05. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 36.10.

Resistance level: 43.05, 47.05

Support level: 36.10, 29.15

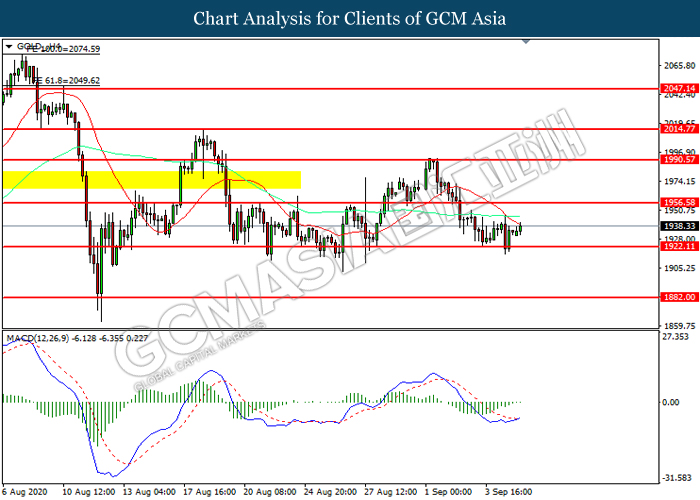

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1922.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level at 1956.60.

Resistance level: 1956.60, 1990.55

Support level: 1922.10, 1882.00