07 September 2020 Morning Session Analysis

Greenback surged after upbeat employment data.

Dollar index which gauges its value against a basket of six major currencies soared after US labour market released a series of bullish bias data, which eventually limit the recent losses of dollar. According to the Bureau of Labor Statistics (BLS), US Nonfarm Payroll data grew 1,371K, no far from the market economist expectation at 1,400K, showing that the US economy recovery are still in the right pace after pandemic shutdown. Besides, US unemployment rate also dropped significantly from July 10.2% to 8.4%, noticeably far lower than the economist forecast at 9.8%, recorded the lowest rate by far since the outbreak of coronavirus at the beginning of this year. The largest portion of drop in unemployment rate was mainly due to the surge in government rehiring activity, said by BLS. Besides, US Vice President Mike Pence also revealed that these job gains are the real evidence showing that the US economy is coming back, most of the sectors and industry undergoing a strong recovery after lockdown measure removed. However, he also reiterated that there is still a big gap and need more catalyst to get US back to where its economy were in the beginning of this year, likely a vaccine. As of writing, dollar index rose 0.12% to 92.85.

In the commodities market, crude oil price depreciated by 0.40% to $38.75 per barrel as market fears over the resurgence of covid-19 may sap the energy demand. According to the latest news, Saudi Arabia has cut their pricing for the oil sales in October, a sign that Saudi are not optimistic toward the short term future of oil market due to flare up of covid-19. Besides, gold price up 0.12% to $1936.30 a troy ounce as heightening of market worries over the pandemic.

Today’s Holiday Market Close

Time Market Event

All Day USD Labor Day

All Day CAD Labor Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

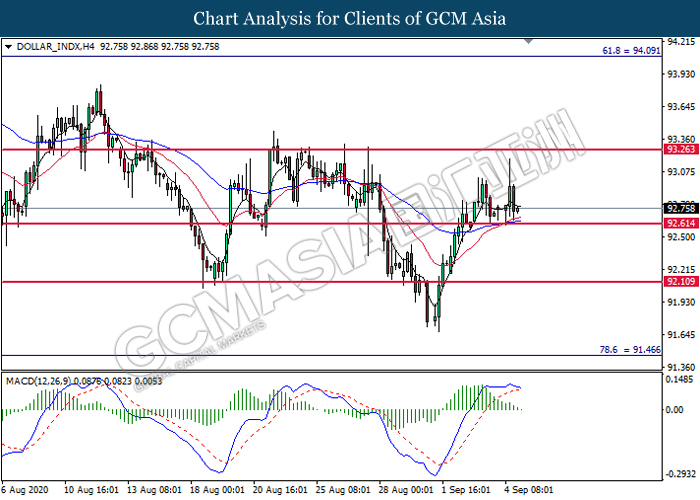

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement near the resistance level at 93.25. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses toward the support level at 92.60.

Resistance level: 93.25, 94.10

Support level: 92.60, 92.10

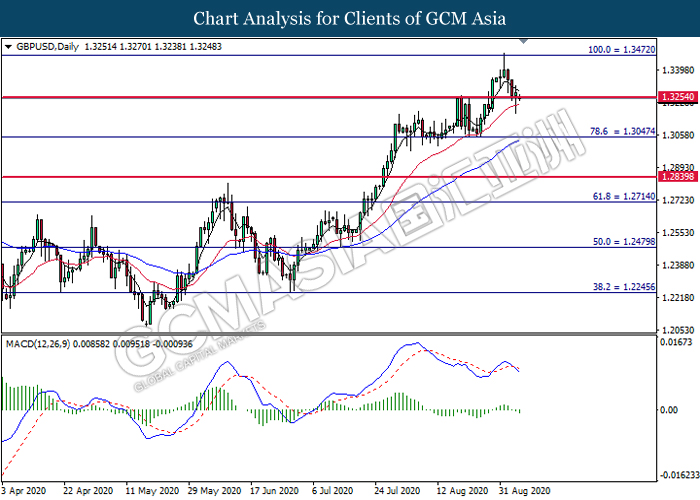

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.3255. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 1.3255.

Resistance level: 1.3470, 1.3590

Support level: 1.3255, 1.3045

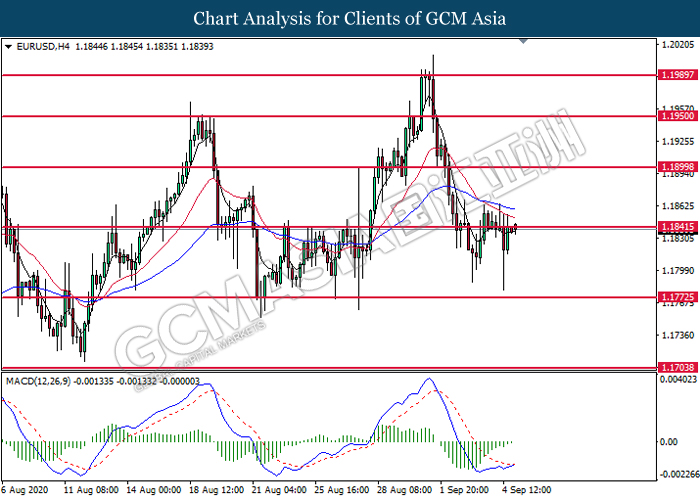

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.1840. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 1.1840.

Resistance level: 1.1840, 1.1900

Support level: 1.1775, 1.1705

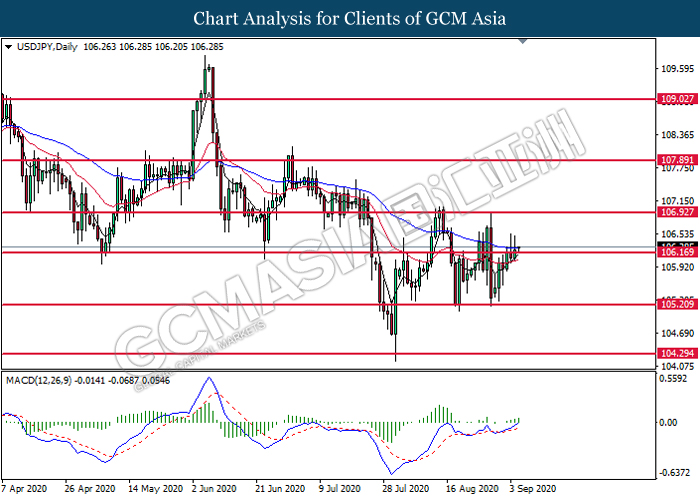

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 106.15. MACD which illustrates bullish bias momentum suggest the pair to extend its gains toward the resistance level at 106.95.

Resistance level: 106.95, 107.90

Support level: 106.15, 105.20

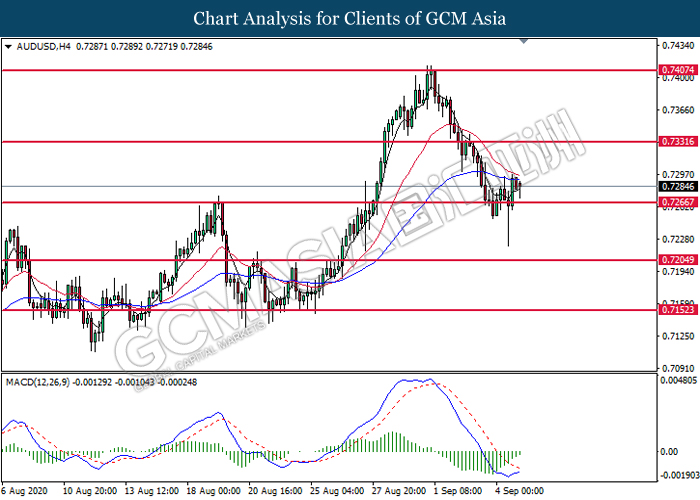

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7265. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.7330.

Resistance level: 0.7330, 0.7405

Support level: 0.7265, 0.7205

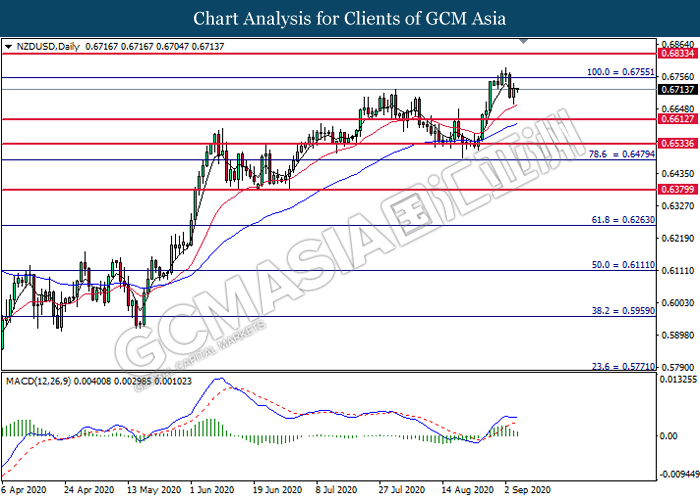

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6755. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6615.

Resistance level: 0.6755, 0.6835

Support level: 0.6615, 0.6535

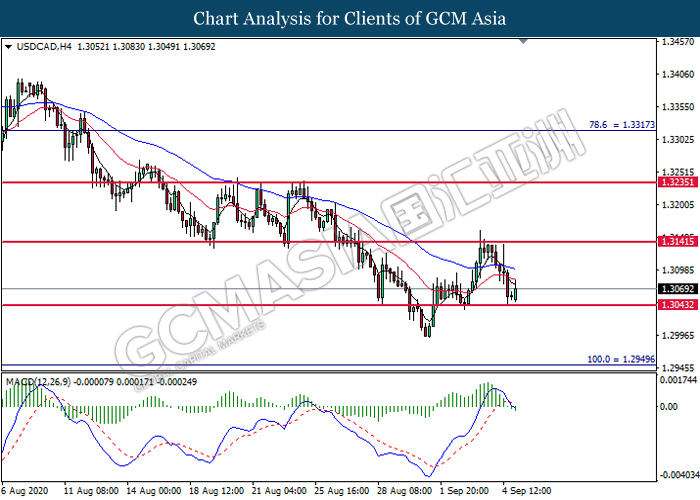

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.3045. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction toward the support level.

Resistance level: 1.3140, 1.3235

Support level: 1.3045, 1.2950

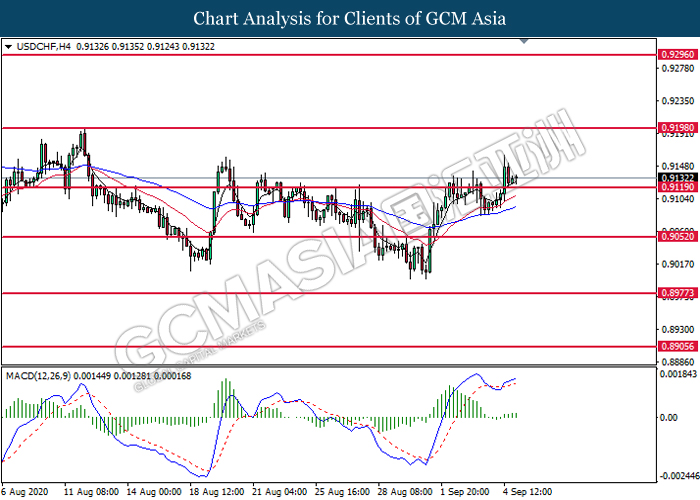

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level at 0.9120. MACD which illustrates bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9200.

Resistance level: 0.9200, 0.9295

Support level: 0.9120, 0.9050

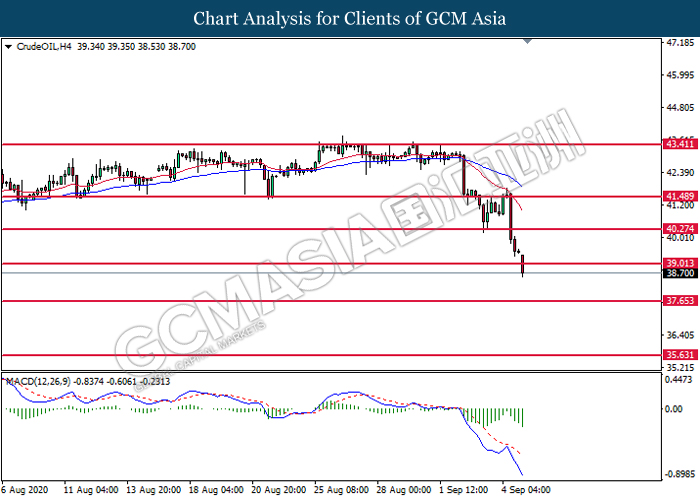

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 39.00. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level at 39.00.

Resistance level: 40.25, 41.50

Support level: 39.00, 37.65

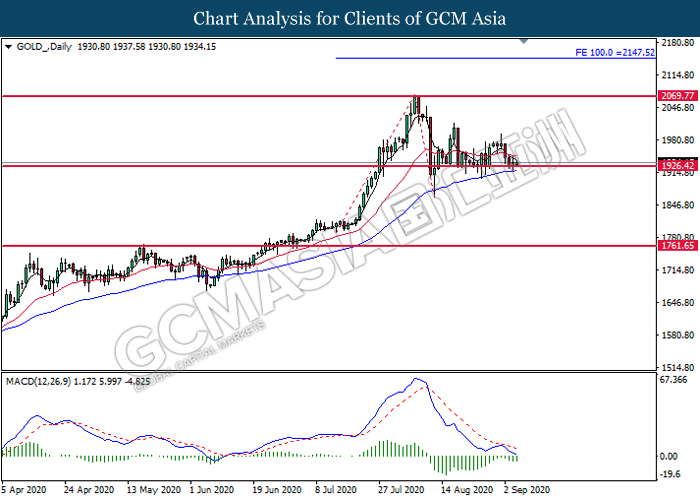

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1926.40. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level at 1926.40.

Resistance level: 2067.75, 2147.50

Support level: 1926.40, 1761.65