7 October 2022 Afternoon Session Analysis

Euro slumped as recession risk heightened.

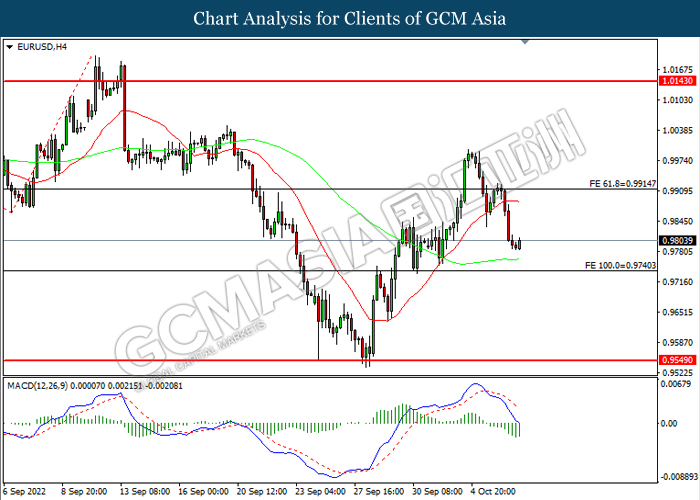

The Euro retreated from its higher level following the European Central Bank expressed their concerns toward the economic slowdown in the Euro area. After a significant rebound in manufacturing activity in the first half of 2022, the recent data had signaled to a substantial slowdown in economic growth in European region, with the economy expected to stagnate later in 2022 and in the first quarter of 2023 as the rising rate hike decision as well as stagflation risk continue to spur negative prospect toward the global economic growth. In addition, the adverse geopolitical situation as the Russia’s war in Ukraine had also diminished the confidence of businesses and consumers. Currently, the inflation remained far too high and was likely to stay above target for an extended period. Spiking soaring energy and food prices, demand pressures in some sectors following the reopening of the economy still accelerated the inflation. As of writing, EUR/USD appreciated by 0.21% to 0.9810.

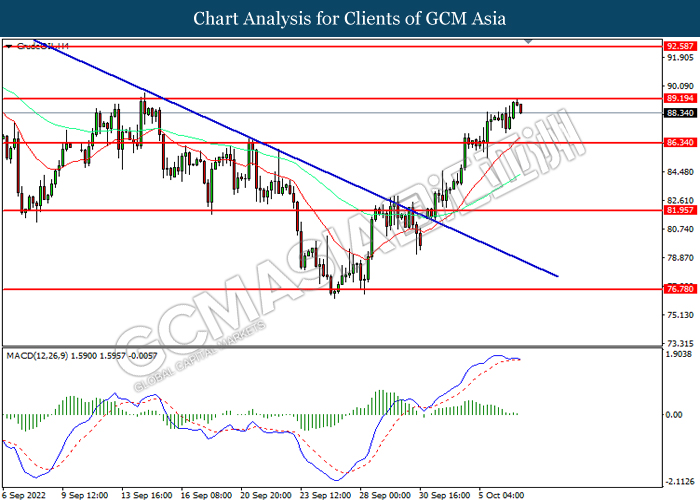

In the commodities market, the crude oil price surged 0.01% to $88.40 per barrel as of writing. The oil price was traded higher following the OPEC+ decided to reduce their oil production at 2 million barrels per day (bpd), while Goldman Sachs has raised its oil price forecast for this year and 2023. On the other hand, the gold price depreciated by 0.02% to $1712.00 per troy ounces ahead of crucial Nonfarm Payroll data tonight.

Today’s Holiday Market Close

Time Market Event

All Day CNY China – National Day

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (Sep) | 315K | 250K | – |

| 20:30 | USD – Unemployment Rate (Sep) | 3.70% | 3.70% | – |

| 20:30 | CAD – Employment Change (Sep) | -39.7K | 20.0K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains toward resistance level.

Resistance level: 113.65, 117.30

Support level: 111.40, 109.95

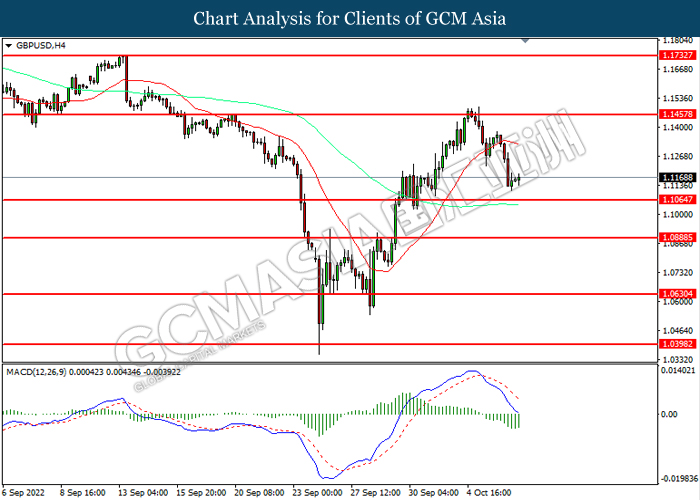

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.1455, 1.1730

Support level: 1.1065, 1.0890

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.9915, 1.0145

Support level: 0.9740, 0.9550

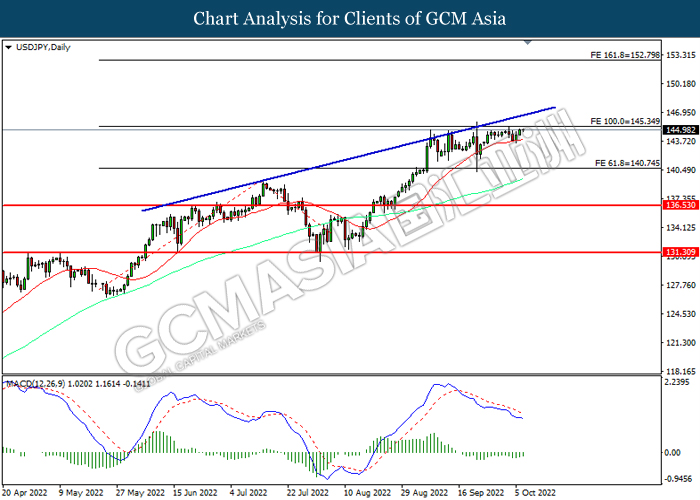

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

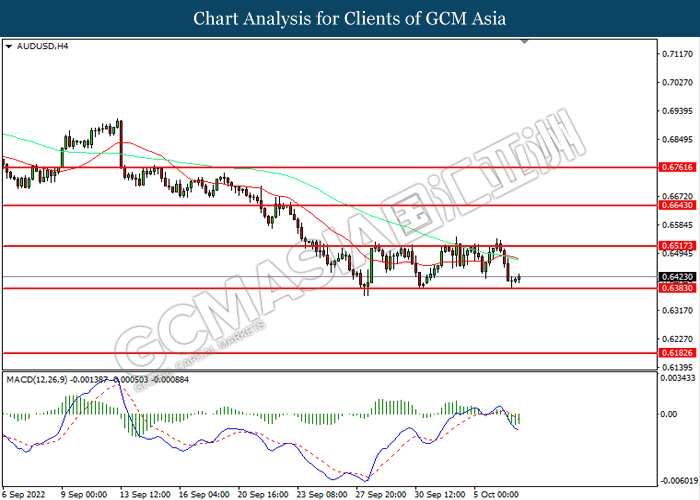

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6515, 0.6645

Support level: 0.6385, 0.6185

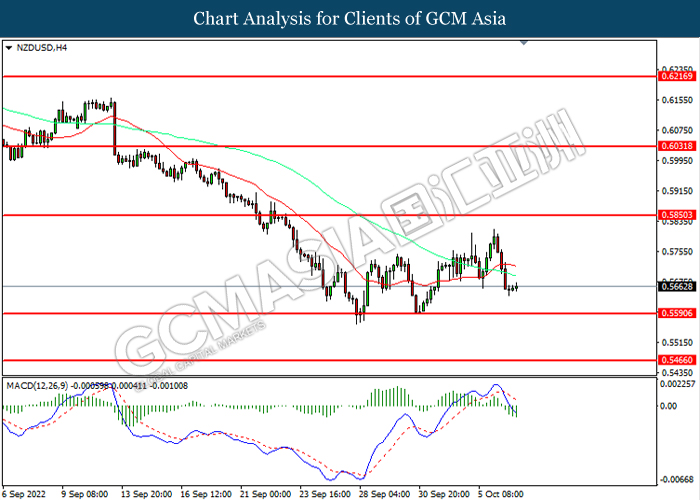

NZDUSD, H4: NZDUSD was traded lower while currently near the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.5850, 0.6030

Support level: 0.5590, 0.5465

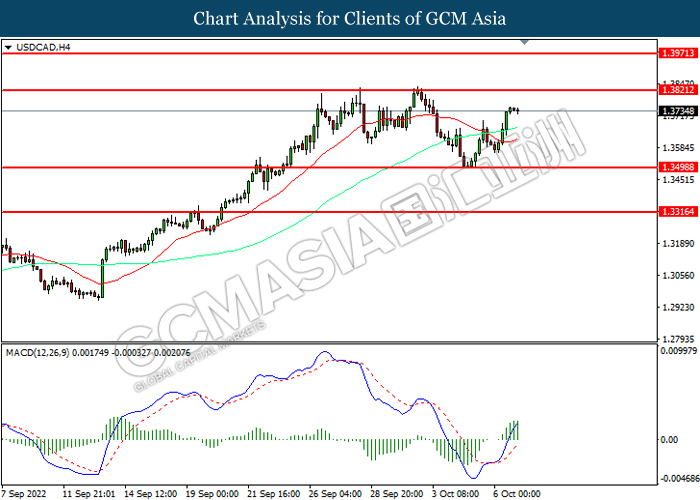

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.3820, 1.3970

Support level: 1.3500, 1.3315

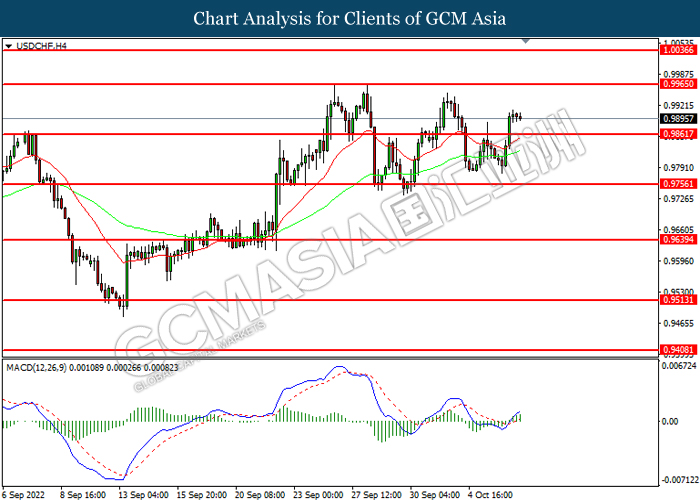

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9965, 1.0035

Support level: 0.9860, 0.9755

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 89.20, 92.60

Support level: 86.35, 81.95

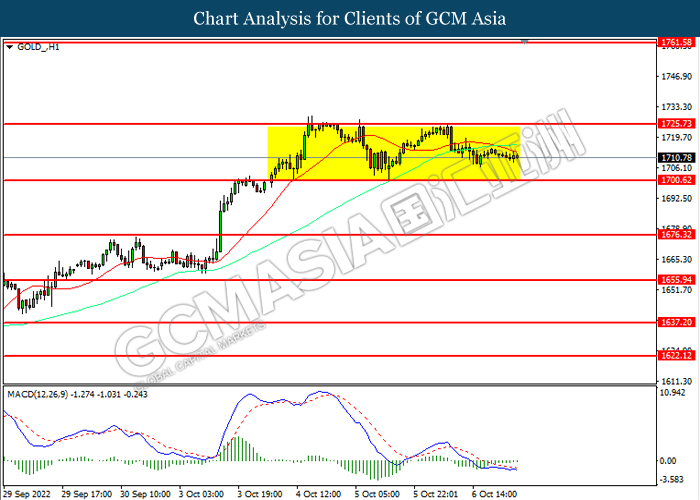

GOLD_, H1: Gold price was traded lower following prior retracement from the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1725.75, 1761.60

Support level: 1700.60, 1676.30