7 October 2022 Morning Session Analysis

US Dollar rallied despite the US weekly jobless claims increased.

The Dollar Index which traded against a basket of six major currencies rose significantly on yesterday although the downbeat employment data has been released. According to Department of Labor, the US Initial Jobless Claims notched up from the previous reading of 190K to 219K, exceeding the market expectation of 203K. Such bearish data has shown that the increasing of unemployment. Nonetheless, within the background of hawkish statement from Fed’s member, the Dollar Index has extended its gains. According to Reuters, the Chicago Fed President Charles Evans claimed on Thursday that the Fed’s policy rate was likely headed to 4.5% – 4.75% by the spring of 2023 in order to bring down too-high inflation back to 2%. Besides, Fed Governor Lisa Cook and Minneapolis Fed President Neel Kashkari has emphasized that the Fed would stand with its contractionary monetary policy as long as the inflation fights was ongoing. As the Fed officials showed little sign of backing away from rate hikes, it sparked the appeal of US Dollar. As of now, the investors would continue to scrutinize the announcement of Nonfarm Payrolls data to receive further trading signals. As of writing, the Dollar Index appreciated by 1.08% to 112.20.

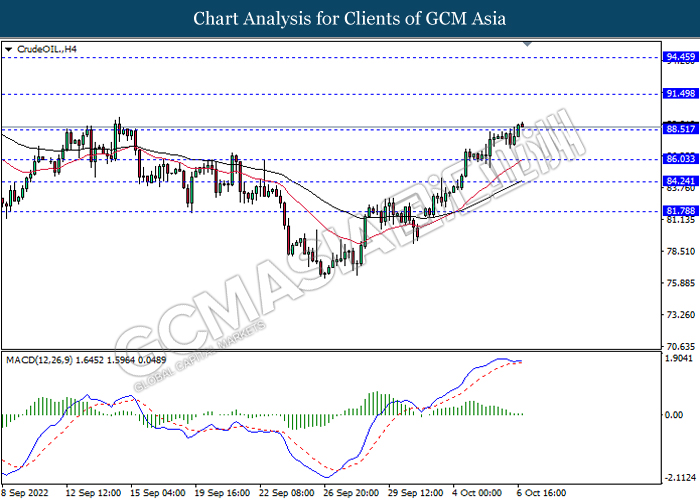

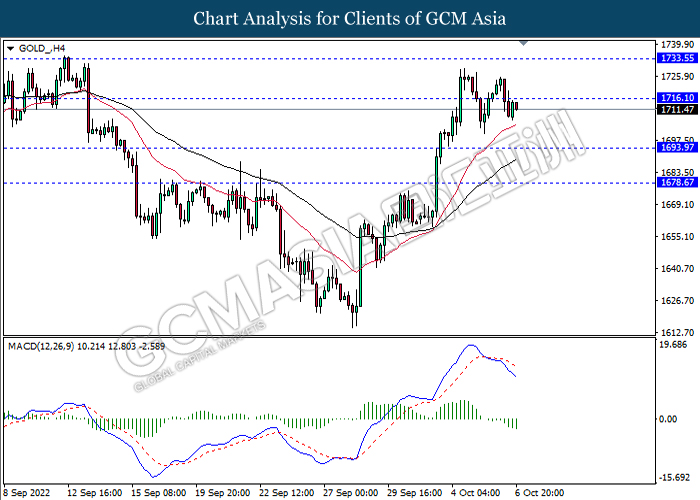

In the commodities market, the crude oil price rallied by 0.59% to $88.97 per barrel as of writing after an output cut announcement from OPEC+. On the other hand, the gold price depreciated by 0.03% to $1711.78 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day CNY China – National Day

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (Sep) | 315K | 250K | – |

| 20:30 | USD – Unemployment Rate (Sep) | 3.70% | 3.70% | – |

| 20:30 | CAD – Employment Change (Sep) | -39.7K | 20.0K | – |

Technical Analysis

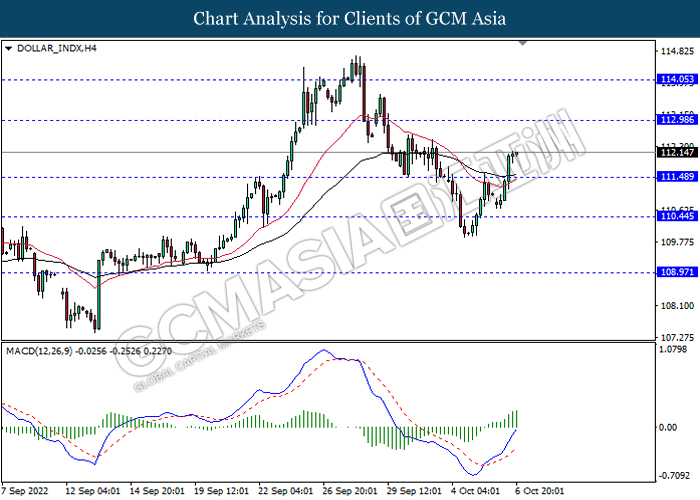

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 113.00, 114.05

Support level: 111.50, 110.45

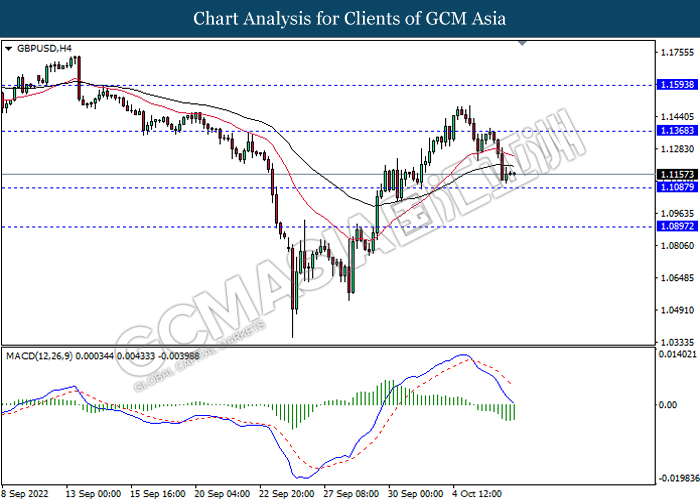

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1370, 1.1595

Support level: 1.1085, 1.0895

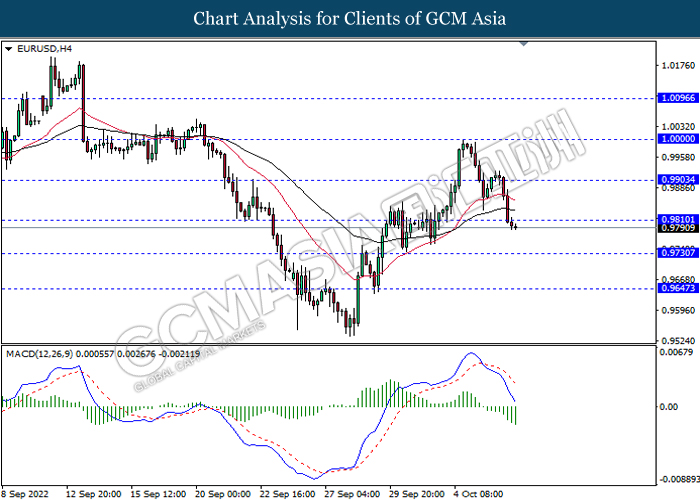

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9810, 0.9905

Support level: 0.9730, 0.9645

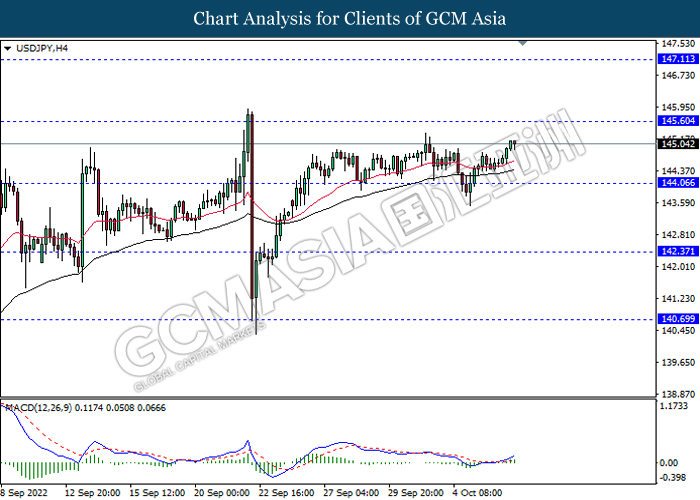

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 145.60, 147.10

Support level: 144.05, 142.35

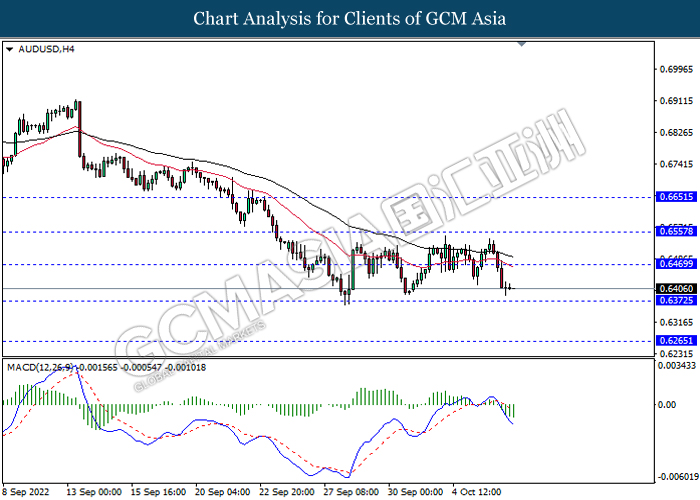

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6470, 0.6555

Support level: 0.6370, 0.6265

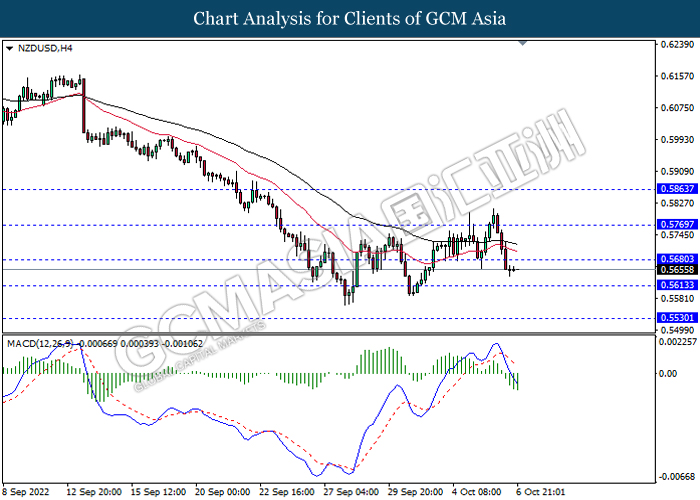

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.5680, 0.5770

Support level: 0.5615, 0.5530

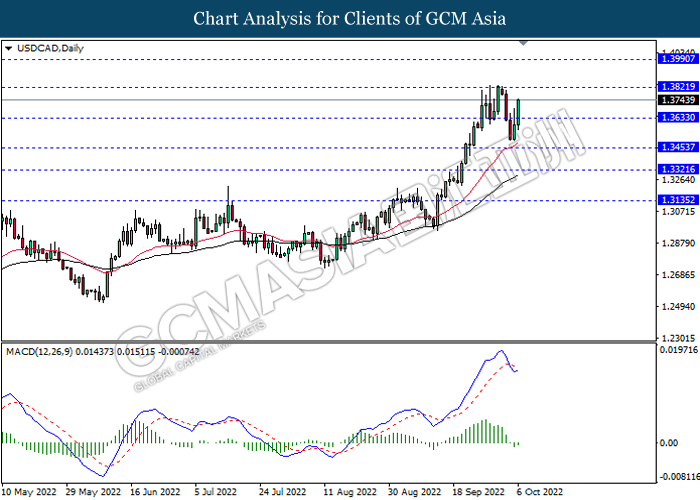

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3820, 1.3990

Support level: 1.3635, 1.3455

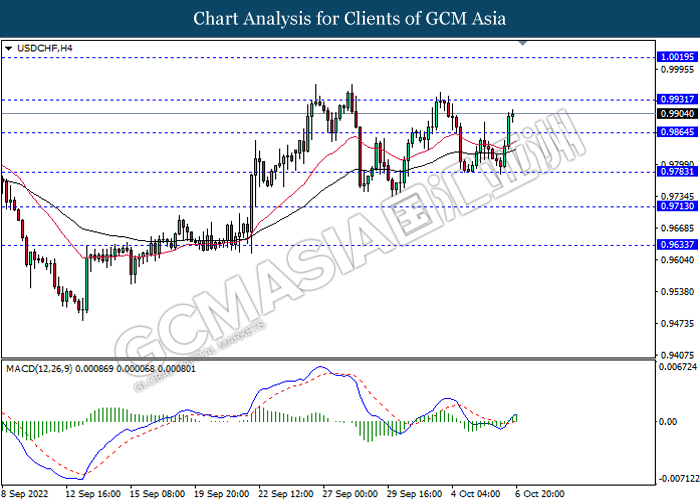

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9930, 1.0020

Support level: 0.9865, 0.9785

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 91.50, 94.45

Support level: 88.50, 86.05

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1716.10, 1733.55

Support level: 1693.95, 1678.65