7 December 2021 Afternoon Session Analysis

Euro remains weak on recent downbeat data.

The Euro which traded against the dollar and other currency pairs have fell amid disappointing release of German manufacturing data recently. According to Deutsche Bundesbank, German Manufacturing Orders have fell much more than expectation in October and decline -6.9% against market expectation of -0.5%. The data further clouding the growth outlook for manufacturers in Europe’s largest economy. Elsewhere, Eurozone Sentix Investor Confidence also receive a huge blow in its reading, dropping to 13.5 from 18.3 last month, its lowest level since April. Besides that, news of IMF to downgrade forecast for the Eurozone also triggered pressure for the pair. According to reports, The International Monetary Fund could be about to cut growth forecasts for the euro area as concerns over the Omicron Covid variant and persistently higher inflation grow. The institution has now warned about the possibility of revision after it previously said the Eurozone economy grow by 4.3%. At the time of writing, EUR/USD fell 0.05% to 1.1290.

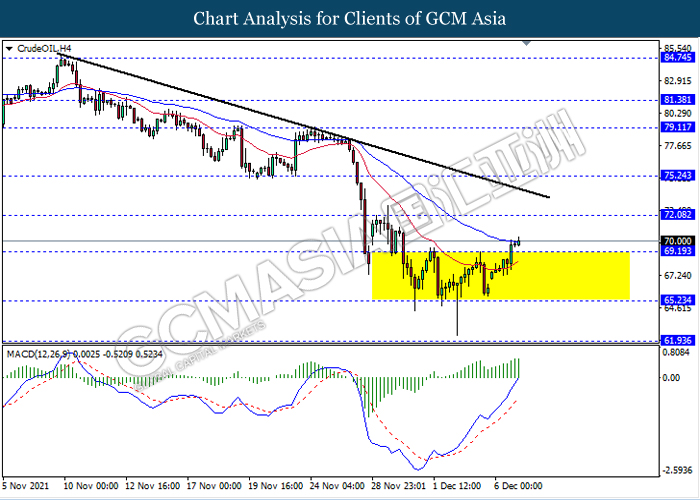

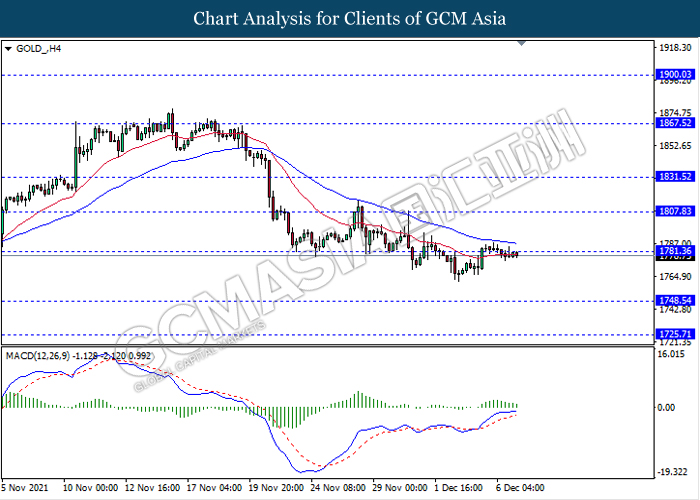

In the commodities market, crude oil price rose 0.04% to $70.08 per barrel as of writing following easing fears of Omicron and Iran delay. Following latest development, a South African health official reported over the weekend that Omicron cases there had only shown mild symptoms. Also, the top U.S. infectious disease official, Anthony Fauci, has told CNN “it does not look like there’s a great degree of severity” so far. On the other hand, lack of progression in indirect U.S – Iran nuclear talks also help crude oil price. Germany urged Iran to present realistic proposals over its nuclear program. On the other hand, gold price fell 0.03% to $1779.10 a troy ounce following dollar strength.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:30 AUD RBA Rate Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:30 | AUD – RBA Interest Rate Decision (Dec) | 0.10% | 0.10% | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Dec) | 31.7 | 25.3 | – |

| 23:00 | CAD – Ivey PMI (Nov) | 59.3 | – | – |

Technical Analysis

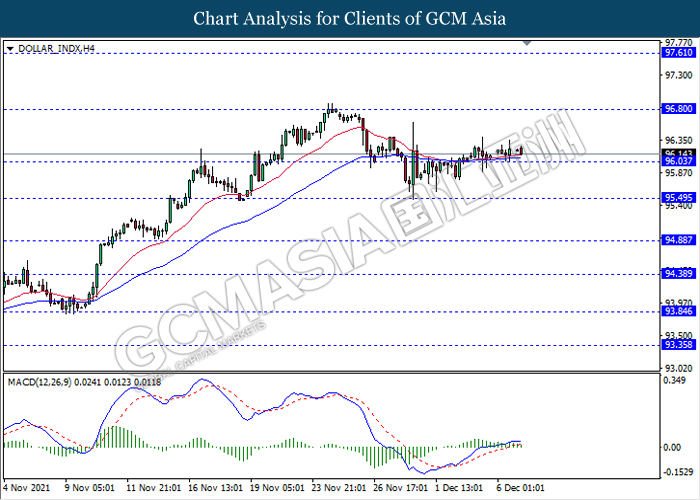

DOLLAR_INDX, H4: Dollar index was traded flat near the support level 96.05. However, MACD which illustrate bullish momentum signal suggest the dollar to be traded higher towards the resistance level 96.80.

Resistance level: 96.80, 97.60

Support level: 96.05, 95.50

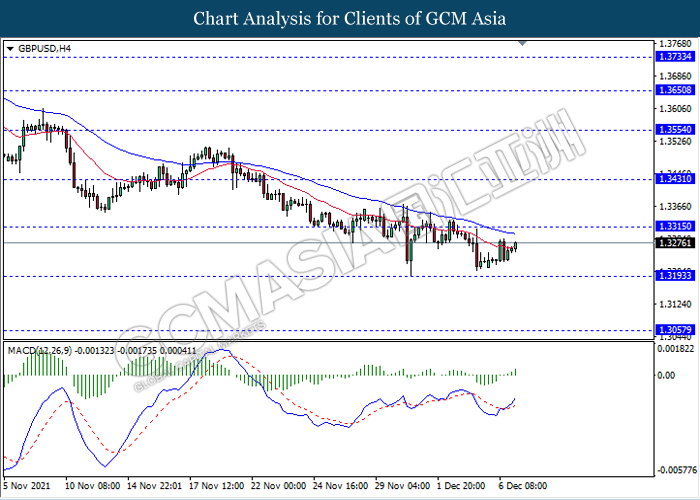

GBPUSD, H4: GBPUSD was traded higher while currently testing near the resistance level 1.3315. MACD which illustrate bullish momentum signal with the formation of golden cross suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 1.3315, 1.3430

Support level: 1.3195, 1.3055

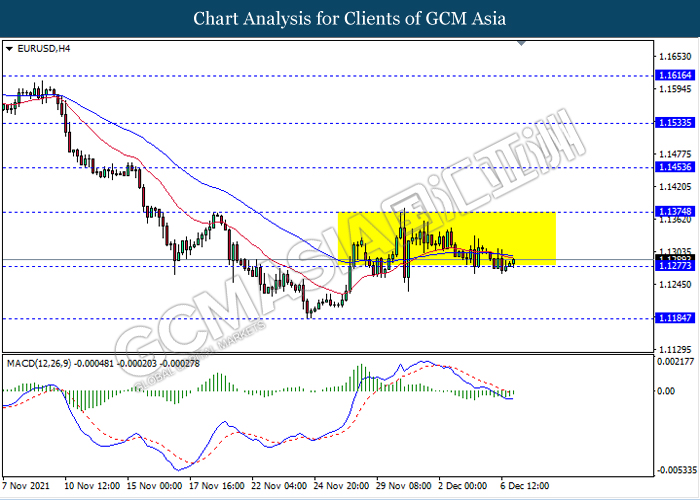

EURUSD, H4: EURUSD remain traded in sideway channel while currently testing the support level 1.1275. However, MACD which illustrate diminishing bearish momentum signal suggest the pair to be traded higher in short term towards the resistance level 1.1375.

Resistance level: 1.1375, 1.1455

Support level: 1.1275, 1.1185

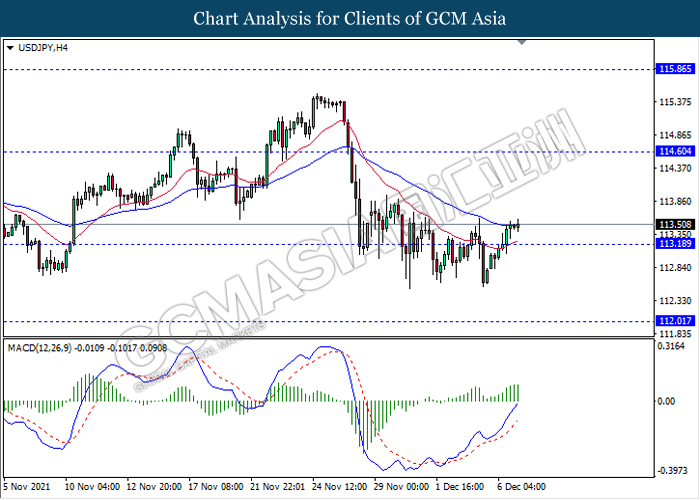

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level 114.60. MACD which illustrate bullish bias signal suggest the pair to extend its gains towards the resistance level 114.60.

Resistance level: 114.60, 115.85

Support level: 113.20, 112.00

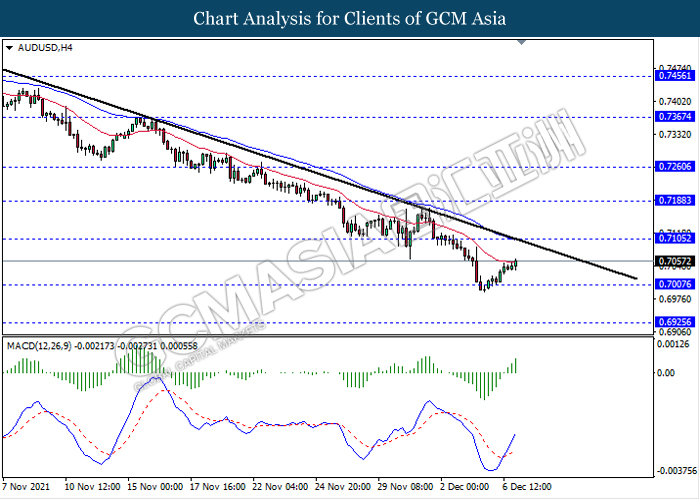

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level 0.7005. MACD which illustrate bullish momentum signal with the formation of golden cross suggest the pair to extend its rebound towards the resistance level 0.7105.

Resistance level: 0.7105, 0.7190

Support level: 0.7005, 0.6925

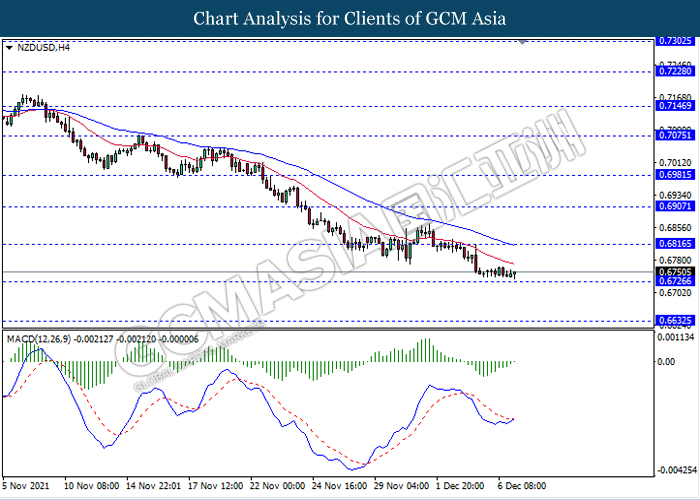

NZDUSD, H4: NZDUSD was traded flat while currently testing the support level 0.6725. However, MACD which illustrate diminishing bearish momentum signal with the formation of golden cross suggest the pair to be traded higher as a technical correction towards the resistance level 0.6815.

Resistance level: 0.6815, 0.6905

Support level: 0.6725, 0.6630

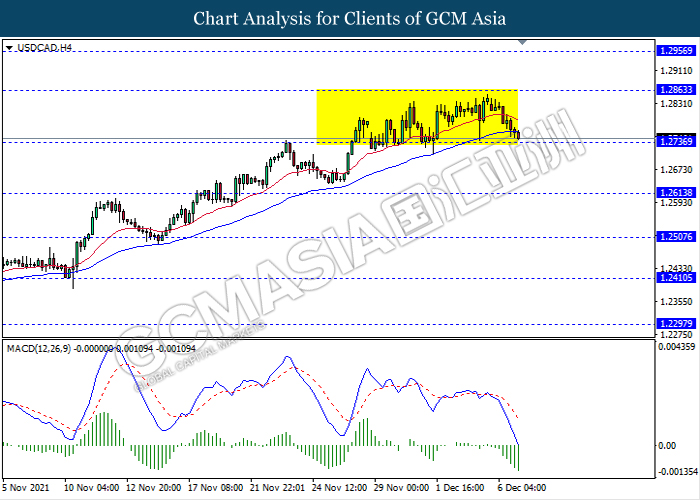

USDCAD, H4: USDCAD remain traded in a sideway channel while currently testing the support level 1.2735. MACD which illustrate bearish bias signal suggest the pair to extend its losses after it breaks below the support level 1.2735.

Resistance level: 1.2865, 1.2955

Support level: 1.2735, 1.2615

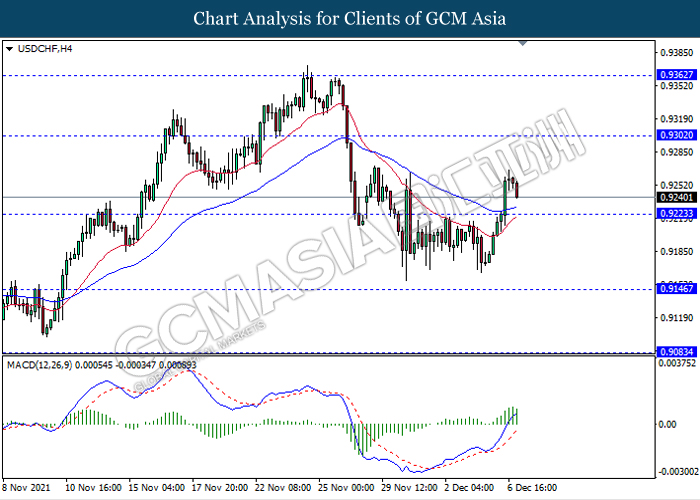

USDCHF, H4: USDCHF was traded lower following prior retracement from its high level. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its retracement in short term towards the support level 0.7225.

Resistance level: 0.9300, 0.9360

Support level: 0.9225, 0.9145

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level 69.15. MACD which illustrate persistent bullish momentum signal suggest the commodity to extend its gains towards the resistance level 72.10.

Resistance level: 72.10, 75.25

Support level: 69.20, 65.25

GOLD_, H4: Gold price was traded flat near the resistance level 1781.35. However, MACD which illustrate diminishing bullish momentum signal suggest the commodity to be traded lower towards the support level 1748.55.

Resistance level: 1781.35, 1807.85

Support level: 1748.55, 1725.70