07 December 2021 Morning Session Analysis

Pound slumped as dovish expectation.

The Pound Sterling extend its losses over the backdrop of dovish stance from the Bank of England. The new Omicron variant in the U.K. regions had spurred the uncertainty toward the economic progression in the United Kingdom. The Bank of England Governor Andrew Bailey acknowledged after the November policy meeting that the inflation rate would consistently run above 3%, significantly exceeding the target of the central bank. Though, Bailey suggested the central bank to continue scrutinize the implication of Omicron variant to gauge the likelihood decision for monetary policy. Economists expect majority of Monetary Policy Committee (MPC) would decide to maintain their current low interest rate in long-term basis in order to stabilize the economic momentum. High inflation risk as well as continuing expansionary monetary policy would be dragging down the appeal for the Pound Sterling, which prompting investors to shift their portfolio toward other assets. As of writing, GBP/USD depreciated by 0.05% to 1.3260.

In the commodities market, the crude oil price surged 0.10% to $70.15 per barrel as of writing. The crude oil price rebounded significantly following the top U.S. Infectious disease official, Anthony Fauci claimed that the infections cases in South Africa had only shown mild symptoms. Despite that, investors would wait for further data from WHO with regards of the Omicron virus to gauge the likelihood movement for the crude oil. On the other hand, the gold price slumped 0.05% to $1780.60 per troy ounces as of writing amid positive sentiment on the Covid-19 variant had spurred risk-on sentiment in the FX market, diminishing the demand on the safe-haven commodity.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:30 AUD RBA Rate Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:30 | AUD – RBA Interest Rate Decision (Dec) | 0.10% | 0.10% | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Dec) | 31.7 | 25.3 | – |

| 23:00 | CAD – Ivey PMI (Nov) | 59.3 | – | – |

Technical Analysis

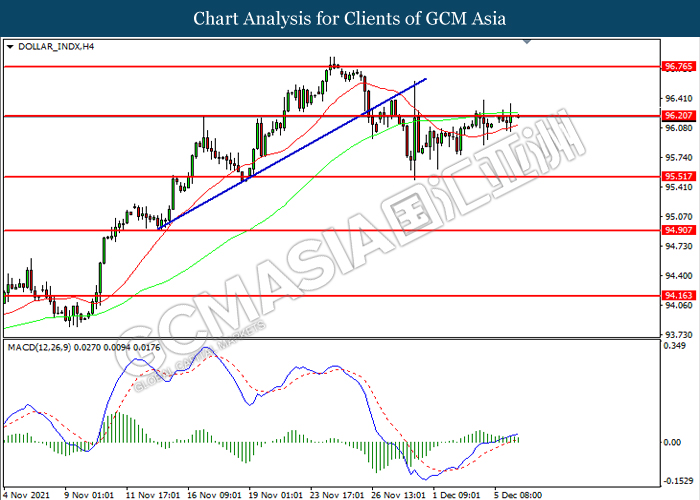

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 96.20. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower in short-term as technical correction.

Resistance level: 96.20, 96.75

Support level: 95.50, 94.90

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.3195. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3355, 1.3505

Support level: 1.3195, 1.3050

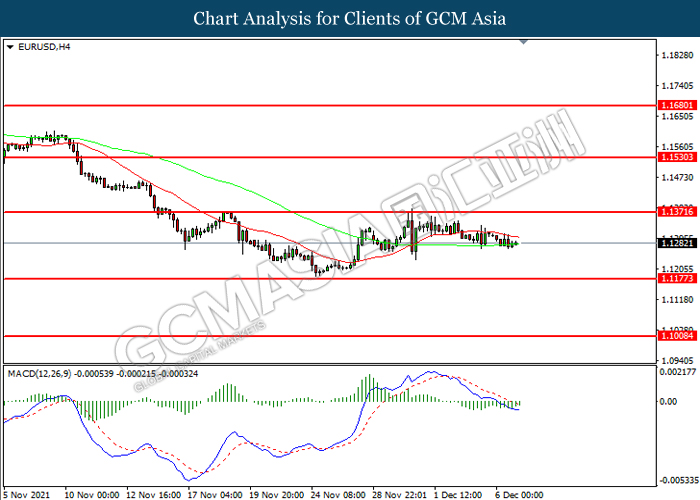

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level at 1.1370. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1370, 1.1530

Support level: 1.1175, 1.1010

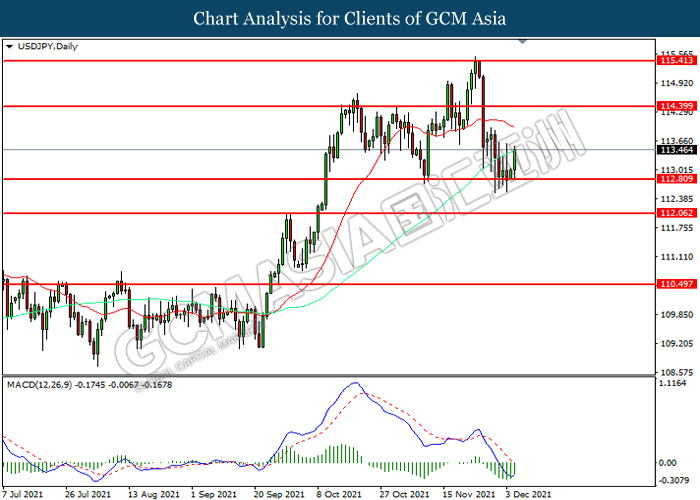

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 112.80. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 114.40.

Resistance level: 114.40, 115.40

Support level: 112.80, 112.05

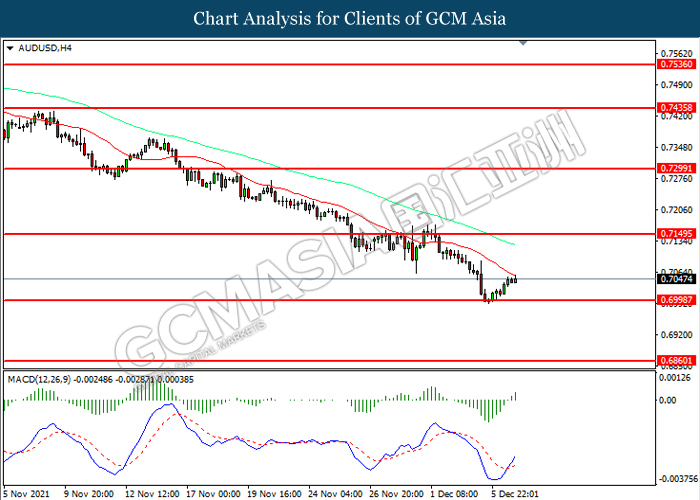

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7000. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7150.

Resistance level: 0.7150, 0.7300

Support level: 0.7000, 0.6860

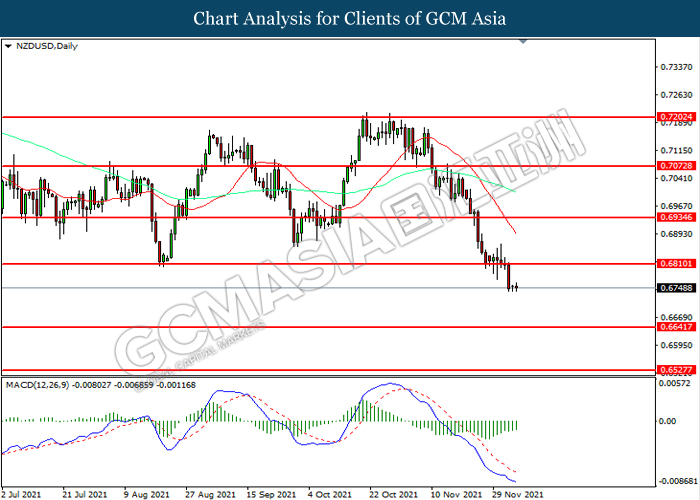

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6810. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6810, 0.6935

Support level: 0.6640, 0.6530

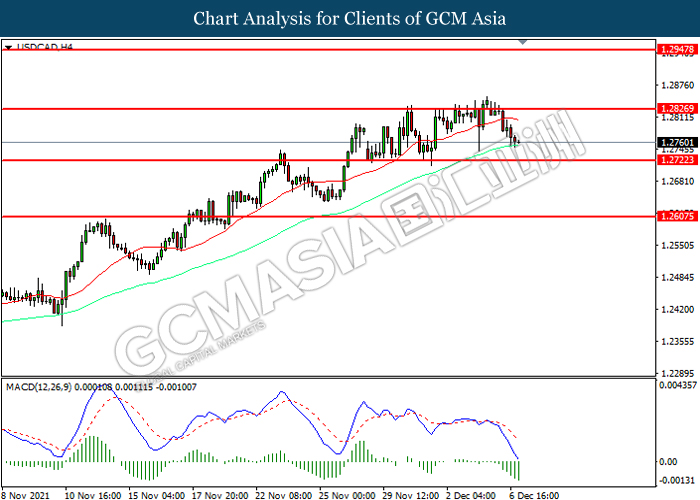

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.2720. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2825, 1.2950

Support level: 1.2720, 1.2610

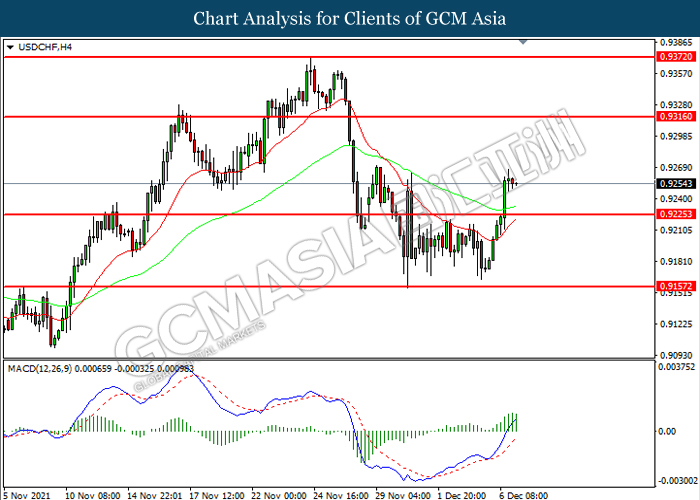

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9225. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.9315.

Resistance level: 0.9315, 0.9370

Support level: 0.9225, 0.9155

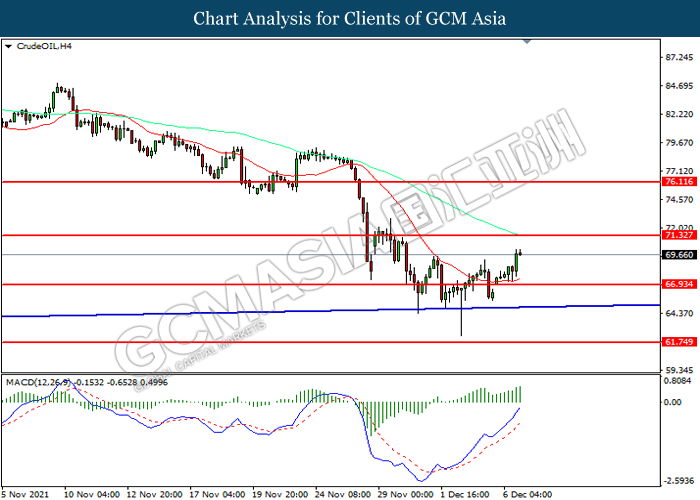

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 71.35. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 71.35, 76.10

Support level: 66.95, 61.75

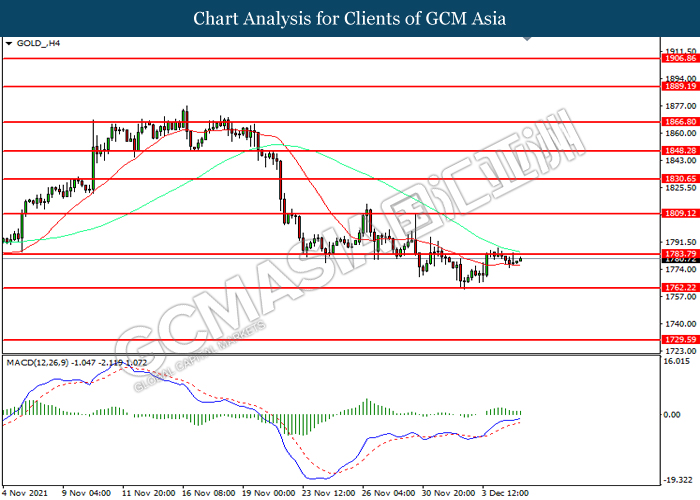

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1783.80. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1783.80, 1809.10

Support level: 1762.20, 1729.60