7 December 2022 Afternoon Session Analysis

Pound Sterling slipped following pessimistic market prospects.

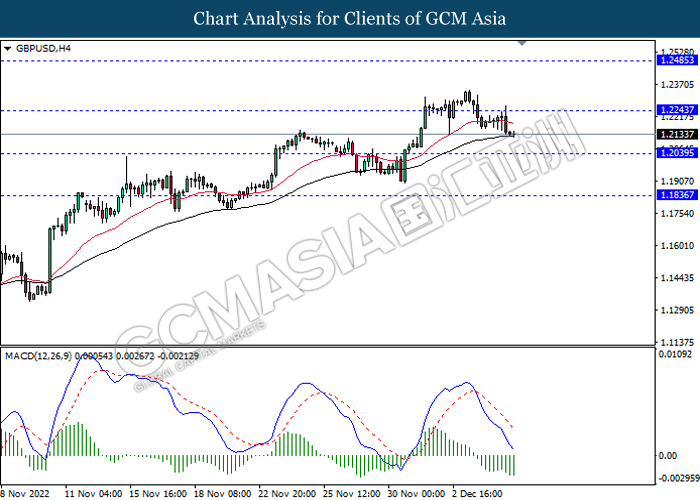

The GBP/USD, which widely traded by global investors dropped significantly over the downbeat economic data, which clouded the economic outlook in the UK. According to Markit/CIPS, the UK Construction Purchasing Managers Index (PMI) for November notched down from the previous reading of 53.2 to 50.4, much lower than the consensus anticipation of 52.0. Besides, both Bank of England (BoE) and government’s Office for Budget Responsibility were estimating that the UK economy was entering recession, after output dropped by 0.2% in the three months to the end of September. With such background, it dialed down the market optimism toward economic progression in the UK. On the other hand, the value of Australia Dollar eased after the bearish economic data has been unleashed. The Australia Gross Domestic Product (GDP) QoQ for third quarter slid from the prior figure of 0.9% to 0.6%, missing the market expectation of 0.7%. As of writing, the GBP/USD edged down by 0.01% to 1.2136 while the AUD/USD down by 0.02% to 0.6690.

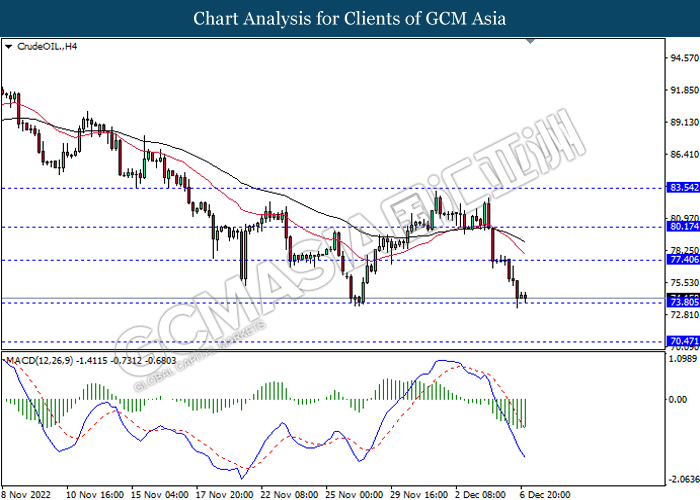

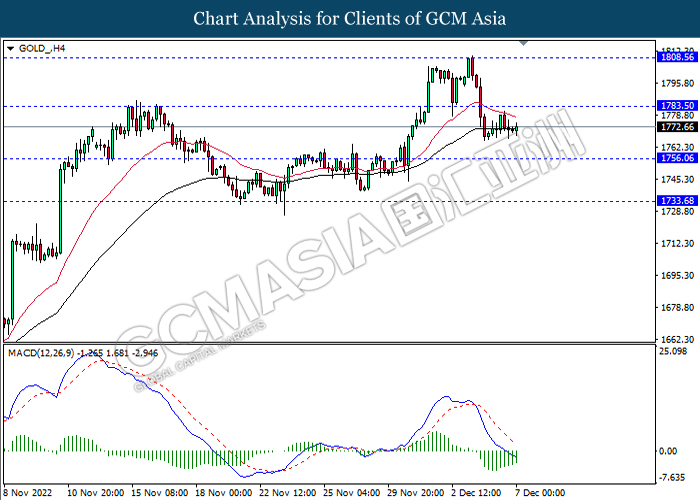

In the commodities market, the crude oil price depreciated by 0.23% to $74.08 per barrel as of writing following the economic uncertainty and the prospects of higher interest rate pressured oil price. In addition, the gold price appreciated by 0.04% to $1771.03 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 CAD BoC Rate Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | CAD – BoC Interest Rate Decision | 3.75% | 4.25% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -12.580M | -3.305M | – |

Technical Analysis

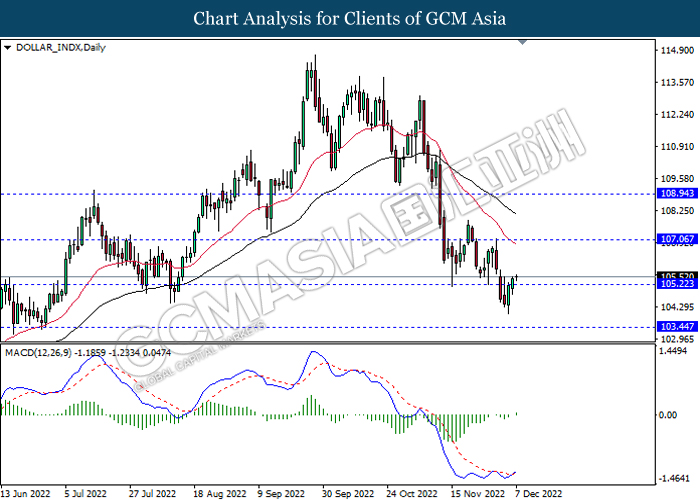

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 107.05, 108.95

Support level: 105.20, 103.45

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2245, 1.2485

Support level: 1.2040, 1.1835

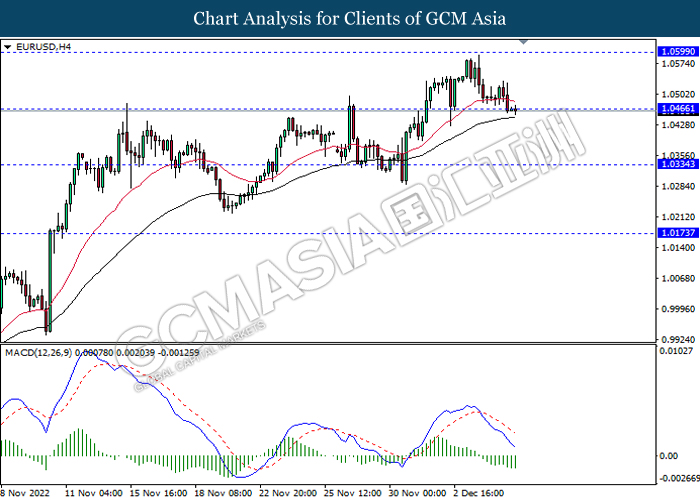

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0465, 1.0600

Support level: 1.0335, 1.0210

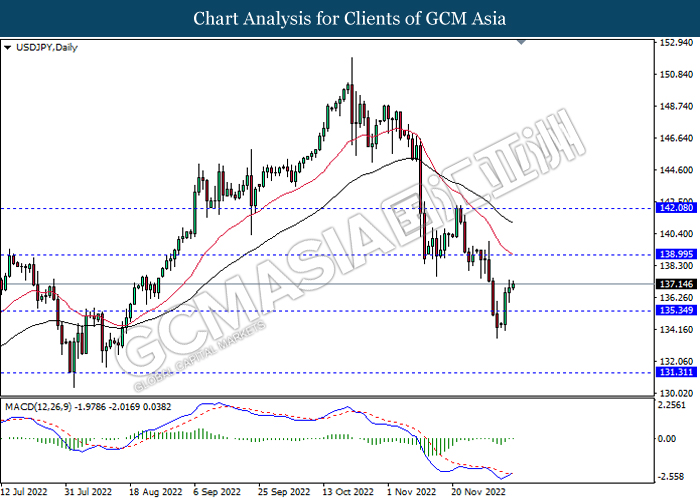

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

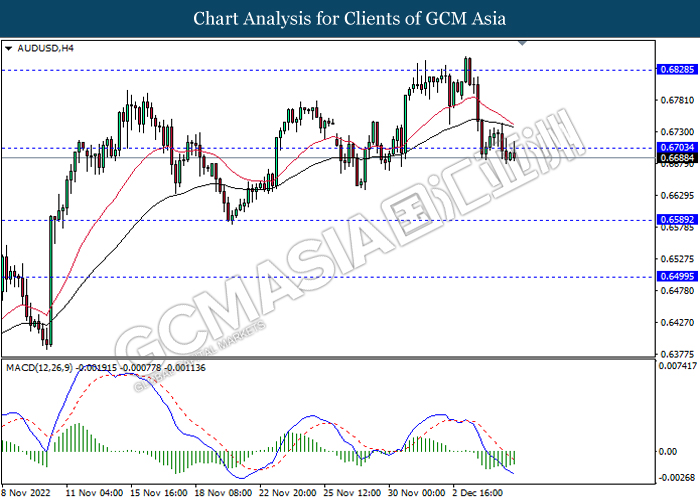

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6500

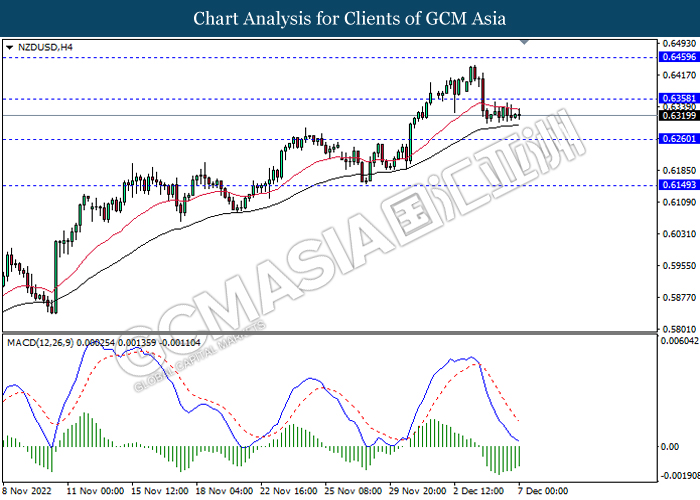

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

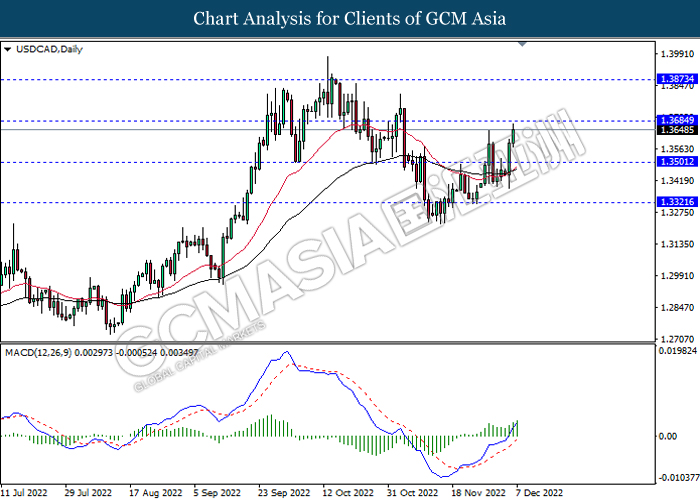

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

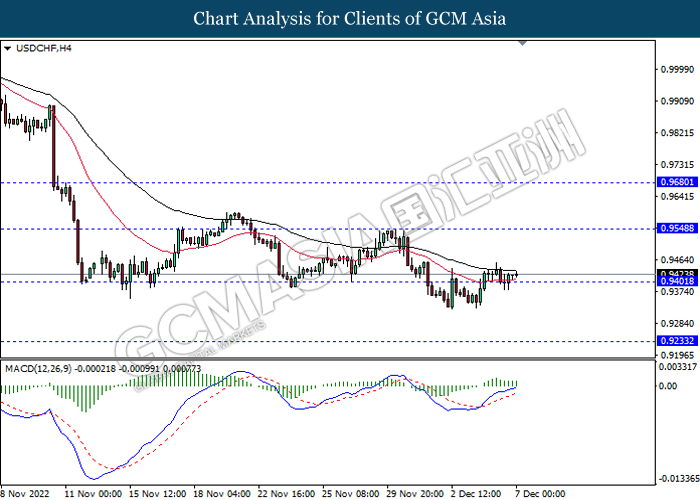

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9550, 0.9680

Support level: 0.9400, 0.9235

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 77.40, 80.15

Support level: 73.80, 70.45

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1783.50, 1808.55

Support level: 1756.05, 1733.70