8 June 2017 Daily Analysis

Bumpy ride ahead as Super Thursday approaches.

US dollar was offered higher on Thursday as while market participants look ahead to a trio of events that will heighten market risk namely European Central Bank (ECB) policy review, UK general election and testimony by former FBI director James Comey to the Congress. The dollar index ticked up 0.03% to 96.67 against six major peers. Overnight, greenback pared some gains as euro recovered some losses following reports that ECB may remain their dovish outlook at today’s policy announcement. Euro dipped 0.64% to $1.1204 after an alleged ECB draft suggests that they will cut its inflation forecast for the next three years to 1.5% due to slumping energy prices. The large sell-off in euro spurred a rise in greenback although its upside remained limited as investors adopt cautious approach before Comey testifies about Russia’s alleged involvement in US election last year. In the other region, pound sterling was held steady at $1.2961 while UK election will be the main focal point for the currency and its political outlook.

As for commodities market, crude oil price was up 0.57% to $45.98 following overnight’s slump after EIA reported a surprise swell in US crude inventories for the first time in 10 weeks. Crude inventories rose 3.3 million barrels for week ended June 2nd, missing economist expectation for a draw of 3.5 million barrels. Otherwise, gold price depreciates by 0.38% to $1,285.22 due to stronger dollar while investors anticipates a flurry of risky events later in the day.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

All Day GBP UK General Election

20:30 EUR ECB Press Conference

23:15 CAD BoC Gov Poloz Speaks

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 07:50 | JPY – GDP (QoQ) (Q1) | 0.5% | 0.6% | 0.3% |

| 09:30 | AUD – Trade Balance (Apr) | 3.107B | 1.950B | 0.555B |

| 10:30 | CNY – Trade Balance (USD) (May) | 38.05B | 46.32B | – |

| 15:15 | CHF – CPI (MoM) (May) | 0.2% | 0.1% | – |

| 19:45 | EUR – Deposit Facility Rate | -0.40% | -0.40% | – |

| 19:45 | EUR – ECB Interest Rate Decision (June) | 0.00% | 0.00% | – |

| 20:30 | USD – Initial Jobless Claims | 248K | 240K | – |

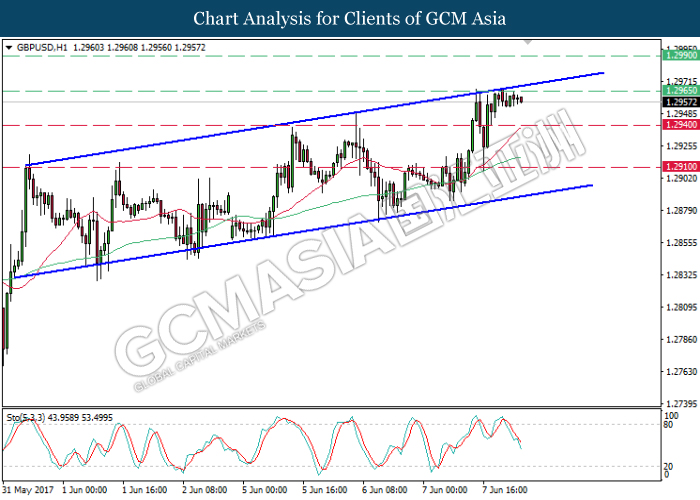

GBPUSD

GBPUSD, H1: GBPUSD remained traded within an upward channel while currently testing at the top level. Stochastic Oscillator illustrates a retrace signal from overbought level suggests GBPUSD to advance further down, towards the lower level of the channel after breaking the support level of 1.2940.

Resistance level: 1.2965, 1.2990

Support level: 1.2940, 1.2910

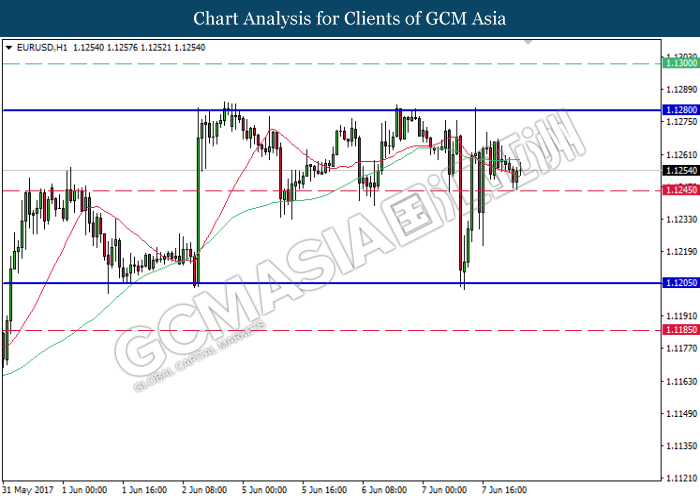

EURUSD

EURUSD, H1: EURUSD remained traded within a sideways channel while recently rebounded from the support level of 1.1245. A closure above the 60-moving average line (green) would suggest EURUSD to advance further up, towards the upper level of the channel. Long-term trend direction could only be determined following a successful breakout from either side of the channel.

Resistance level: 1.1280, 1.1300

Support level: 1.1245, 1.1205, 1.1185

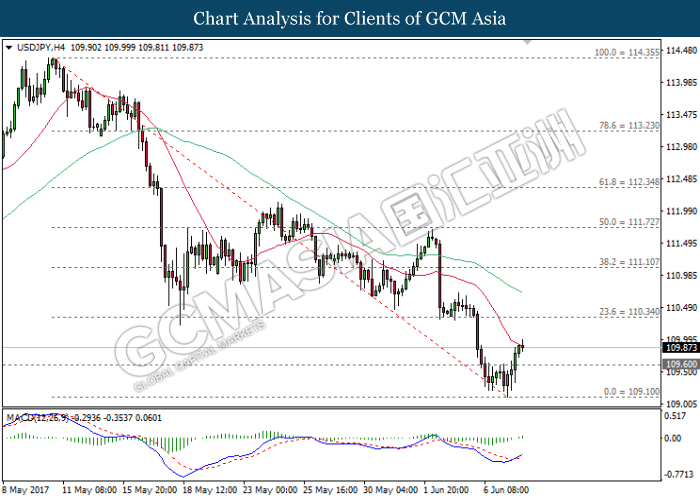

USDJPY

USDJPY, H4: USDJPY extended its technical correction following prior rebound from the support level of 109.10. With regards to MACD histogram which illustrates substantial upward signal, it is expected to move further up towards the target of resistance level at 110.35.

Resistance level: 110.35, 111.10

Support level: 109.60, 109.10

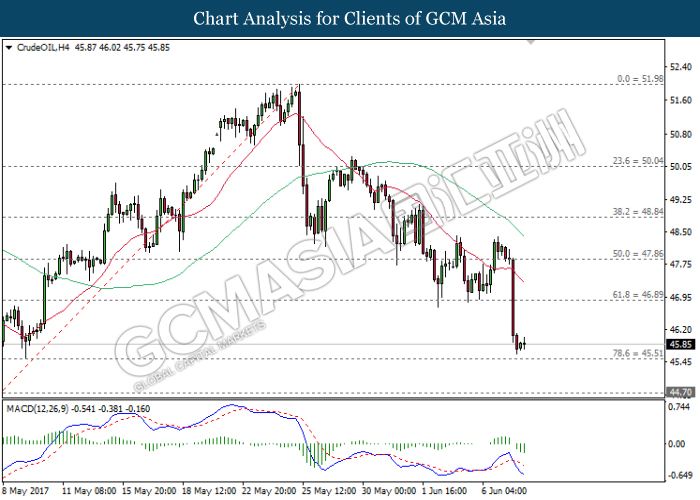

CrudeOIL

CrudeOIL, H4: Crude oil price slumped sharply following prior breakthrough from the strong support level of 46.90. MACD histogram which illustrates downward signal and momentum suggests crude oil price to extend its losses after breaking the support level of 45.50.

Resistance level: 46.90, 47.85

Support level: 45.50, 44.70

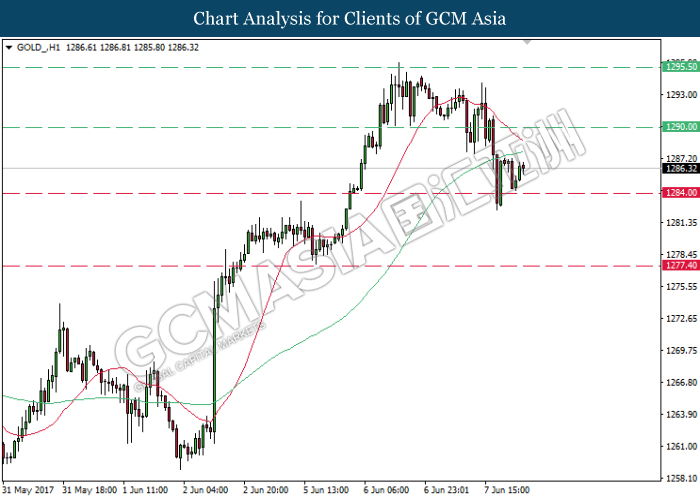

GOLD

GOLD_, H1: Gold price was traded higher following prior rebound from the support level of 1284.00. However, as both moving average line continues to narrow downwards and may form an imminent death cross formation, gold price is subject to downside bias towards the target of support level at 1284.00.

Resistance level: 1290.00, 1295.50

Support level: 1284.00, 1277.40