08 June 2021 Morning Session Analysis

US Dollar slumped amid dovish expectation.

The Dollar Index which traded against a basket of six major currency pairs extend its losses yesterday amid U.S. Treasury yields were lower while investors continue to scrutinize the U.S. Central Bank meetings. Worse-than-expectation economic data had spurred the expectation that the Federal Reserve will continue to maintain its aggressive expansionary monetary policy in order to support the jobs market in United States, which diminishing the appeal of the US Dollar. Nonetheless, as for now investors would continue to focus on the U.S. inflation data in future to gauge the likelihood movement for the currency. A jump in prices could be prompting the Federal Reserve to be tightening back its monetary policy plan to combat the high inflation risk in future. As of writing, the Dollar Index slumped 0.18% to 90.00.

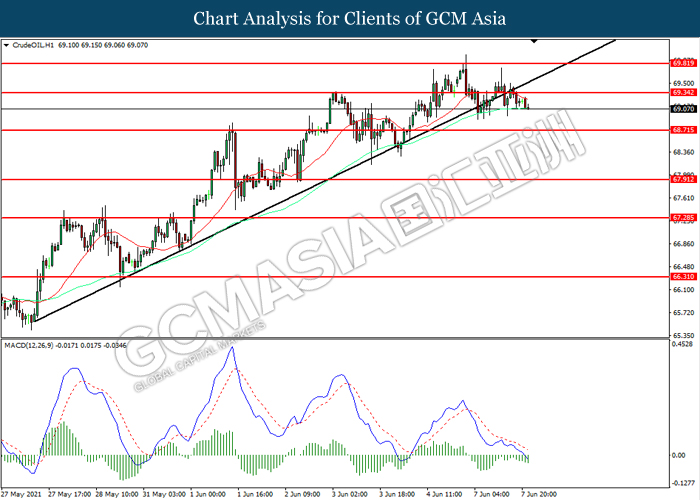

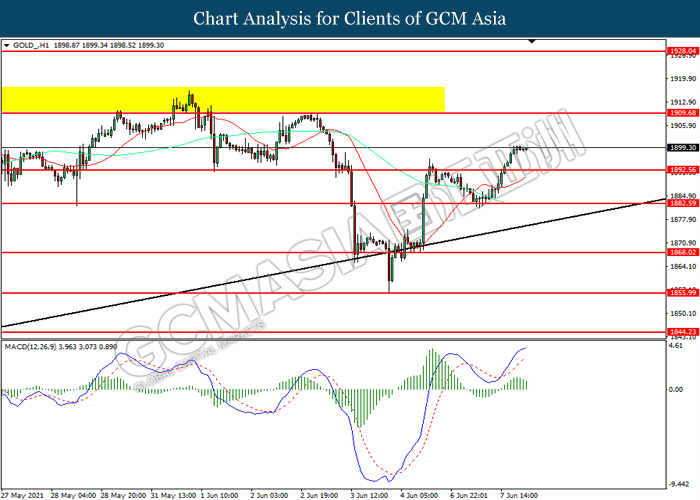

In the commodities market, the crude oil price slumped 0.33% to $68.75 per troy ounces as of writing. The oil market edged lower on profit taking after reaching 2-year high. Though, the overall trend for the crude oil price remained bullish on expectations of improved demand and OPEC producers keeping supply curbs in place. On the other hand, the gold price surged 0.01% to $1899.15 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German ZEW Economic Sentiment (Jun) | 84.4 | 85.3 | – |

| 22:00 | USD – JOLTs Job Openings (Apr) | 8.123M | – | – |

Technical Analysis

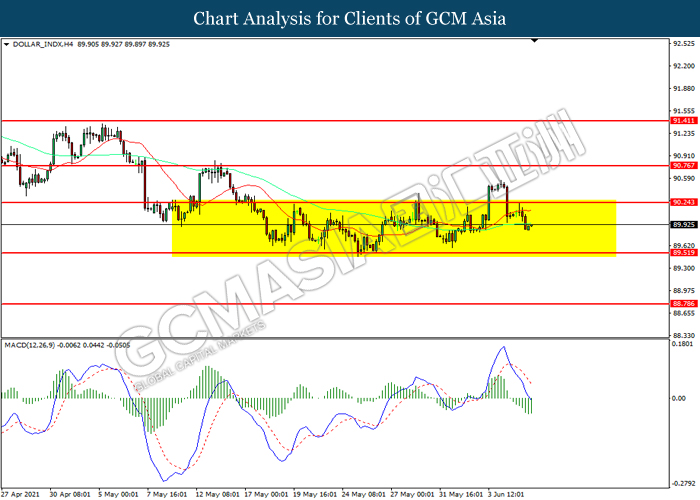

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level at 90.25. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward support level at 89.50.

Resistance level: 90.25. 90.75

Support level: 89.50, 88.80

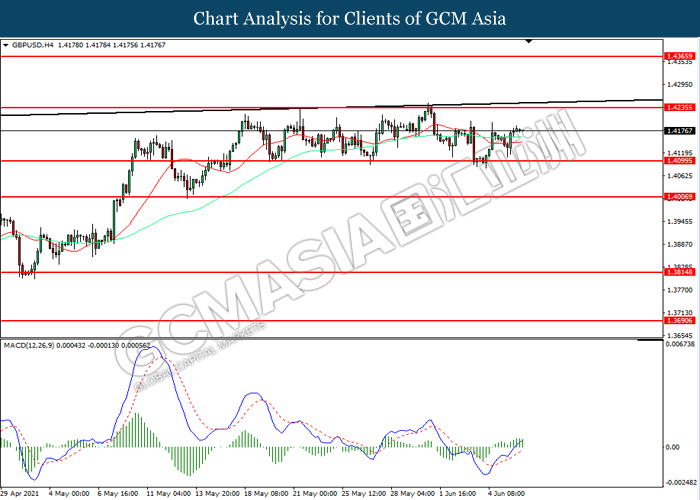

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.4100. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.4235, 1.4365

Support level: 1.4100, 1.4005

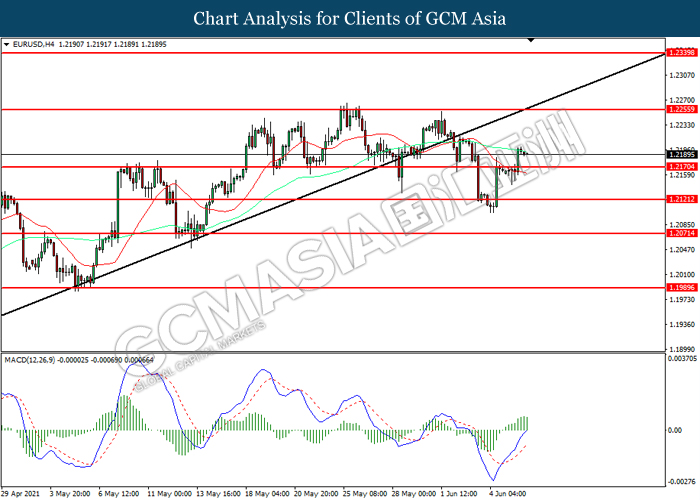

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level at 1.2170. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.2255, 1.2340

Support level: 1.2170, 1.2120

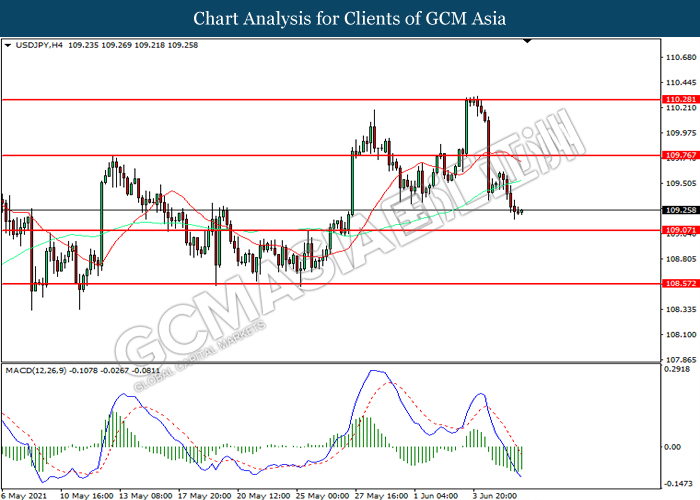

USDJPY, H4: USDJPY was traded lower while currently near the support level at 109.05. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 109.75, 110.30

Support level: 109.05, 108.55

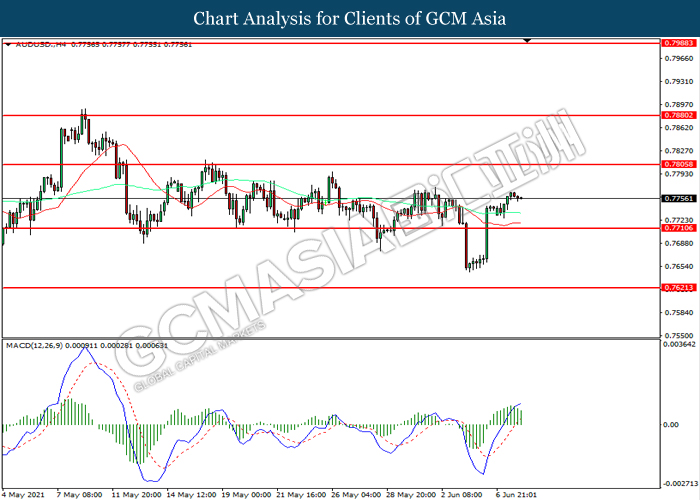

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7710. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.7805, 0.7880

Support level: 0.7710, 0.7620

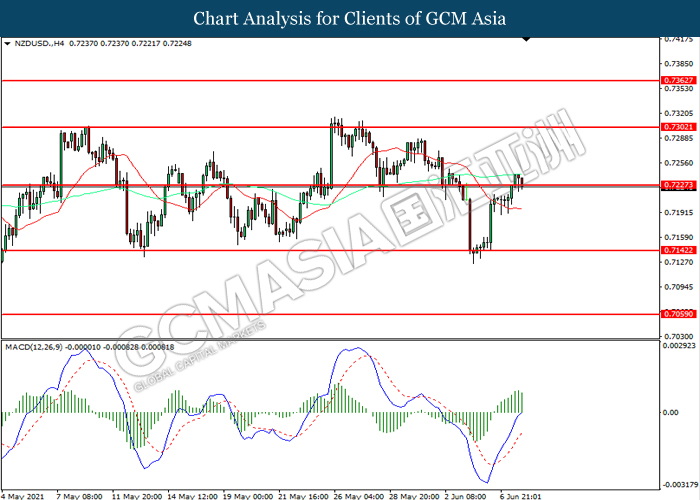

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.7725. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.7225, 0.7300

Support level: 0.7140, 0.7060

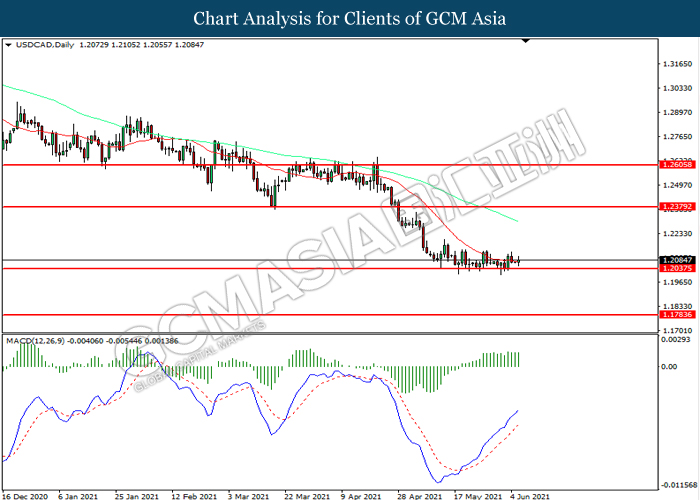

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2040. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2380, 1.2605

Support level: 1.2040, 1.1785

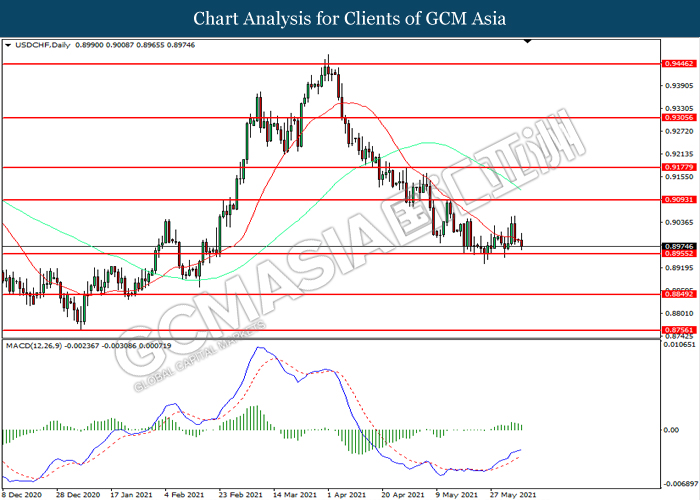

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.8955. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9095, 0.9175

Support level: 0.8955, 0.8850

CrudeOIL, H1: Crude oil price was traded lower following prior breakout below the previous support level at 69.35. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 68.70.

Resistance level: 69.35, 69.80

Support level: 68.70, 67.90

GOLD_, H1: Gold price was traded higher following prior breakout above the previous resistance level at 1892.55. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1909.70, 1928.05

Support level: 1892.55, 1882.60