8 August 2022 Morning Session Analysis

Dollar surged as risk-off sentiment took hold.

The dollar index, which was traded against a basket of major currencies, jumped as the deteriorating of the tensions between the US and China exerted unstoppable bullish momentum in the market. According to the latest development, China has taken some retaliatory measures such as halting the dialogue between the US and Chinese defense officials, while suspending the co-operation on issue of illegal immigrants returns, climate change and International crime. Such decision was made following the visit of Ms Pelosi to Taiwan a week ago, which showing the US obstinate stance on disregarding the China’s strong opposition and serious representations. Going forward, we reck on that the military drill would likely to keep going for an extended of time, whereby the geopolitical tensions would heighten further. On the other side, the upbeat NFP and unemployment data have also pushed the dollar index higher on last Friday trading session. As of writing, the dollar index retraced slightly by 0.02% to 106.60.

In the commodities market, the crude oil price up 0.47% to $90.10 a barrel as the black commodity market is still surrounded by the supply shortage concerns. However, with the heightening of geopolitical tensions between the US and China, the black commodity outlook remains clouded. Besides, the gold prices dropped -0.14% to $1772.40 per troy ounce as the upbeat employment data dragged down the traditional safe-haven asset.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

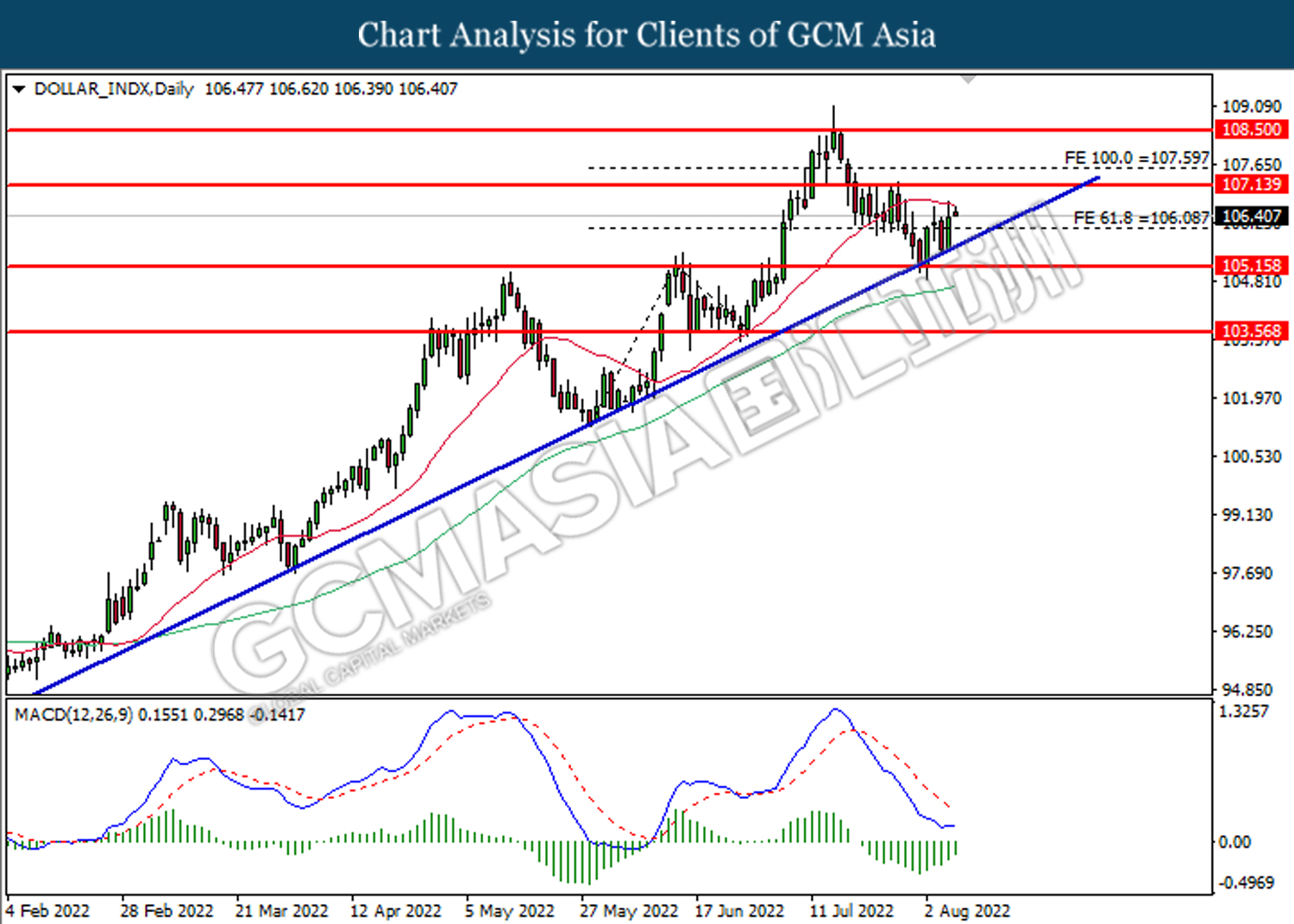

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the upward trendline. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 107.15.

Resistance level: 107.15, 107.60

Support level: 106.10, 105.15

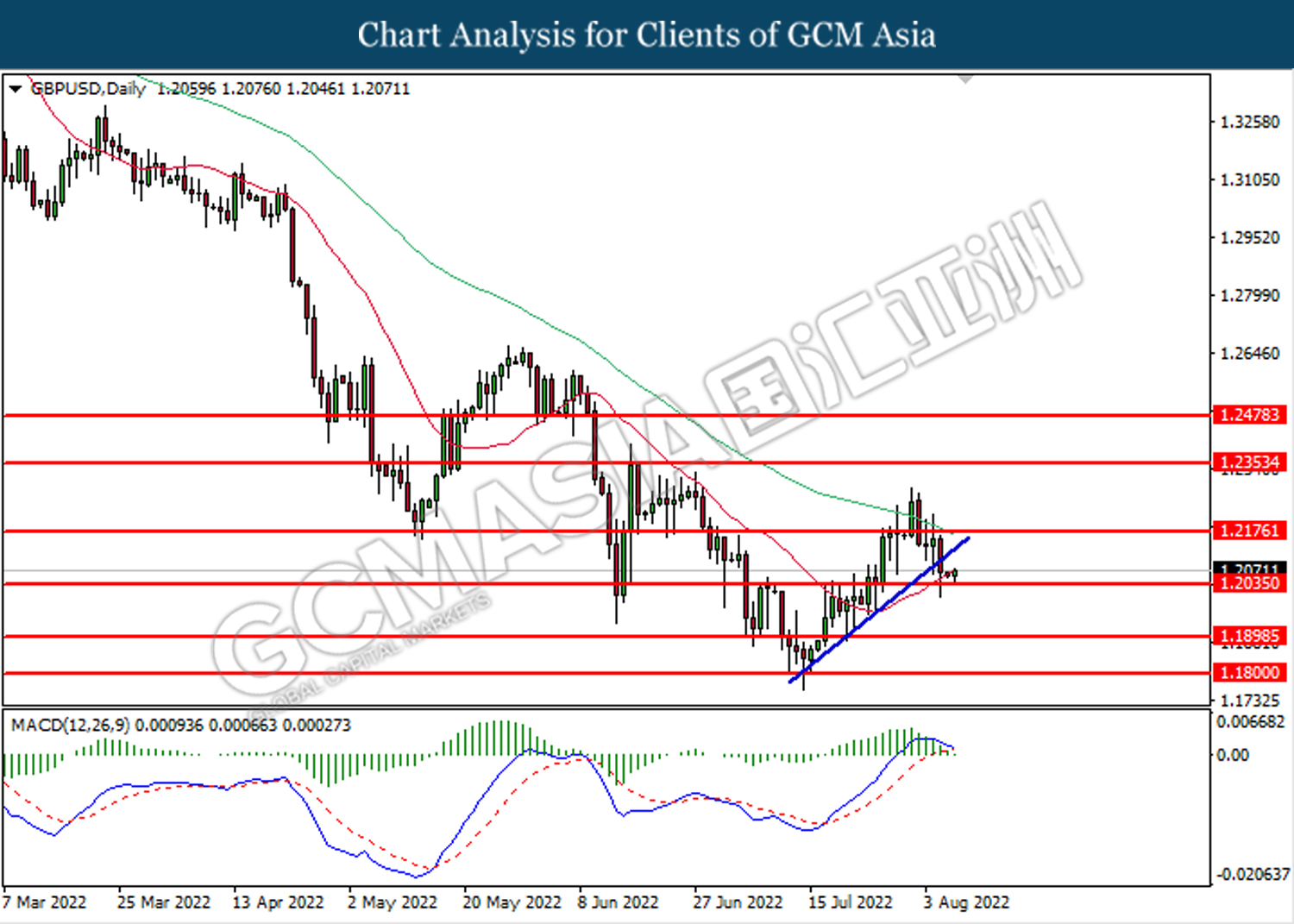

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2035. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0155. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo short term technical correction.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

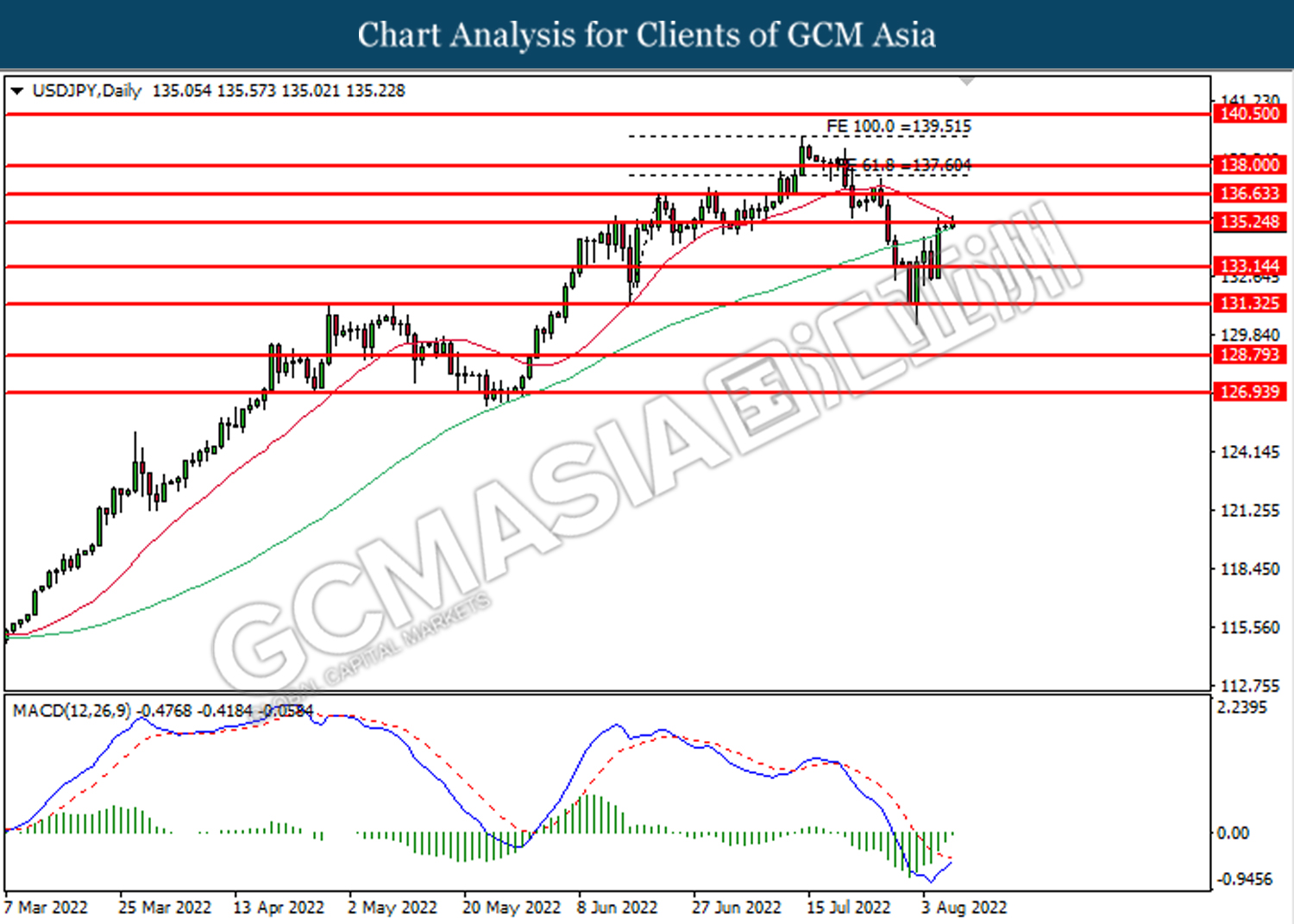

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 135.25. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 135.25, 136.65

Support level: 133.15, 131.35

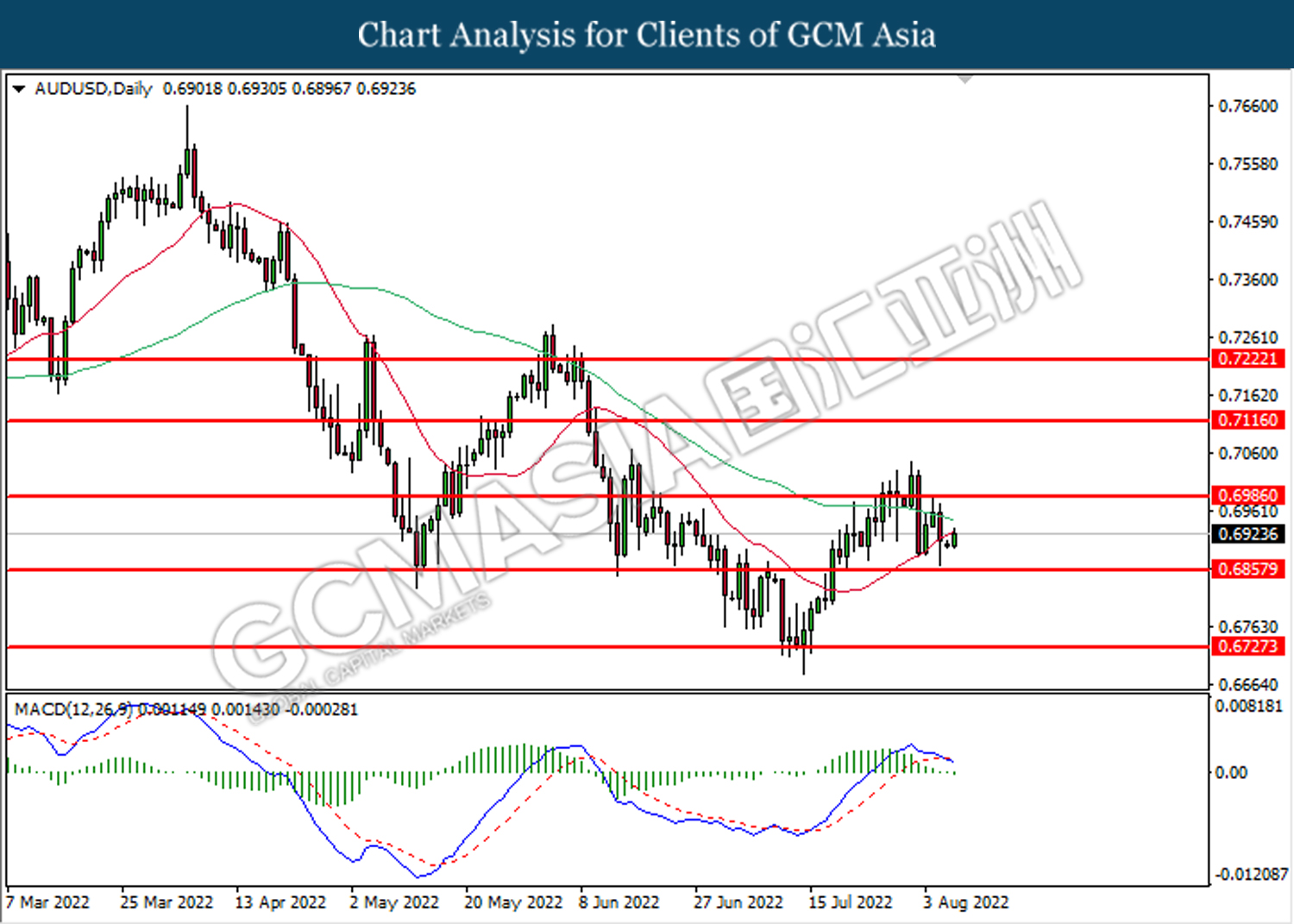

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6855. However, MACD which illustrated bearish momentum suggest the pair to undergo a short term technical correction.

Resistance level: 0.6985, 0.7115

Support level: 0.6855, 0.6725

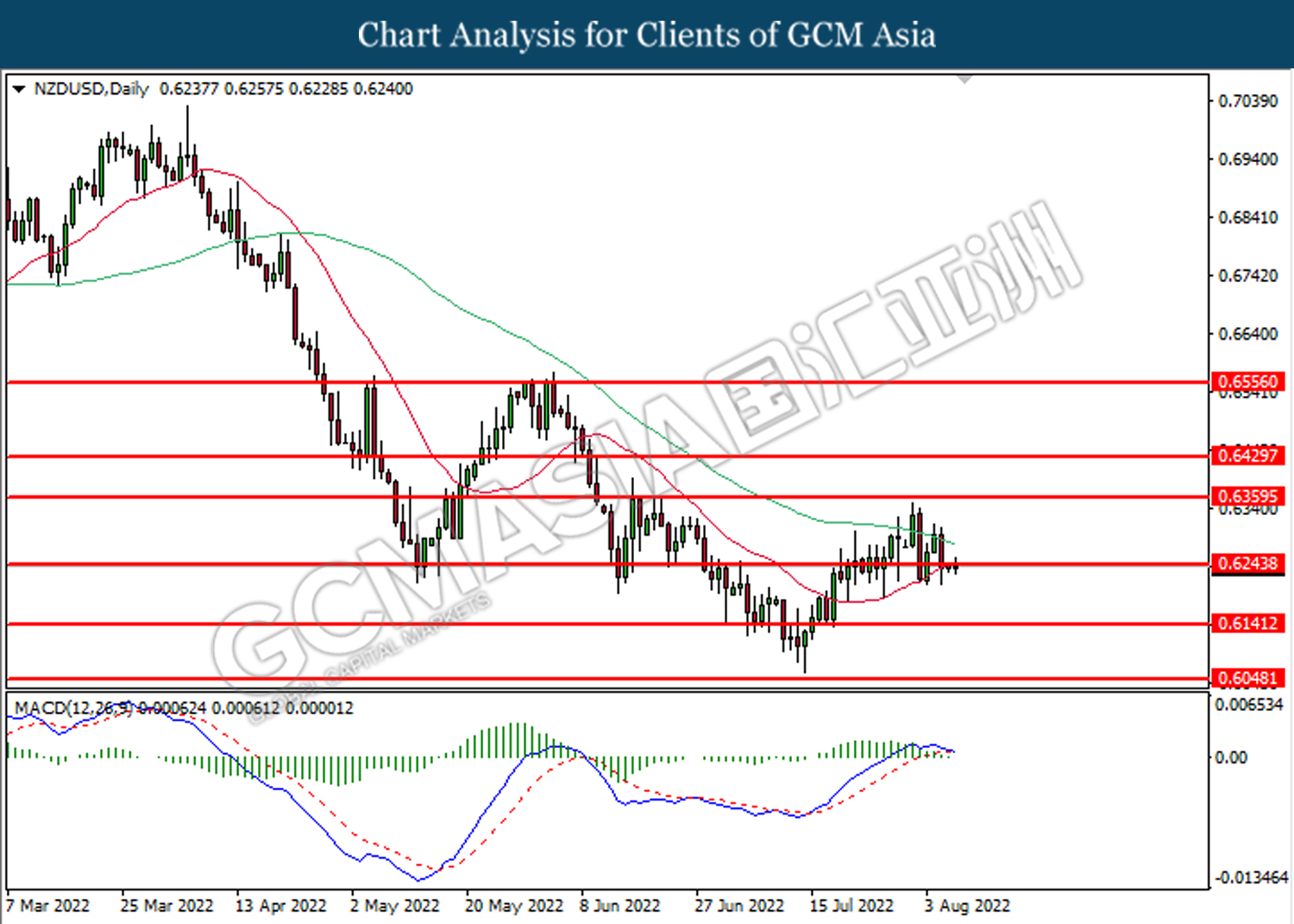

NZDUSD, Daily: NZDUSD was traded lower while currently testing near the support level at 0.6245. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

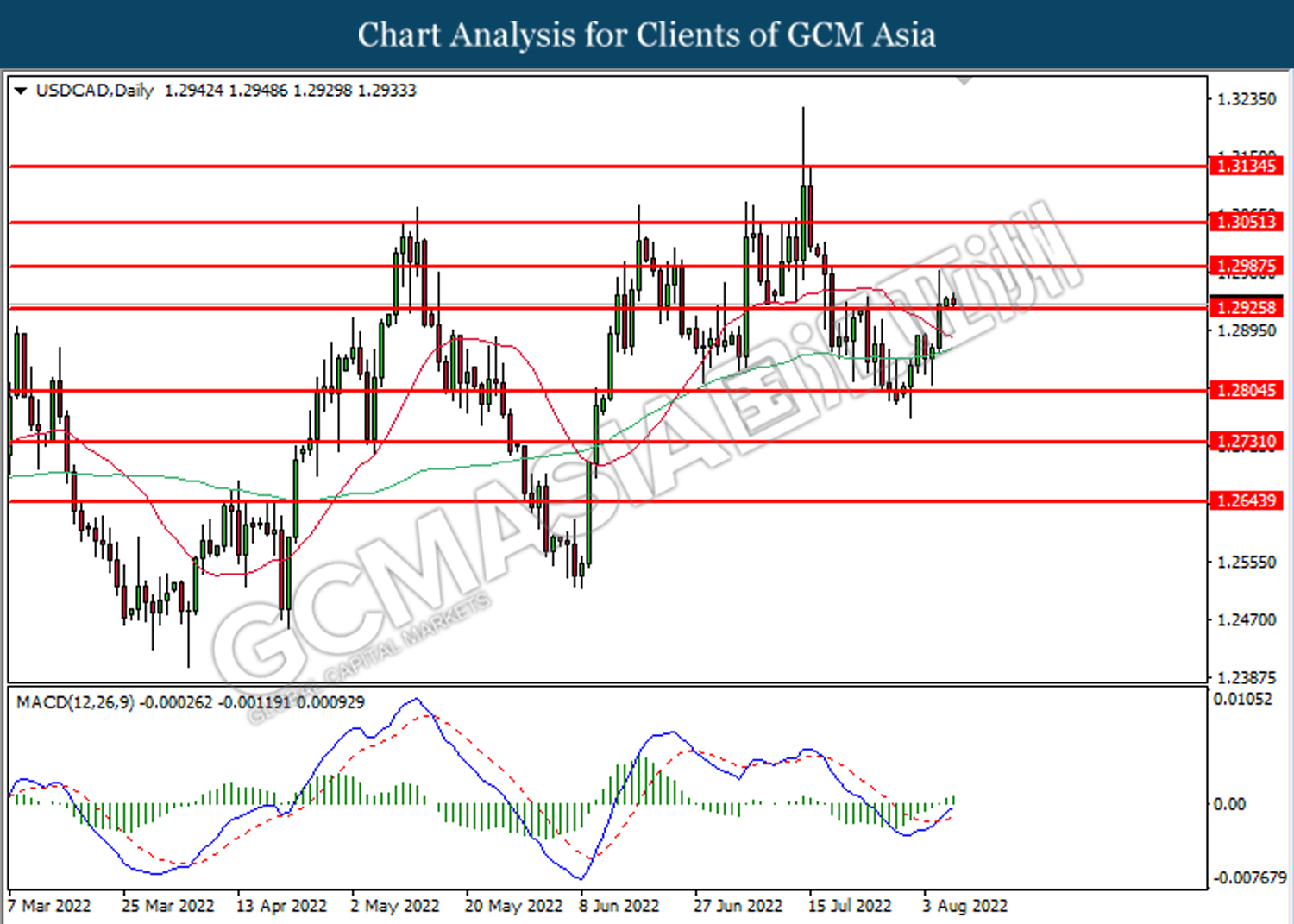

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.2925. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.2985.

Resistance level: 1.2985, 1.3050

Support level: 1.2925, 1.2805

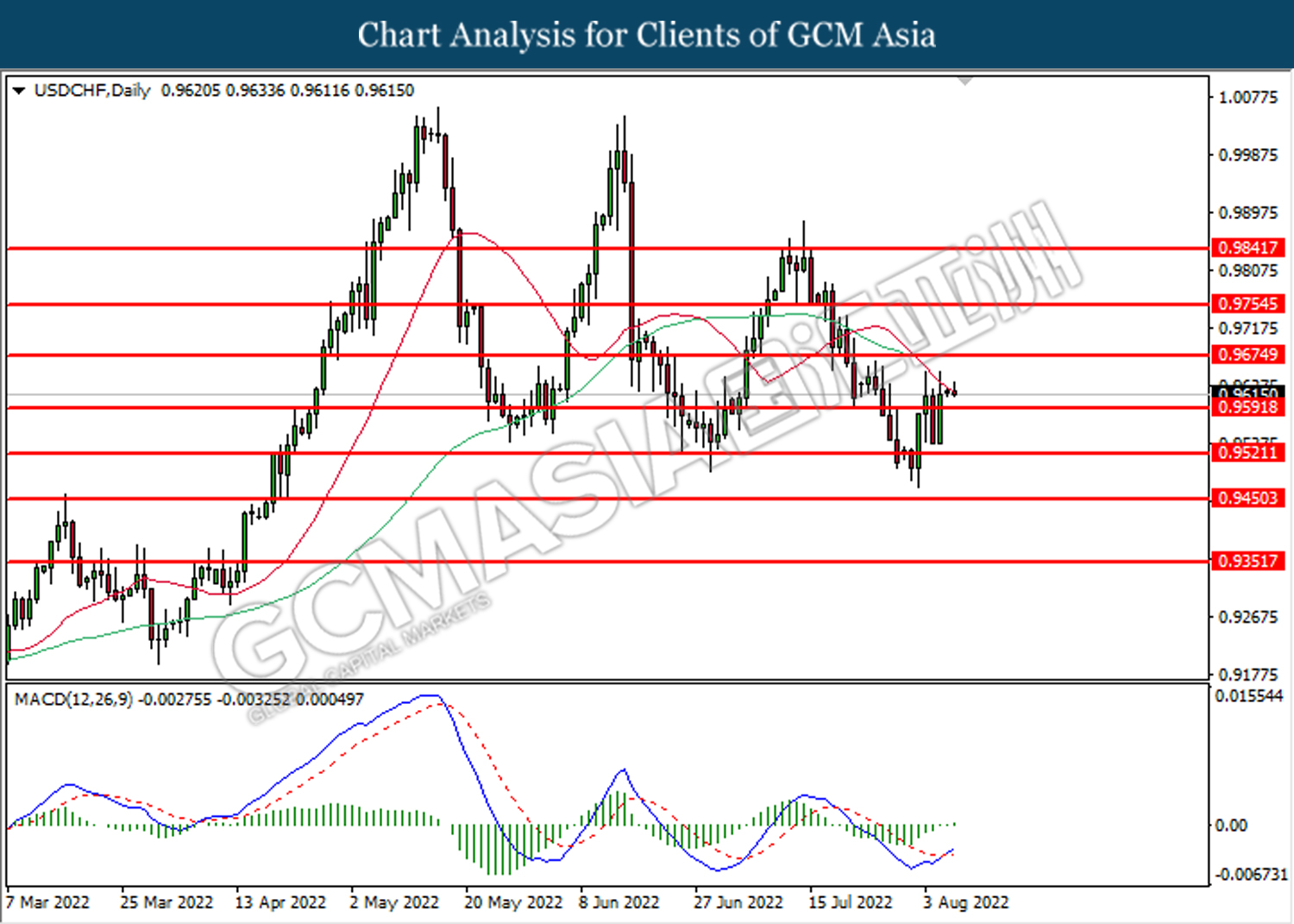

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9590. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9675.

Resistance level: 0.9675, 0.9755

Support level: 0.9590, 0.9520

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level at 87.30. MACD which illustrated ongoing bullish momentum suggests the commodity to extend its gains toward the resistance level at 89.70.

Resistance level: 89.70, 91.80

Support level: 87.30, 82.70

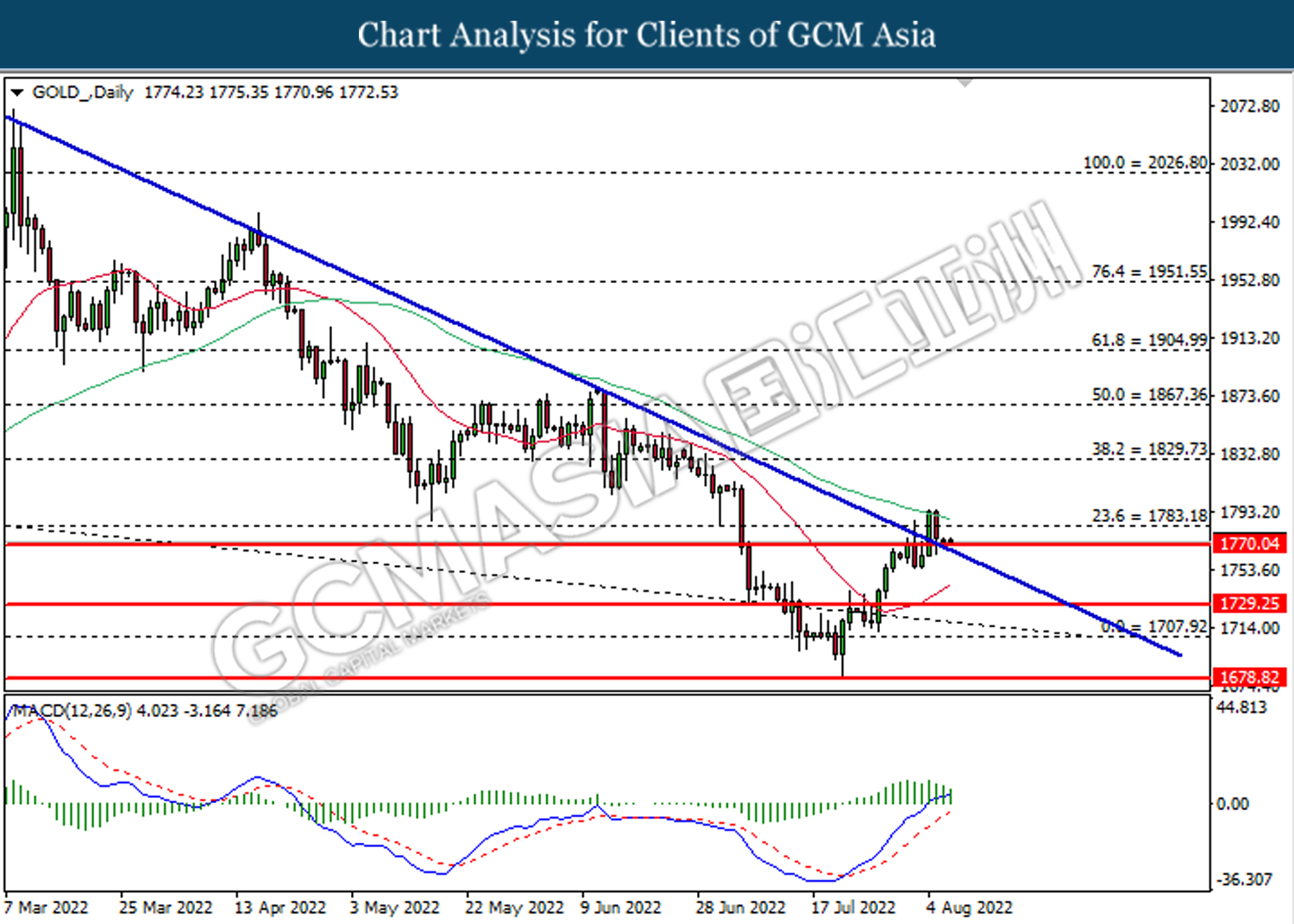

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1770.05. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1783.20, 1829.75

Support level: 1770.05, 1729.25