8 August 2022 Morning Session Analysis

US Dollar surged over the bullish employment data.

The Dollar Index which traded against a basket of six major currencies rose significantly after the upbeat employment data have been released. According to Bureau of Labor Statistics, the US Nonfarm Payrolls for the month of July notched up from the previous reading of 398K to 528K, exceeding the consensus forecast of 250K. Besides, the US Unemployment Rate for July had posted at the reading of 3.5%, which lower than the 3.6% as widely expected. The optimistic reading of these two crucial employment data hinted that the current US labor market remained forceful, which led investors to turn their eyes on economic progression in the US. In addition, the Dollar Index extended its gains following the hawkish statement from Fed member. According to CNBC, Federal Reserve Governor Michelle Bowman claimed that she supports the big rate hikes which recently implemented by the central bank as well as the path of rate hikes would likely to continue until inflation is subdued. As of writing, the Dollar Index appreciated by 0.04% to 106.53.

In the commodities market, the crude oil price dropped by 1.17% to $87.97 per barrel as of writing as the global economy outlook remained clouded. On the other hand, the gold price depreciated by 0.04% to $1774.18 per troy ounce as of writing amid the value of US Dollar heightened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

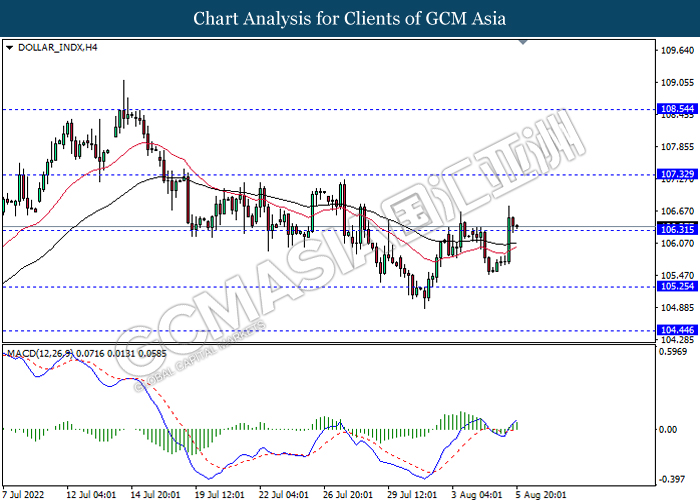

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the index to be traded higher as technical correction.

Resistance level: 107.30, 108.55

Support level: 106.30, 105.25

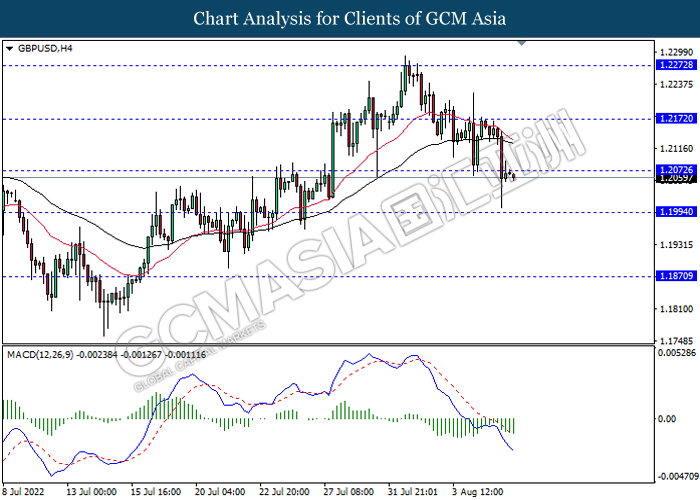

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2070, 1.2170

Support level: 1.1995, 1.1870

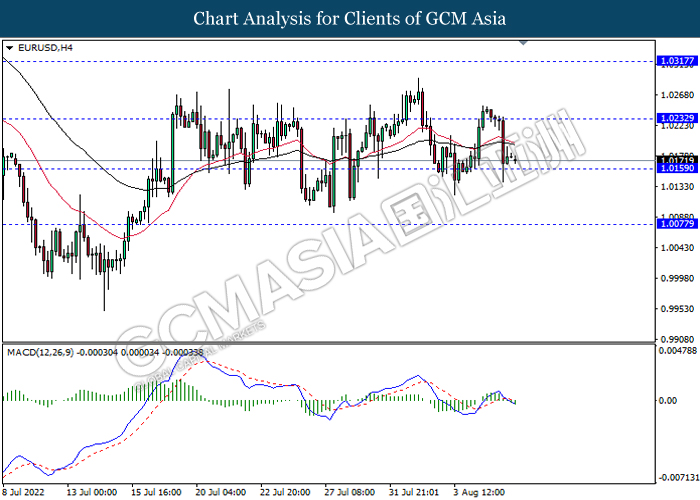

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0230, 1.0315

Support level: 1.0160, 1.0075

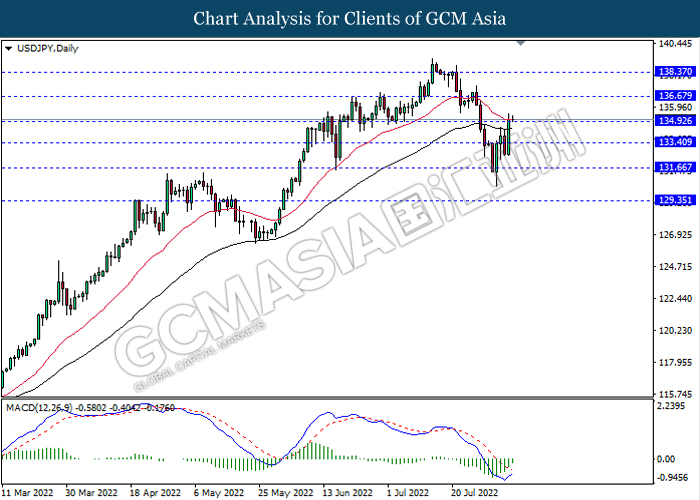

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 136.65, 138.35

Support level: 134.90, 133.40

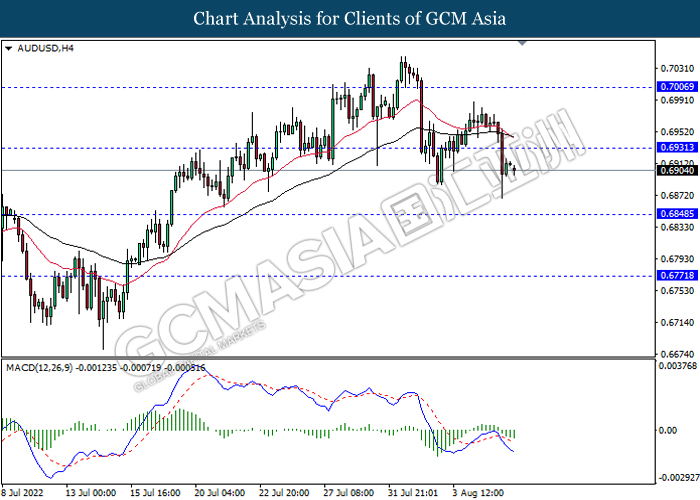

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6930, 0.7005

Support level: 0.6850, 0.6770

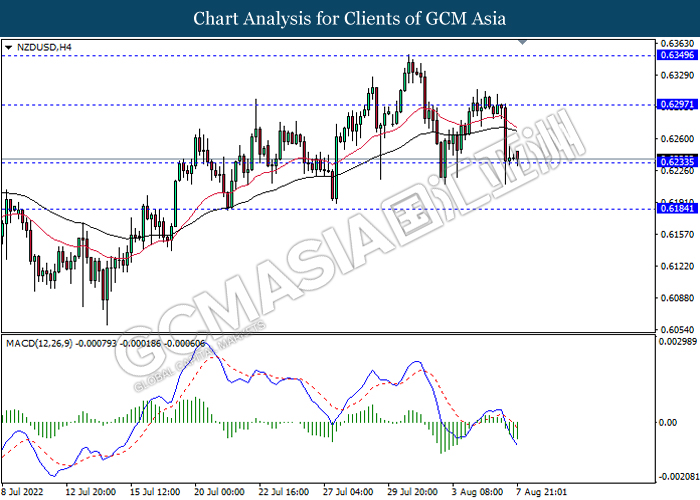

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6185

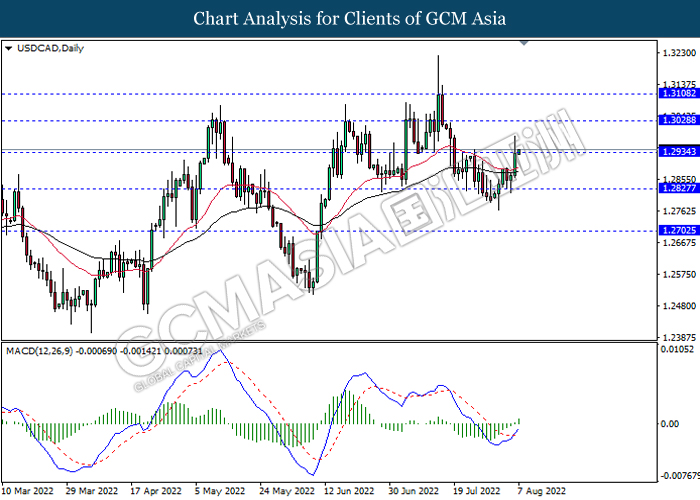

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3030, 1.3110

Support level: 1.2935, 1.2825

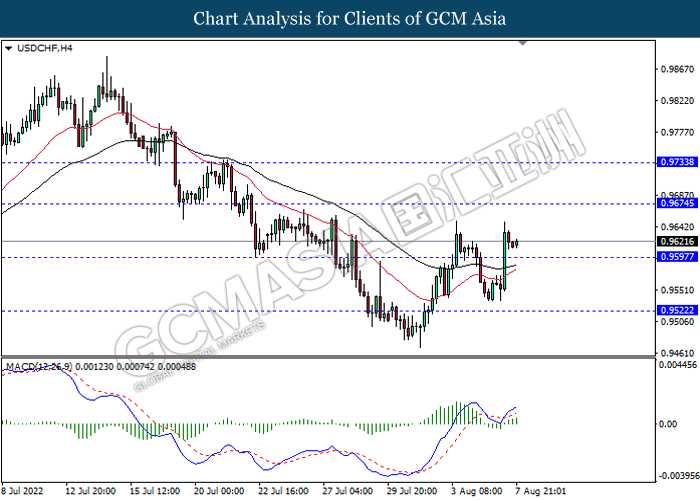

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9675, 0.9735

Support level: 0.9595, 0.9520

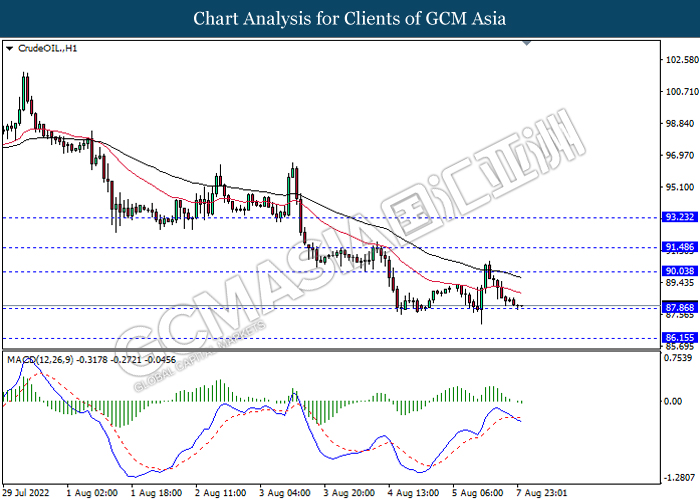

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 90.05, 91.48

Support level: 87.85, 86.15

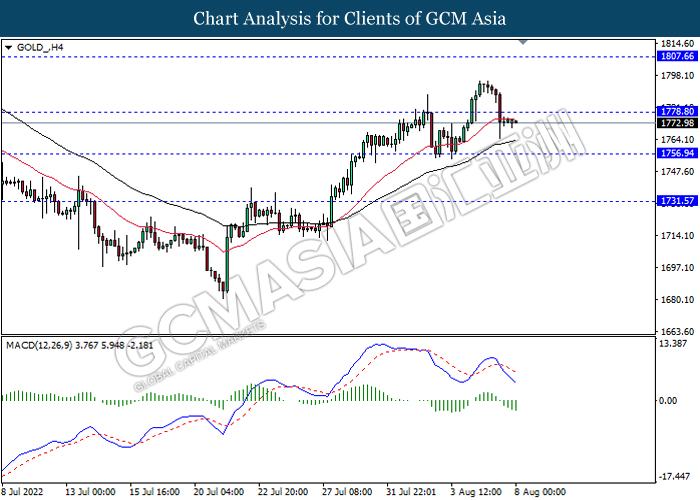

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1778.80, 1807.65

Support level: 1756.95, 1731.55