08 September 2020 Afternoon Session Analysis

Japanese Yen rose following upbeat data.

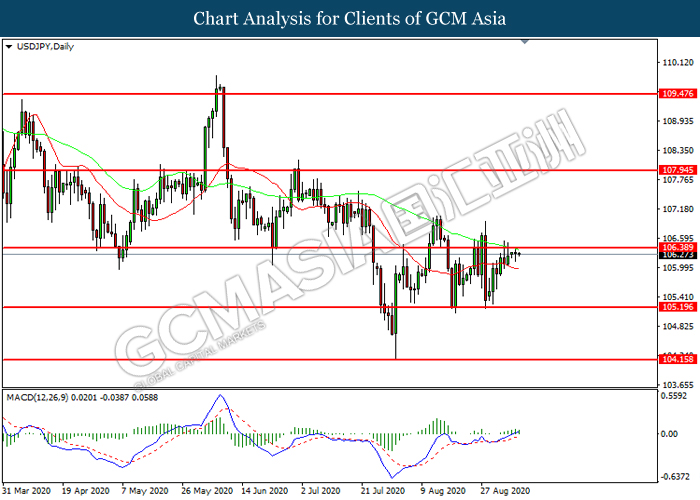

The Japanese Yen which traded against the dollar and other currency pairs have edge higher following a better-than-expected GDP. According to the Japan Cabinet Office, Japan GDP for the second quarter have improved to -7.9, beating market expectation of -8.1. The annual figure also came in better at -28.1% against market forecast of -28.6%. Besides risk-aversion mood remains high which help supporting the Yen amid the escalating tension between U.S and China as well as the recent border tussle between India and Beijing. On the other hand, call for snap election in Japan also weigh on the risk sentiment. Japan’s Chief Cabinet Yoshihide Suga, which is also a potential frontrunner to succeed Prime Minister Shinzo Abe have stated to Asahi that the prime minister has the right to dissolve parliament and call for a snap election. If the next one decides to call on, that should be the case. If not, it won’t happen. At the time of writing, USD/JPY rose 0.02% to 106.26.

In the commodities market, crude oil price extend losses and fell 0.11% to $39.10 per barrel as of writing following price reduction from Saudi Arabia and worsening relations between U.S and China. As of now, demand outlook remains uncertain after Saudi Aramco reduce pricing for October crude oil sales. At the same time, President Donald Trump stated that he intends to curb the U.S economic relationship with China and threatening to punish any companies that have any business activities with China. On the other hand, gold price slips 0.12% to $1925.20 a troy ounce at the time of writing amid upbeat performance in U.S dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

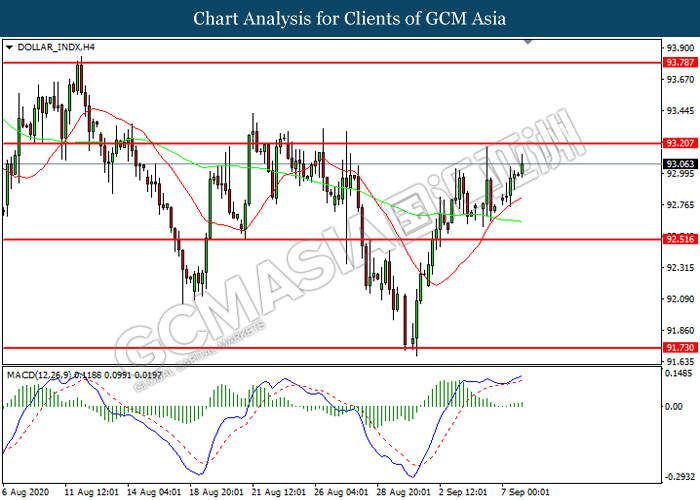

DOLLAR_INDX, H4: Dollar index was traded higher while currently near the resistance level at 93.20. MACD which illustrated increasing bullish momentum suggest the index to extend its gains toward resistance level at 93.20.

Resistance level: 93.20, 93.80

Support level: 92.50, 91.75

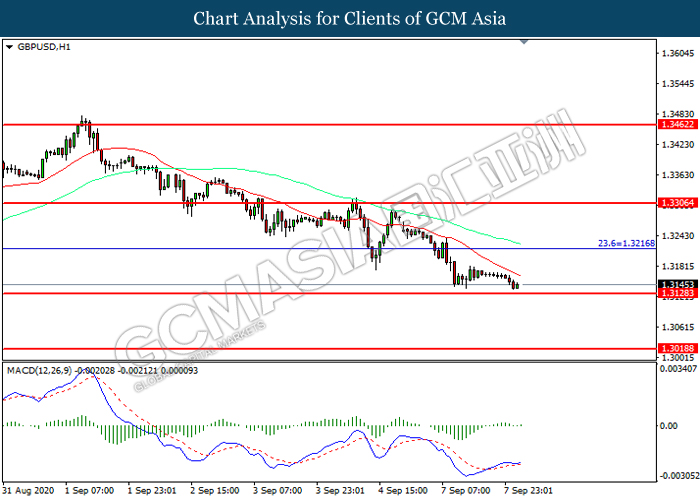

GBPUSD, H1: GBPUSD was traded lower while currently testing the support level at 1.3130. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3215, 1.3305

Support level: 1.3130, 1.3020

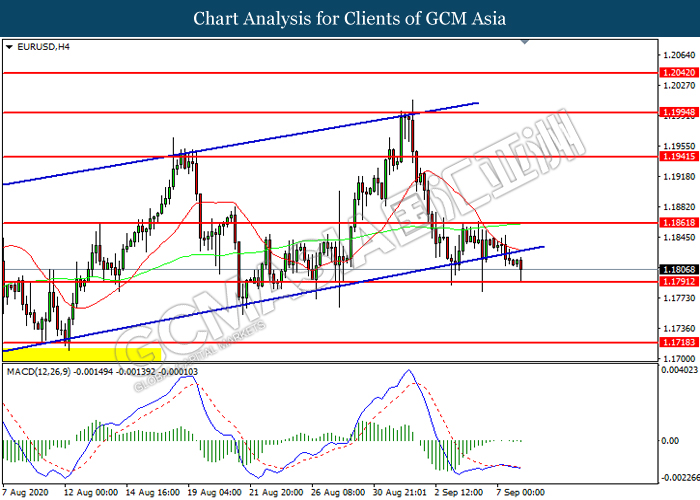

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1790. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1860, 1.1940

Support level: 1.1790, 1.1720

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 106.40. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 106.40, 107.95

Support level: 105.20, 104.15

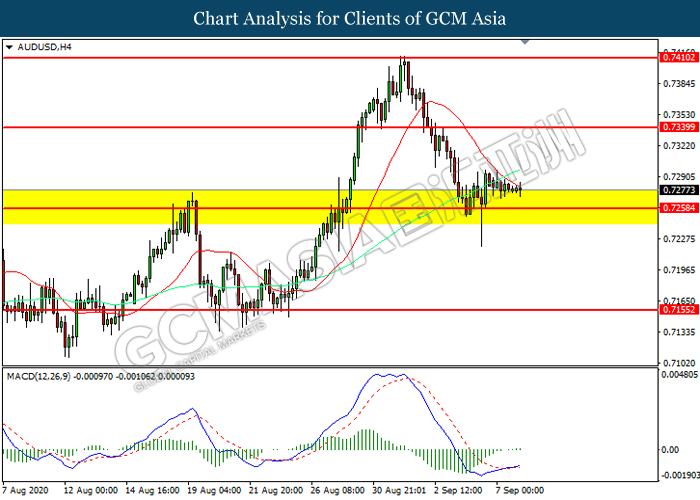

AUDUSD, H4: AUDUSD was traded lower while currently near the support level at 0.7260. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.7340, 0.7410

Support level: 0.7260, 0.7155

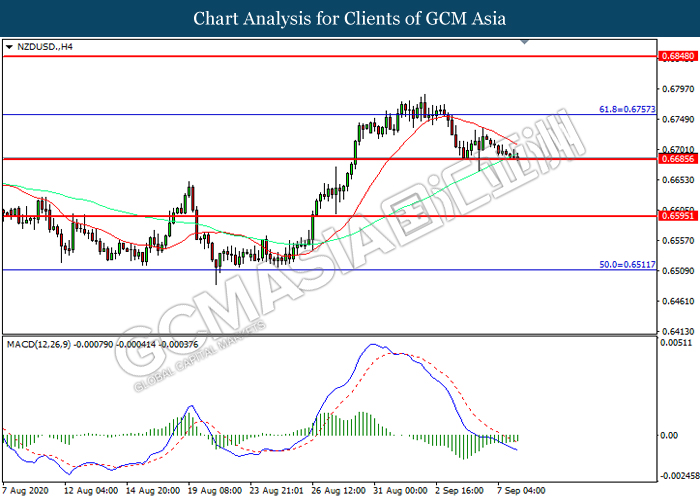

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level at 0.6685. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6755, 0.6850

Support level: 0.6685, 0.6595

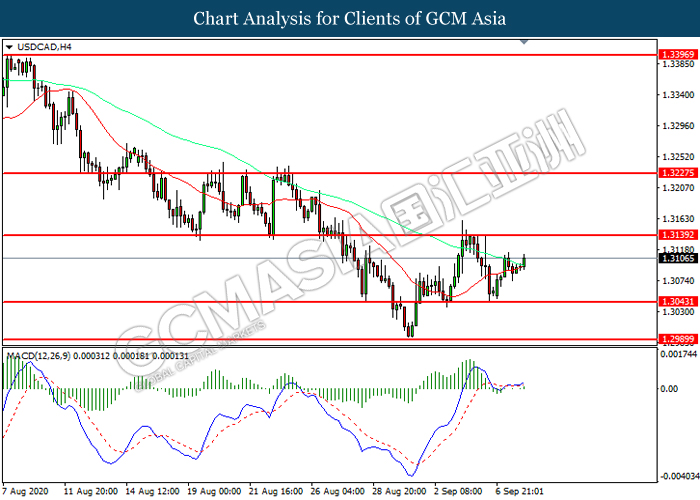

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.3045. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.3140.

Resistance level: 1.3140, 1.3225

Support level: 1.3045, 1.2990

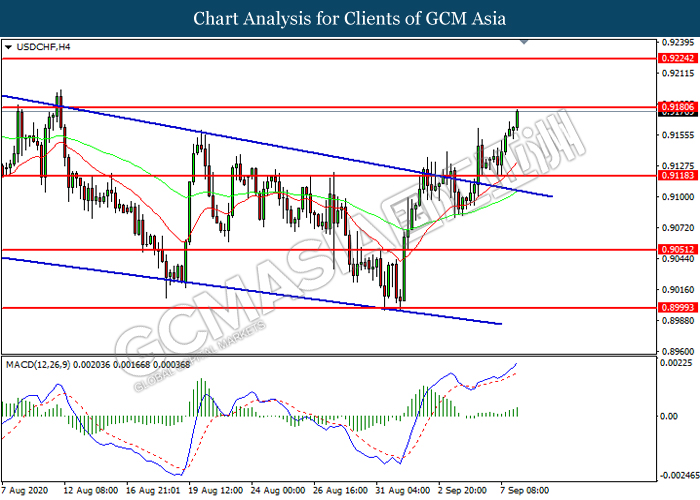

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9180. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9180, 0.9225

Support level: 0.9120, 0.9050

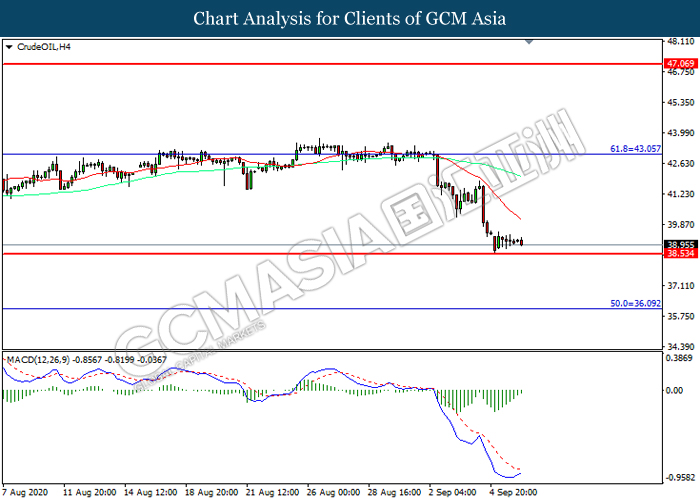

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 38.55. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 43.05, 47.05

Support level: 38.55, 36.10

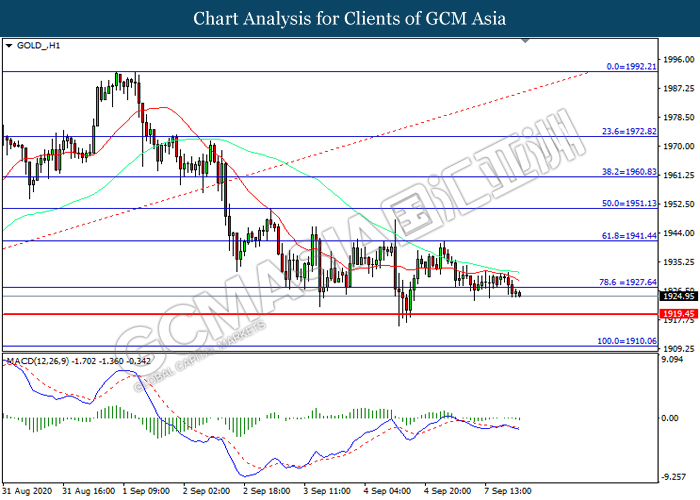

GOLD_, H1: Gold price was traded lower following prior breakout below the previous support level at 1927.65. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 1919.45.

Resistance level: 1927.65, 1941.45

Support level: 1919.45, 1910.05