08 September 2020 Morning Session Analysis

Dollar surged despite thin trading on US holiday.

Dollar index which gauges its value against a basket of six major currencies managed to extend its gains despite low trading volume on US Labour day. In overall, Fx market was traded thinly by the market participants as they are awaiting for more catalyst after holiday ended. Nonetheless, greenback market remain scented as market participants continued to digest some of the key economic data which released last week, such as upbeat unemployment data. However, broader sentiment of this market remain weak and sour after Federal Reserve Chairman Jerome Powell reiterated that they will keep the interest rate lower for a longer period before US economy showed a strong recovery or expansionary happened. In last Powell speech, he revealed that Federal Reserve have shifted their monetary policy framework to average inflation target policy where it allowed the inflation to float above 2%, while maximum employment objective was now given lesser role. As of writing, dollar index rose 0.36% to 93.05.

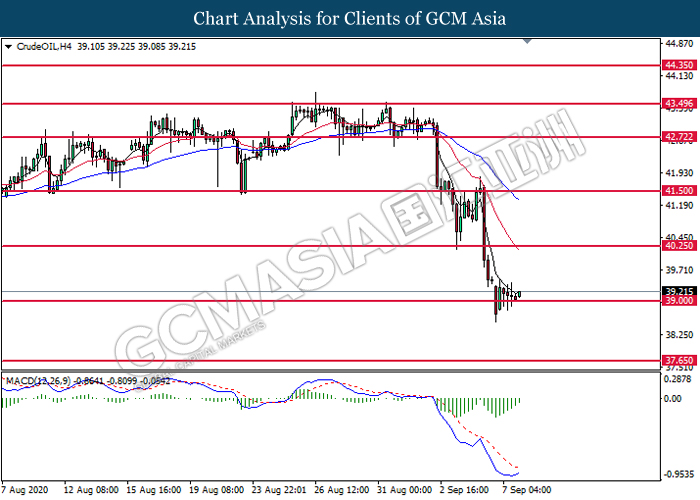

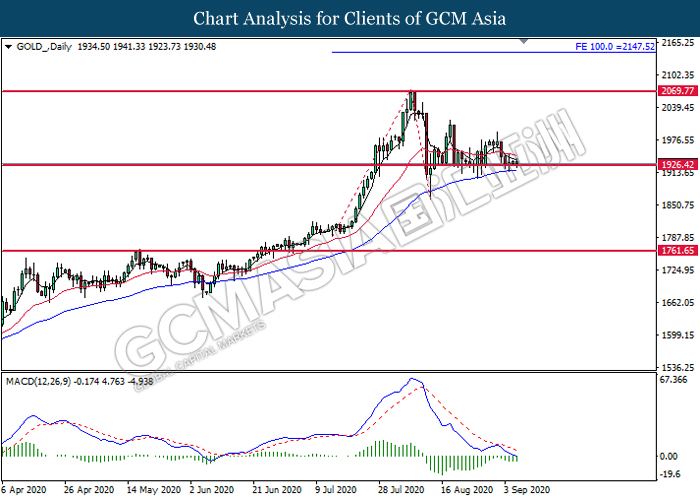

In the commodities market, crude oil price appreciated by 0.47% to $39.15 per barrel after hitting two months low level as Saudi Arabia cut their oil supply price to Asia as having bearish outlook on oil market. At the same time, optimism of market participants toward the oil market faded as recovery of economy turn cooled amid resurgence of pandemic. Besides, gold price rose 0.07% to $1929.90 a troy ounce amid market fears over the pandemic heightened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

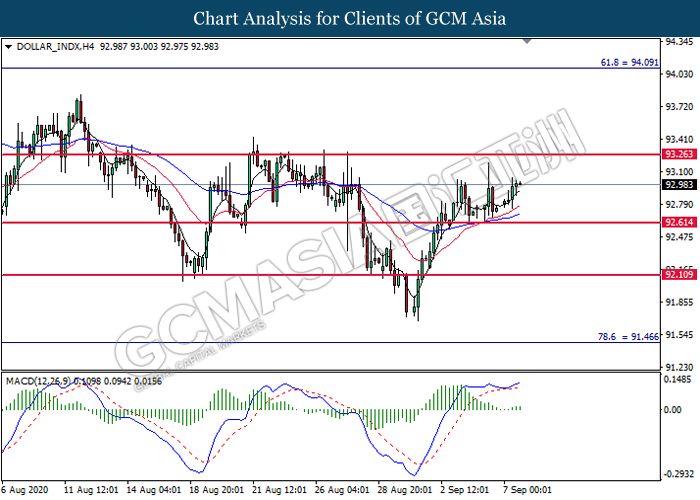

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 92.60. MACD which illustrated bullish bias momentum suggest the index to extend its gains toward the resistance level at 93.25.

Resistance level: 93.25, 94.10

Support level: 92.60, 92.10

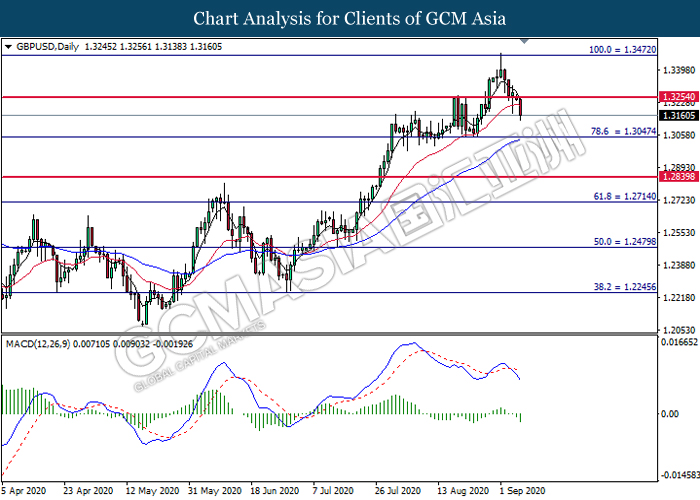

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.3255. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.3045.

Resistance level: 1.3255, 1.3470

Support level: 1.3045, 1.2840

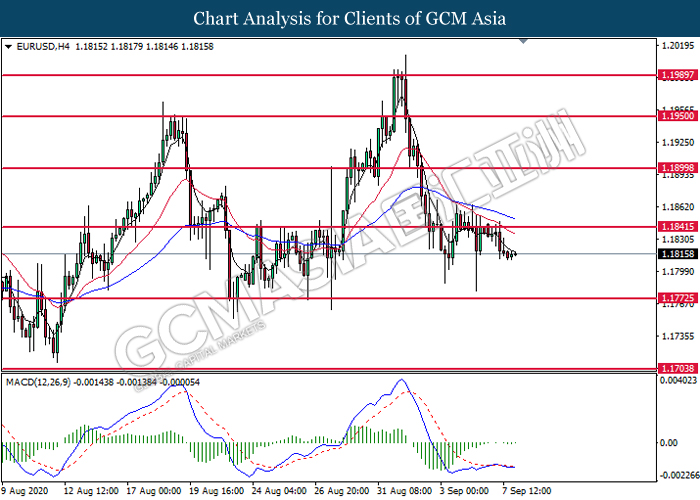

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level at 1.1840. Due to lack of signal from MACD, it is suggested to wait for further confirmation before entering into the market.

Resistance level: 1.1840, 1.1900

Support level: 1.1775, 1.1705

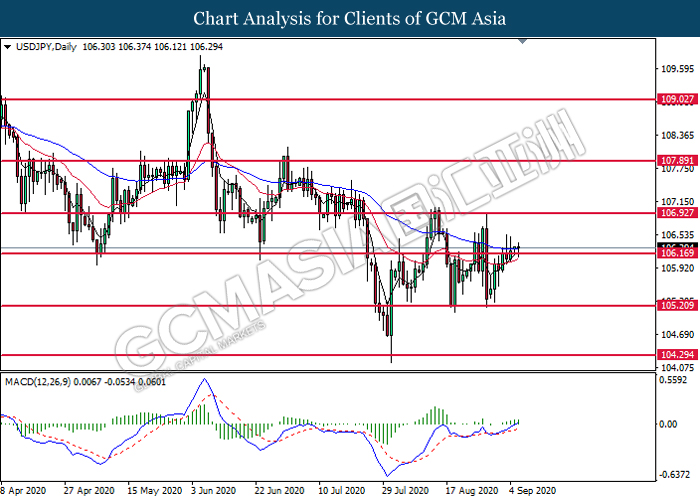

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 106.15. MACD which illustrates bullish bias momentum suggest the pair to extend its gains toward the resistance level at 106.95.

Resistance level: 106.95, 107.90

Support level: 106.15, 105.20

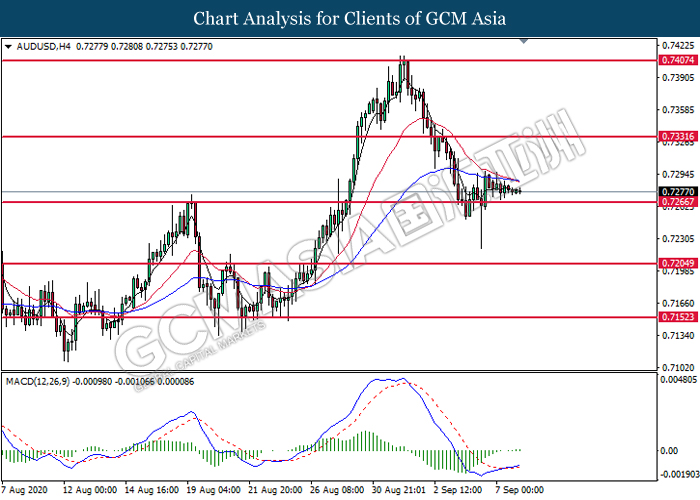

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7265. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.7330.

Resistance level: 0.7330, 0.7405

Support level: 0.7265, 0.7205

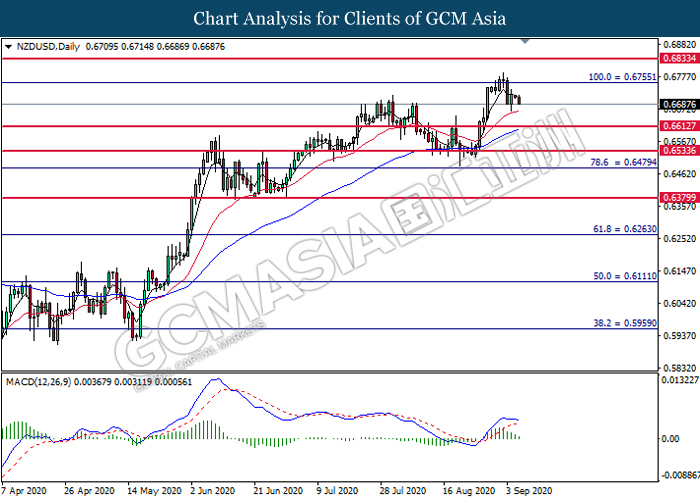

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6755. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6615.

Resistance level: 0.6755, 0.6835

Support level: 0.6615, 0.6535

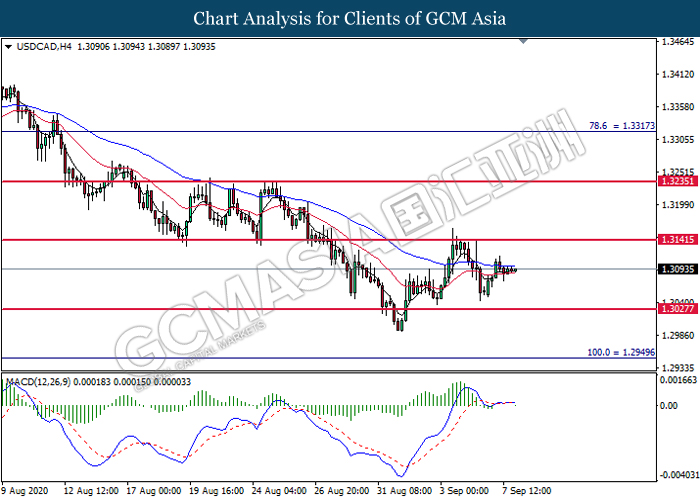

USDCAD, H4: USDCAD was traded higher following prior rebound near the support level at 1.3030. Due to lack of signal from MACD, it is suggested to wait for further confirmation before entering into the market.

Resistance level: 1.3140, 1.3235

Support level: 1.3030, 1.2950

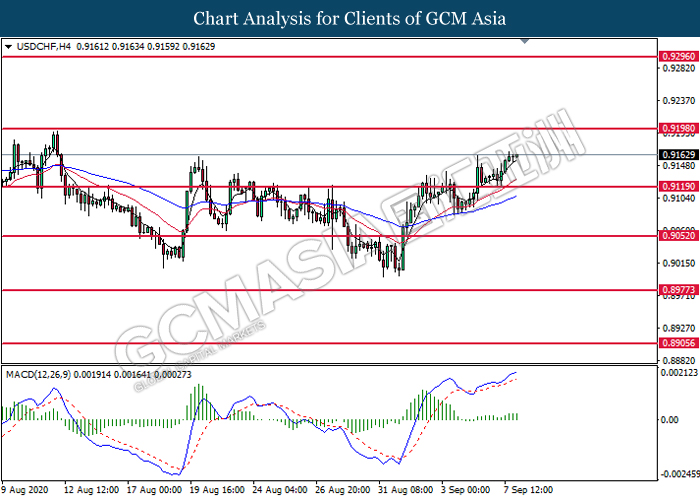

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level at 0.9120. MACD which illustrates bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9200.

Resistance level: 0.9200, 0.9295

Support level: 0.9120, 0.9050

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level at 39.00. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 40.25.

Resistance level: 40.25, 41.50

Support level: 39.00, 37.65

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1926.40. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level at 1926.40.

Resistance level: 2067.75, 2147.50

Support level: 1926.40, 1761.65