9 May 2017 Daily Analysis

Dollar, Euro losses its steam, focus on ECB and Fed.

Euro retreats from prior six-months high on Tuesday although remained well-supported as worries over political populism continues to subside while signs of improving economic conditions in EU as further catalyzed investors’ confidence. Pairing of EUR/USD eased 0.02% and was last seen at $1.0922. “Euro retreat was solely driven by profit-taking. I think it is going to regain some momentum over time,” said Yukio Ishizuki, senior currency analyst. With the French election being done with, investors will pay attention to how and when the European Central Bank will dial back its quantitative easing given the recent rebound in euro zone economy. In the other region, US dollar regained some footing while investors look ahead towards upcoming US economic data to gauge the timing of next interest rate hike. The dollar index appreciates by 0.07% to 98.98 as of writing. However, analyst postulate that the dollar may struggle to extend its rally further as the next rate hike is deemed to be fully priced in.

Looking into the commodities market, crude oil price was up 0.45% to $46.64 per barrel while investors look ahead towards near-term weekly industry estimates of US oil and refined product stockpiles for further market indication. Otherwise, gold price rose 0.13% to $1,226.95 albeit remained under pressure as prospect for an US interest hike as soon as June gains its traction.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 09:30 | AUD – Retail Sales (MoM) (Mar) | -0.1% | 0.3% | -0.1% |

| 20:30 | CAD – Building Permits (MoM) (Mar) | -2.5% | 5.5% | – |

| 22:00 | USD – JOLTs Job Openings (Mar) | 5.743M | 5.670M | – |

| 04:35 | Crude Oil – API Weekly Crude Oil Stock | -4.158M | – | – |

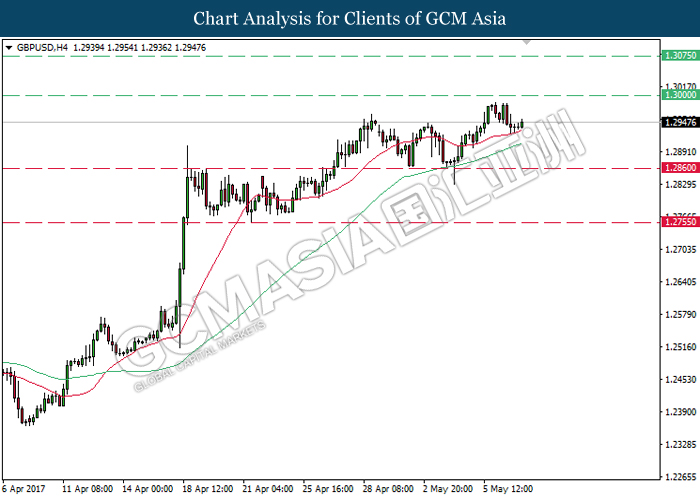

GBPUSD

GBPUSD, H4: GBPUSD were traded lower following prior retracement before the resistance level of 1.3000. A rebound from the 20-moving average line (red) would suggests GBPUSD to advance further upwards and retest near the resistance level of 1.3000.

Resistance level: 1.3000, 1.3075

Support level: 1.2860, 1.2755

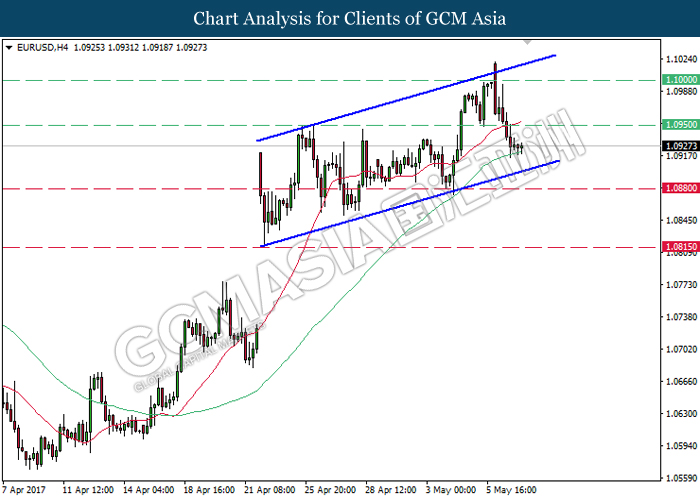

EURUSD

EURUSD, H4: EURUSD remains traded within an upward channel following prior retracement from the top level of the channel. A closure below the 60-moving average line (green) would suggest EURUSD to advance further down, towards the bottom level of the upward channel.

Resistance level: 1.0950, 1.1000

Support level: 1.0880, 1.0815

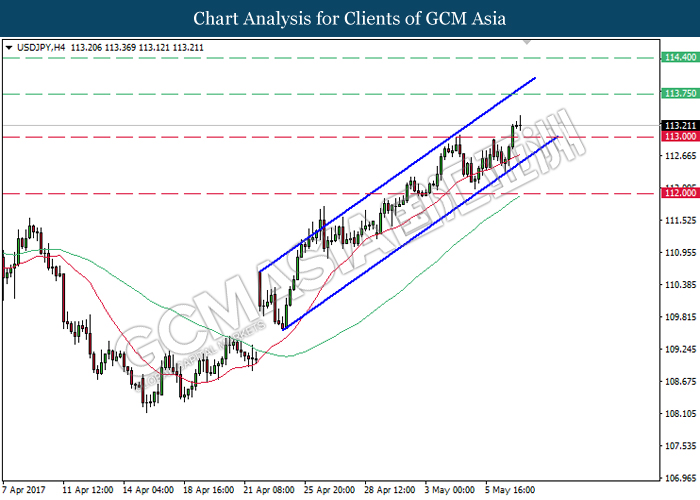

USDJPY

USDJPY, H4: USDJPY remains traded within an upward channel following prior rebound from the bottom level of the channel. It is expected to advance further upwards, towards the target of resistance level at 113.75.

Resistance level: 113.75, 114.40

Support level: 113.00, 112.00

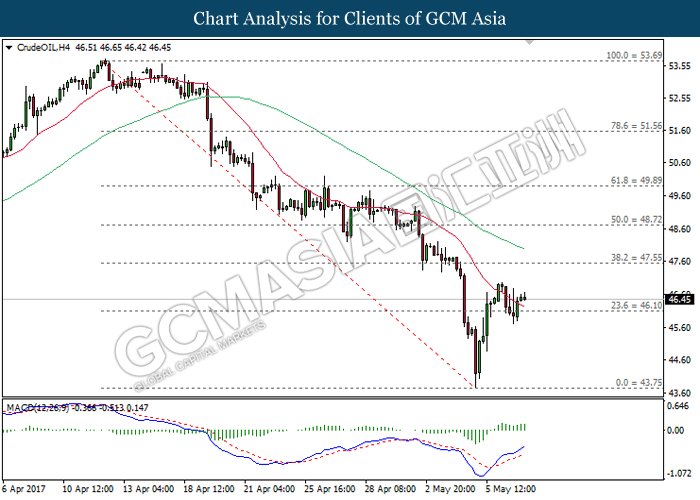

CrudeOIL

CrudeOIL, H4: Crude oil price was traded higher following prior rebound near the support level of 46.10 while closing above the 20-moving average line (red). With regards to the MACD histogram which continues to illustrate upward signal and momentum, crude oil price may be traded higher in short-term as technical correction. Long-term trend direction still suggests crude oil price to extend its losses.

Resistance level: 47.55, 48.70

Support level: 46.10, 43.75

GOLD

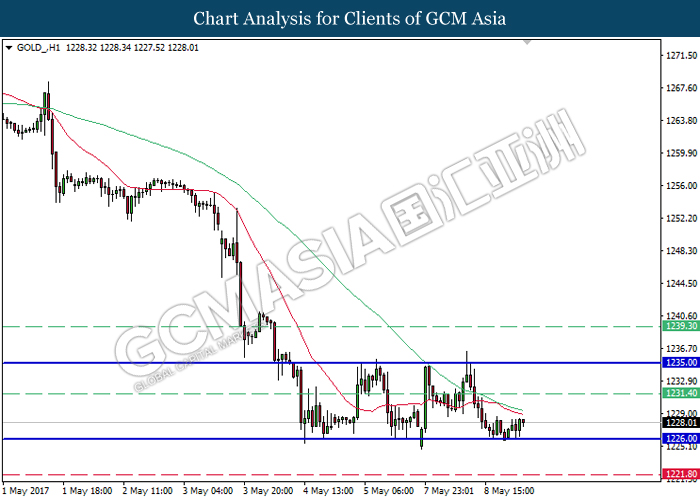

GOLD_, H1: Gold price remains traded within the sideways channel while currently testing at the bottom level of the channel. A breakout from this level will signal a change in trend direction to move further downwards thereafter. Otherwise, a rebound from this level would suggest gold price to be traded higher in short-term within the sideways channel.

Resistance level: 1231.40, 1235.00, 1239.30

Support level: 1226.00, 1221.80