Ghastly exit polls spooks sterling to nosedive.

Great British Pound fell sharply on Friday after British election exit poll showed possibility of Prime Minister Theresa May’s Conservative Party falling short of a majority, likely to result in a hung parliament. Sterling was down 0.67% to $1.2746 after touching one-month low of $1.2690. However, analysts suggest that it is too early to call for and that initial reads of key constituencies gives hope to hold majorities. “There were many participants whom take advantage of the volatility resulted from the election, thus explaining its initial steep nosedive,” said Yukio Ishizuki, senior currency strategist. “The swings in pound has not spilled over to other currencies as the market are well hedged and prepared for a variety of election scenarios.” In the EU, euro slid 0.24% to $1.1183 as the European Central Bank scaled back inflation expectation for the next two years while hinting further interest rate cuts. Otherwise, the dollar index was up 0.45% to 97.27, buoyed by a large sell-offs from pound sterling. Overnight, former FBI director James Comey accused US President Donald Trump of undermining its investigation over possible collusion of his administration with Russia. However, his testimony did not offer fresh insight for the financial market to catalyze significant momentum on the greenback.

In the commodities market, oil prices extended its losses by 0.44% to $45.44 a barrel as the market remained pessimist due to fuel supply overhang which continues to linger despite OPEC’s effort to tighten the market by holding back its daily production. On the other hand, gold price eases 0.09% to $1,280.63 while investors stood on the edge over UK election results.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 09:30 | CNY – CPI (YoY) (May) | 1.2% | 1.5% | 1.5% |

| 16:30 | GBP – Manufacturing Production (MoM) (Apr) | -0.6% | 0.9% | – |

| 20:30 | CAD – Employment Change (May) | 3.2K | 11.0K | – |

| 01:00 | Crude Oil – US Baker Hughes Oil Rig Count | 733 | – | – |

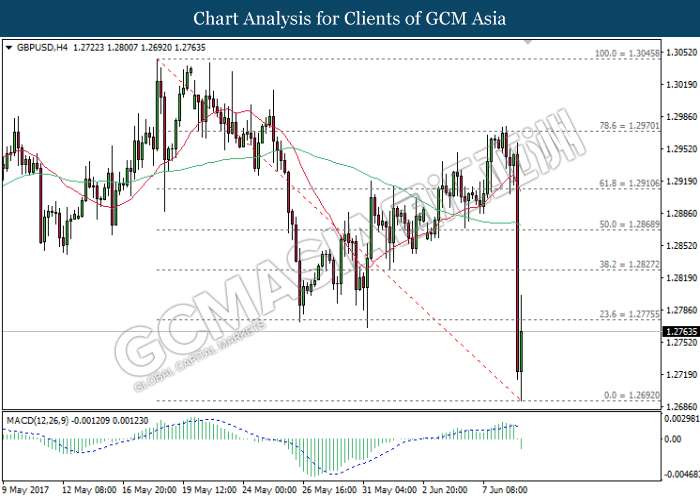

GBPUSD

GBPUSD, H4: GBPUSD was traded lower following prior nosedive while closing below both moving average line. However, MACD indicator continues to drift outside of downward momentum suggests GBPUSD to be traded higher in short-term as technical correction. Long-term trend direction suggests GBPUSD to extend its losses after breaking the support level of 1.2690.

Resistance level: 1.2775, 1.2825

Support level: 1.2690, 1.2620

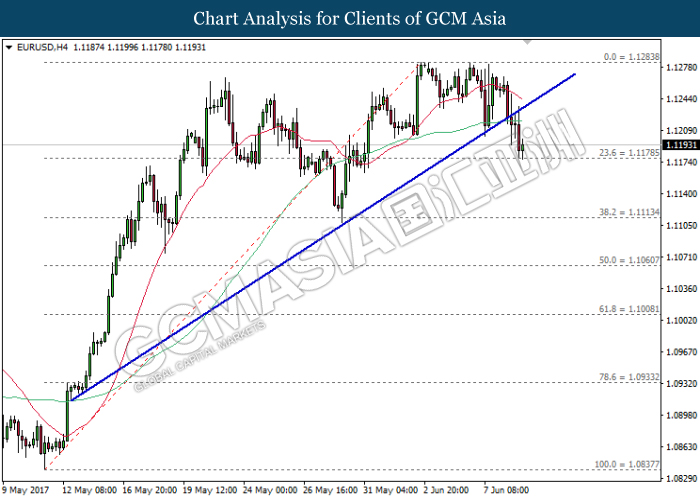

EURUSD

EURUSD, H4: EURUSD has recently broke the upward trend line, signaling a change in trend direction to move further downwards. Both MA lines which continues to narrow downward suggests EURUSD to extend its losses after breaking the support level of 1.1180.

Resistance level: 1.1285, 1.1330

Support level: 1.1180, 1.1115

USDJPY

USDJPY, H1: USDJPY remains traded within an upward channel following prior rebound from the bottom level. Recent closure above the 20-moving average line (red) suggests USDJPY to advance further up towards the target of 110.40 in short-term.

Resistance level: 110.40, 110.70

Support level: 110.10, 109.70

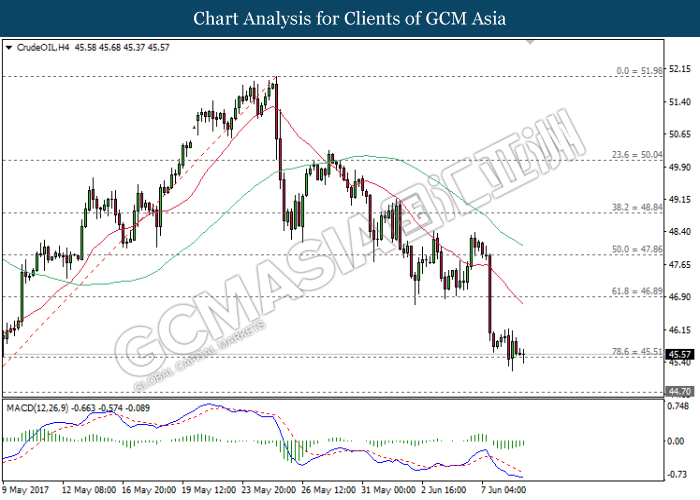

CrudeOIL

CrudeOIL, H4: Crude oil price extended its prior losses following the downward expansion of both MA line after the formation of death cross. MACD histogram continues to illustrate downward signal suggests crude oil price to move further down after breaking the support level of 45.50.

Resistance level: 46.90, 47.85

Support level: 45.50, 44.70

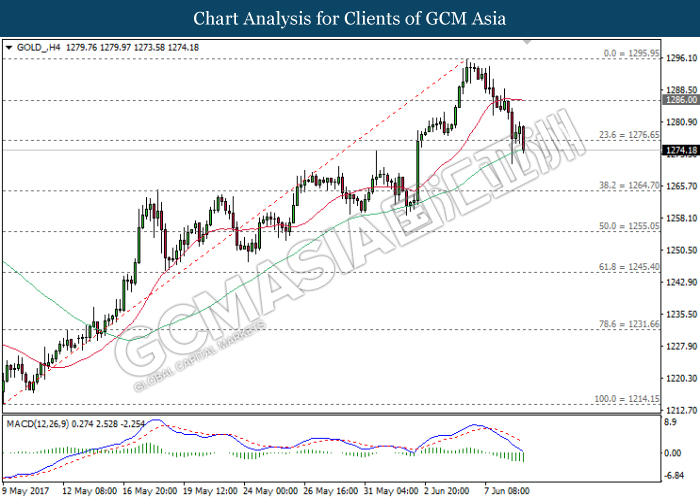

GOLD

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level of 1286.00 while currently testing near the support level of 1276.65. MACD histogram continues to illustrate downward signal suggests gold price to extend its losses after breaking the level of 1276.65.

Resistance level: 1286.00, 1295.95

Support level: 1276.65, 1264.70