9 August 2022 Morning Session Analysis

US Dollar dived as inflation expectation lowered.

The Dollar Index which traded against a basket of six major currencies eased on Monday after Federal Reserve Bank of New York released its monthly Consumer Expectation survey. According to the survey, the inflation expectations at the 1-year horizon slipped to 6.22% in July from the previous month of 6.78%, which is the lowest since February. At the same time, median three-year-ahead inflation expectations also declined from 3.62% to 3.18%, the lowest since April 2021. The reducing inflation expectation had suggested a less forcefully rate hikes from Fed, which dragged down the market interest on US Dollar. As of now, investors would continue to scrutinize the latest updates with regards of the announcement of CPI data in order to gauge the likelihood movement of the US Dollar. Currently, the market participants are predicting that the CPI in July would notch down from the previous reading of 9.1% to 8.7%. As of writing, the Dollar Index depreciated by 0.20% to 106.38.

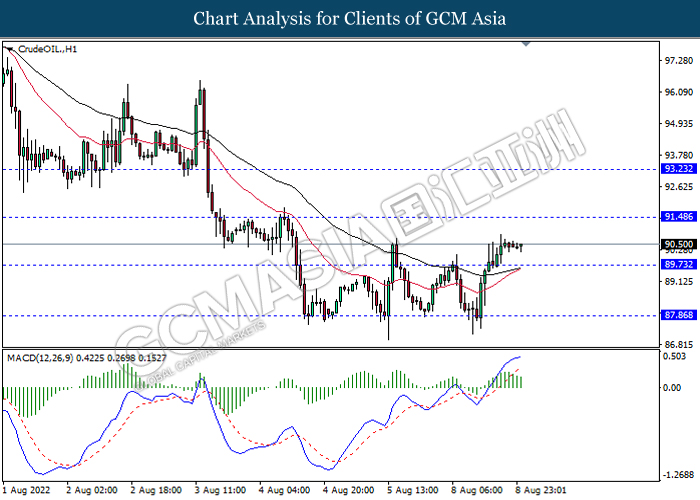

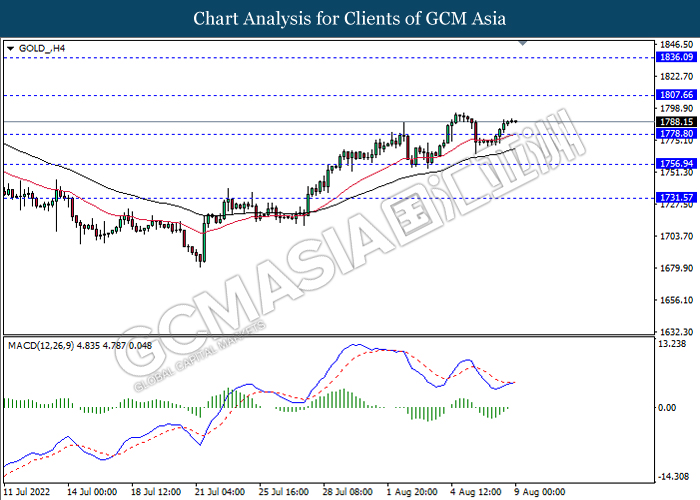

In the commodities market, the crude oil price rallied by 0.29% to $90.50 per barrel as of writing following China purchased 8.79 million barrels of oil in July, which is higher than market expectations. On the other hand, the gold price edged up by 0.05% to $1789.85 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

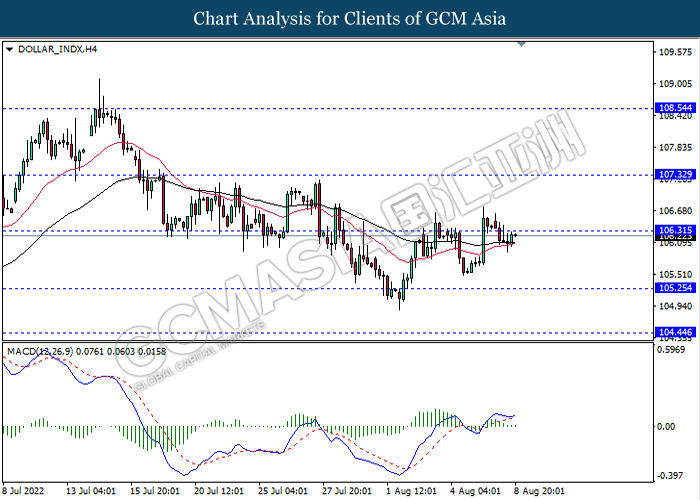

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 106.30, 107.30

Support level: 105.25, 104.45

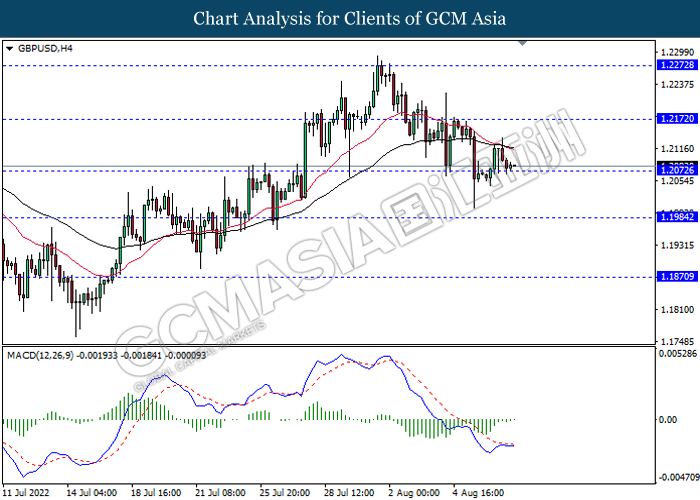

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2170, 1.2270

Support level: 1.2070, 1.1985

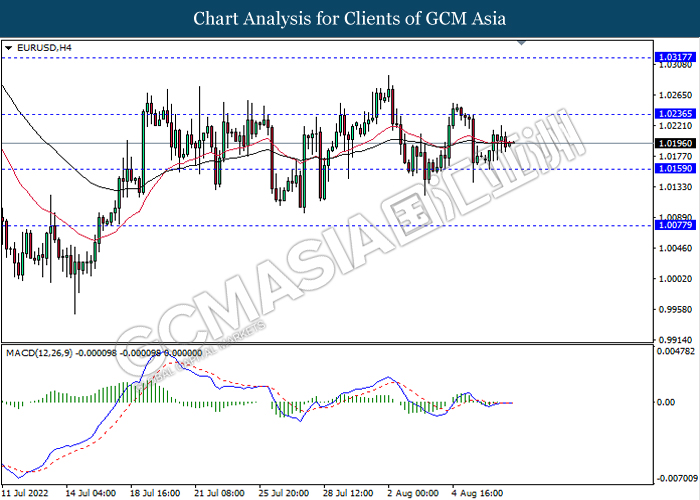

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0235, 1.0315

Support level: 1.0160, 1.0075

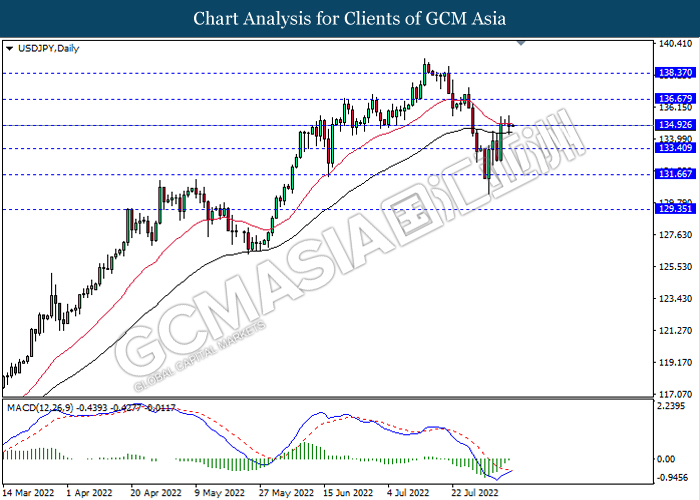

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 134.90, 136.65

Support level: 133.40, 131.65

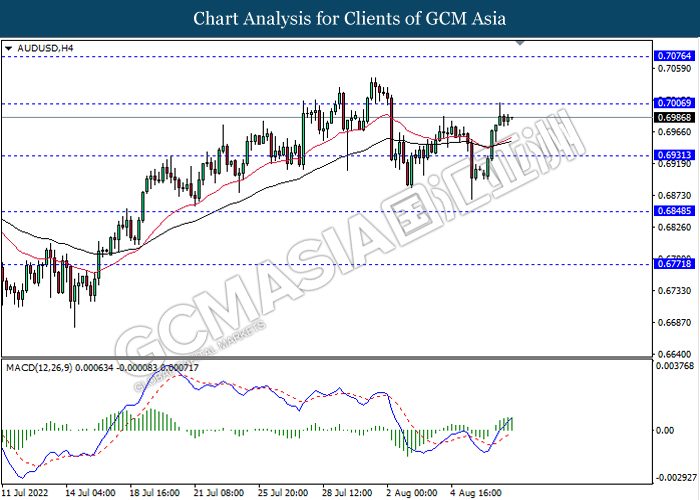

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

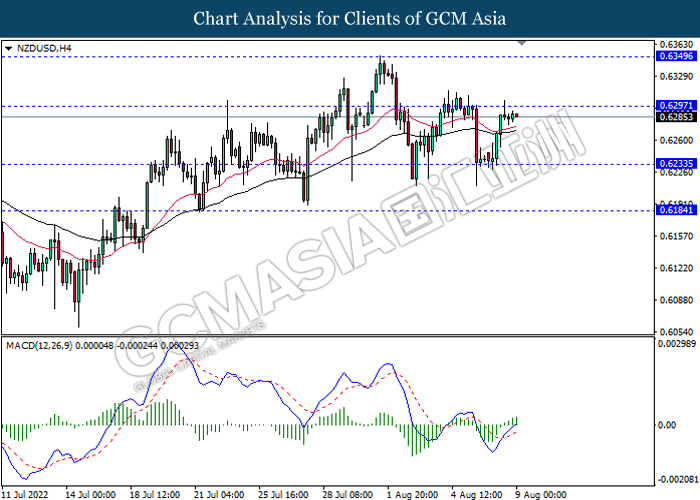

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6185

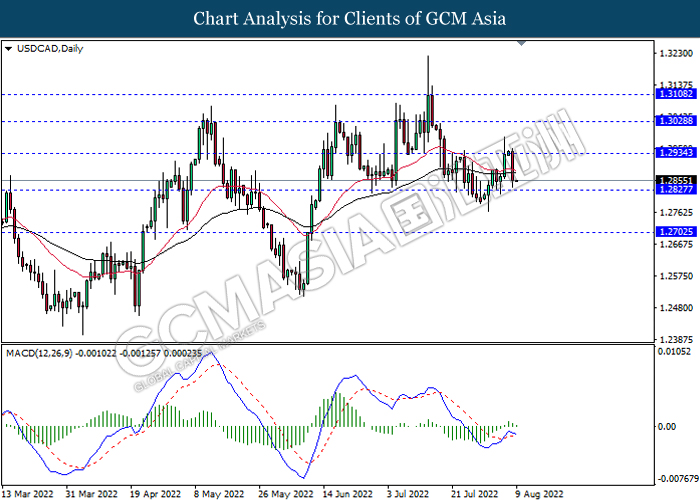

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2935, 1.3030

Support level: 1.2825, 1.2700

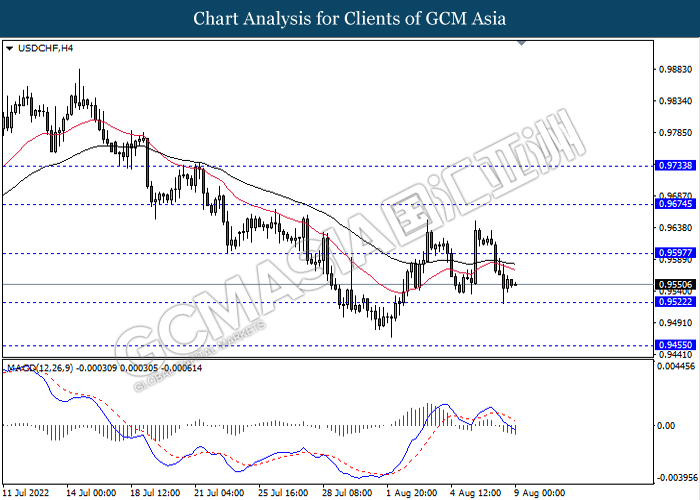

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

CrudeOIL, H1: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 91.50, 93.25

Support level: 89.75, 87.85

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1807.65, 1836.10

Support level: 1778.80, 1756.95