09 September 2020 Afternoon Session Analysis

Aussie hold steady amid upbeat data.

During late Asian session, the Aussie dollar which traded against the dollar and other currency pairs have pick up some bids after the recent release of China CPI. According to the National Bureau of Statistics of China, China CPI (CPI) reached market expectation of 2.4% in August while PPI also eased from -2.4% to -2.0%. At the same time, positive data from Australia also provide further boost for the pair. Australia’s Home Loans have surged to 10.7%, surpassed market forecast of 3.1% in July. Australia’s Westpac Consumer Confidence for September also reversed from previous reading of -9.5% to +18%. Following the upbeat data, the Aussie manage to hold its ground above 0.7200 mark and limit its previous losses. At the time of writing, AUD/USD rose 0.08% to 0.7190 at the time of writing.

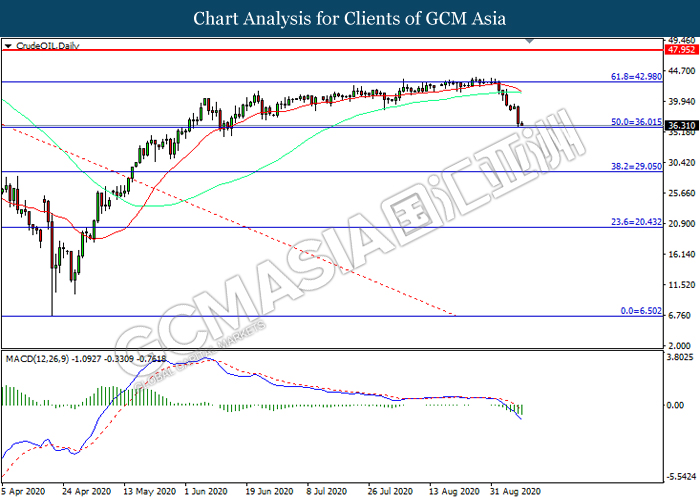

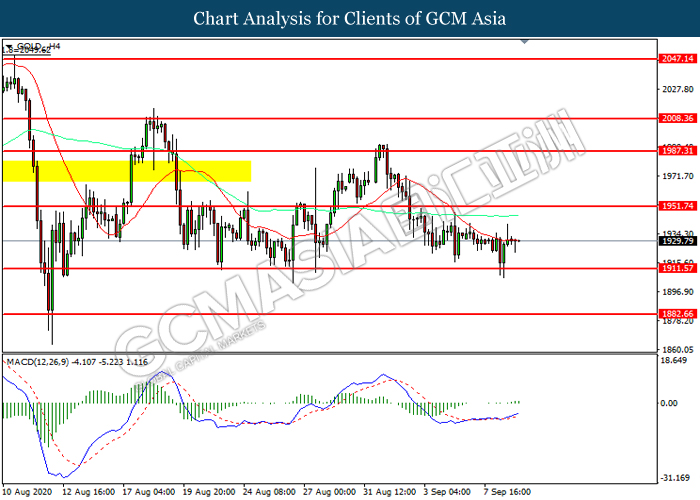

In the commodities market, crude oil price extend losses and plunged 1.28% to $36.24 per barrel as of writing amid heightening concerns over second wave coronavirus. As of now, the biggest global health crisis continue to flare up with cases continue to increase in India, UK, Spain and several parts of U.S. The worsening outbreak have impact the outlook for fuel demand, thus dragging the crude price further. On the other hand, gold price edge up 0.05% to $1929.75 a troy ounce at the time of writing following risk-aversion mood remain supported by ongoing coronavirus crisis.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 CrudeOIL EIA Short-Term Energy Outlook

22:00 CAD BoC Rate Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – JOLTs Job Openings (Jul) | 5.889M | 6.000M | – |

| 22:00 | CAD – BoC Interest Rate Decision | 0.25% | 0.25% | – |

| 04:30

(10th) |

CrudeOIL – API Weekly Crude Oil Stock | -6.360M | – | – |

Technical Analysis

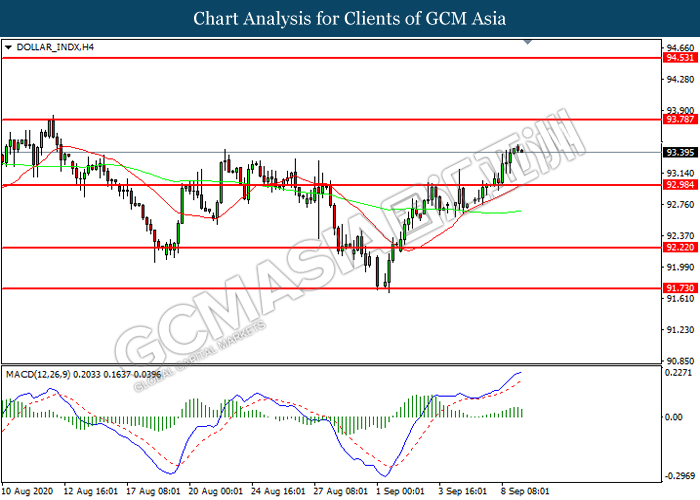

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level at 93.00. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower in short-term as technical correction.

Resistance level: 93.80, 94.55

Support level: 93.00, 92.20

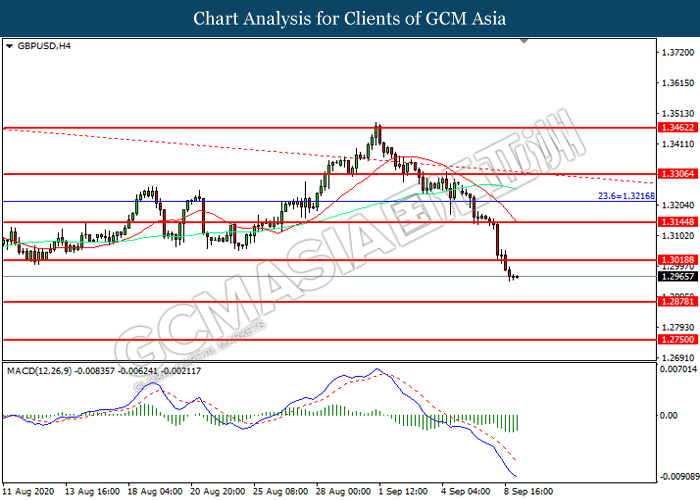

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level at 1.3020. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3020, 1.3145

Support level: 1.2880, 1.2750

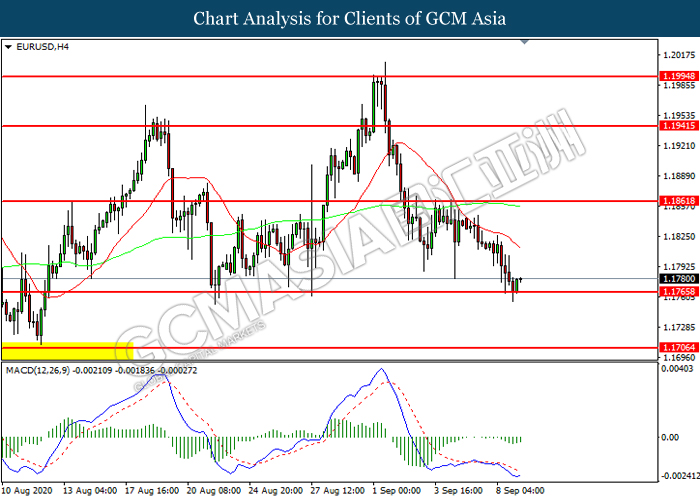

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1765. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1860, 1.1940

Support level: 1.1765, 1.1705

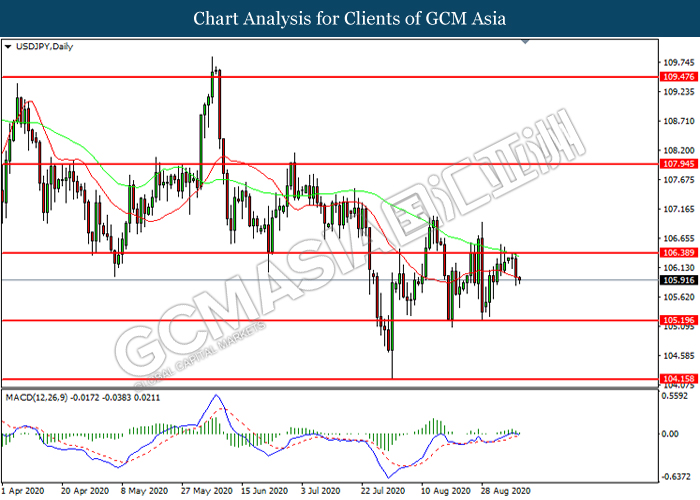

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level at 106.40. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 105.20.

Resistance level: 106.40, 107.95

Support level: 105.20, 104.15

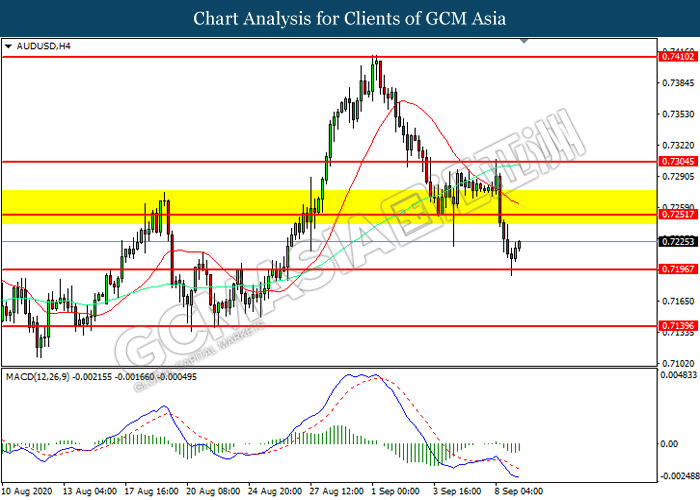

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7195. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.7250.

Resistance level: 0.7250, 0.7305

Support level: 0.7195, 0.7140

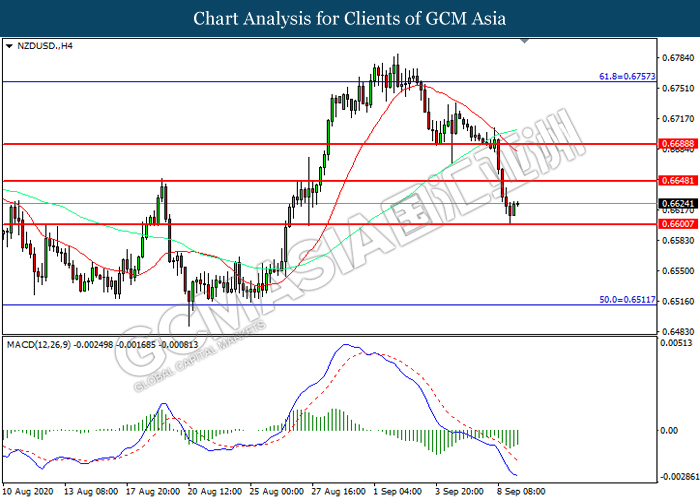

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level at 0.6600. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.6650.

Resistance level: 0.6650, 0.6690

Support level: 0.6600, 0.6510

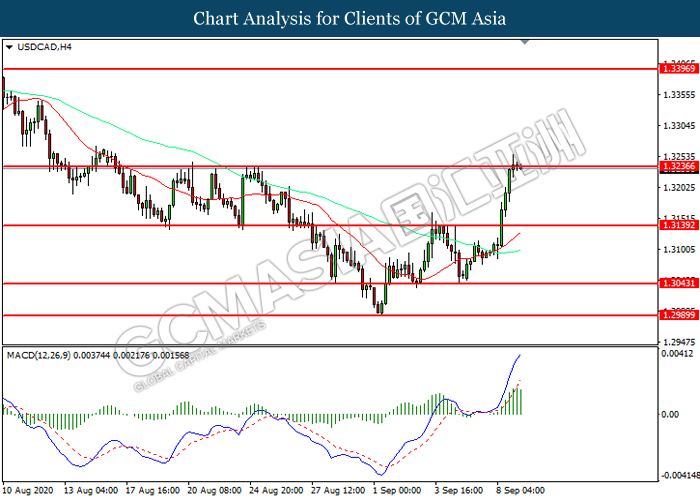

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.3235. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3235, 1.3395

Support level: 1.3140, 1.3045

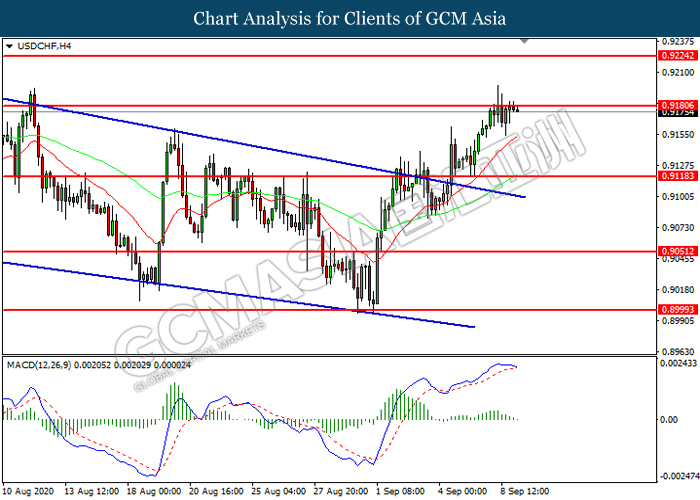

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9180. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.9180, 0.9225

Support level: 0.9120, 0.9050

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 36.00. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 43.00, 47.95

Support level: 36.00, 29.05

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1911.55. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 1951.75.

Resistance level: 1951.75, 1987.30

Support level: 1911.55, 1882.65