09 September 2020 Morning Session Analysis

Dollar gains amid new aid being proposed.

Dollar index which gauges its value against a basket of six major currencies surged significantly as likelihood of another round of stimulus package will be put on the table as soon as this week. According to CNBC, Senate Majority Leader Mitch McConnell rolled out a new proposal of relief package which amounted to $300 billion, while the targeted segments will be focused on healthcare, education and economy. However, no any portion of this amount will be included for direct payment to individuals or money for state and local governments. This plan is slated to get initial vote as early as this week, but it is unlikely to garner 60 votes to get through Senate or receive support from opposing parties. Democrats opposed the introduction of this stimulus package right after Mitch McConnell making a proposal of it as this plan against the intention of meeting the urgent of American during the pandemic. Besides, Democratic Party’s members also reiterated that Republicans are not in the right track in solving the burden and difficulty of the country. Therefore, senate’s vote on new stimulus package will be the focus point of investors in this week. During Asian early trading session, dollar index rose 0.86% to 93.50.

In the commodities market, crude oil price depreciated 0.92% to $36.40 per barrel as market increasingly concern over the faltering demand, while the driving season in US is over and dovish signal sent by Saudi early this week. Besides, gold price appreciated by 0.02% to $1931.40 a troy ounce as market’s risk appetite eased.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 CrudeOIL EIA Short-Term Energy Outlook

22:00 CAD BoC Rate Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – JOLTs Job Openings (Jul) | 5.889M | 6.000M | – |

| 22:00 | CAD – BoC Interest Rate Decision | 0.25% | 0.25% | – |

| 04:30

(10th) |

CrudeOIL – API Weekly Crude Oil Stock | -6.360M | – | – |

Technical Analysis

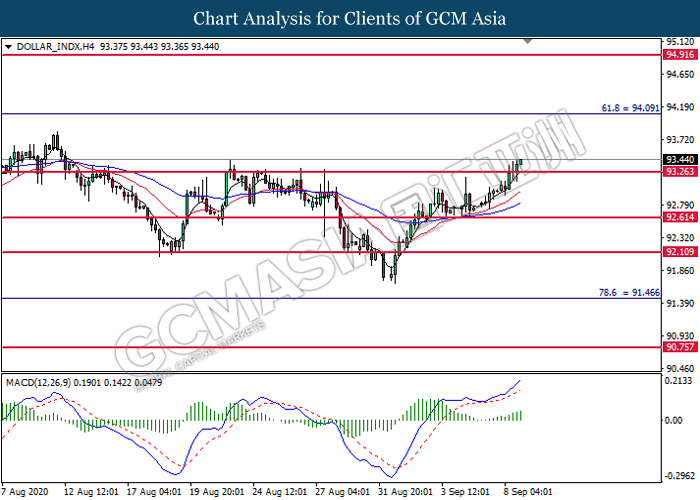

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level at 93.25. MACD which illustrated bullish bias momentum suggest the index to extend its gains toward the resistance level at 94.10.

Resistance level: 94.10, 94.90

Support level: 93.25, 92.60

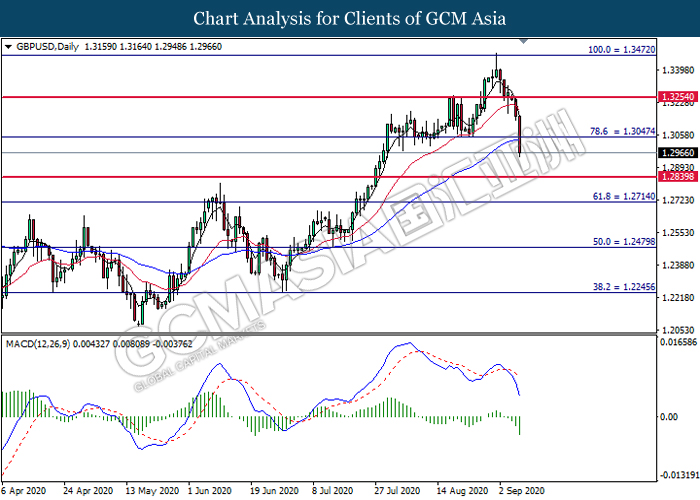

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.3045. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully close its candle below the support level.

Resistance level: 1.3255, 1.3470

Support level: 1.3045, 1.2715

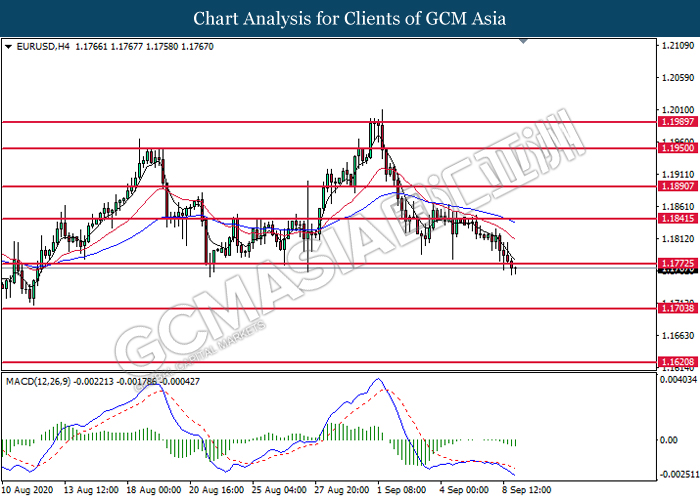

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level at 1.1775. MACD which illustrate bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1705.

Resistance level: 1.1775, 1.1840

Support level: 1.1705, 1.1620

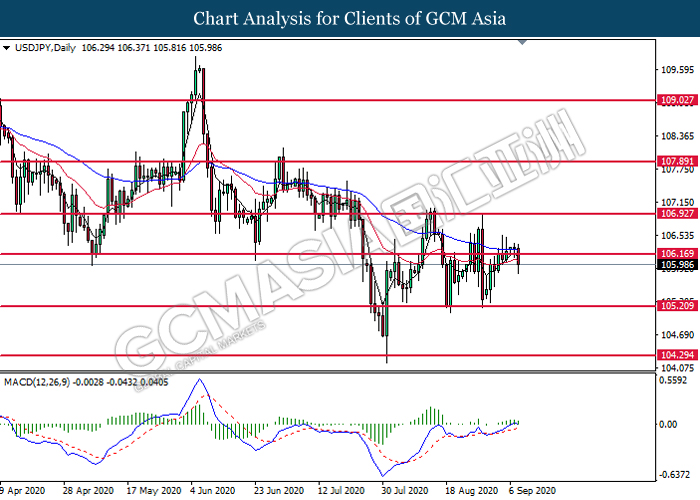

USDJPY, Daily: USDJPY was traded lower following prior rebound near the resistance level at 106.15. MACD which illustrates diminishing bullish momentum suggest the pair to extend its retracement toward the support level at 105.20.

Resistance level: 106.15, 106.95

Support level: 105.20, 104.30

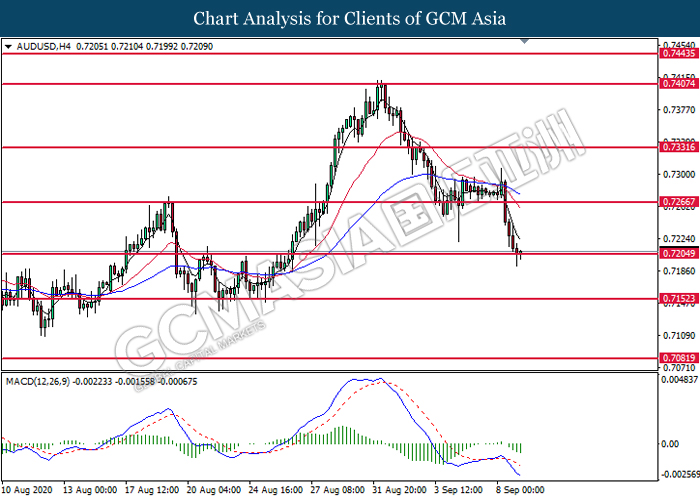

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7205. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.7265, 0.7330

Support level: 0.7205, 0.7150

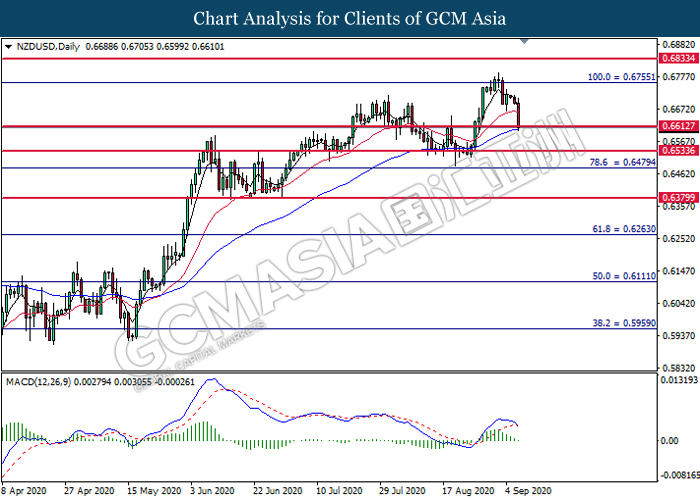

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6615. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6615.

Resistance level: 0.6755, 0.6835

Support level: 0.6615, 0.6535

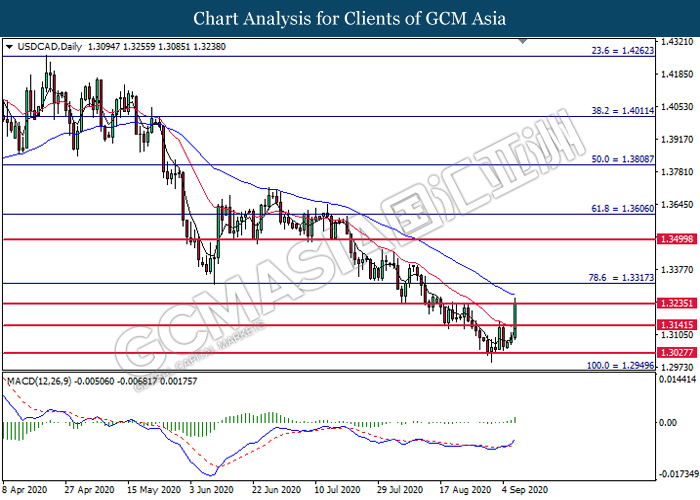

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3235. MACD which illustrate bearish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 1.3235.

Resistance level: 1.3235, 1.3315

Support level: 1.3140, 1.3030

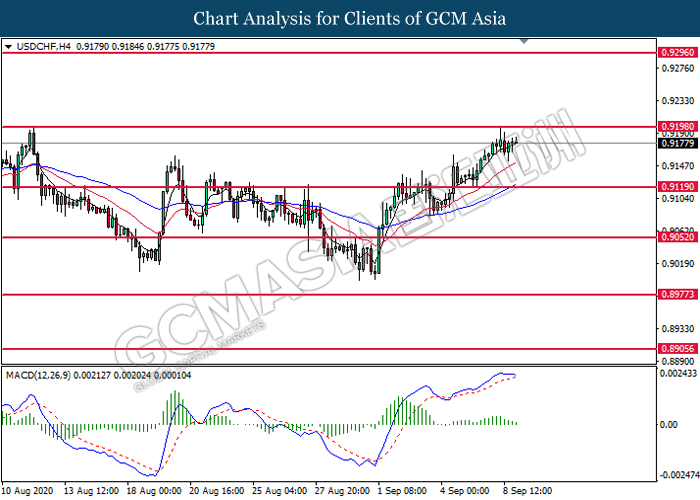

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level at 0.9120. However, MACD which illustrates diminishing bullish momentum suggest the pair to undergo technical correction in short term toward the support level at 0.9120.

Resistance level: 0.9200, 0.9295

Support level: 0.9120, 0.9050

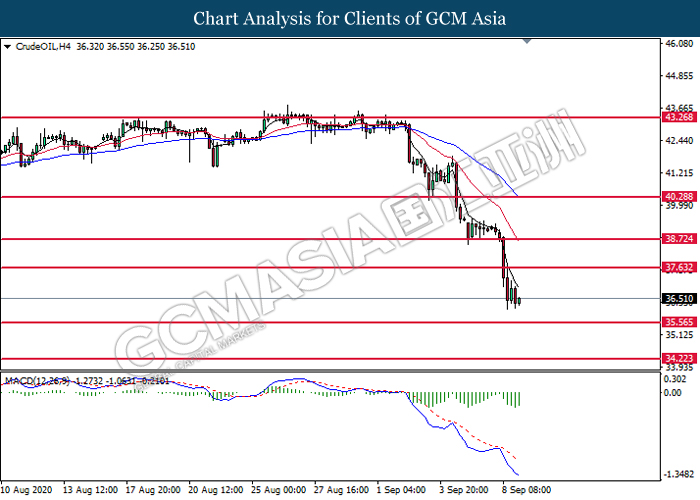

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 37.65. However, MACD which illustrated diminishing bearish momentum suggest the commodity to undergo technical rebound in short term.

Resistance level: 37.65, 38.75

Support level: 35.65, 34.25

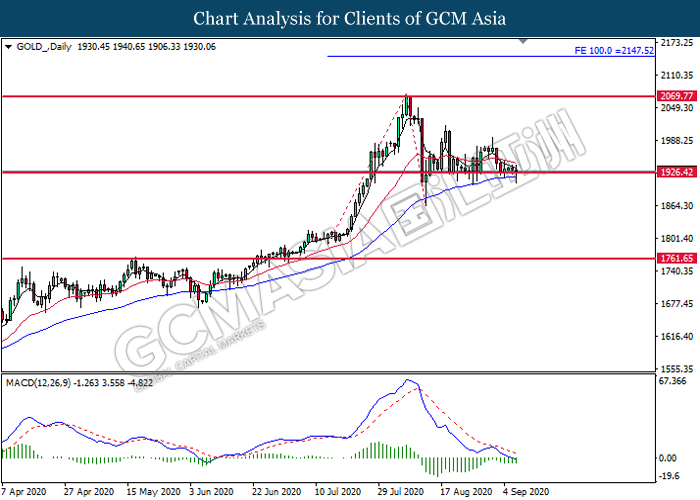

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1926.40. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level at 1926.40.

Resistance level: 2067.75, 2147.50

Support level: 1926.40, 1761.65