09 November 2020 Afternoon Session Analysis

Pound rose on Biden, but Brexit may limit gains.

The pound sterling which traded against the dollar and other currency pairs continue to extend its gains during late Asian session, however the continuous stalemate in Brexit talks may kept the pair in check. After U.S election delivers Biden’s victory, the dollar has weaken in anticipation of Biden’s presidency may bring calmer politics which also help boost the pound sterling at the same time. Still, the ongoing Brexit issue also continue to weigh on the market which could diminished market confidence towards the pound. Following a call between UK Prime Minister Boris Johnson and EU Commission President Ursula von der Leyen, little progress has been made and Boris Johnson stated that there is still significant differences remain in a number of areas such as level playing field and fisheries. As the deadline for the Brexit is getting nearer, investors will now turn their attention towards ongoing development in talks where both parties agreed to remain in close contact over the coming days. At the time of writing, GBP/USD rose 0.19% to 1.3179.

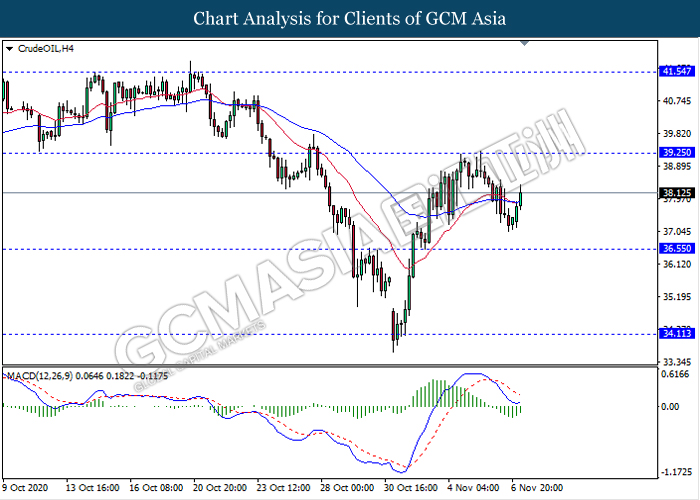

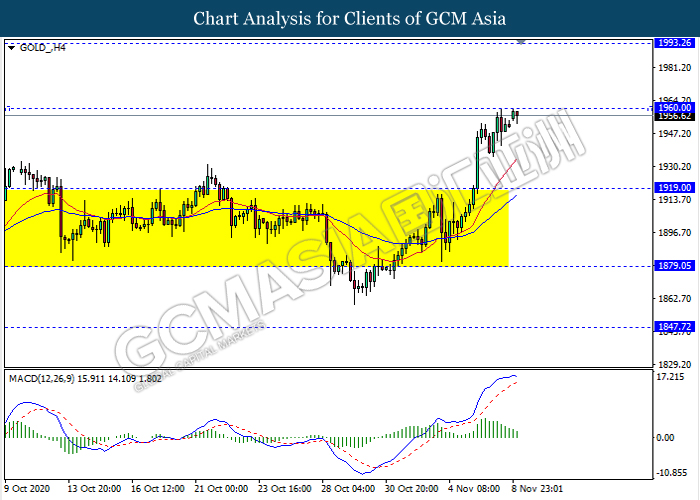

In the commodities market, crude oil price rose regains momentum and rose 2.04% to $38.17 per barrel as of writing following prospect of Biden’s presidency. Crude oil price recovered after Joe Biden clinched the U.S. presidency and buoyed risk appetite, offsetting worries about impact on fuel demand from the worsening coronavirus pandemic. Biden’s victory could push for a bigger stimulus which could help support the economy and increase fuel consumption. On the other hand, gold price soars 0.26% to $1955.59 a troy ounce at the time of writing amid continuous drop on dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:25 EUR ECB President Lagarde Speaks

18:35 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

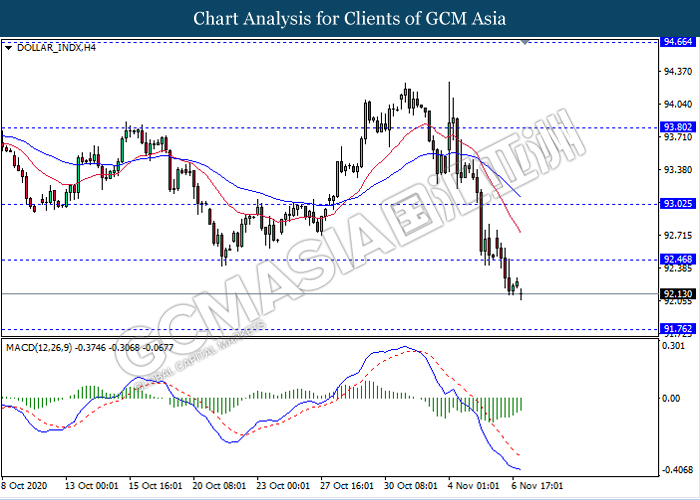

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level 92.45. However, MACD which illustrate diminishing bearish momentum signal suggest the dollar to experience a short term technical correction back towards the level 92.45.

Resistance level: 92.45, 93.00

Support level: 91.75, 91.00

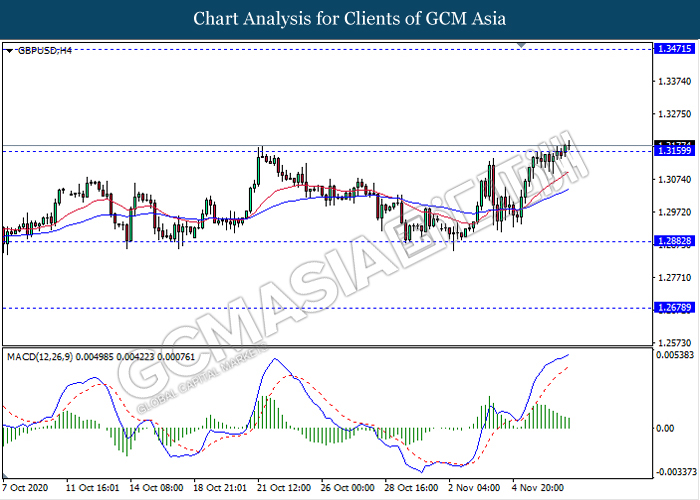

GBPUSD, H4: GBPUSD was traded flat near the support level after recently breaks above the previous resistance level 1.3160. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to be traded lower after it breaks back below the level 1.3160.

Resistance level: 1.3300, 1.3470

Support level: 1.3160, 1.3060

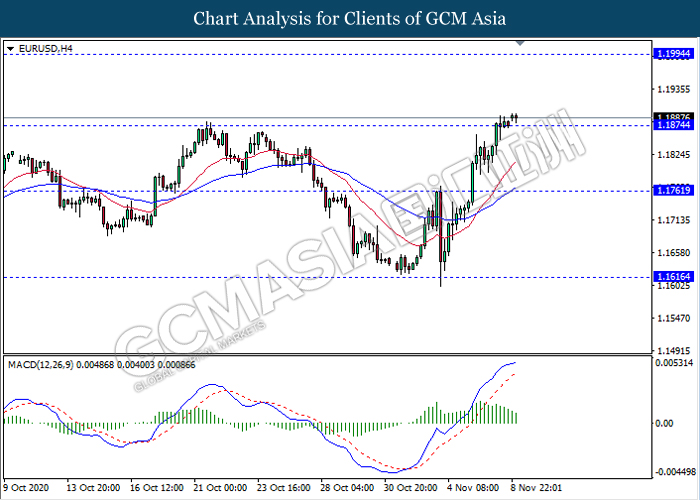

EURUSD, H4: EURUSD was traded flat near the support level after it recently breaks above the previous resistance level 1.1875. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to be traded lower after it breaks back below the level 1.1875.

Resistance level: 1.1995, 1.2125

Support level: 1.1875, 1.1760

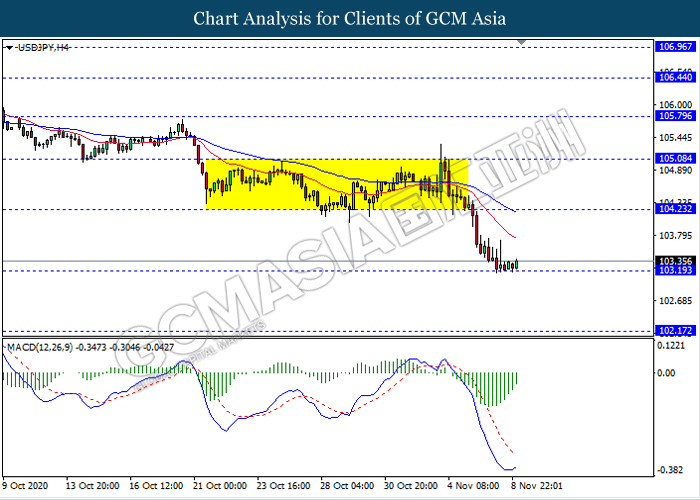

USDJPY, H4: USDJPY was traded lower while currently testing the support level 103.20. However, MACD which illustrate diminishing bearish momentum signal suggest the pair to be traded higher as a technical correction towards the resistance level 104.25.

Resistance level: 104.25, 105.10

Support level: 103.45, 102.15

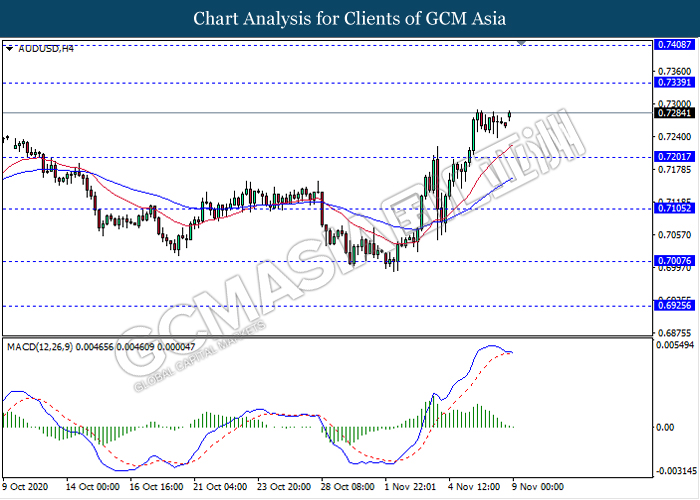

AUDUSD, H4: AUDUSD was traded flat after recent breakout above the previous resistance level 0.7200. However, MACD which illustrate diminishing bullish momentum signal with the starting formation of death cross suggest the pair to be traded lower in short term towards the support level 0.7200.

Resistance level: 0.7340, 0.7410

Support level: 0.7200, 0.7105

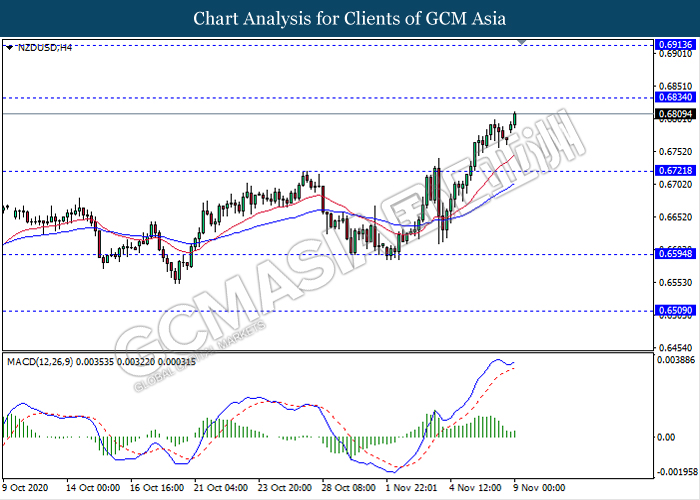

NZDUSD, H4: NZDUSD was traded higher while currently testing near the resistance level 0.6835. MACD which illustrate ongoing bullish momentum signal suggest the pair to extend its gains after it breaks above the resistance level 0.6835.

Resistance level: 0.6835, 0.6915

Support level: 0.6720, 0.6595

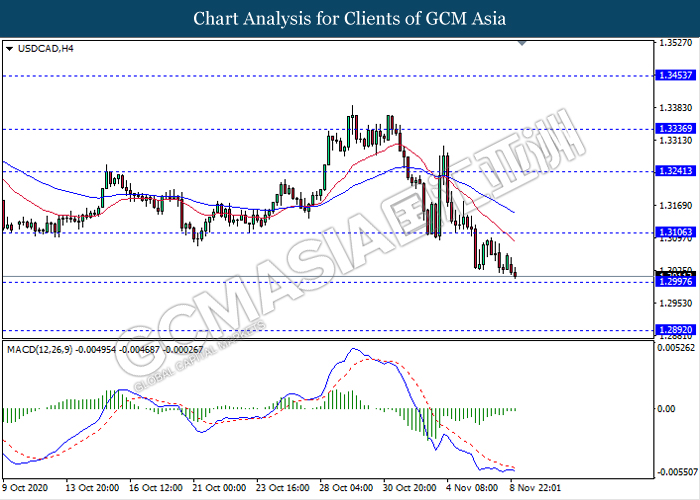

USDCAD, H4: USDCAD was traded lower while currently testing the support level 1.2995. However, MACD which illustrate diminishing bearish momentum signal suggest the pair to be traded higher as a short term technical correction towards the resistance level 1.3105.

Resistance level: 1.3105, 1.3240

Support level: 1.2995, 1.2890

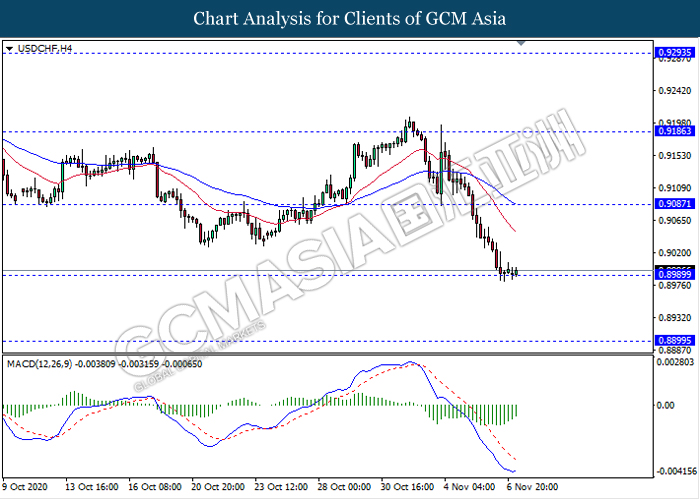

USDCHF, H4: USDCHF was traded lower while currently testing the support level 0.8990. However, MACD which illustrate diminishing bearish momentum signal suggest the pair to experience a short term technical correction towards the resistance level 0.9085.

Resistance level: 0.9085, 0.9185

Support level: 0.9000, 0.8900

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from its low level. MACD which illustrate diminishing bearish momentum signal suggest the commodity to extend its gains towards the resistance level 39.25.

Resistance level: 39.25, 41.55

Support level: 36.55, 34.10

GOLD_, H4: Gold price was traded higher while currently testing the resistance level 1960.00. However, MACD which illustrate diminishing bullish momentum signal suggest the commodity to experience a technical correction towards the support level 1919.00.

Resistance level: 1960.00, 1993.25

Support level: 1919.00, 1879.05