09 November 2020 Morning Session Analysis

Dollar plunged after Joe Biden defeats Trump.

Dollar index which gauge its value against a basket of six major currencies failed to recover from its previous losses while extending the bearish trend after Joe Biden from Democratic Party defeated the incumbent Donald Trump in the US election and become the 46th US President. Yesterday, Joe Biden claimed his victory in the US Presidential Election after the Associated Press, CNN and NBC respectively announced him winning in decisive states including Pennsylvania and Nevada and gaining more than the threshold of 270 Electoral College votes needed to secure the presidency. At the same time, California Senator Kamala Harris becomes the first Black and Indian-American woman vice president to assists Biden in handling White House’s affair. Despite, Joe Biden’s victory would not be set in stone until the 538 in total of Electoral College follow the well-established protocol which formally to go through a process of voting the next president on 14th Dec. Besides, Donald Trump have also filed for a lawsuit to appeal against the final result of the presidential election while questioning integrity of absentee and mail-in ballots in some of the states. During Asian early trading session, dollar index dropped 0.31% to 92.25.

In the commodities market, the crude oil price depreciated by 0.15% to $37.30 per barrel as recent spike of Covid-19 in European Zone tampered the demand’s outlook of this black commodity market. Oil prices are continue pressured by the uncertainty of the pandemic which urged a lot of countries re-implemented national lockdown measures. Besides, gold price up 0.23% to $1955.50 a troy ounce amid weakening of US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:25 EUR ECB President Lagarde Speaks

18:35 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

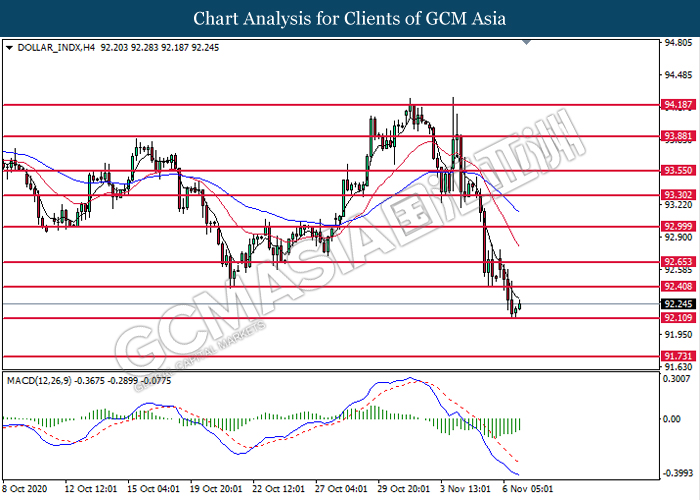

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 92.10. MACD which illustrate diminishing bearish momentum signal suggest the dollar to extend it gains toward the resistance level at 92.40.

Resistance level: 92.40, 92.65

Support level: 92.10, 91.75

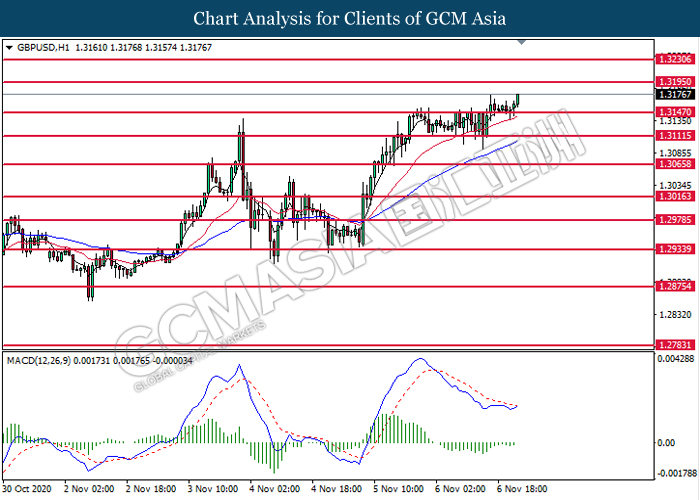

GBPUSD, H1: GBPUSD was traded higher following prior rebound from the support level at 1.3145. MACD which illustrates diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.3195.

Resistance level: 1.3195, 1.3230

Support level: 1.3145, 1.3110

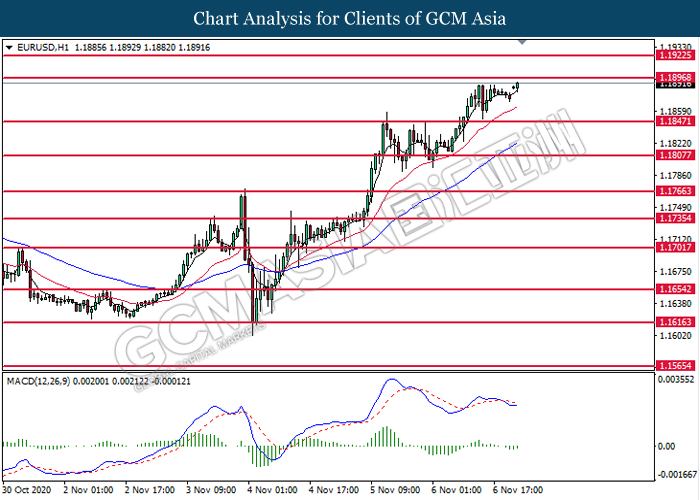

EURUSD, H1: EURUSD was traded higher while currently testing the resistance level at 1.1895. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its gains after it successfully breakout above the resistance level at 1.1895.

Resistance level: 1.1895, 1.1925

Support level: 1.1845, 1.1805

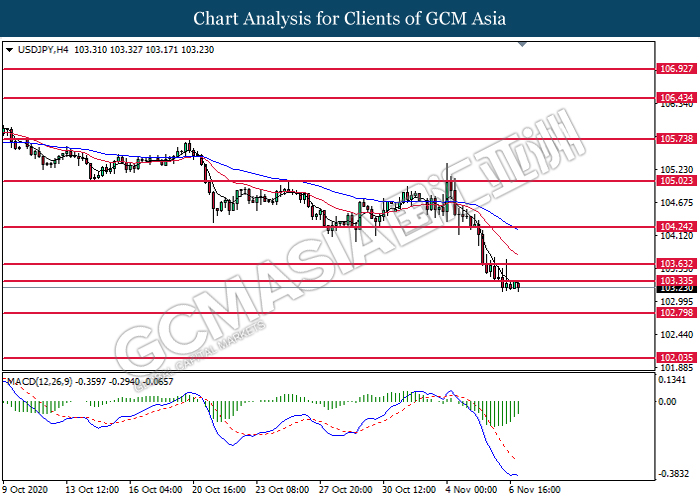

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level at 103.35. However, MACD which illustrate diminishing bearish momentum suggest the pair to undergo technical correction in short term toward higher level.

Resistance level: 103.35, 103.65

Support level: 102.80, 102.05

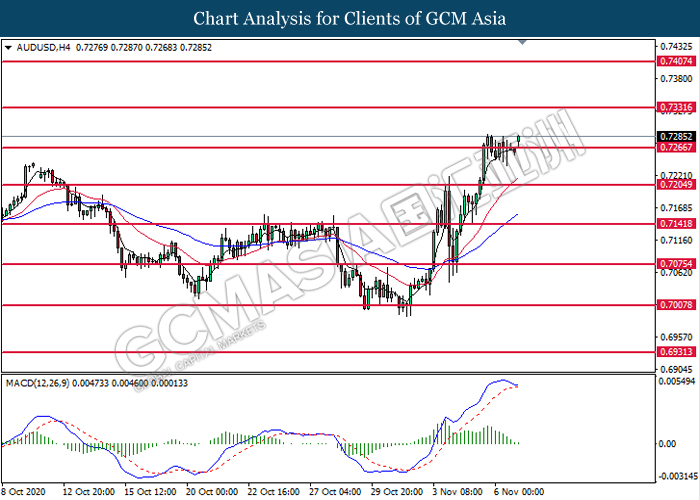

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7265. However, MACD which illustrate diminishing bullish momentum suggest the pair to undergo technical correction toward the lower level.

Resistance level: 0.7330, 0.7405

Support level: 0.7265, 0.7205

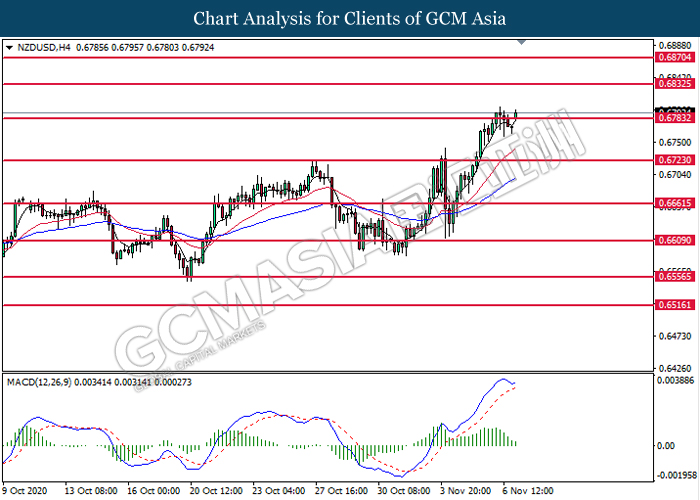

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6785. MACD which illustrate bullish bias momentum signal suggest the pair to extend its gains toward the resistance level at 0.6835.

Resistance level: 0.6835, 0.6870

Support level: 0.6785, 0.6725

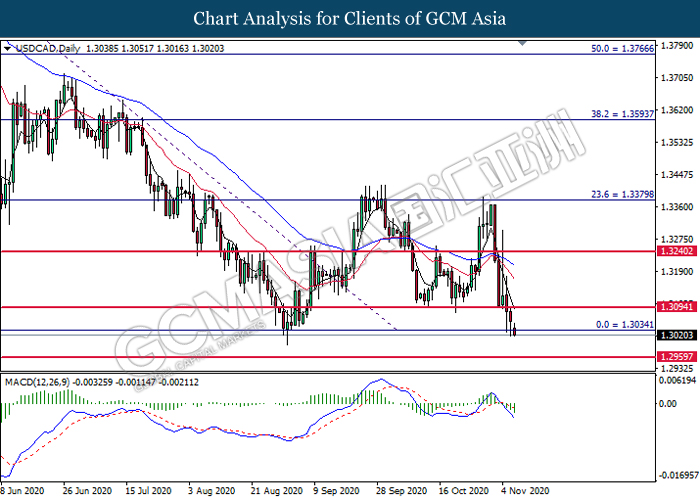

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3035. MACD which illustrate bearish bias momentum signal suggest the pair to extend its losses after it successfully breakout support level at 1.3035.

Resistance level: 1.3095, 1.3240

Support level: 1.3035, 1.2960

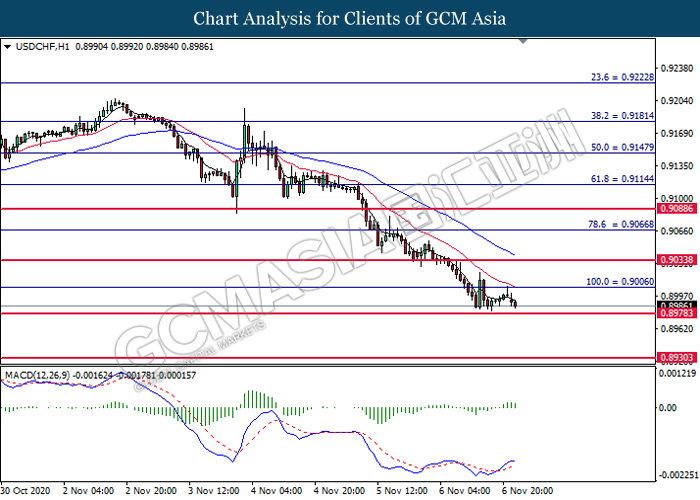

USDCHF, H1: USDCHF was traded lower following prior retracement from the resistance level at 0.9005. MACD which display diminishing bullish momentum signal suggest the pair to extend its losses toward the support level at 0.8980.

Resistance level: 0.9005, 0.9035

Support level: 0.8980, 0.8930

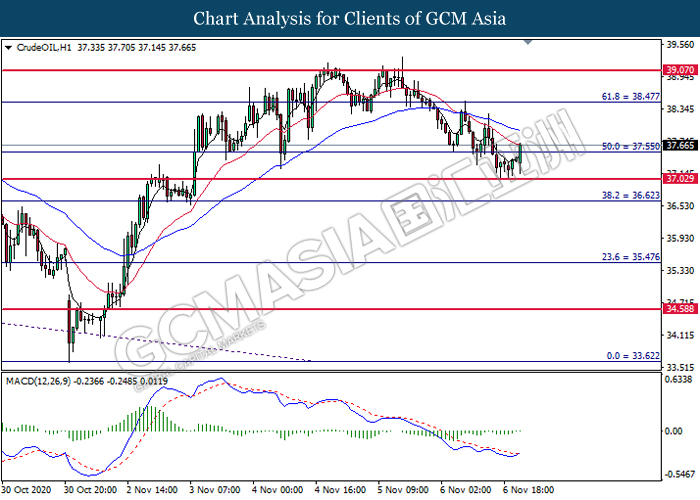

CrudeOIL, H1: Crude oil price was traded higher while currently testing the resistance level at 37.55. MACD which illustrate diminishing bearish momentum signal suggest the commodity to extend its gains after it successfully breakout above the resistance level at 37.55.

Resistance level: 37.55, 38.45

Support level: 37.05, 36.65

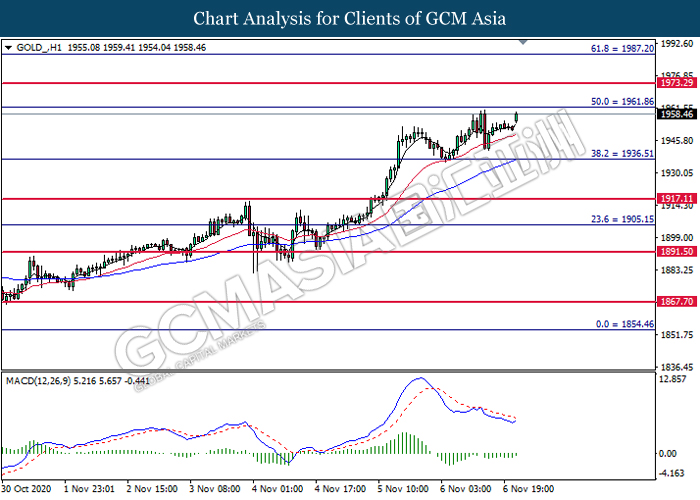

GOLD_, H1: Gold price was traded higher following prior rebound from the support level at 1936.50. MACD which illustrate diminishing bearish momentum signal suggest the commodity to extend its gains toward the resistance level at 1961.85.

Resistance level: 1961.85, 1973.30

Support level: 1936.50, 1917.10