10 May 2017 Daily Analysis

Greenback slips following Comey’s dismissal.

US dollar sagged during Asian trading hours on Wednesday while perceived safe-haven yen soared after US President Donald Trump abruptly fired FBI Director James Comey in a move that shocked Washington and financial market alike. Comey had been leading his agency’s investigation over alleged Russian meddling in 2016 US presidential campaign and possible collusion with Trump’s campaign. Any US political turmoil will weigh on the dollar as currently divided Congress could derail Trump’s effort to implement tax reform and fiscal stimulus. The dollar index slipped 0.25% to 99.25 while pairing of USD/JPY was down 0.07% to 113.92. Otherwise, euro was up 0.20% to $1.0896, snapping out from prior decline as of writing. President of European Central Bank Mario Draghi is scheduled to deliver his speech at Dutch House of Representatives later tonight while investors observe if he would alter his dovish tone in light of recent economic rebound within the euro zone.

As for the commodities, crude oil price gained 0.76% to $46.23 a barrel following sharper draw in US crude inventories. According to the American Petroleum Institute, crude inventories fell more than expected with 5.79 million barrels, easing investors worry over ongoing rebound in US shale production. Similarly, gold price added up 0.57% to $1,221.23 following Trump’s abrupt decision to dismiss FBI Director James Comey which sparked risk aversion among investors.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 EUR ECB President Draghi Speaks

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 09:30 | CNY – CPI (YoY) (Apr) | 0.9% | 1.1% | 1.2% |

| 09:30 | CNY – PPI (YoY) (Apr) | 7.6% | 6.9% | 6.4% |

| 20:30 | USD – Import Price Index (MoM) (Apr) | -0.2% | 0.2% | – |

| 22:30 | Crude Oil – Crude Oil Inventories | -0.930M | -1.786M | – |

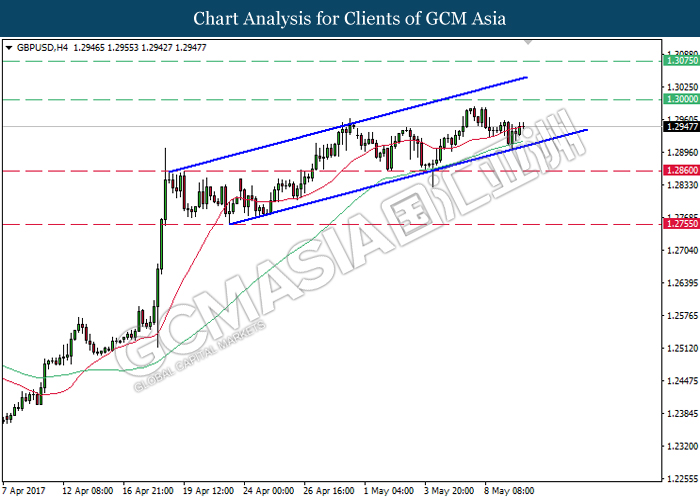

GBPUSD

GBPUSD, H4: GBPUSD remains traded within an upward channel following prior rebound from the bottom level of the channel. A successful closure above the 20-moving average line (red) would suggest GBPUSD to advance towards the target of resistance level at 1.3000.

Resistance level: 1.3000, 1.3075

Support level: 1.2860, 1.2755

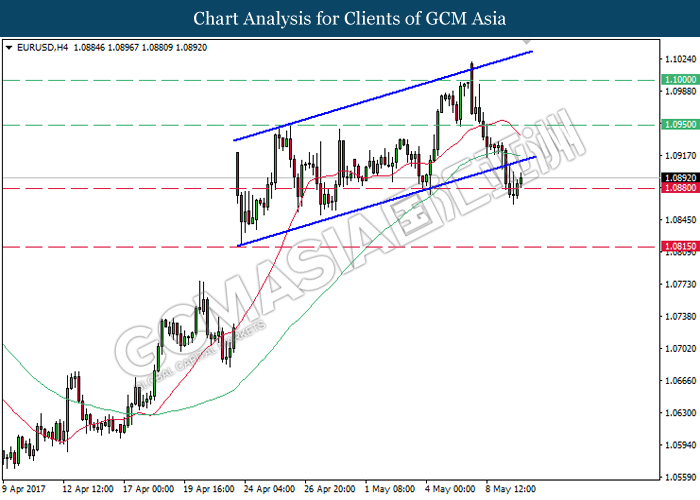

EURUSD

EURUSD, H4: EURUSD has recently rebounded following prior breakout from the bottom level of upward channel. Such rebound suggests EURUSD to be traded higher in short-term as retracement period. Long-term trend direction suggests EURUSD to be traded lower as both MA line continues to narrow downwards.

Resistance level: 1.0950, 1.1000

Support level: 1.0880, 1.0815

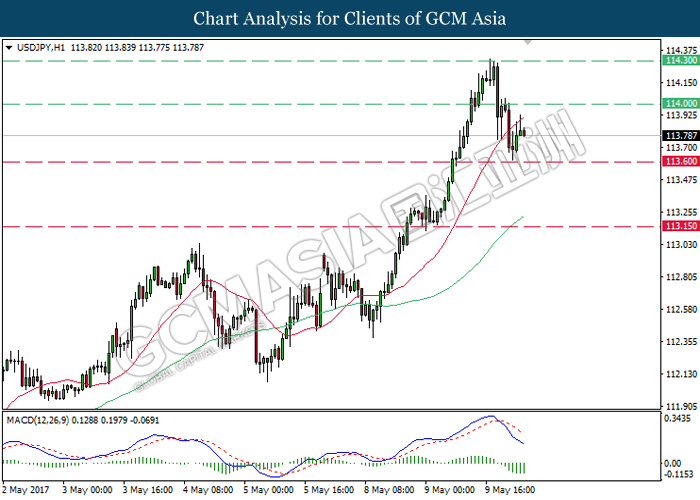

USDJPY

USDJPY, H1: USDJPY was traded lower following prior retracement from the recent high of 114.30. Referring to the MACD histogram which illustrates downward signal and momentum, USDJPY is expected to be traded lower towards the target of support level at 113.60.

Resistance level: 114.00, 114.30

Support level: 113.60, 113.15

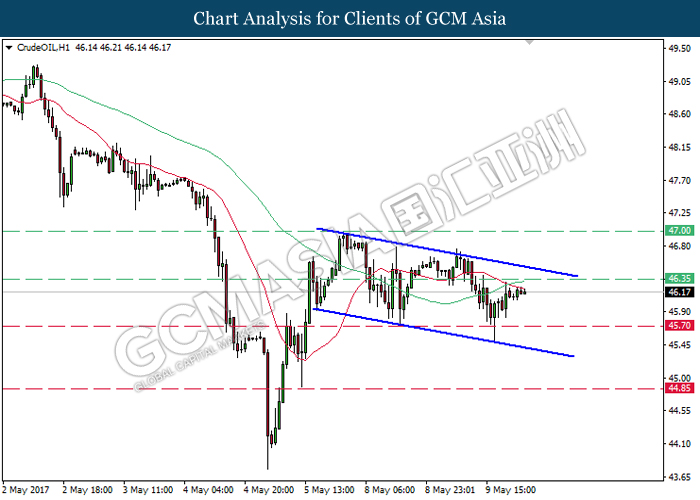

CrudeOIL

CrudeOIL, H1: Crude oil price remains traded within a small downward channel while currently testing near the top level of the channel. A retracement from this level would suggest crude oil price to be traded lower, towards the target of support level at 45.70.

Resistance level: 46.35, 47.00

Support level: 45.70, 44.85

GOLD

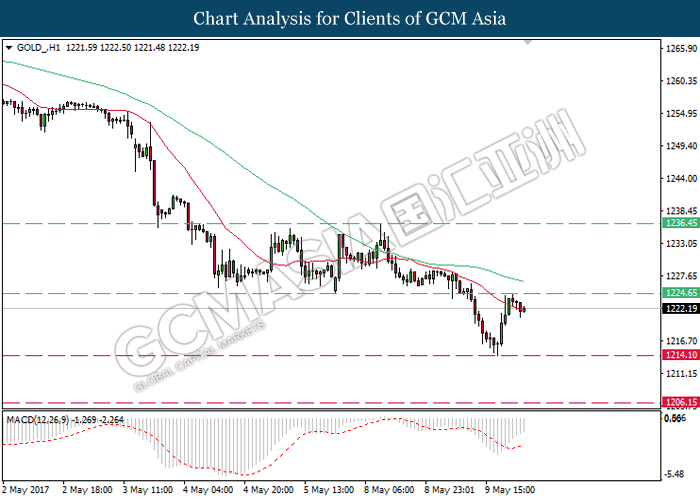

GOLD_, H1: Gold price was traded lower following prior retracement from the resistance level of 1224.65. However, as the MACD indicator remained hovered outside of downward momentum, gold price is expected to be traded higher in short-term as technical corrections. Long-term trend direction still suggests gold price to move further downwards.

Resistance level: 1224.65, 1236.45

Support level: 1214.10, 1206.15