10 July 2023 Afternoon Session Analysis

Canadian dollar soars as job changes soar in June.

The Canadian dollar (Loonie) which traded against the dollar index, extended its gains after the Canadian June employment changes soared and weaker US labor conditions. The Canadian June employment increased to 59.9K from -17.3K, beating the market estimations of 20.0K, data from Statistic Canada (StatsCan) showed last Friday. However, the unemployment rate rose to 5.4% from 5.2%, more than the market expected of 5.3%. Canadian jobless rate increased for two consecutive months and hit its highest level since February 2022, though still below a pre-pandemic 12-month average, StatsCan reported. With such a backdrop, a stronger than expected employment conditions in June prompted investors that the central bank to hike for the next monetary policy, the Loonie strengthened. Nonetheless, the Ivey PMI reflects a fragile situation after the reading eased to 50.2 from 53.5, lower than expectations of 51.5. The Ivey PMI decreased for 4 straight months after the central bank continues its tightening its rates and limited the business for growth. At this movement, investors will eye on Bank of Canada’s monetary policy to get further direction of the policy moves. As of writing, the pair of USDCAD traded up by 0.16% to 1.3293.

In the commodities market, crude oil prices ticked down by -0.69% to $73.35 per barrel as the China CPI and PPI stood at 0.0% and -5.4%, slipping more than the expected 0.2% and -5.0%. On the other hand, the price of gold slipped by -0.06% to 1924.05 as the dollar rebounded after the significant drop in the previous session.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

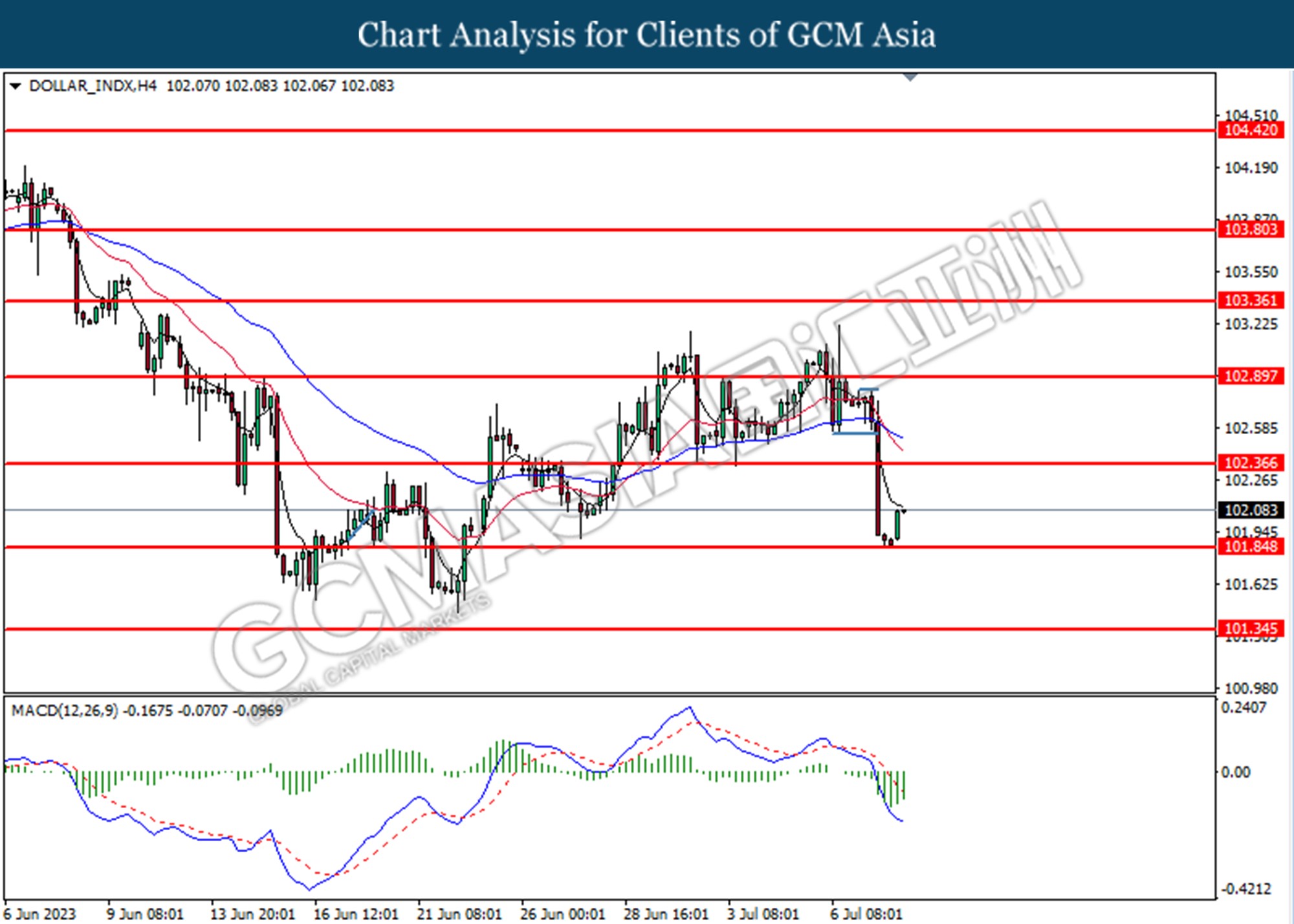

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from the support level at 101.85. MACD which illustrated diminishing bearish momentum suggests the index extended its gains toward the resistance level.

Resistance level: 102.35, 102.90

Support level: 101.85, 101.35

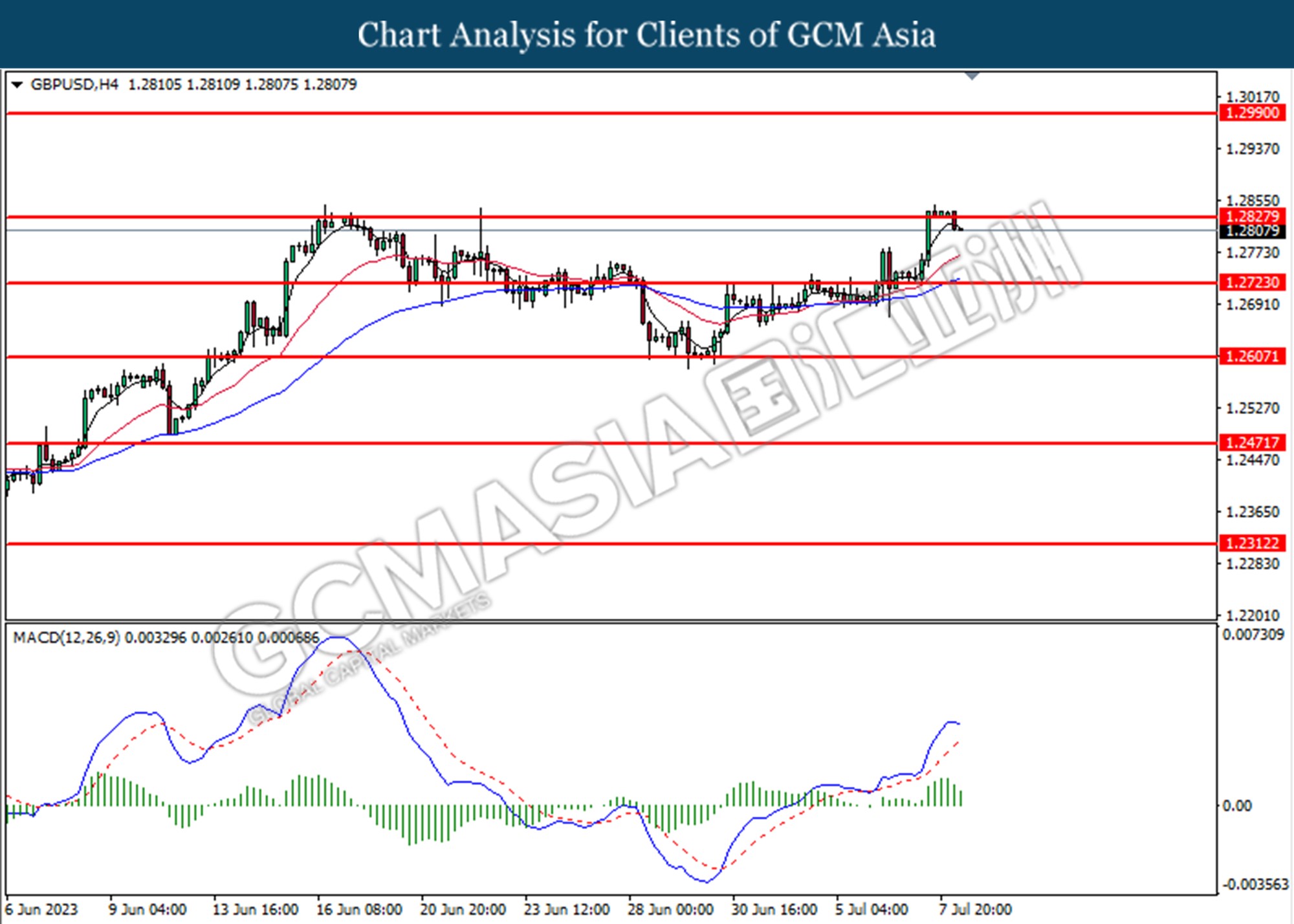

GBPUSD, H4: GBPUSD was traded lower following the prior breaks below the previous support level at 1.2830. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.2830, 1.2990

Support level: 1.2730, 1.2610

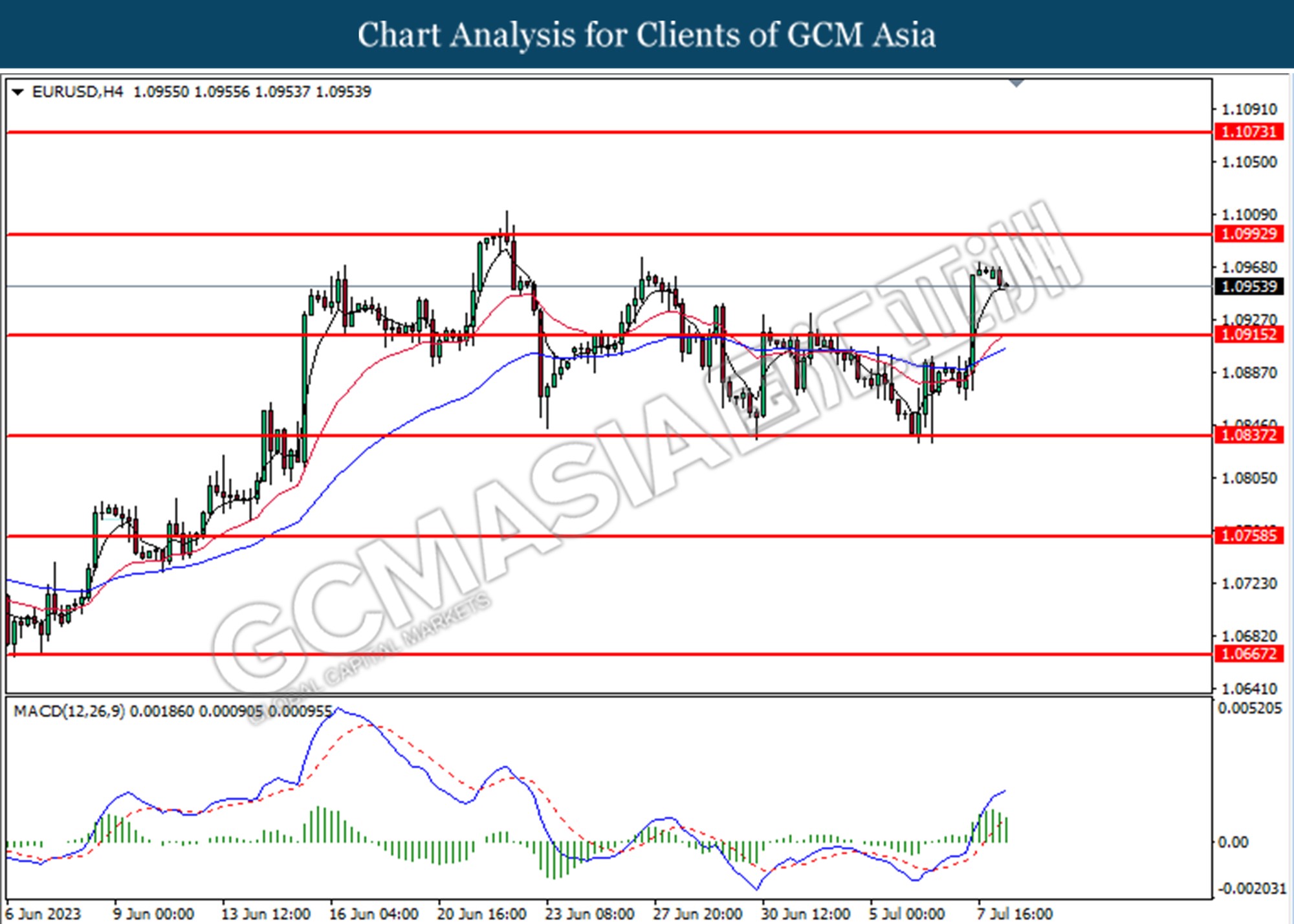

EURUSD, H4: GBPUSD was traded lower following a prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses towards the support level at 1.0915.

Resistance level: 1.0990, 1.1075

Support level: 1.0915, 1.0840

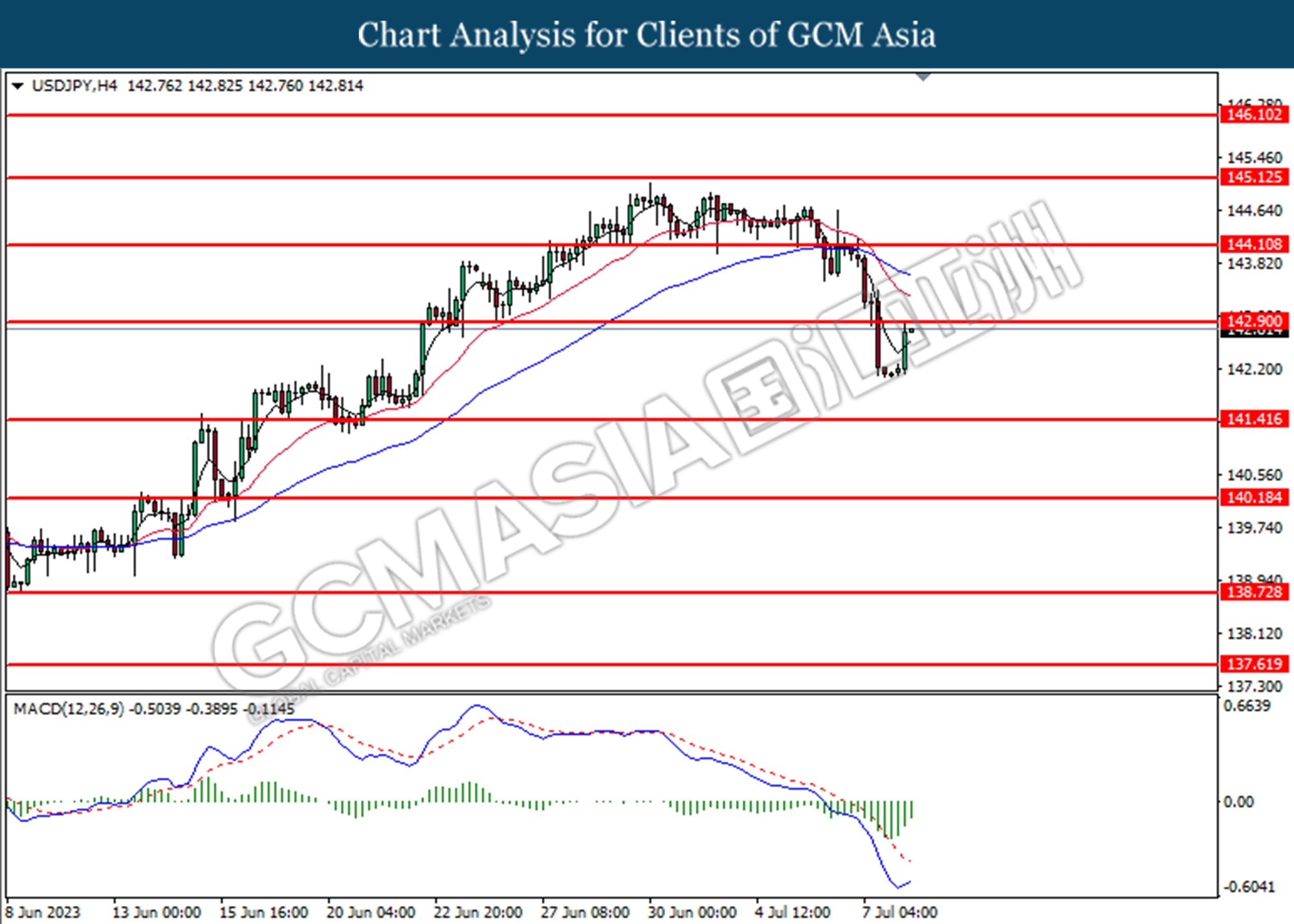

USDJPY, H4: USDJPY was traded higher while currently testing for the resistance level at 142.90. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains after it successfully breaks above the resistance level.

Resistance level: 142.90, 144.10

Support level: 141.40, 140.20

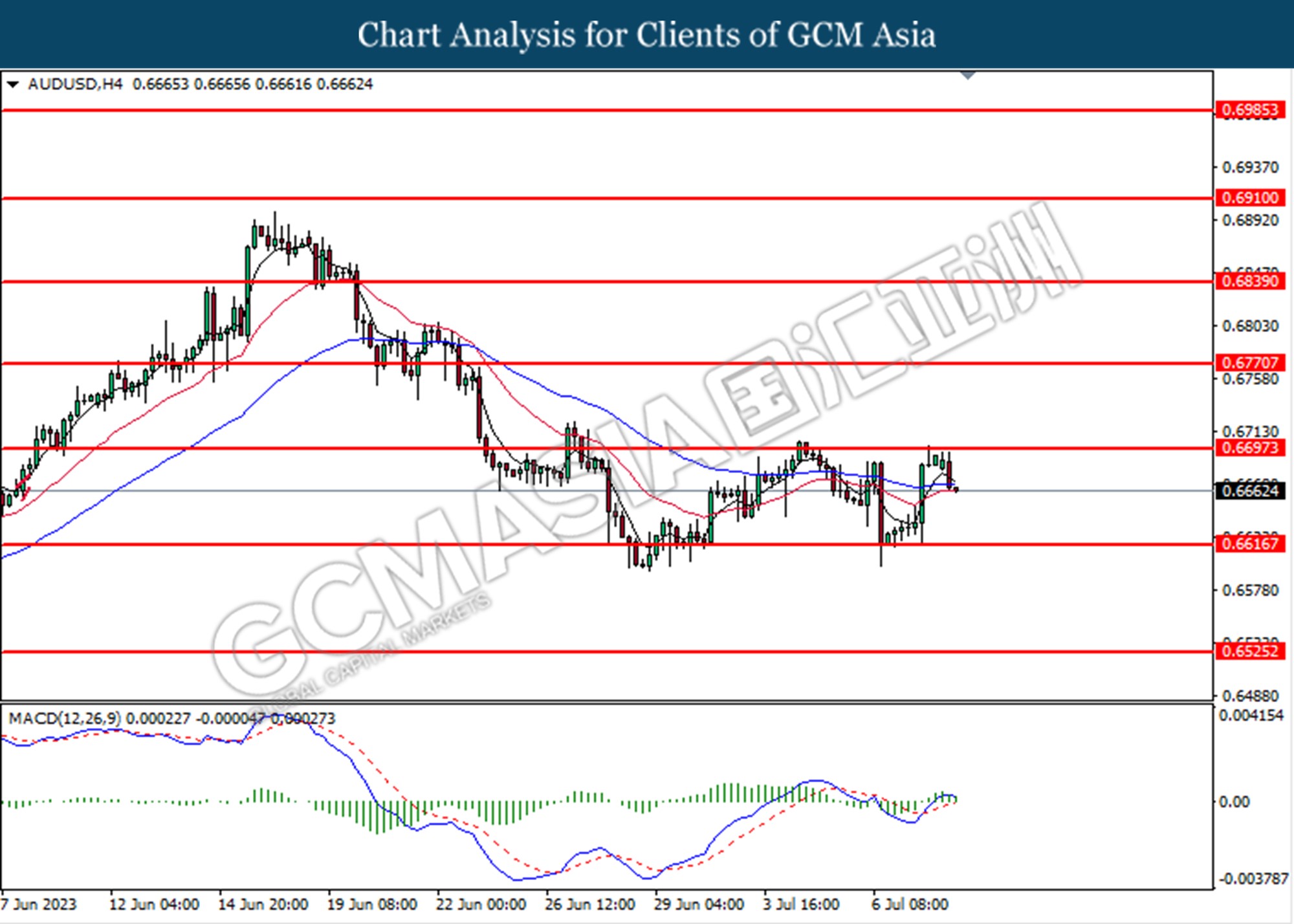

AUDUSD, H4: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6700. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses toward the support level at 0.6615.

Resistance level: 0.6700, 0.6770

Support level: 0.6615, 0.6525

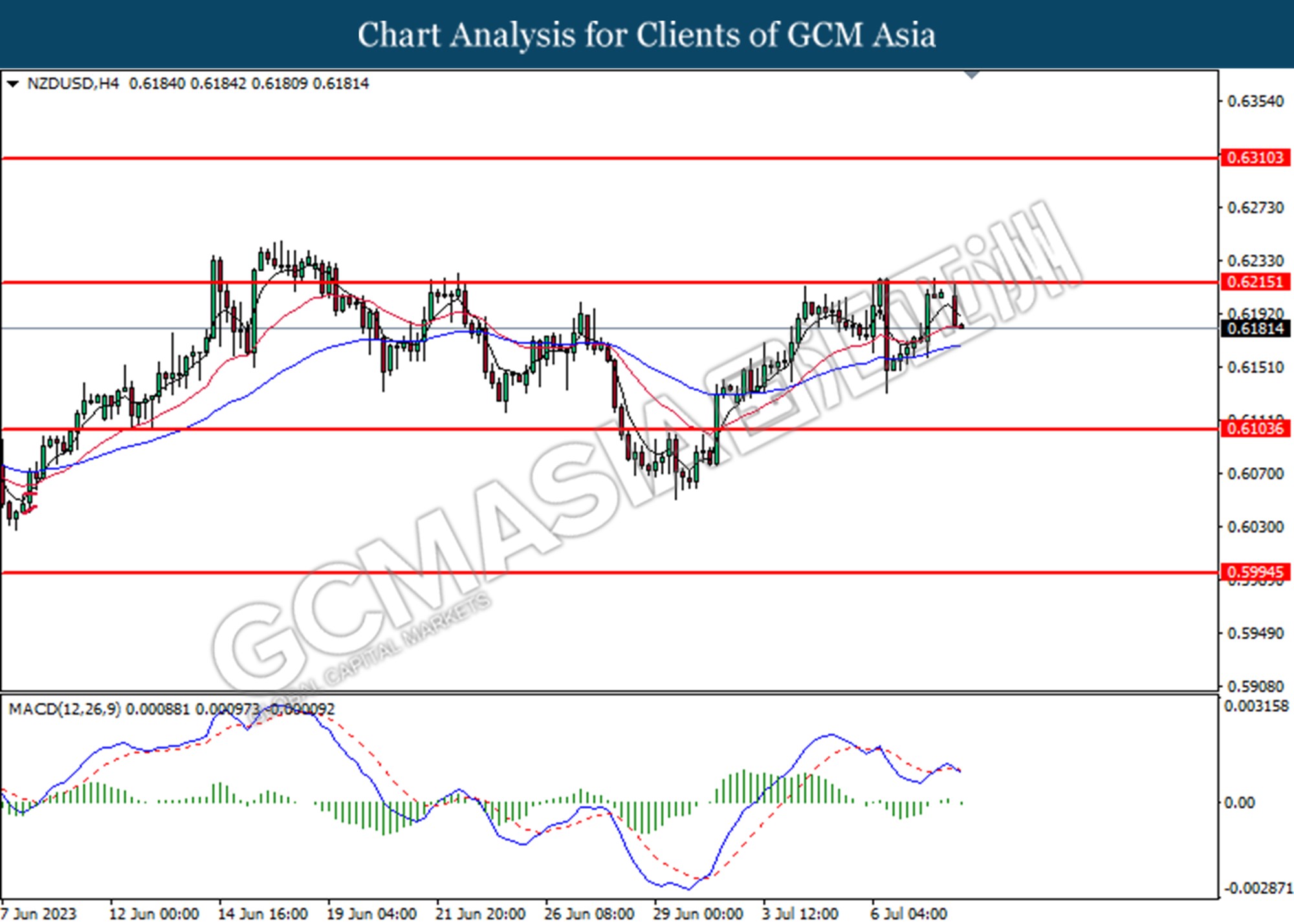

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6215. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

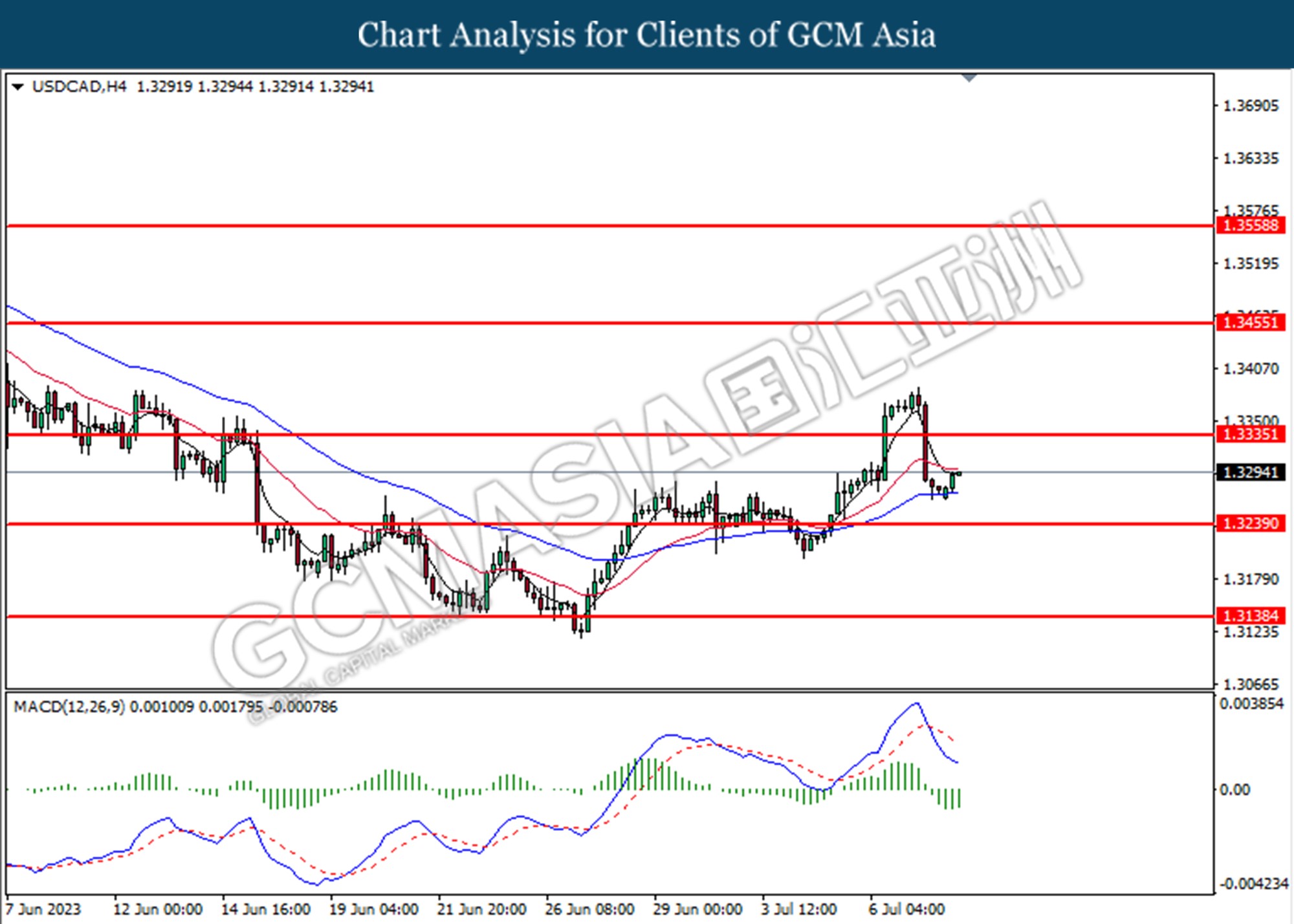

USDCAD, H4: USDCAD was traded higher following the prior rebound from the lower level. However, MACD which illustrated diminishing bearish momentum suggests the pair extended its gains towards the resistance level at 1.3335

Resistance level: 1.3335, 1.3455

Support level: 1.3240, 1.3140

USDCHF, H4: USDCHF was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

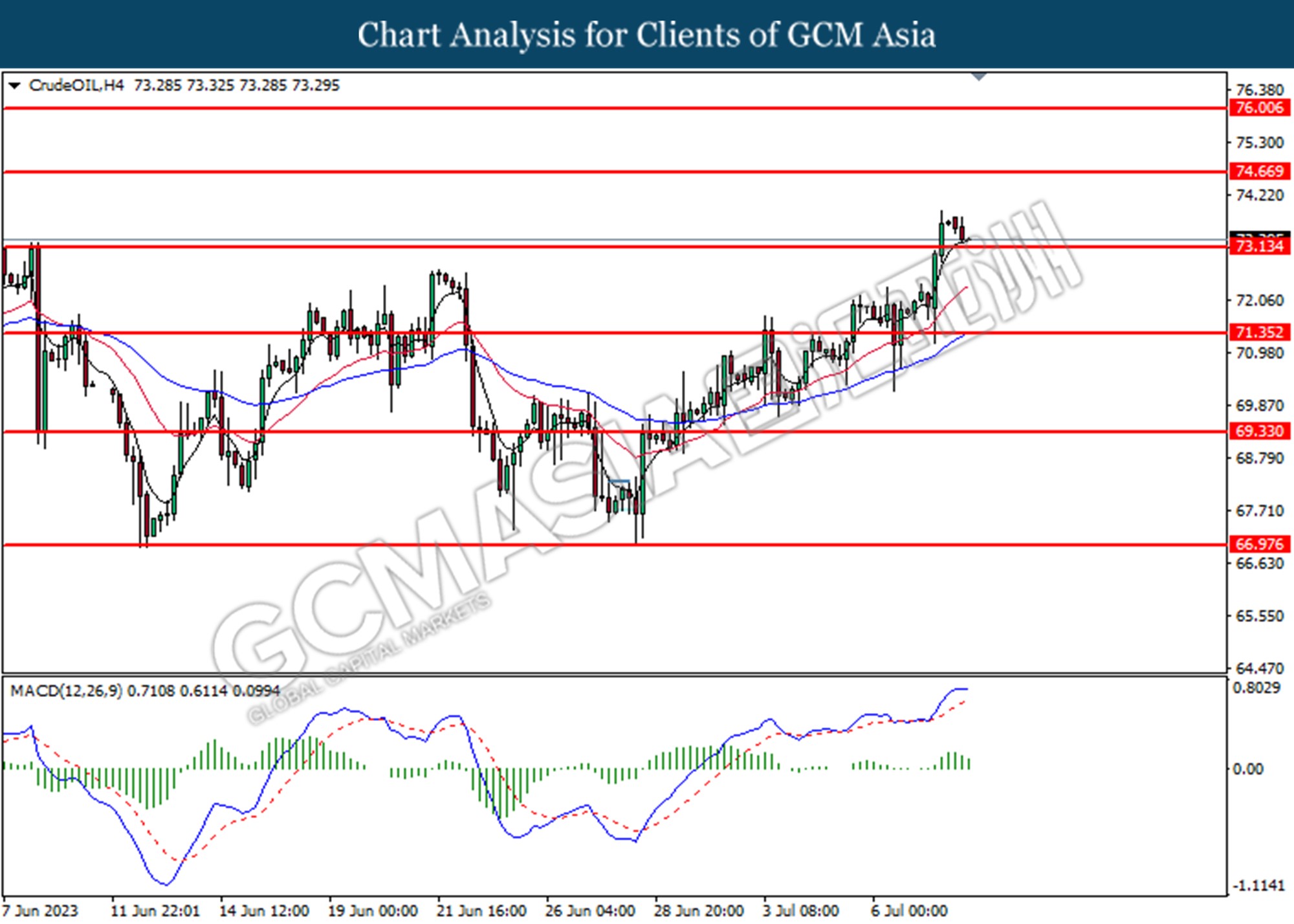

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the commodity extended its losses towards the support level at 73.15.

Resistance level: 74.65, 76.00

Support level: 73.15, 71.35

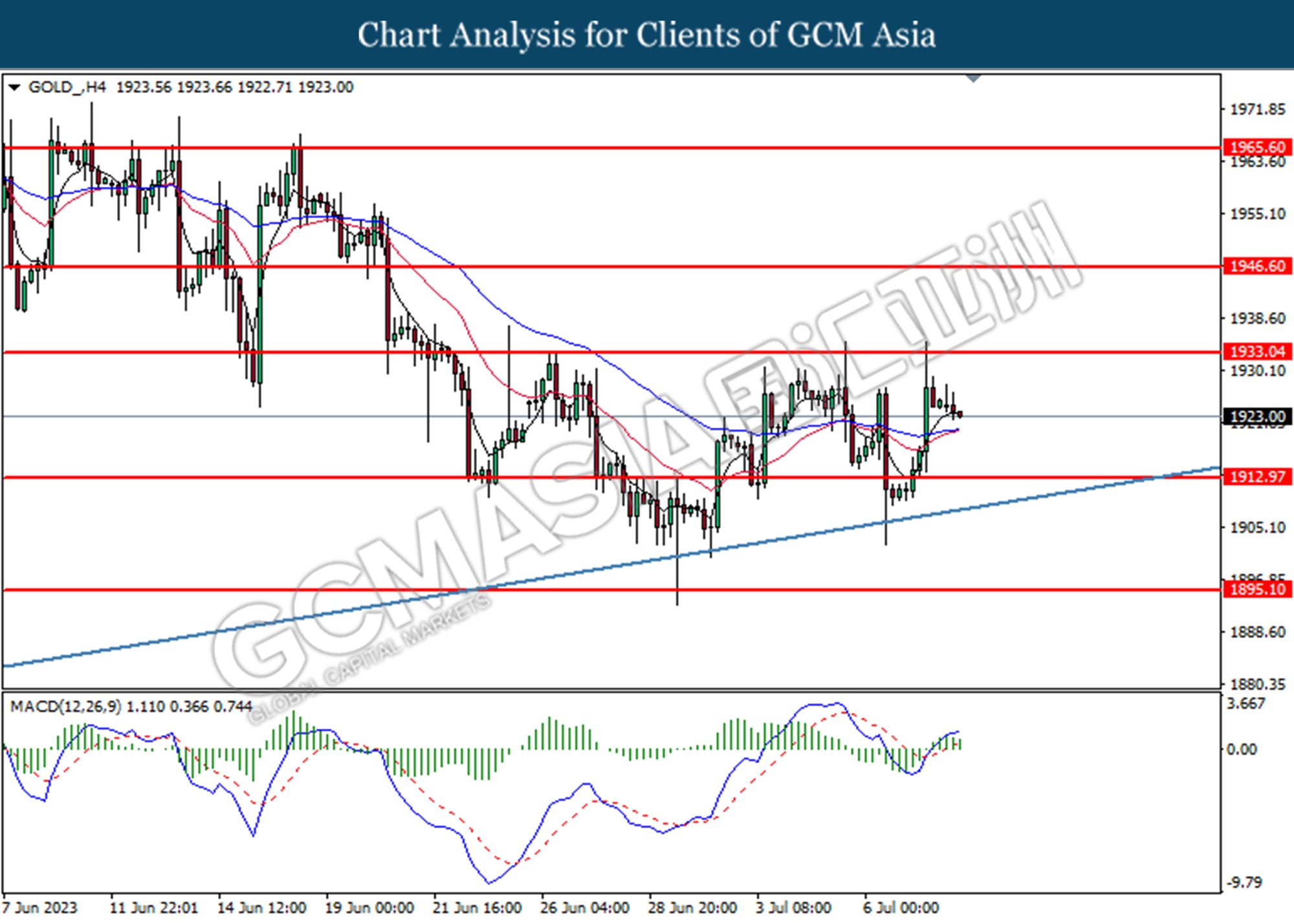

GOLD_, H4: Gold price was traded lower following the prior retracement from the resistance level at 1933.05. MACD which illustrated diminishing bearish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 1933.05, 1946.60

Support level: 1913.00, 1895.10