10 July 2023 Morning Session Analysis

US dollar plunged amid downbeat NFP report.

The dollar index, which was traded against a basket of six major currencies, lost its ground as the last Friday’s Nonfarm Payroll report disappointed the market participants, diminishing the market concern of how high the interest rate will go. In June, the U.S. economy saw the lowest job growth in two and a half years. According to the Labor Department’s employment report, there were 110,000 fewer jobs created in April and May, suggesting that businesses were becoming more cautious in expanding their workforce due to higher borrowing costs. The survey of establishments revealed that nonfarm payrolls only increased by 209,000 jobs in June, marking the smallest gain since December 2020. This figure fell short of economists’ expectations, as they had predicted a rise of 225,000 jobs. However, the US Unemployment managed to lighten up the optimism in the US labor market. According to the Bureau of Labour Statistics, the US unemployment rate dropped from 3.7% to 3.6%, in line with the market expectation. As of writing, the dollar index slipped -0.02% to 102.30.

In the commodities market, crude oil prices were up by 0.11% to $73.55 per barrel as the weakening of US dollar prompted the non-US oil buyers to rush into the oil market. Besides, gold prices spiked 0.08% to $1926.65 per troy ounce amid the disappointing Nonfarm Payroll report.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 103.00. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 100.65.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

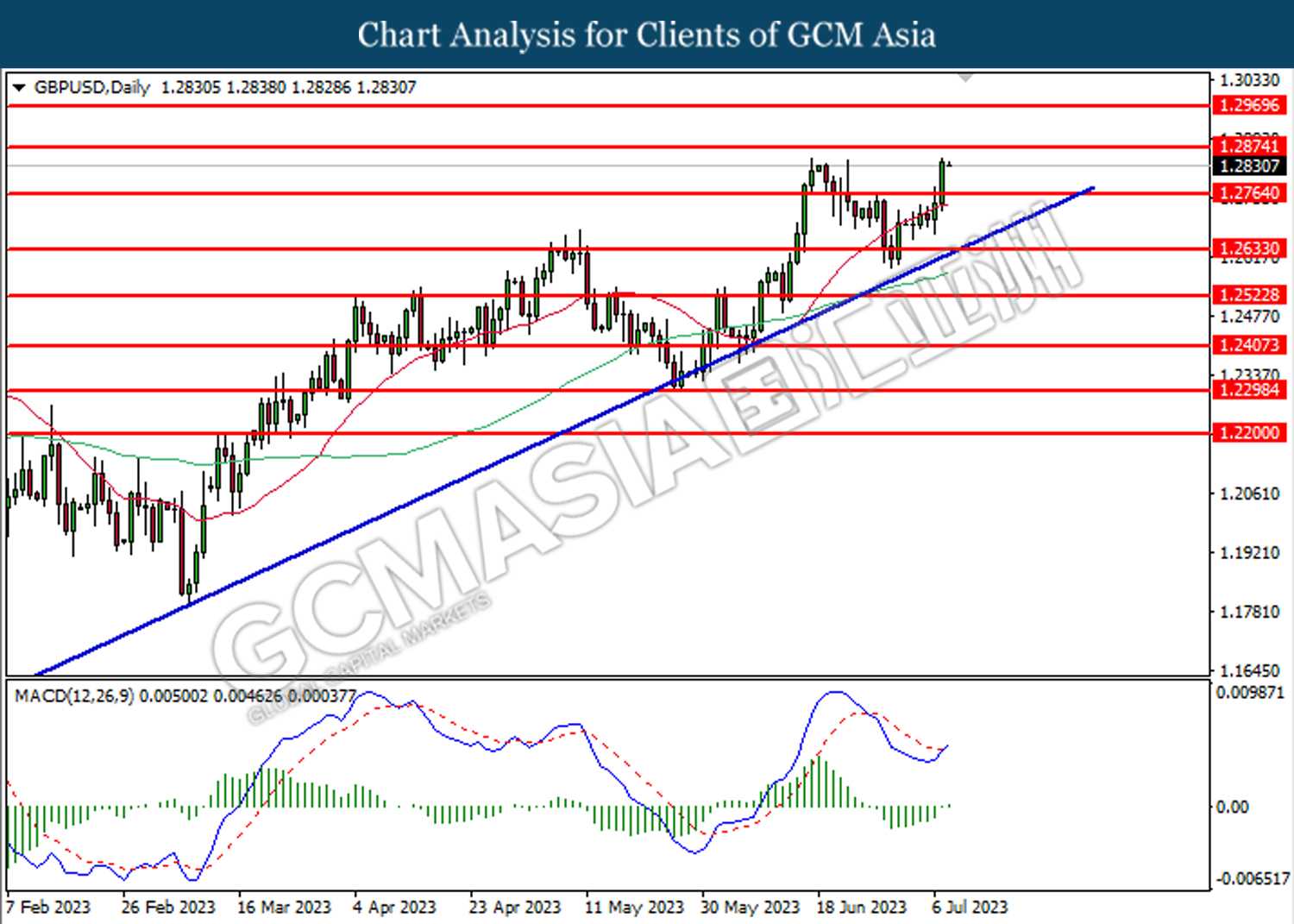

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2765. MACD which illustrated bullish bias momentum suggest the pair to extend its toward the resistance level at 1.2875.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2635

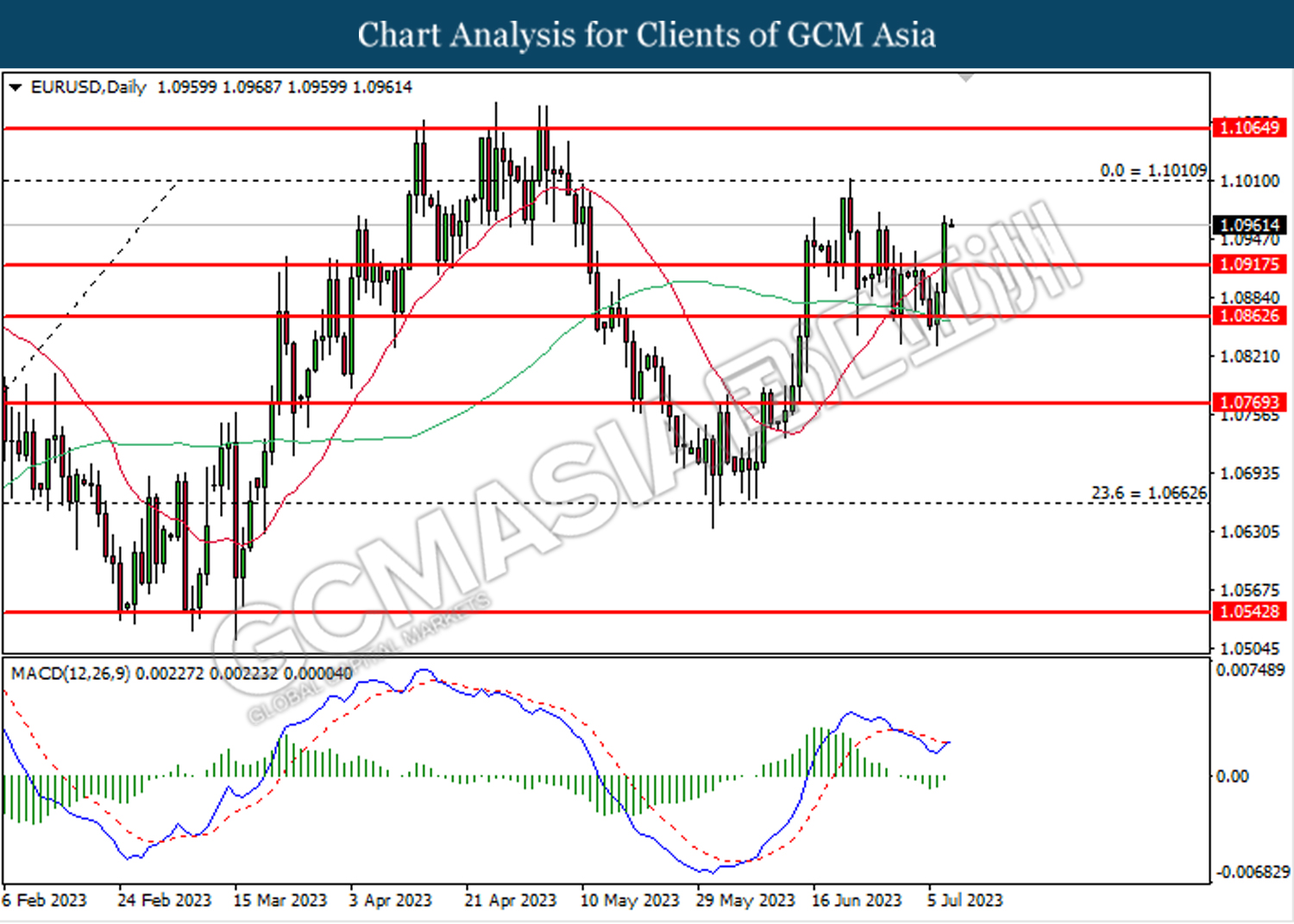

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.0915. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.1010.

Resistance level: 1.1010, 1.1065

Support level: 1.0915, 1.0865

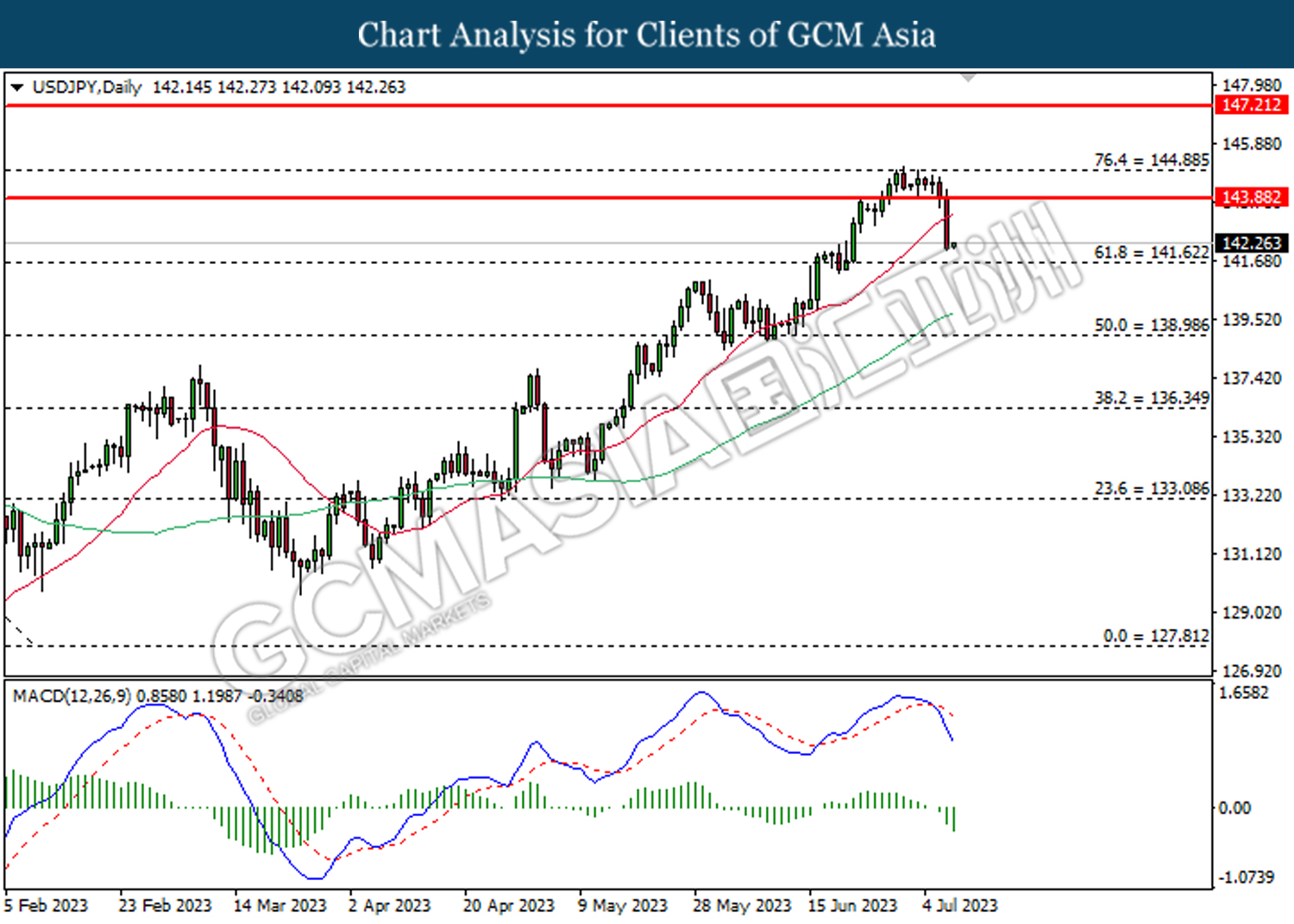

USDJPY, Daily: USDJPY was traded lower following the prior breakout below the previous support level at 143.90. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 141.60.

Resistance level: 143.90, 144.90

Support level: 141.60, 139.00

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

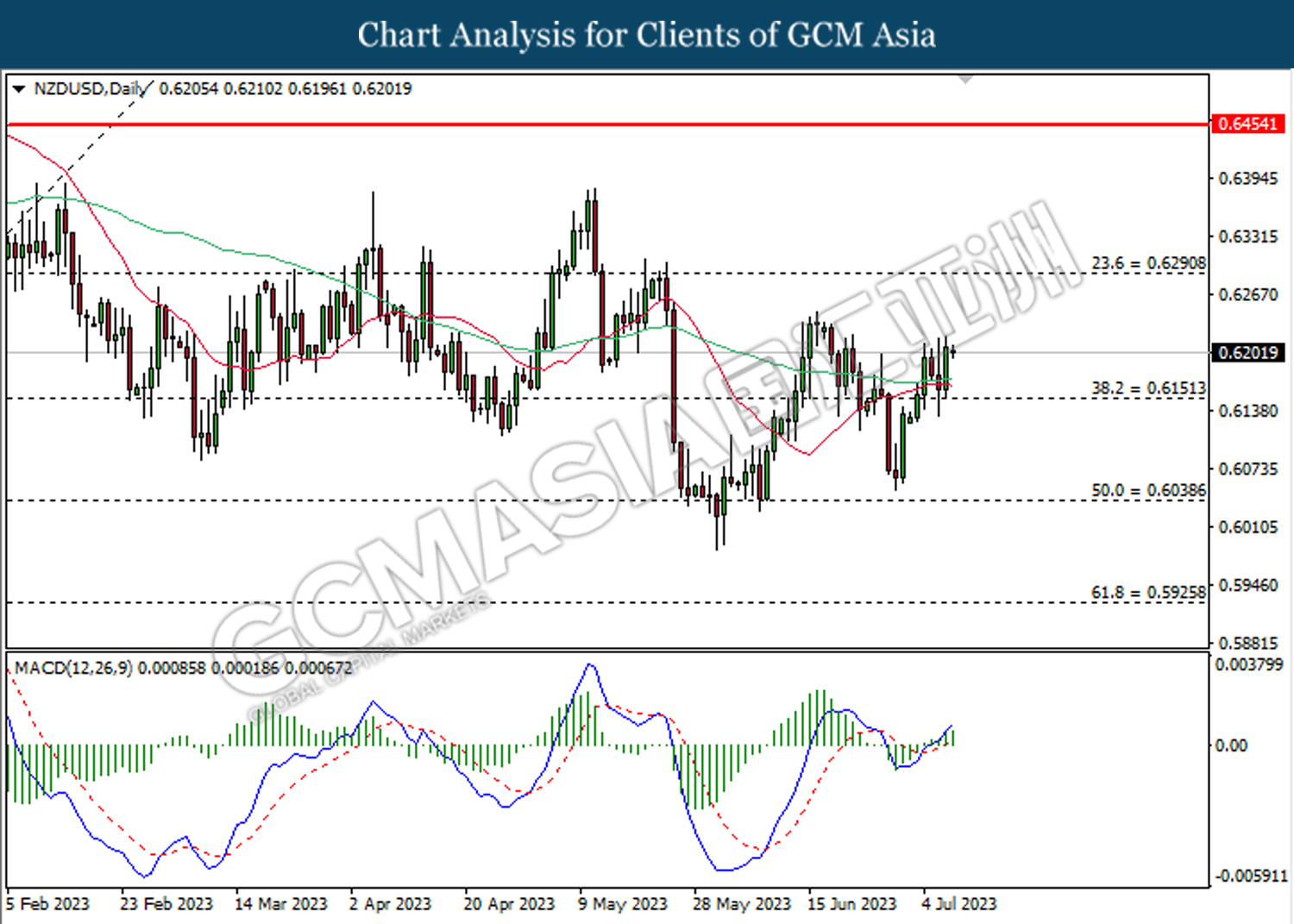

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

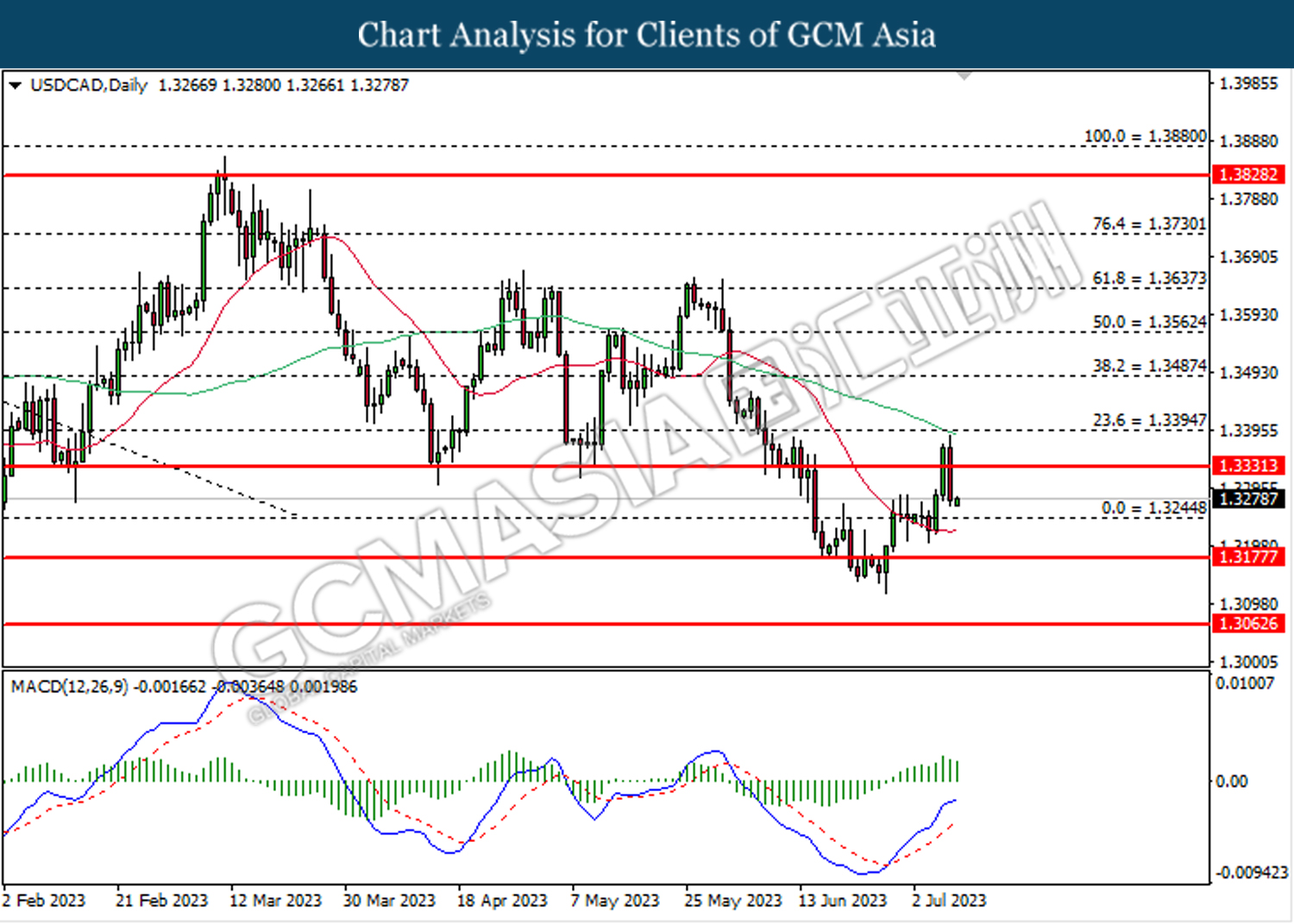

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3330. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3245.

Resistance level: 1.3330, 1.3395

Support level: 1.3245, 1.3175

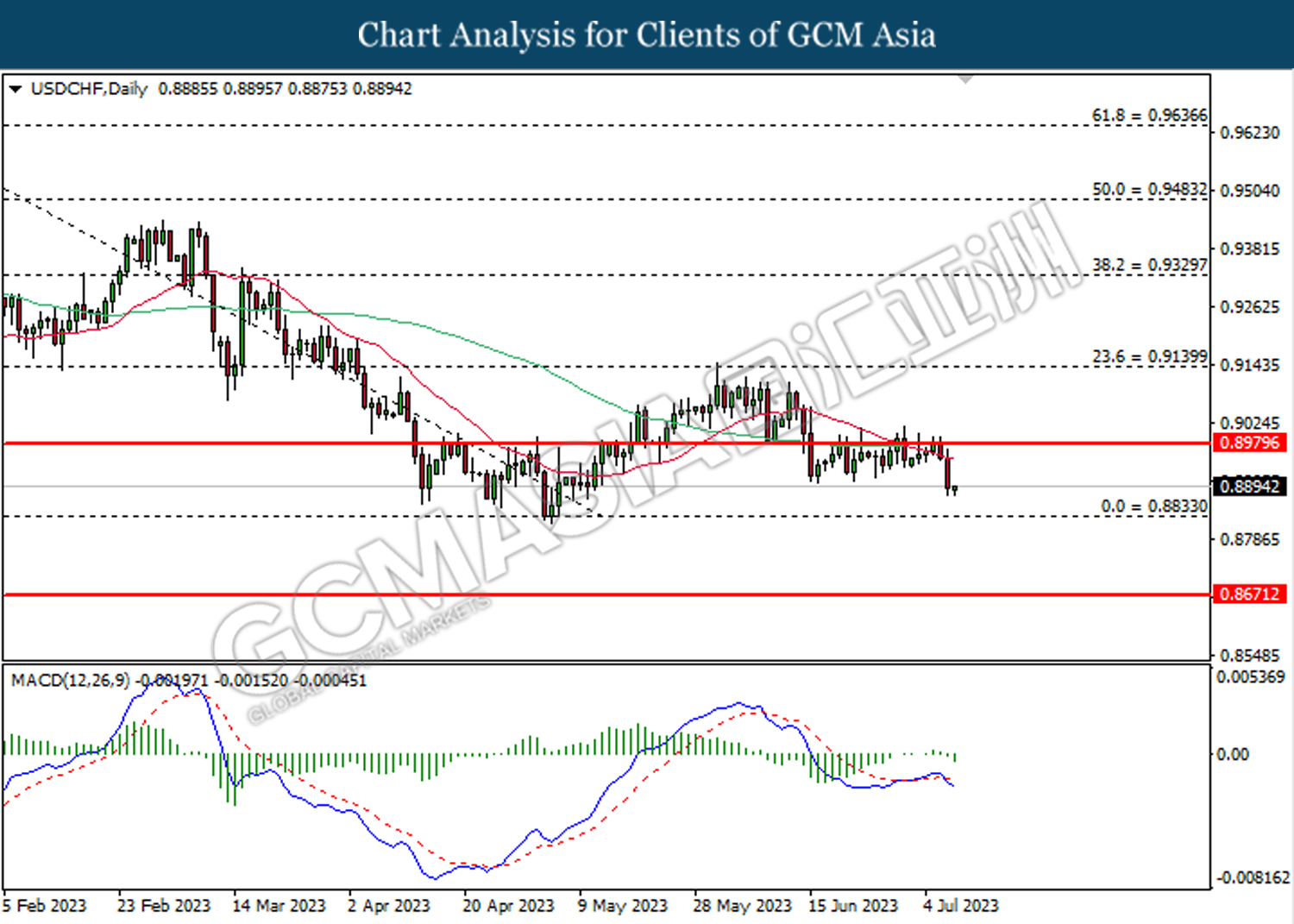

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.8980. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.8830.

Resistance level: 0.8980, 0.9140

Support level: 0.8830, 0.8670

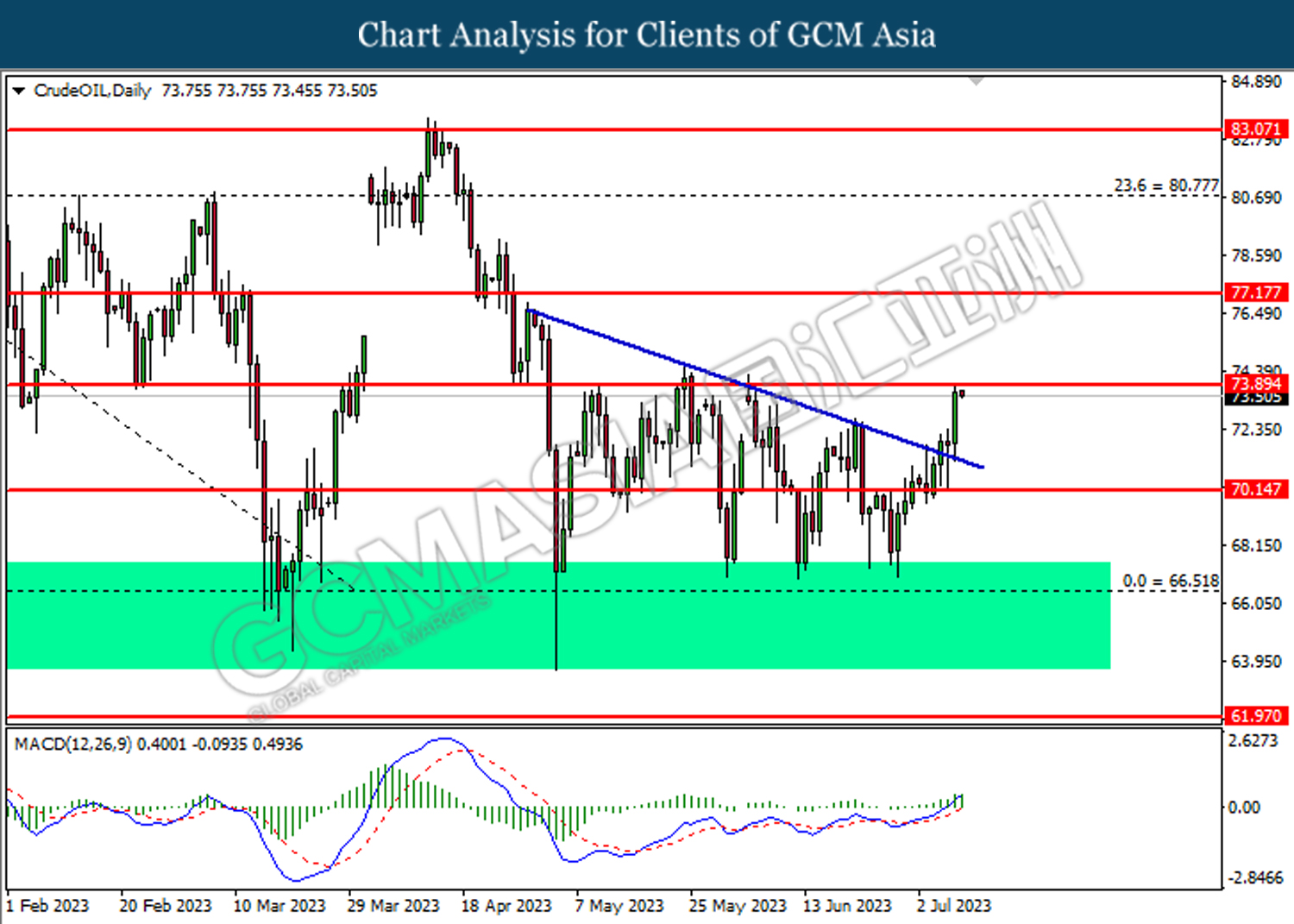

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 73.90. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

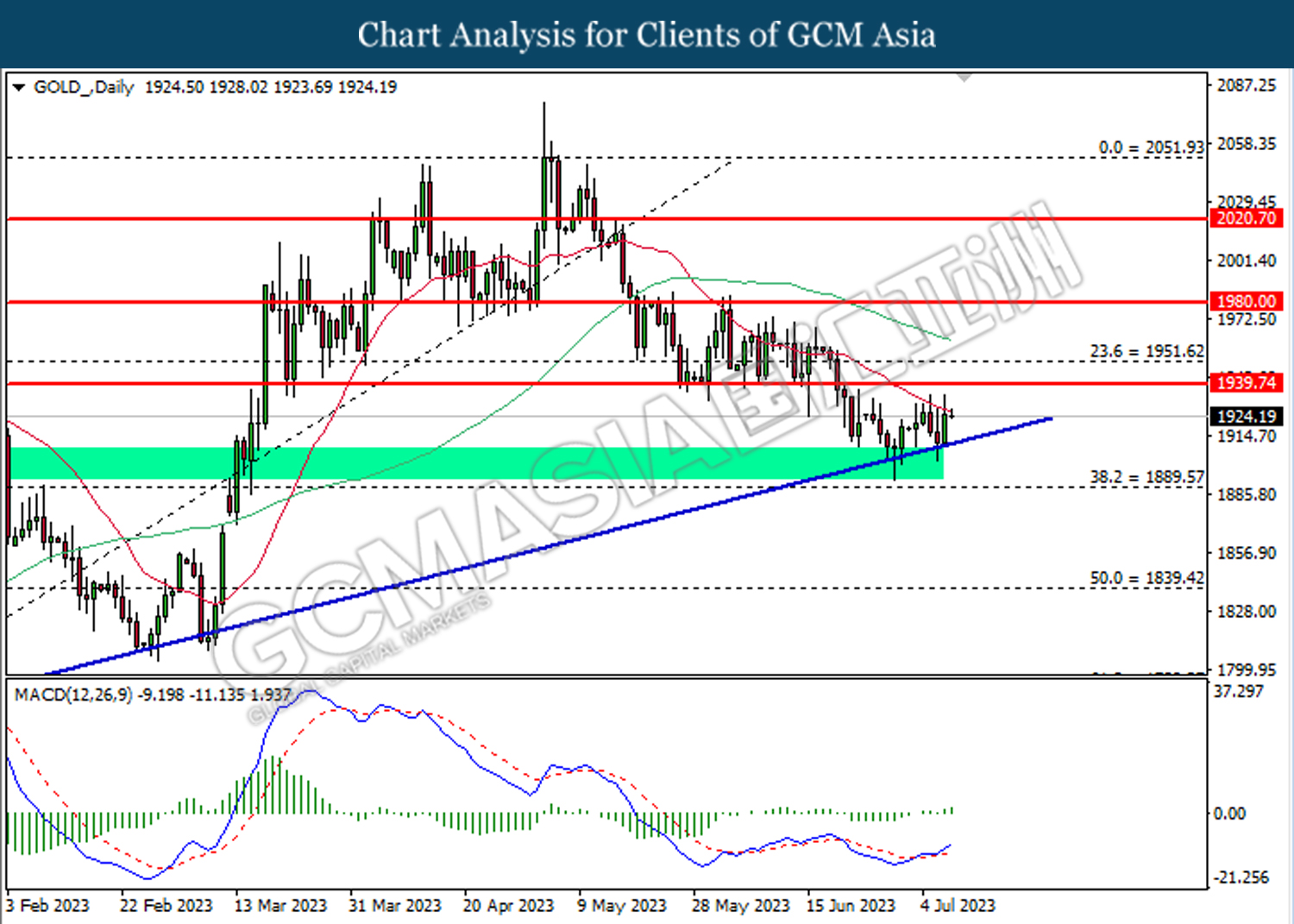

GOLD_, Daily: Gold price was traded higher following the prior rebound from the upward trend line. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1939.75.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40