10 August 2022 Afternoon Session Analysis

Pound turned sour upon potential power suspension.

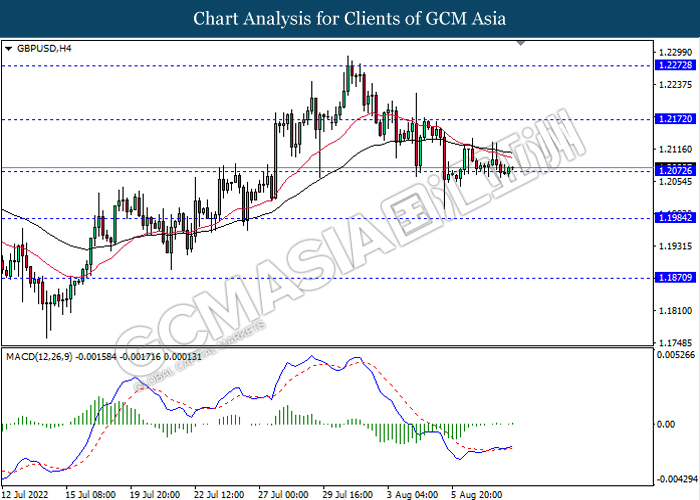

The GBP/USD, which widely traded by majority of investors dipped during the overnight trading session amid the backdrop of rising uncertainty of energy crisis which faced by UK. According to Bloomberg, UK had drawn up plans for potential power cuts to homes and industries in January’s winter, which driven by the storm of cold weather and gas shortages. Besides, the UK government had asked for the emergency plans from food and beverage industry in order to avoid empty shelves in case of blackout happened. The move implemented by UK government would bring negative impacts on businesses and homes across the country, as well as forcing the closure of railways, libraries and other Government buildings. In addition, Pound Sterling remained under pressure following the economy slowdown that caused by soaring inflation risk. Last week, Bank of England had emphasized that UK economy would enter to a recession in fourth quarter. As of writing, GBP/USD edged up by 0.03% to 1.2084.

In the commodities market, the crude oil price depreciated by 0.33% to $90.20 per barrel as of writing. Nonetheless, crude oil price surged on yesterday as Ukraine has stopped the oil pipeline which from Russia flows to Europe. On the other hand, the gold price appreciated by eased by 0.28% to $1790.93 per troy ounce as of writing. Though, trend of gold price remained bullish over the rising tensions between US and China.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core CPI (MoM) (Jul) | 0.7% | 0.5% | – |

| 20:30 | USD – CPI (YoY) (Jul) | 9.1% | 8.7% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 4.467M | 0.073M | – |

Technical Analysis

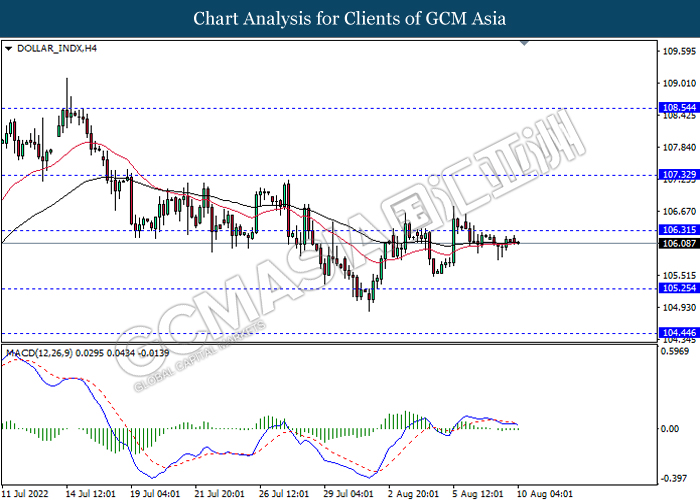

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 106.30, 107.30

Support level: 105.25, 104.45

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2170, 1.2270

Support level: 1.2070, 1.1985

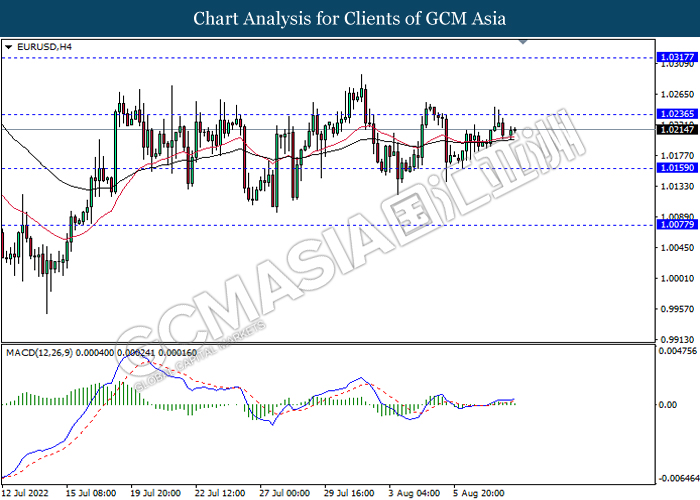

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0235, 1.0315

Support level: 1.0160, 1.0075

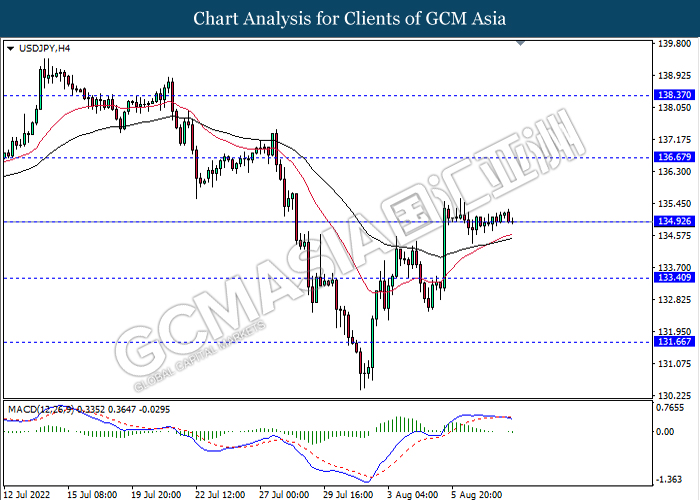

USDJPY, H4: USDJPY was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 136.65, 138.35

Support level: 134.90, 133.40

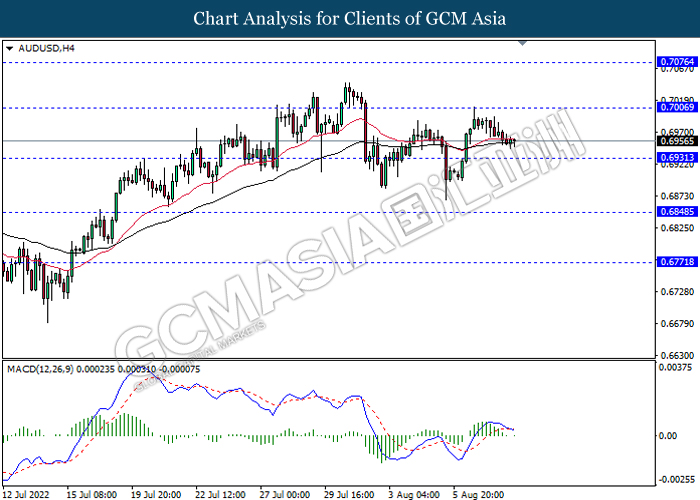

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

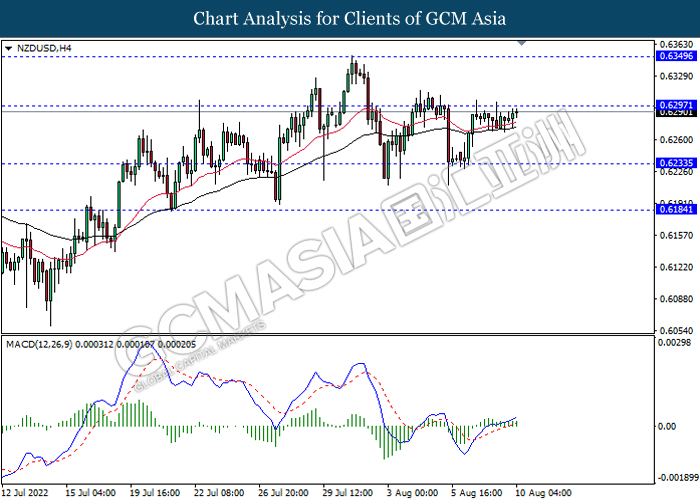

NZDUSD, H4: NZDUSD was traded higher while current testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6185

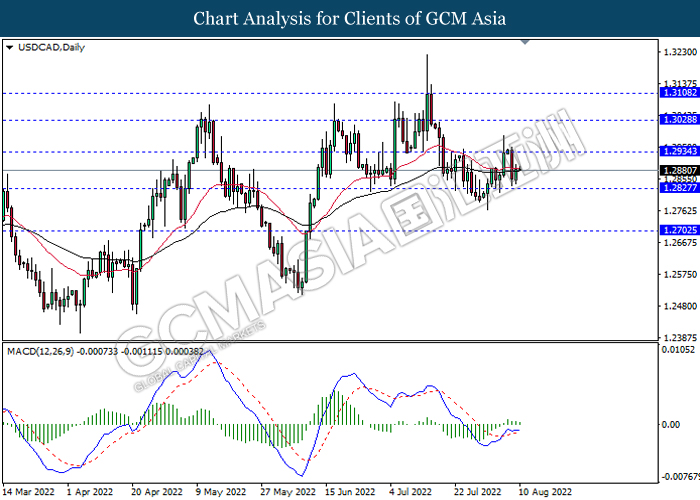

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2935, 1.3030

Support level: 1.2825, 1.2700

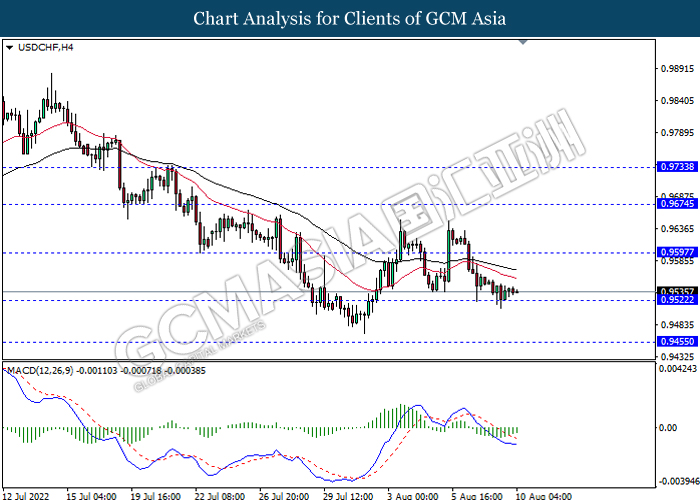

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

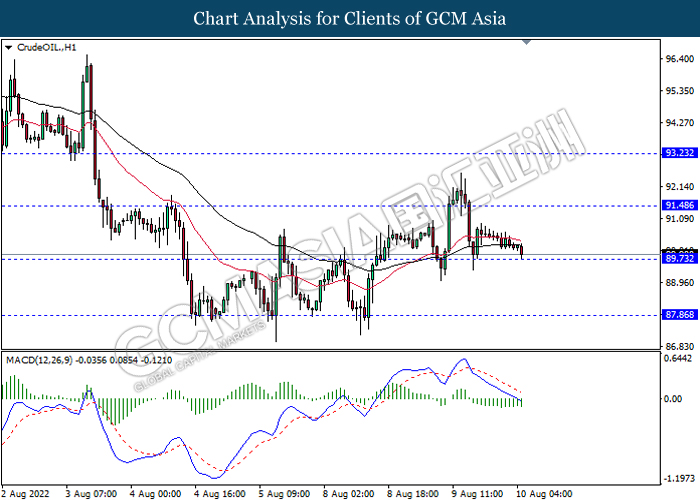

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 91.50, 93.25

Support level: 89.75, 87.85

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1807.65, 1836.10

Support level: 1778.80, 1756.95