10 August 2022 Morning Session Analysis

US dollar paralyzed ahead of inflation report.

The Dollar Index which traded against a basket of six major currencies hovered near the level above 106.00 since early this week as market participants are waiting for the announcement of the inflation data. The Consumer Price Index (CPI), which is used to gauge the inflationary pressures of the nation, is scheduled to be announced later today, whereby it would provide further clues on the tightening path of the Federal Reserve going forward. According to the Fed Rate Monitor Tool, the possibility of a 75-basis point rate hike is about 58.0% as of now, while 42% of the possibility that the Fed would only hike a 50-basis points in the upcoming meeting. With the backdrop of falling energy prices, economists are expecting the inflation figures for the month of July to fall from 9.1% to 8.7%. If the final reading of the data does not deviate from the market expectation far, it would likely urge the Fed officials to tilt toward a less aggressive rate hike in the next Fed meeting, says a 50-basis point instead of 70-basis point. As of writing, the dollar index edged lower -0.12% to 106.30.

In the commodities market, the crude oil price dropped by 0.02% to $90.50 per barrel as the API Weekly Crude Oil Stock has shown some stockpile over the week, where the crude oil inventories rose by 2.156M, missing the consensus forecast of 0.073M. On the other hand, the gold price appreciated by 0.05% to $1793.55 per troy ounce as the market risk appetite dwindled amid the ongoing tensions between the US and China.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core CPI (MoM) (Jul) | 0.7% | 0.5% | – |

| 20:30 | USD – CPI (YoY) (Jul) | 9.1% | 8.7% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 4.467M | 0.073M | – |

Technical Analysis

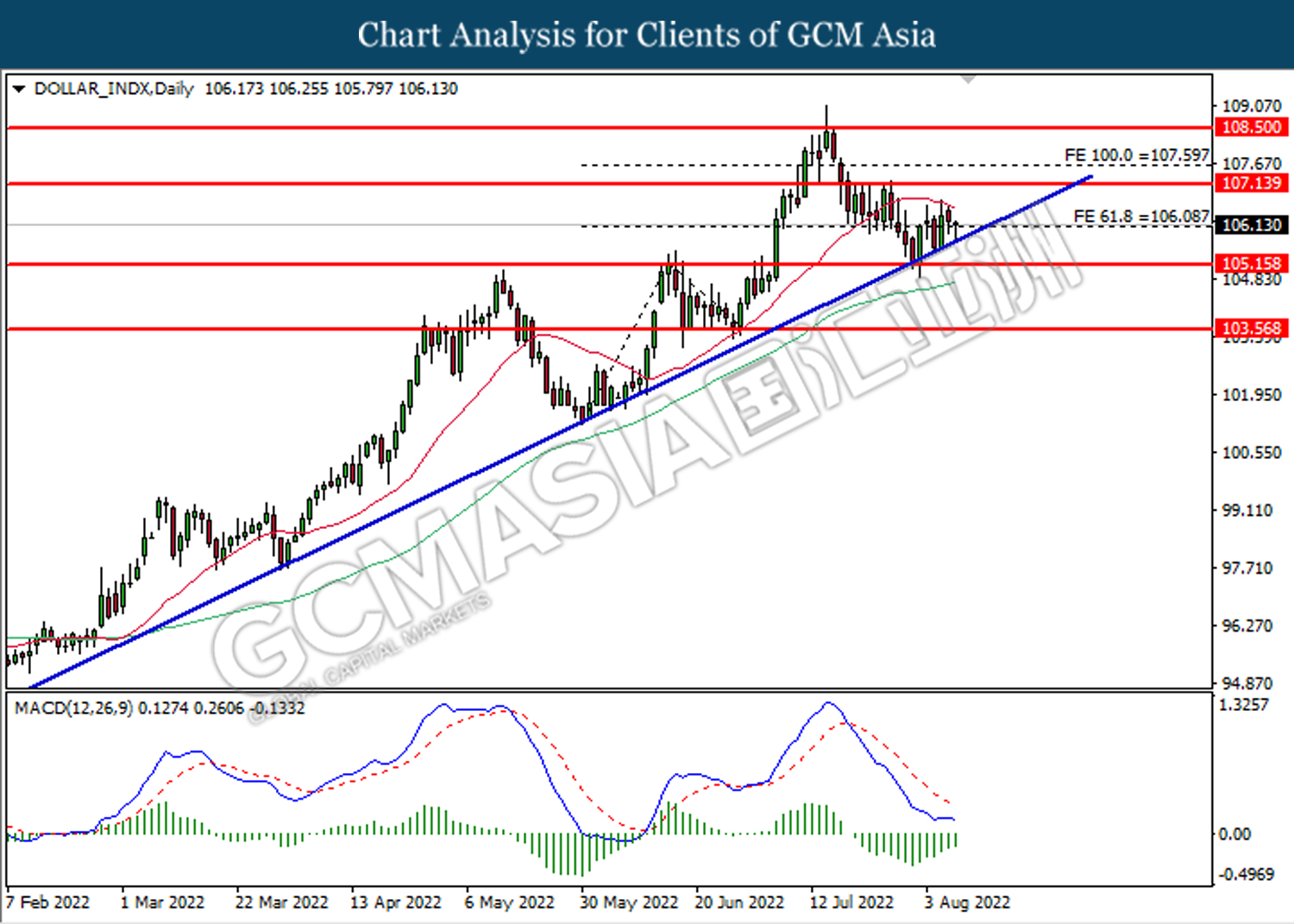

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the upward trendline. However, MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 107.15.

Resistance level: 107.15, 107.60

Support level: 106.10, 105.15

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level at 1.2035. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0155. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0265.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

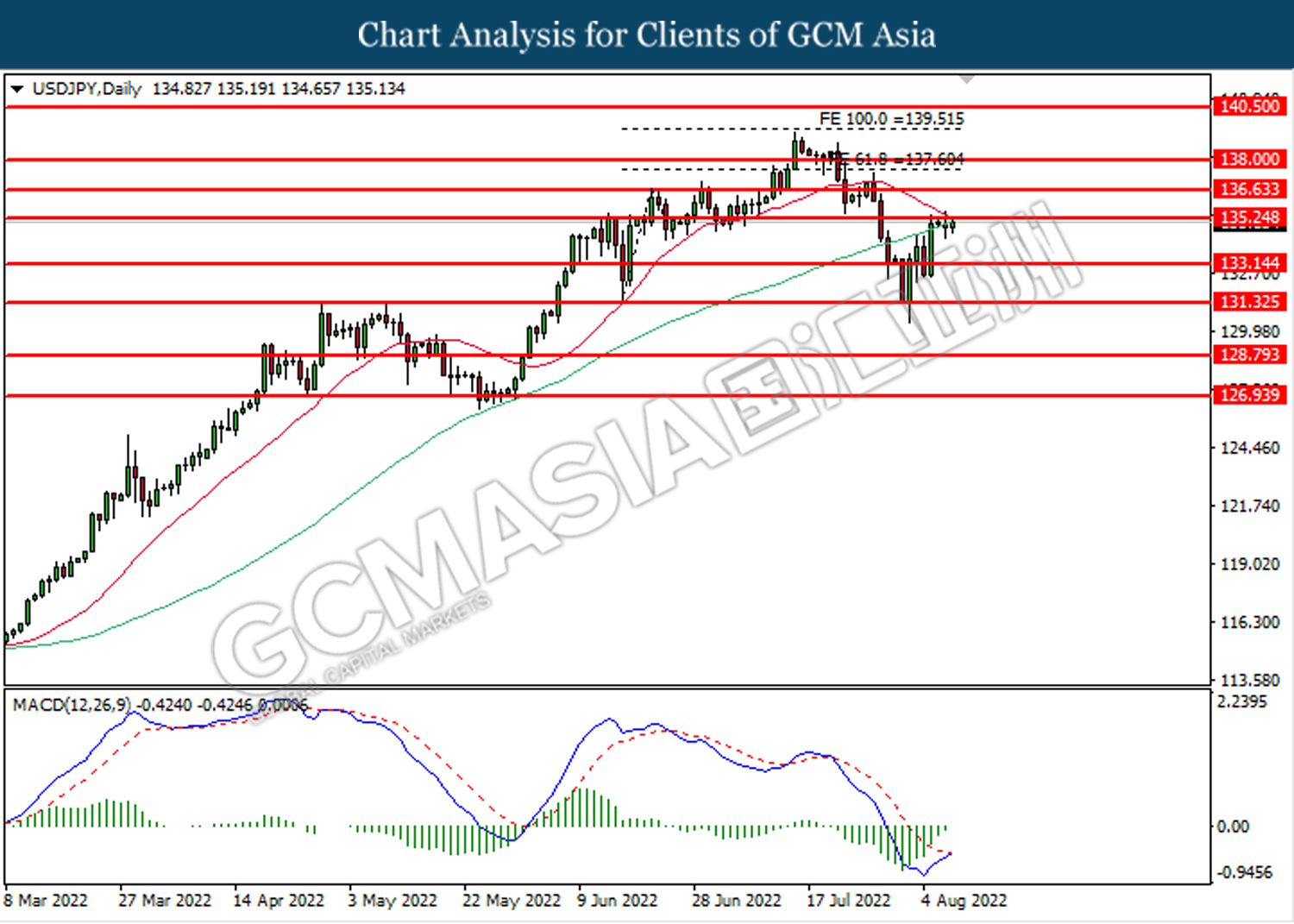

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 135.25. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 135.25, 136.65

Support level: 133.15, 131.35

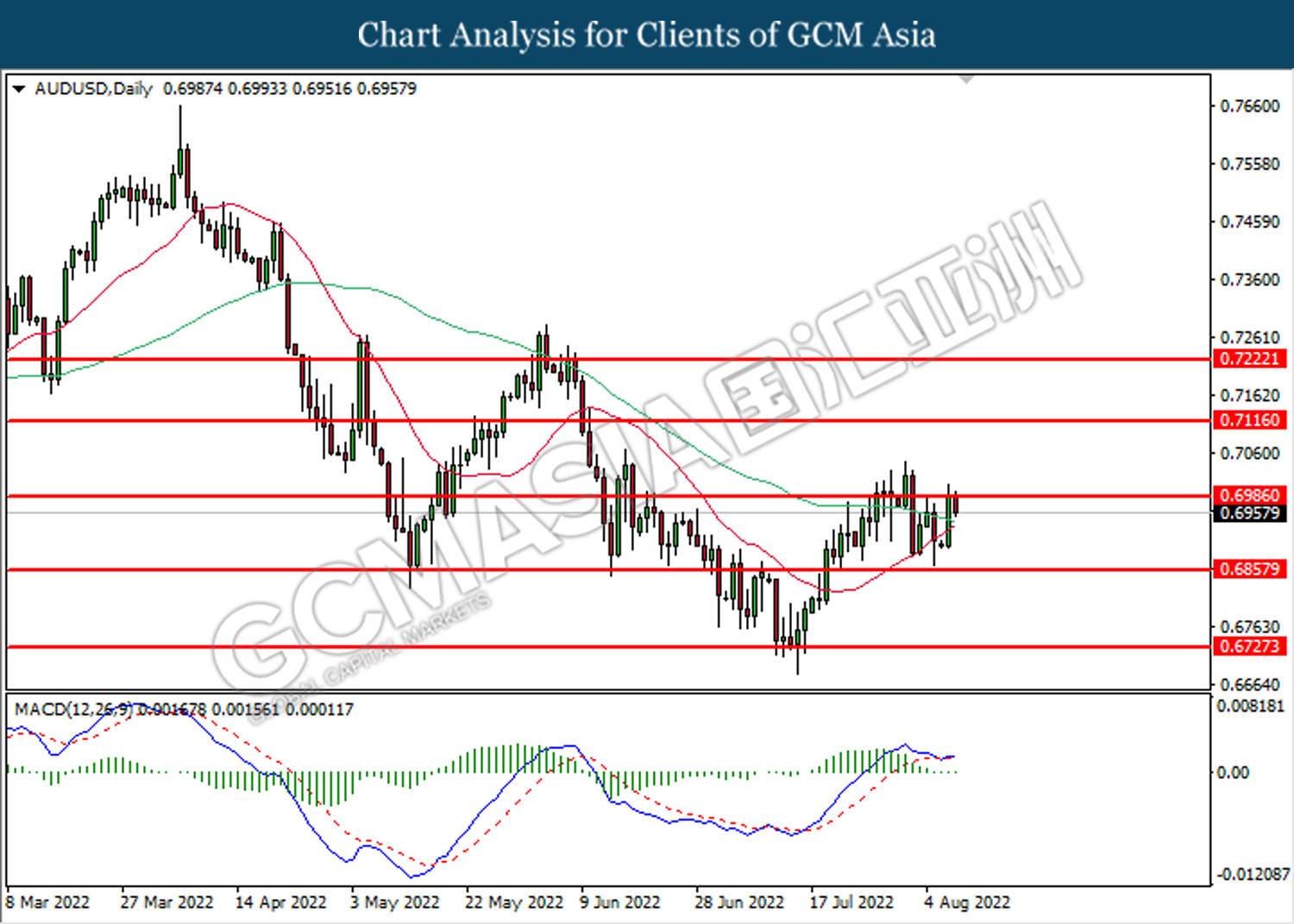

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6985. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6985, 0.7115

Support level: 0.6855, 0.6725

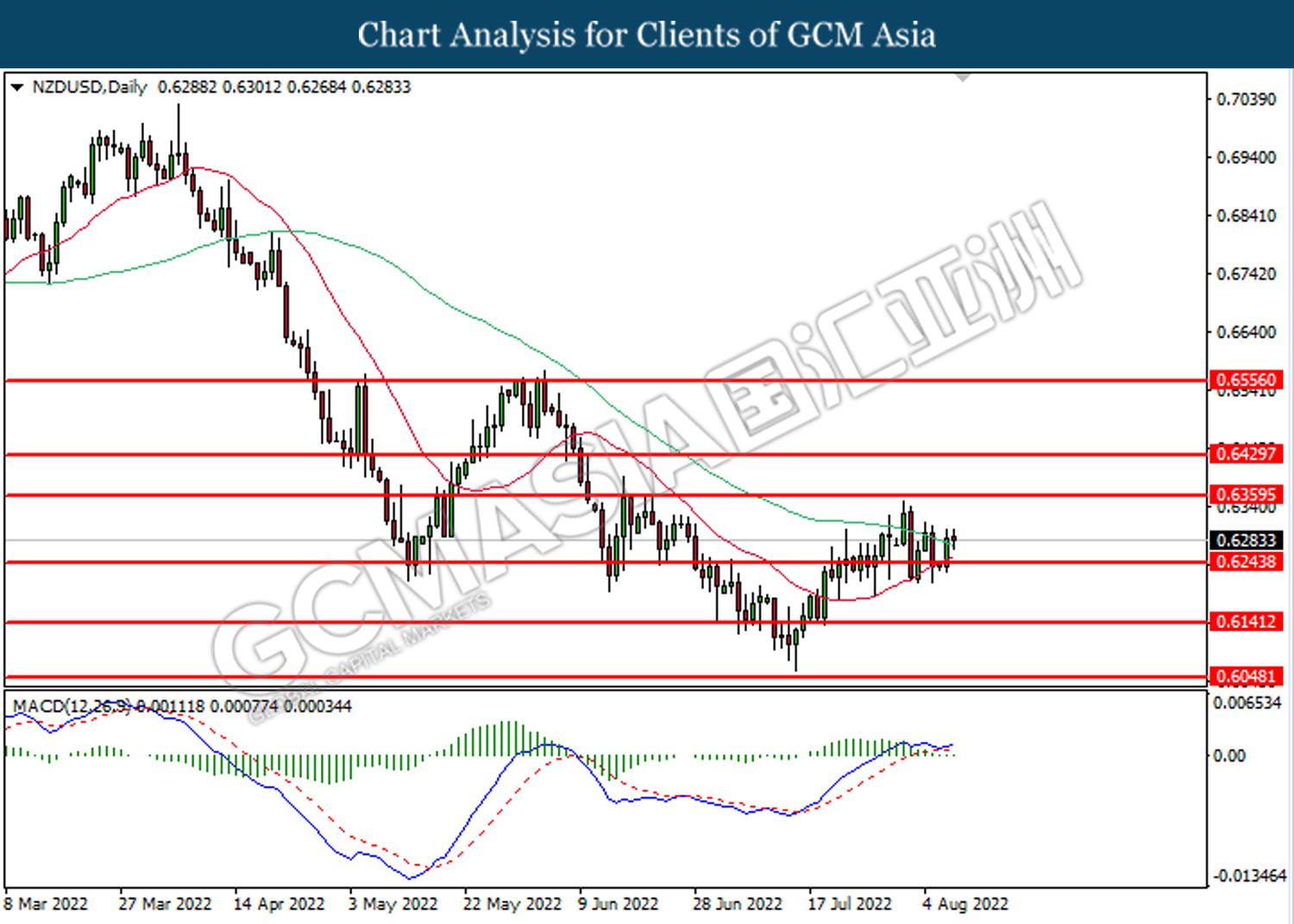

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6245. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6360.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

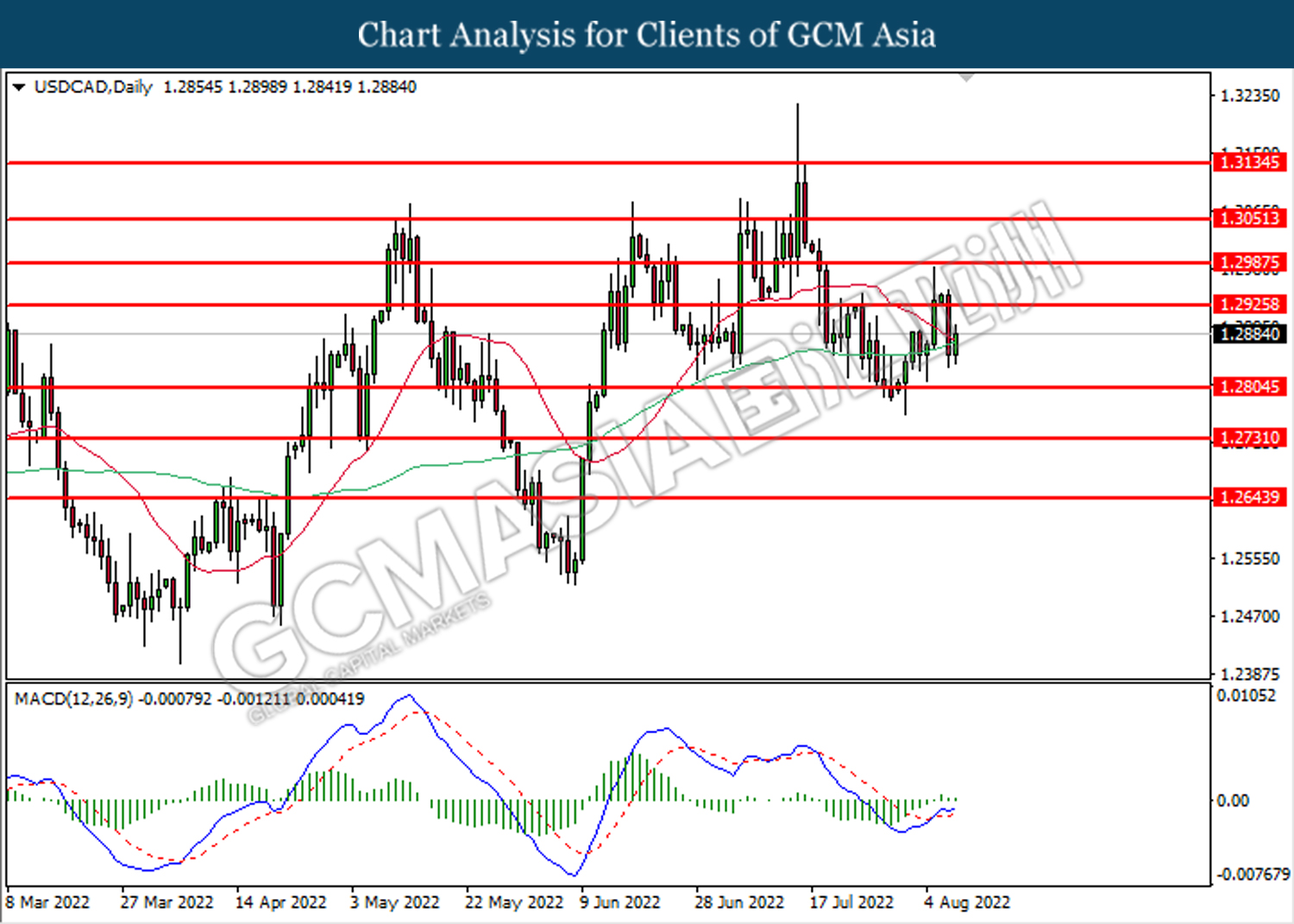

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.2925. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.2805.

Resistance level: 1.2925, 1.2985

Support level: 1.2805, 1.2730

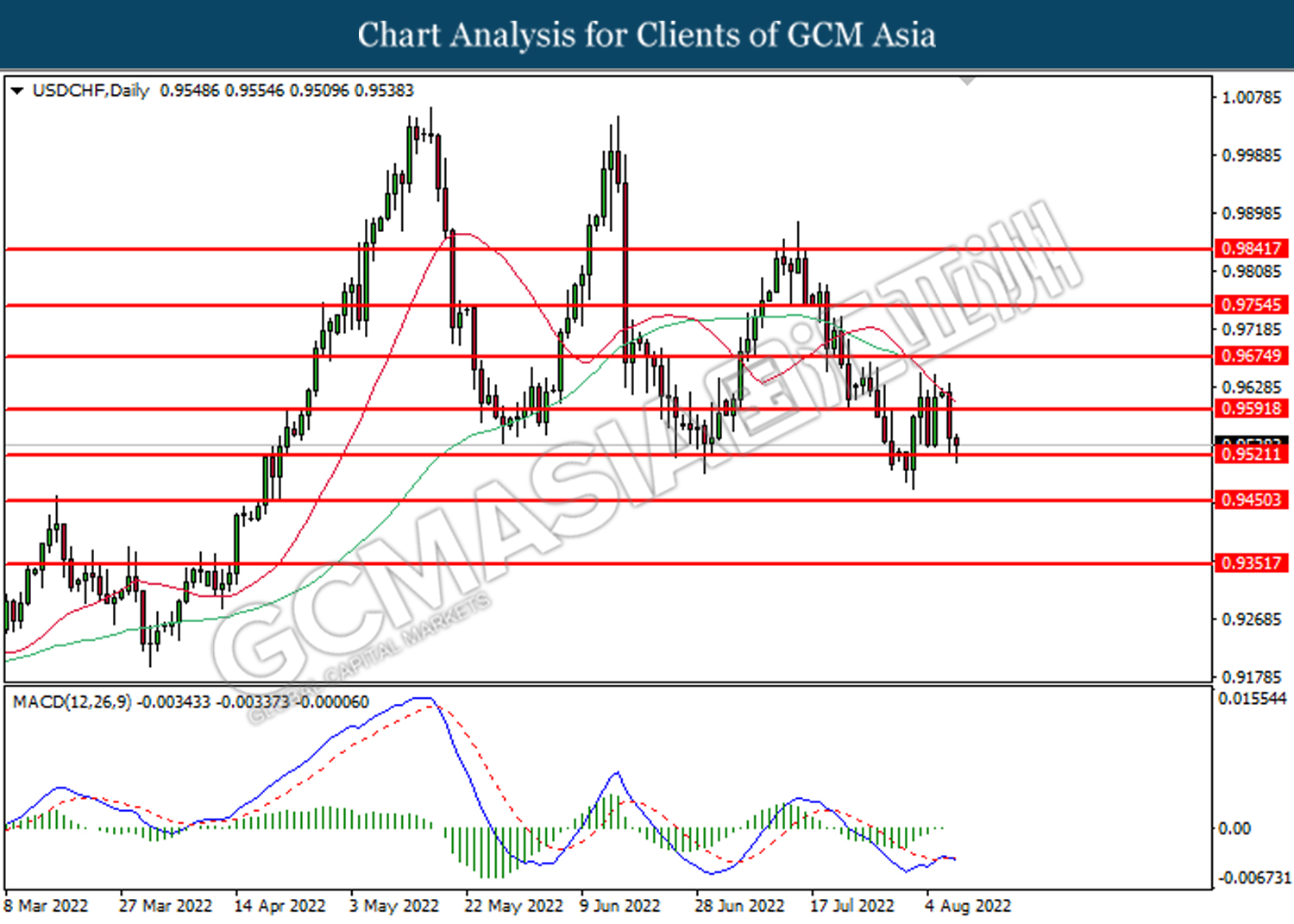

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9520. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9590, 0.9675

Support level: 0.9520, 0.9450

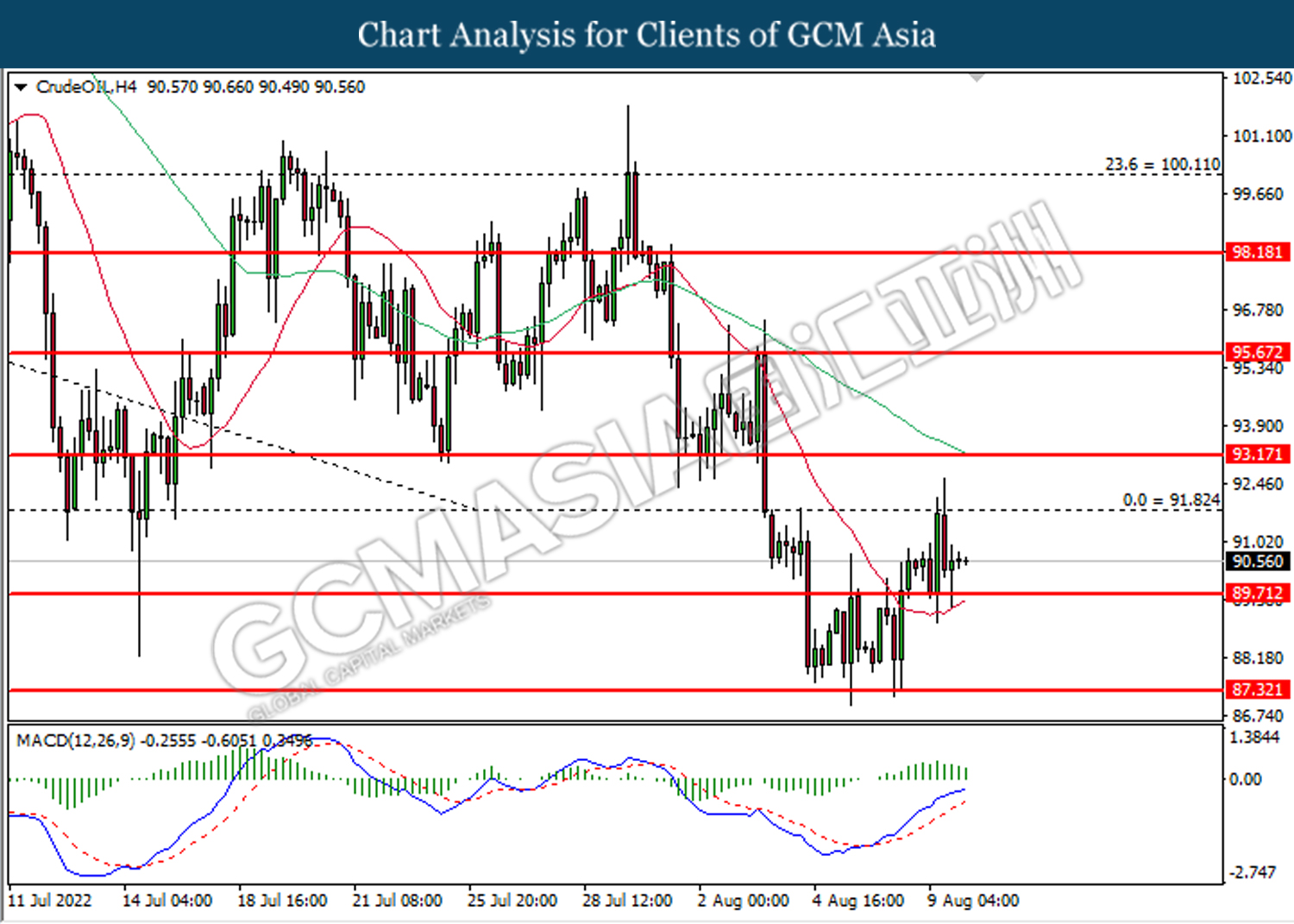

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level at 89.70. MACD which illustrated ongoing bullish momentum suggests the commodity to extend its gains toward the resistance level at 91.80.

Resistance level: 91.80, 93.15

Support level: 89.70, 87.30

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1783.20. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 1829.75.

Resistance level: 1829.75, 1867.35

Support level: 1783.20, 1770.05