10 September 2020 Afternoon Session Analysis

Euro rose following positive ECB forecast.

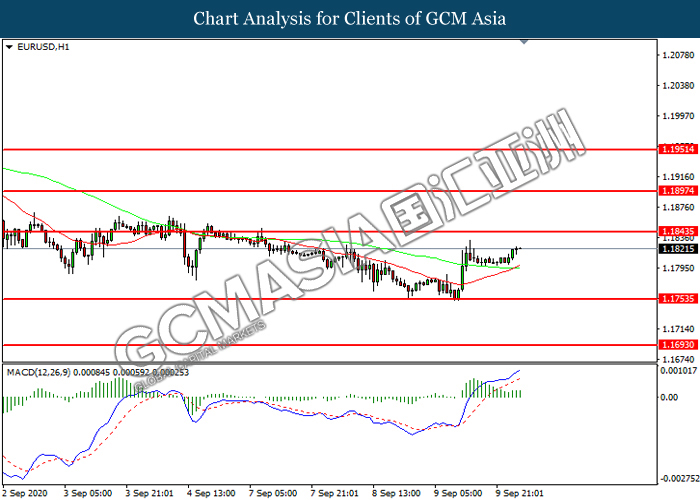

During late Asian session, the Euro which traded against the dollar and other currency pairs have soared following positive economic outlook from ECB forecast. According to Bloomberg, some European Central Bank policy makers have become more confident in their forecasts for the region’s economic recovery, potentially reducing the need for more monetary stimulus this year. Based on statement from Euro officials that is familiar with the discussion, the latest projections for output and inflation will only show slight changes to the June outlook. The report provide some relief and showered that the downside risks that the ECB previously mentioned in the previous round of forecast so far haven’t been materialized, thus boosting the appeal for the Euro. Meanwhile, investors will now focus on upcoming ECB meeting to attain further signal. At the time of writing, EUR/USD rose 0.15% to 1.1818.

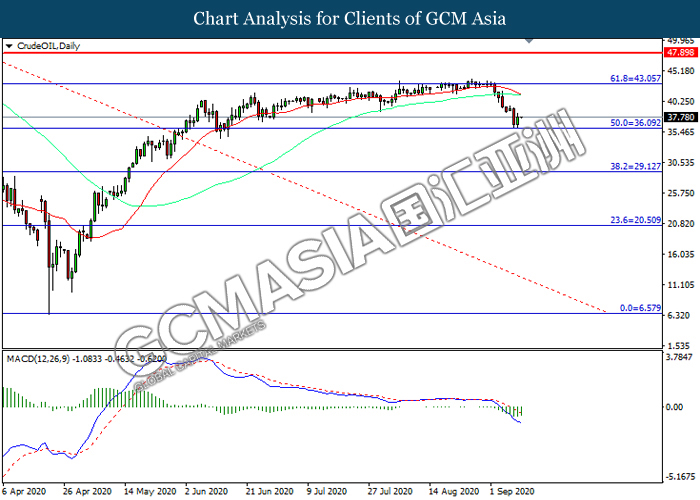

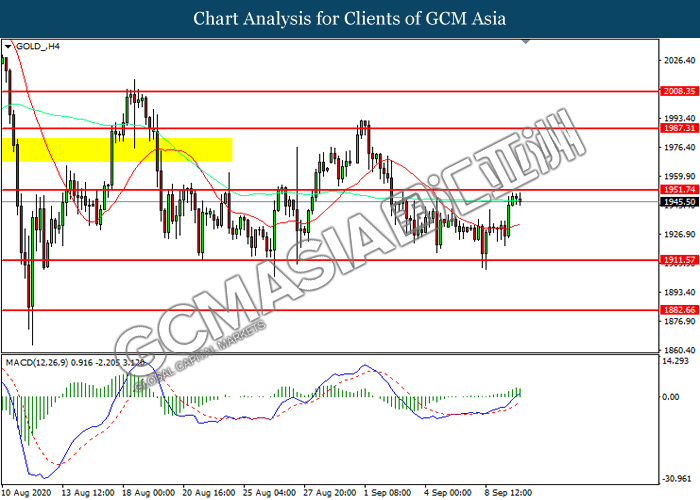

In the commodities market, crude oil price slips 0.24% to $37.79 per barrel as of writing following uncertainty in demand recovery. Following with the increasing coronavirus cases around the world and increase in inventory reported by API, worries over fuel demand remains high which currency continue to weigh on the black commodity. Adding further selling pressure was the news about leading commodity trades are now booking tankers to store crude oil on water which signal supply outpaced consumption. On the other hand, gold price gains 0.09% to $1946.60 a troy ounce at the time of writing following risk-off mood continue to support the safe-haven market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:45 EUR ECB Monetary Policy Statement

20:30 EUR ECB Press Conference

01:00 EUR ECB President Lagarde Speaks

(11th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 19:45 | EUR – Deposit Facility Rate (Sep) | -0.50% | -0.50% | – |

| 19:45 | EUR – ECB Marginal Lending Facility | 0.25% | – | – |

| 19:45 | EUR – ECB Interest Rate Decision | 0.00% | 0.00% | – |

| 20:30 | USD – Initial Jobless Claims | 881K | 846K | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | -9.362M | -1.335M | – |

Technical Analysis

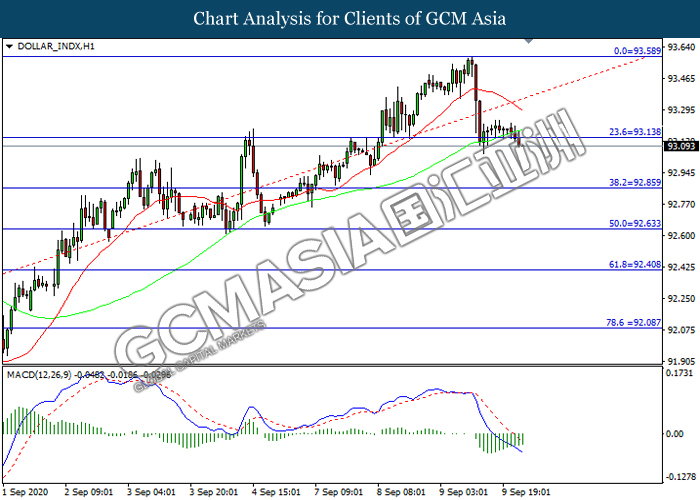

DOLLAR_INDX, H1: Dollar index was traded lower following prior breakout below the previous support level at 93.15. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher in short-term as technical correction.

Resistance level: 93.15, 93.60

Support level: 92.85, 92.65

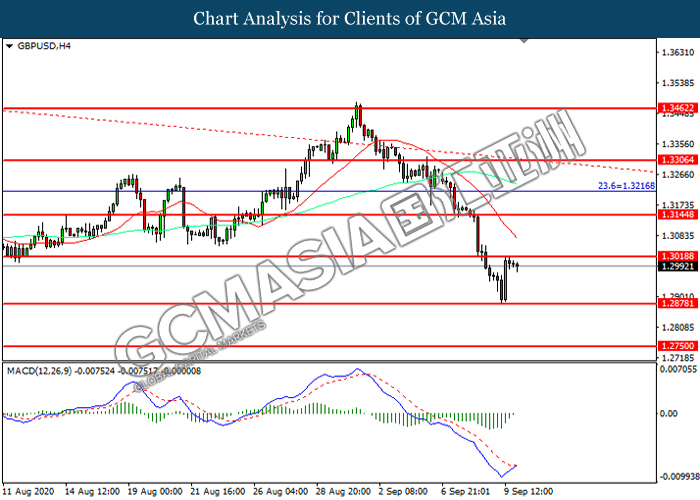

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.3020 MACD Which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3020, 1.3145

Support level: 1.2880, 1.2750

EURUSD, H1: EURUSD was traded higher while currently near the resistance level at 1.1845. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1845, 1.1895

Support level: 1.1755, 1.1695

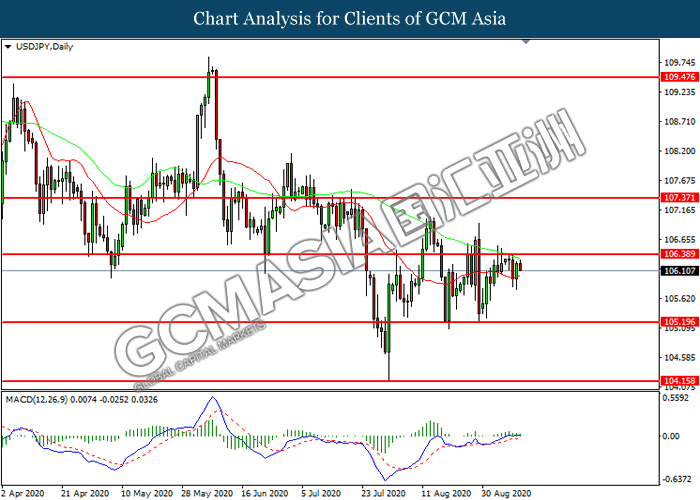

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level 106.40. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 106.40, 107.35

Support level: 105.20, 104.15

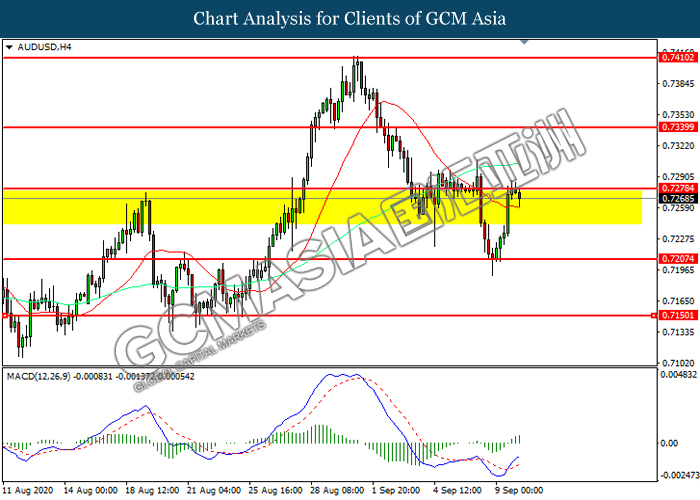

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.7280. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7280, 0.7340

Support level: 0.7205, 0.7150

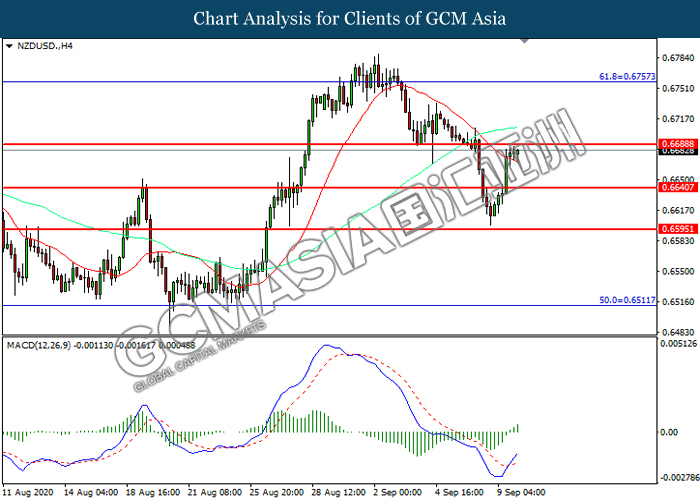

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6690. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6690, 0.6755

Support level: 0.6640, 0.6595

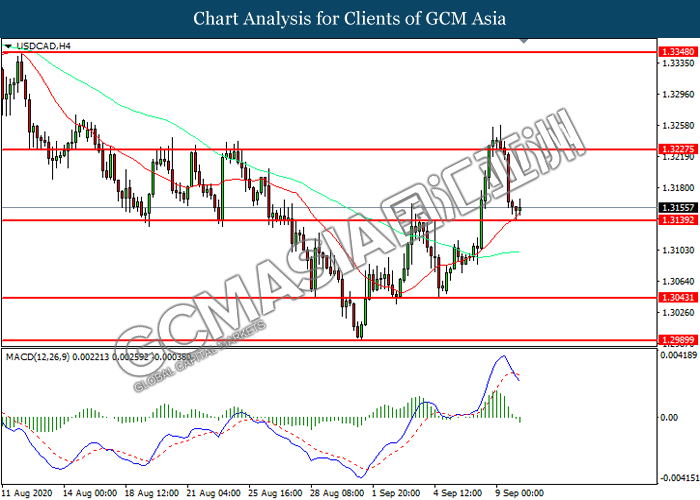

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.3140. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3225, 1.3350

Support level: 1.3140, 1.3045

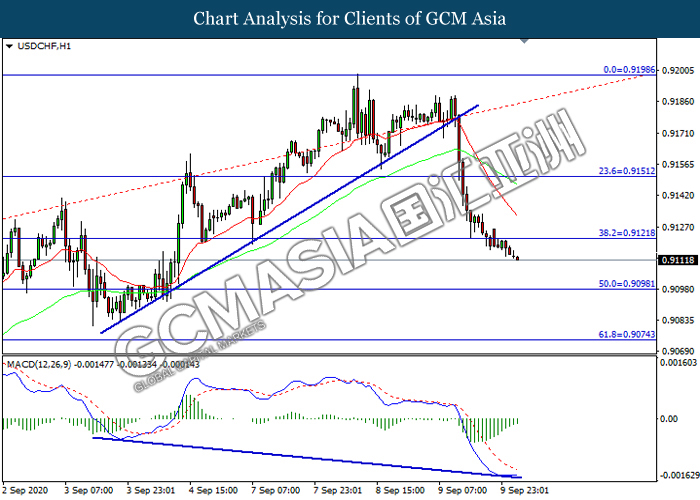

USDCHF, H1: USDCHF was traded lower following prior breakout below the previous support level at 0.9120. MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9120, 0.9150

Support level: 0.9095, 0.9075

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the support level at 36.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level at 43.05.

Resistance level: 43.05, 47.90

Support level: 36.10, 29.15

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1951.75. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1951.75, 1987.30

Support level: 1911.55, 1882.65