10 September 2020 Morning Session Analysis

Canadian dollar spiked amid positive economic outlook from BoC.

Canadian dollar which broadly known as oil’s currency surged significantly amid Bank of Canada hawkish stance with regards to the economy future outlook. Yesterday, BoC unanimously voted to maintain its interest rate at effective lower bound of 0.25% which in line with the market expectation. Besides, BoC also revealed that they will continues their quantitative easing program (QE) until a strong recovery reflected on the Canada’s economy. In detail, BoC’s scale purchase of government bond in their QE program will still stick to $5 billion per week. Nonetheless, BoC sees that the economy are shifting from reopening to recuperation, as household spending rebounded sharply over the summer season while the employment rate increased. Therefore, it also means that the nation’s economy may require extraordinary monetary policy to support the pace of recuperation at the meantime. Therefore, BoC said that they will maintain their unfolding monetary policy until economic slack fully been absorbed so that 2% of economic inflation target is sustainably to achieve. As of now, the pair of USD/CAD rose 0.07% to 1.3150.

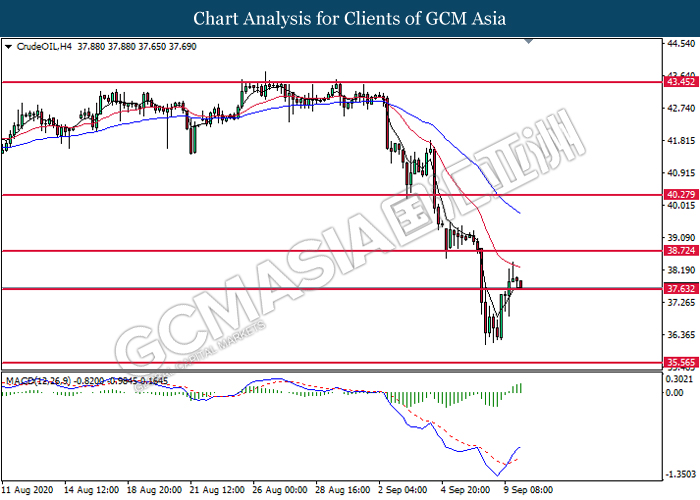

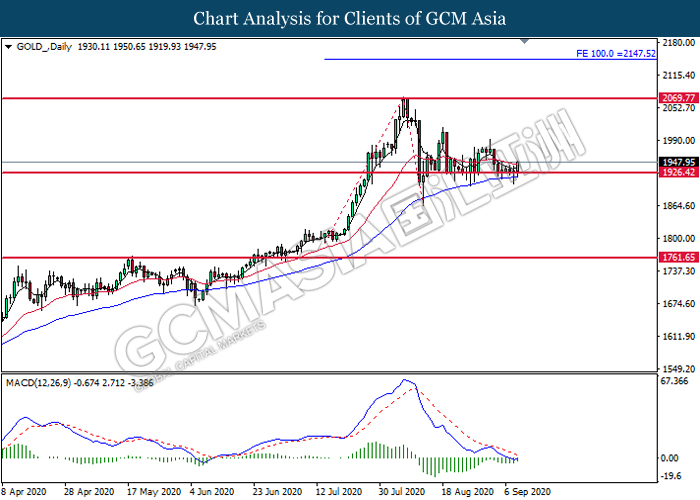

In the commodities market, crude oil price depreciated 0.47% to $37.85 per barrel as unexpected inventory build in US dragged down the appeal of this black commodity market. According to the API, US weekly Crude Oil Stock grew by 2.970M, higher than the previous reading of -6.360M barrel. Besides, gold price appreciated 0.04% to $1947.45 a troy ounce amid increasing of market’s risk avoidance behaviour.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:45 EUR ECB Monetary Policy Statement

20:30 EUR ECB Press Conference

01:00 EUR ECB President Lagarde Speaks

(11th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 19:45 | EUR – Deposit Facility Rate (Sep) | -0.50% | -0.50% | – |

| 19:45 | EUR – ECB Marginal Lending Facility | 0.25% | – | – |

| 19:45 | EUR – ECB Interest Rate Decision | 0.00% | 0.00% | – |

| 20:30 | USD – Initial Jobless Claims | 881K | 846K | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | -9.362M | -1.335M | – |

Technical Analysis

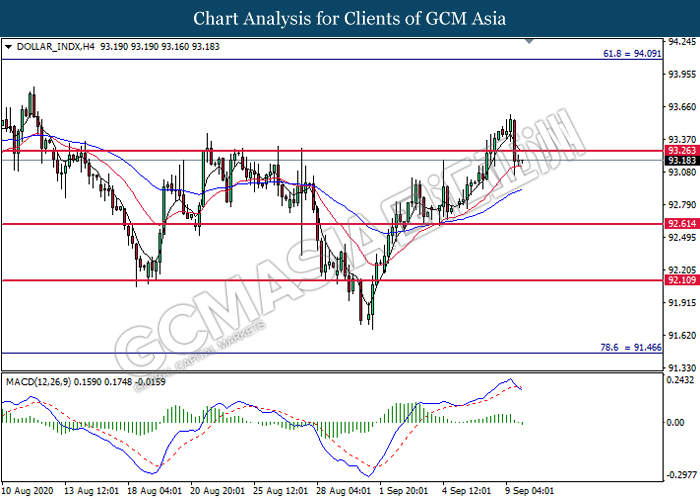

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level at 93.25. MACD which illustrated bearish bias momentum with the formation of death cross suggest the index to extend its losses toward the support level at 92.60.

Resistance level: 93.25, 94.10

Support level: 92.60, 92.10

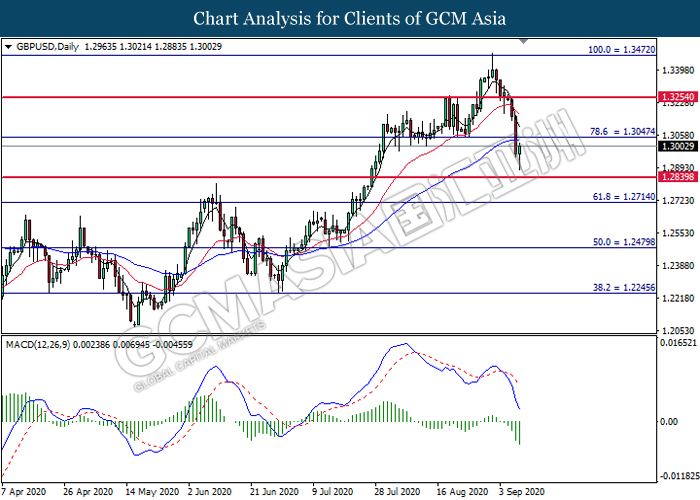

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.3045. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2840.

Resistance level: 1.3045, 1.3255

Support level: 1.2840, 1.2715

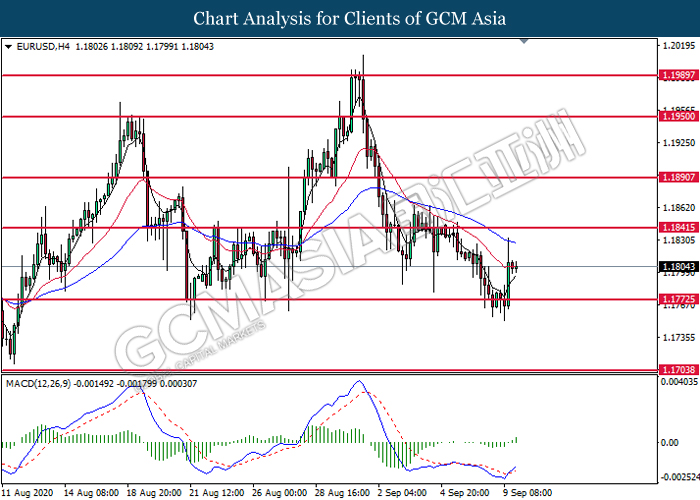

EURUSD, H4: EURUSD was traded higher following prior rebound form the support level at 1.1775. MACD which illustrate bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.1840.

Resistance level: 1.1840, 1.1890

Support level: 1.1775, 1.1705

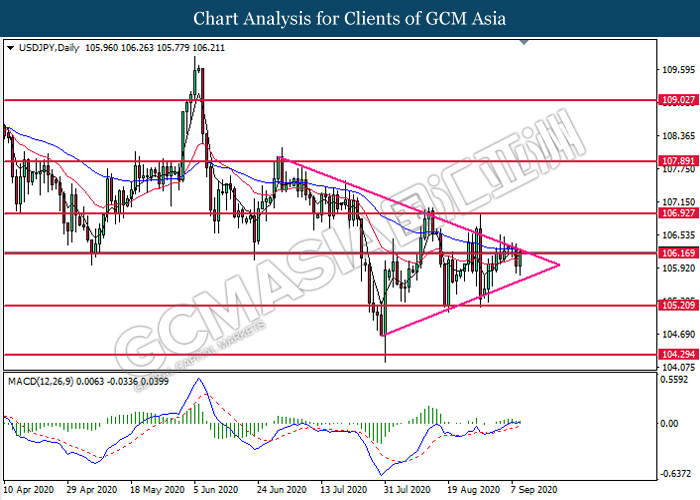

USDJPY, Daily: USDJPY was traded higher while currently testing the triangle’s top level. MACD which illustrates bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the top level of triangle.

Resistance level: 106.15, 106.95

Support level: 105.20, 104.30

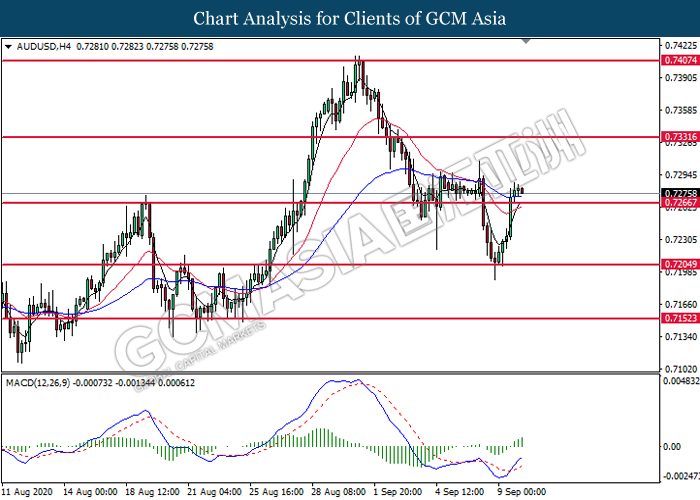

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7265. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.7330.

Resistance level: 0.7330, 0.7405

Support level: 0.7265, 0.7205

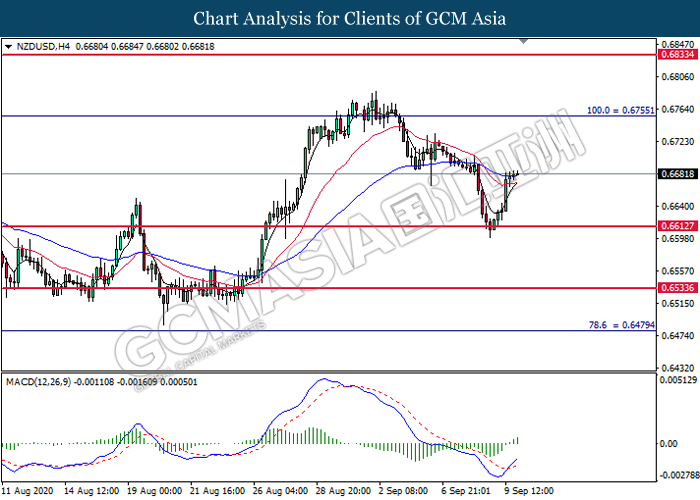

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6615. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6755.

Resistance level: 0.6755, 0.6835

Support level: 0.6615, 0.6535

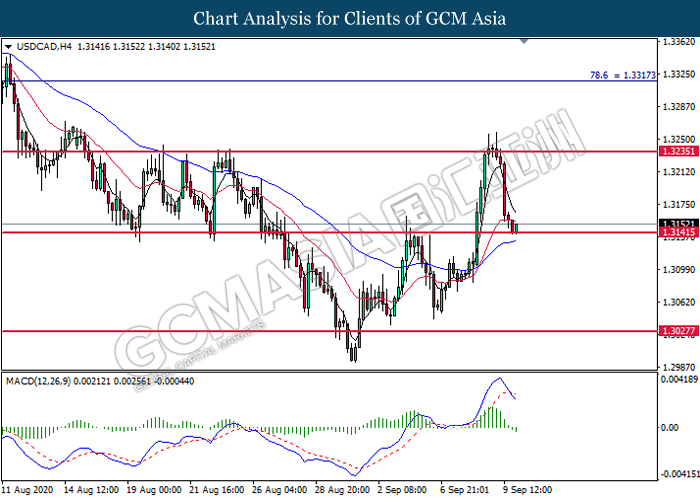

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3140. MACD which illustrate bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3235, 1.3315

Support level: 1.3140, 1.3030

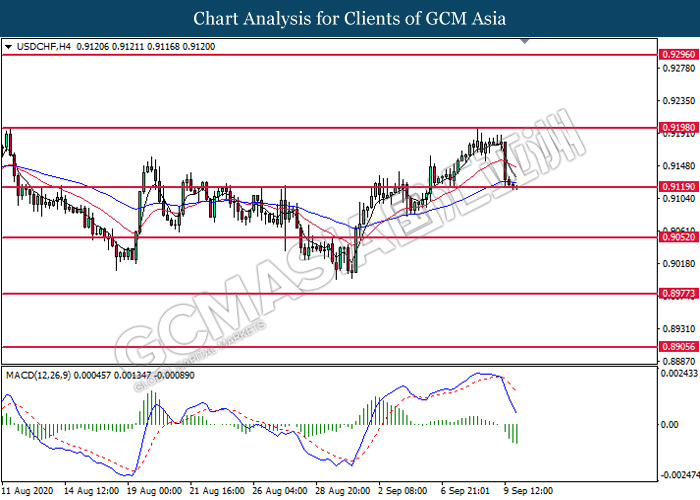

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9120. MACD which illustrates bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.9120.

Resistance level: 0.9200, 0.9295

Support level: 0.9120, 0.9050

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 37.65. However, MACD which illustrate bullish bias momentum suggest the commodity to undergo technical rebound in short term.

Resistance level: 38.70, 40.30

Support level: 35.65, 34.25

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1926.40. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its rebound toward the resistance level at 2069.75.

Resistance level: 2069.75, 2147.50

Support level: 1926.40, 1761.65