11 April 2017 Daily Analysis

Euro haunted by election and Le Pen.

Euro was held steady during Asian trading hours, last seen at $1.0591 after mending some losses from overnight’s low of $1.0568. The common currency received broader pressure due to heightened uncertainty ahead of France’s presidential election. Recent polls indicated that far-right candidate Marine Le Pen and centrist Emmanuel Macron will come ahead during April 23rd first round off, before a face off on May 7th run-off. “Le Pen presidency is perceived to increase the likelihood of France’s withdrawal from the EU and the uncertainty is likely to continue about what this could mean for the euro, along with potential hit to global markets,” said Mark Burgess, global head of equities in London. Otherwise, the greenback sag against its major peers as tensions over against North Korea and Syria weighed on US Treasury yields, offsetting expectations for interest rate hike. The dollar index was down 0.10% and last seen at 101.89.

As for commodities, crude oil price extended its overnight gains by 0.15%, touching five-weeks high of $53.16 following a shutdown at Libya’s largest oilfield. Concurrently, gold price was up 0.24% to $1,254.05 due to higher geopolitical risks and a weaker dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 09:30 | AUD – NAB Business Confidence (Mar) | 7 | – | 6 |

| 16:30 | GBP – CPI (YoY) (Mar) | 2.3% | 2.3% | – |

| 17:00 | EUR – German ZEW Economic Sentiment (Apr) | 12.8 | 14.0 | – |

| 22:00 | USD – JOLTs Job Openings (Feb) | 5.626M | 5.655M | – |

| 04:30 | Crude Oil – API Weekly Crude Oil Stock | -1.830M | – | – |

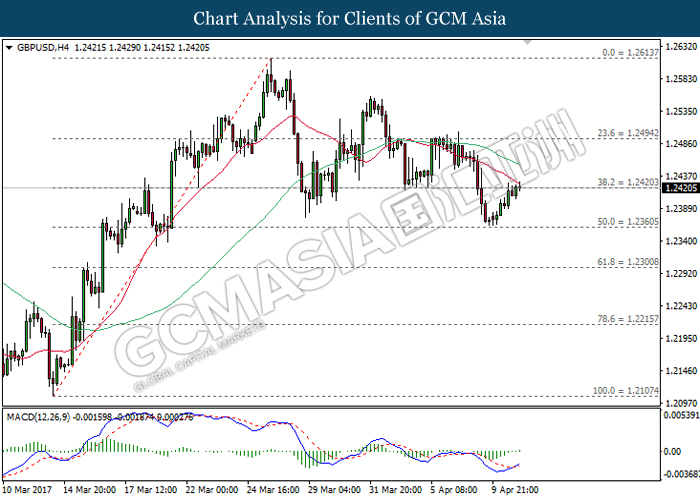

GBPUSD

GBPUSD, H4: GBPUSD extended its gains following prior rebound from the support level of 1.2360. With regards to the MACD histogram which begins to illustrate upward signal and momentum, a closure above the 20-moving average line (red) would suggest GBPUSD to extend its technical correction and to be traded higher in the short-term. Long-term trend direction still suggests GBPUSD to move further downwards.

Resistance level: 1.2495, 1.2615

Support level: 1.2420, 1.2360

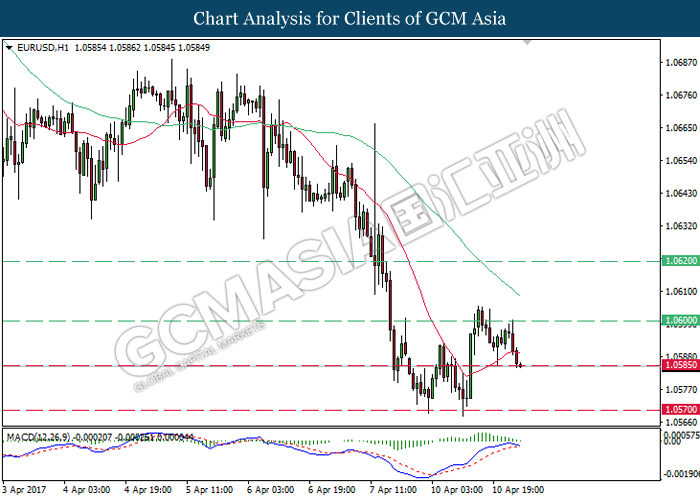

EURUSD

EURUSD, H1: EURUSD was traded lower following previous retracement from the resistance level of 1.0600. As the MACD histogram’s upward signal line begins to narrow sideways and may form an imminent downward signal, EURUSD is expected to extend its downward momentum after breaking the support level of 1.0585.

Resistance level: 1.0600, 1.0620

Support level: 1.0585, 1.0570

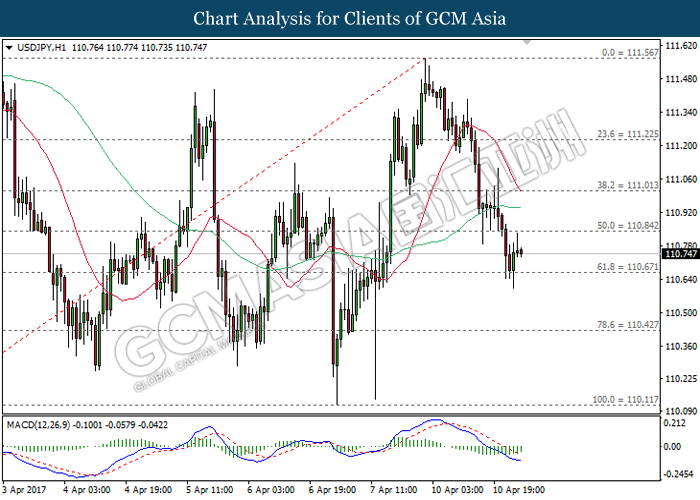

USDJPY

USDJPY, H1: USDJPY was traded higher following previous rebound near the support level of 110.65. However as both moving average line continues to narrow downwards while coupled with MACD histogram which portrays moderate downward signal, a closure below the level of 110.65 would suggest USDJPY to move further downwards.

Resistance level: 110.85, 110.00

Support level: 110.65, 110.40

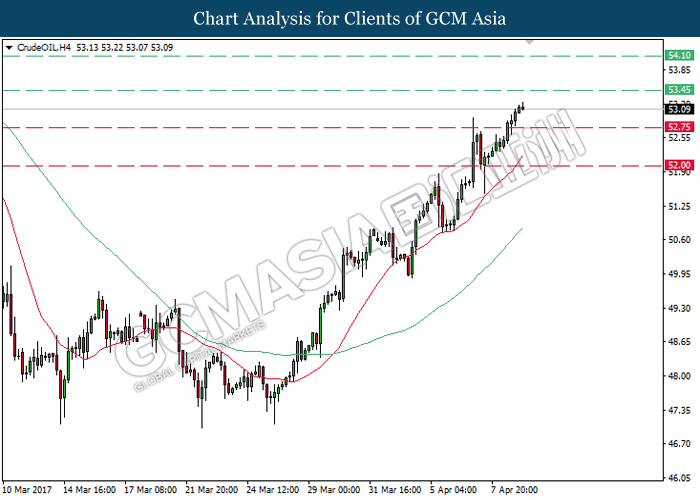

CrudeOIL

CrudeOIL, H4: Crude oil price was traded in an uptrend following prior formation of golden cross by both moving average line. As both lines continue to expand upwards, it is expected to move further upward towards the target of resistance level at 53.45.

Resistance level: 53.45, 54.10

Support level: 52.75, 52.00

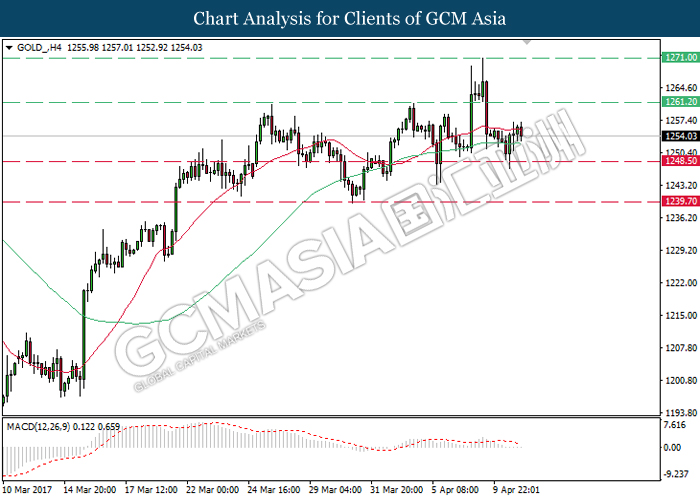

GOLD

GOLD_, H4: Gold price was traded higher following prior rebound from the support level of 1248.50 while currently testing in between both moving average line. However, as the MACD indicator continues to drift outside of upward momentum, gold price is expected to experience brief retracement period and oscillate in between the range of 1248.50 and 1261.20 for short-term. Otherwise, a closure above the resistance level of 1261.20 would suggest gold price to extend its upward momentum in long-term.

Resistance level: 1261.20, 1271.00

Support level: 1248.50, 1239.70