11 July 2023 Afternoon Session Analysis

Pound Sterling extended gains after Bailey delivered hawkish guidance.

The Pound Sterling which traded against the dollar index extended its gains after Bank of England (BoE) Bailey delivered hawkish interest rate guidance. Before that, the UK inflation rate stood at 8.7% in the latest data, the highest among the G7 countries. Britain’s inflation remained elevated due to higher food price pressure and labour shortage in the market. According to a Reuters report, labour shortages as almost one in three female workers in the UK expect to stop working before reaching their retirement age with many citing health and well-being issues. With such a backdrop, financial markets bet that the BoE will raise the interest rate to 6.5% in early 2024, up from a previously expected peak of 6.25%. It also caused the two years UK government bond pushed to its highest level since 2008. Besides, BoE governor Bailer under pressure from politicians and some economists, said that price growth was stickier than BoE expected. This is also a big challenge for UK Prime Minister Rishi Sunak who promised to halve the price pressure by year-end. Meanwhile, investors will keenly observe UK employment changes data to get cues about inflation and interest rate guidance. As of writing, the GBPUSD edged up by 0.11% to 1.2873.

In the commodities market, crude oil prices traded up by 0.62% to $73.44 per barrel ahead of US inflation data announced on Wednesday. On the other hand, the price of gold rose by 0.08% to 1926.70 as investors await US inflation data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:00 USD FOMC Member Bullard Speaks

00:00 CrudeOIL EIA Short-Term Energy Outlook

(12th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 04:30

(12th) |

CrudeOIL – API Weekly Crude Oil Stock | -4.382M | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing for the support level at 101.85. MACD which illustrated diminishing bearish momentum suggests the index extended its losses if successfully breaks the support level.

Resistance level: 101.85, 102.35

Support level: 101.35, 100.80

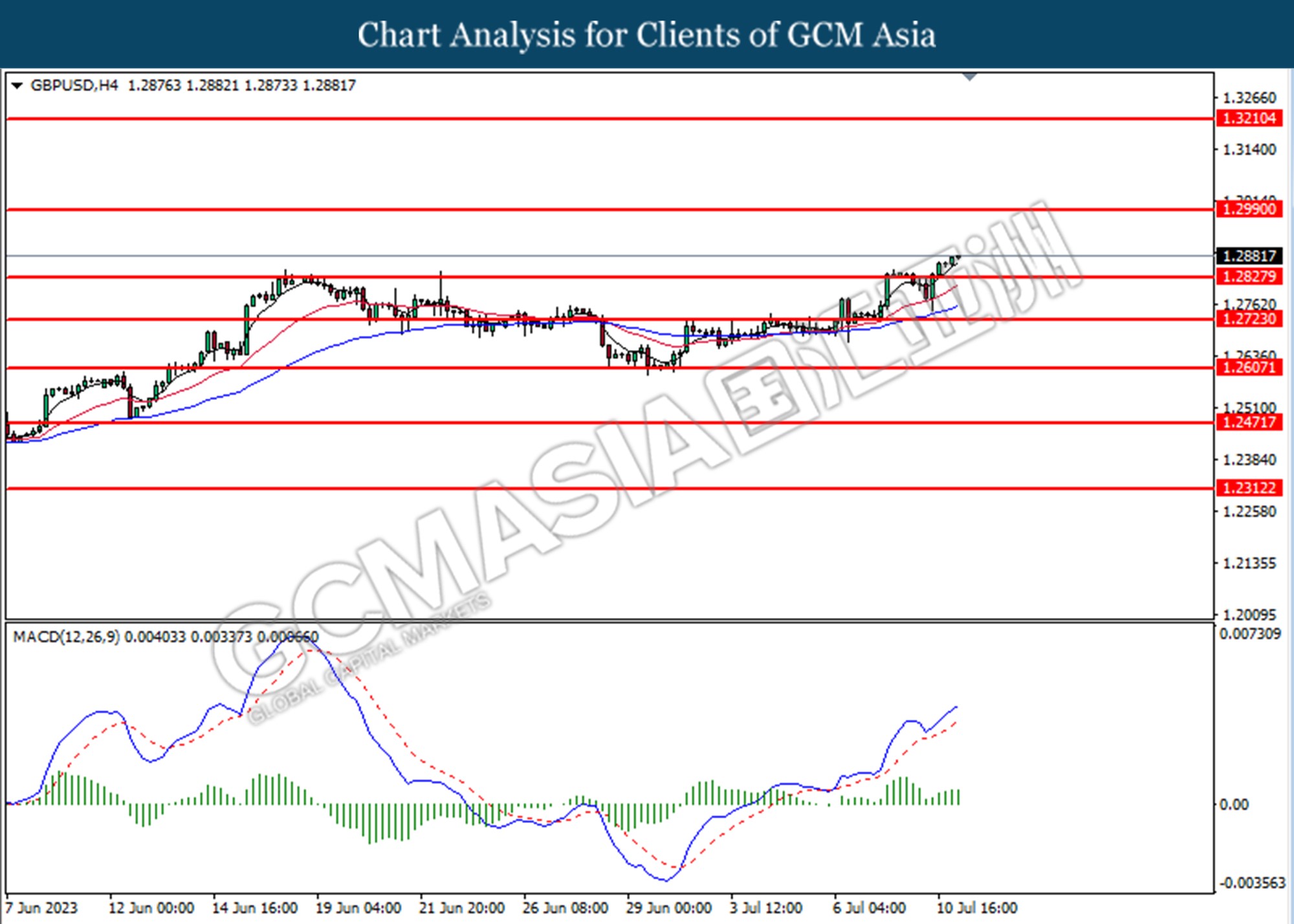

GBPUSD, H4: GBPUSD was traded higher following the prior breaks above the previous resistance level at 1.2990. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.2830, 1.2990

Support level: 1.2730, 1.2610

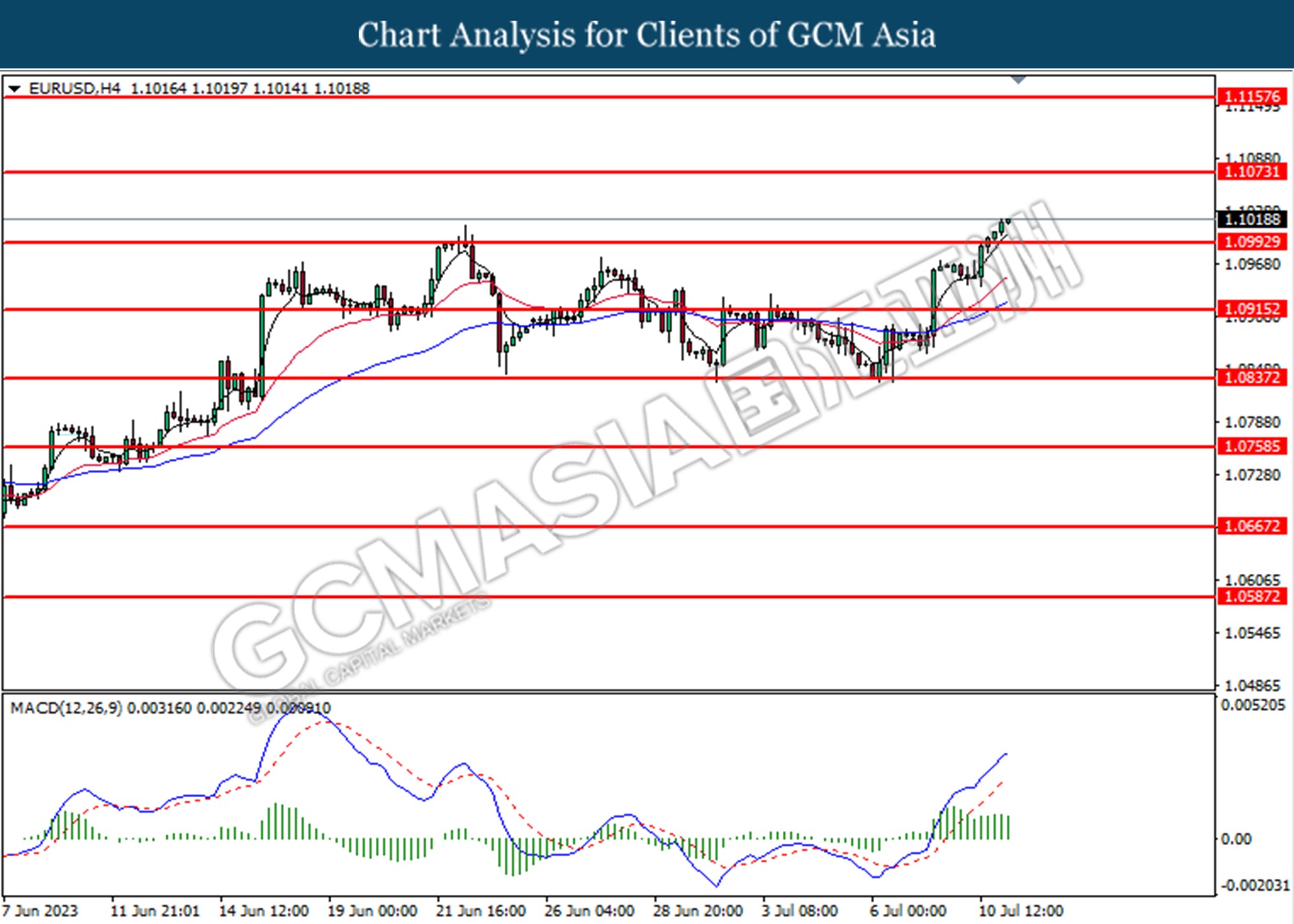

EURUSD, H4: GBPUSD was traded higher following the prior breaks above the previous resistance level at 1.0990. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.1075, 1.1160

Support level: 1.0990, 1.0915

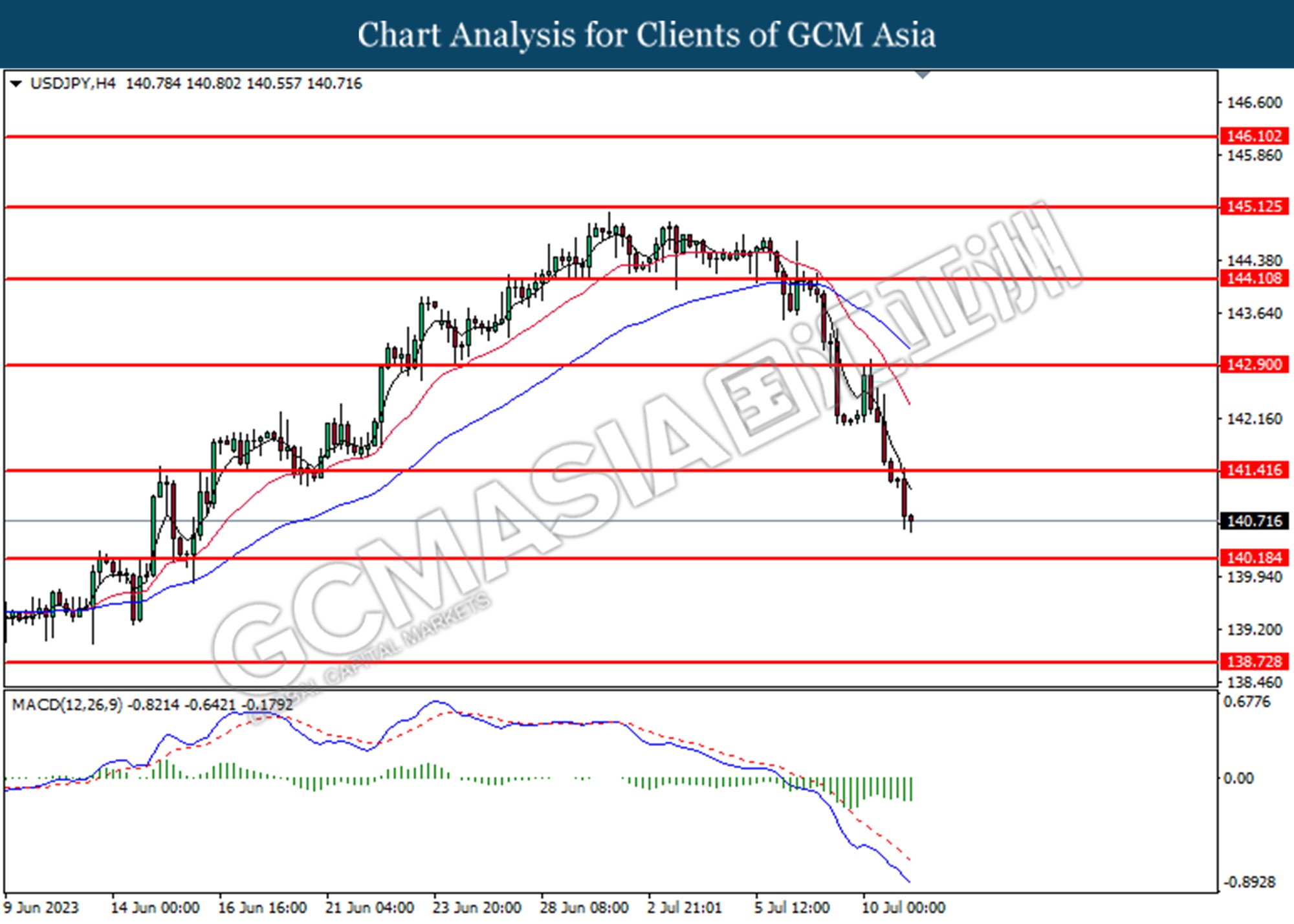

USDJPY, H4: USDJPY was traded lower following the prior breaks below the previous support level at 141.40. MACD which illustrated bearish momentum suggests the pair extended its losses towards the support level at 140.20

Resistance level: 141.40, 142.90

Support level: 140.20, 138.70

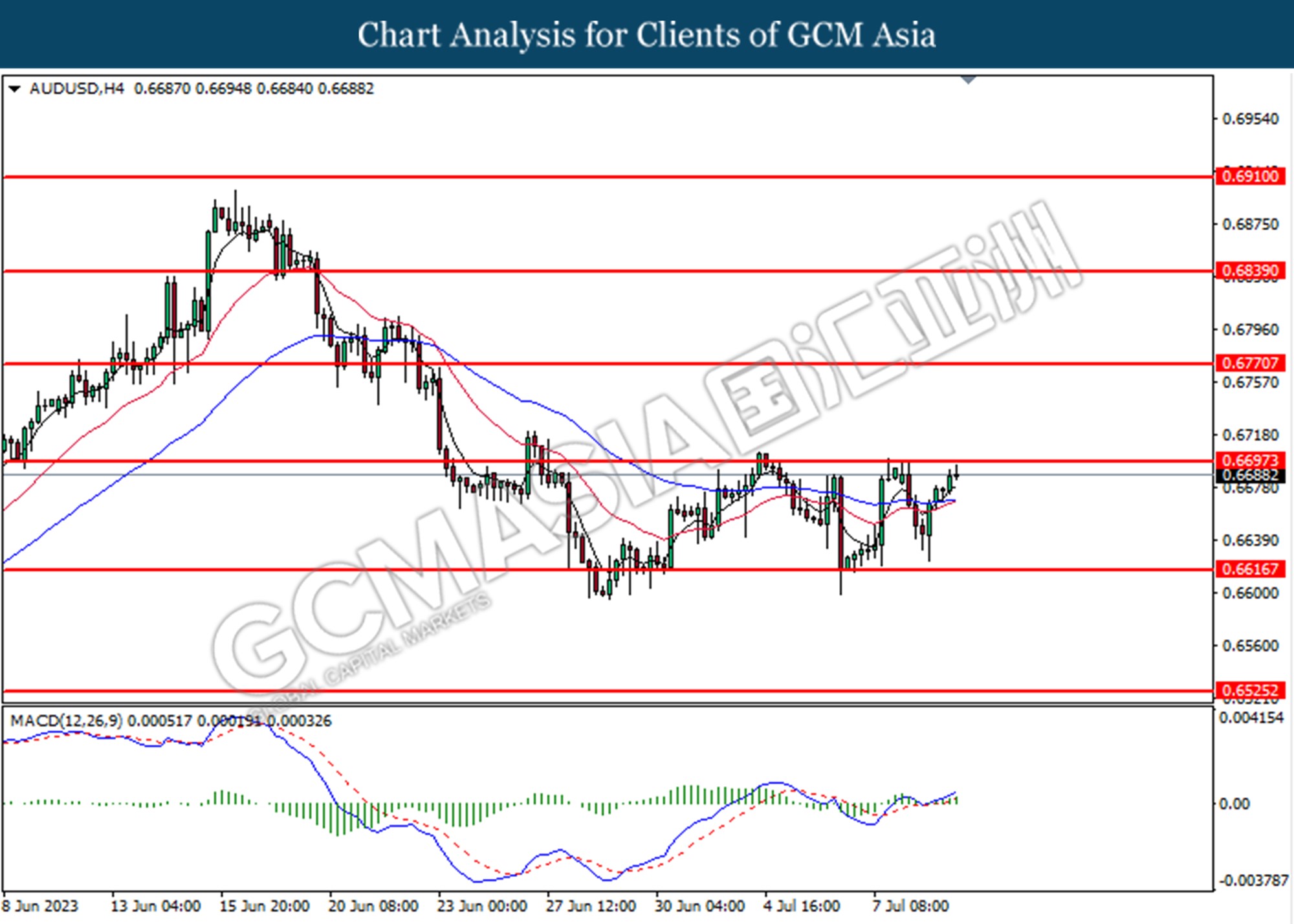

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0.6700.

Resistance level: 0.6700, 0.6770

Support level: 0.6615, 0.6525

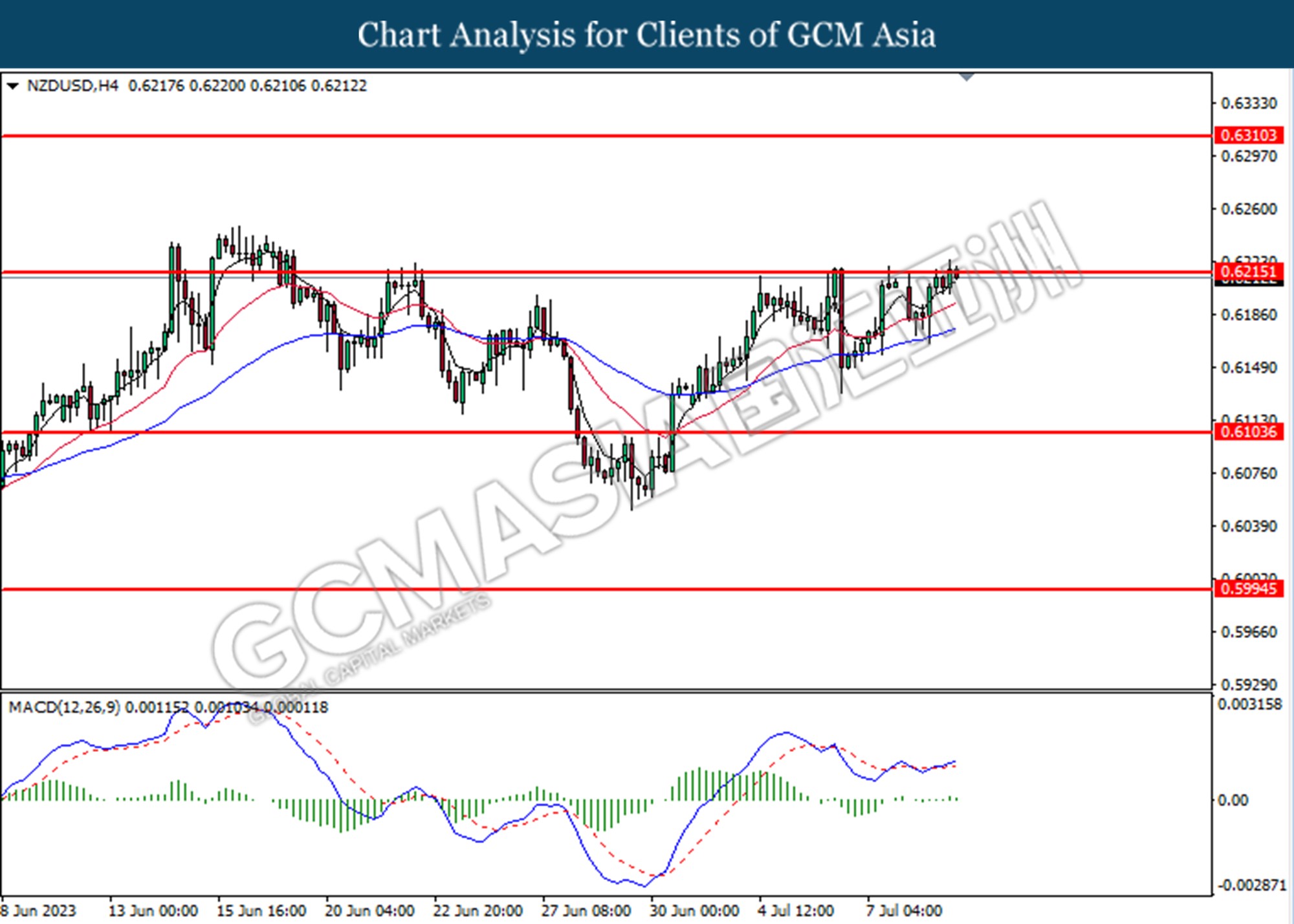

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6215. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

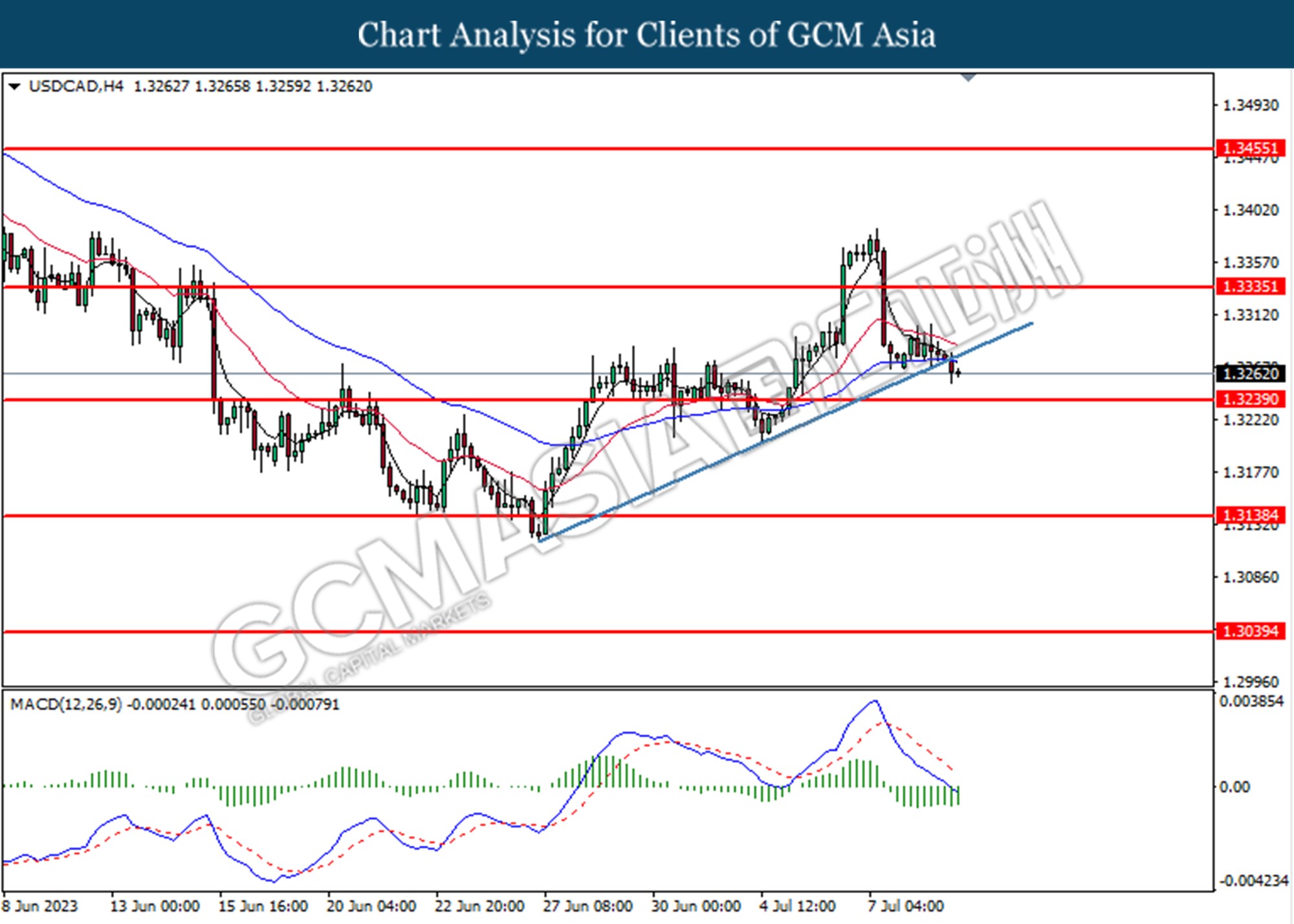

USDCAD, H4: USDCAD was traded lower following the prior breaks below from the upward trend line. MACD which illustrated bearish momentum suggests the pair extended its losses towards the support level at 1.3240.

Resistance level: 1.3335, 1.3455

Support level: 1.3240, 1.3140

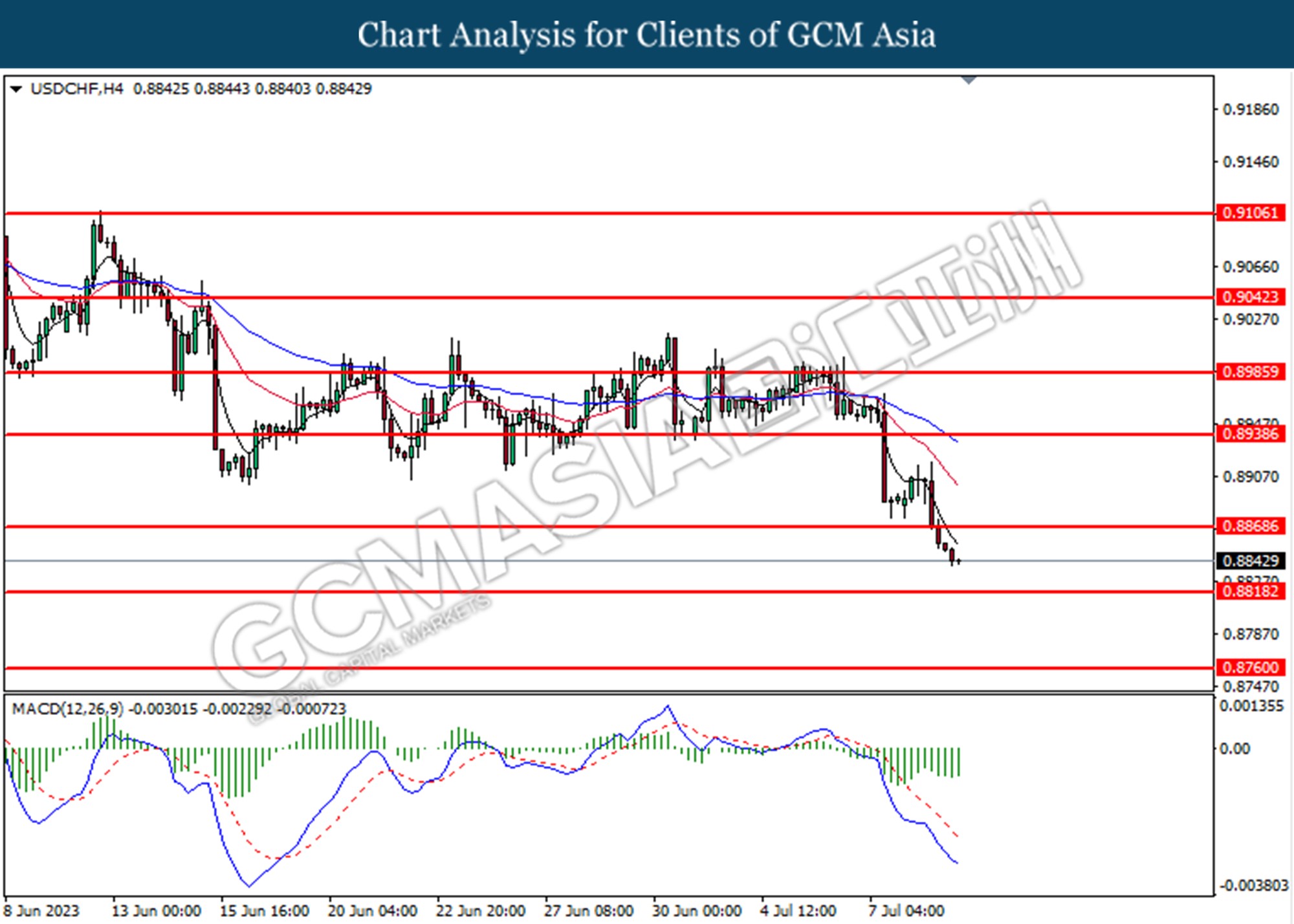

USDCHF, H4: USDCHF was traded lower following the prior breaks below from the previous resistance level at 0.8870. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 0.8870, 0.8940

Support level: 0.8820, 0.8760

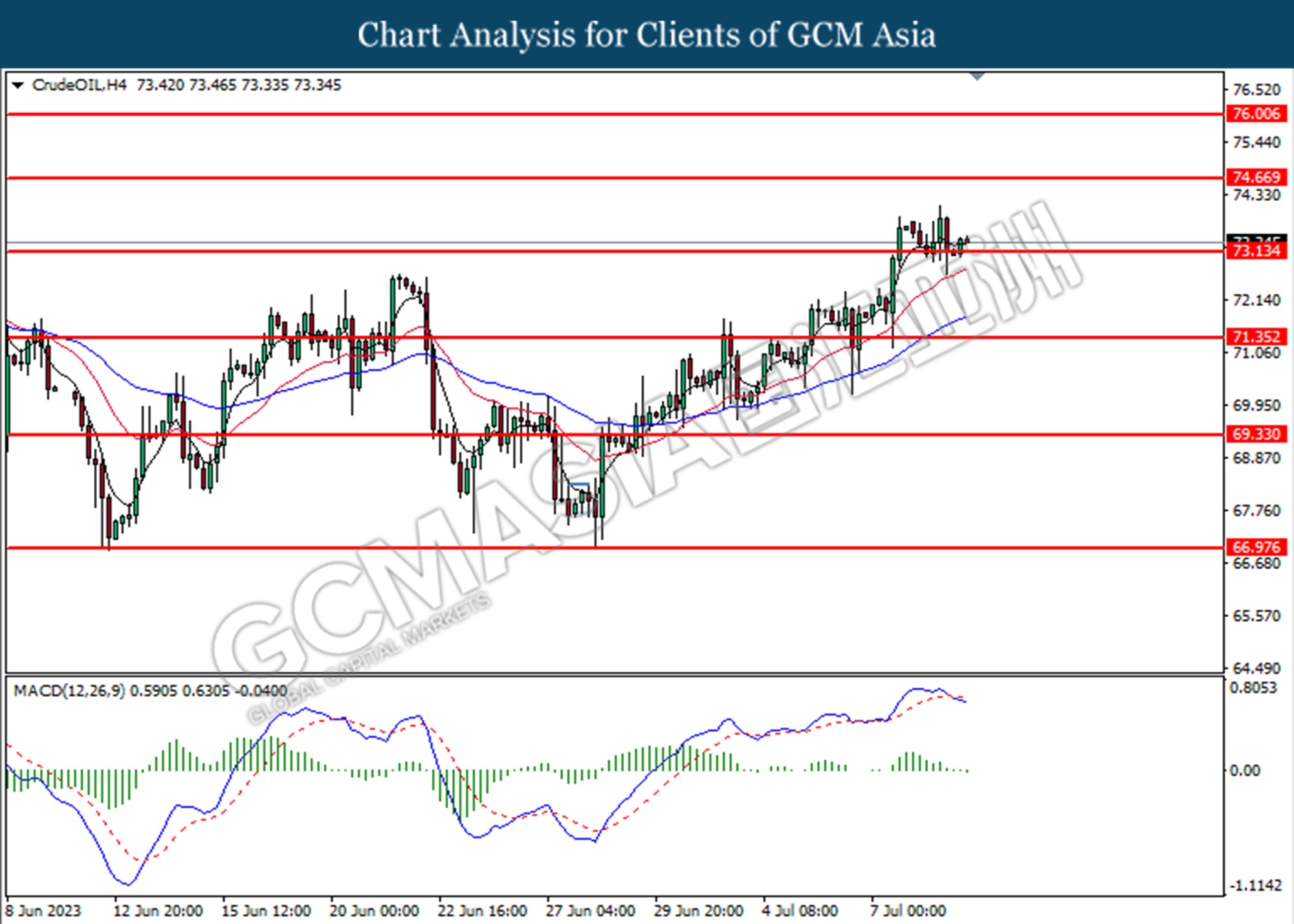

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the support level at 73.15. MACD which illustrated increasing bearish momentum suggests the commodity undergoes a technical correction in a short term.

Resistance level: 74.65, 76.00

Support level: 73.15, 71.35

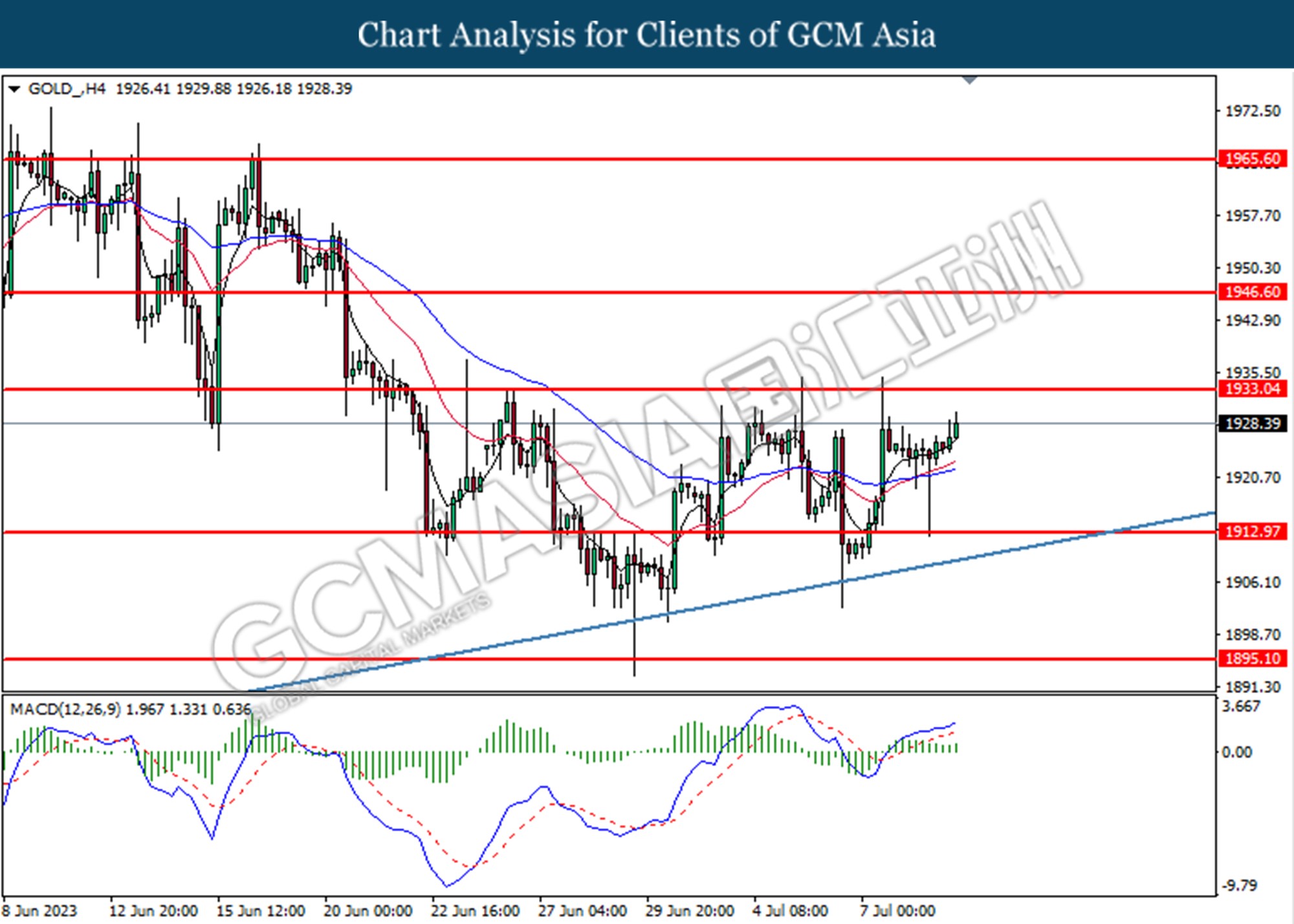

GOLD_, H4: Gold price was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains toward the resistance level at 1933.05.

Resistance level: 1933.05, 1946.60

Support level: 1913.00, 1895.10