11 July 2023 Morning Session Analysis

Greenback dipped as Fed’s rate hikes closed to an end.

The dollar index, which was traded against a basket of six major currencies, failed to revive from its previous day losses as a result of comments made by Federal Reserve officials, reinforcing the market’s anticipation that the U.S. central bank is approaching the end of its tightening cycle. Yesterday, the Federal Reserve officials’ statements aligned with their recent messaging regarding the necessity of raising interest rates to address inflation and bring it back to the target level. Despite the latest NFP data showing the smallest job gains in 2.5 years, it is widely expected that the Fed will proceed with another 25 basis points interest rate increase this month. Some of the Federal Reserve officials, led by San Francisco Fed President Mary Daly on Monday, expressed the view that the central bank will likely need to raise interest rates further to address the persistently high inflation. However, they also acknowledged that the end of the current monetary policy tightening cycle is drawing near. As a result, market participants made the decision to reallocate their capital away from the dollar and towards other riskier markets that are expected to experience more future interest rate hikes, such as Pound and Euro. As of writing, the dollar index dropped -0.31% to 101.95.

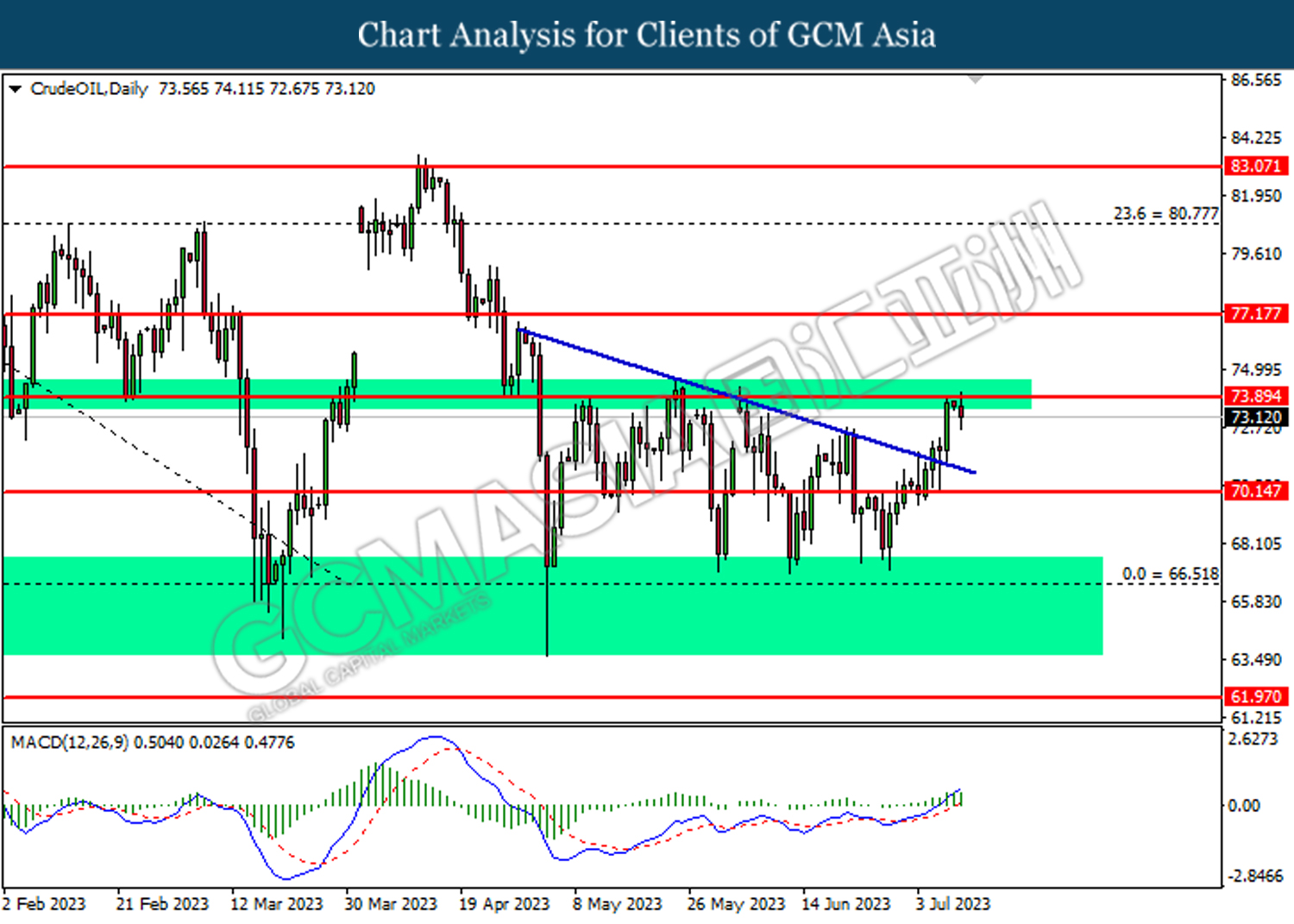

In the commodities market, crude oil prices were up by 0.02% to $73.20 per barrel as the depreciation of the US dollar urged non-US buyers of oil enter into the oil market. Besides, gold prices ticked up 0.01% to $1925.30 per troy ounce amid the weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:00 USD FOMC Member Bullard Speaks

00:00 CrudeOIL EIA Short-Term Energy Outlook

(12th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German CPI (MoM) (Jun) | 0.4% | 0.3% | – |

| 04:30

(12th) |

CrudeOIL – API Weekly Crude Oil Stock | -4.382M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 103.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 100.65.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

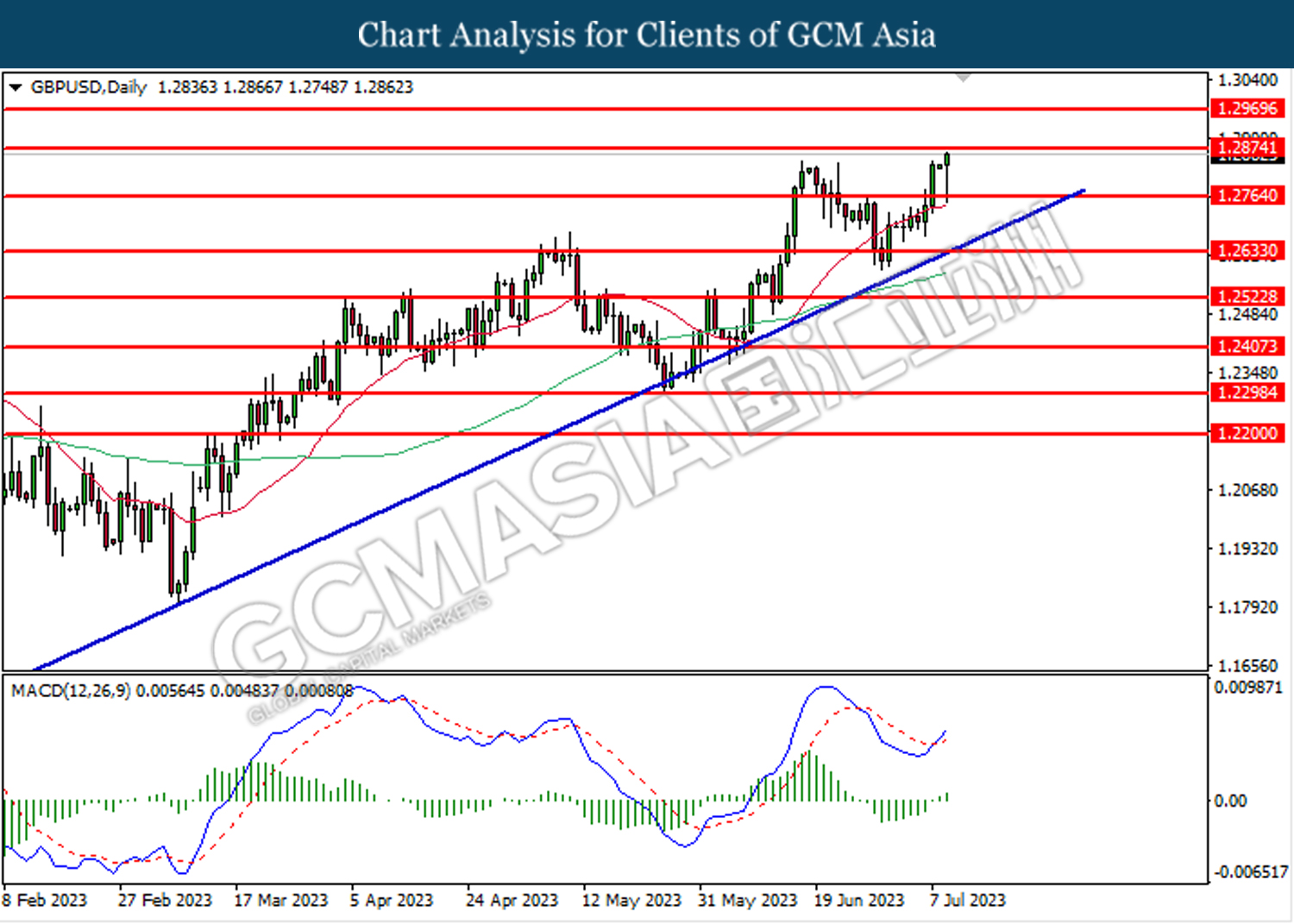

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2765. MACD which illustrated bullish bias momentum suggest the pair to extend its toward the resistance level at 1.2875.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2635

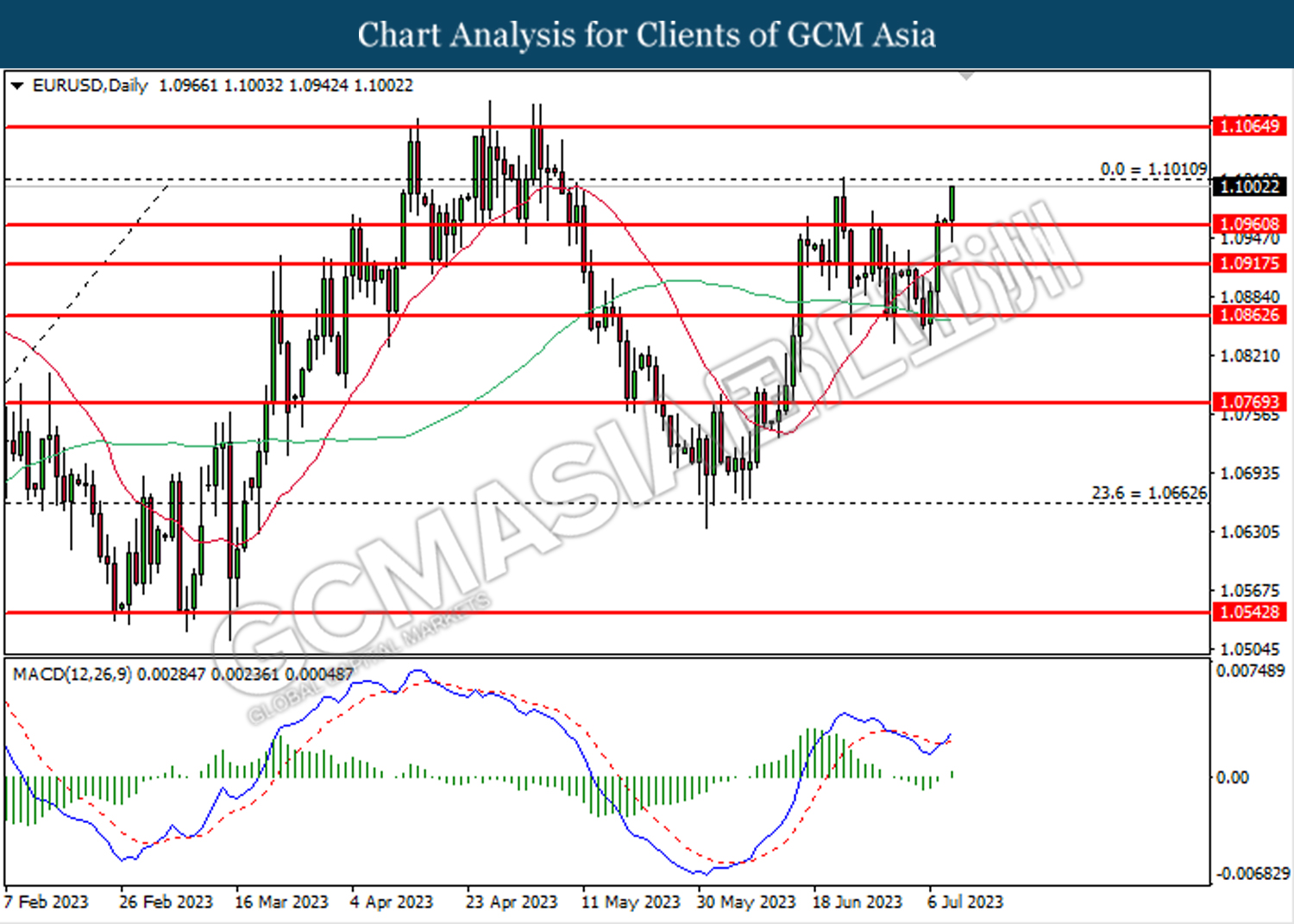

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.0915. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.1010.

Resistance level: 1.1010, 1.1065

Support level: 1.0915, 1.0865

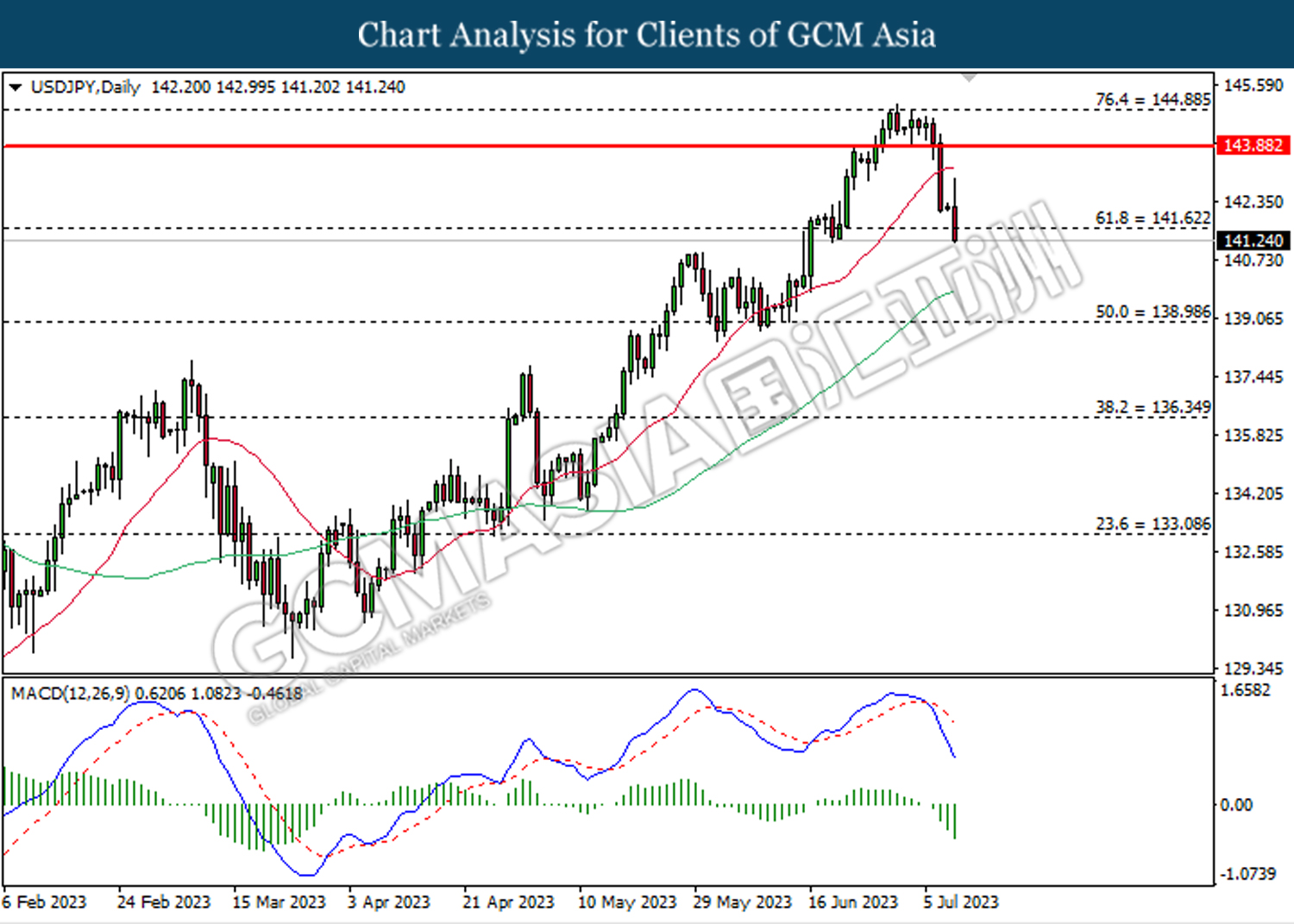

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 141.60. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 143.90, 144.90

Support level: 141.60, 139.00

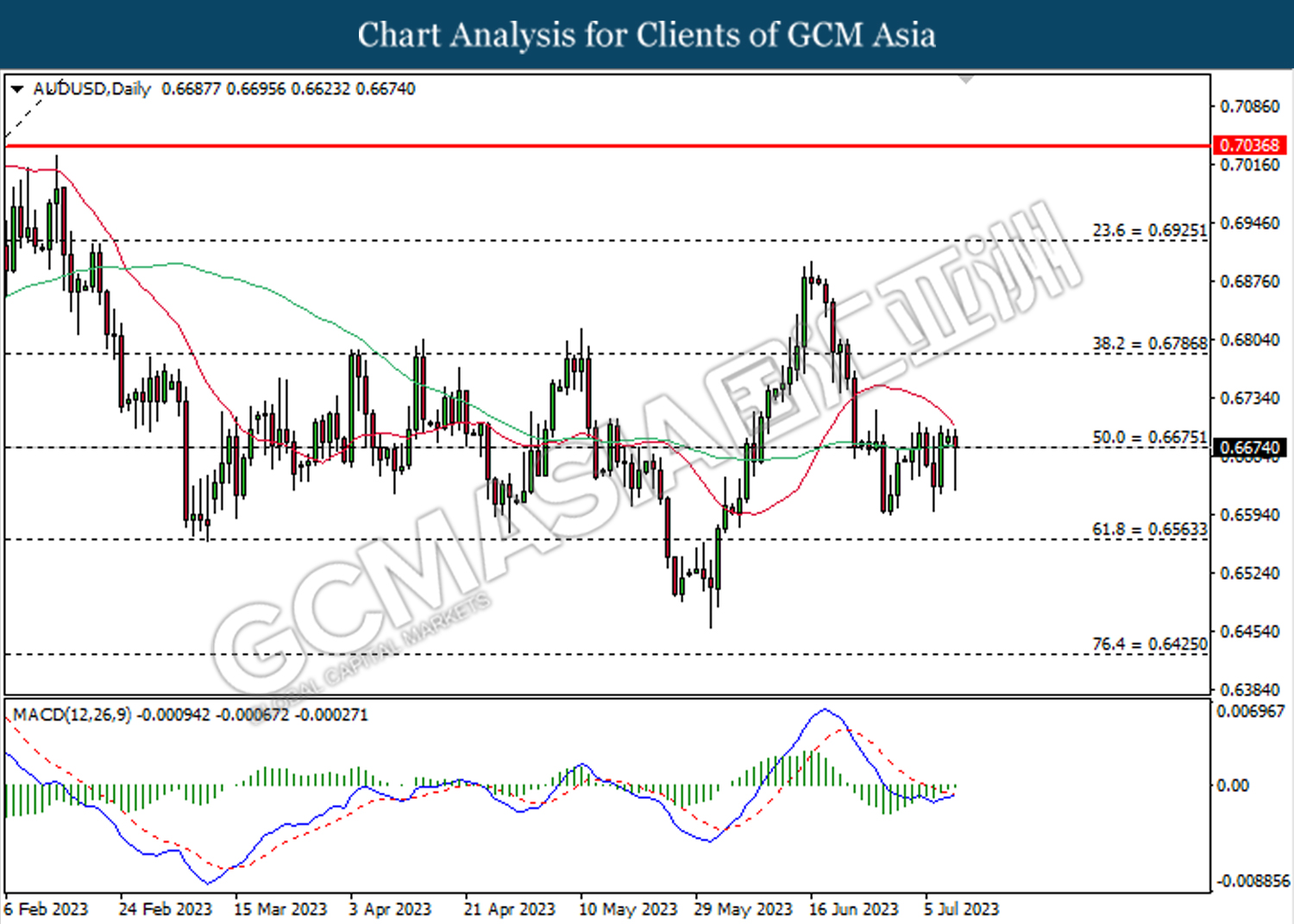

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

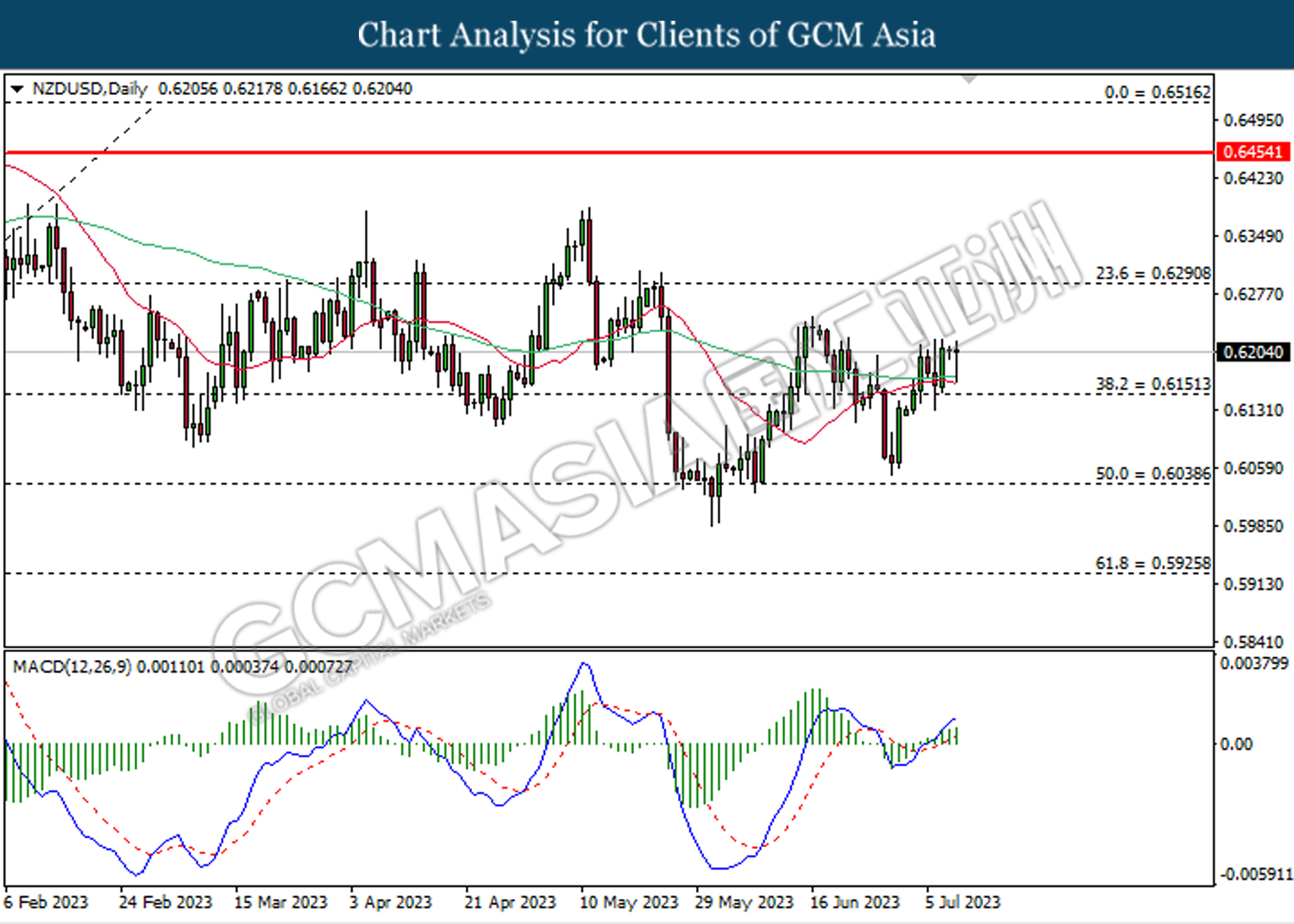

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

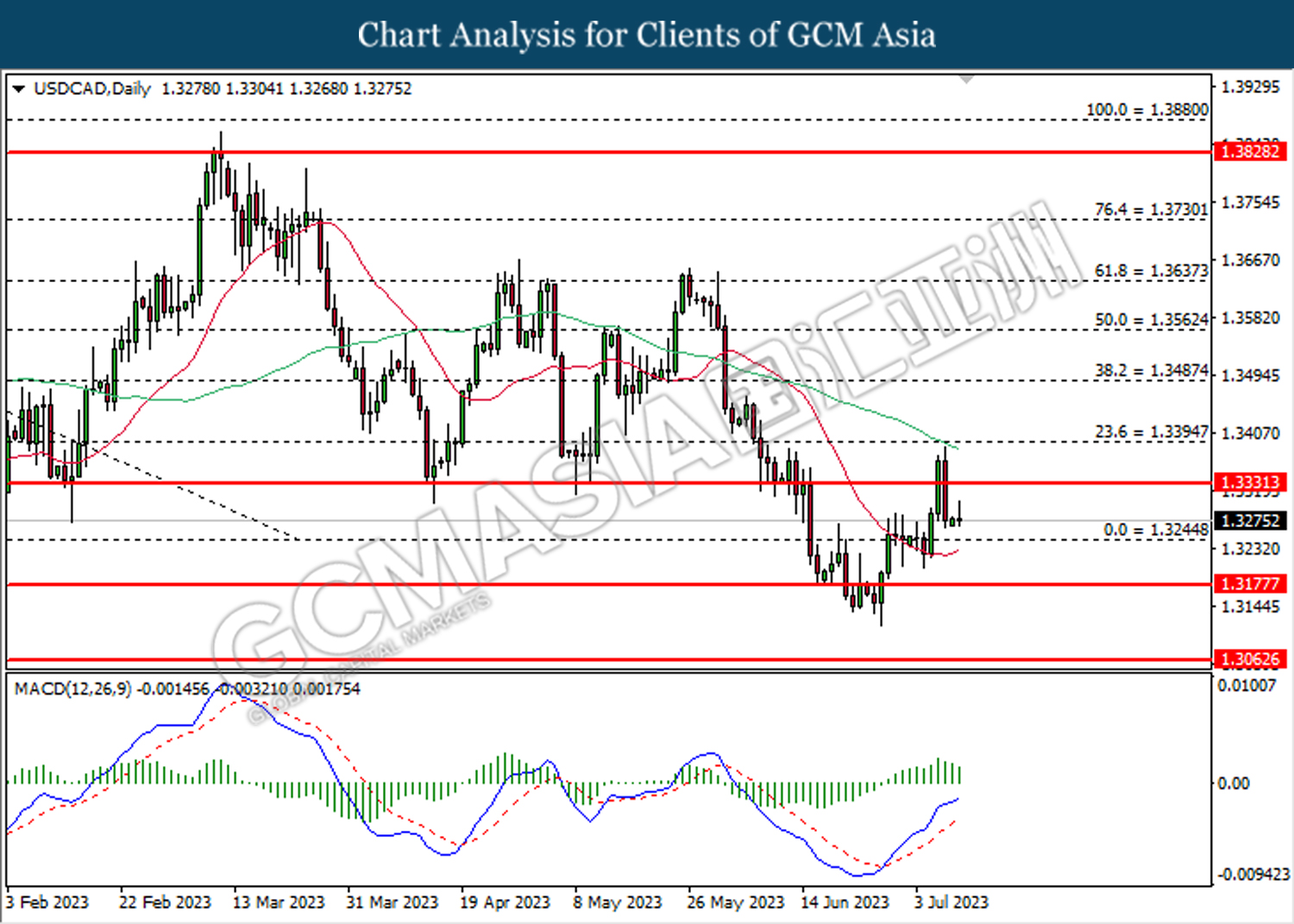

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3330. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3245.

Resistance level: 1.3330, 1.3395

Support level: 1.3245, 1.3175

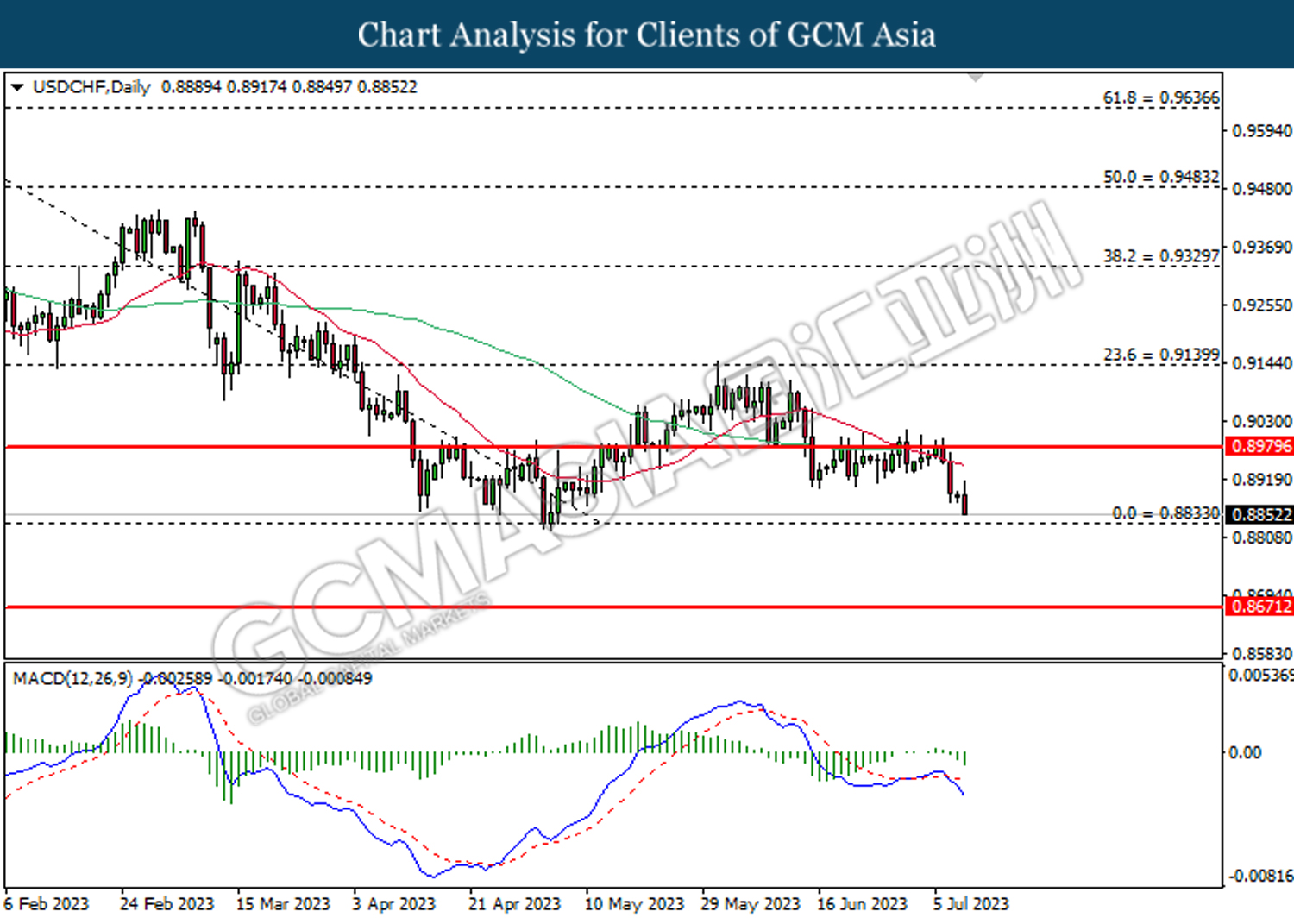

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.8980. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.8830.

Resistance level: 0.8980, 0.9140

Support level: 0.8830, 0.8670

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 73.90. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

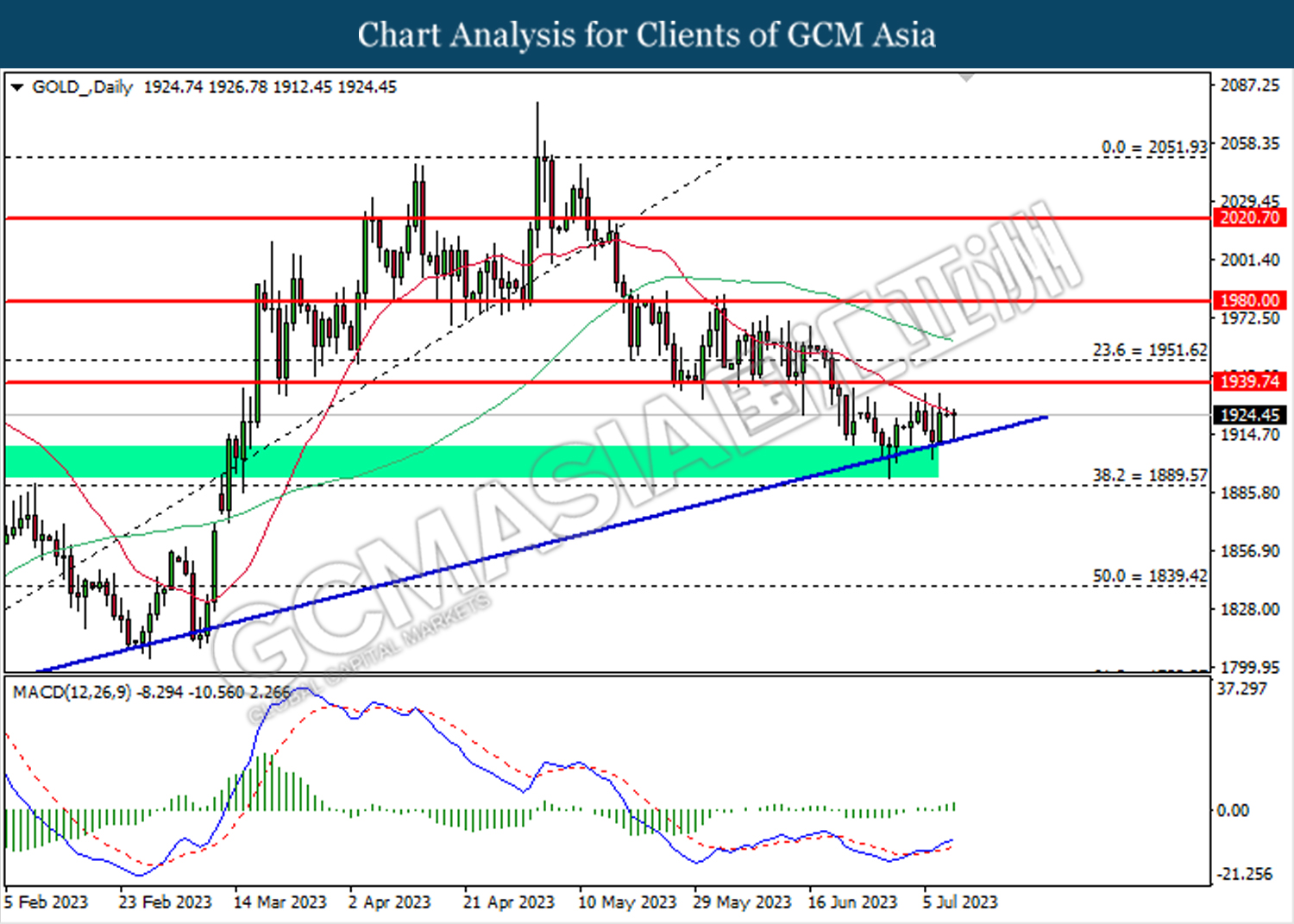

GOLD_, Daily: Gold price was traded higher following the prior rebound from the upward trend line. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1939.75.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40