11 September 2020 Afternoon Session Analysis

Pound sterling fell amid EU issued ultimatum.

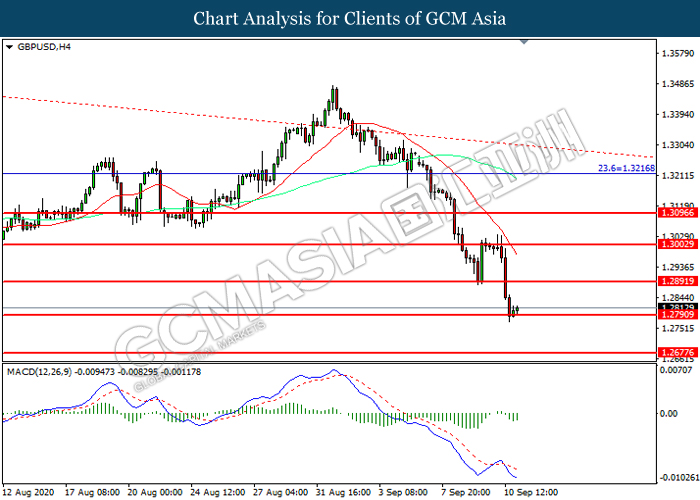

During late Asian session, the pound sterling which traded against the dollar and other currency pairs have records its biggest weekly drop in nearly six months and plummet as EU threatened to pursue legal against the UK on Brexit issue. According to the latest development, EU have demand the U.K to drop its internal market bill by the end of the month or facing risk of jeopardizing further negotiations and legal actions. The bill is likely to clash with key terms in the withdrawal agreement that requiring Northern Ireland to follow EU rules in the post Brexit and apply across the whole U.K including England, Northern Ireland, Scotland and Wales. Cabinet minister Michael Gove insisted that U.K will stand firm and will not withdraw the bill. Following the worsening relation between U.K and E.U, hopes of Brexit deal are fading further, thus dragging on the pair heavily. At the time of writing, GBP/USD slips 0.09% to 1.2815.

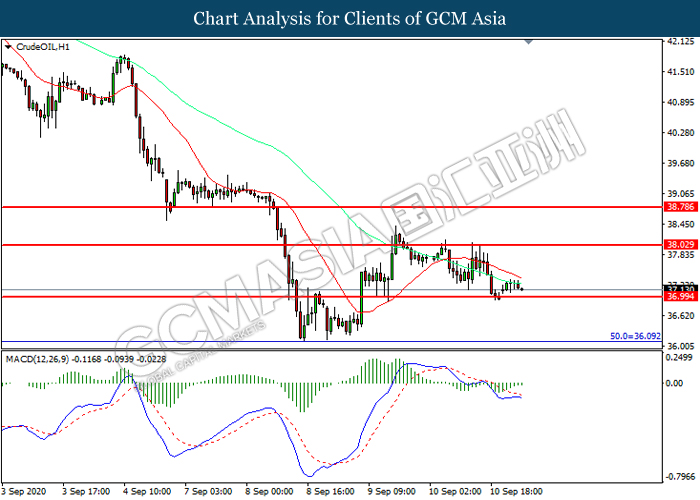

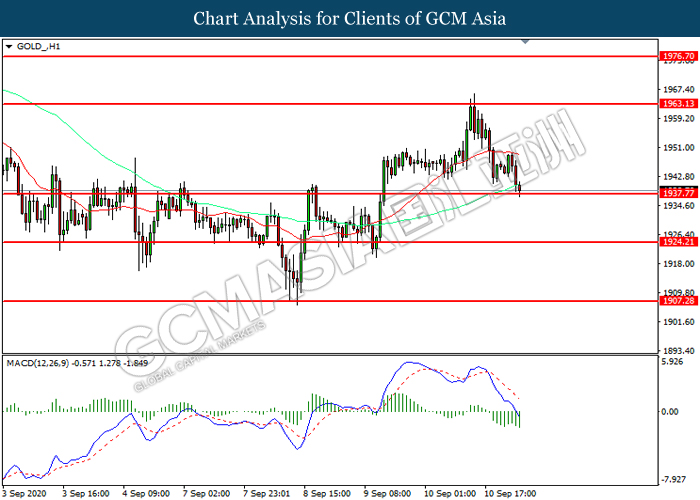

In the commodities market, crude oil price remains weak and edge lower 0.45% to $37.29 per barrel as of writing amid ongoing pressure from weak demand outlook and increasing supply. As EIA reports an unexpected increase of 2 million barrel in supply, the black commodity was added further losses. On top of that, reports of onshore storage are nearing full capacity which reflect supplies have outpace demand also weighing heavily on the commodity. On the other hand, gold price slips 0.03% to $1945.40 amid dollar gains.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP(MoM) | 8.7% | 6.7% | – |

| 14:00 | GBP – Manufacturing Production (MoM)(Jul) | 11.0% | 5.0% | – |

| 20:30 | USD – Core CPI (MoM)(Aug) | 0.6% | 0.2% | – |

Technical Analysis

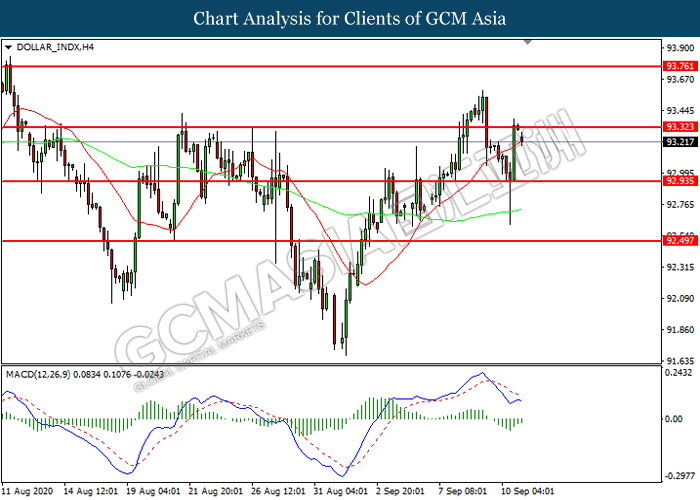

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 93.30. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 93.30, 93.75

Support level: 92.95, 92.50

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.2790. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2890, 1.3005

Support level: 1.2790, 1.2675

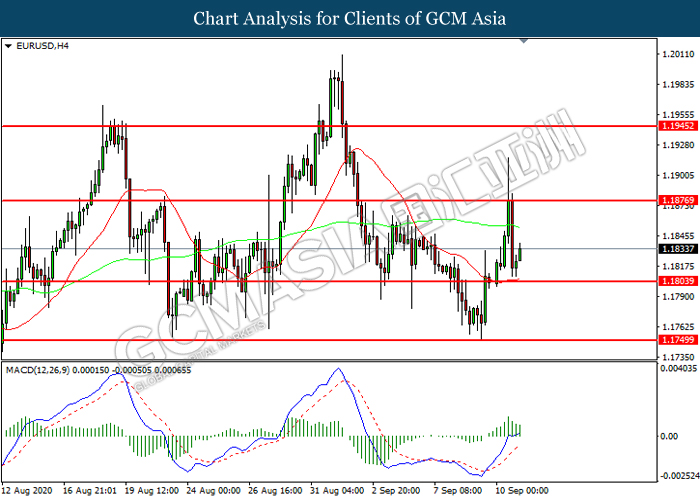

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.1805. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.1875, 1.1945

Support level: 1.1805, 1.1750

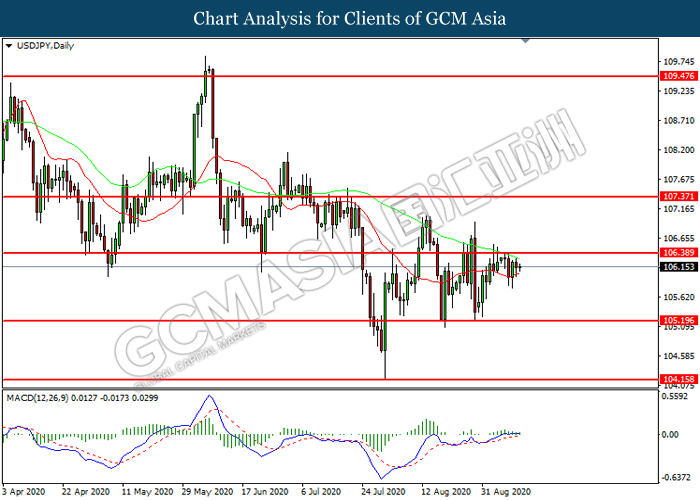

USDJPY, Daily : USDJPY was traded higher while currently testing the resistance level at 106.40. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 106.40, 107.35

Support level: 105.20, 104.15

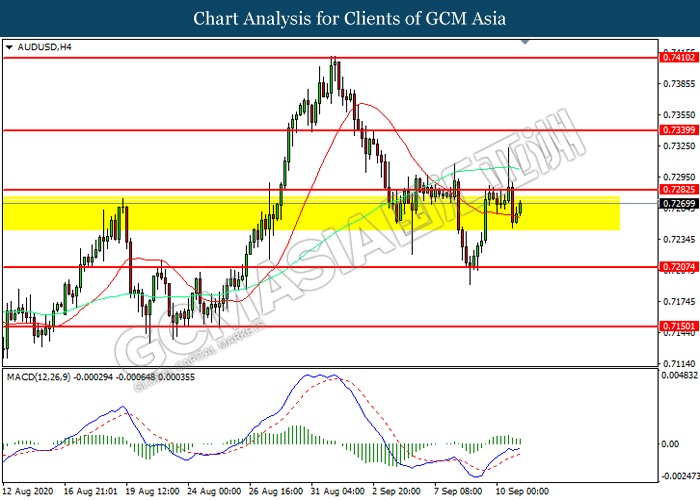

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level 0.7285. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.7285, 0.7340

Support level: 0.7205, 0.7150

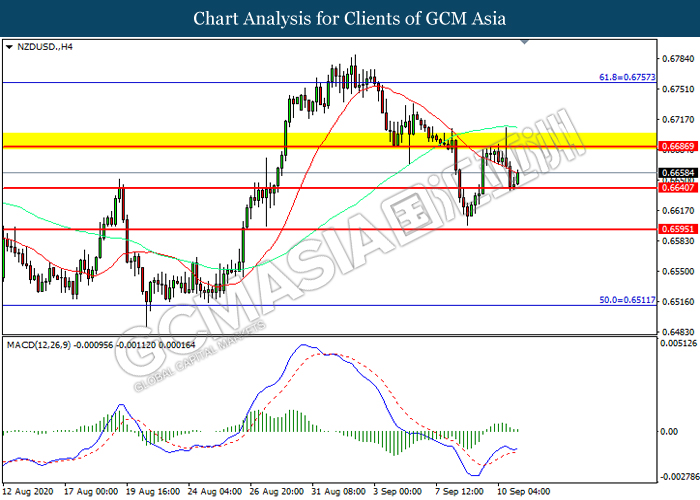

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level at 0.6640. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.6685, 0.6755

Support level: 0.6640, 0.6595

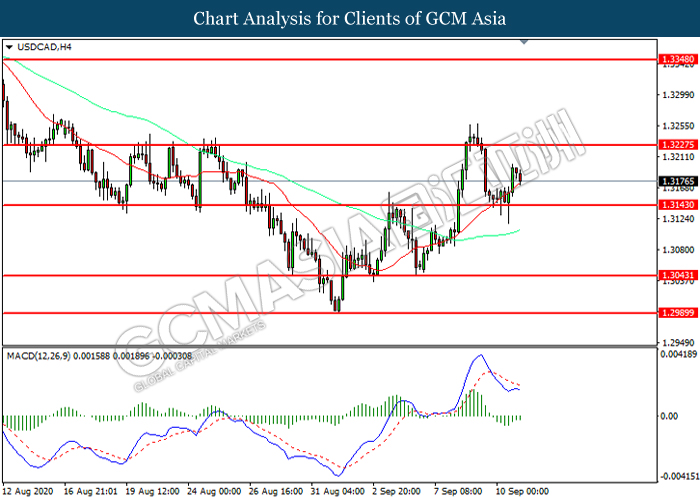

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.3145. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.3225.

Resistance level: 1.3225, 1.3350

Support level: 1.3145, 1.3045

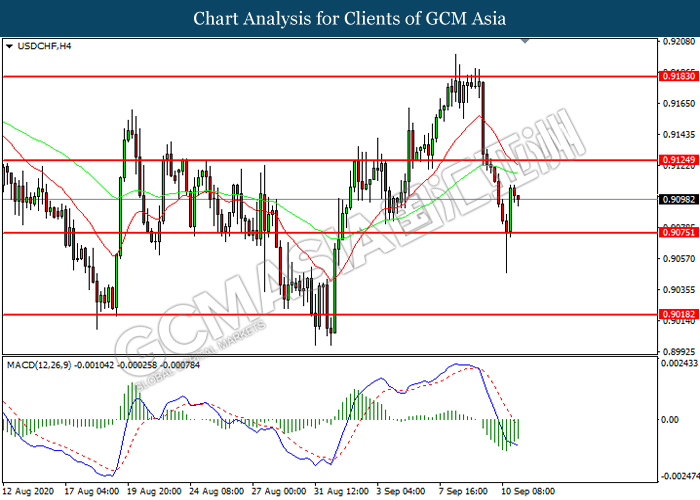

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level at 0.9075. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.9125.

Resistance level: 0.9125, 0.9185

Support level: 0.9075, 0.9020

CrudeOIL, H1: Crude oil price was traded within a range while currently testing the support level at 37.00. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 38.05, 38.80

Support level: 37.00, 36.10

GOLD_, H1: Gold price was traded lower while currently testing the support level at 1937.75. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1963.15, 1976.70

Support level: 1937.75, 1924.20