11 September 2020 Morning Session Analysis

Euro skyrocketed following ECB interest rate decision.

The European Union single currency – Euro managed to extend its gains after ECB unleashed their neutral stance in their latest monetary policy decision. At the yesterday ECB meeting, the board members of ECB generally decided to maintain its interest rate at 0.00% while will keep it low until they see a strong recovery in the economy’s underlying inflation dynamics. Moreover, the pandemic emergency of purchase programme (PEPP) with a total envelope of €1350 billion will still be carried on in order to limit the downside impact of pandemic while supporting the economy back to the correct or normal path of inflation. Other than that, ECB also emphasized that ample liquidity tools will continued be ready, such as the refinancing tool of (TLTRO III) in order to provide sufficient loan for household and businesses. However, President of ECB Christine Lagarde revealed that they will ‘carefully monitor’ the recent appreciation of euro, but they will not overreact to it and not targeting FX rate now. Despite, the gains of EUR/USD limited as upbeat inflation linked data from US slashed the appeal of this pair of currency. During Asian early trading session, the pair of EUR/USD surged 0.10% to 1.1825.

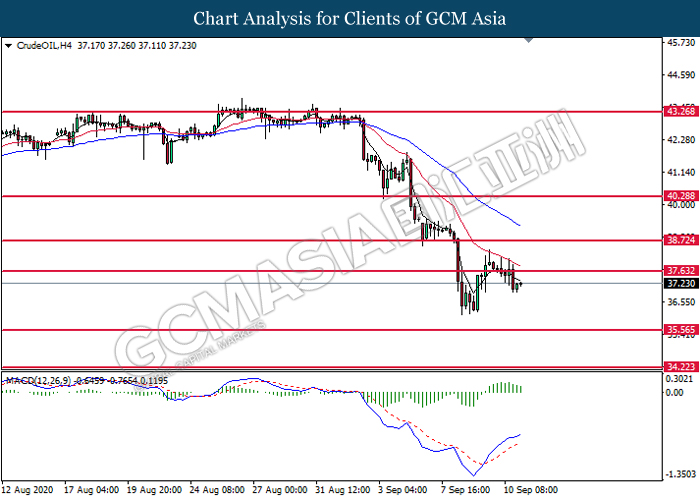

In the commodities market, crude oil price rose 0.62% to $37.25 per barrel after sliding for more than 3% yesterday amid downbeat inventory data. According to the EIA, US Crude Oil Inventories data came in at 2.032M, higher than the economist forecast of -1.335M, indicating a surprise build in US stockpiles and thus dragged down the appeal of this black commodity market. Besides, gold price dropped 0.02% to $1946.00 per troy ounce amid positive economic data from US dampened the risk-avoidance of market participants.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP(MoM) | 8.7% | 6.7% | – |

| 14:00 | GBP – Manufacturing Production (MoM)(Jul) | 11.0% | 5.0% | – |

| 20:30 | USD – Core CPI (MoM)(Aug) | 0.6% | 0.2% | – |

Technical Analysis

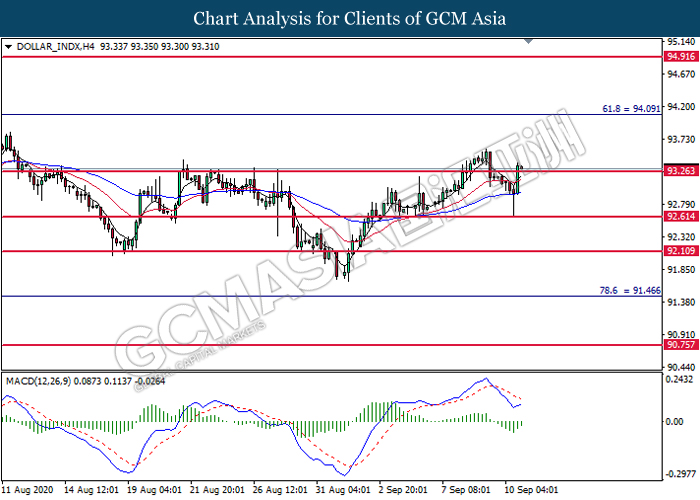

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level at 93.25. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains toward the resistance level at 94.10.

Resistance level: 94.10, 94.90

Support level: 93.25, 92.60

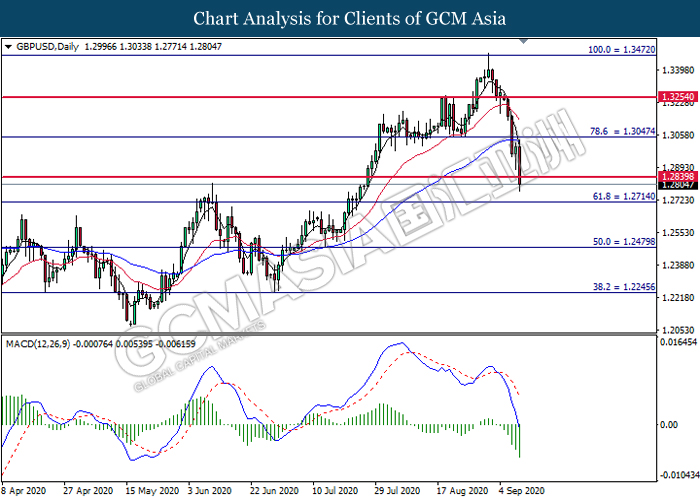

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2840. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 1.2840.

Resistance level: 1.3045, 1.3255

Support level: 1.2840, 1.2715

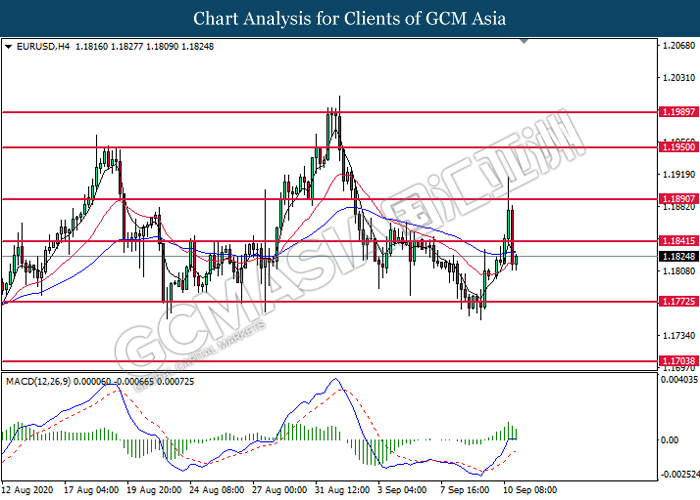

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level at 1.1840. MACD which illustrate diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1775.

Resistance level: 1.1840, 1.1890

Support level: 1.1775, 1.1705

USDJPY, Daily: USDJPY was traded higher while currently testing the triangle’s top level. MACD which illustrates diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 106.15, 106.95

Support level: 105.20, 104.30

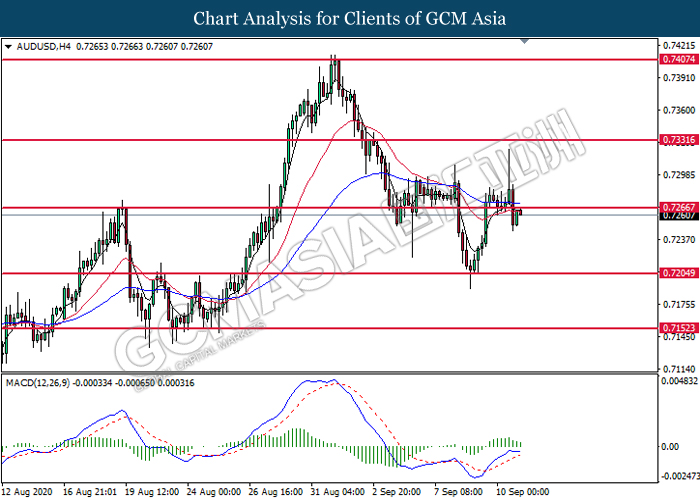

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level at 0.7265. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.7205.

Resistance level: 0.7265, 0.7330

Support level: 0.7205, 0.7150

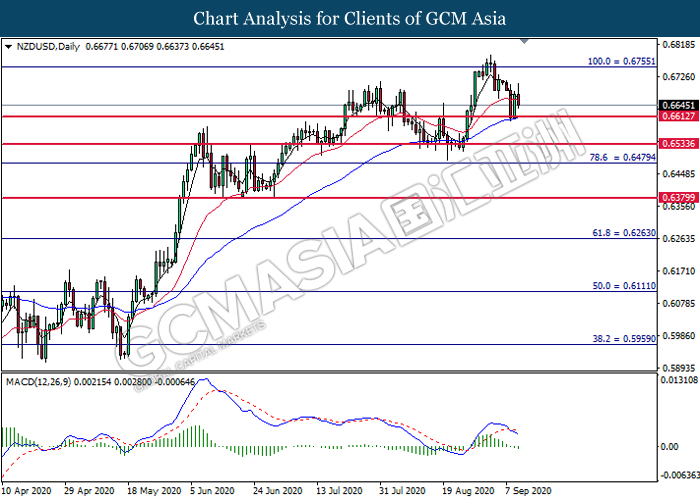

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6615. However, MACD which illustrated bearish momentum with the formation of death cross suggest the pair to undergo technical correction toward the support level at 0.6615.

Resistance level: 0.6755, 0.6835

Support level: 0.6615, 0.6535

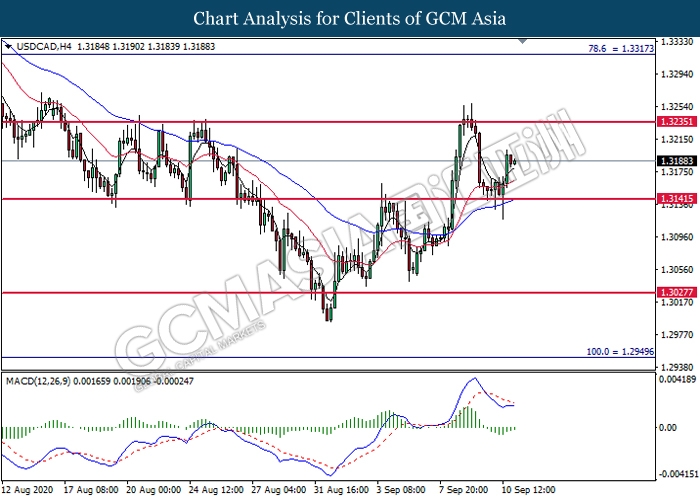

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.3140. MACD which illustrate diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.3235.

Resistance level: 1.3235, 1.3315

Support level: 1.3140, 1.3030

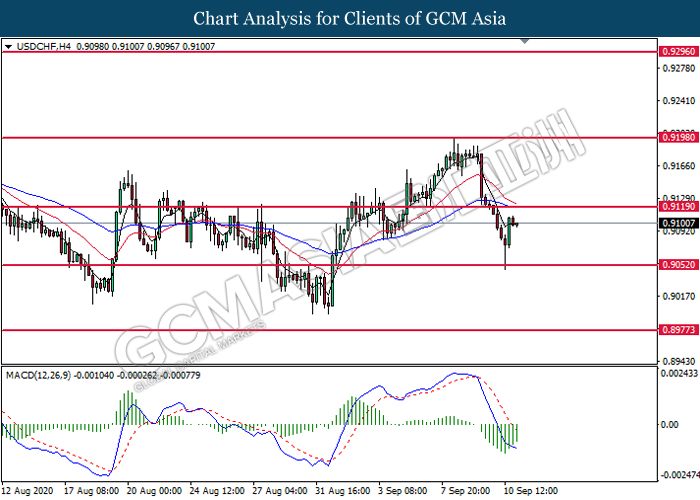

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level at 0.9050. MACD which illustrates diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9120.

Resistance level: 0.9120, 0.9200

Support level: 0.9050, 0.8970

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 37.65. MACD which illustrate diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 35.55.

Resistance level: 37.65, 38.70

Support level: 35.55, 34.20

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1926.40. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its rebound toward the resistance level at 2069.75.

Resistance level: 2069.75, 2147.50

Support level: 1926.40, 1761.65