10 November 2020 Morning Session Analysis

Safe haven yen plunged amid positive vaccine results.

Japanese Yen which acting as one of the major trading currencies in FX market was dumped by the market participants tremendously after drug maker Pfizer announced that the coronavirus vaccine trial shows positive result in preventing Covid-19. According to Pfrizer’s statement, the vaccine produced by German drug maker BioNTEch and themselves have entered clinical trial stage and result shows that the vaccine was more than 90 percent effective in preventing the disease among trial volunteers. Besides, all the trial volunteers who had no evidence of prior coronavirus infection shows no side-effect after injecting the vaccine. Therefore, Pfizer is now planning to request for emergency authorization of the vaccine later this month from US Food and Drug Administration after they have successfully proven that the results stay positive with two months of safety data. However, Scientist and experts have warned to against the whoop and a holler of early result, as long-term safety issue and feasibility of the vaccine remains unknown. As of now, investors will now eyes on the further evidence of result over the development of Pfizer’s vaccine as well as the vaccine from other companies. During Asian early trading session, the pair of USD/JPY retrace 0.07% to 105.30.

In the commodities market, the crude oil price surged by 0.05% to $40.10 per barrel as positive result of vaccine’s development boosted up the market sentiment of this black commodity. With the expectation of vaccine will be born in near future, global oil demand is expected to recover rapidly and therefore lifted the price of crude oil. Besides, gold price depreciated by 0.10% to $1861.00 a troy ounce as market risk appetite surge amid encouraging result of vaccine’s development.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 CrudeOIL EIA Short-Term Energy Outlook

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index + Bonus (Sep) | 0.0% | 1.0% | – |

| 15:00 | GBP – Claimount Count Change | 28.0K | 50.0K | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Nov) | 56.1 | 41.7 | – |

| 23:00 | USD – JOLTs Job Openings (Sep) | 6.493M | 6.500M | – |

| 05:30

(11th) |

CrudeOIL – API Weekly Crude Oil Stock | -8.010M | – | – |

Technical Analysis

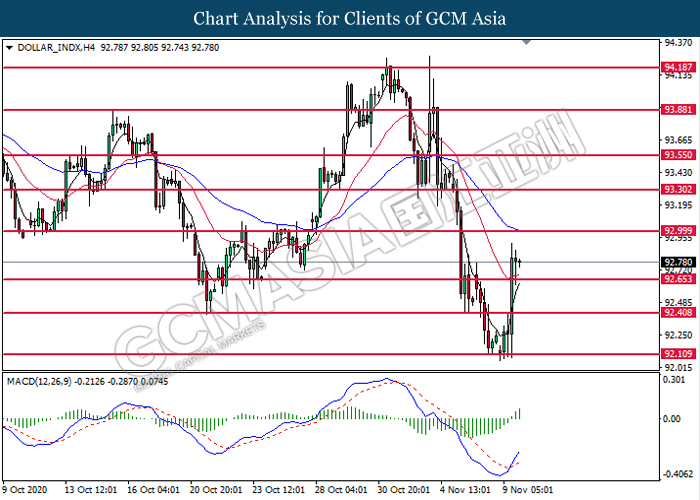

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level at 92.65. MACD which illustrate bullish bias momentum signal suggest the dollar to extend it gains toward the resistance level at 93.00.

Resistance level: 93.00, 93.30

Support level: 92.65, 92.40

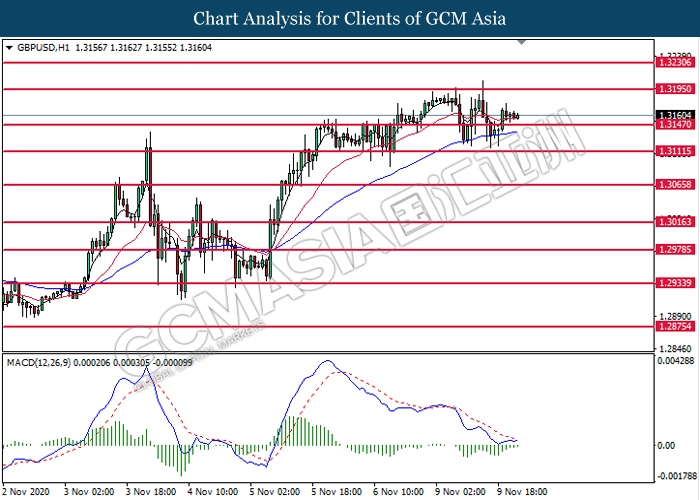

GBPUSD, H1: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.3145. MACD which illustrates diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.3195.

Resistance level: 1.3195, 1.3230

Support level: 1.3145, 1.3110

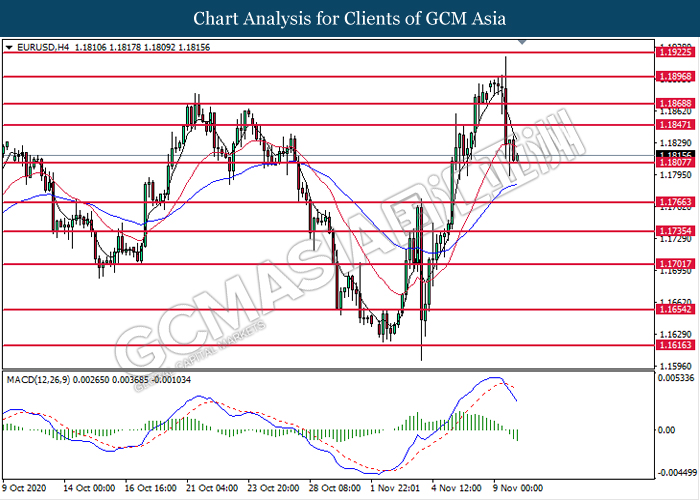

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1810. MACD which illustrate bearish bias momentum signal suggest the pair to extend its losses after it successfully breakout below the support level at 1.1810.

Resistance level: 1.1845, 1.1870

Support level: 1.1810, 1.1765

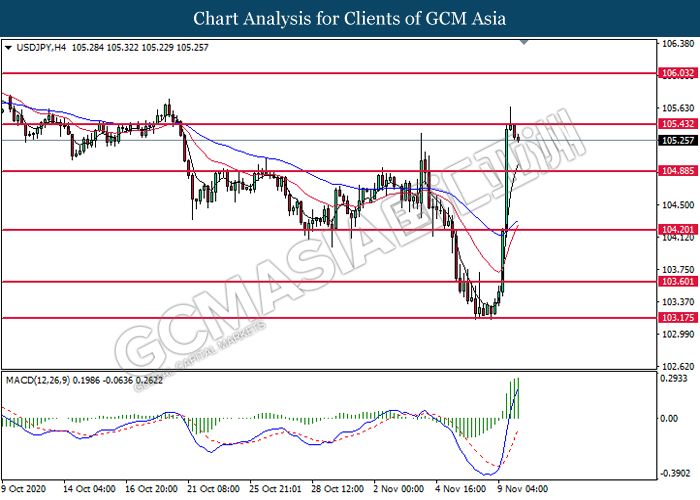

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 105.45. MACD which illustrate diminishing bullish momentum suggest the pair to extend its losses toward the support level at 104.90.

Resistance level: 105.45, 106.05

Support level: 104.90, 104.20

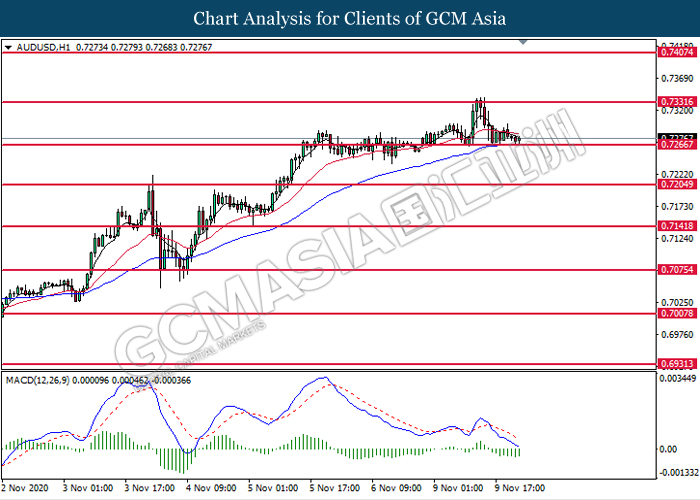

AUDUSD, H1: AUDUSD was traded higher following prior rebound from the support level at 0.7265. MACD which illustrate diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.7330.

Resistance level: 0.7330, 0.7405

Support level: 0.7265, 0.7205

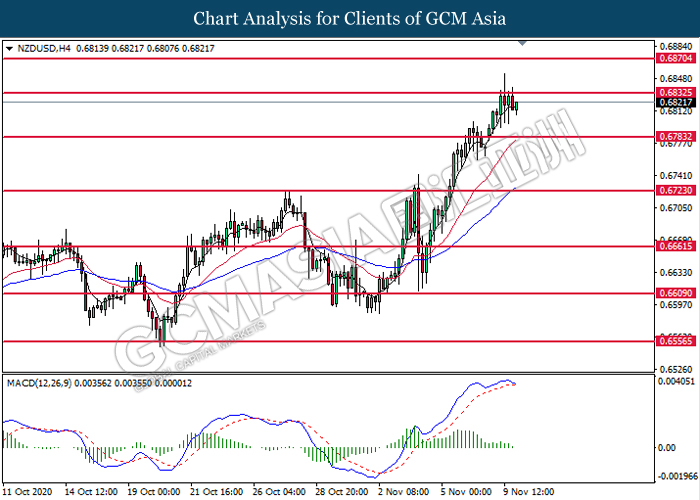

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6835. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to undergo technical correction in short term toward a lower level.

Resistance level: 0.6835, 0.6870

Support level: 0.6785, 0.6725

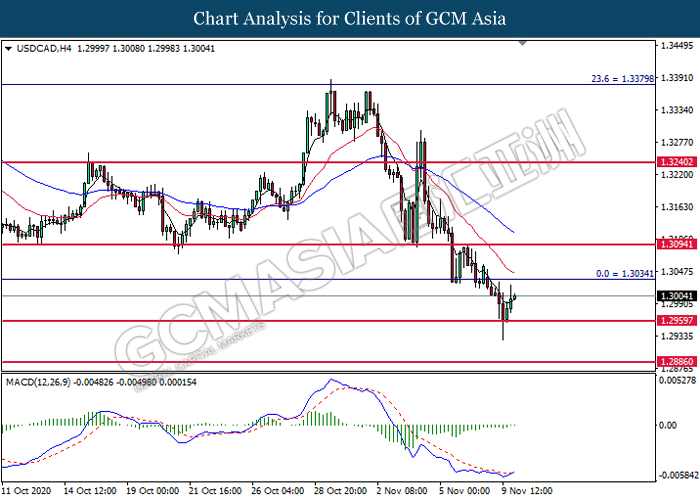

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.2960. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its gains toward the resistance level at 1.3035.

Resistance level: 1.3035, 1.3095

Support level: 1.2960, 1.2885

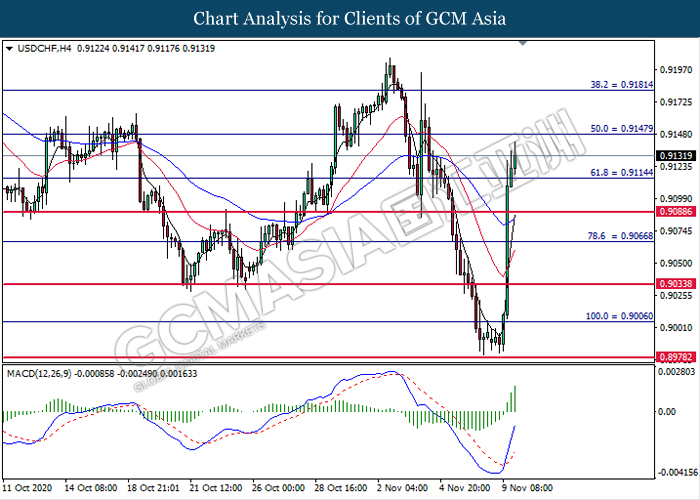

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9115. MACD which display bullish bias momentum signal suggest the pair to extend its gains toward the resistance level at 0.9150.

Resistance level: 0.9150, 0.9180

Support level: 0.9115, 0.9090

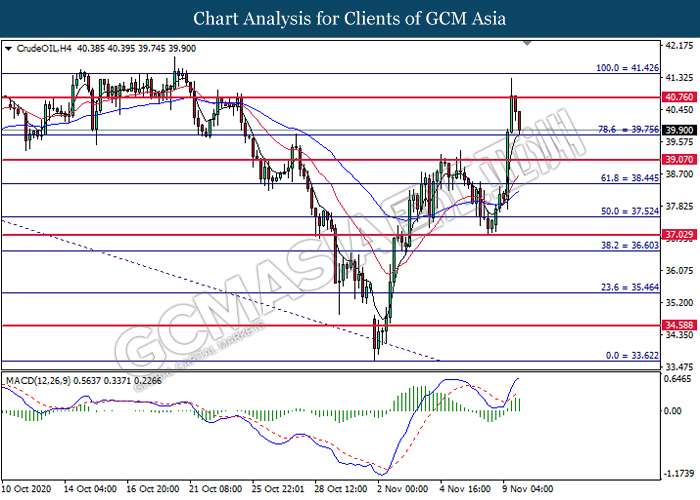

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 39.75. MACD which illustrate diminishing bullish momentum signal suggest the commodity to extend its losses after it successfully breakout below the support level at 39.75.

Resistance level: 40.75, 41.45

Support level: 39.75, 39.05

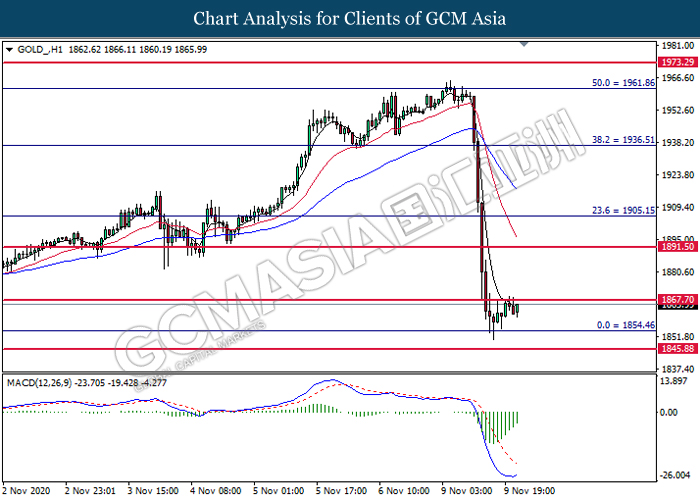

GOLD_, H1: Gold price was traded higher while currently testing the resistance level at 1867.70. MACD which illustrate diminishing bearish momentum signal suggest the commodity to extend its gains after it successfully breakout above the resistance level at 1867.70.

Resistance level: 1867.70, 1891.50

Support level: 1854.45, 1845.90