Safe–haven boosted by continued geopolitical tension

The dollar slumped against a basket of major currencies on Tuesday, with the U.S. dollar index fell by 0.33% to 100.61, as the ‘flight to safety’ sentiment began to set in for investors amid rising geopolitical tensions. In the absence of top-tier market moving economic data on Tuesday, rising geopolitical events remained front and center, as investors poured into safe-haven assets, after expectations grew the U.S. may take military action against North Korea. The U.S decided to move a Navy strike group toward the Korean peninsula amid continued missile tests by North Korea. Meanwhile, President Donald Trump tweeted on Tuesday, “North Korea is looking for trouble” and signaled that the U.S. is prepared to solve the problem on its own, should China decline to offer assistance. Some analysts, expected the dollar to continue its downward bias but warned that sentiment has improved in recent trading sessions.

Looking into commodities market, gold prices traded higher on Tuesday, added $20.95, or 1.66%, to $1,274.75 a troy ounce as investors fled risk assets and sought refuge in safe-haven gold amid rising geopolitical tensions. Meanwhile, Crude oil price settled higher, gained 32 cents to settle at $53.40 a barrel after reports surfaced that Saudi Arabia supported the idea of extending OPEC-led cuts by an additional six months to the end of the year.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:30 GBP BoE Gov Carney Speaks

23:15 CAD BoC Poloz Speaks

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 09:30 | CNY – CPI (YoY) (Mar) | 0.8% | 1.0% | 0.9% |

| 16:30 | GBP – Average Earnings Index + Bonus (Feb) | 2.2% | 2.2% | – |

| 16:30 | GBP – Claimant Count Change (Mar) | -11.3K | -3.0K | – |

| 22:00 | CAD – BoC Interest Rate Decision | 0.50% | 0.50% | – |

| 22:30 | Crude Oil – Crude Oil Inventories | 1.566M | 0.087M | – |

GBPUSD

GBPUSD, H4: GBPUSD jumped higher to the level above the both MA lines, currently hovering below the resistance level of 1.2500. Referring to the both movement lines showed in the MACD indicator which pointing upward now, in addition with the momentum seen above 0, GBPUSD suggested to move further higher in short term after the price close above the resistance level of 1.2500.

Resistance level: 1.2500, 1.2610

Support level: 1.2420, 1.2360

EURUSD

EURUSD, H1: EURUSD traded higher following a rebound from recent low at the support level of 1.0580. Currently the price traded between the both MA lines, signaled to be traded flat in short term. As for the trend direction for long term, it remained suggested as downtrend.

Resistance level: 1.0650, 1.0700

Support level: 1.0580, 1.0500

USDJPY

USDJPY, H1: USDJPY was closed out of the lowest level of recent trading range and below the support level of 110.10, signaled for further downside movement towards the next target of support level at 108.80.

Resistance level: 110.10, 111.40

Support level: 108.80, 106.50

CrudeOIL

CrudeOIL, H4: Crude oil price continued its uptrend following a rebound from 20 MA line (Red), currently the price testing to close above the resistance level of 53.30. Closing above this level suggested for further upside movement towards the next target of resistance level at 55.00.

Resistance level: 53.30, 55.00

Support level: 51.95, 51.00

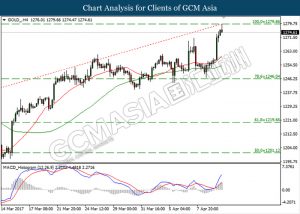

GOLD

GOLD_, H4: Gold price surged sharply and was take a breathed at the resistance level of 1280.00. Based on the both movement lines showed in the MACD indicator which pointing upward now suggested the gold price to move further higher. In addition with the trend directions pointed by both MA line, the price is in a strong uptrend now.

Resistance level: 1280.00, 1300.00

Support level: 1246.00, 1220.00

Risk Statement:

Forex, Gold, Crude Oil, Commodities, CFD and all other margin trading investment products involve high level of risk and may not be suitable for all investors. Your previous investment success in stock, futures or any other investment achieved does not mean that all your future investment will obtain the same results. You should carefully consider your investment objectives, risk associated and seek professional advice before deciding to trade or if you have any doubts.