5 December 2022 Afternoon Session Analysis

Canadian dollar spiked amid upbeat employment data.

The Canadian dollar regained its luster and hit the highest level in one week following the release of the upbeat employment data. According to Statistics Canada, the Canada Employment Change came in at 10.1K, stronger than the consensus forecast of 5.0K, mirroring that the labor market in Canada remains resilient. However, the pairing of USD/CAD plunged tremendously during Friday’s trading session, mainly due to the knee-jerk reaction following the NFP data. Last Friday, the NFP unexpectedly rose by 263K, significantly higher than the consensus forecast at 200K. However, the market sentiment of the dollar reversed instantly as the upbeat employment data is not expected to shake the decision of a slower rate hike plan in the Fed’s Dec Meeting. Recently, the Fed’s chairman Jerome Powell revealed that they are likely to slow down the pace of rate hikes in the upcoming meeting. However, they are still cautious about the cooling of inflation figures. As of writing, the dollar index dropped -0.31% to 104.30.

In the commodities market, the crude oil price edged up 0.66% to $81.30 per barrel as major cities in China eased their Covid-19 control measures, fueling the hopes of economic recovery. Besides, the gold prices jumped 0.55% to $1807.75 per troy ounce amid the weakness of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Composite PMI (Nov) | 48.3 | 48.3 | – |

| 17:30 | GBP – Services PMI (Nov) | 48.8 | 48.8 | – |

| 23:00 | USD – ISM Non-Manufacturing PMI (Nov) | 54.4 | 53.1 | – |

Technical Analysis

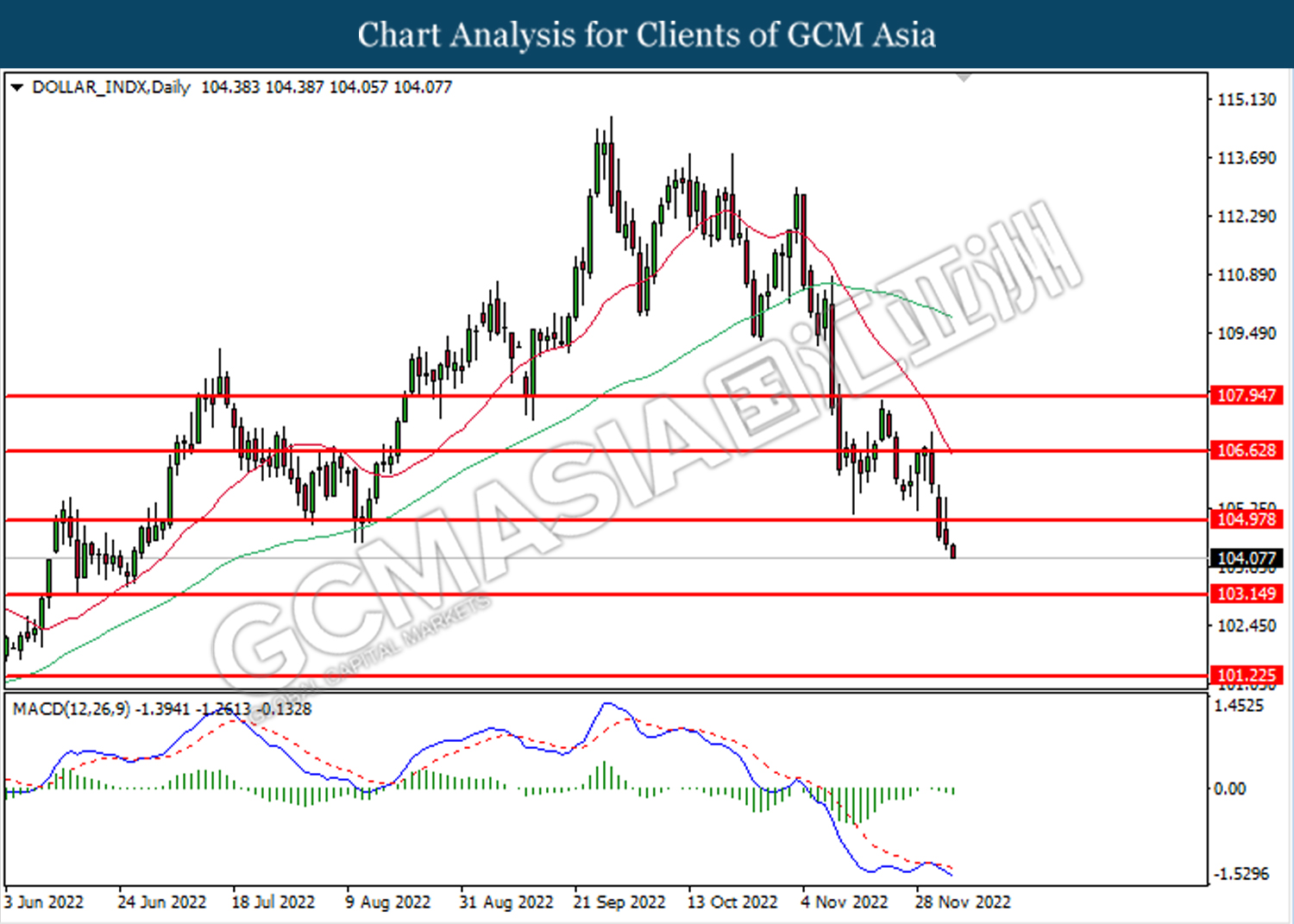

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 104.90. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 103.15.

Resistance level: 104.90, 107.85

Support level: 103.15, 101.25

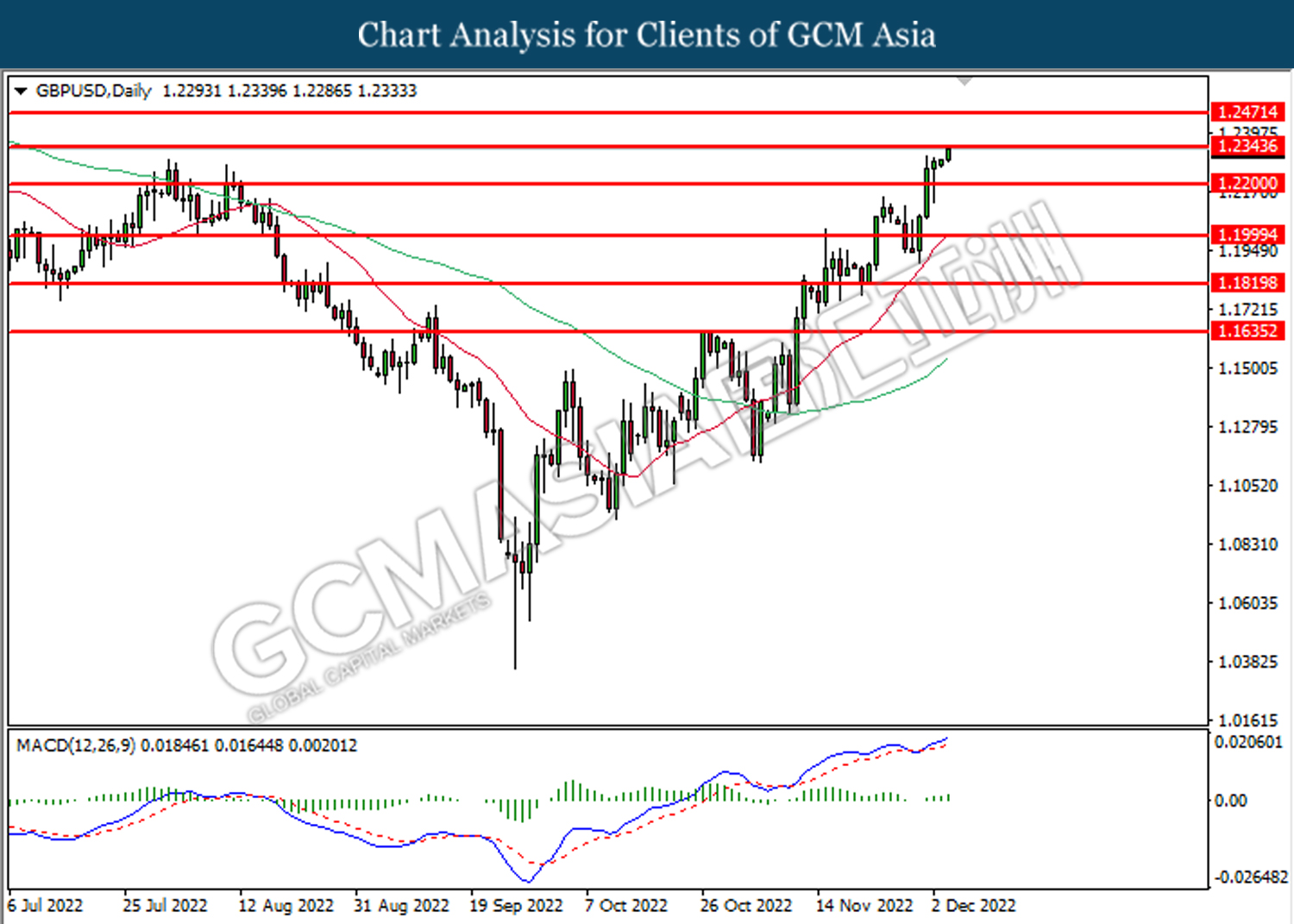

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2345. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2000

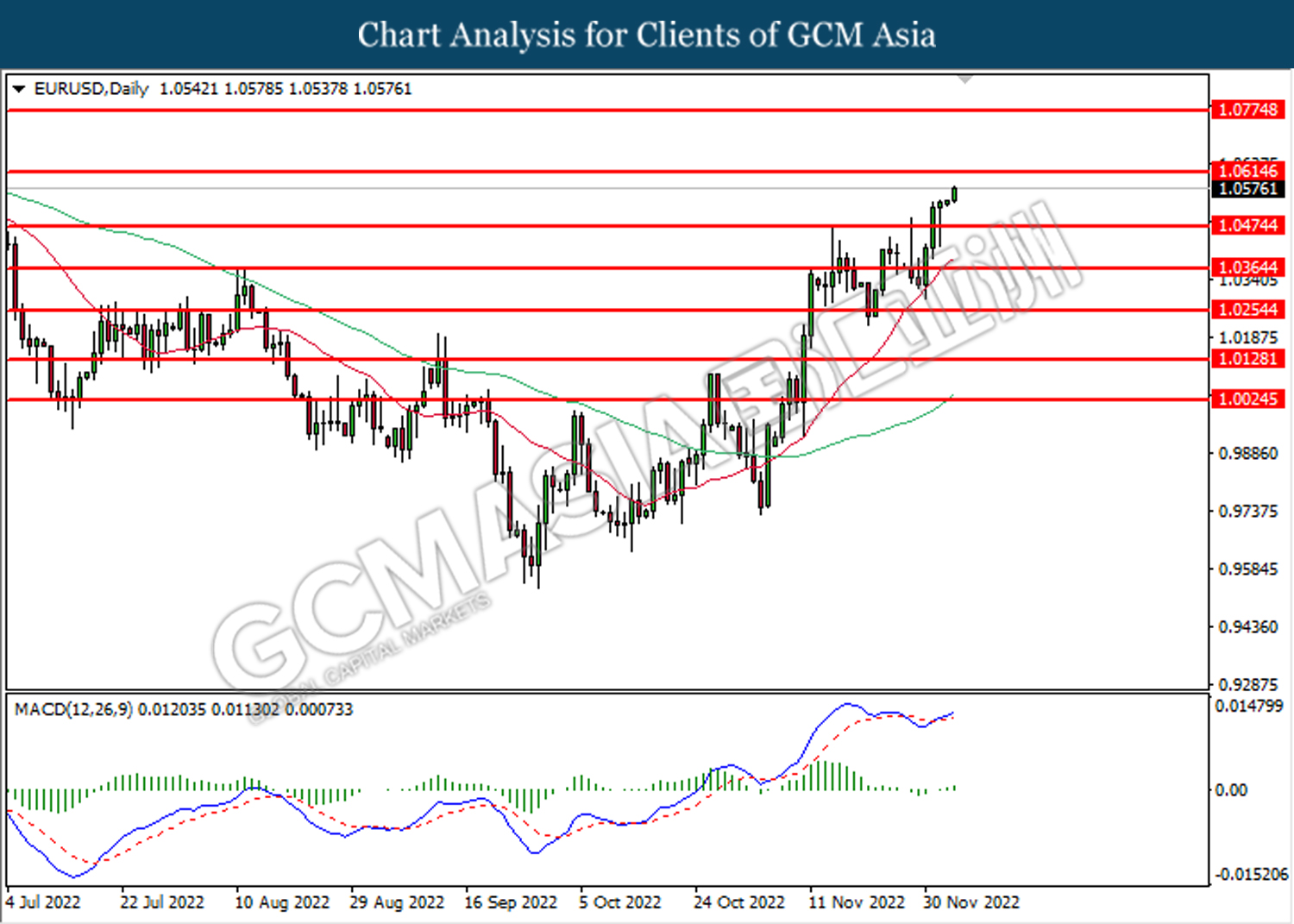

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0475. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0615.

Resistance level: 1.0615, 1.0775

Support level: 1.0475, 1.0365

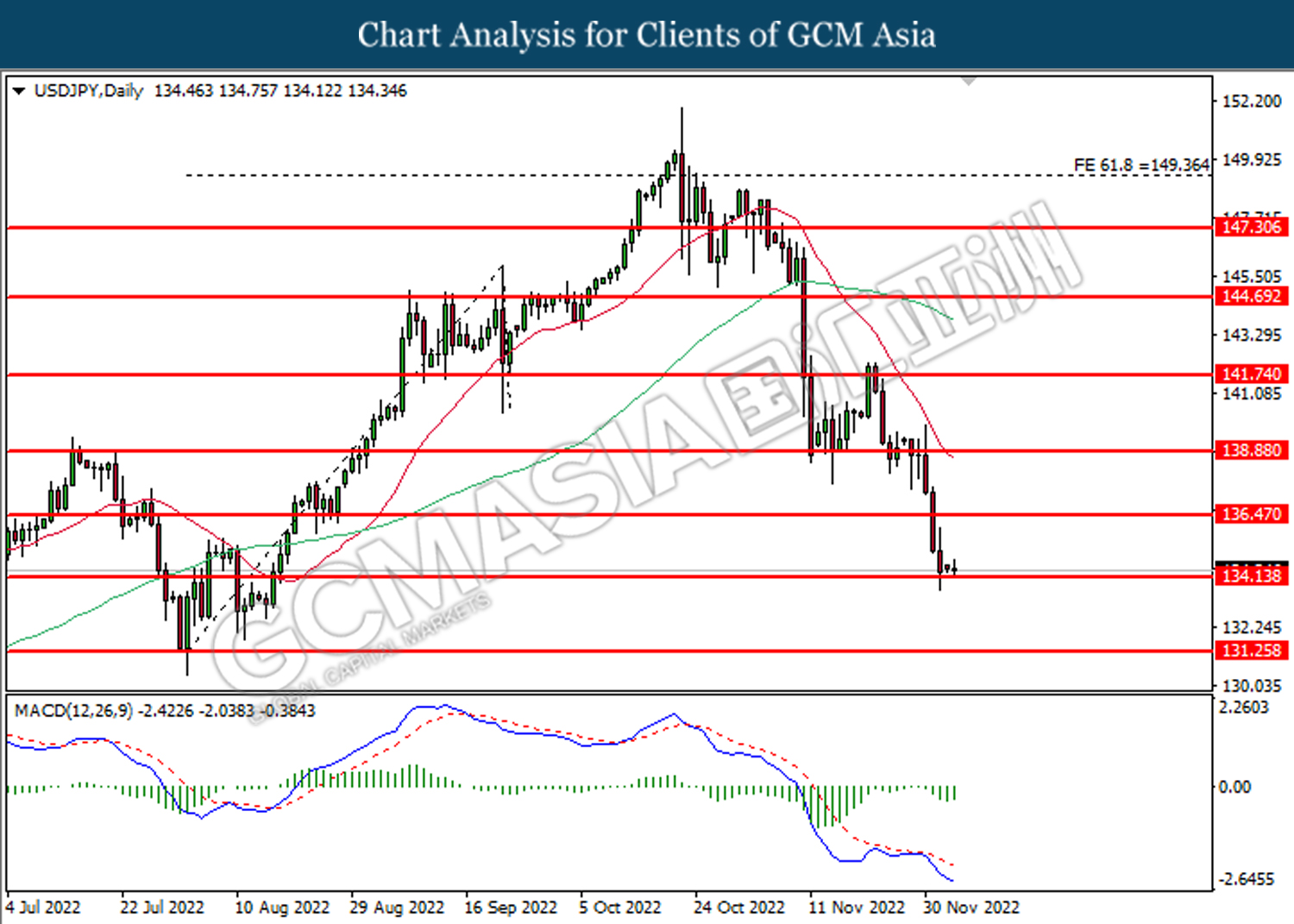

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 134.15. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 136.45, 138.90

Support level: 134.15, 131.25

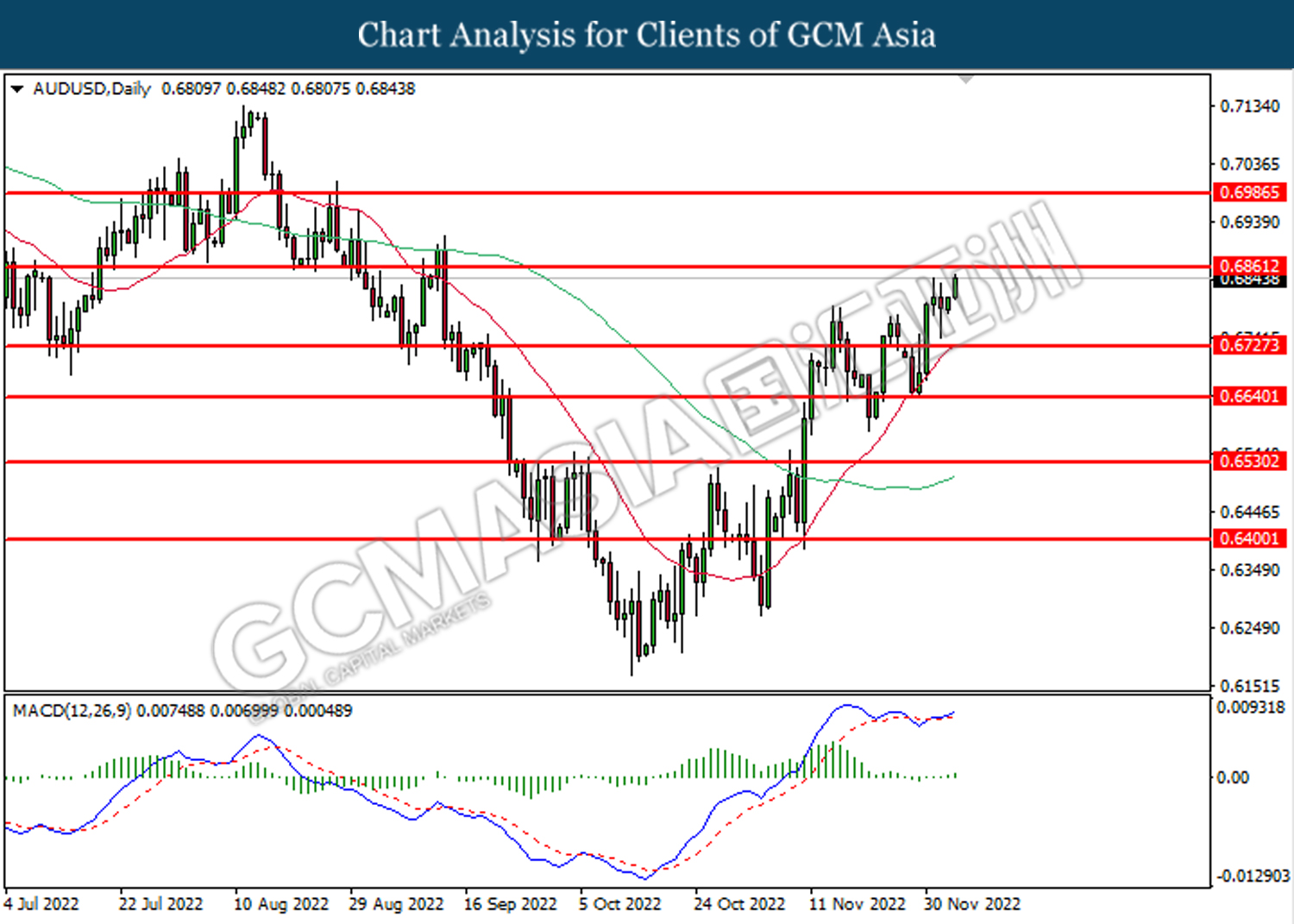

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6725. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

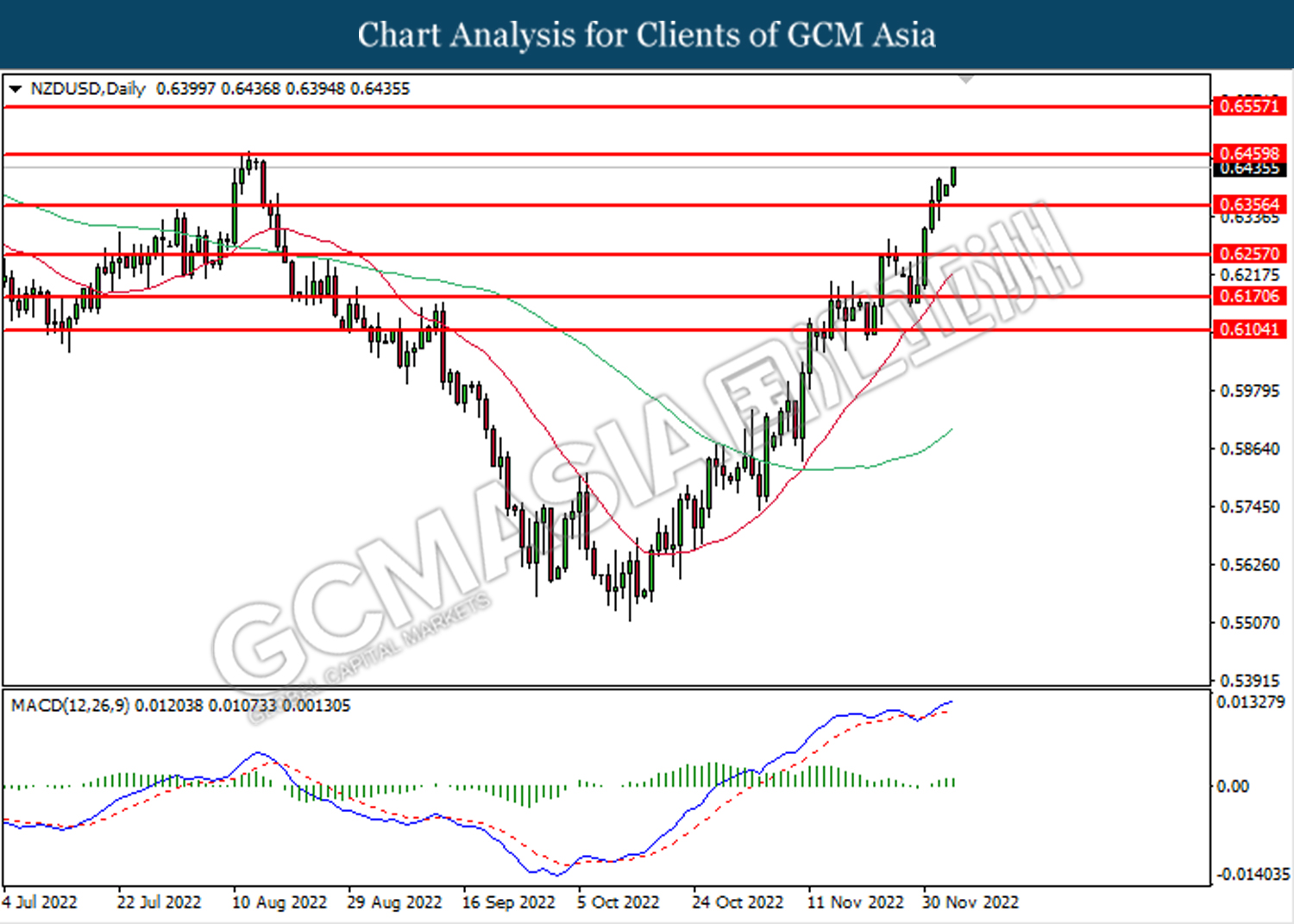

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6355. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6460.

Resistance level: 0.6460, 0.6555

Support level: 0.6355, 0.6255

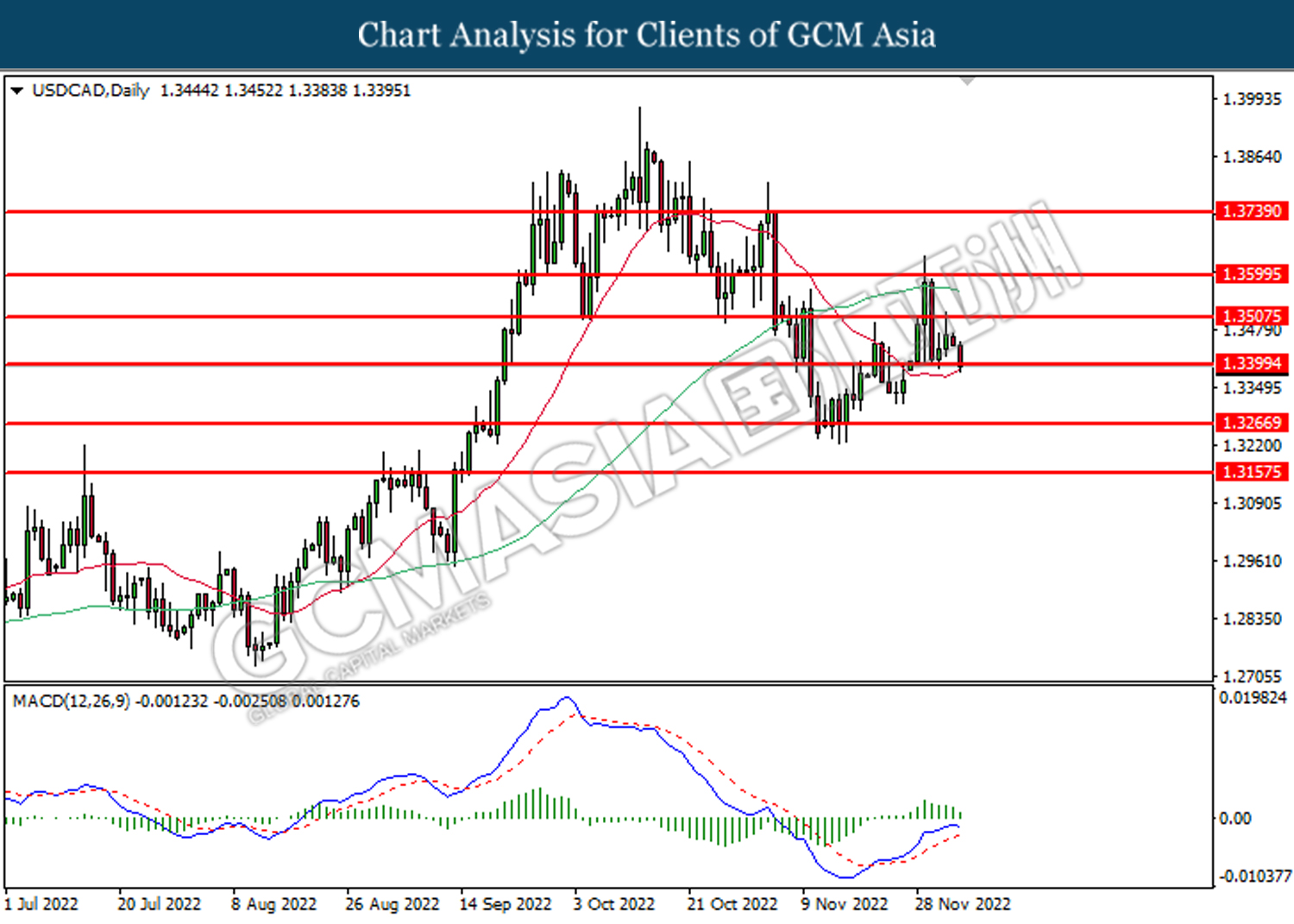

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3400. MACD which illustrated diminishing bullish momentum suggests the pair to extend it losses after it successfully breakout below the support level.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

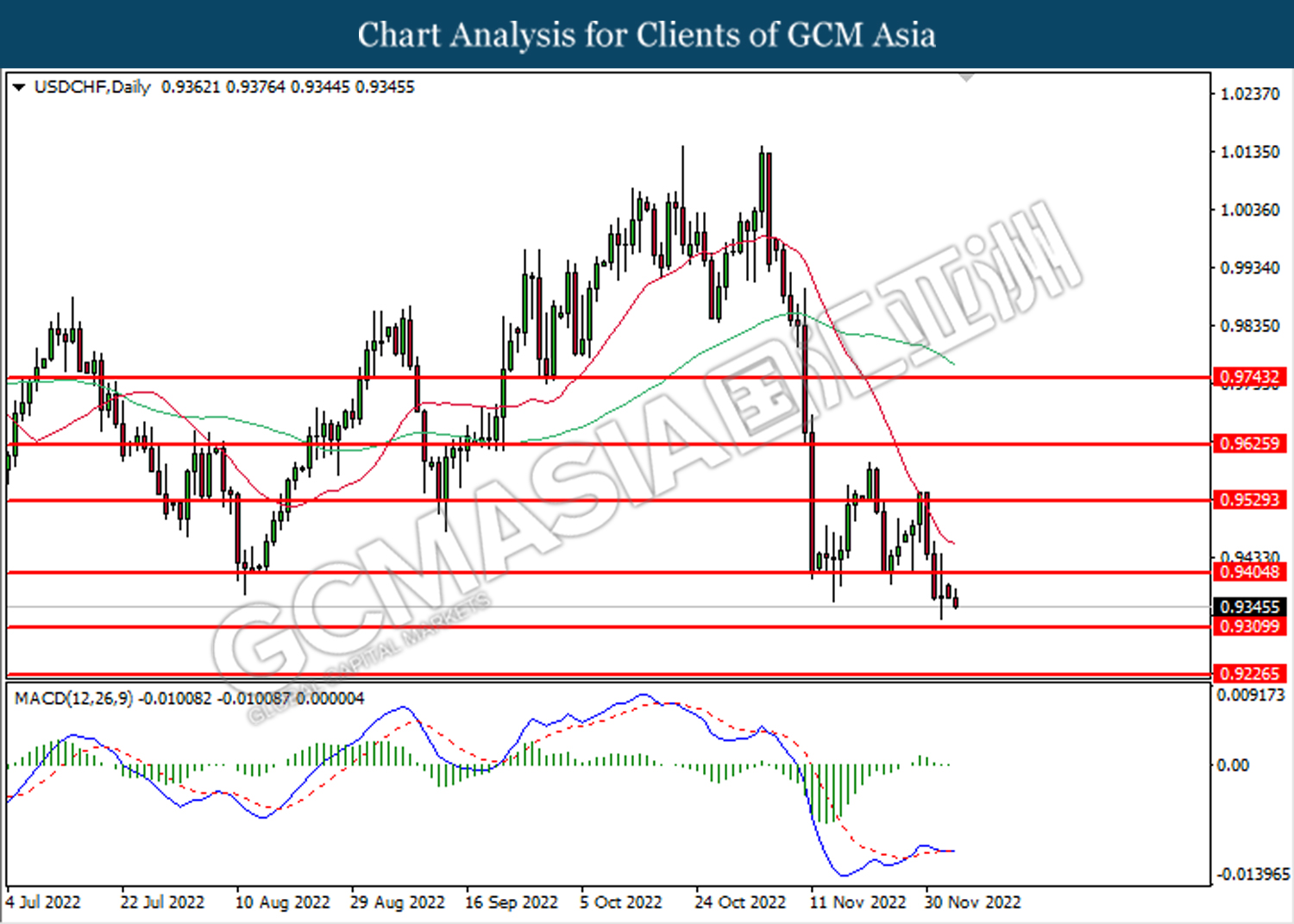

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9405. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9310.

Resistance level: 0.9405, 0.9530

Support level: 0.9310, 0.9225

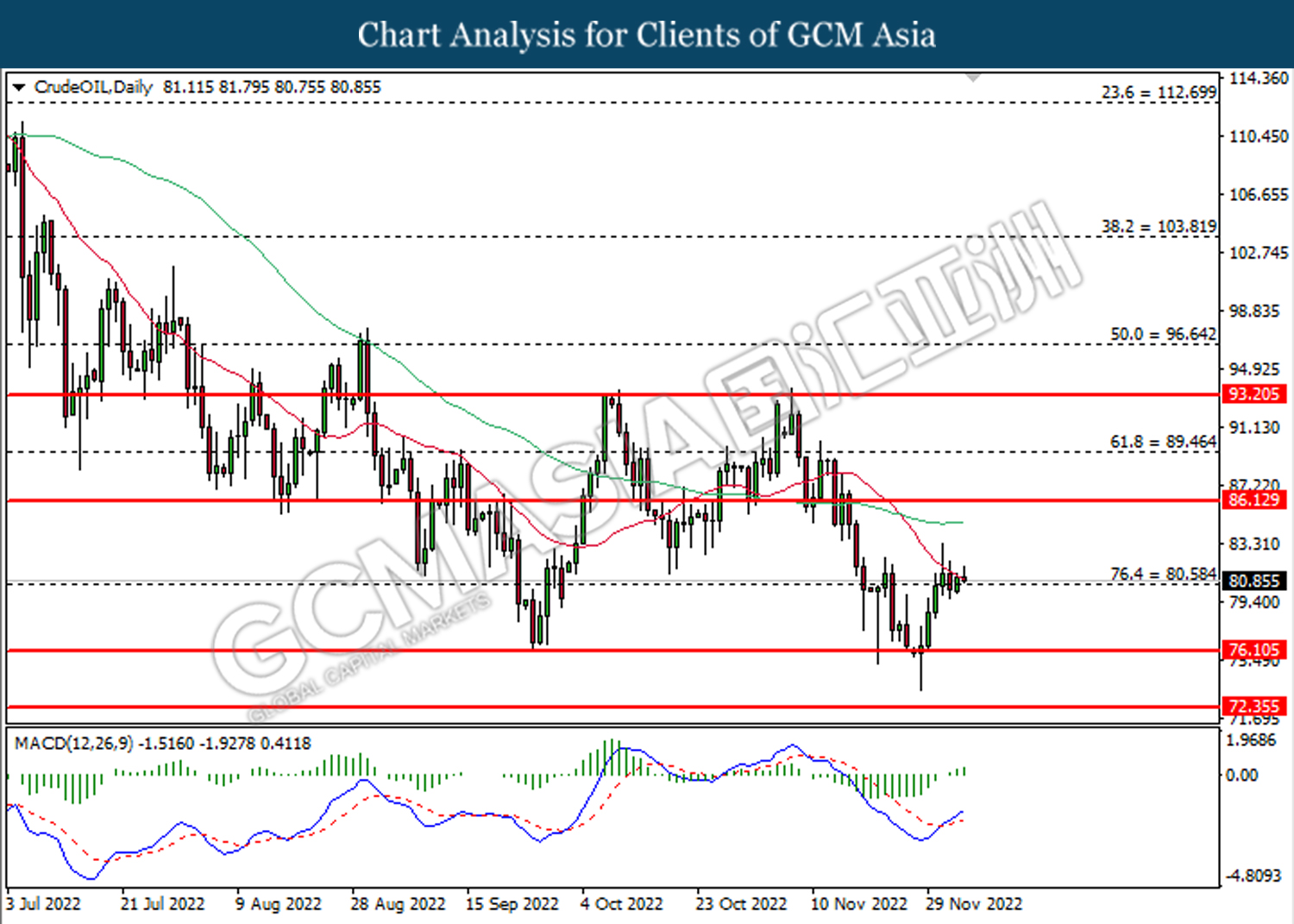

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 80.60. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 86.15.

Resistance level: 86.15, 89.45

Support level: 80.60, 76.10

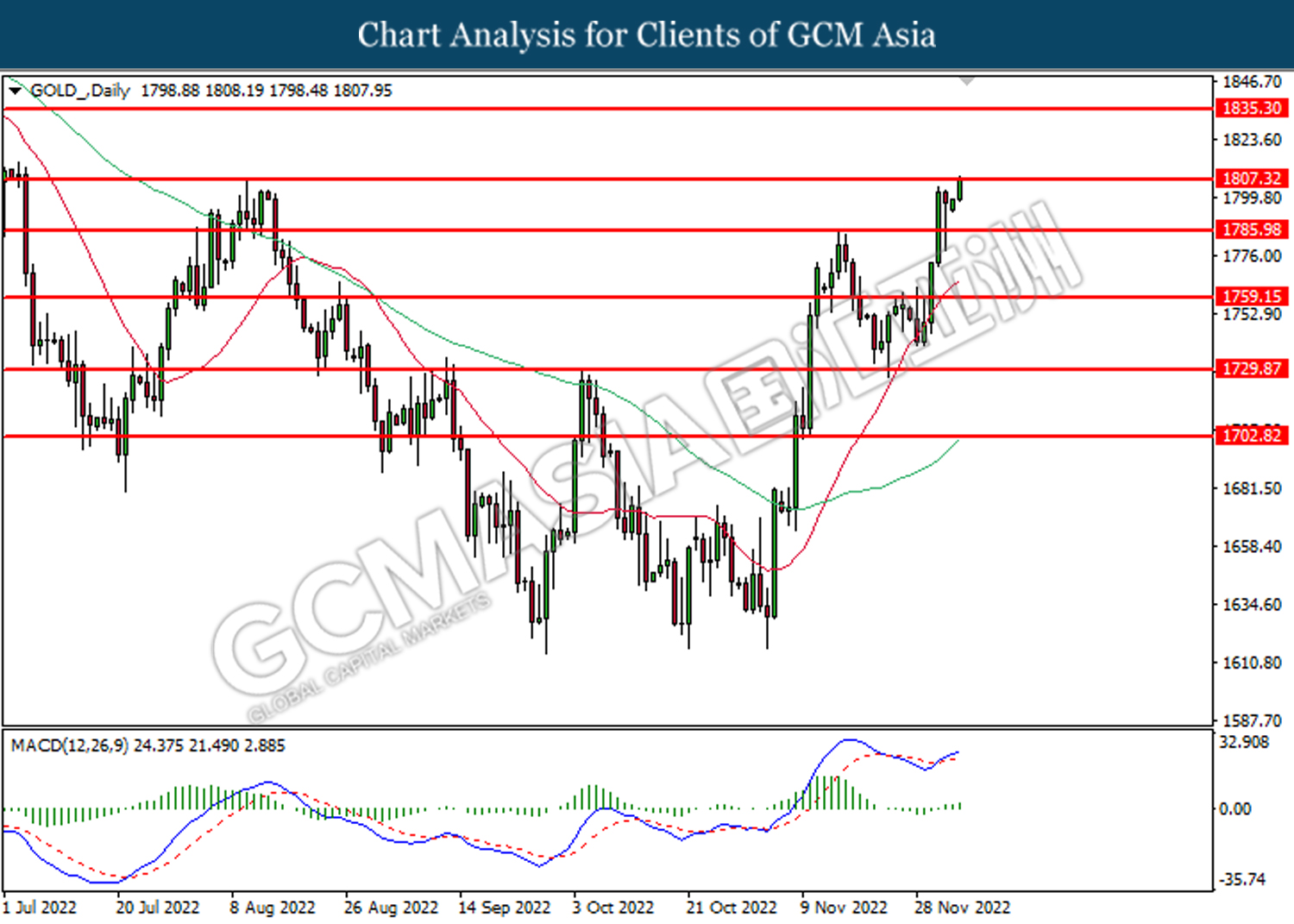

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1807.30. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1807.30, 1835.30

Support level: 1786.00, 1759.15