12 July 2023 Afternoon Session Analysis

The Kiwi edged up despite the central bank maintains its rate.

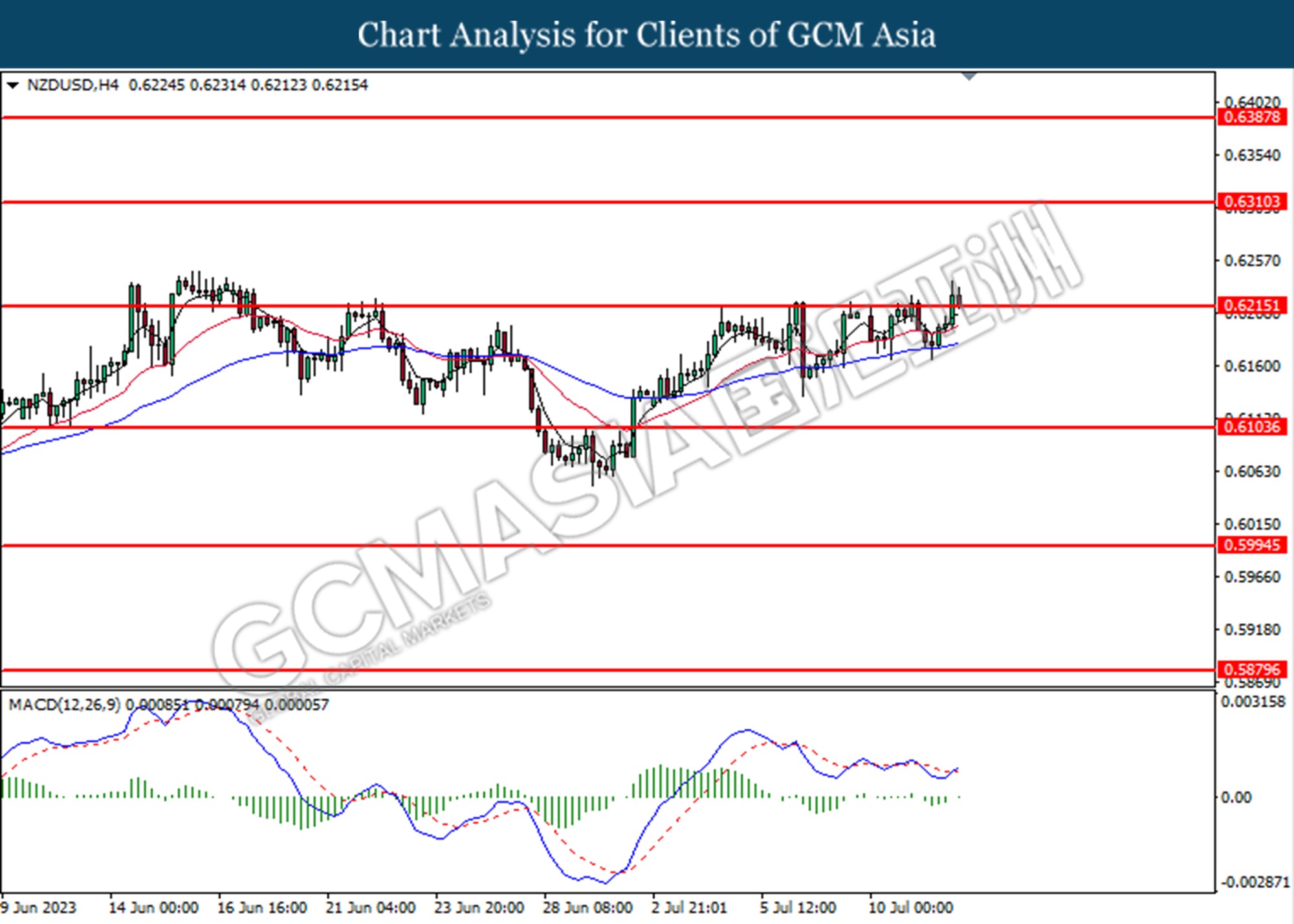

The New Zealand dollar (Kiwi dollar) which traded against the dollar index, fell before the Reserve Bank of New Zealand (RBNZ) monetary policy but rebound afterwards. The RBNZ left the official cash rate remains unchanged at 5.50% and issued a mixed monetary policy statement. The board members noted that monetary conditions had continued to tighten consumer spending and inflationary pressure, as the RBNZ continued a streak of 12 consecutive hikes to curb high inflation pressure in the country. The RBNZ opted not to raise rates and expressed confidence that consumer prices would return to the central bank’s 1% to 3% target However, the pair of NZDUSD quickly reverse its trend after the RBNZ interest rate decision as the core inflation remains high and it might prompt the central bank for a further rate hike. The recent data also continue showed employment remains above its maximum sustainable level, although an easing in labour market conditions. It’s providing room for RBNZ to further tighten. Some economists which included Bloomberg forecast that the RBNZ will resume its tightening moves at the end of the year. As of writing, the NZDUSD edged up by 0.40% to 0.6225.

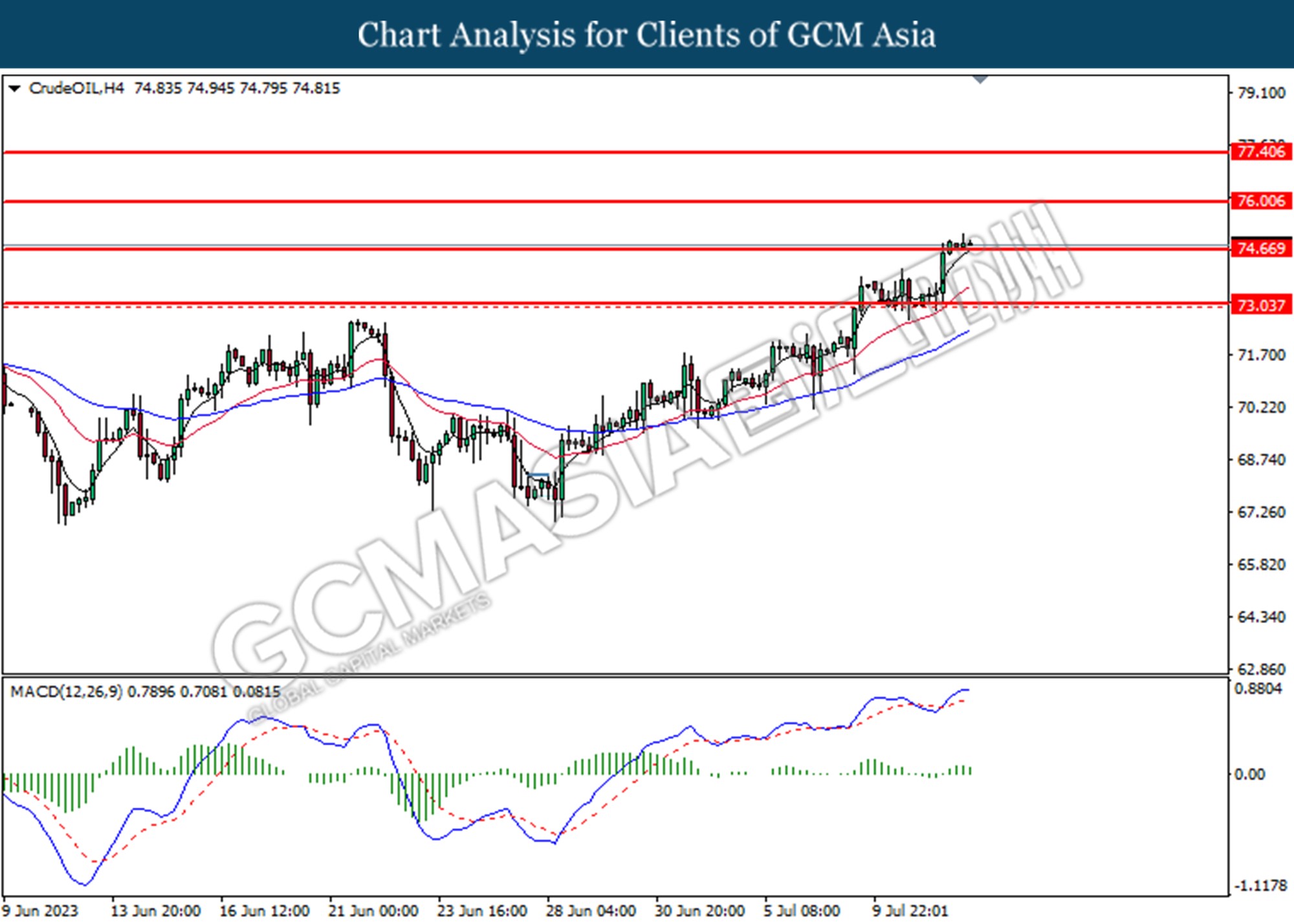

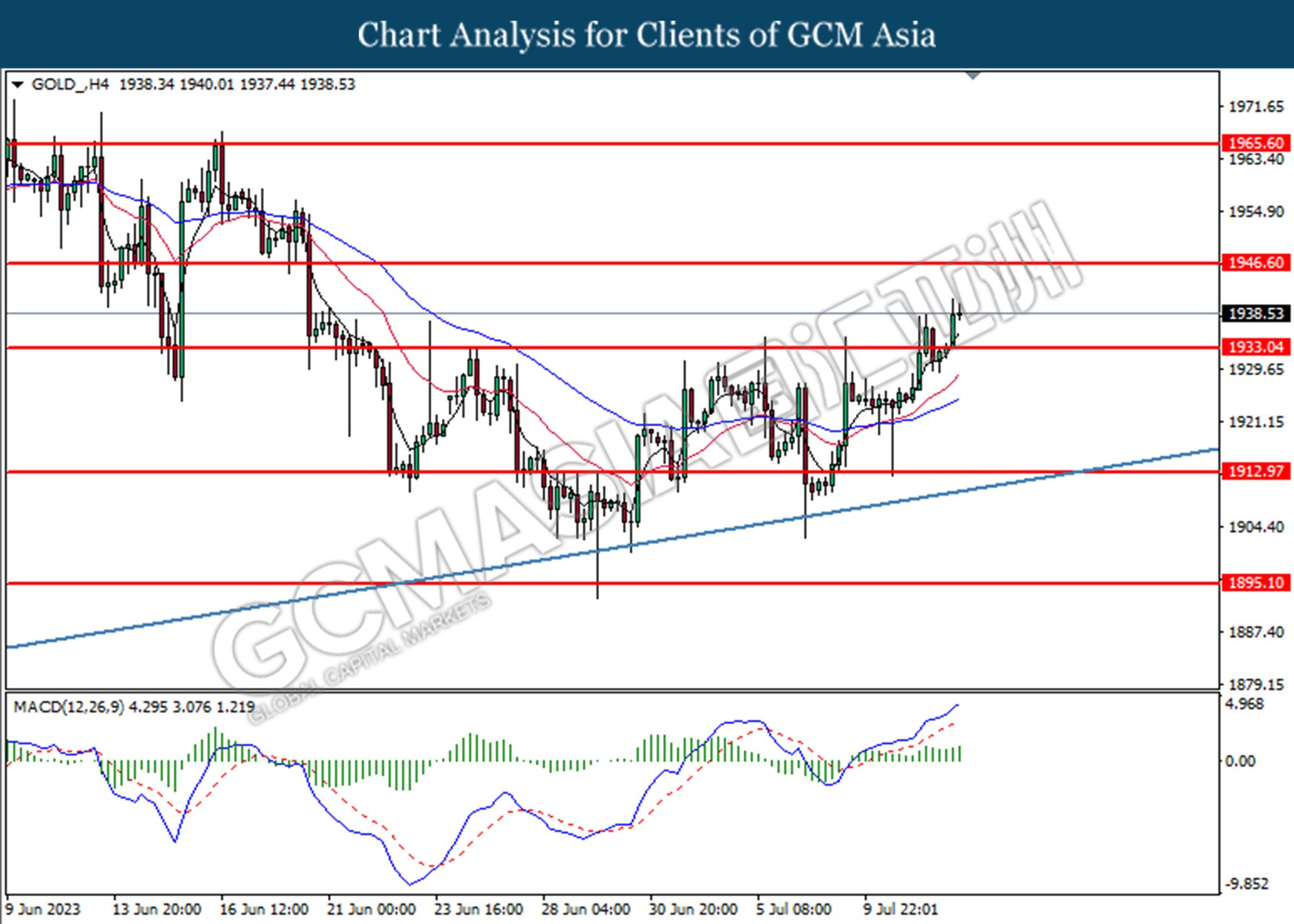

In the commodities market, crude oil prices traded up by 0.17% to $74.96 per barrel after Russia’s July 4 weeks average crude oil sea export dropped by 205K bpd to 3.21 million bpd below its Feb reading of 3.38 million bpd. On the other hand, the price of gold rose by 0.34% to 1938.70 as investors fear ease ahead of the CPI report.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:45 USD FOMC Member Kashkari Speaks

22:00 CAD BoC Rate Statement

02:00 USD Beige Book

(13th)

04:00 USD FOMC Member Mester Speaks

(13th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core CPI (MoM) (Jun) | 0.4% | 0.3% | – |

| 20:30 | USD – CPI (YoY) (Jun) | 4.0% | 3.1% | – |

| 22:00 | CAD – BoC Interest Rate Decision | 4.75% | 5.00% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -1.508M | -2.156M | – |

Technical Analysis

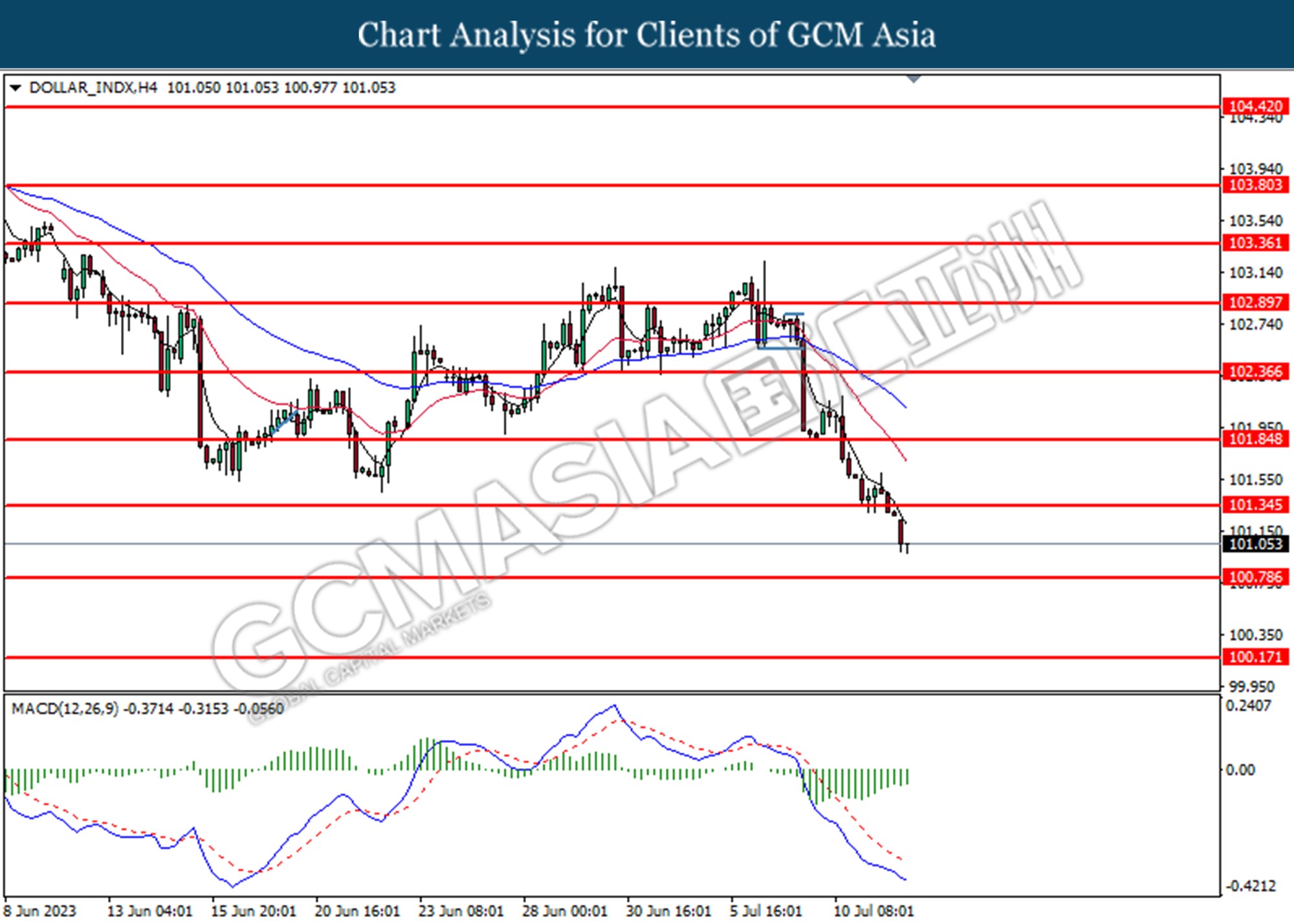

DOLLAR_INDX, H4: Dollar index was traded lower following the prior breaks below for the previous support level at 101.35. However, MACD which illustrated diminishing bearish momentum suggests the index undergoes a technical correction in a short term.

Resistance level: 101.35, 101.85

Support level: 100.80, 100.20

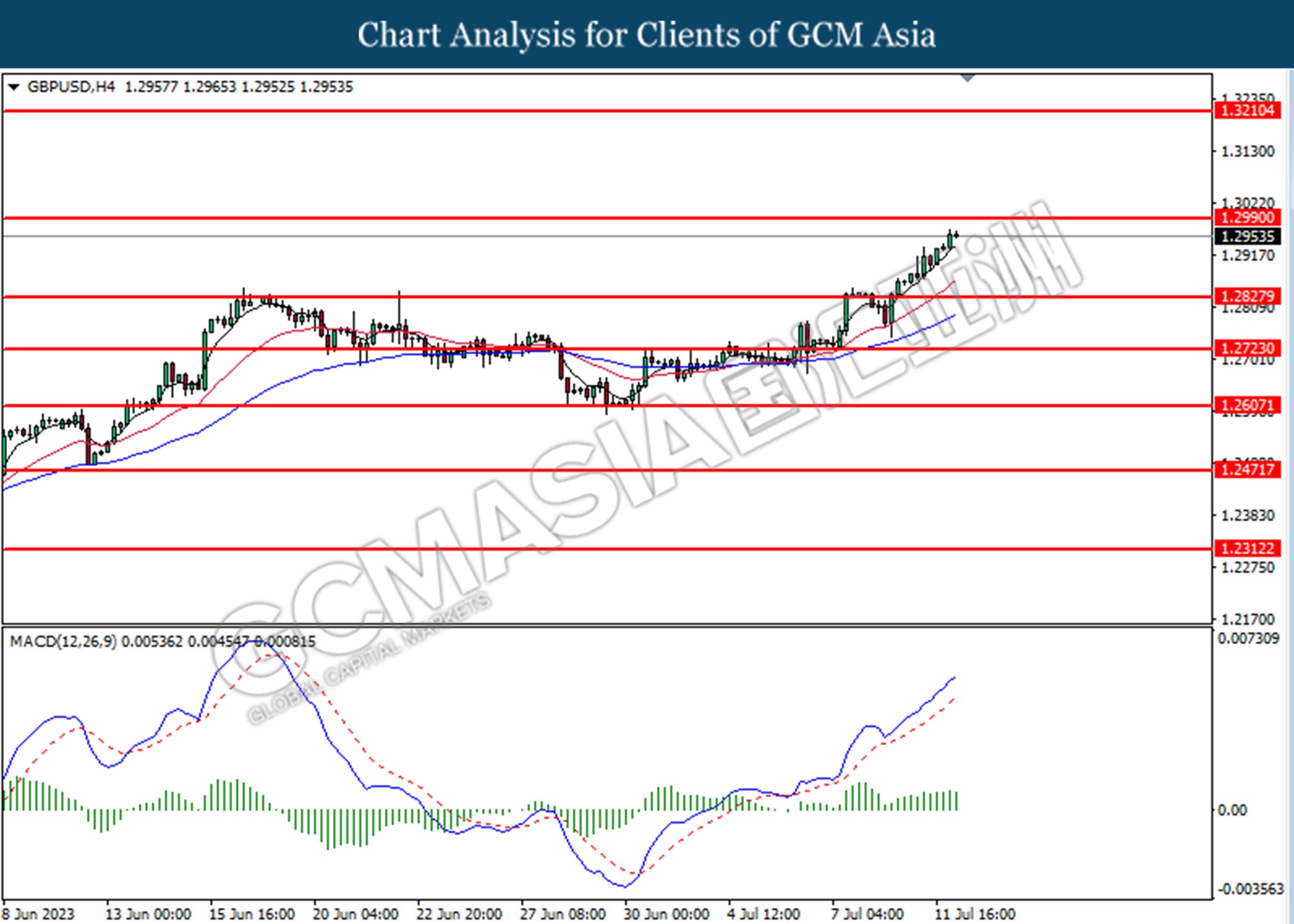

GBPUSD, H4: GBPUSD was traded higher following the prior breaks above the previous resistance level at 1.2830. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level at 1.2990.

Resistance level: 1.2830, 1.2990

Support level: 1.2730, 1.2610

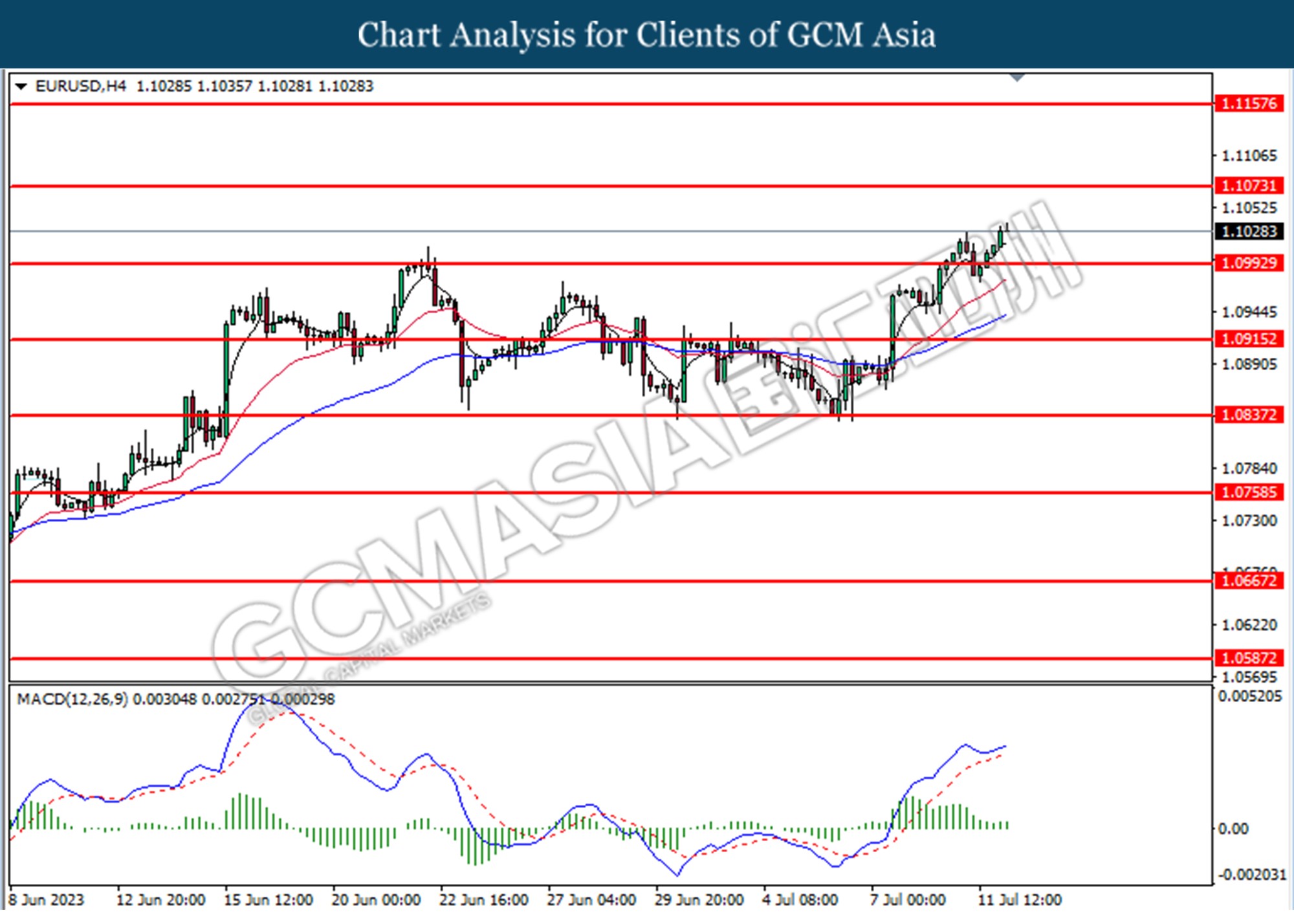

EURUSD, H4: GBPUSD was traded higher following the prior breaks above the previous resistance level at 1.0990. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.1075, 1.1160

Support level: 1.0990, 1.0915

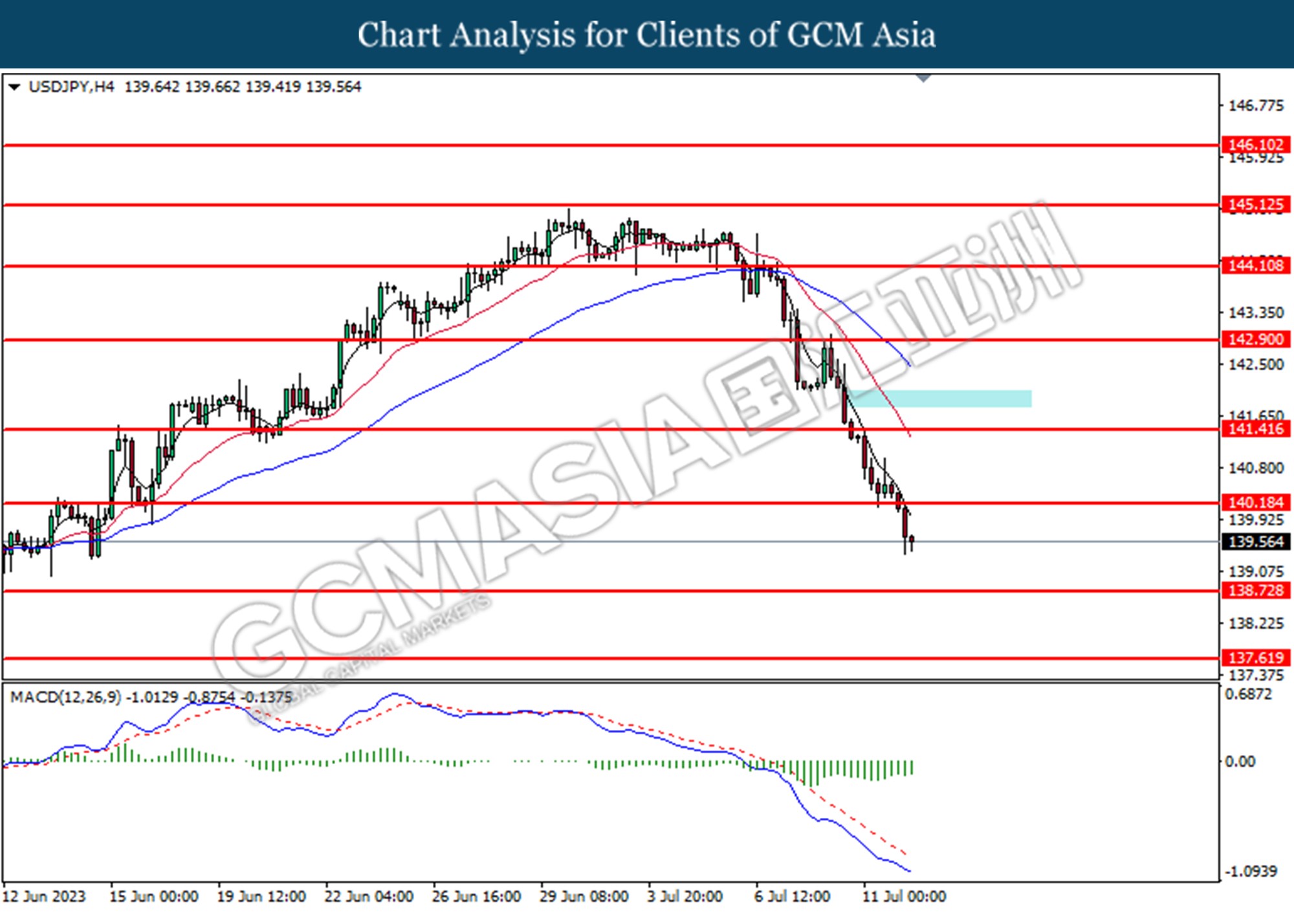

USDJPY, H4: USDJPY was traded lower following the prior breaks below the previous support level at 140.20. MACD which illustrated bearish momentum suggests the pair extended its losses towards the support level at 138.70

Resistance level: 140.20, 141.40

Support level: 138.70, 137.60

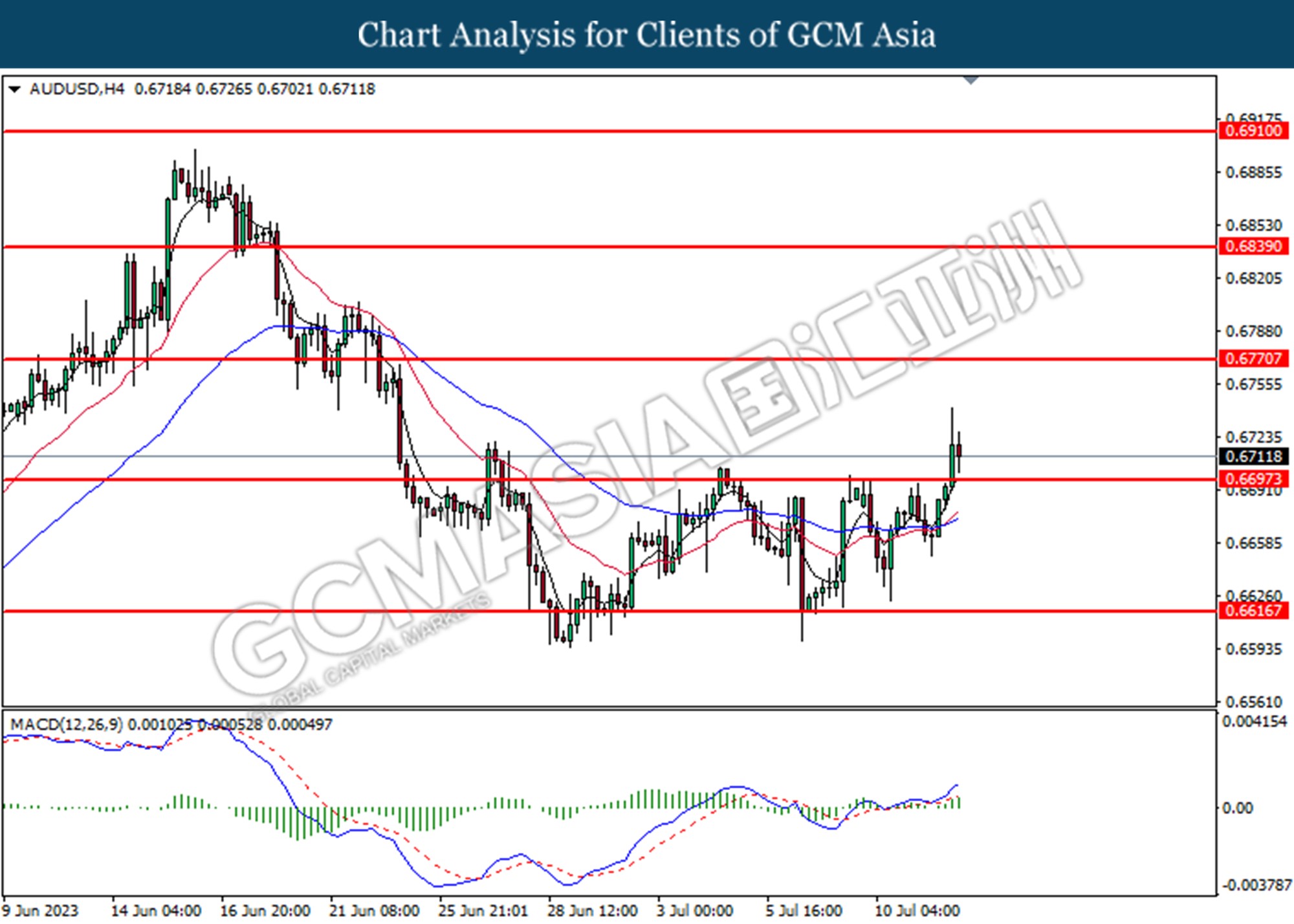

AUDUSD, H4: AUDUSD was traded higher following the prior breaks above the prior resistance level at 0.6700. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.6770, 0.6840

Support level: 0.6700, 0.6615

NZDUSD, H4: NZDUSD was traded lower while currently testing for the support level at 0.6215. However, MACD which illustrated increasing bullish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 0.6310, 0.6390

Support level: 0.6215, 0.6105

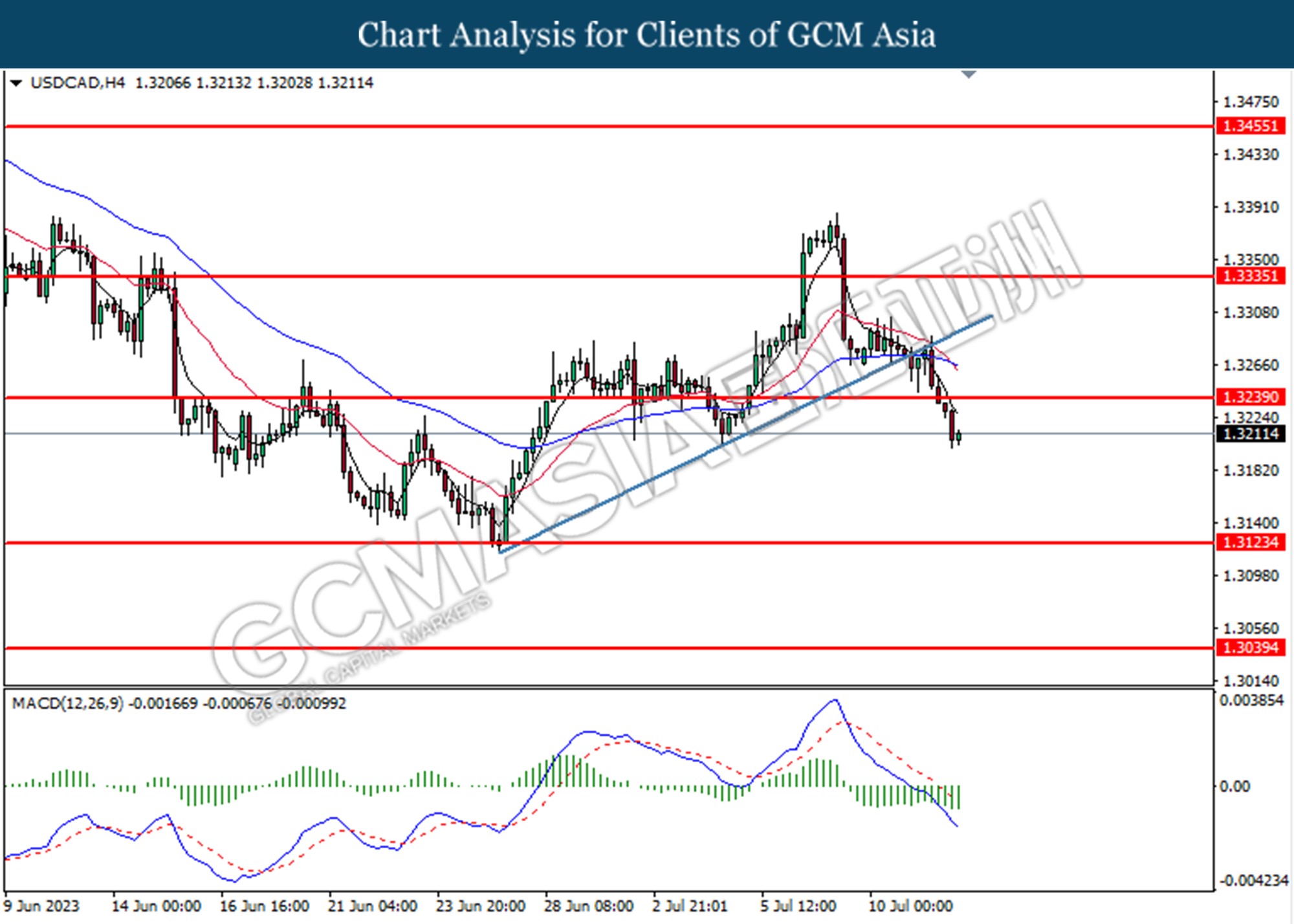

USDCAD, H4: USDCAD was traded lower following the prior breaks below the previous support level at 1.3240. MACD which illustrated bearish momentum suggests the pair extended its losses towards the support level.

Resistance level: 1.3240, 1.3335

Support level: 1.3140, 1.3040

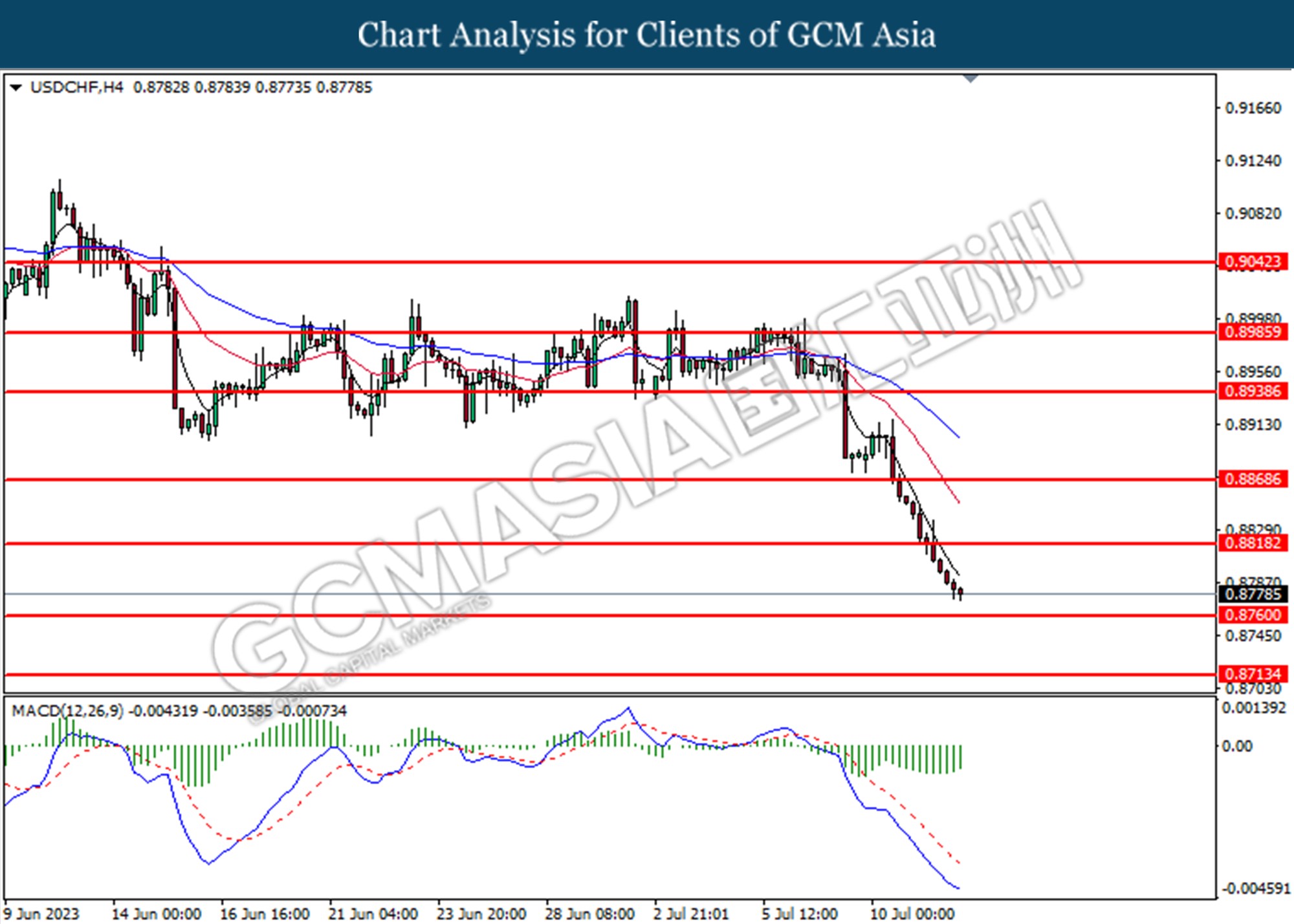

USDCHF, H4: USDCHF was traded lower following the prior breaks below from the previous support level at 0.8820. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 0.8820, 0.8870

Support level: 0.8760, 0.8715

CrudeOIL, H4: Crude oil price was traded higher following the prior breakout above the previous support level at 74.65. However, MACD which illustrated diminishing bullish momentum suggests the commodity undergoes a technical correction in a short term.

Resistance level: 76.00, 77.40

Support level: 74.65, 73.15

GOLD_, H4: Gold price was traded higher following the prior breaks above the previous resistance level at 1933.05. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains toward the resistance level at 1946.60.

Resistance level: 1946.60, 1965.60

Support level: 1933.05, 1913.00