12 July 2023 Morning Session Analysis

US dollar lost its ground as Fed closed to the end of its tightening cycle.

The dollar index, which was traded against a basket of six major currencies, regained its luster unsuccessfully in the previous trading session as the sentiment remained weak in the dollar market. Prior to this, Federal Reserve officials have indicated that the United States central bank is nearing the end of its tightening cycle. These remarks had an impact on the value of the U.S. dollar, which urged it to drop to a two-month low of 101.66 against a basket of currencies. With that, investors adjusted their expectations regarding the extent to which U.S. rates might need to increase. On the other hand, the latest Nonfarm Payrolls (NFP) report, which was released on Friday, revealed potential weaknesses in the U.S. labour market for the first time since the COVID-19 pandemic. This development suggests that the Federal Reserve might only implement one more time of rate hike before it turns the table over. Also, investors are now putting all their attention on the upcoming CPI data as it can provide greater clarity on the Federal Reserve’s progress in addressing persistent high inflation. Forecasts indicate that U.S. consumer prices likely rose by 3.1% in June. As of writing, the US dollar dropped -0.30% to 101.67.

In the commodities market, crude oil prices edged up by 0.01% to $74.75 per barrel on a weaker US dollar and growing expectations of more stimulus plans in China. Besides, gold prices ticked up 0.07% to $1933.40 per troy ounce on a dollar stumble.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:45 USD FOMC Member Kashkari Speaks

22:00 CAD BoC Rate Statement

02:00 USD Beige Book

(13th)

04:00 USD FOMC Member Mester Speaks

(13th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core CPI (MoM) (Jun) | 0.4% | 0.3% | – |

| 20:30 | USD – CPI (YoY) (Jun) | 4.0% | 3.1% | – |

| 22:00 | CAD – BoC Interest Rate Decision | 4.75% | 5.00% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -1.508M | -2.156M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 103.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 100.65.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

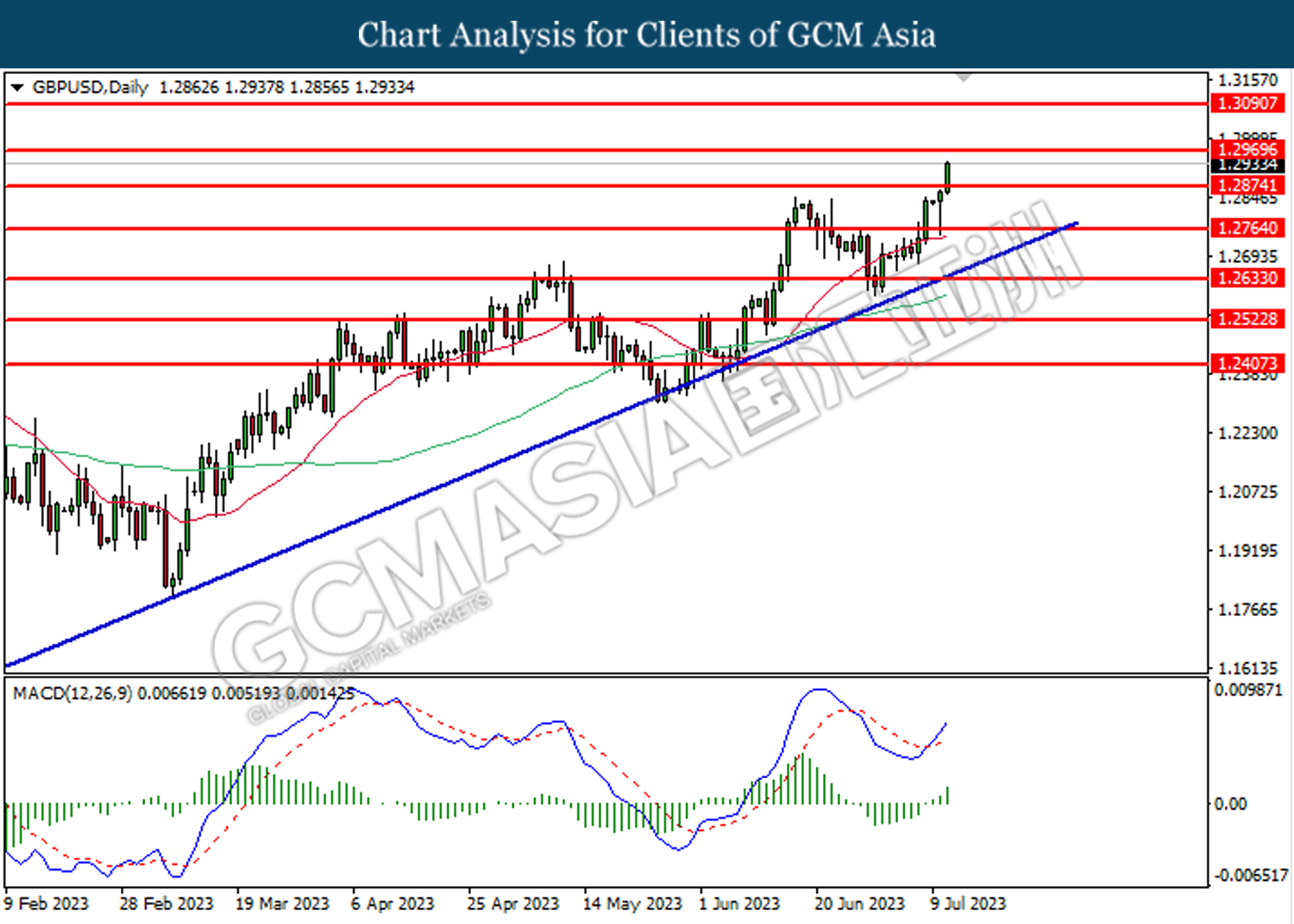

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2875. MACD which illustrated bullish bias momentum suggest the pair to extend its toward the resistance level at 1.2970.

Resistance level: 1.2970, 1.3090

Support level: 1.2875, 1.2765

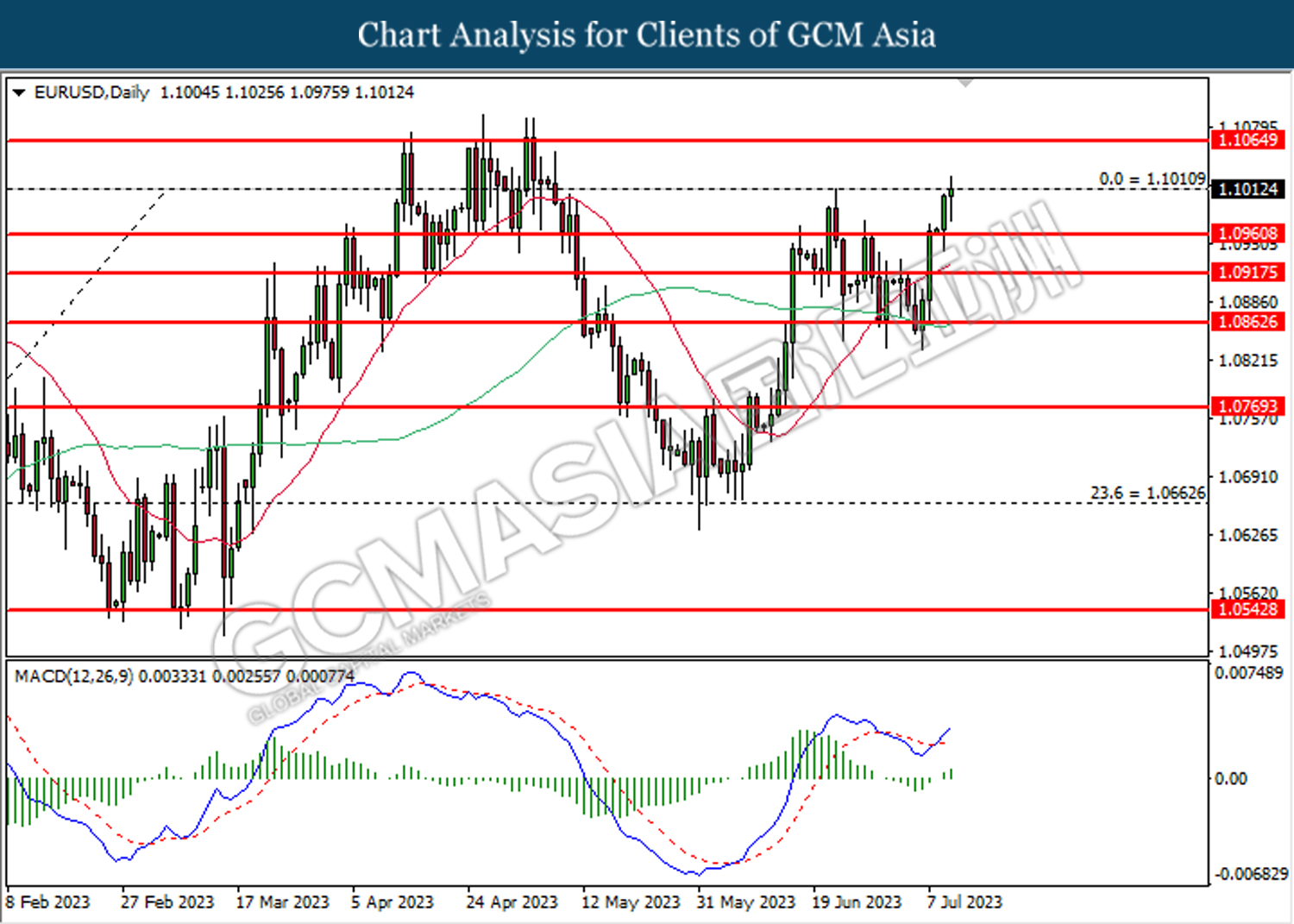

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.1010. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the previous resistance level at 1.1010.

Resistance level: 1.1010, 1.1065

Support level: 1.0915, 1.0865

USDJPY, Daily: USDJPY was traded lower following the prior breakout below the previous support level at 141.60. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 139.00.

Resistance level: 141.60, 143.90

Support level: 139.00, 136.35

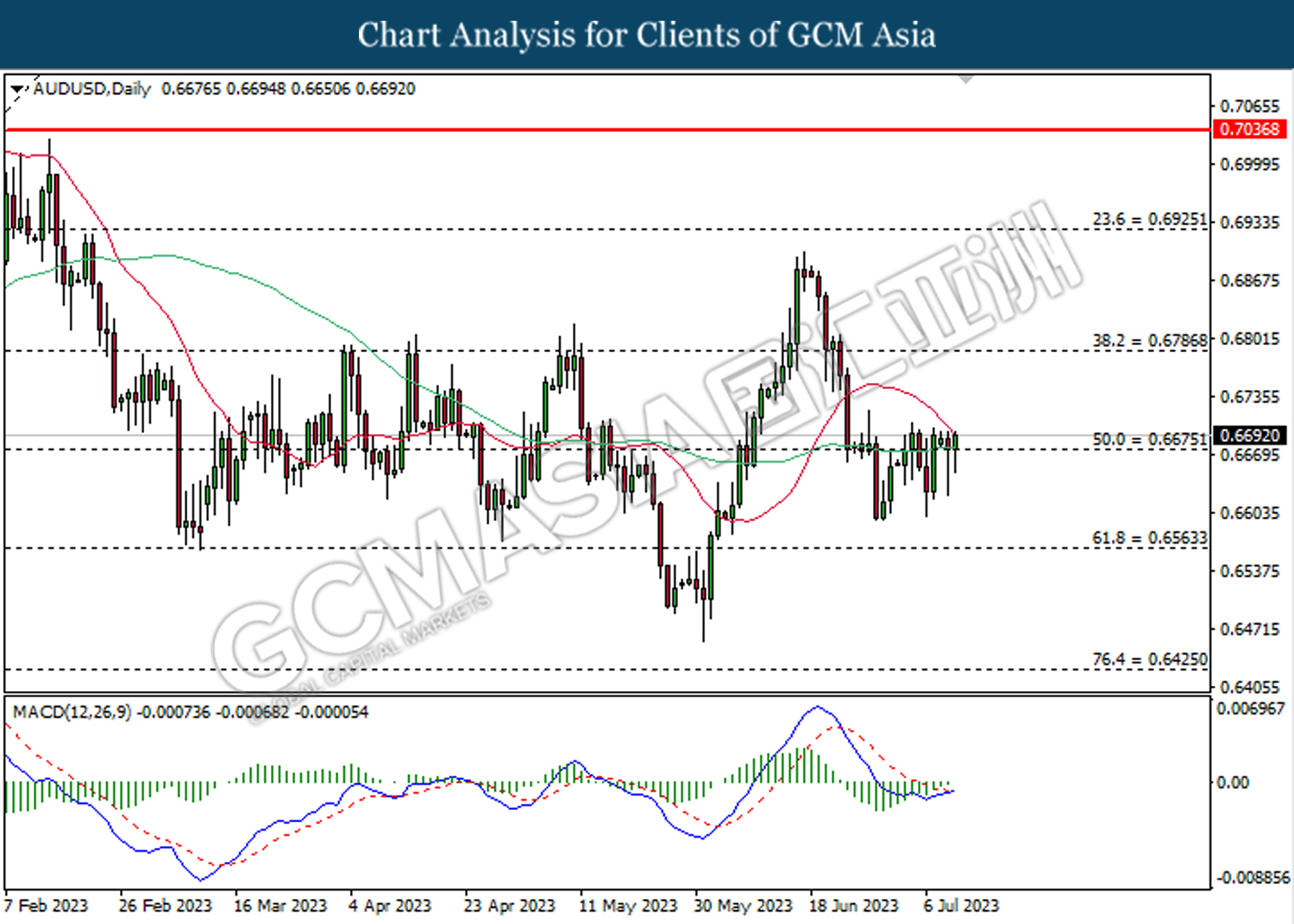

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

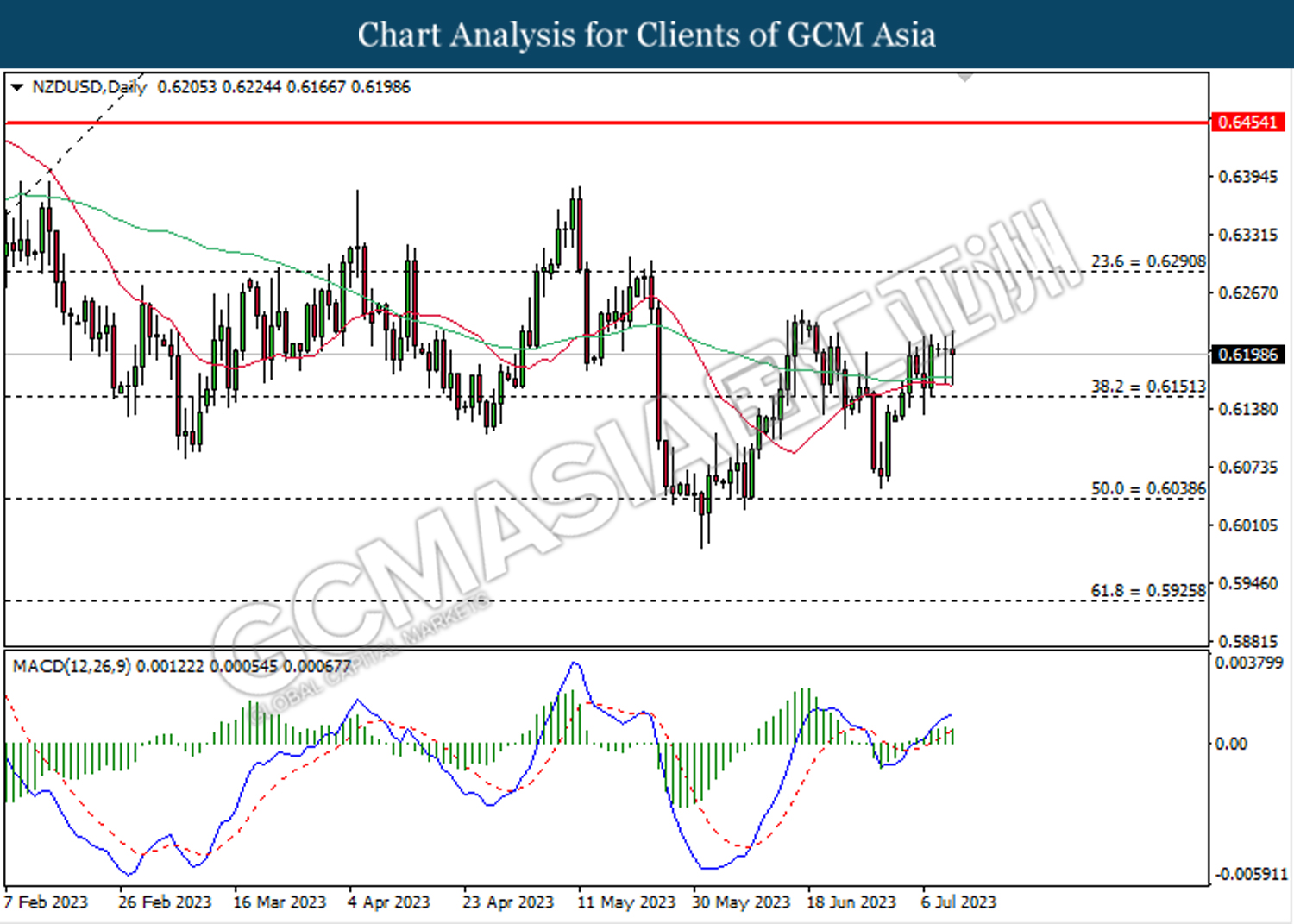

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

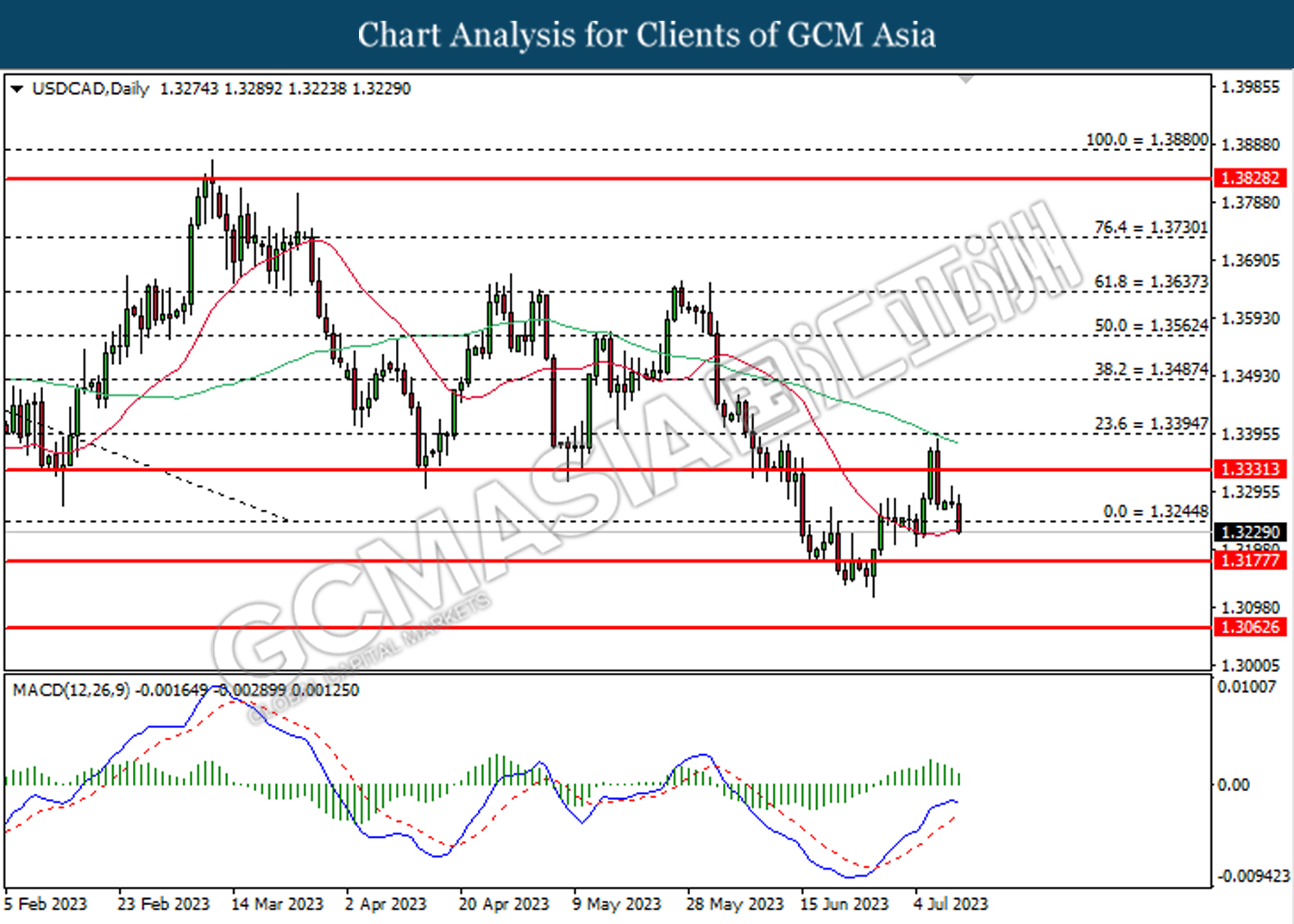

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3245. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3175.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

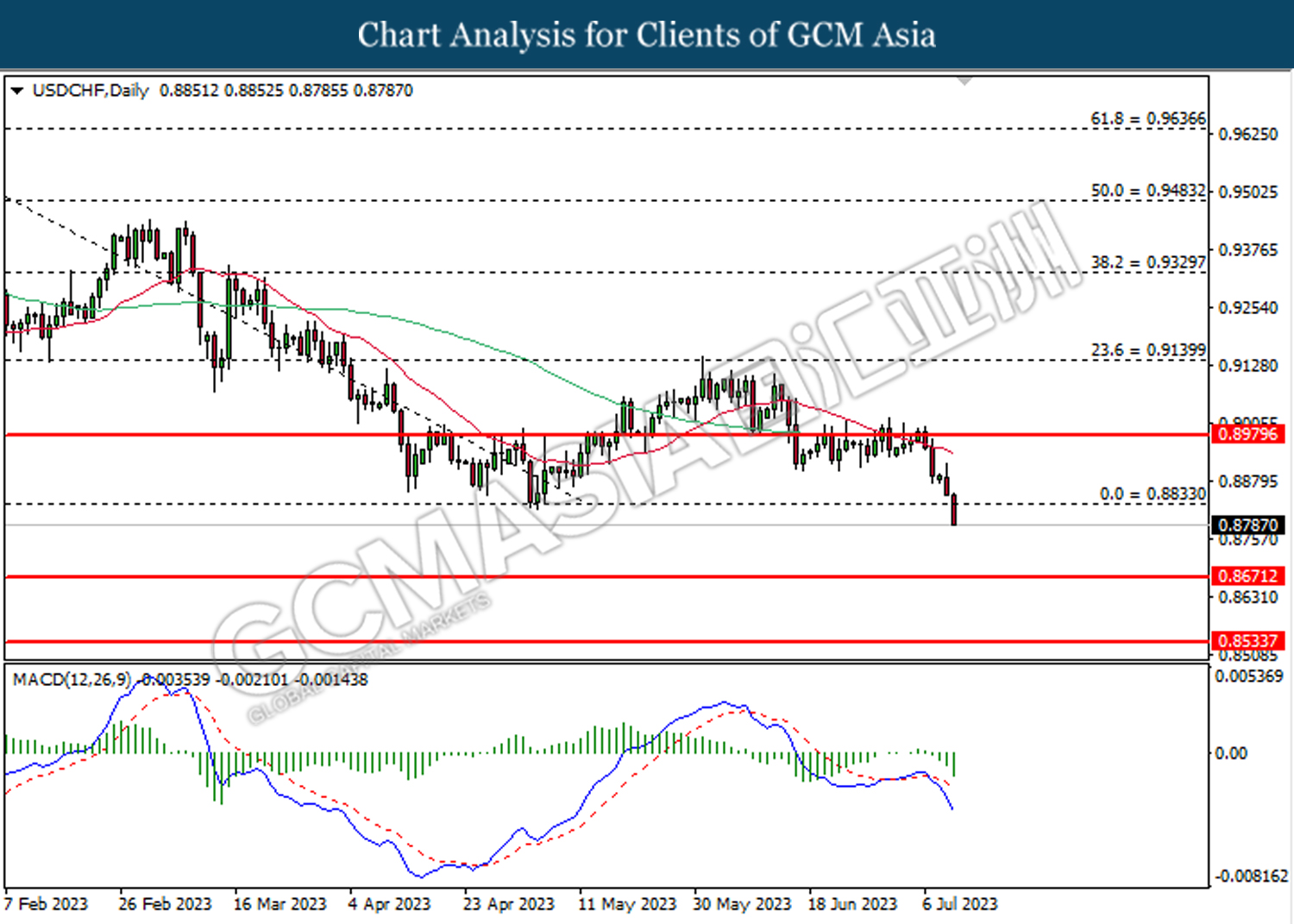

USDCHF, Daily: USDCHF was traded lower following the prior breakout below the previous support level at 0.8835. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.8670.

Resistance level: 0.8835, 0.8980

Support level: 0.8670, 0.8535

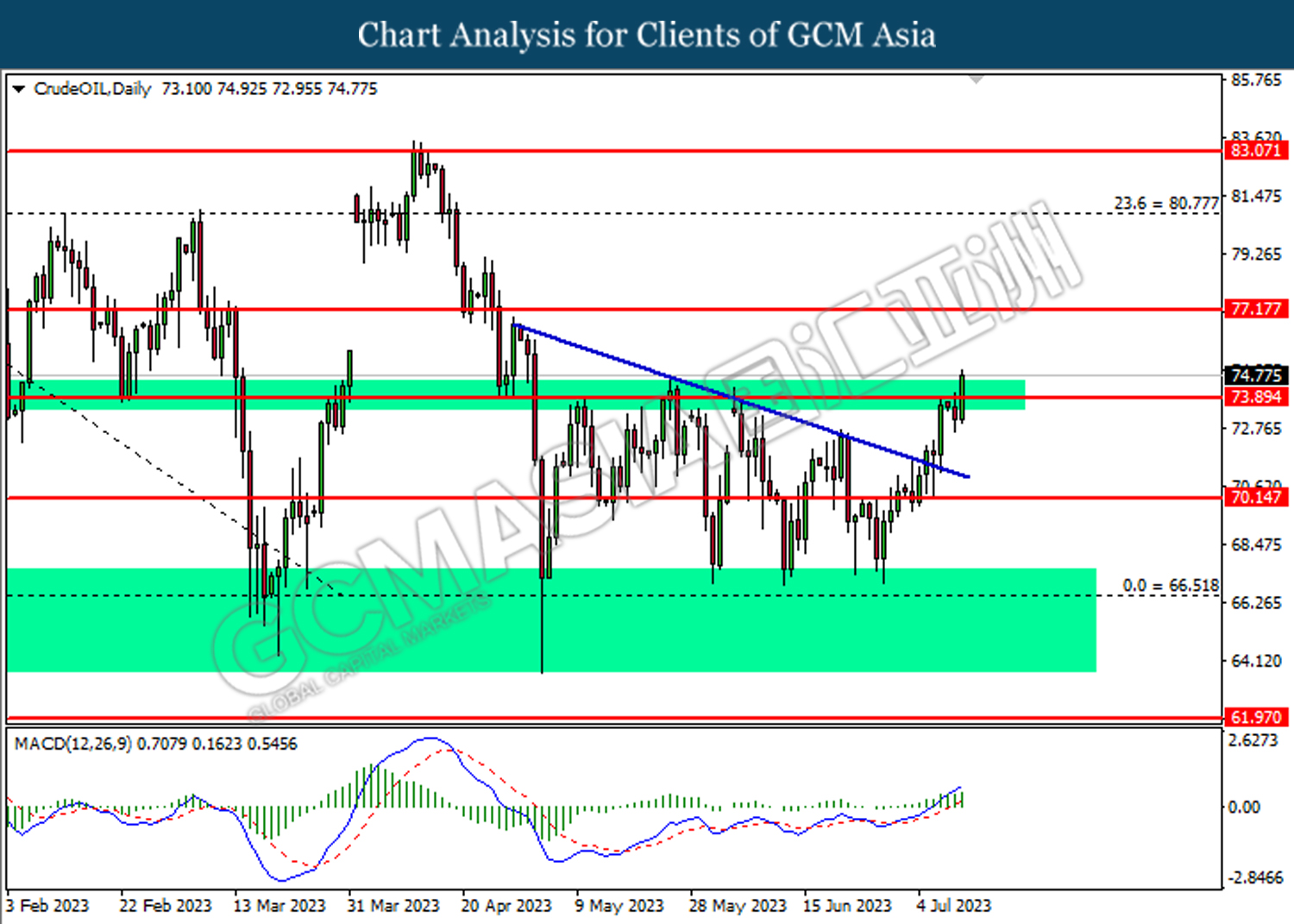

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 73.90. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

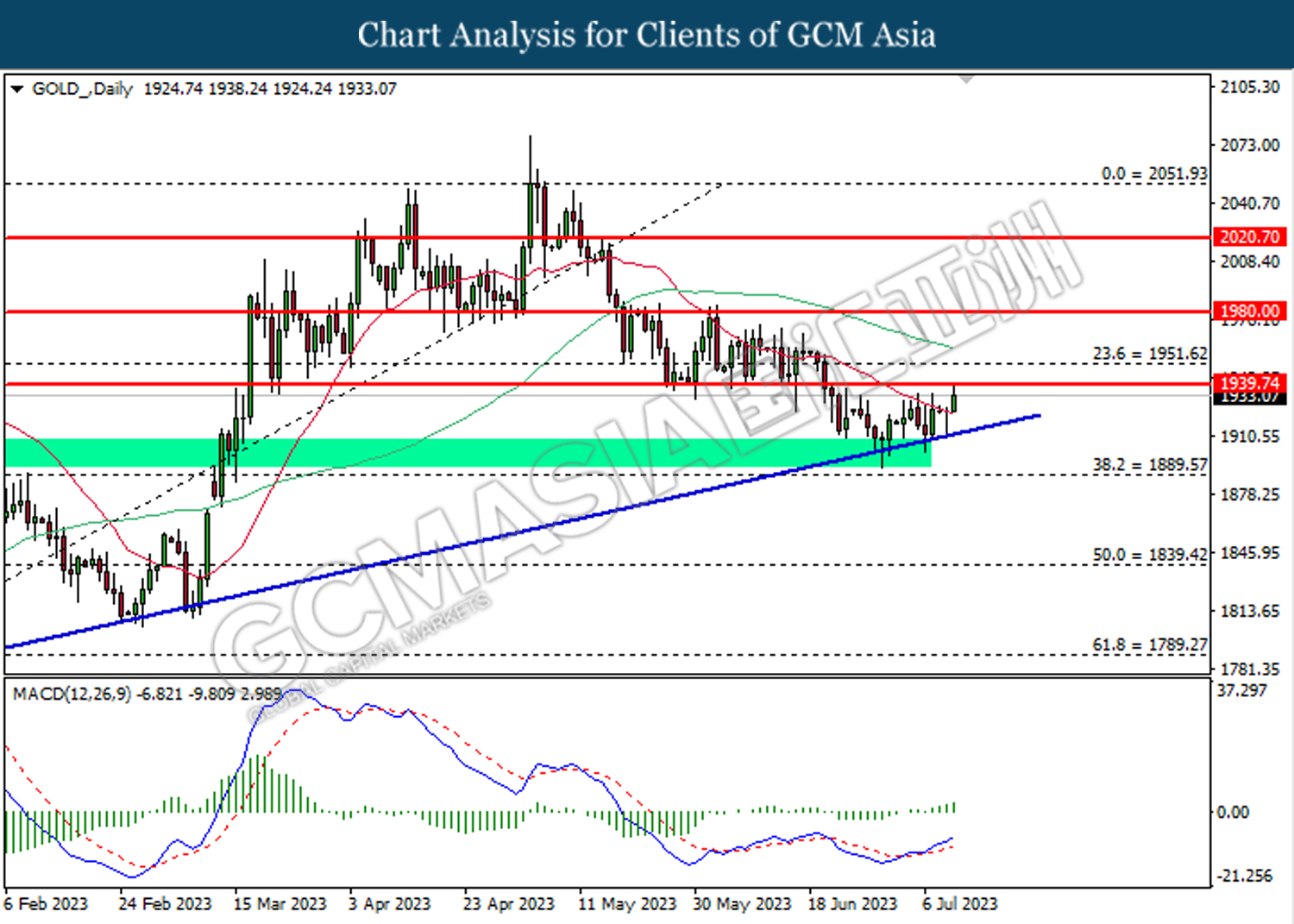

GOLD_, Daily: Gold price was traded higher following the prior rebound from the upward trend line. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1939.75.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40