12 November 2020 Afternoon Session Analysis

Pound fell amid expectation of Brexit talks miss deadline.

During late Asian session, the pound sterling which traded against the dollar and other currency pairs have fell following expectation of the EU and UK is likely to miss next week deadline and to be pushed back even longer. Following latest development, a report reveals that the EU ambassadors will not be updated on the talks at the regular meeting and will be delayed until their meeting on November 18. EU sources stated they now expected negotiators to come up with an agreed text in the middle of next week, unless talks collapse or there is a breakthrough earlier. The situation have signalled that the ongoing stalemate between UK and EU in Brexit agreement and the chance of Brexit deal remains low, thus dragging down the value of pound sterling. At the time of writing, GBP/USD slips 0.08% to 1.3275.

In the commodities market, crude oil price remains steady and edge higher 1.00% to $42.05 per barrel as of writing following rising hopes of OPEC to hold back supply. Algeria’s energy minister recently stated OPEC+ – grouping the Organization of the Petroleum Exporting Countries (OPEC) and other suppliers including Russia – could extend current production cuts of 7.7 million barrels per day (bpd) into 2021, or deepen them further if needed. On the other hand, gold price remains weak and edge lower 0.06% to $1868.95 a troy ounce at the time of writing following dollar strength.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP(QoQ)(Q3) | -19.8% | 15.8% | – |

| 15:00 | GBP – Manufacturing Production (MoM)(Sep) | 0.7% | 1.0% | – |

| 21:30 | USD – Core CPI (MoM)(Oct) | 0.2% | 0.2% | – |

| 21:30 | USD – Initial Jobless Claims | 751K | 735K | – |

| 00:00

(13th) |

CrudeOIL – Crude Oil Inventories | -7.998M | -0.913M | – |

Technical Analysis

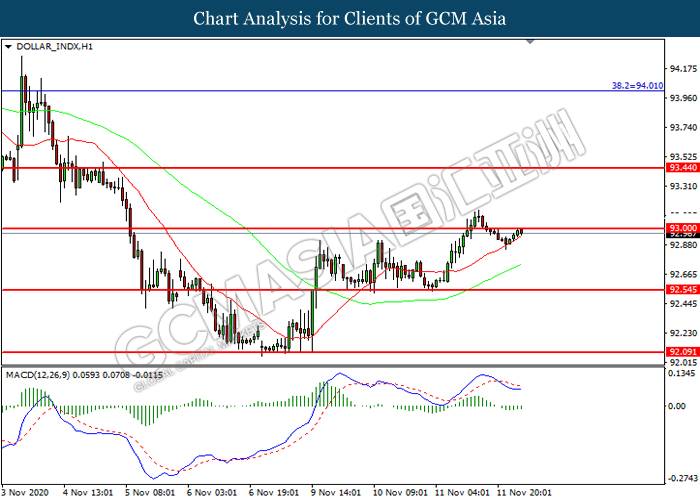

DOLLAR_INDX, H1: Dollar index was traded higher while currently testing the resistance level at 93.00. However, MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 93.00, 93.45

Support level: 92.55, 92.10

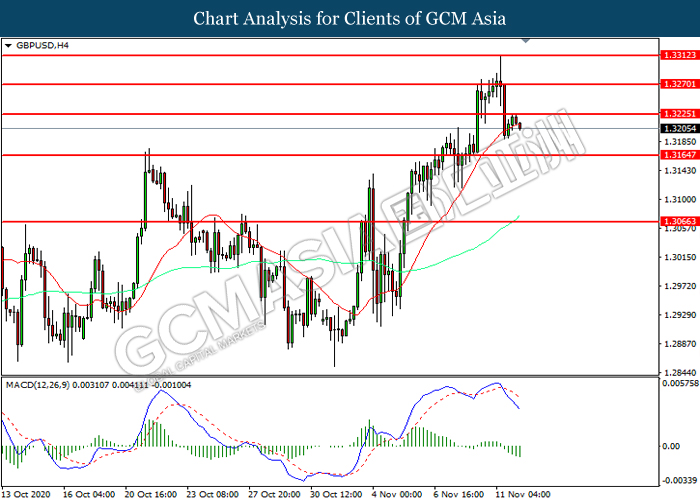

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.3225. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3165.

Resistance level: 1.3225, 1.3270

Support level: 1.3165, 1.3065

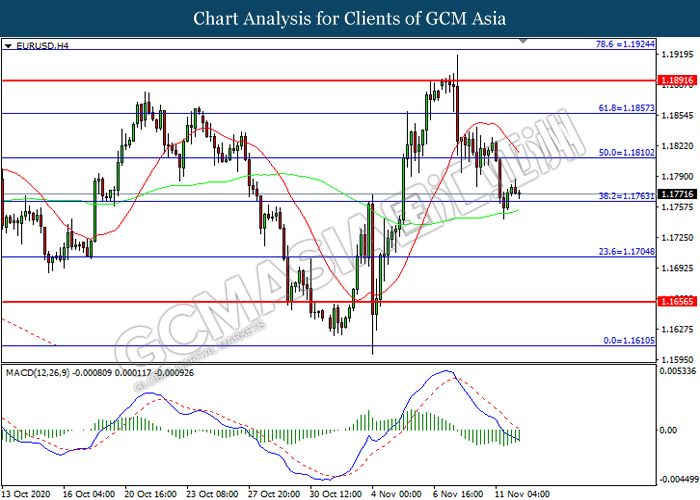

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.1765. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.1810.

Resistance level: 1.1810, 1.1855

Support level: 1.1765, 1.1705

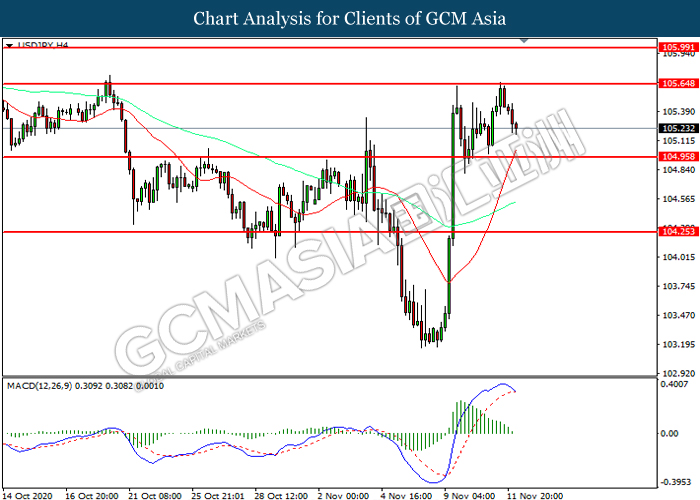

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 105.65. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 104.95.

Resistance level: 105.65, 106.00

Support level: 104.95, 104.25

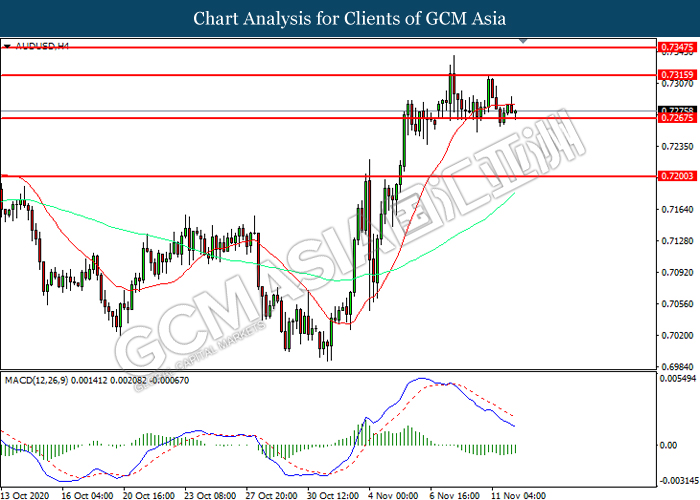

AUDUSD, H1: AUDUSD was traded lower while currently testing the support level at 0.7265. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.7315, 0.7345

Support level: 0.7265, 0.7200

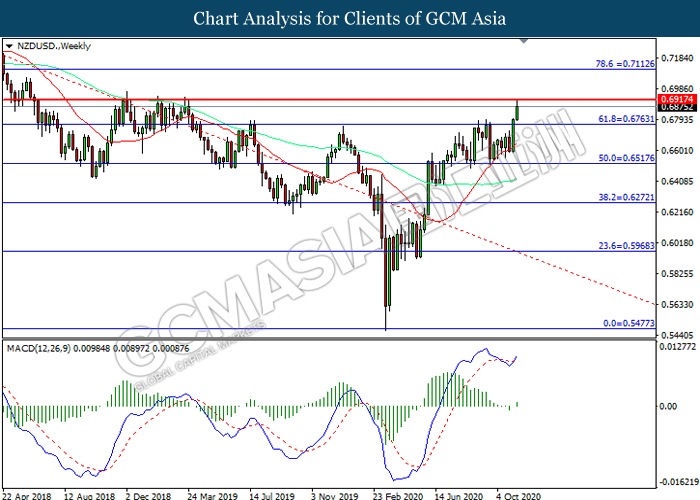

NZDUSD, Weekly: NZDUSD was traded higher while currently testing near the resistance level at 0.6915. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6915, 0.7110

Support level: 0.6765, 0.6515

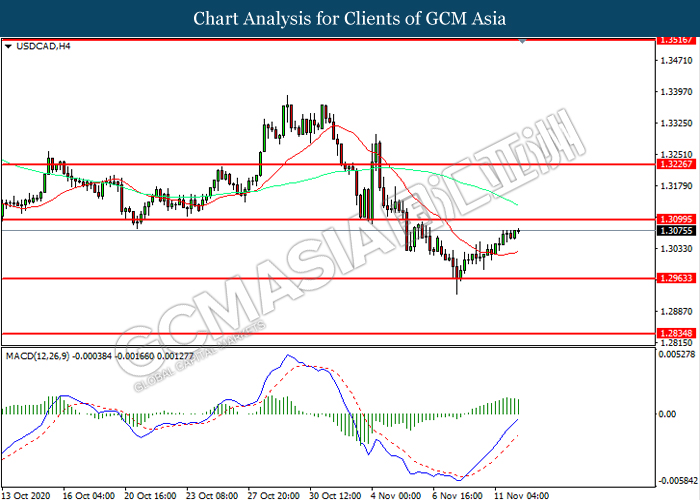

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.3100. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3100, 1.3225

Support level: 1.2965, 1.2835

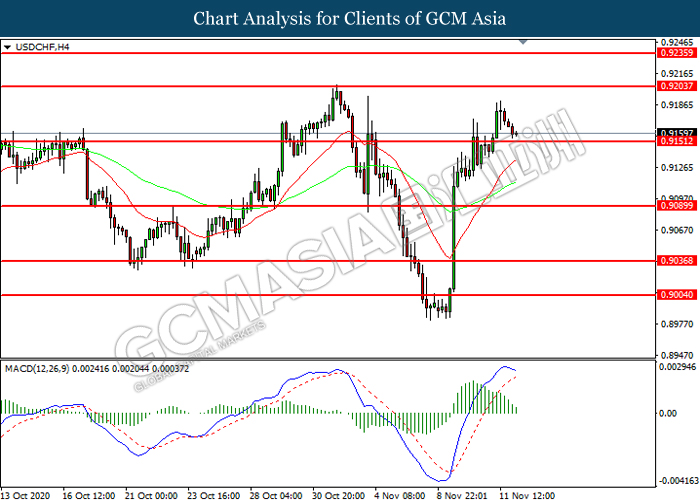

USDCHF, H4: USDCHF was traded lower while currently testing the support level 0.9150. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9205, 0.9235

Support level: 0.9150, 0.9090

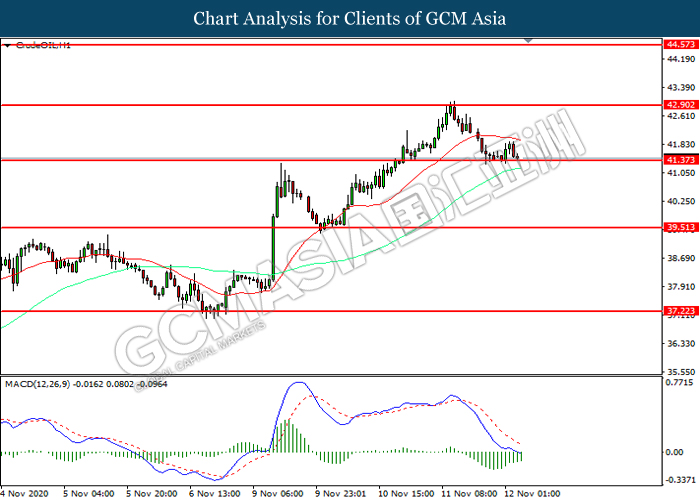

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level at 41.35. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 42.90, 44.55

Support level: 41.35, 39.50

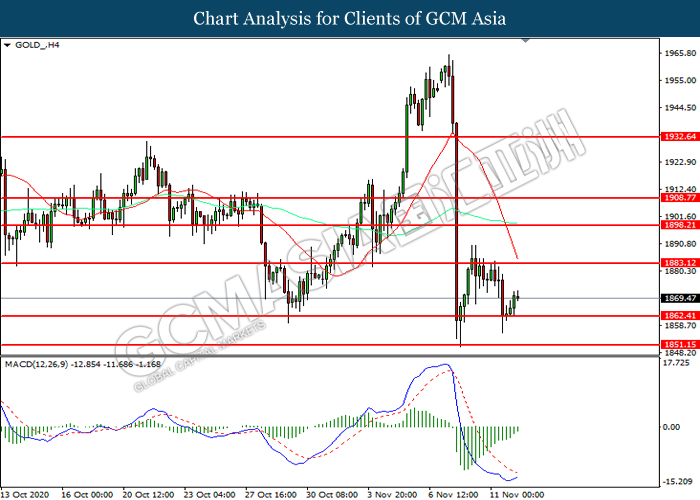

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1862.40. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level at 1883.10.

Resistance level: 1883.10, 1898.20

Support level: 1862.40, 1851.15