12 November 2020 Morning Session Analysis

Euro dipped following pessimistic Christine Lagarde Speaks.

The single currency of Euro which playing an important role in the FX market received huge sell-off momentum after ECB Chairman Christine Lagarde revealed that the Covid-19 pandemic has produced a highly unusual recession in European Zone economy while warning market to not be excessive optimism over the short-term positive news from vaccine. Last weekend, a vaccine which produced by US drugmaker Pfizer and BioNtech had shown a positive result in the clinical trial stage, where the effectiveness of preventing the virus is close to 90%. Despite latest news from vaccine’s development looks encouraging, however the economy may hit badly by the accelerating of viral spread and a tighter restriction may also be implemented in EU until the virus shows a critical sign of slowing down, said by Christine Lagarde. Besides, Lagarde also revealed that ECB might loosen the monetary policy further in next month as European Zone country are turning their head back to the recession direction after the resurgence of infection recently. As of now, the total recorded cases in EU since the outbreak of virus have break the threshold of 12 million, while the death toll has risen to 300K. During Asian early trading session, the pair of EUR/USD dropped 0.02% to 1.1772.

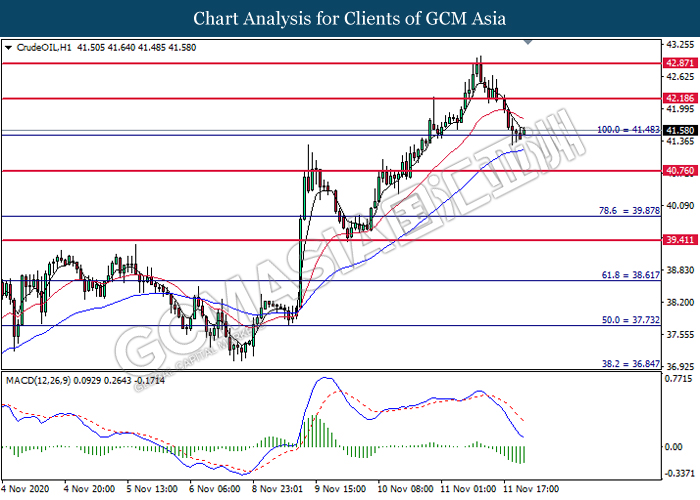

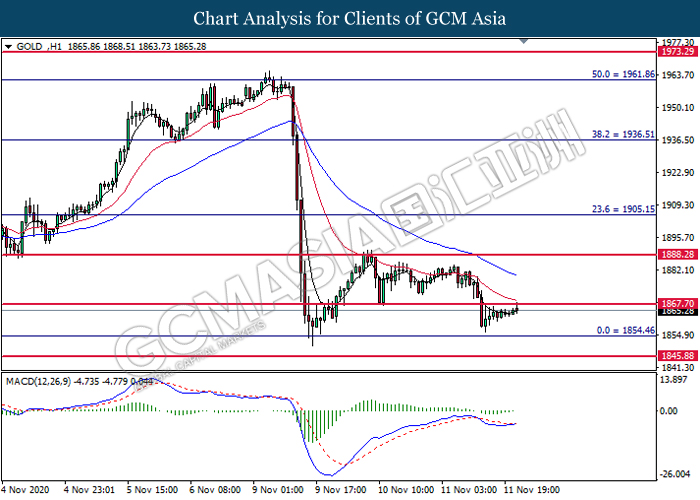

In the commodities market, the crude oil price dropped by 0.05% to $41.50 per barrel as after OPEC revised down its forecast for the global oil demand for this year. According to the Monthly Oil Market Report (MOMR), OPEC cut its oil demand expectation for year 2020 by 300K bpd compared to last month estimation. Besides, gold price inched down 0.02% to $1863.00 a troy ounce amid vaccine’s positive news continue ride on the market sentiment.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP(QoQ)(Q3) | -19.8% | 15.8% | – |

| 15:00 | GBP – Manufacturing Production (MoM)(Sep) | 0.7% | 1.0% | – |

| 21:30 | USD – Core CPI (MoM)(Oct) | 0.2% | 0.2% | – |

| 21:30 | USD – Initial Jobless Claims | 751K | 735K | – |

| 00:00

(13th) |

CrudeOIL – Crude Oil Inventories | -7.998M | -0.913M | – |

Technical Analysis

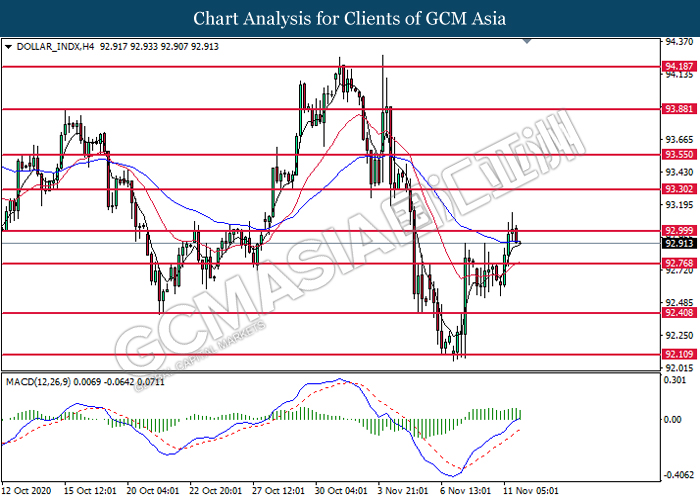

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level at 93.00. MACD which illustrate diminishing bullish momentum signal suggest the dollar to extend its losses toward the support level at 92.75.

Resistance level: 93.00, 93.30

Support level: 92.75, 92.40

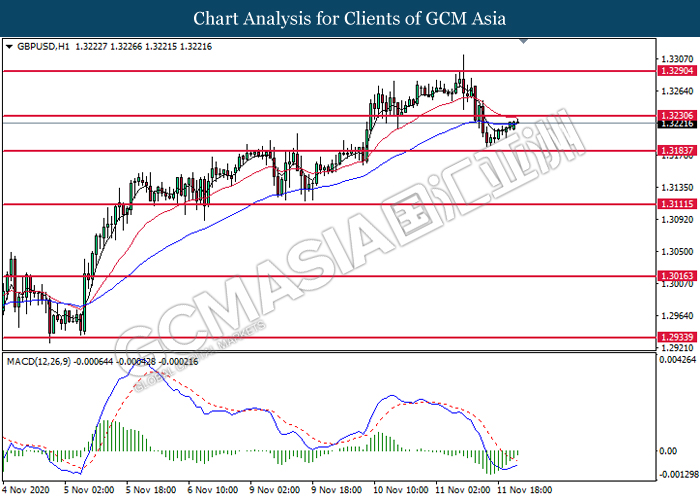

GBPUSD, H1: GBPUSD was traded higher while currently testing the resistance level at 1.3230. MACD which illustrates diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 1.3230.

Resistance level: 1.3230, 1.3290

Support level: 1.3185, 1.3110

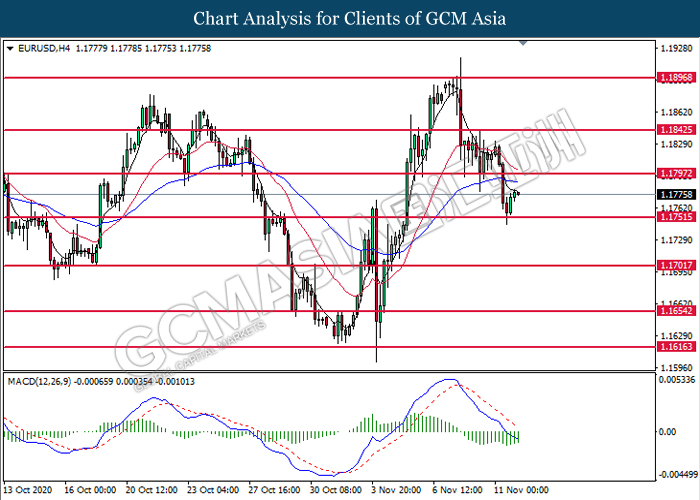

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.1750. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its gains toward the resistance level at 1.1795.

Resistance level: 1.1795, 1.1840

Support level: 1.1750, 1.1700

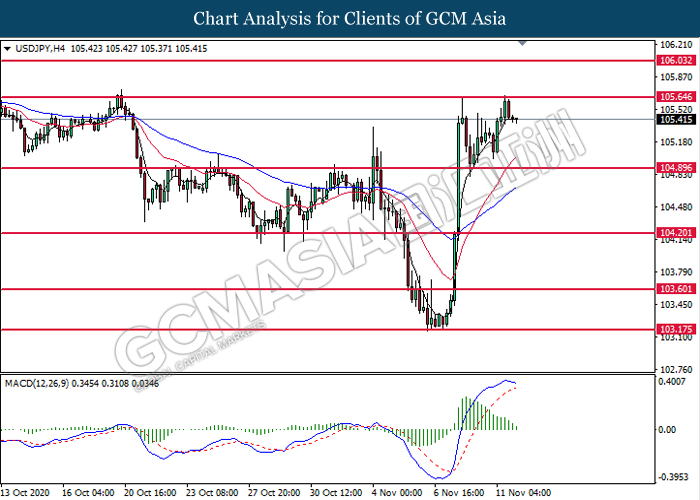

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 105.65. MACD which illustrate diminishing bullish momentum suggest the pair to extend its losses toward the support level at 104.90.

Resistance level: 105.65, 106.05

Support level: 104.90, 104.20

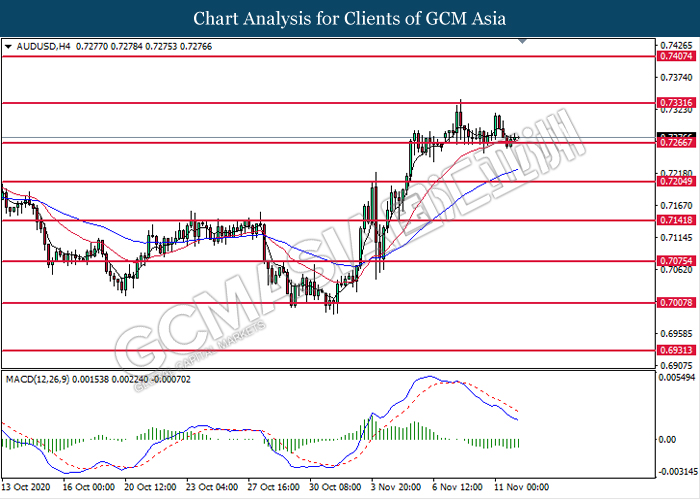

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7265. MACD which illustrate diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.7330.

Resistance level: 0.7330, 0.7405

Support level: 0.7265, 0.7205

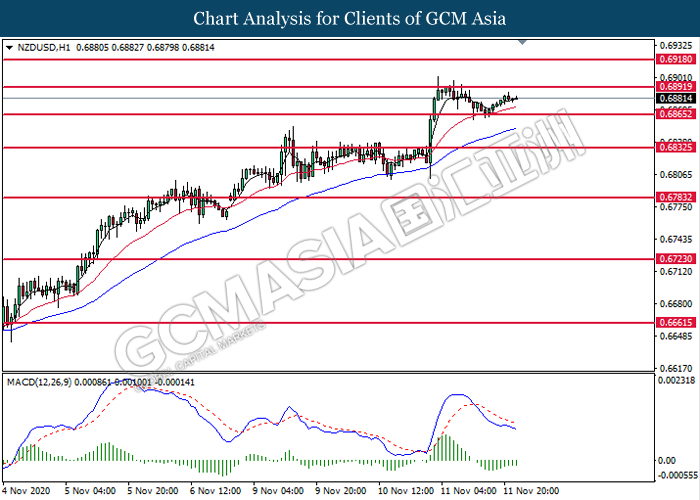

NZDUSD, H1: NZDUSD was traded higher following prior rebound from the support level at 0.6865. However, MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its gains toward the resistance level at 0.6890.

Resistance level: 0.6890, 0.6920

Support level: 0.6865, 0.6835

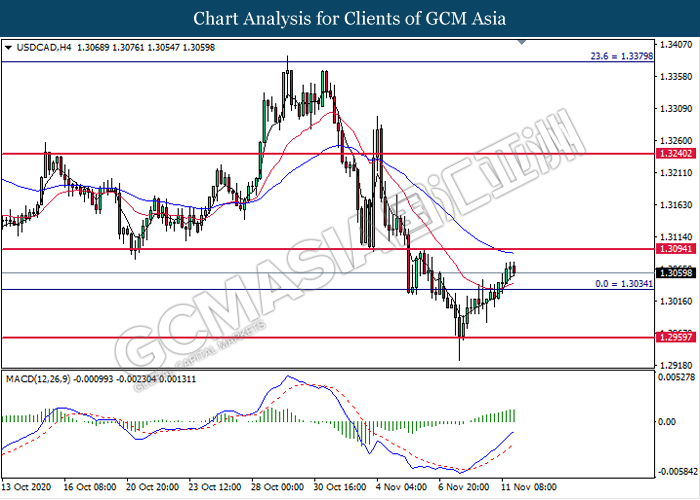

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3035. MACD which illustrate bullish bias momentum signal suggest the pair to extend its gains toward the resistance level at 1.3095.

Resistance level: 1.3095, 1.3240

Support level: 1.3035, 1.2960

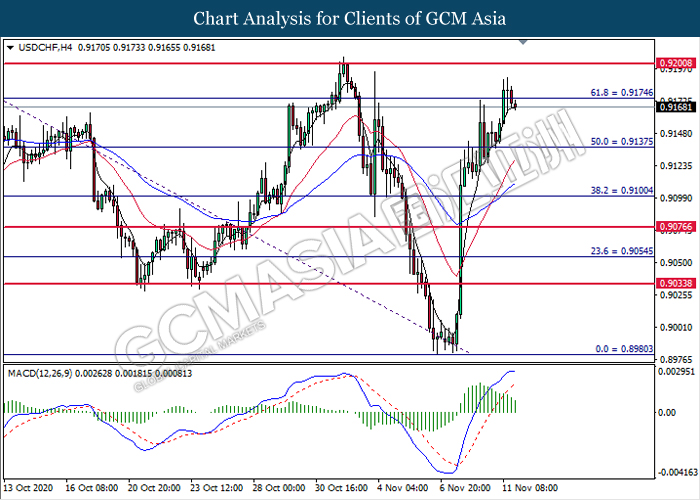

USDCHF, H4: USDCHF was traded lower following prior retracement near the resistance level at 0.9175. MACD which display diminishing bullish momentum signal suggest the pair to extend its losses toward the support level at 0.9135.

Resistance level: 0.9175, 0.9200

Support level: 0.9135, 0.9100

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from the support level at 41.50. MACD which illustrate diminishing bearish momentum signal suggest the commodity to extend its gains toward the resistance level at 42.20.

Resistance level: 42.20, 42.85

Support level: 41.50, 40.75

GOLD_, H1: Gold price was traded higher while currently testing the resistance level at 1867.70. MACD which illustrate diminishing bearish momentum signal suggest the commodity to extend its gains after it successfully breakout above the resistance level at 1867.70.

Resistance level: 1867.70, 1888.30

Support level: 1854.45, 1845.90