13 January 2021 Afternoon Session Analysis

Aussie slips on weak data, virus woes.

During late Asian session, the Australian dollar which traded against the dollar and other currency pairs have failed to extend its gains and retreat as surging cases in China coupled with weak data exert some selling pressure for the currency. On data front, Australia’s Job Vacancies for three months to November dropped below 59.4% prior to 23.4%. The data reflects a weakness in jobs number that challenges policymakers and could prompt Aussie government to potential extend relief measures. On coronavirus front, China’s virus numbers jumped to the highest in five months with 115 new confirmed cases on the mainland (55 the previous day) including 107 local infections. Besides that, rising global coronavirus also challenge risk sentiment. At the time of writing, AUD/USD slips 0.07% to 0.7765.

In the commodities market, crude oil price continues to extend its gains and jumped 1.05% to $53.77 per barrel as of writing following U.S inventory drop. According to API, crude inventories in the U.S. dropped by 5.8 million barrels last week to around 484.5 million barrels. On the other hand, gold price rebounds 0.28% to $1859.81 a troy ounce at the time of writing amid weakening dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core CPI (MoM)(Dec) | 0.2% | 0.1% | – |

| 23:30 | CrudeOIL – Crude OIL Inventories | -8.010M | -2.266M | – |

Technical Analysis

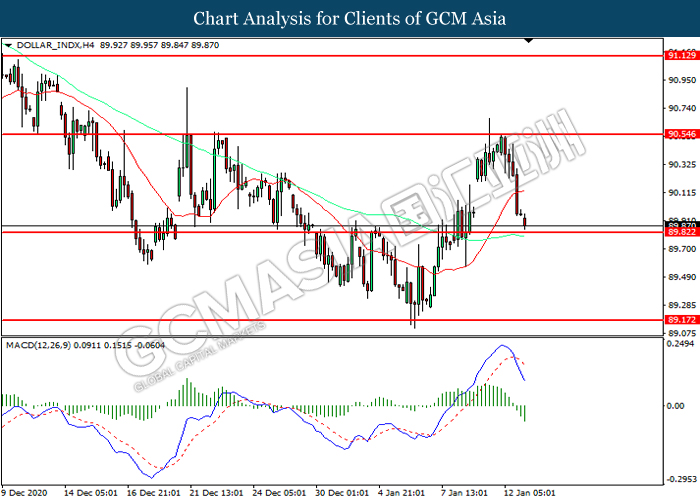

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level at 89.80. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 90.55, 91.15

Support level: 89.80, 89.15

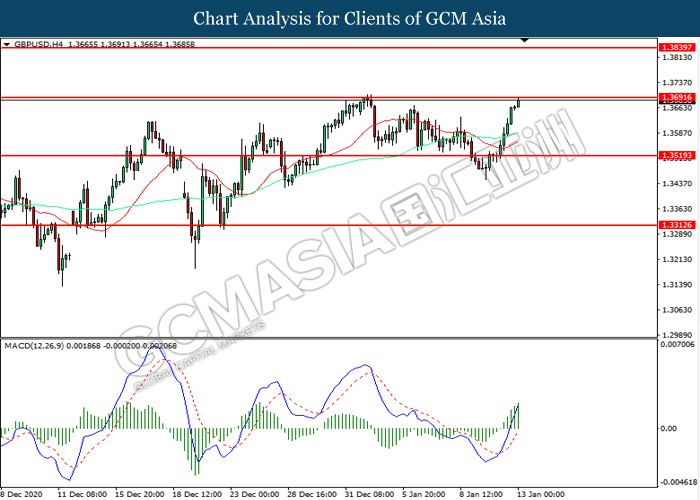

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.3690. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3690, 1.3840

Support level: 1.3520, 1.3315

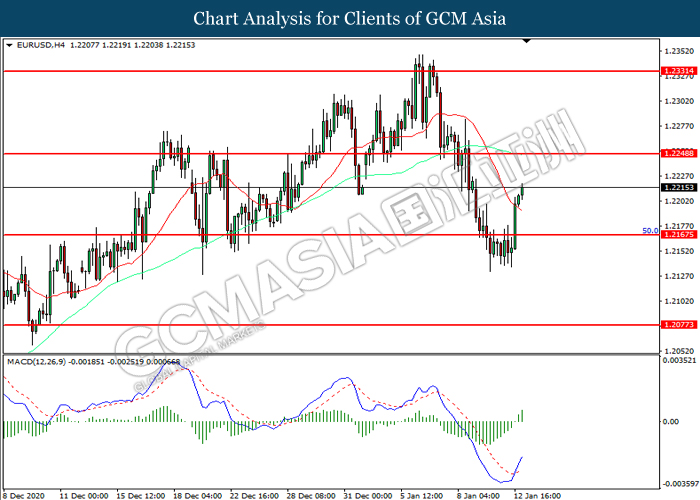

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.2165. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.2250.

Resistance level: 1.2250, 1.2330

Support level: 1.2165, 1.2075

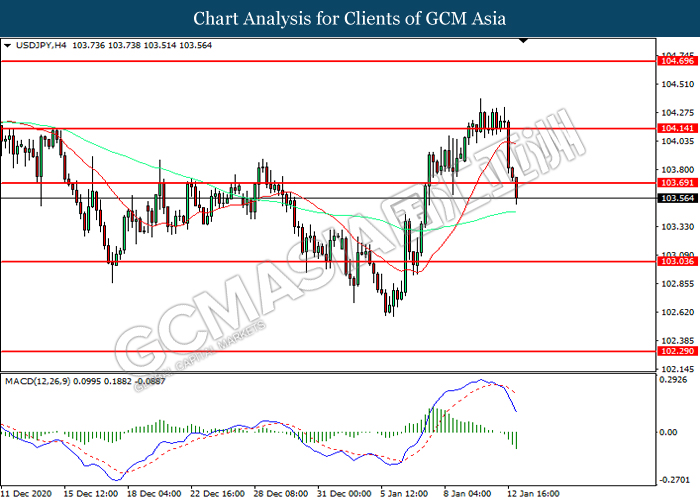

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level at 103.70. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 103.05.

Resistance level: 103.70, 104.15

Support level: 103.05, 102.30

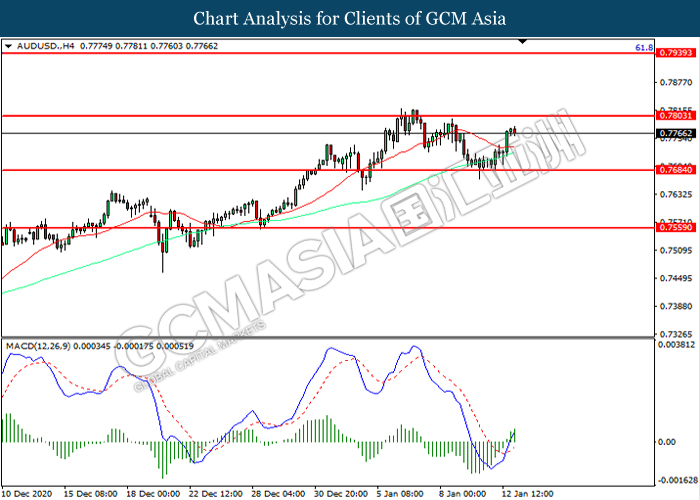

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7685. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7805.

Resistance level: 0.7805, 0.7940

Support level: 0.7685, 0.7560

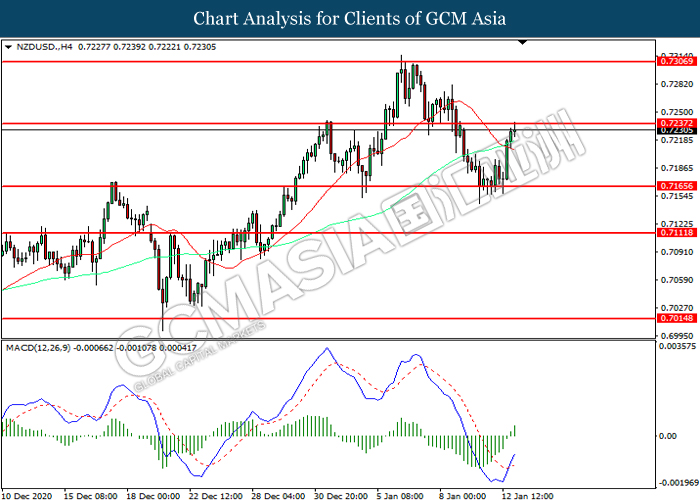

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.7235. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7235, 0.7305

Support level: 0.7165, 0.7110

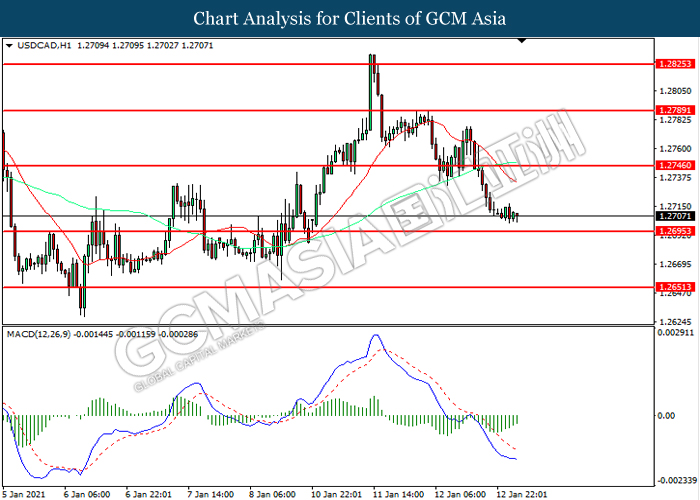

USDCAD, H1: USDCAD was traded lower while currently testing the support level at 1.2695. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2745, 1.2790

Support level: 1.2695, 1.2650

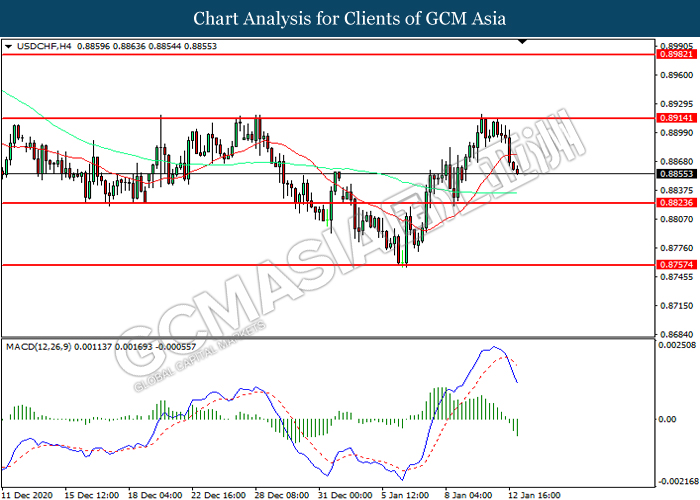

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.8915. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.8825.

Resistance level: 0.8915, 0.8980

Support level: 0.8825, 0.8755

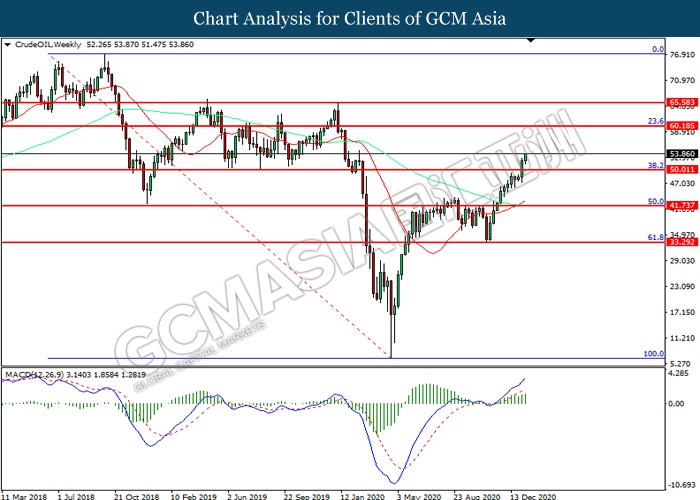

CrudeOIL, Weekly: Crude oil price was traded higher following prior breakout above the previous resistance level at 50.00. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 60.20.

Resistance level: 60.20, 65.50

Support level: 50.00, 41.75

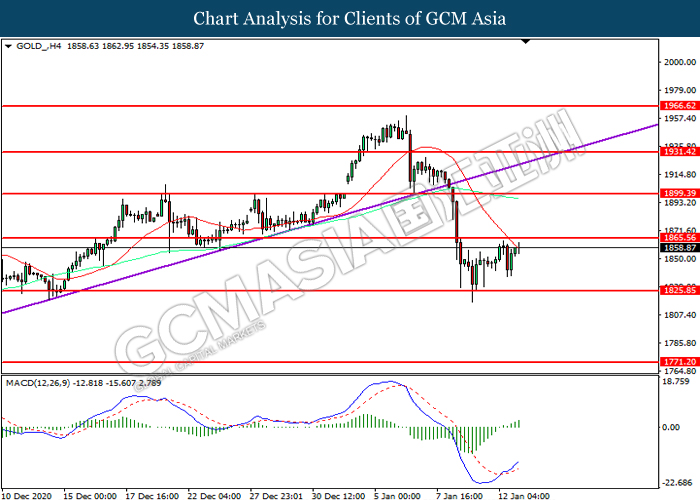

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1865.55. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1865.55, 1899.40

Support level: 1825.85, 1771.20