13 January 2022 Afternoon Session Analysis

Sterling rides high as Omicron fear diminishes.

Pound sterling shines brightly for the past few weeks as investors gauge the possibility if lower economic hurdles from recent Omicron infections. According to recent data, hospitalization risk with Omicron variant is one third that of Delta variant even though daily average cases surpasses 150,000 mark. Likewise, when compared to Delta, Omicron variant’s death rate stays at a low of 3%, significantly milder than previously expected. As UK coronavirus cases surges drastically since late last year, UK government has held off from initiating lockdown, instead looking towards alternatives to contain the spread. Investors speculate that milder than expected Omicron variant while coupled with recent government initiatives may not jeopardize overall economic recovery momentum. Likewise, as UK’s inflation extended its rise due to ongoing supply chain issues, Bank of England is expected to initiate another round of rate hike in the coming months. As of writing, pair of GBP/USD rose 0.02% to 1.3711.

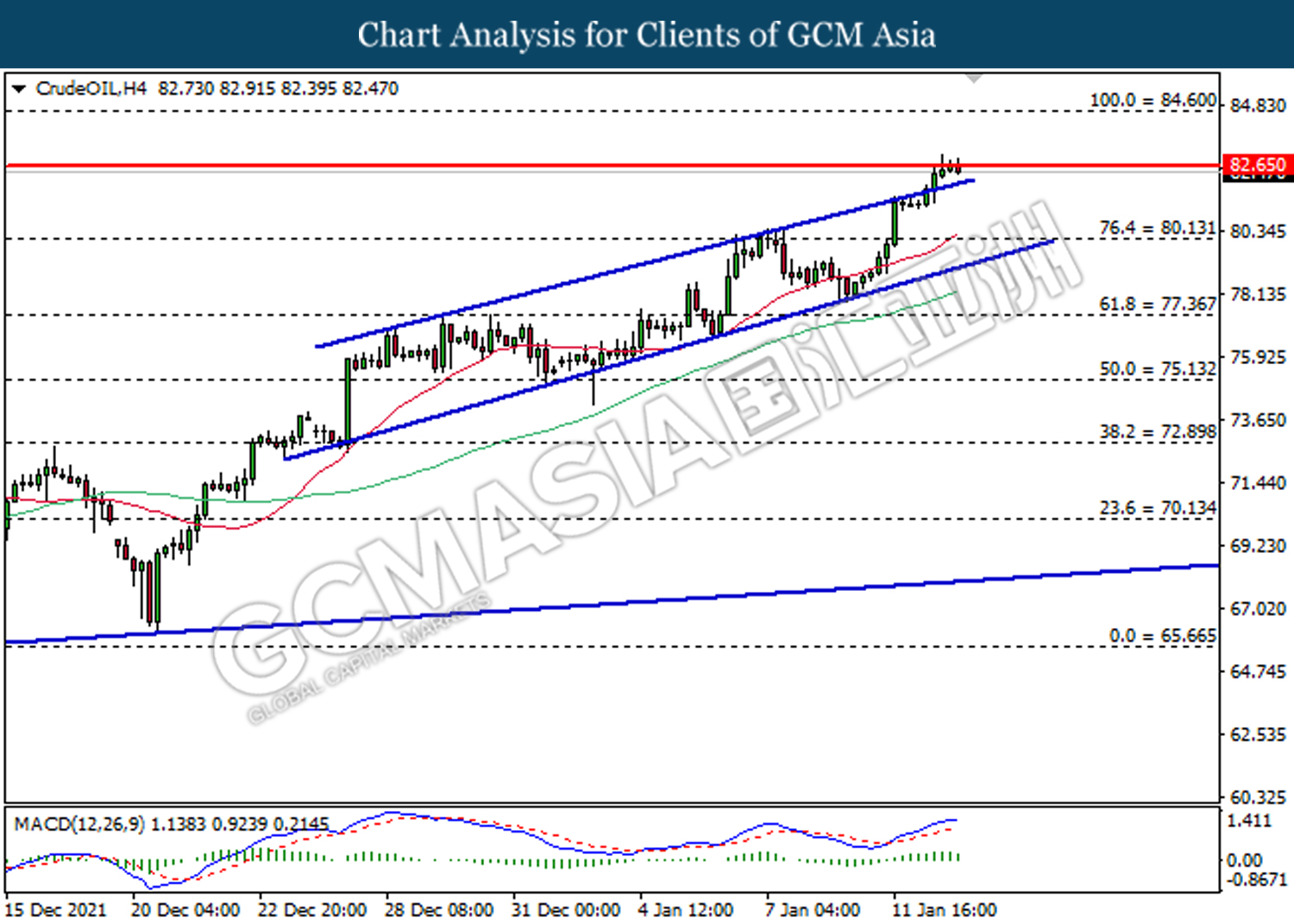

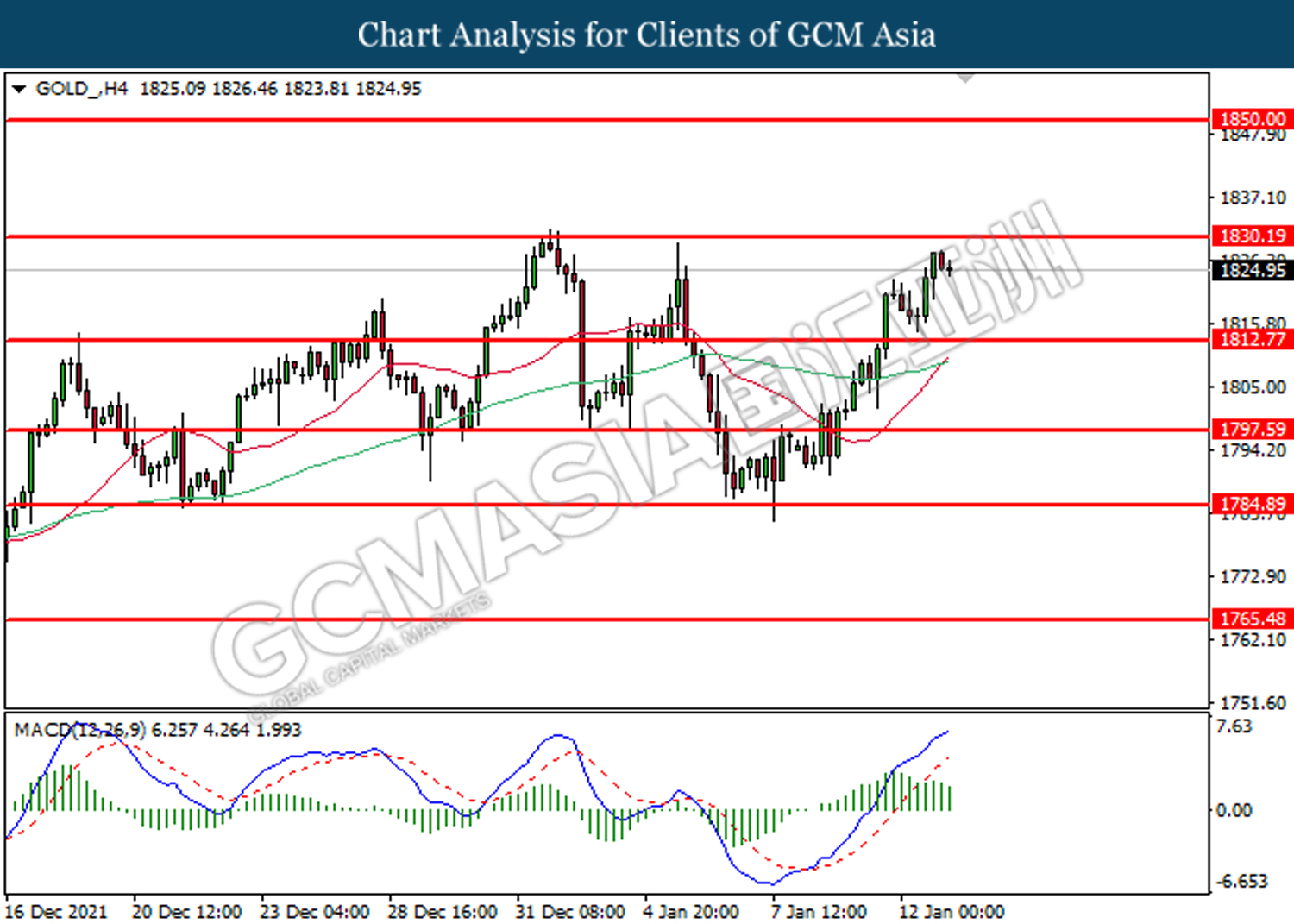

As for commodities, crude oil price depreciates by 0.35% to $82.47 per barrel. Oil prices begins to undergo retracement due to take-profit initiatives among investors following its recent uptrend. On the other hand, gold price was down by 0.14% to $1,824.62 a troy ounce as market expects a 76.2% for an interest rate hike from Federal Reserve in March.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Initial Jobless Claims | 207K | 205K | – |

| 21:30 | USD – PPI (MoM) (Dec) | 0.80% | 0.40% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the index to be traded lower in short-term.

Resistance level: 95.00, 95.45

Support level: 94.60, 94.10

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.3745, 1.3810

Support level: 1.3690, 1.3630

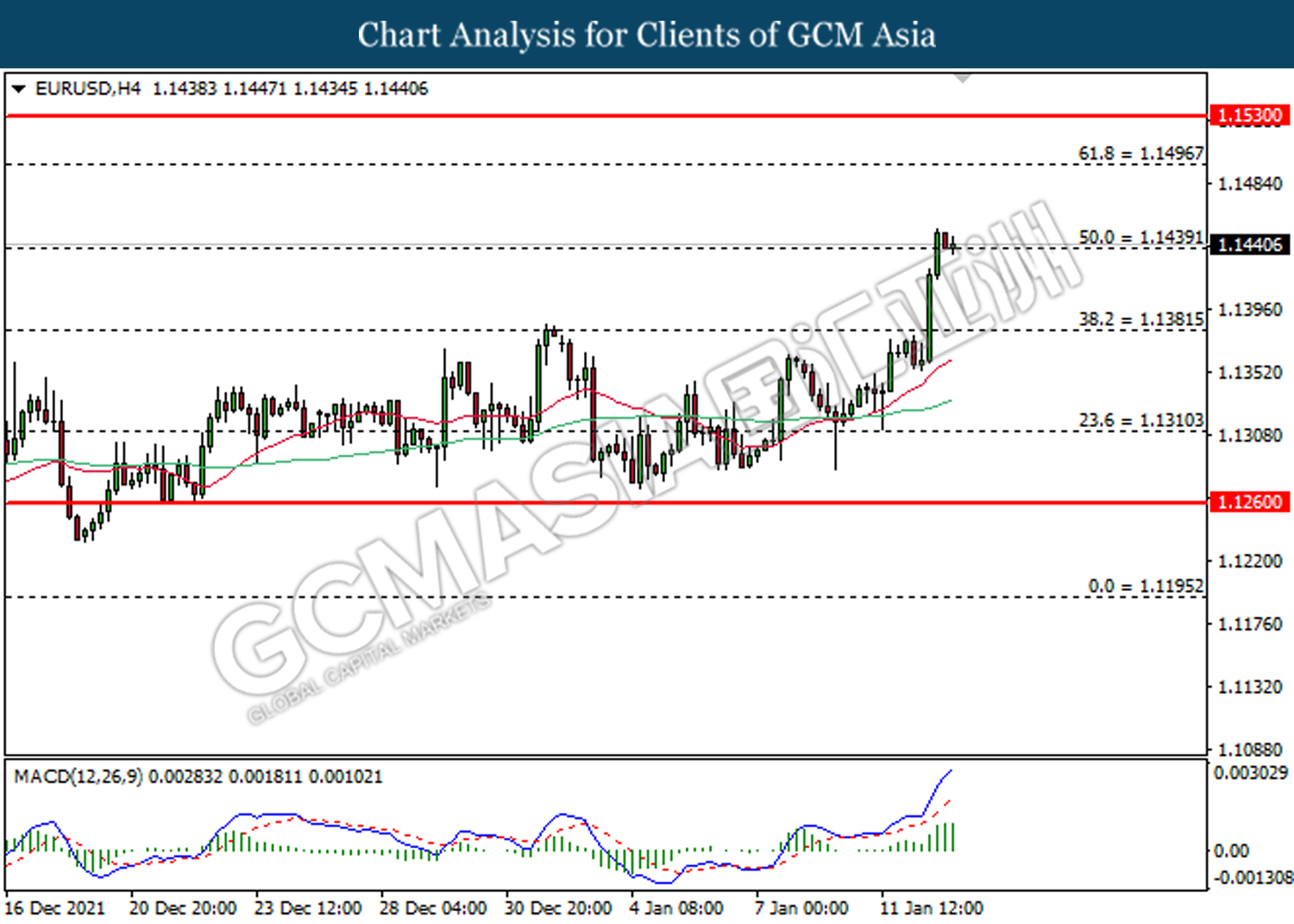

EURUSD, H4: EURUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.1495, 1.1530

Support level: 1.1440, 1.1380

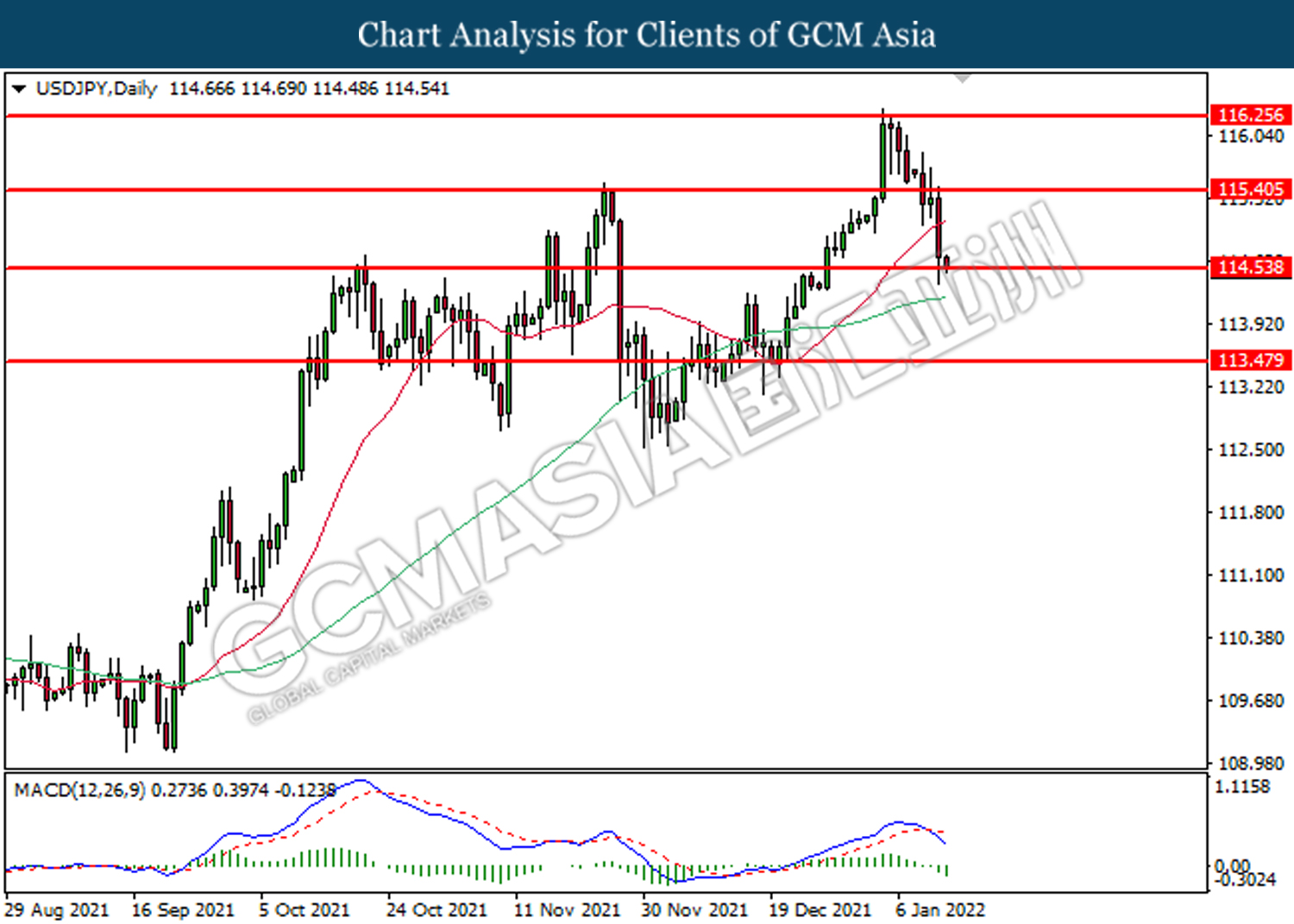

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher levels. MACD which illustrate bearish momentum suggests the pair to be traded lower after closing below its support level.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher short-term.

Resistance level: 0.7320, 0.7370

Support level: 0.7280, 0.7225

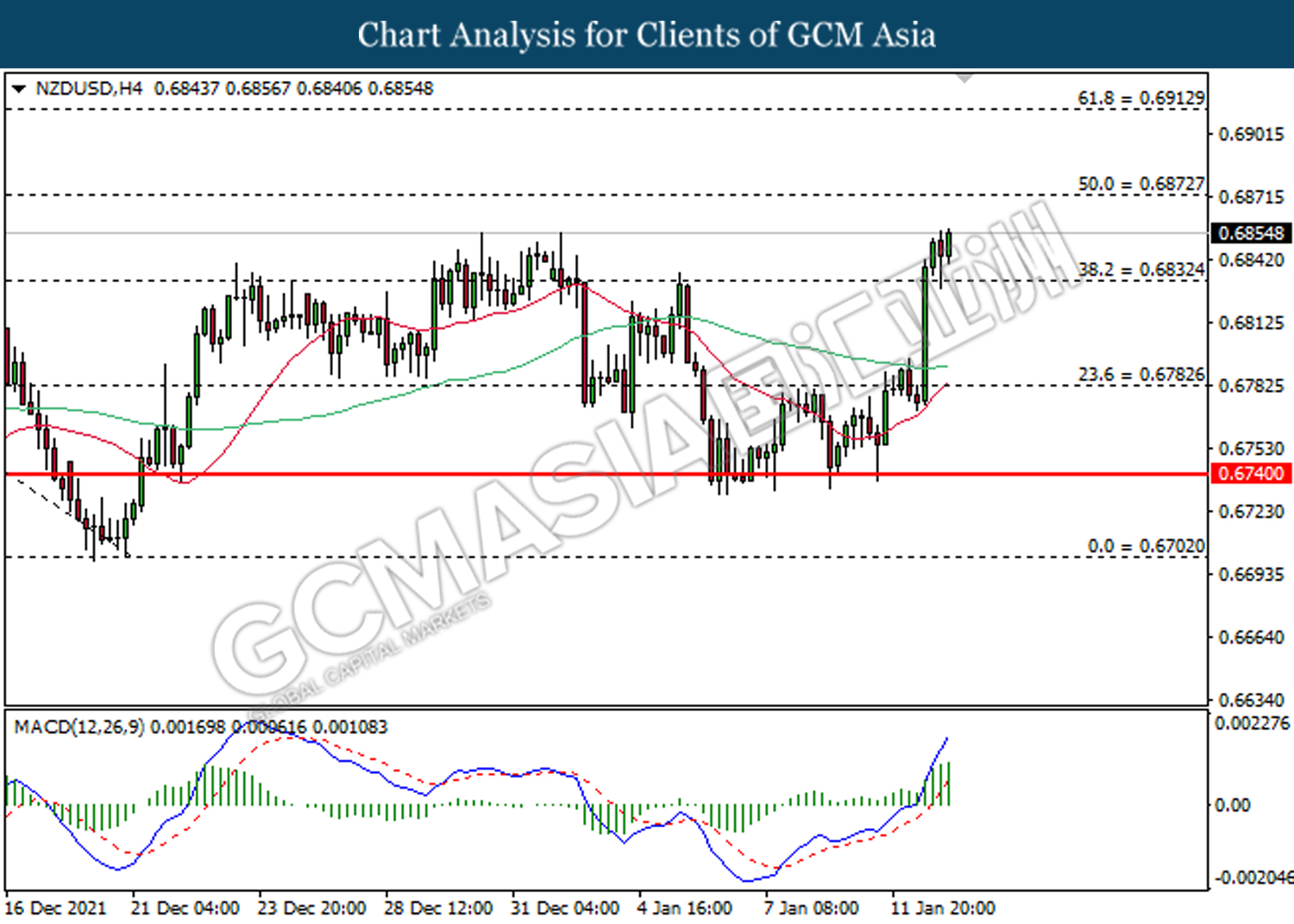

NZDUSD, H4: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.6870, 0.6910

Support level: 0.6830, 0.6780

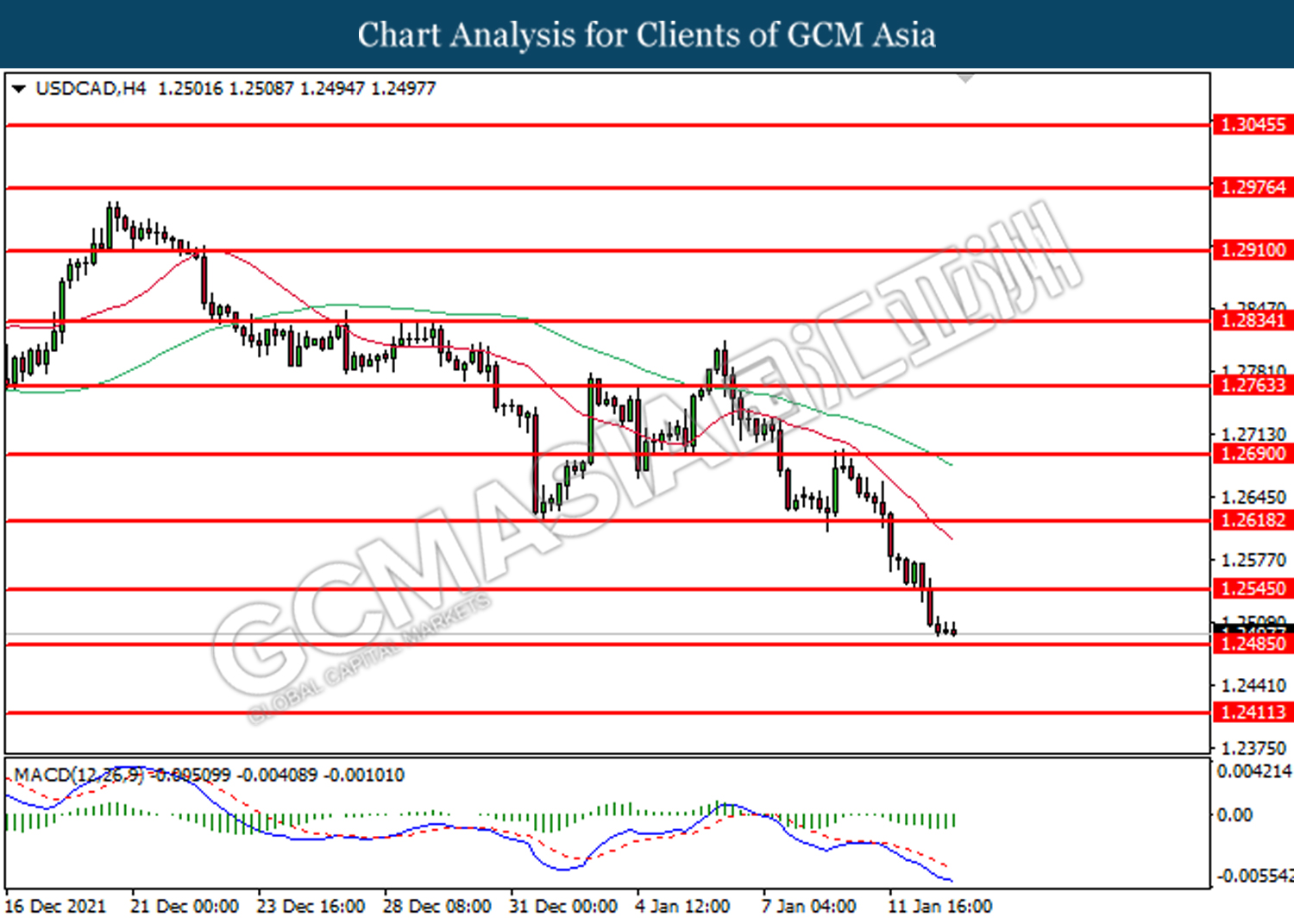

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking its support level.

Resistance level: 1.2545, 1.2620

Support level: 1.2485, 1.2410

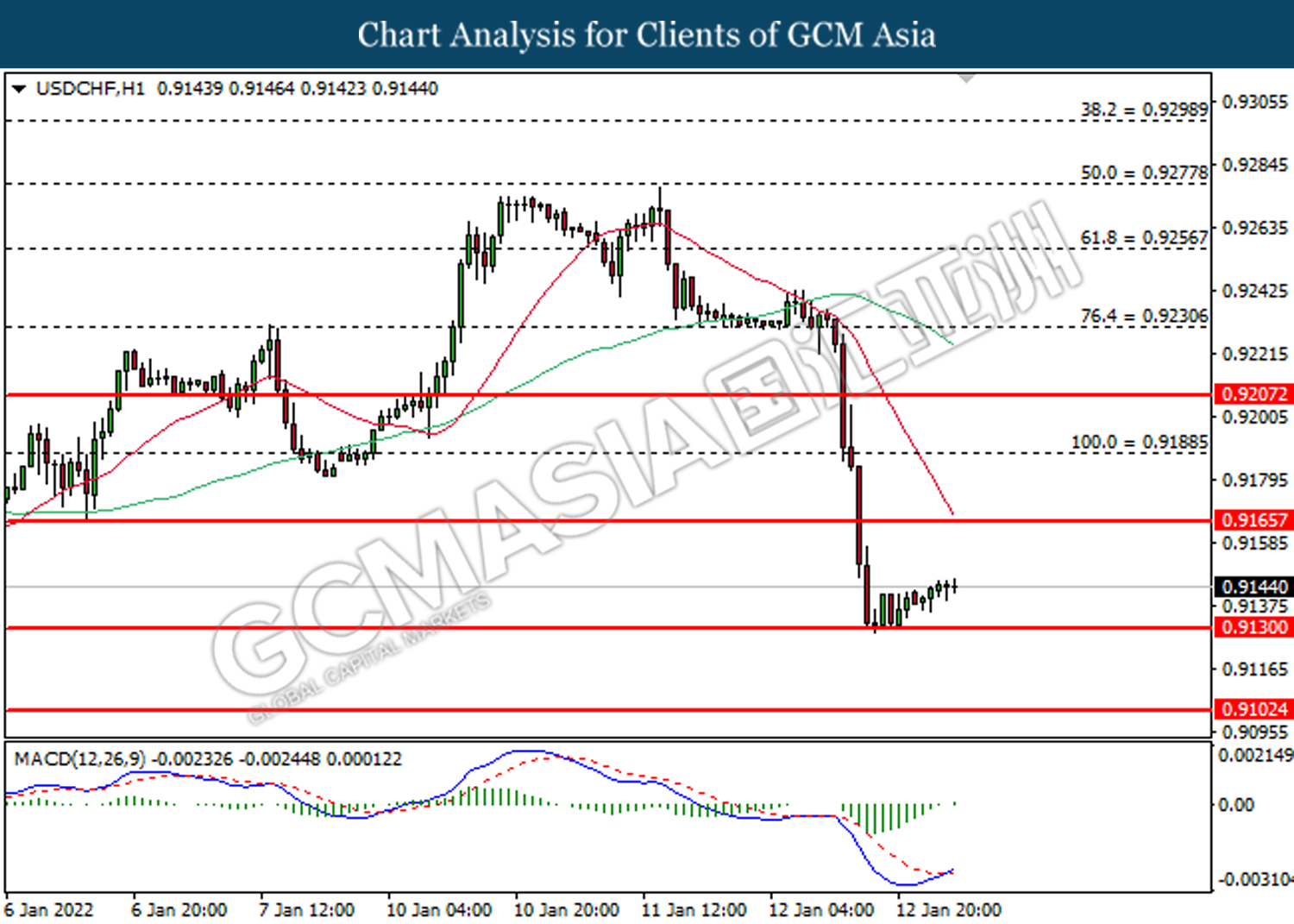

USDCHF, H1: USDCHF was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish momentum suggests the pair to be traded higher in short-term.

Resistance level: 0.9165, 0.9190

Support level: 0.9130, 0.9100

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking the resistance level.

Resistance level: 82.65, 84.60

Support level: 80.15, 77.35

GOLD_, H4: Gold price was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish momentum suggests its price to be traded lower in short-term.

Resistance level: 1830.20, 1850.00

Support level: 1812.80, 1797.60