13 June 2017 Daily Analysis

Cautious investors await Fed’s decision.

US dollar was traded flat against a basket of six major currencies, failing to rebound from a sharp dip in sterling while expectations for an interest rate hike by the Federal Reserve on Thursday limit its downside bias. The dollar index was last seen at 97.13 during early Asian session. According to the Fed Rate Monitor Tool, traders are currently pricing in at 90% for the Fed to increase its benchmark rate by 25 basis points after its two-day meeting concludes. While interest hike is widely expected, most investors remained cautious over a potential shift in tone on the prospect of US economy as prior released data showed a weaker-than-expected performance. Meanwhile in the UK, pound sterling ticked up 0.06% to $1.2666 albeit remained under pressure as political uncertainty continues to dominate the currency while investors remained concerned over upcoming Brexit negotiations in the wake of surprise election results.

As for commodities, crude oil price rose 0.35% to $46.24 per barrel while market participants look ahead for fresh readings from US inventories and reports from both OPEC and IEA for further market signals. Otherwise, gold price was down 0.18% to $1,263.84 as attention shift towards the US Federal Reserve interest rate decision.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Event

Time Market Event

Tentative Crude Oil OPEC Monthly Report

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 09:30 | AUD – NAB Business Confidence (May) | 13 | – | 7 |

| 16:30 | GBP – CPI (YoY) (May) | 2.7% | 2.7% | – |

| 17:00 | EUR – German ZEW Economic Sentiment (June) | 20.6 | 21.5 | – |

| 20:30 | USD – PPI (MoM) (May) | 0.5% | 0.1% | – |

| 04:30 | Crude Oil – API Weekly Crude Oil Stock | -4.620M | – | – |

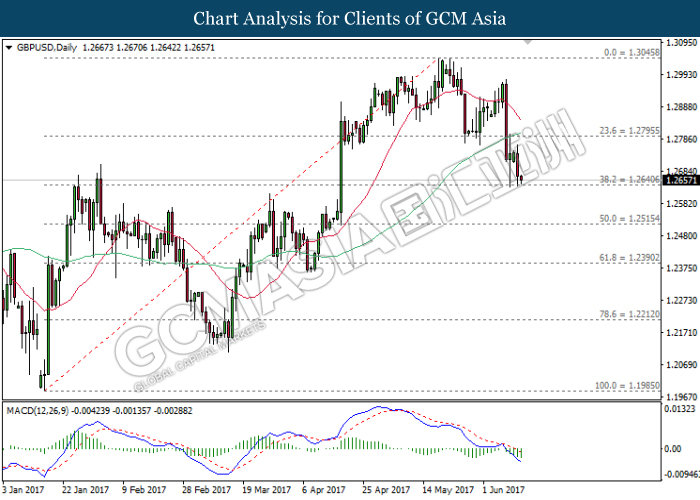

GBPUSD

GBPUSD, Daily: GBPUSD remained under pressure as both moving average line continues to narrow downwards. MACD histogram which illustrates a significant downward signal and momentum suggests GBPUSD to extend its downtrend after breaking the support level of 1.2640.

Resistance level: 1.2795, 1.3045

Support level: 1.2640, 1.2515

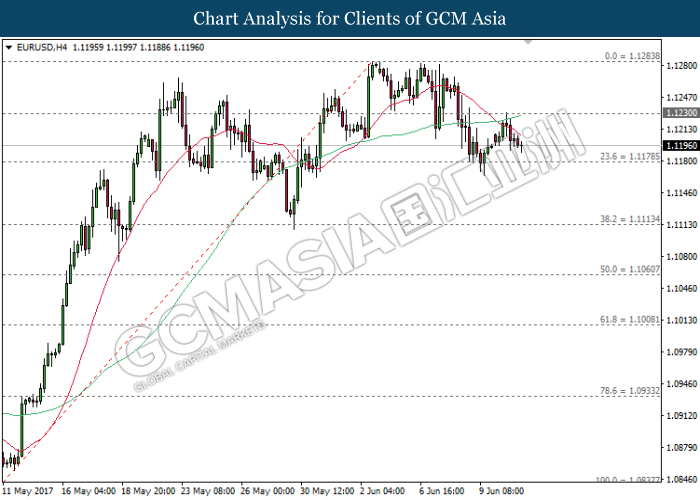

EURUSD

EURUSD, H4: EURUSD was traded lower following prior retracement from the strong resistance level at 1.1230. The recent formation of death cross by both MA line suggests further downside bias for EURUSD to extend its losses, towards the target of support level at 1.1180.

Resistance level: 1.1230, 1.1285

Support level: 1.1180, 1.1115

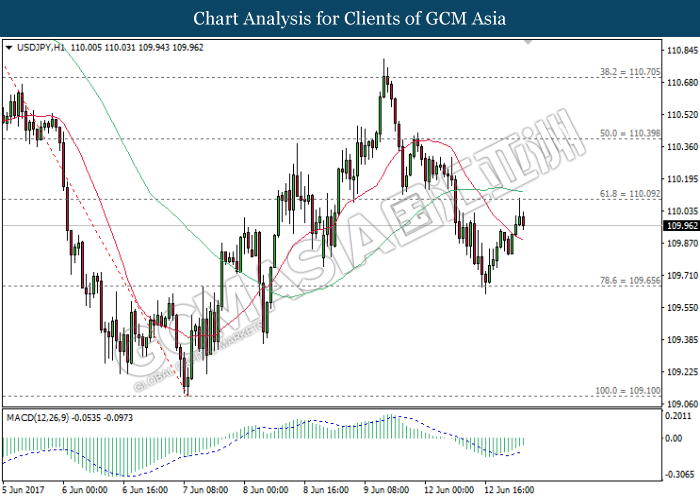

USDJPY

USDJPY, H1: USDJPY was traded higher following prior rebound from the support level of 109.65. With regards to MACD indicator which continues to hover outside of downward momentum suggests USDJPY to extend its technical correction towards the resistance level of 110.10.

Resistance level: 110.10, 110.40

Support level: 109.65, 109.10

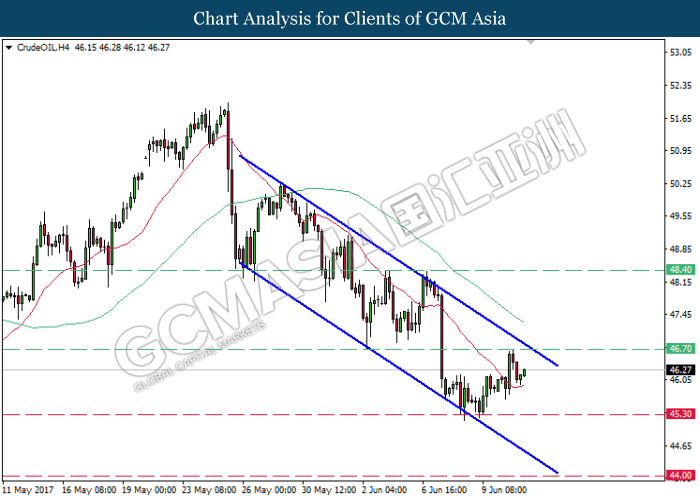

CrudeOIL

CrudeOIL, H4: Crude oil price remained traded within a downward channel following prior rebound from the support level of 45.30. Recent closure above the 20-moving average line suggests crude oil price to move further up, towards the target of resistance level at 46.70 in short-term.

Resistance level: 46.70, 48.40

Support level: 45.30, 44.00

GOLD

GOLD_, H4: Gold price was traded lower following prior formation of death cross by both moving average line. The formation suggests a further downside bias for gold price to extend its losses after breaking the strong support level of 1264.70.

Resistance level: 1276.65, 1295.95

Support level: 1264.70, 1255.05