13 July 2023 Afternoon Session Analysis

Canadian dollar rises as Bank of Canada hikes rates to 23-year high.

The Canadian dollar, which traded against the dollar index extended its gains after the Bank of Canada (BoC) raised its interest rate to 5.0%, the highest level since 2001. The BoC announced that the board committees agreed to raise the monetary rate by 25 basis points to 5.00% from 4.75%, in line with market expectations. Although global inflation was easing, the Canadian robust demand and tight labour market are causing the underlying price pressure to remain more persistent than the central bank thought. The latest CPI report was eased in May to 3.4% from a peak of 8.1% in the summer, but it is still far from the BoC target of 2%. The bank now predicts that the headline inflation of 2% target will only be returned in mid of 2025, six months later than previously thought. The central bank also mentioned that the Canadian labour market remains tight with a shortage of workers and wage growth as recent data showed the unemployment rate stood at 5.4%. Following that, BoC Governor Mackle issues a mixed statement tone after the monetary policy decision. He mentioned that the central bank is close to the end of the tightening cycle but reiterates it is too early to be talking about rate cuts. BoC will be based on the latest economic data to decide on its monetary policy decision if the inflation is more persistent than expected, the central bank is prepared to hike again if needed. As of writing, the USDCAD niche is down by -0.06% to 1.3177.

In the commodities market, crude oil prices traded up by 0.41% to $76.06 per barrel as the dollar weakened after soft CPI data. On the other hand, the price of gold rose by 0.13% to 1959.95 as investors anticipate that Fed will less aggressive in its tightening moves.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 CrudeOIL IEA Monthly Report

19:00 CrudeOIL OPEC Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claim | 248K | 249K | – |

| 20:30 | USD – PPI (MoM) (Jun) | -0.3% | 0.2% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the prior breaks below for the previous support level at 100.20. However, MACD which illustrated diminishing bearish momentum suggests the index undergoes a technical correction in a short term.

Resistance level: 100.80, 100.20

Support level: 99.70, 99.25

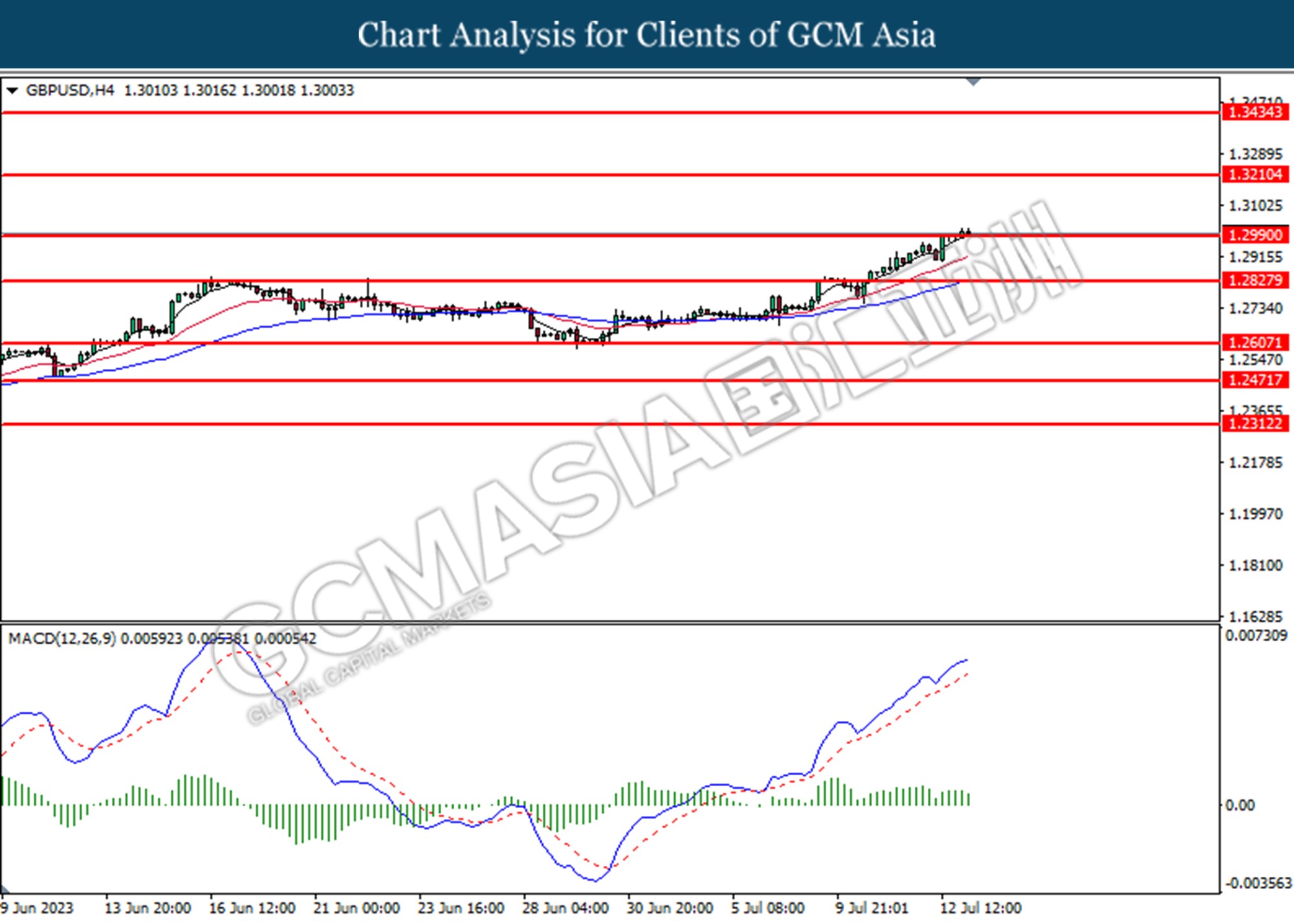

GBPUSD, H4: GBPUSD was traded higher following the prior breaks above the previous resistance level at 1.2990. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.3210, 1.3435

Support level: 1.2990, 1.2830

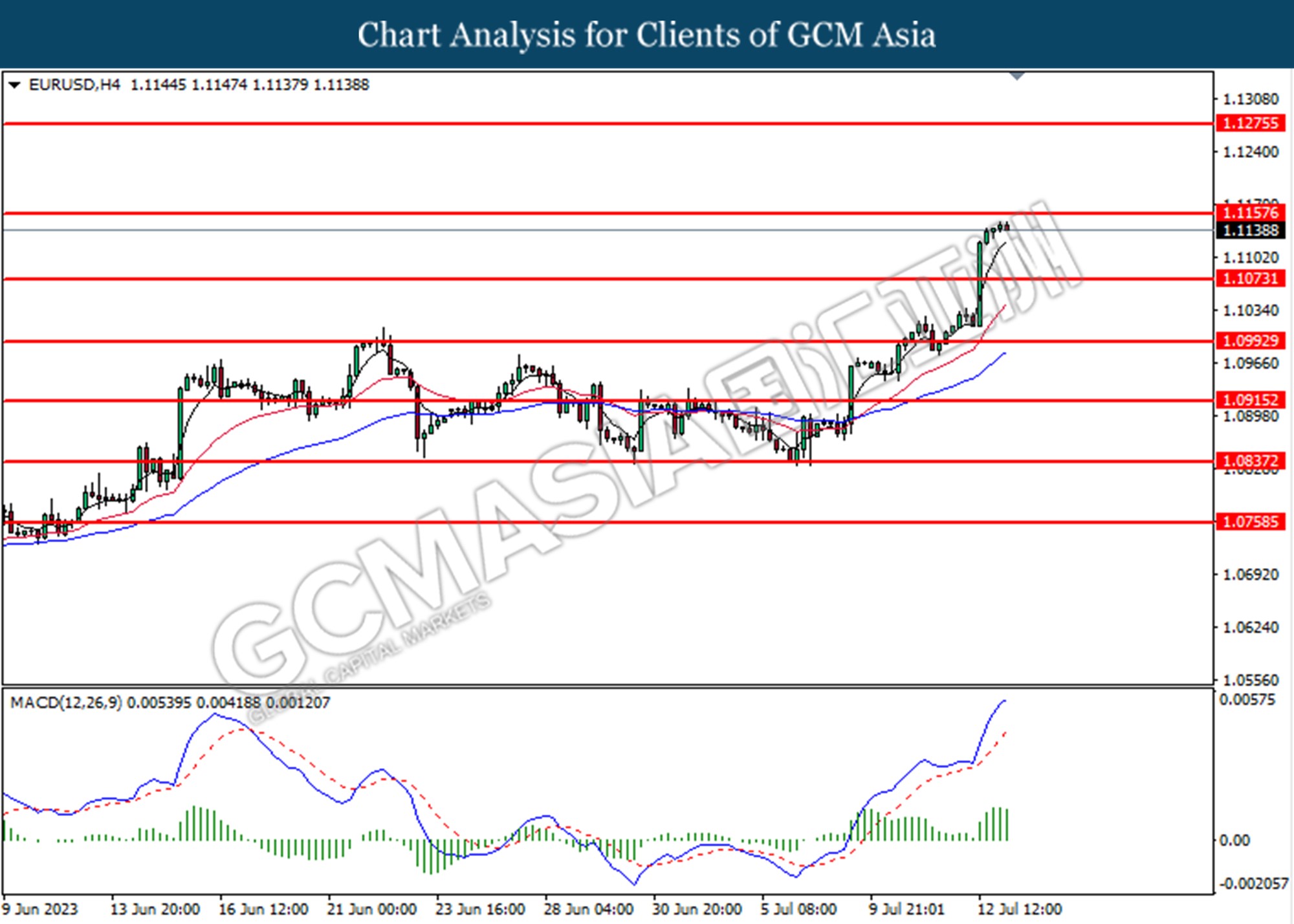

EURUSD, H4: GBPUSD was traded higher following the prior breaks above the previous resistance level at 1.1075. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.1160, 1.1275

Support level: 1.1075, 1.0990

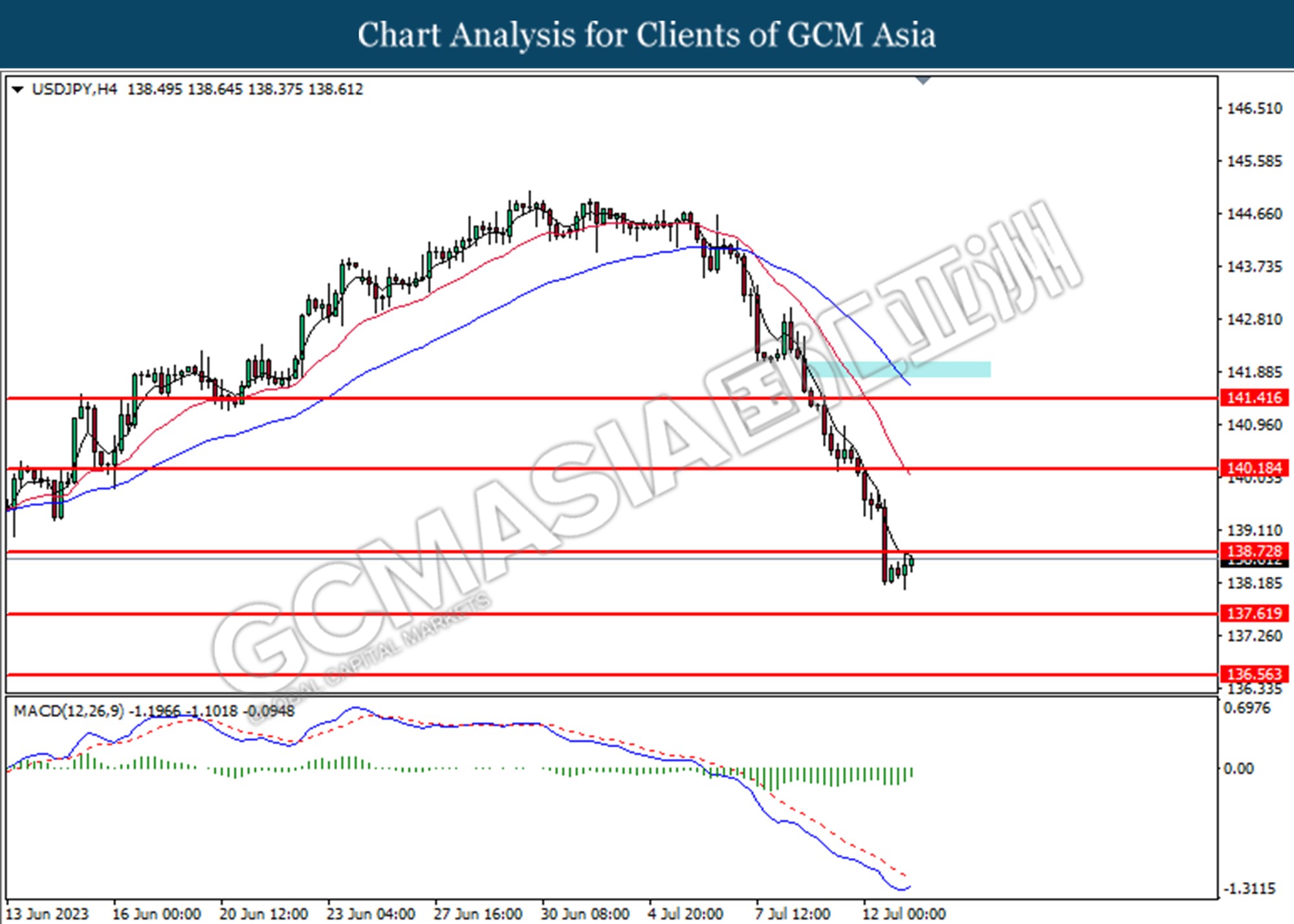

USDJPY, H4: USDJPY was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains towards the resistance level at 138.70.

Resistance level: 138.70, 140.20

Support level: 137.60, 136.55

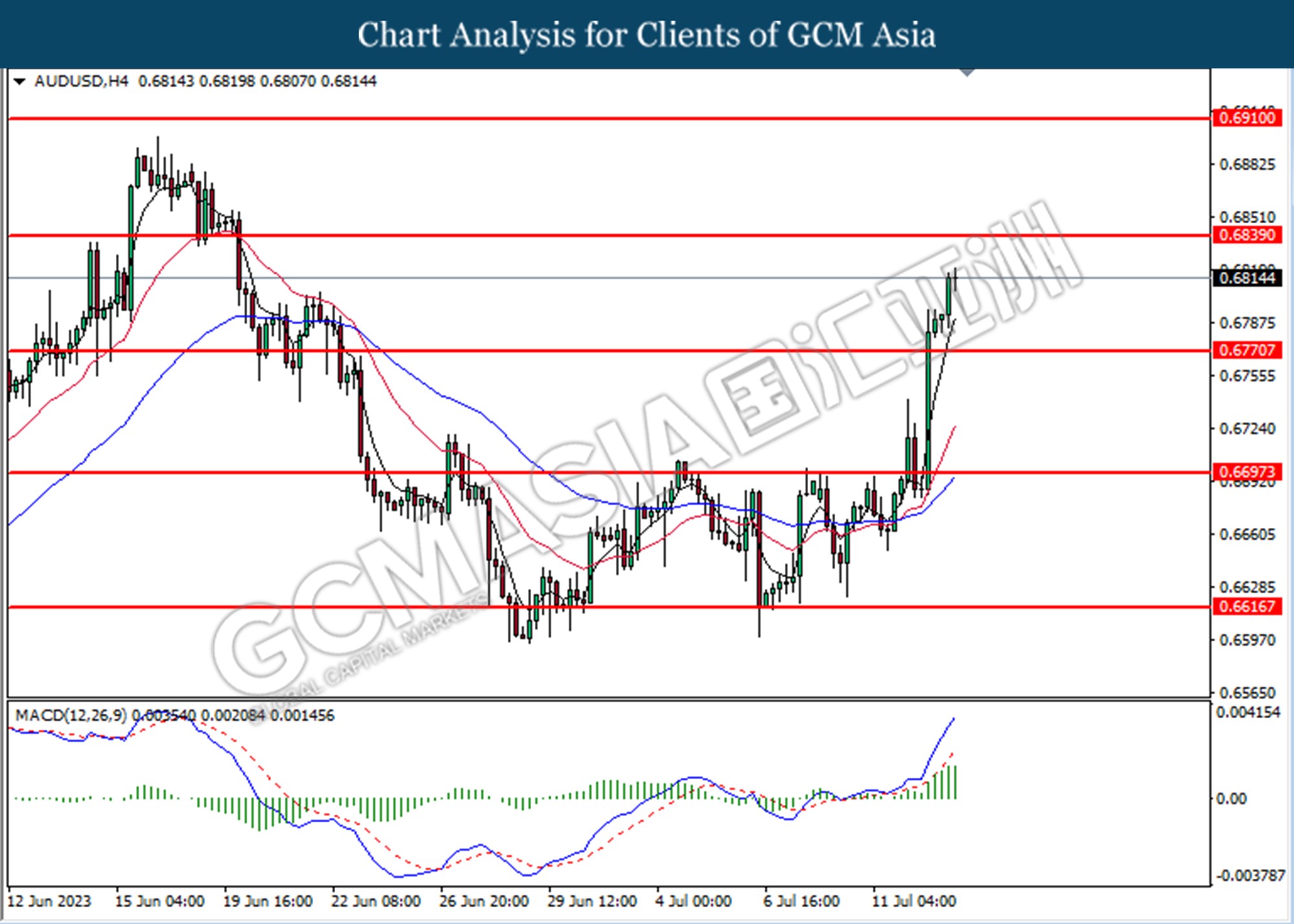

AUDUSD, H4: AUDUSD was traded higher following the prior breaks above the prior resistance level at 0.6770. However. MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 0.6840, 0.6910

Support level: 0.6770, 0.6700

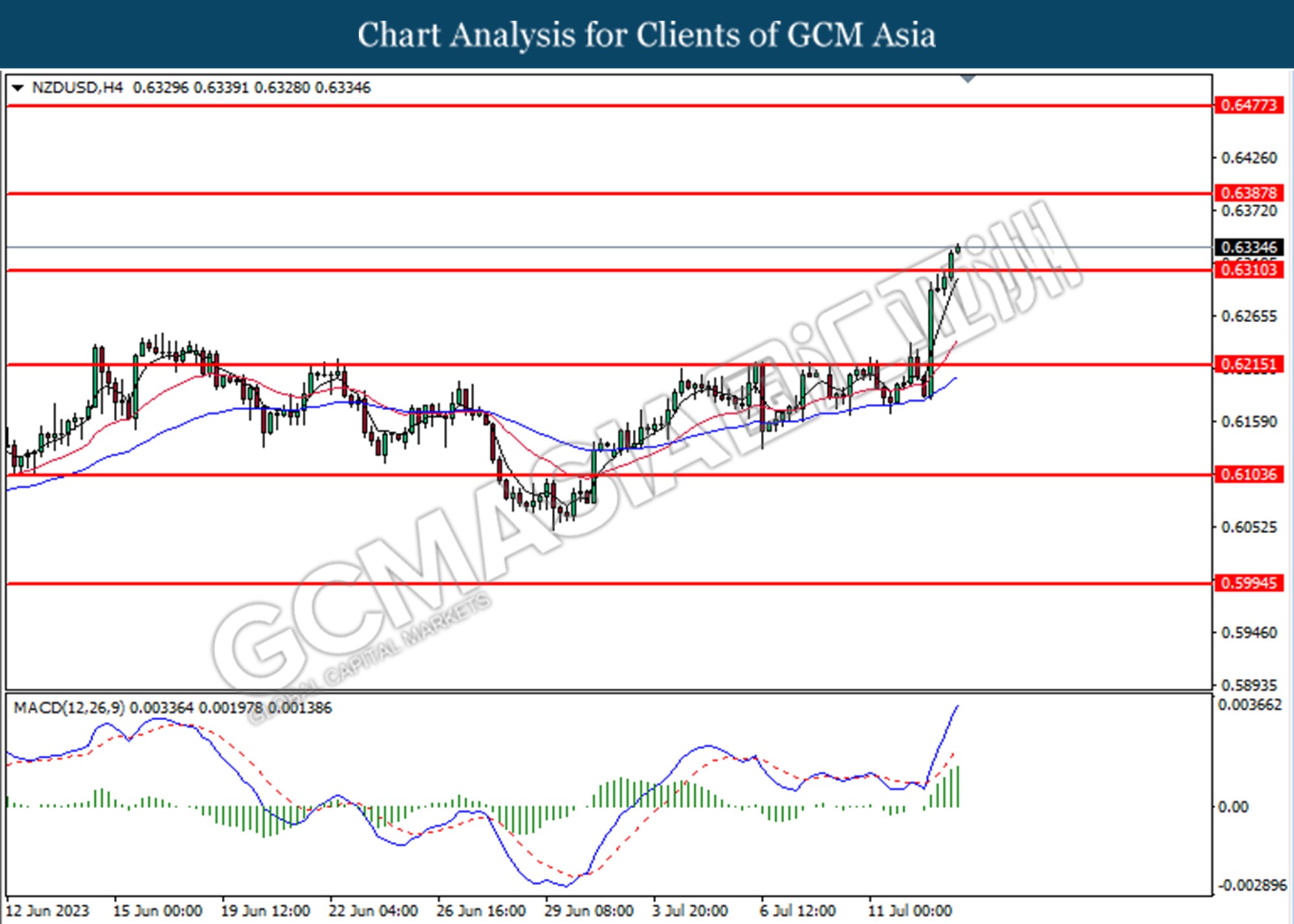

NZDUSD, H4: NZDUSD was traded higher following the prior breaks above the previous resistance level at 0.6310. MACD which illustrated increasing bullish momentum suggests the pair extended its gains towards to the resistance level.

Resistance level: 0.6390, 0.6480

Support level: 0.6310, 0.6215

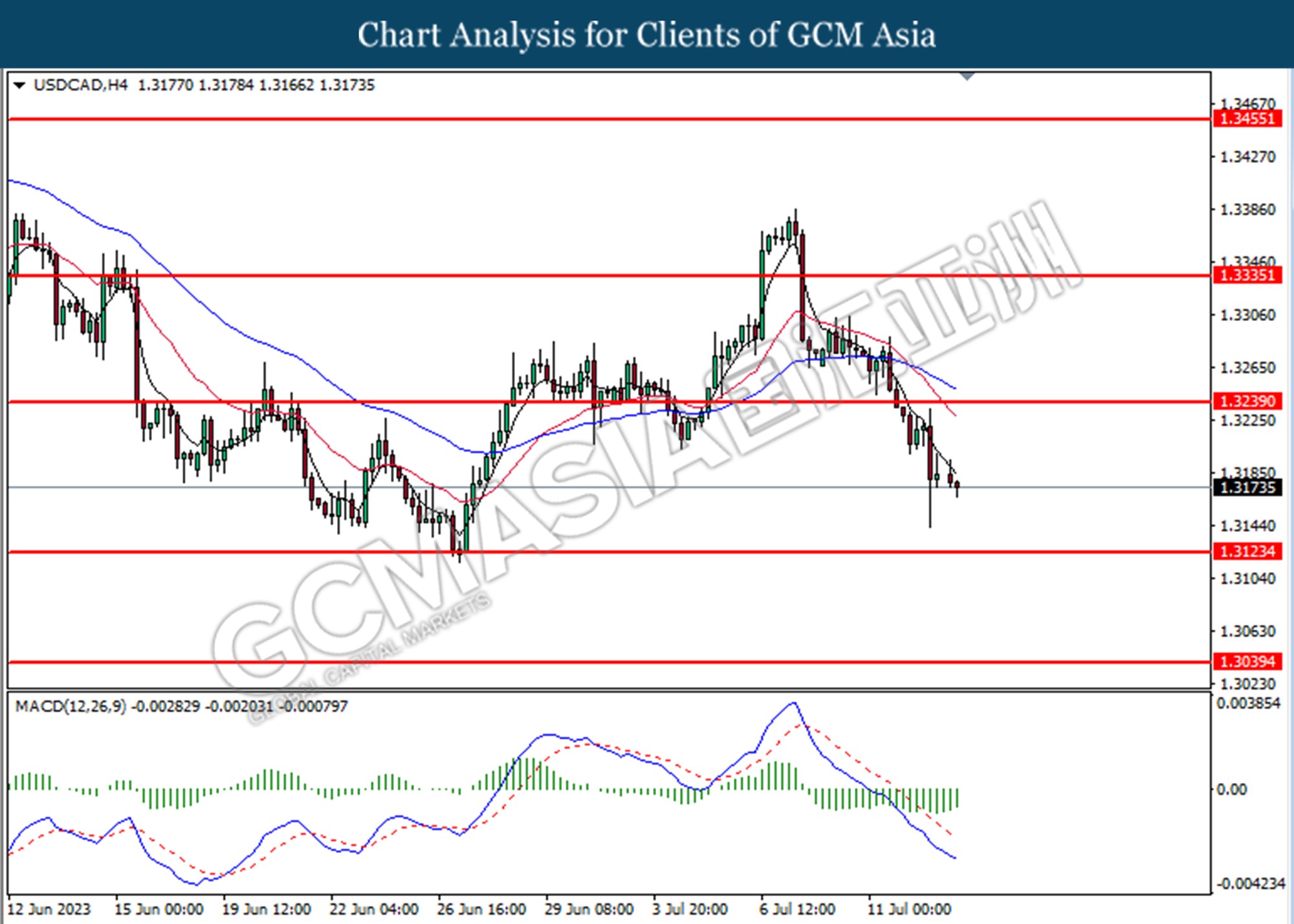

USDCAD, H4: USDCAD was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.3240, 1.3335

Support level: 1.3140, 1.3040

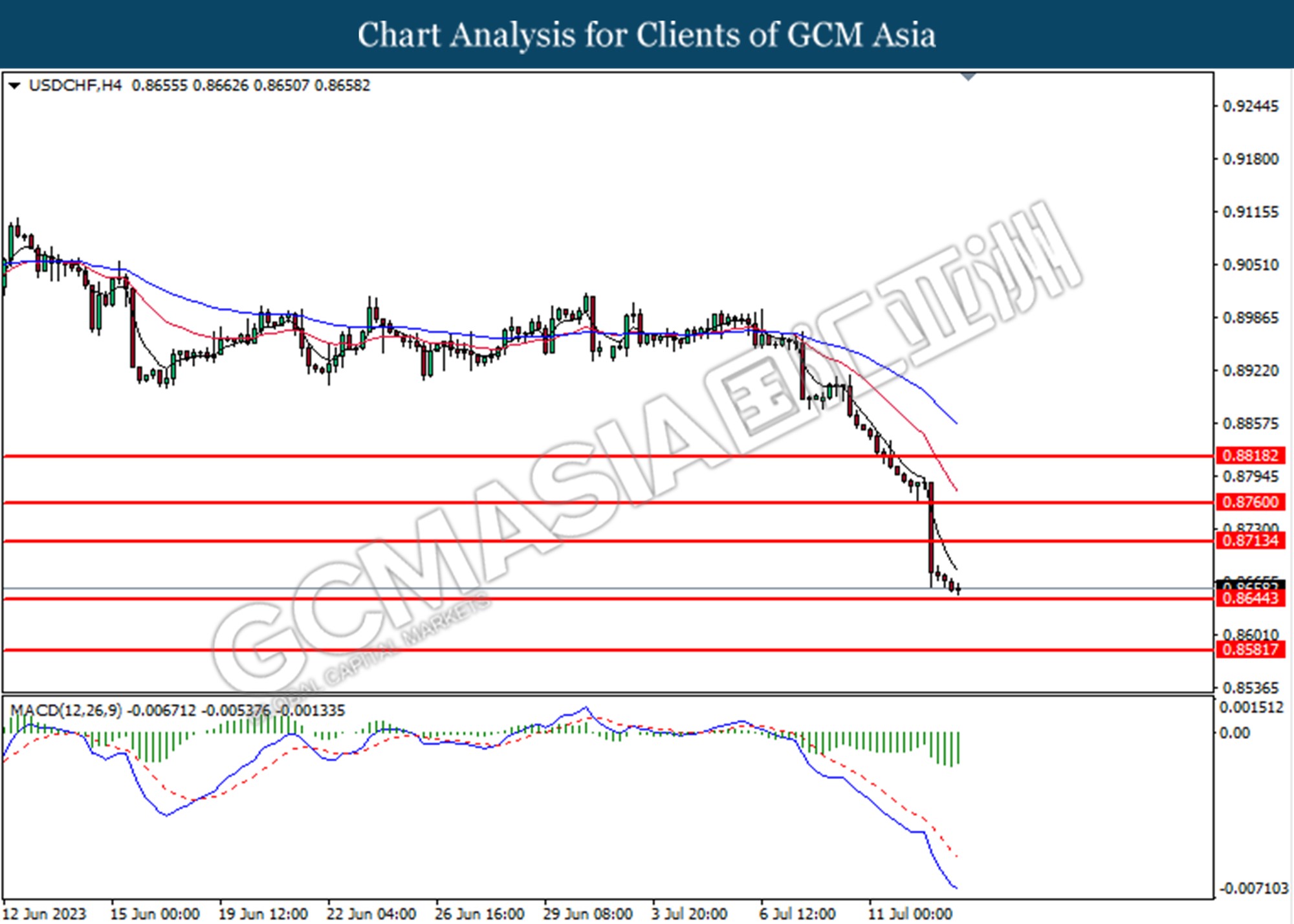

USDCHF, H4: USDCHF was traded lower following the prior breaks below from the previous support level at 0.8715. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 0.8760, 0.8715

Support level: 0.8645, 0.8580

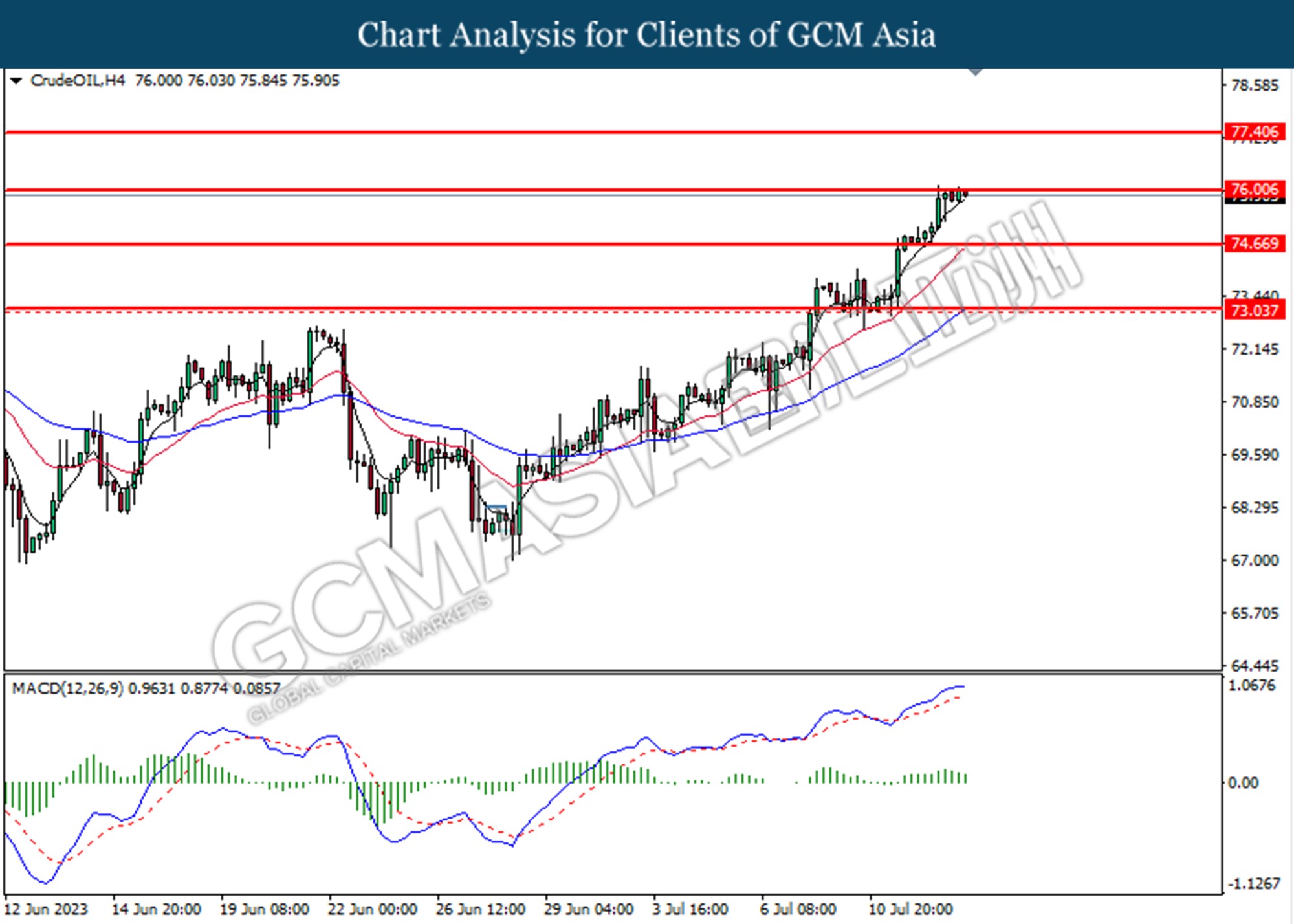

CrudeOIL, H4: Crude oil price was traded higher while currently testing for the resistance level at 76.00. However, MACD which illustrated diminishing bullish momentum suggests the commodity undergoes a technical correction in a short term.

Resistance level: 76.00, 77.40

Support level: 74.65, 73.15

GOLD_, H4: Gold price was traded higher following the prior breaks above the previous resistance level at 1946.60. However, MACD which illustrated diminishing bullish momentum suggests the commodity undergoes a technical correction in a short term.

Resistance level: 1965.60, 1963.25

Support level: 1946.60, 1933.05