13 July 2023 Morning Session Analysis

Greenback plunged as inflation rate cooled further in June.

The dollar index, which was traded against a basket of six major currencies, extended its ground of losses yesterday as the US inflation cooled for the 12th straight month in June. According to the latest Consumer Price Index released Wednesday by the Bureau of Labor Statistics, the US annual inflation slowed to 3% last month, registering the record of the smallest year-on-year increase since March 2021 and following a 4.0% rise in May. The June Consumer Price Index (CPI) reading was just slightly above the average inflation level of 2.9% observed two decades before the global financial crisis. The data further indicates a moderation in the underlying price trends, highlighting an improved inflationary environment. With that, it probably will discourage the Federal Reserve from raising interest rates aggressively throughout the end of the year. However, it is noteworthy to highlight that the inflation rate remains well above the Federal Reserve’s target of 2% while the labour market continues to exhibit tight conditions. Therefore, the market participants are awaiting for the speeches and statements from the Federal officials in order to assess how far their tightening path may go. As of writing, the dollar index sank -1.15% to 100.55.

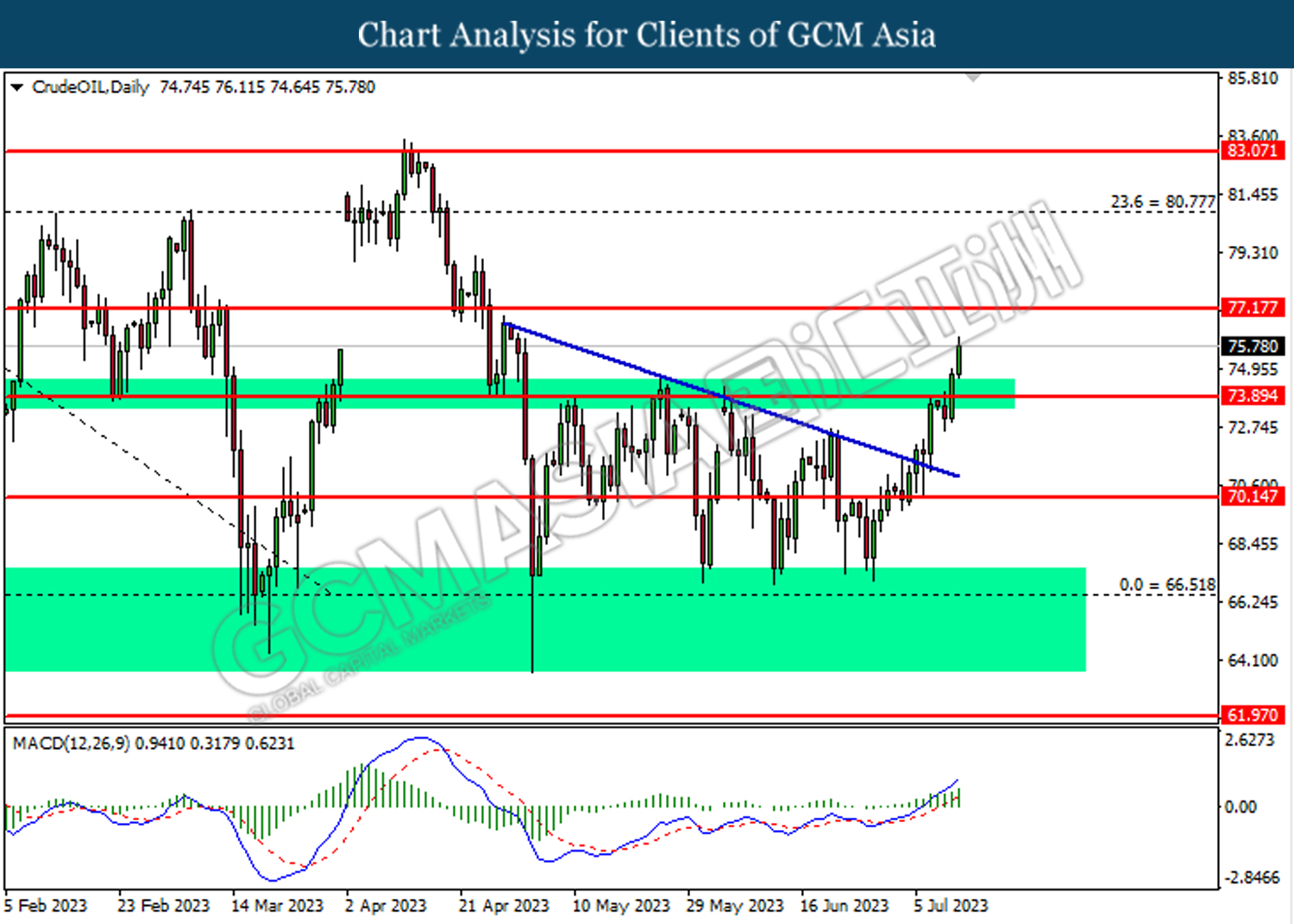

In the commodities market, crude oil prices edged up by 1.48% to $75.85 per barrel as the weaker–than–expected CPI weighed on the US dollar, prompting the demand for oil products to surge subsequently. Besides, gold prices ticked up 0.02% to $1957.85 per troy ounce as the US inflation rate showed further signs of easing.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 CrudeOIL IEA Monthly Report

19:00 CrudeOIL OPEC Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:00 | CNY – Trade Balance (USD) (Jun) | 65.81B | 93.90B | – |

| 14:00 | GBP – GDP (MoM) (May) | 0.2% | 0.4% | – |

| 20:30 | USD – Initial Jobless Claim | 248K | 249K | – |

| 20:30 | USD – PPI (MoM) (Jun) | -0.3% | 0.2% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout below the previous support level at 100.65. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 99.40.

Resistance level: 100.65, 103.00

Support level: 99.40, 97.75

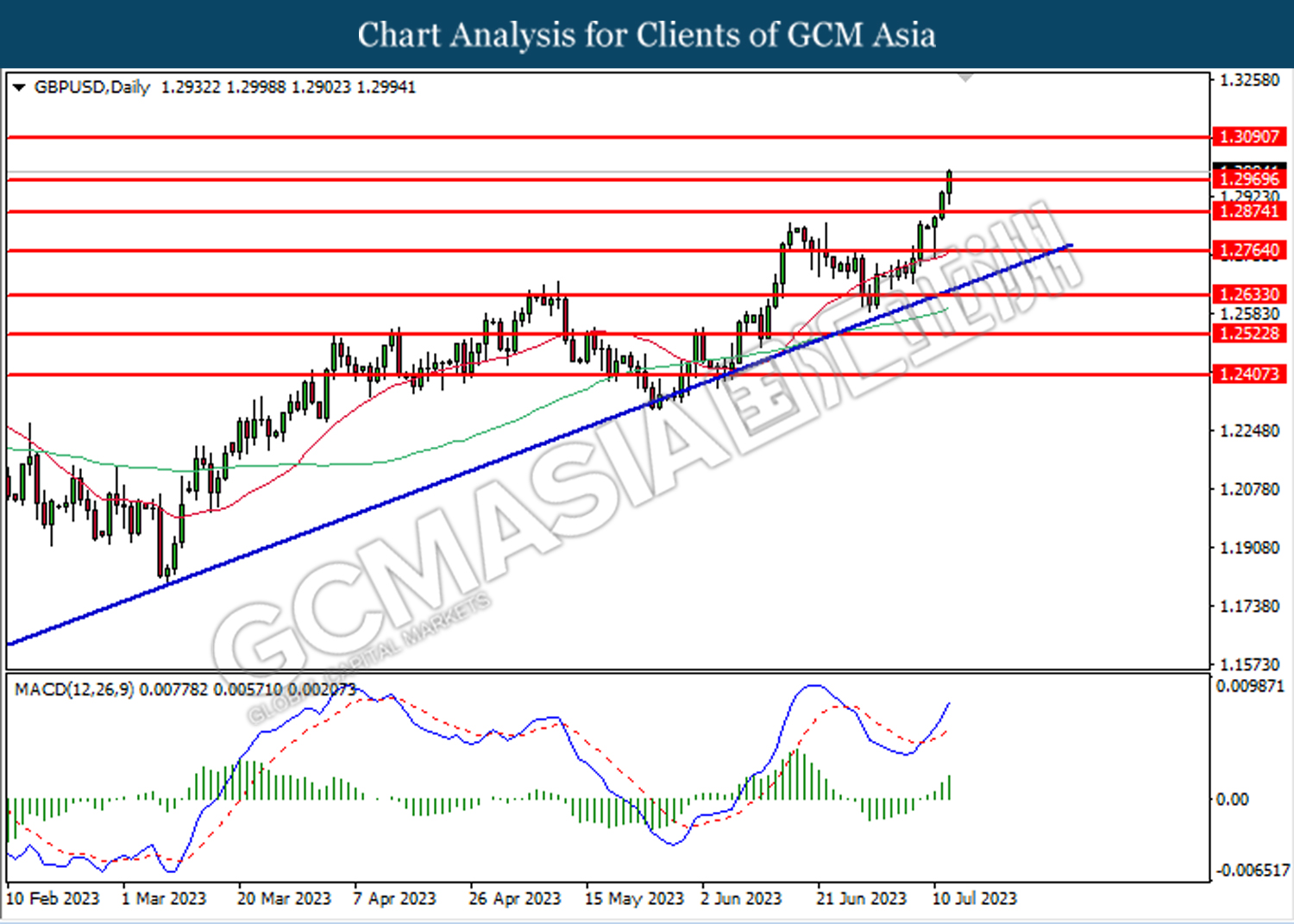

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2970. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.3090.

Resistance level: 1.3090, 1.3260

Support level: 1.2970, 1.2875

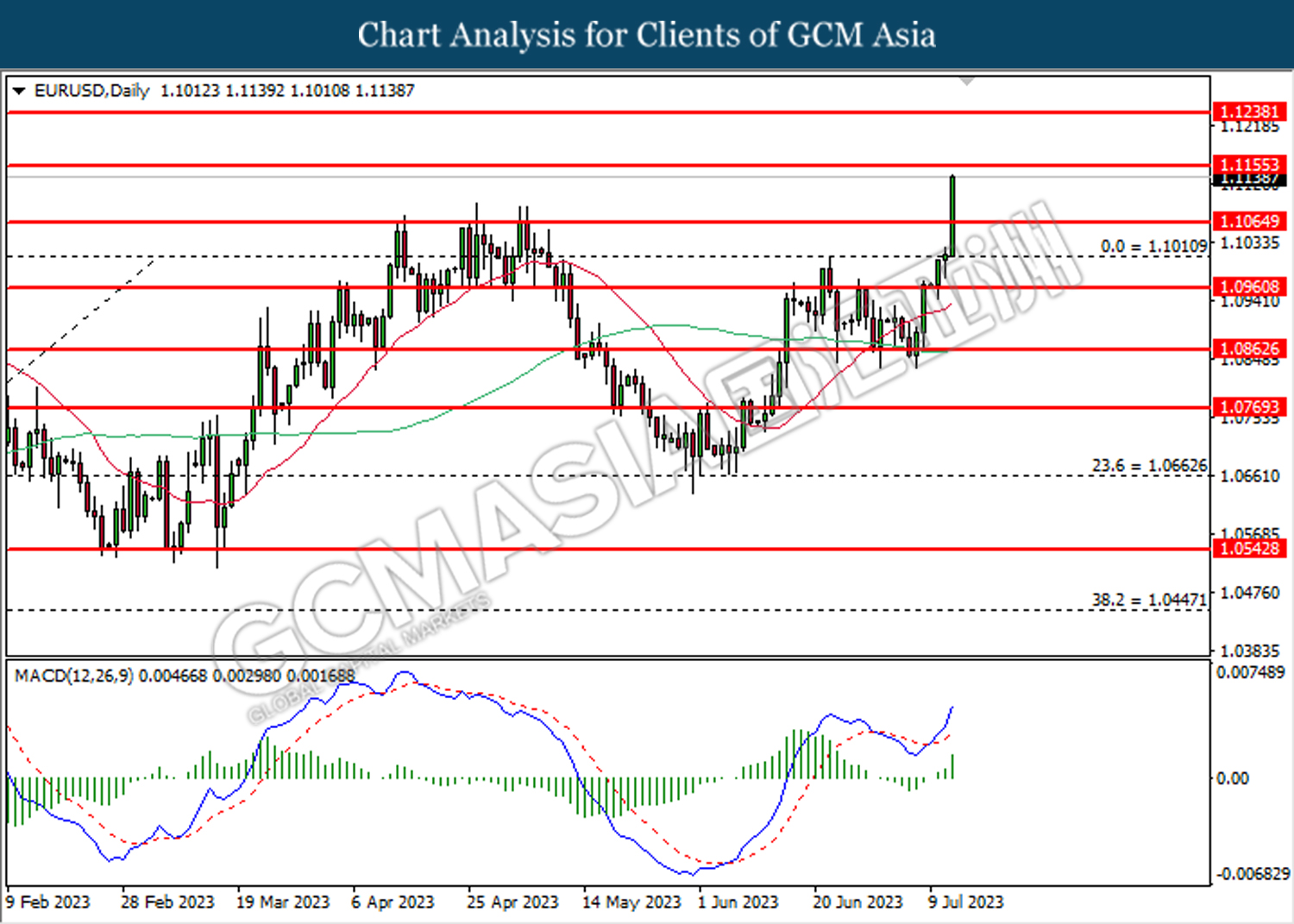

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.1065. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the previous resistance level at 1.1155.

Resistance level: 1.1155, 1.1240

Support level: 1.1065, 1.1010

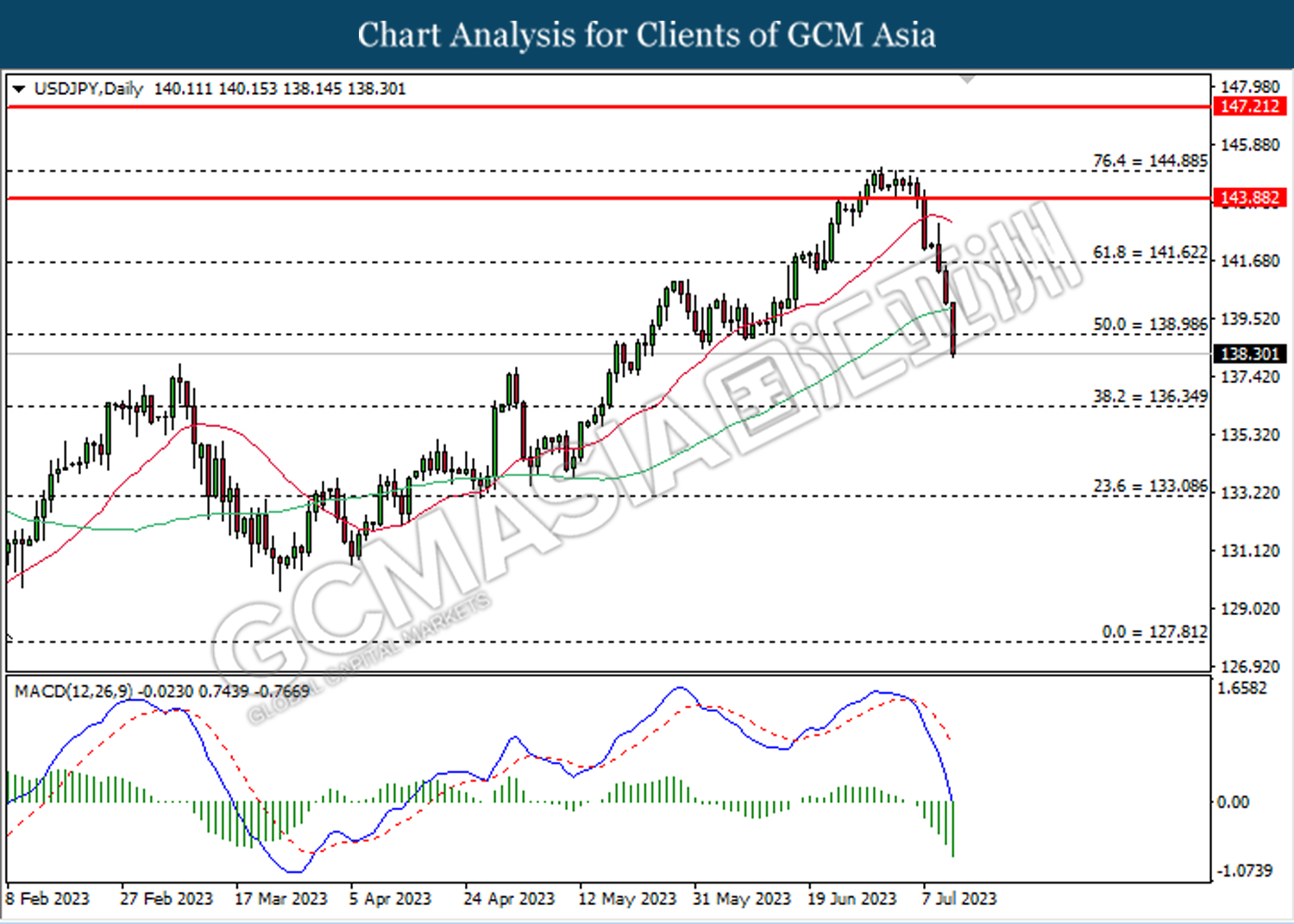

USDJPY, Daily: USDJPY was traded lower following the prior breakout below the previous support level at 139.00. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 139.00, 141.60

Support level: 136.35, 133.10

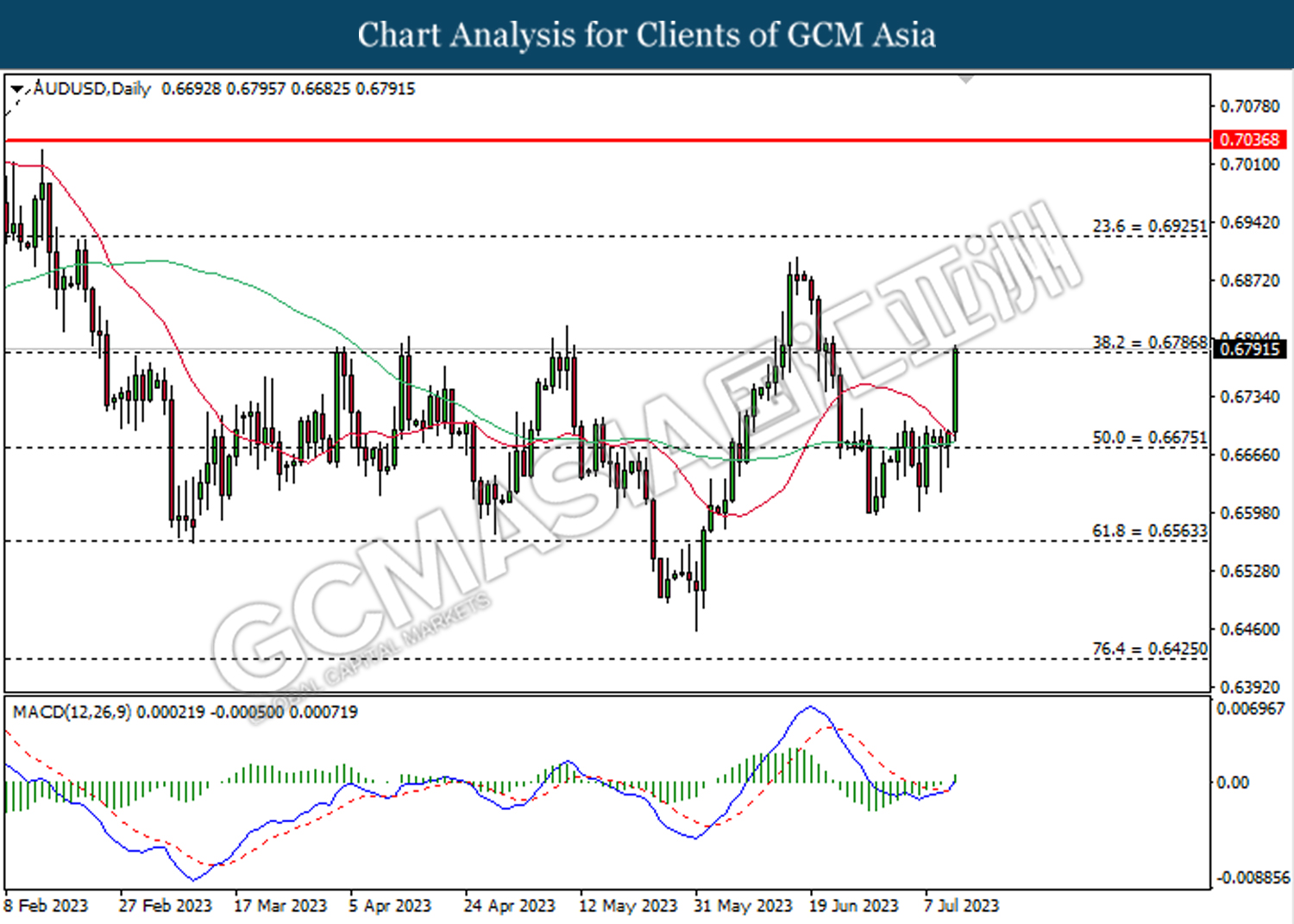

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6785. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

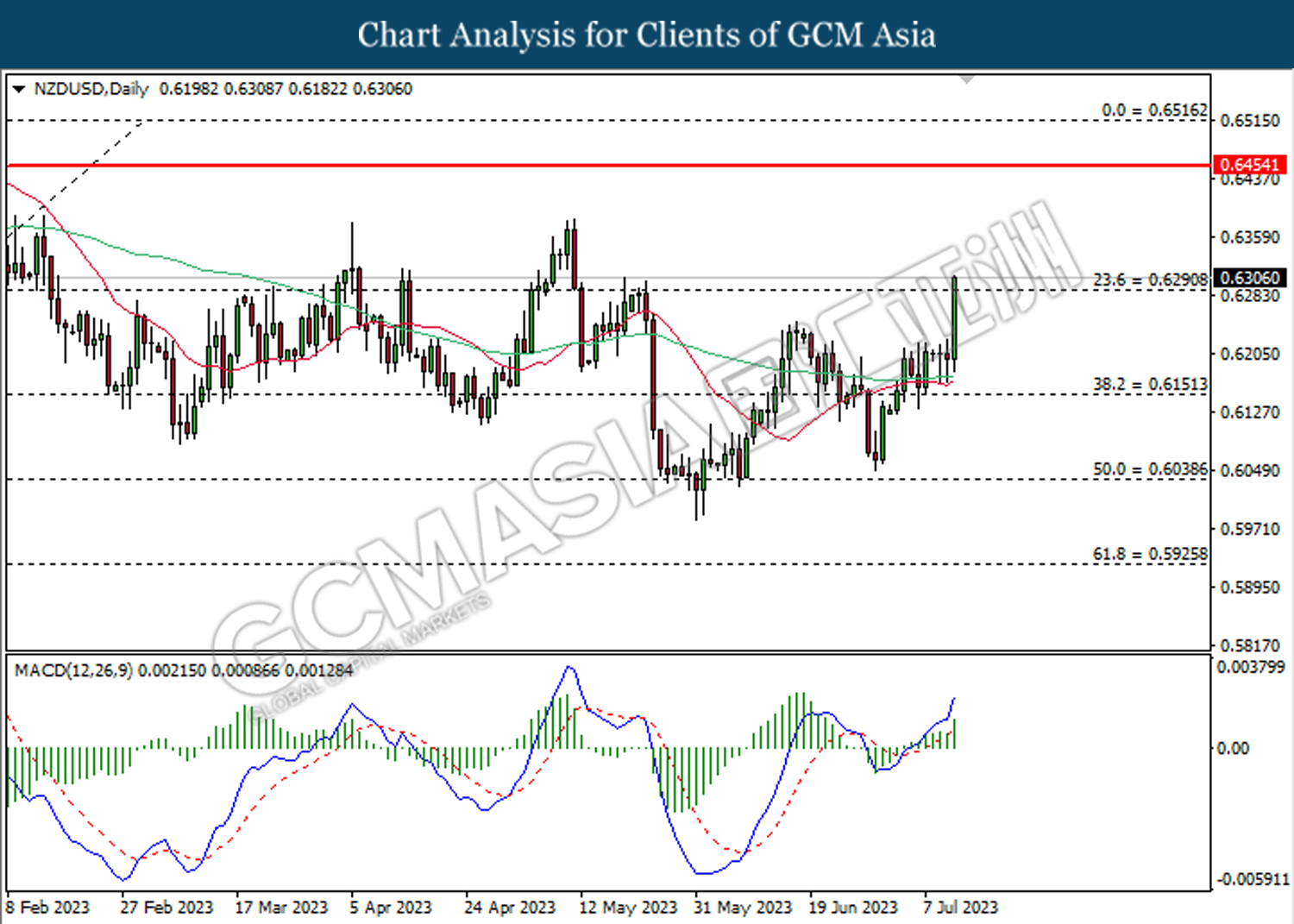

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6290. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6455.

Resistance level: 0.6455, 0.6515

Support level: 0.6290, 0.6150

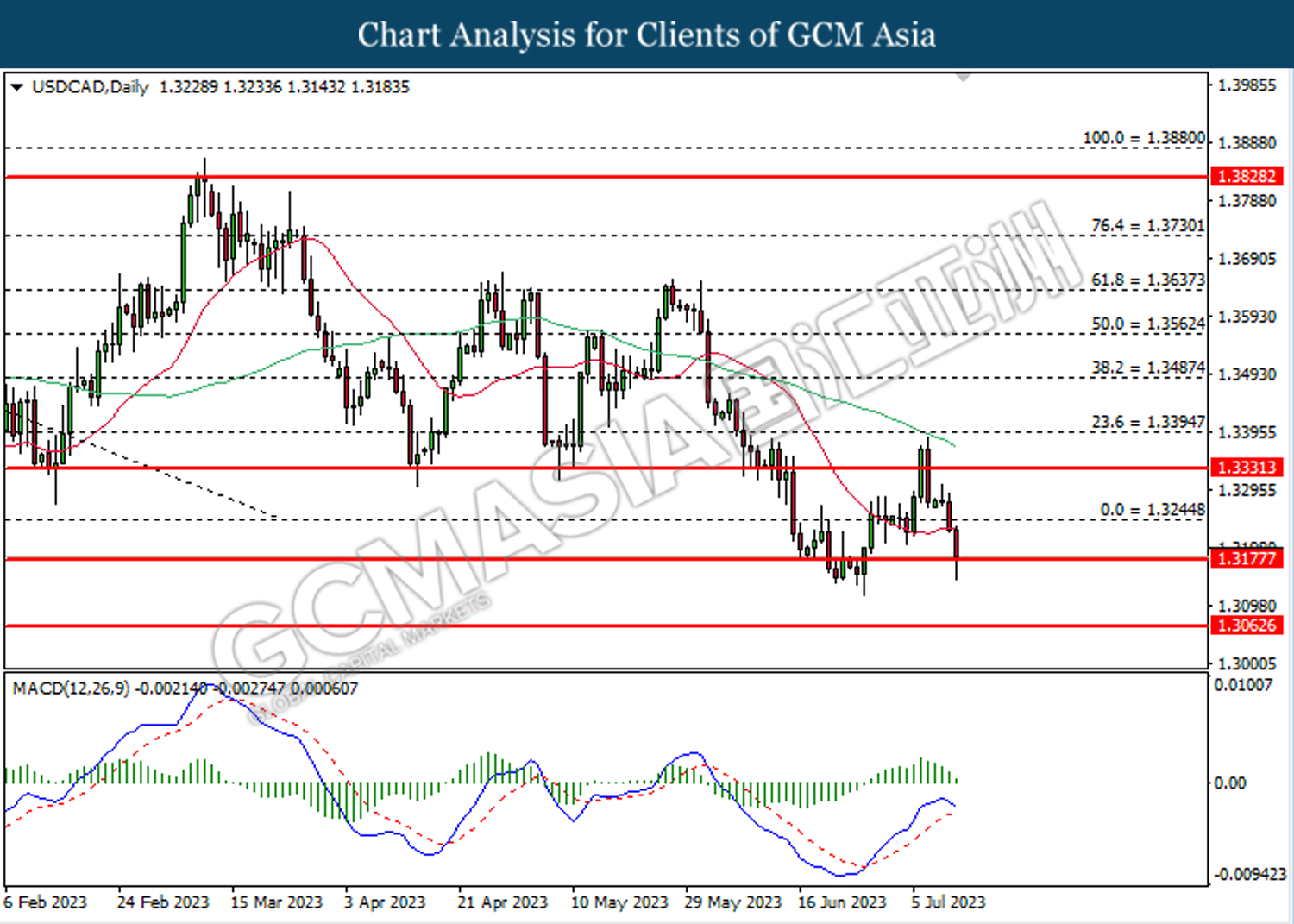

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3175. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level at 1.3175.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

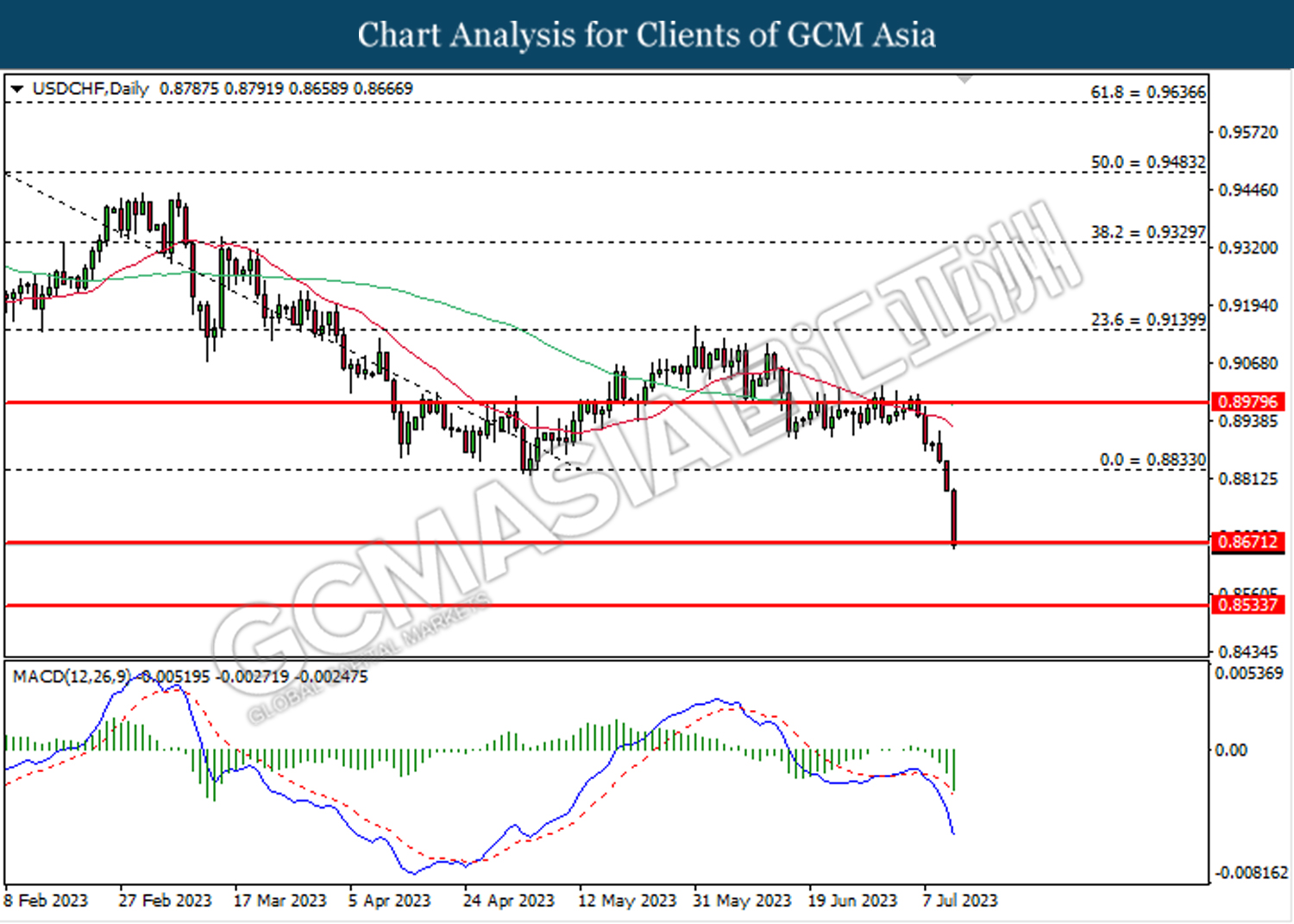

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.8670. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.8835, 0.8980

Support level: 0.8670, 0.8535

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 73.90. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 77.15.

Resistance level: 77.15, 80.75

Support level: 73.90, 70.15

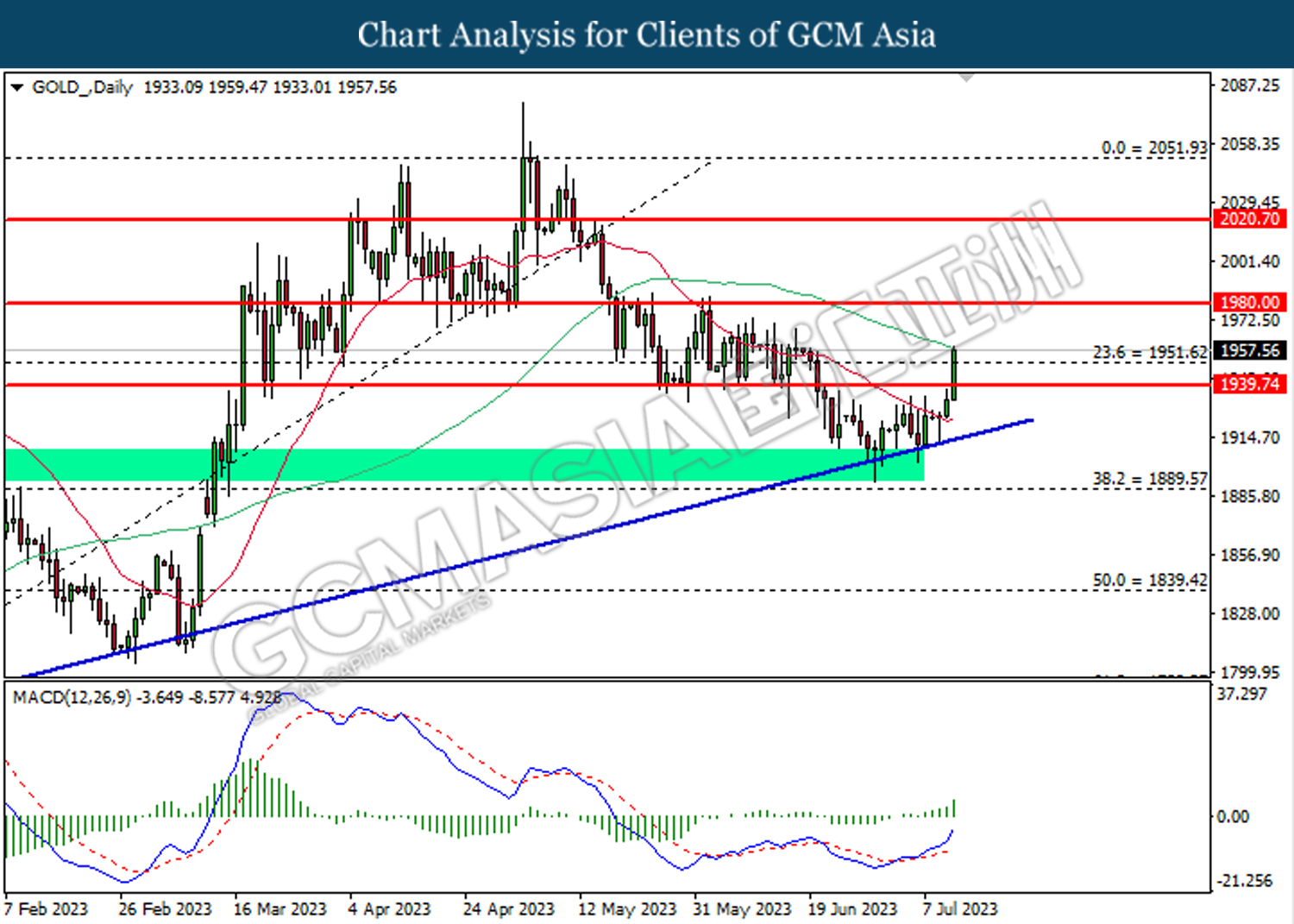

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1951.60. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1939.75