13 November 2020 Afternoon Session Analysis

Dollar held steady amid COVID-19 uncertainty.

During late Asian session, the dollar index which traded against a basket of six major currency pairs remain steady and rose following worsening cases of COVID-19 cases in Europe and the U.S reducing the appeal for risker currencies and spurred demand for the greenback as safe-haven currency. Despite with recent positive development where Pfizer and Biotech reported a 90% efficiency in their trial vaccine, market remains cautious over logistical issues in mass producing and transporting these vaccine would require a certain period of time. Thus, the optimism on vaccine to be available in near term have diminished. On data front, improving job markets also weigh on the dollar. On data front, initial jobless claims improved to 709K, better than market expectation of 735K. Still, US CPI which came in at 0.0% against market expectation of 0.02% proved that U.S recovery still have a long way to go. At the time of writing, dollar index edge higher 0.02% to 92.96.

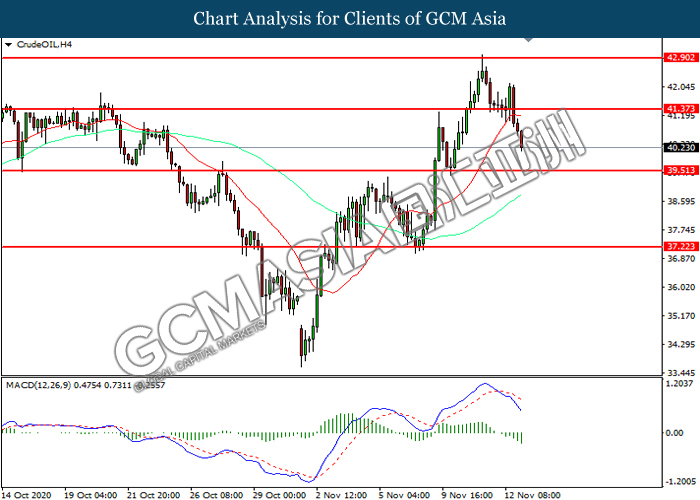

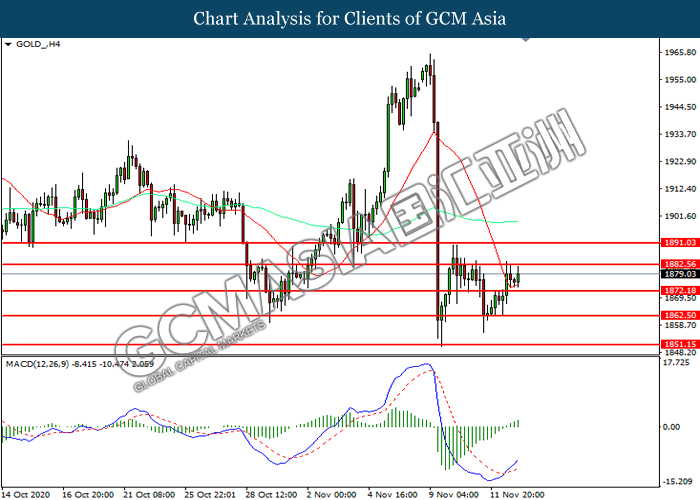

In the commodities market, crude oil price plunged 1.48% to $40.24 per barrel as of writing amid COVID-19 fears and increasing supply continue to dominate the market. U.S. coronavirus cases hit a new daily record high on Wednesday, with 140,543 reported, marking the ninth straight day where they stood at above 100,000. The worsening coronavirus would slowed the economic recovery, thus affecting the future consumption outlook for the commodity. Besides that, sentiment also continue to be pressured by increasing supply reported by EIA recently. On the other hand, gold price slips 0.03% to $1877.68 a troy ounce at the time of writing following dollar strength.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

00:00 GBP BoE Gov Bailey Speaks

(14th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – PPI(MoM)(Oct) | 0.4% | 0.2% | – |

Technical Analysis

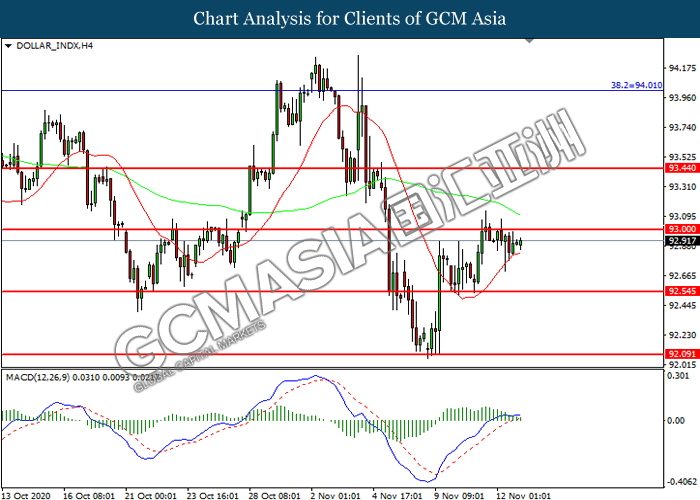

DOLLAR_INDX, H1: Dollar index was traded within a range while currently testing the resistance level at 93.00. MACD which illustrated diminishing bullish momentum suggest the index to be traded lower in short-term as technical correction.

Resistance level: 93.00, 93.45

Support level: 92.55, 92.10

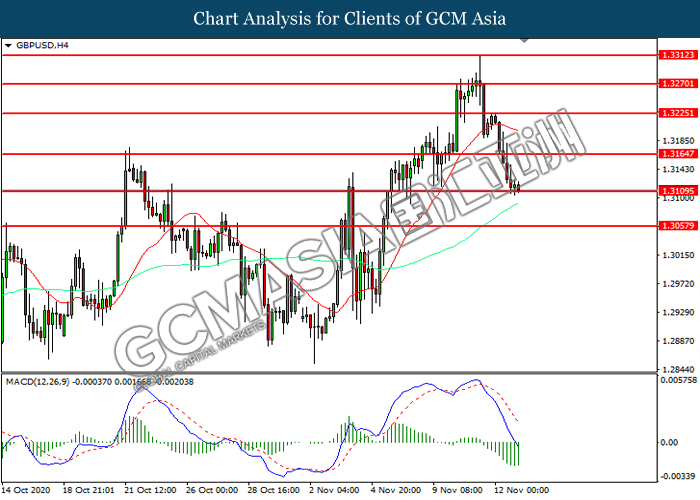

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.3110. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3165, 1.3225

Support level: 1.3110, 1.3055

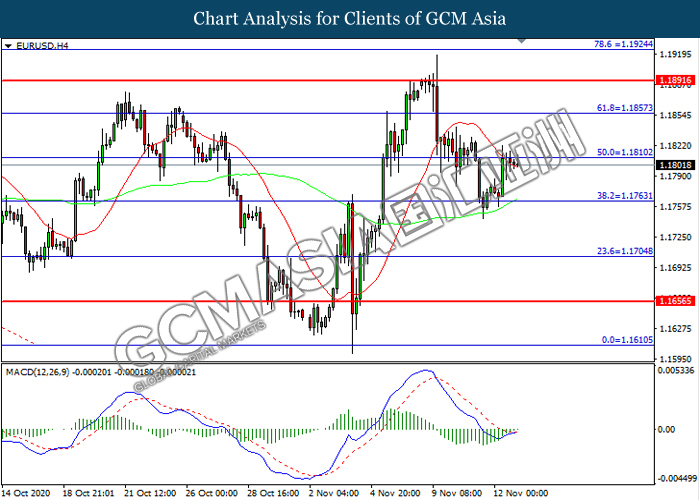

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.1810. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1810, 1.1855

Support level: 1.1765, 1.1705

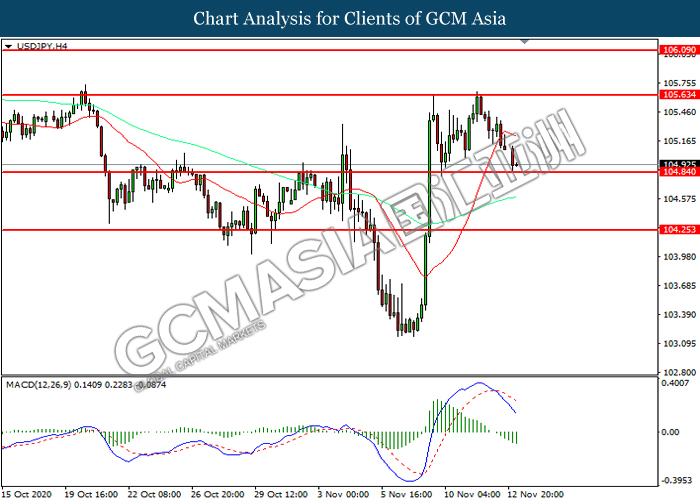

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 104.85. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 105.65, 106.10

Support level: 104.85, 104.25

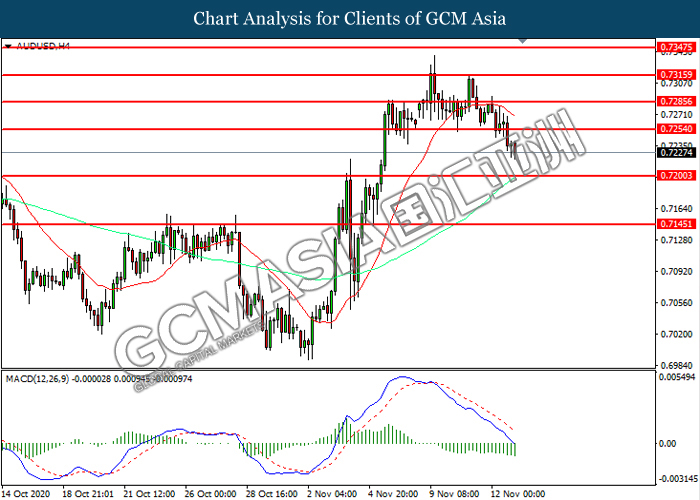

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level at 0.7255. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.7200.

Resistance level: 0.7255, 0.7285

Support level: 0.7200, 0.7145

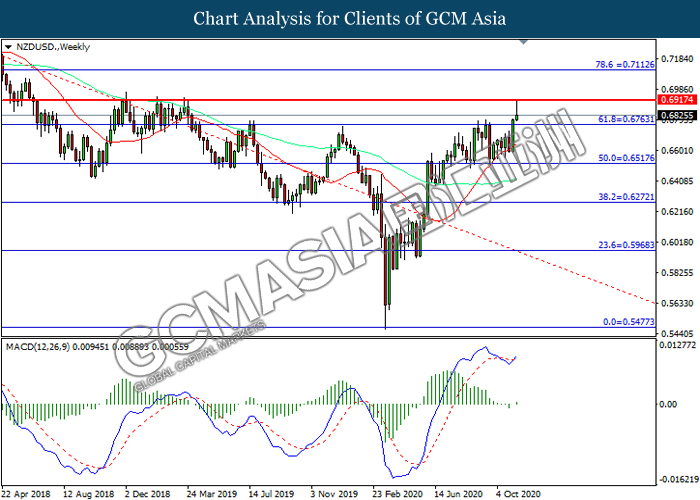

NZDUSD, Weekly: NZDUSD was traded higher while currently testing near the resistance level at 0.6915. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6915, 0.7110

Support level: 0.6765, 0.6515

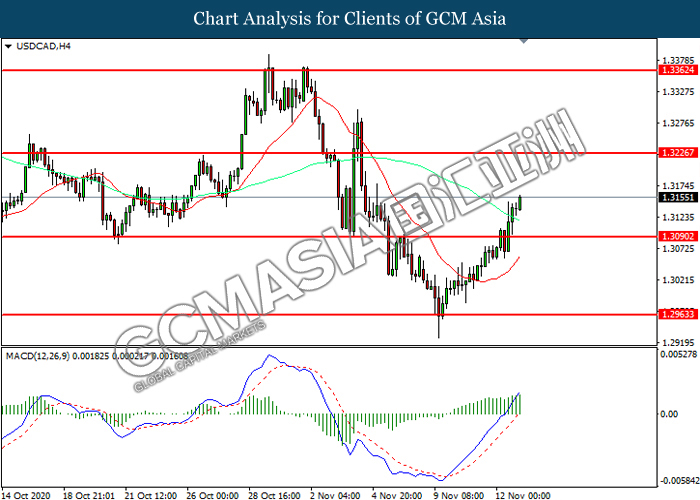

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3090. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.3225.

Resistance level: 1.3225, 1.3360

Support level: 1.3090, 1.2965

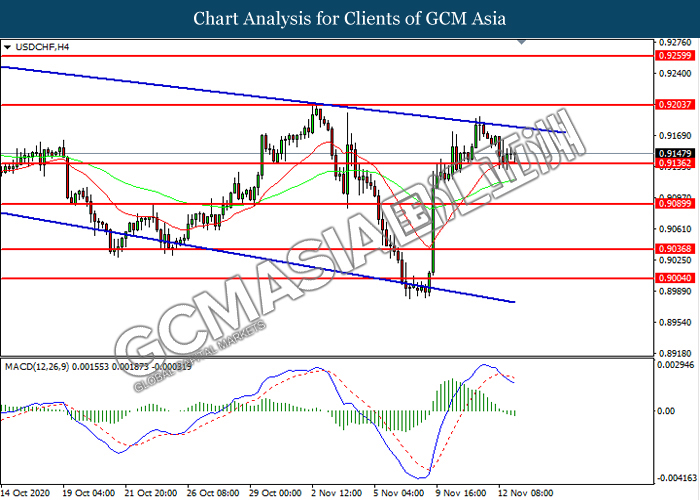

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9135. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9205, 0.9260

Support level: 0.9135, 0.9090

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 41.35. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 39.50.

Resistance level: 41.35, 42.90

Support level: 39.50, 37.20

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1882.55. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1882.55, 1891.05

Support level: 1872.20, 1862.50