13 November 2020 Morning Session Analysis

Pound plunged amid disappointing economic data.

Pound sterling which acts as one of the major currency that being traded in the FX market was sell-off massively by the market participant after downbeat UK economic data released. According to the Office for National Statistics, UK GDP for the last month was came in at 1.1% only, far lower than the economist forecast at 1.5%, showing that economic recovery has lost its momentum ahead of the second round of lockdown. It is noteworthy that the data was measured before the implementation of the second round lockdown, which signalling UK GDP growth might turn even worse in the upcoming month. Prior to weeks ago, UK government decided to re-implement a lockdown measure but slightly lighter while comparing to the measure in spring, in order to curb the fast-spreading virus after a resurgence of pandemic in UK. However, the new round of national lockdown has also halted part of the major economy activity in UK, which shifting the pace of economic recovery backward. Besides, UK Finance Minister Rishi Sunak also revealed that the steps taken by the government to restrict the spread of Covid-19 were likely to slow down the economy growth since September. During Asian early trading session, the pair of GBP/USD ticked up 0.05% to 1.3120.

In the commodities market, the crude oil price dropped by 0.36% to $41.00 per barrel as US oil inventory reported a surprise stockpile for the week to 6th November. According to the EIA, US Crude Oil Inventory data came in at 4.278M, lower than the economist forecast at -0.913M, showing supply glut issue continues suppressing the black commodity market sentiment. Besides, gold price inched down 0.05% to $1876.25 per troy ounce amid dollar’s strengthening.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

00:00 GBP BoE Gov Bailey Speaks

(14th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – PPI(MoM)(Oct) | 0.4% | 0.2% | – |

Technical Analysis

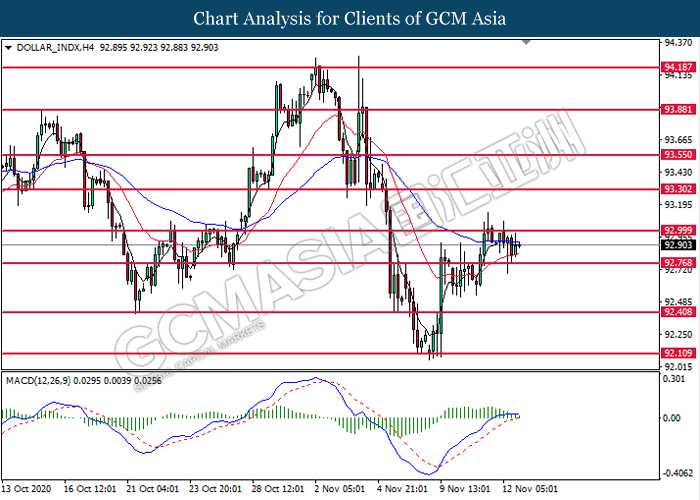

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level at 93.00. MACD which illustrate diminishing bullish momentum signal suggest the dollar to extend its losses toward the support level at 92.75.

Resistance level: 93.00, 93.30

Support level: 92.75, 92.40

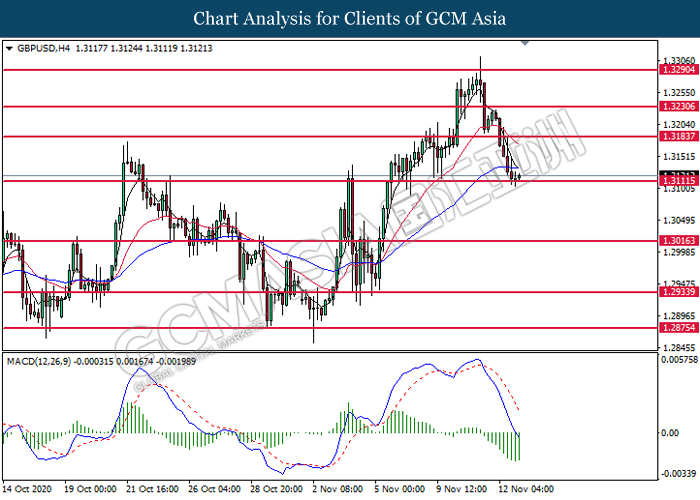

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.3110. MACD which illustrates bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 1.3110.

Resistance level: 1.3185, 1.3230

Support level: 1.3110, 1.3015

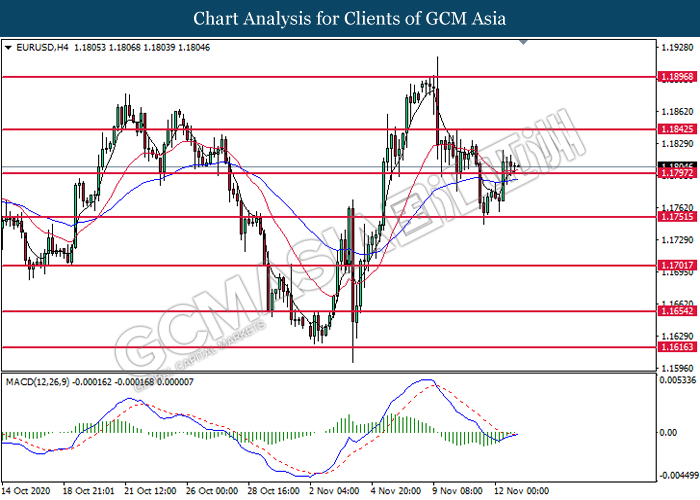

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level at 1.1795. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its gains toward the resistance level at 1.1845.

Resistance level: 1.1845, 1.1895

Support level: 1.1795, 1.1750

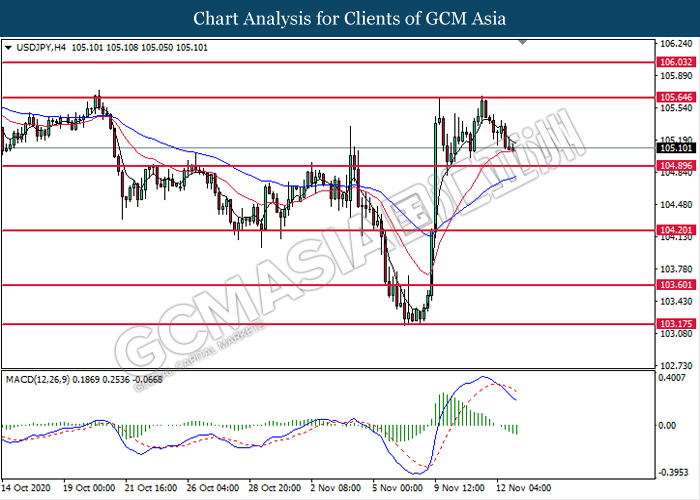

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 105.65. MACD which illustrate increasing of bearish momentum suggest the pair to extend its losses toward the support level at 104.90.

Resistance level: 105.65, 106.05

Support level: 104.90, 104.20

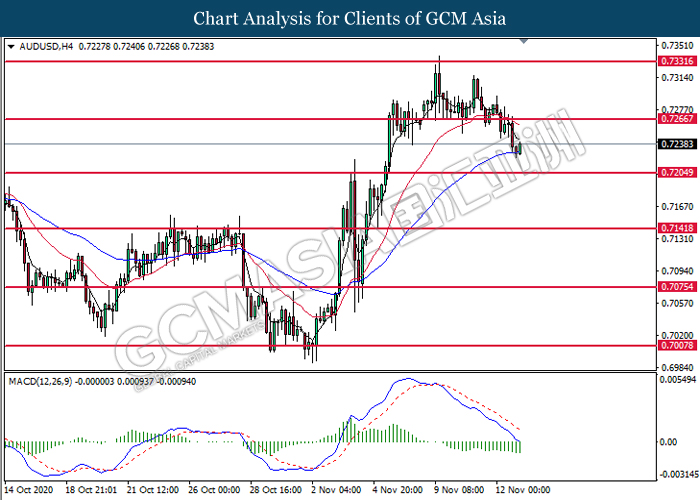

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level at 0.7265. MACD which illustrate bearish bias momentum suggest the pair to extend its losses toward the support level at 0.7205.

Resistance level: 0.7265, 0.7330

Support level: 0.7205, 0.7140

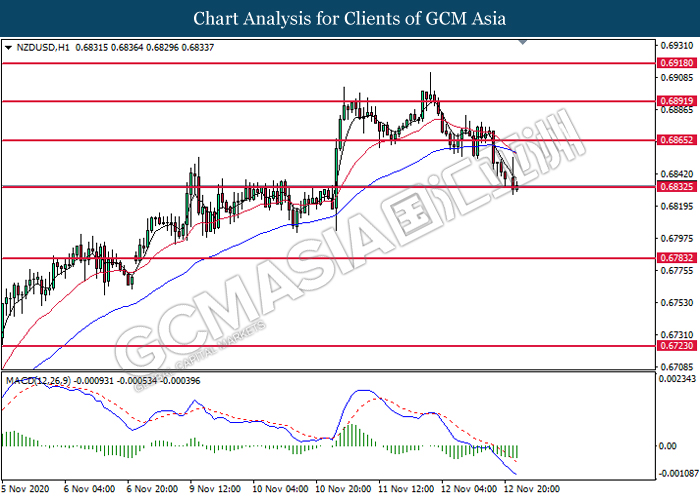

NZDUSD, H1: NZDUSD was traded lower while currently testing the support level at 0.6835. MACD which illustrate bearish bias momentum signal suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6865, 0.6890

Support level: 0.6835, 0.6785

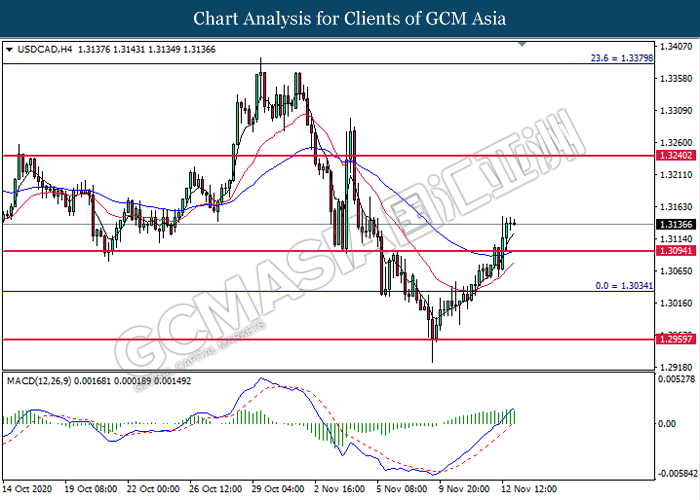

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3095. MACD which illustrate bullish bias momentum signal suggest the pair to extend its gains toward the resistance level at 1.3240.

Resistance level: 1.3240, 1.3380

Support level: 1.3095, 1.3035

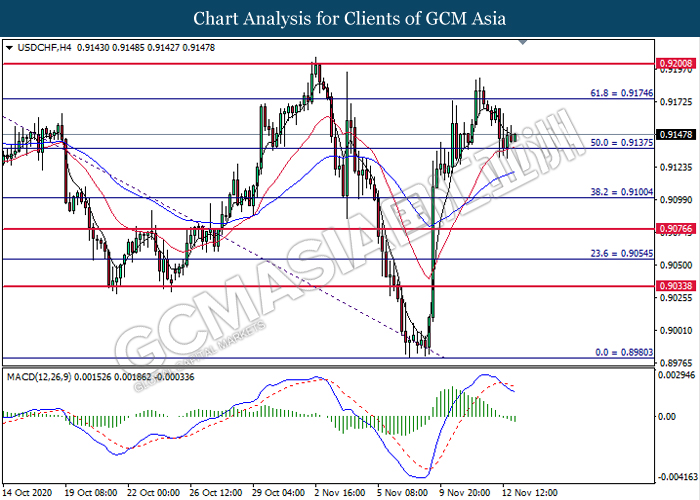

USDCHF, H4: USDCHF was traded lower while currently testing the support level near 0.9135. MACD which display diminishing bearish bias momentum signal suggest the pair to extend its losses after it breakout below the support level.

Resistance level: 0.9175, 0.9200

Support level: 0.9135, 0.9100

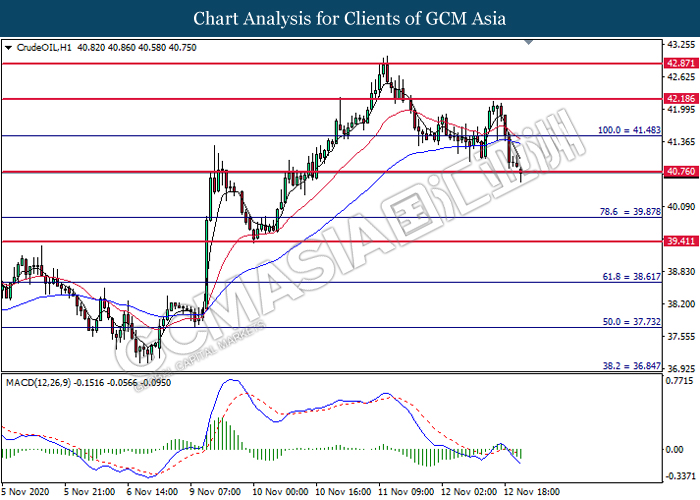

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level at 40.75. MACD which illustrate bearish bias momentum signal suggest the commodity to extend its losses after it successfully breakout below the support level at 40.75.

Resistance level: 41.50, 42.20

Support level: 40.75, 39.85

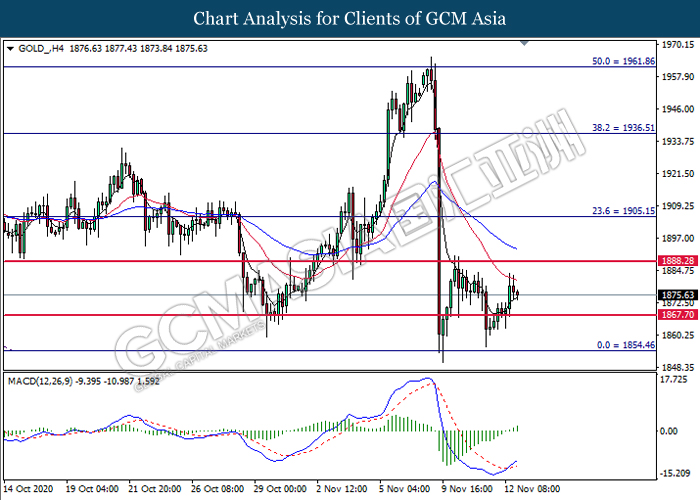

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level at 1867.70. MACD which illustrate bullish bias momentum signal suggest the commodity to extend its gains toward the resistance level at 1888.30.

Resistance level: 1888.30, 1905.15

Support level: 1867.70, 1854.45