14 January 2021 Morning Session Analysis

Dollar held gains following CPI data, stabilize yields

During early Asian session, the dollar index which traded against a basket of six major currency pairs have rose back into positive territory following the recent release of CPI data and stabilising U.S treasury yields. On data front, U.S Core CPI for December was in line with market expectation of 0.1%, although it was still slightly lower than previous reading. However, US showed annual CPI stood at 1.4% in December, slightly above the 1.3% expected. On the other hand, benchmark 10-year Treasury yields fell more than 6 basis points from a 10-month high. They last traded 2 basis points lower at 1.12%, helping the greenback traded higher against its peers. Market also expects that a huge sum in government borrowing to fund stimulus plan would possibly lead to a higher U.S rates and make the dollar attractive, thus buying into the greenback. At the time of writing, dollar index rose 0.27% to 90.25.

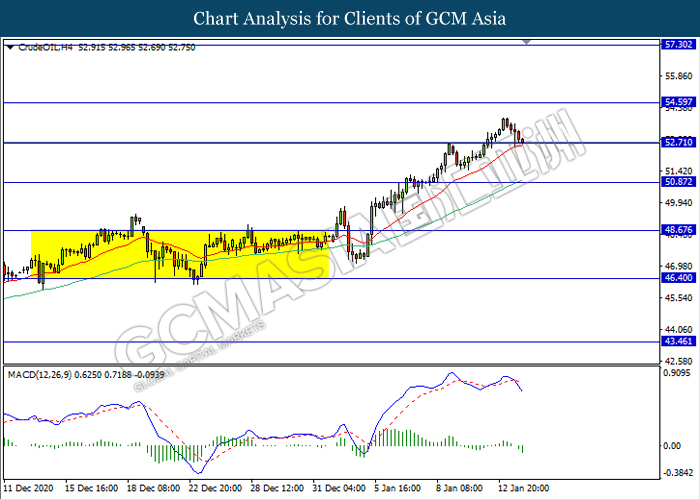

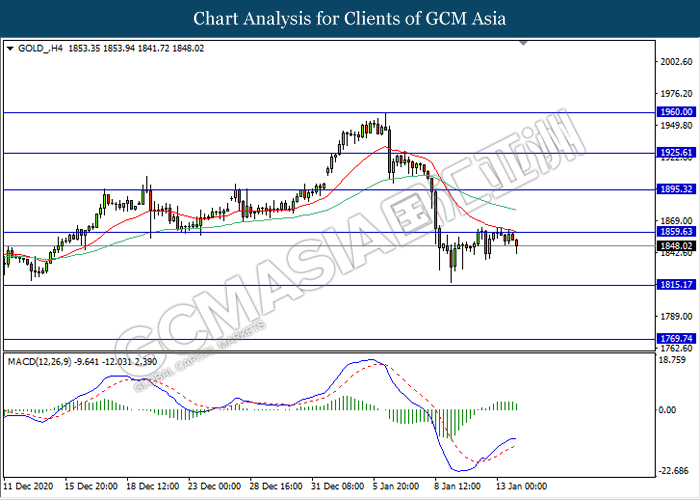

In the commodities market, crude oil price fell 0.15% to $52.76 per barrel as of writing following EIA lowered global oil demand growth forecast. Despite with EIA reported a draw in crude inventories, it was offset by EIA’s negative view on demand forecast. According to EIA in its latest estimate, global oil demand is expected to grow by 5.6 million barrels per day in 2021 compared to the 2020 low of 92.2 million bpd. the growth forecast now around 200,000 bpd lower compared to last month’s outlook. On the other hand, gold price fell 0.11% to $90.25 a troy ounce at the time of writing amid dollar strength.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20.30 EUR ECB Monetary Policy Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15.00 | EUR – German GDP (QoQ) | 8.5% | – | – |

| 21.30 | USD – Initial Jobless Claims | 787K | 780K | – |

Technical Analysis

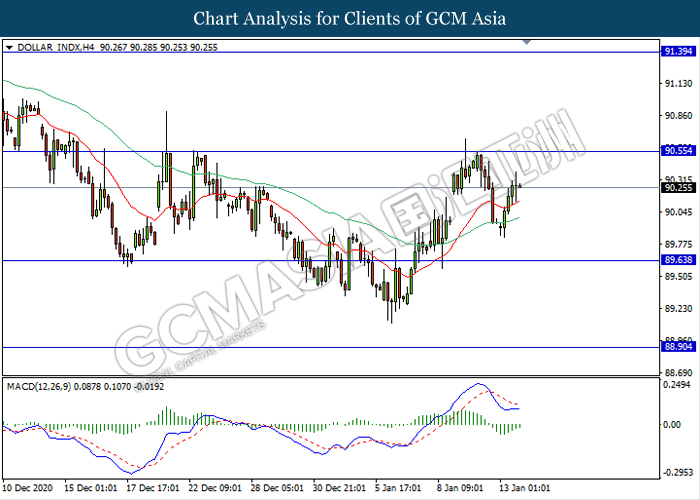

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from its low level. MACD which illustrate diminishing bearish momentum signal suggest the dollar to extend its rebound towards the resistance level 90.55.

Resistance level: 90.55, 91.40

Support level: 89.65, 88.90

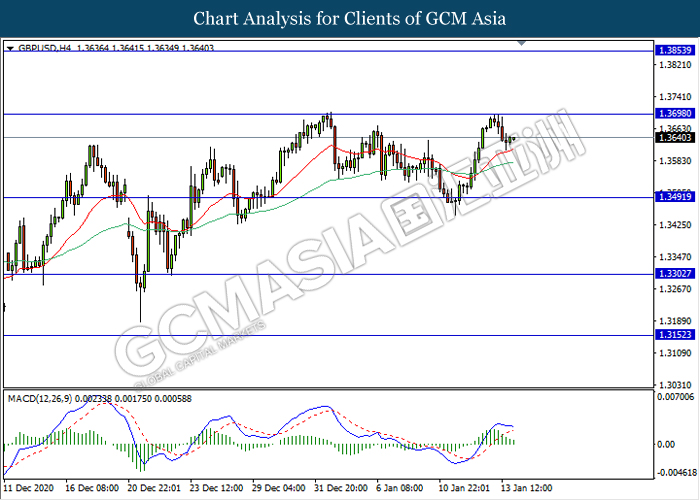

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level 1.3700. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its retracement towards the support level 1.3490.

Resistance level: 1.3700, 1.3855

Support level: 1.3490, 1.3300

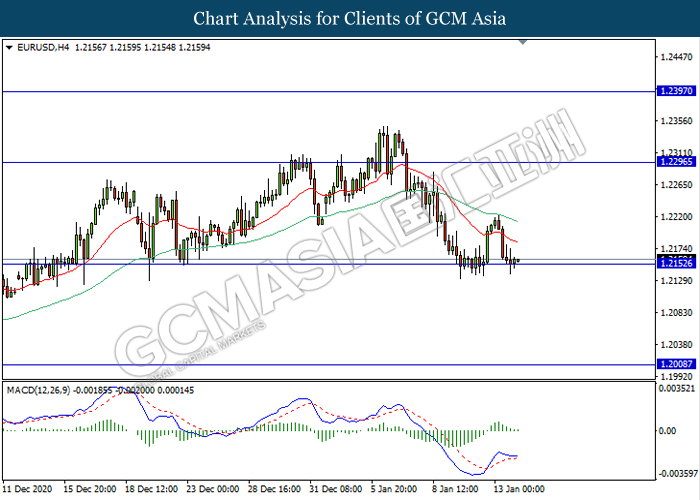

EURUSD, H4: EURUSD was traded lower while currently testing the support level 1.2150. MACD which illustrate bearish bias signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.2295, 1.2395

Support level: 1.2150, 1.2010

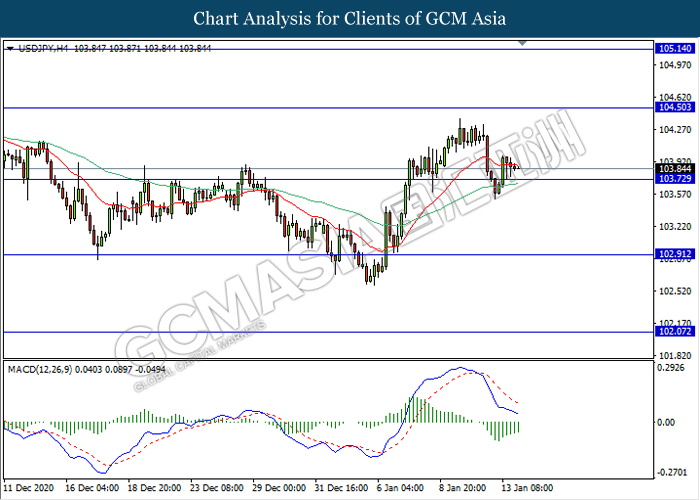

USDJPY, H4: USDJPY was traded higher following recent rebound from the support level 103.70. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound towards the resistance level 104.50.

Resistance level: 104.50, 105.15

Support level: 103.70, 102.90

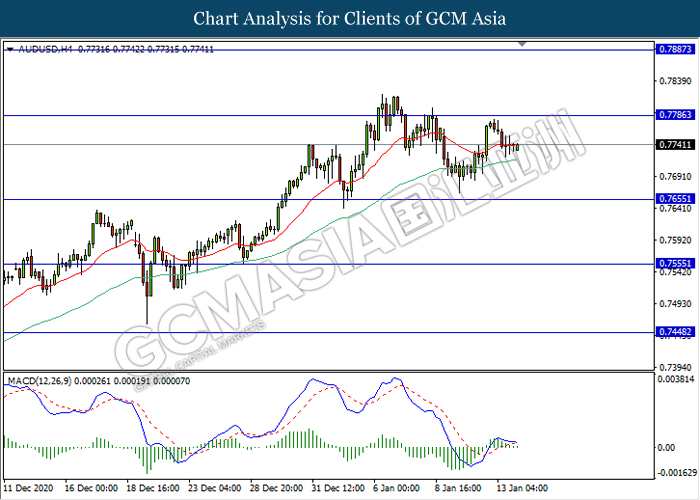

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level 0.7785. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its retracement towards the support level 0.7655.

Resistance level: 0.7785, 0.7885

Support level: 0.7655, 0.7555

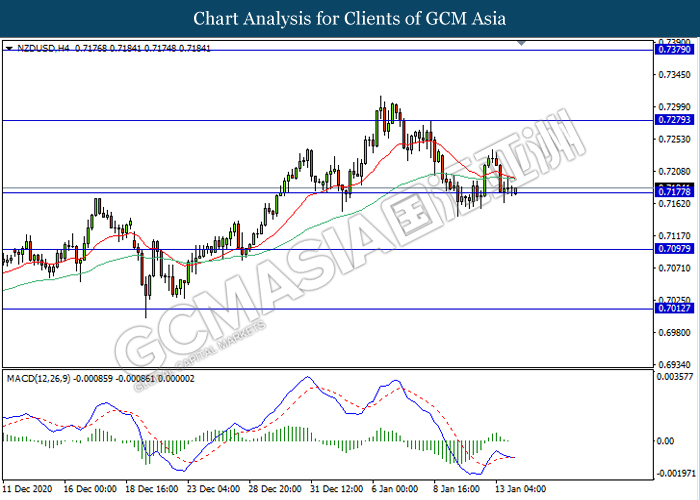

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level 0.7175. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.7280, 0.7380

Support level: 0.7175, 0.7095

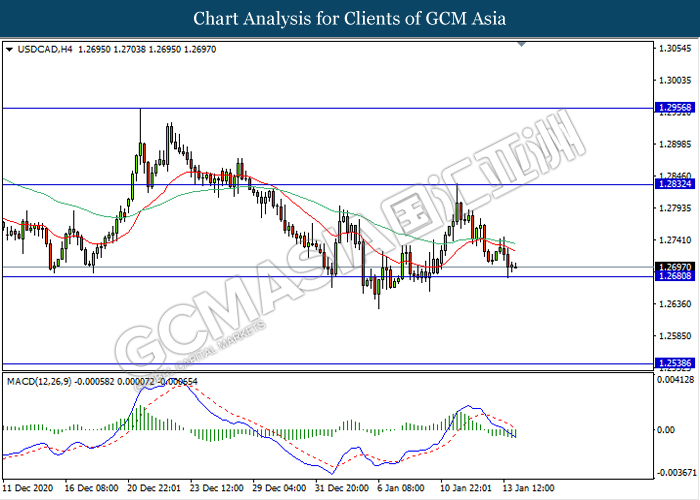

USDCAD, H4: USDCAD was traded lower while currently testing the support level 1.2680. MACD which illustrate ongoing bearish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.2830, 12955

Support level: 1.2680, 1.2540

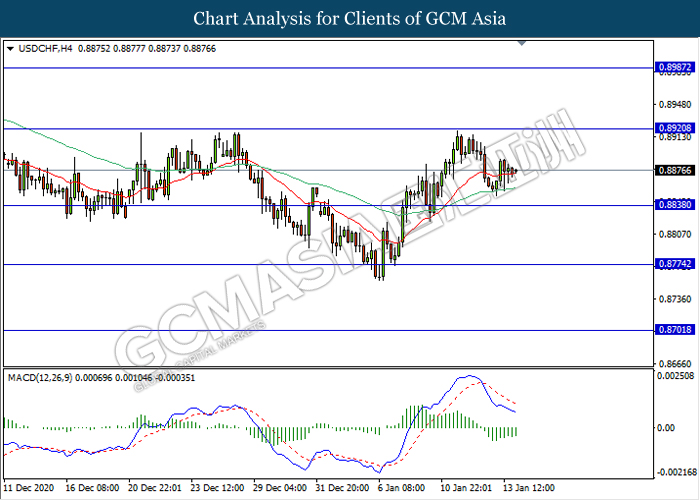

USDCHF, H4: USDCHF was traded higher following recent rebound from the support level 0.8840. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound towards the resistance level 0.8920.

Resistance level: 0.8920, 0.8985

Support level: 0.8840, 0.8775

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level 52.70. MACD which illustrate bearish momentum signal with the formation of death cross suggest the commodity to extend its losses after it breaks below the support level.

Resistance level: 54.60, 57.30

Support level: 52.70, 50.85

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level 1859.65. MACD which illustrate diminishing bullish momentum signal suggest the commodity to extend its losses towards the support level 1815.15.

Resistance level: 1859.65, 1895.30

Support level: 1815.15, 1769.75.