14 January 2022 Afternoon Session Analysis

Euro propels as inflation at 30-years high.

Euro hovers comfortably at two-months high following bullish expectation towards the European Central Bank. As of recent, inflation in the EU zone climbs further, coming in at 30 years high of 5.0%. Rising price of consumer goods has dialed down consumer sentiment, possibly jeopardizing their spending momentum in the long-run. Over the backdrop of rising inflation, European Central Bank (ECB) President Christine Lagarde emphasized the market to place their confidence upon the central bank to curb rising inflation. On yesterday, ECB Vice President Luis de Guindos commented that EU’s economy is getting accustomed to rising coronavirus cases as economic momentum remains intact. Guindos also stated that he expects inflation to extend its appreciation due to ongoing supply chain issues and strong demand among consumers. His remark sparked speculation that ECB may change their monetary policy strategy in order to address inflationary issues in the EU. Investors will look forward for the next ECB meeting scheduled later this month. As of writing, pair of EUR/USD rose 0.03% to 1.1469.

In the commodities market, crude oil price was traded flat around $81.80 per barrel while investors wait for further signals with regards to global oil supply and demand levels. On the other hand, gold price rose 0.23% to $1,825.83 a troy ounce due to weaker greenback.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (MoM) | 0.10% | – | – |

| 15:00 | GBP – Manufacturing Production (MoM) (Nov) | 0.00% | 0.20% | – |

| 21:30 | USD – Core Retail Sales (MoM) (Dec) | 0.30% | 0.20% | – |

| 21:30 | USD – Retail Sales (MoM) (Dec) | 0.30% | -0.10% | – |

| 21:30 | EUR – ECB President Lagarde Speaks | – | – | – |

Technical Analysis

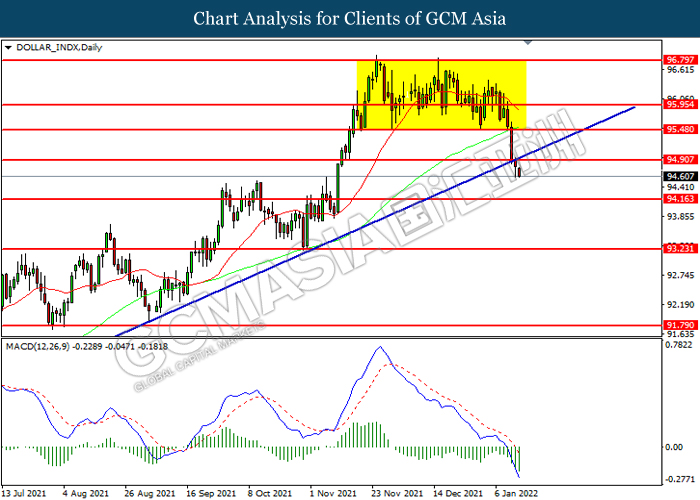

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 94.90. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward support level at 94.15.

Resistance level: 94.90, 95.50

Support level: 94.15, 93.25

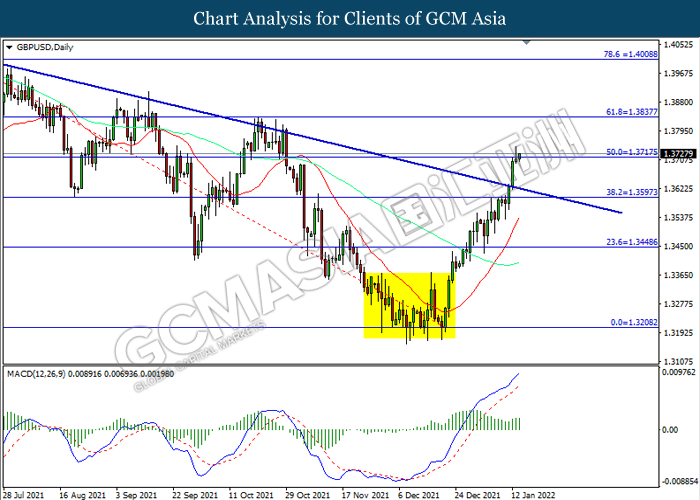

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.3715. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.3835.

Resistance level: 1.3835, 1.4010

Support level: 1.3715, 1.3595

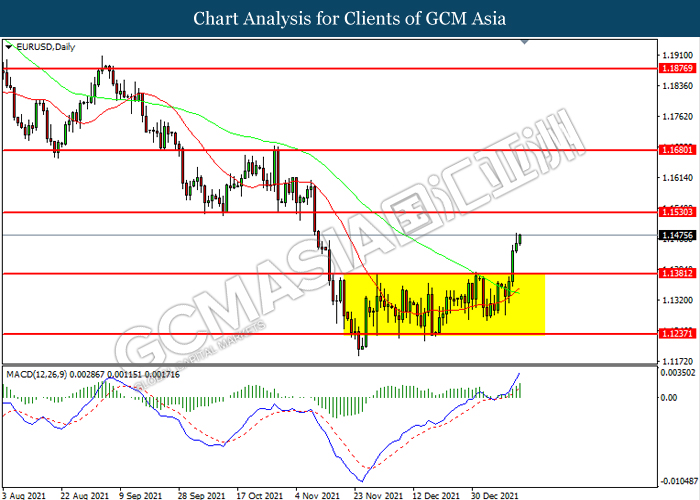

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.1380. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.1530.

Resistance level: 1.1530, 1.1680

Support level: 1.1380, 1.1235

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level at 114.55. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 112.85.

Resistance level: 114.55, 116.25

Support level: 112.85, 110.90

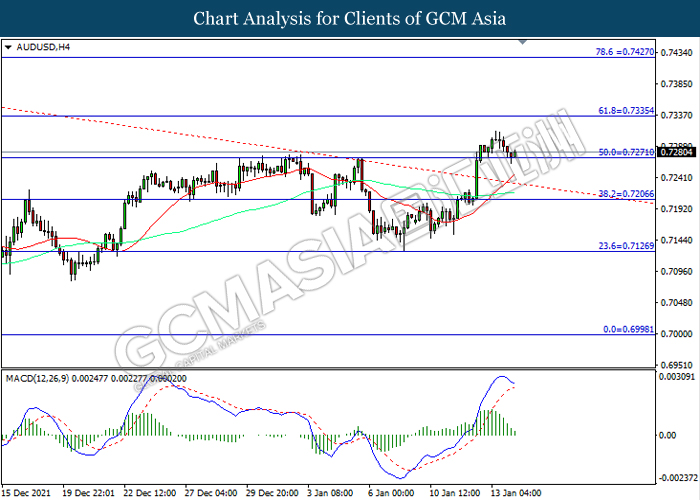

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7270. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.7335, 0.7425

Support level: 0.7270, 0.7205

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6865. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6865, 0.6960

Support level: 0.6710, 0.6570

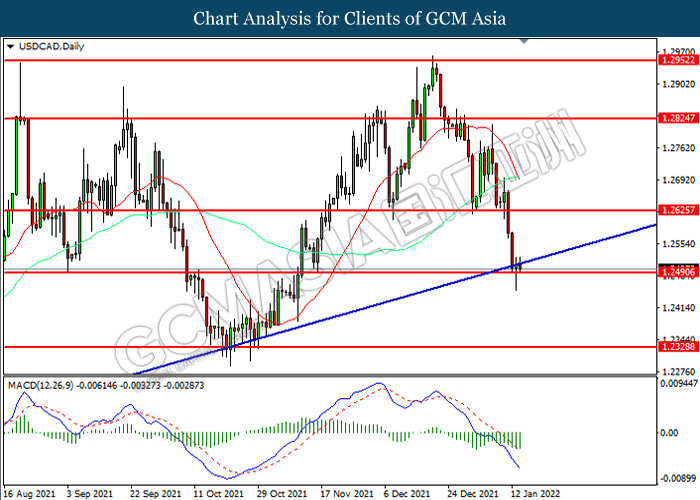

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2490. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2625, 1.2825

Support level: 1.2490, 1.2330

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9095. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9175, 0.9270

Support level: 0.9095, 0.9035

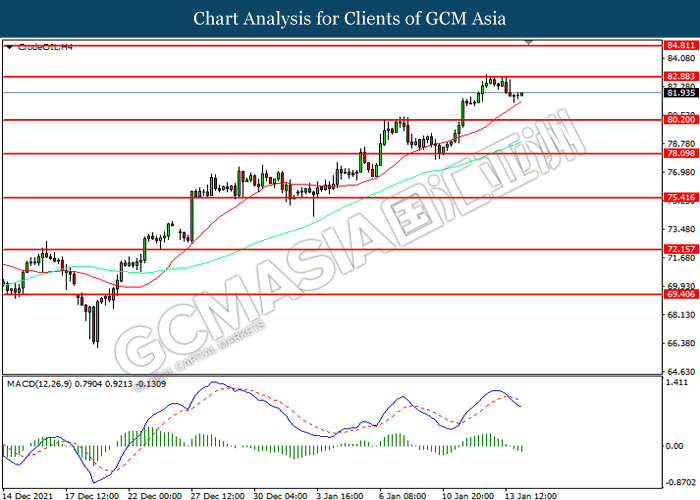

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 82.90. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 80.20.

Resistance level: 82.90, 84.80

Support level: 80.20, 78.10

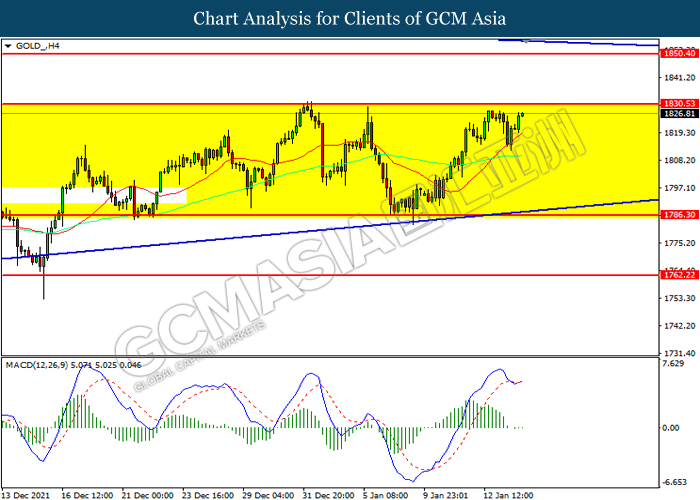

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1830.55. MACD which illustrated increasing bearish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1830.55, 1850.40

Support level: 1786.30, 1762.20