14 January 2022 Morning Session Analysis

Fed hawks saves the day.

Greenback successfully rebounds from its low levels after Fed officials gives a rather bullish take on interest rate hike. Last night, US dollar spiked down after 2 recent economic data shows some sign of easing in terms of economic momentum. Both Initial Jobless Claims and PPI came in lower than expected, sending market hopes for a faster monetary policy tightening lower. However, US dollar found some support after Fed official Charles Evans remarked that current US inflation is still “too high”. He commented that the current monetary policy setting is inadequate to stem its rise due to ongoing supply chain issue following the pandemic. Evans stated that while 3 interest rate hikes is suitable, Fed may need to increase it to 4 interest rate hikes if inflationary pressure persists. Following his comments, investors are currently hoping to garner more signals during Fed’s monetary policy meeting next week in order to gauge likelihood of a faster pace of monetary policy tightening. During Asian trading session, the dollar index was up 0.02% to 94.80.

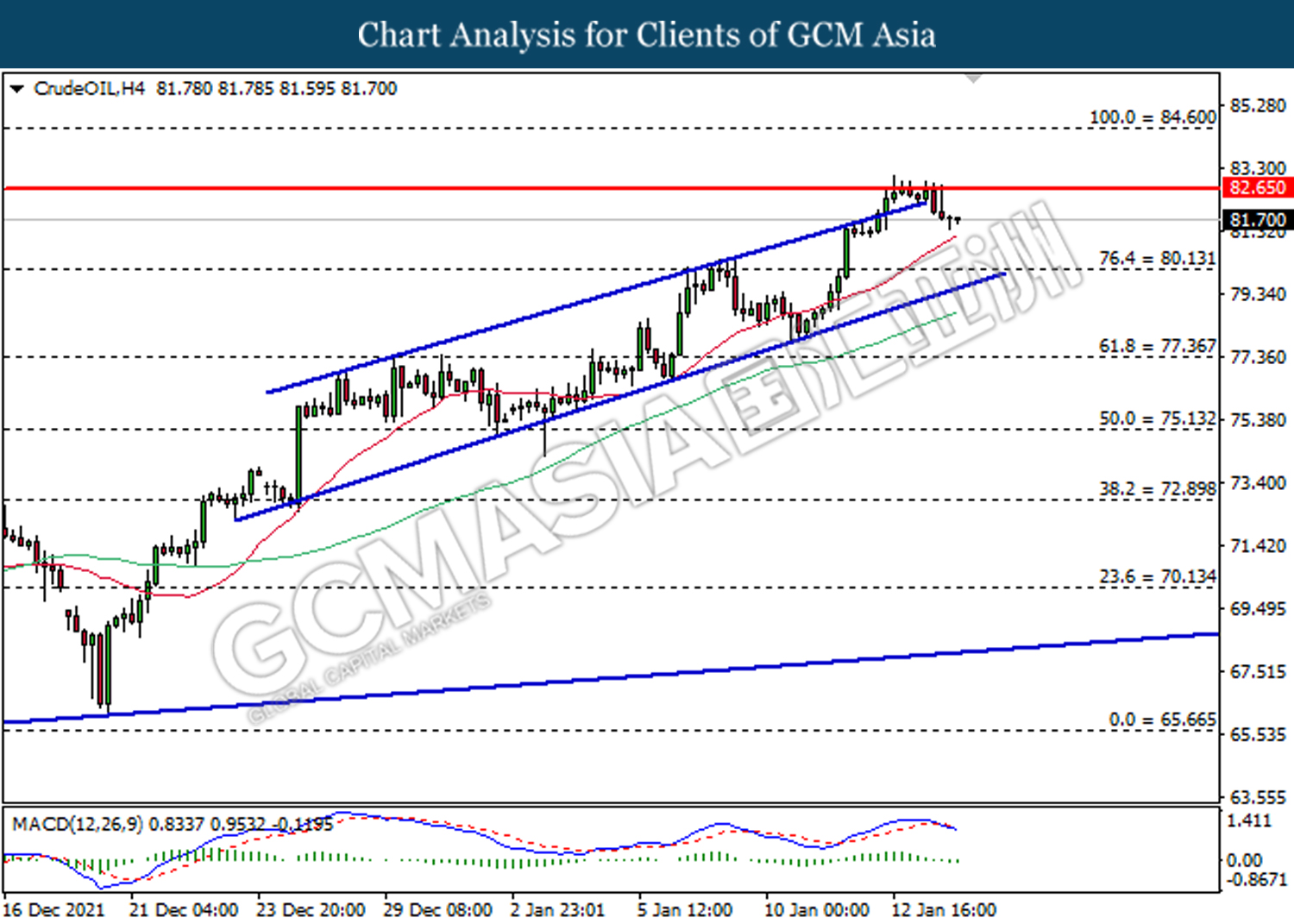

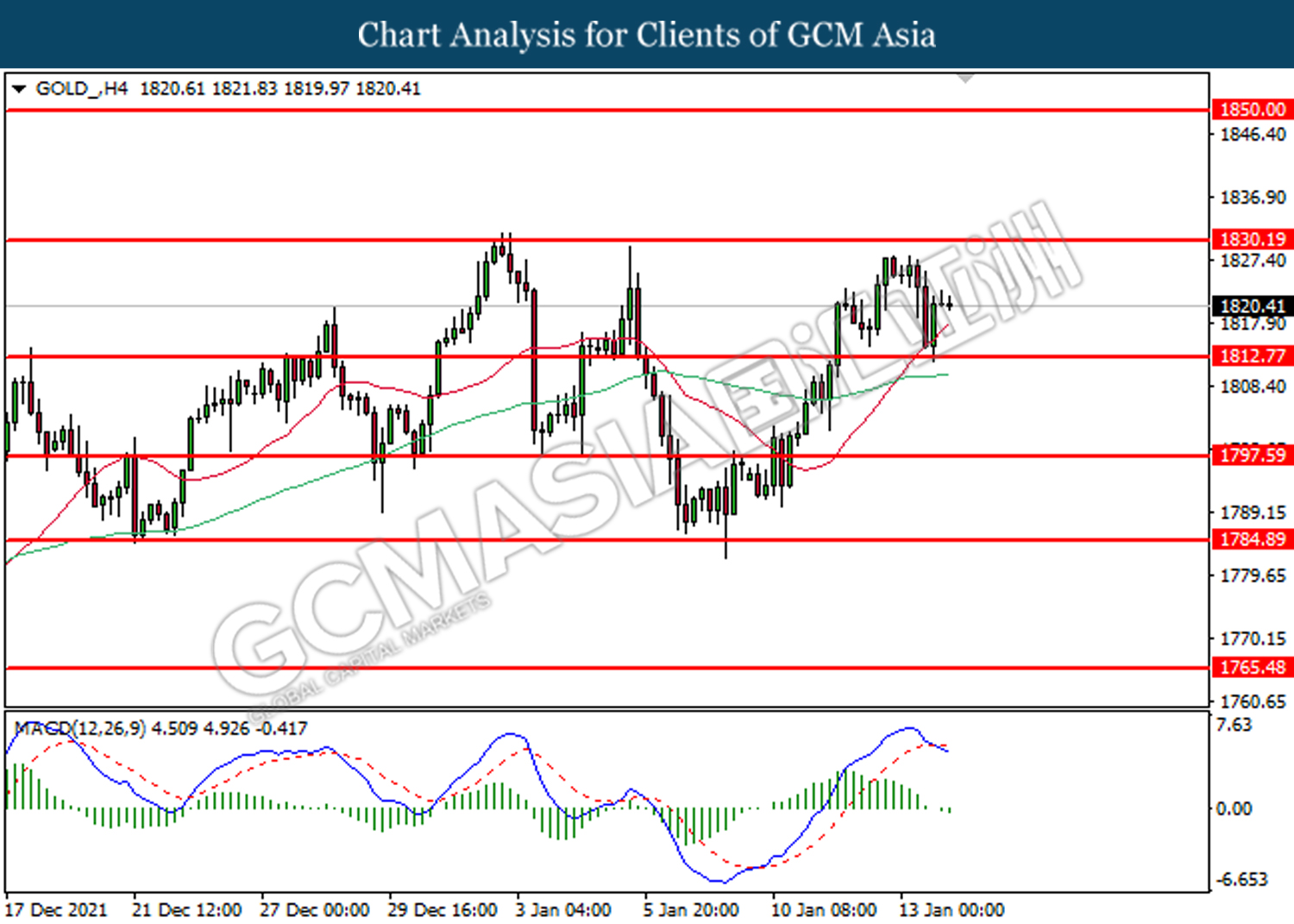

As for commodities, crude oil price slumped 0.35% to $81.71 due to profit taking. Likewise, gold price depreciated by 0.03% to $1,820.99 a troy ounce as US dollar rebounds from lower levels.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (MoM) | 0.10% | – | – |

| 15:00 | GBP – Manufacturing Production (MoM) (Nov) | 0.00% | 0.20% | – |

| 21:30 | USD – Core Retail Sales (MoM) (Dec) | 0.30% | 0.20% | – |

| 21:30 | USD – Retail Sales (MoM) (Dec) | 0.30% | -0.10% | – |

| 21:30 | EUR – ECB President Lagarde Speaks | – | – | – |

Technical Analysis

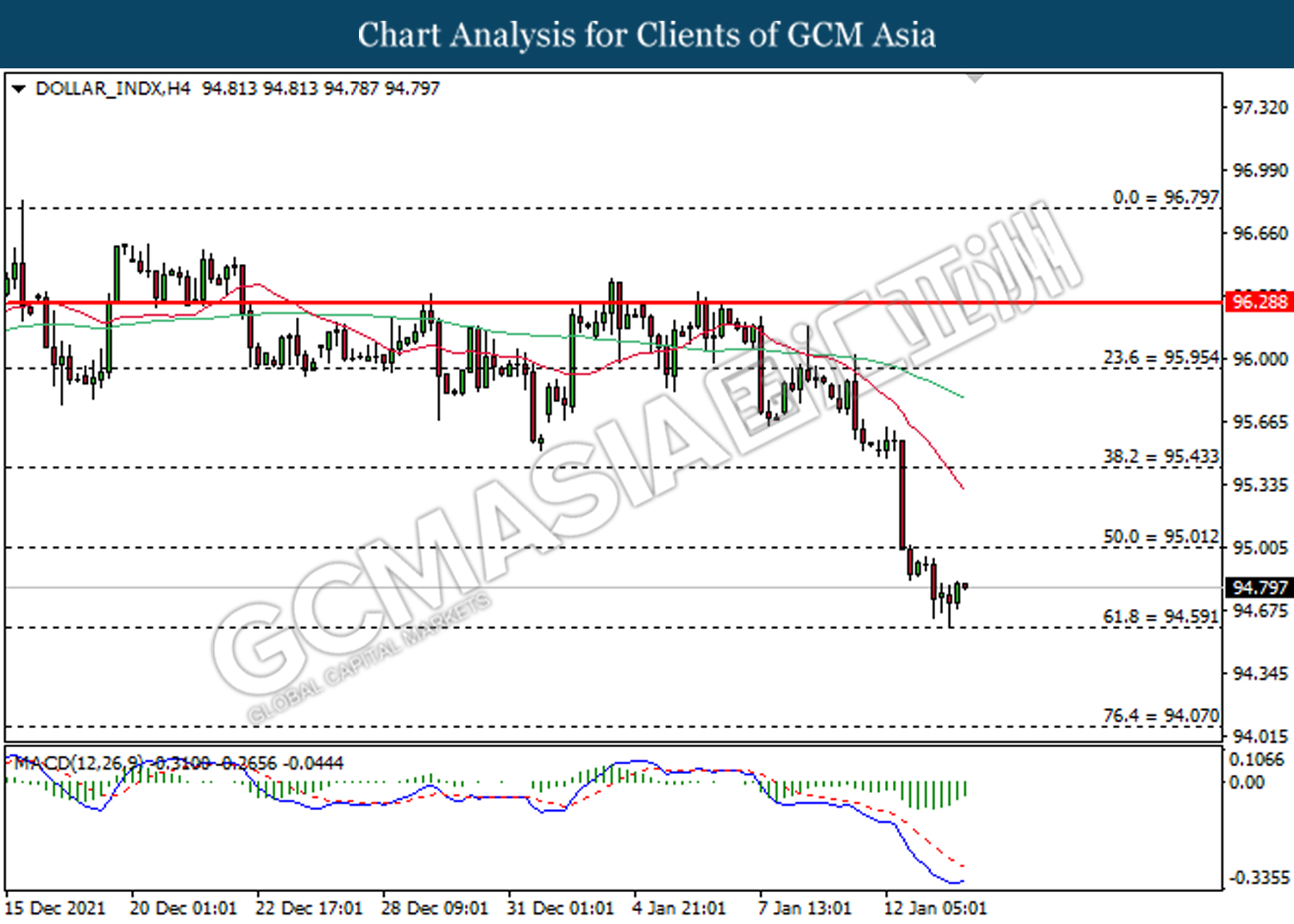

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the index to be traded higher in short-term.

Resistance level: 95.00, 95.45

Support level: 94.60, 94.10

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signals suggests the pair to be traded lower in short-term.

Resistance level: 1.3745, 1.3810

Support level: 1.3690, 1.3630

EURUSD, H4: EURUSD was traded lower following prior retrace from higher level. MACD which illustrate diminished bullish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.1465, 1.1495

Support level: 1.1440, 1.1380

USDJPY, Daily: USDJPY was traded lower following breakout from 114.55. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 114.55, 115.40

Support level: 113.50, 112.75

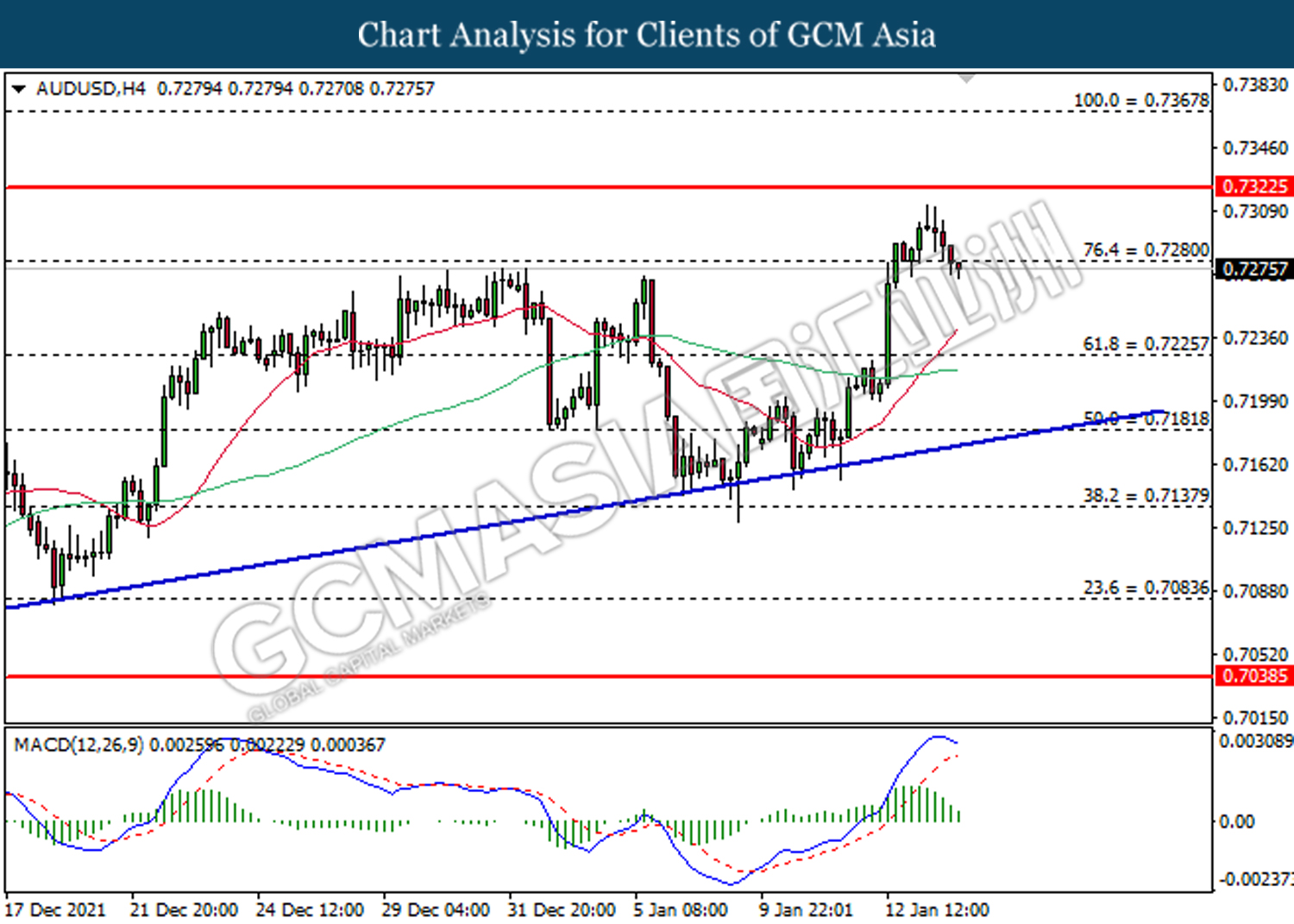

AUDUSD, H4: AUDUSD was traded lower following retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower short-term.

Resistance level: 0.7280, 0.7320

Support level: 0.7225, 0.7180

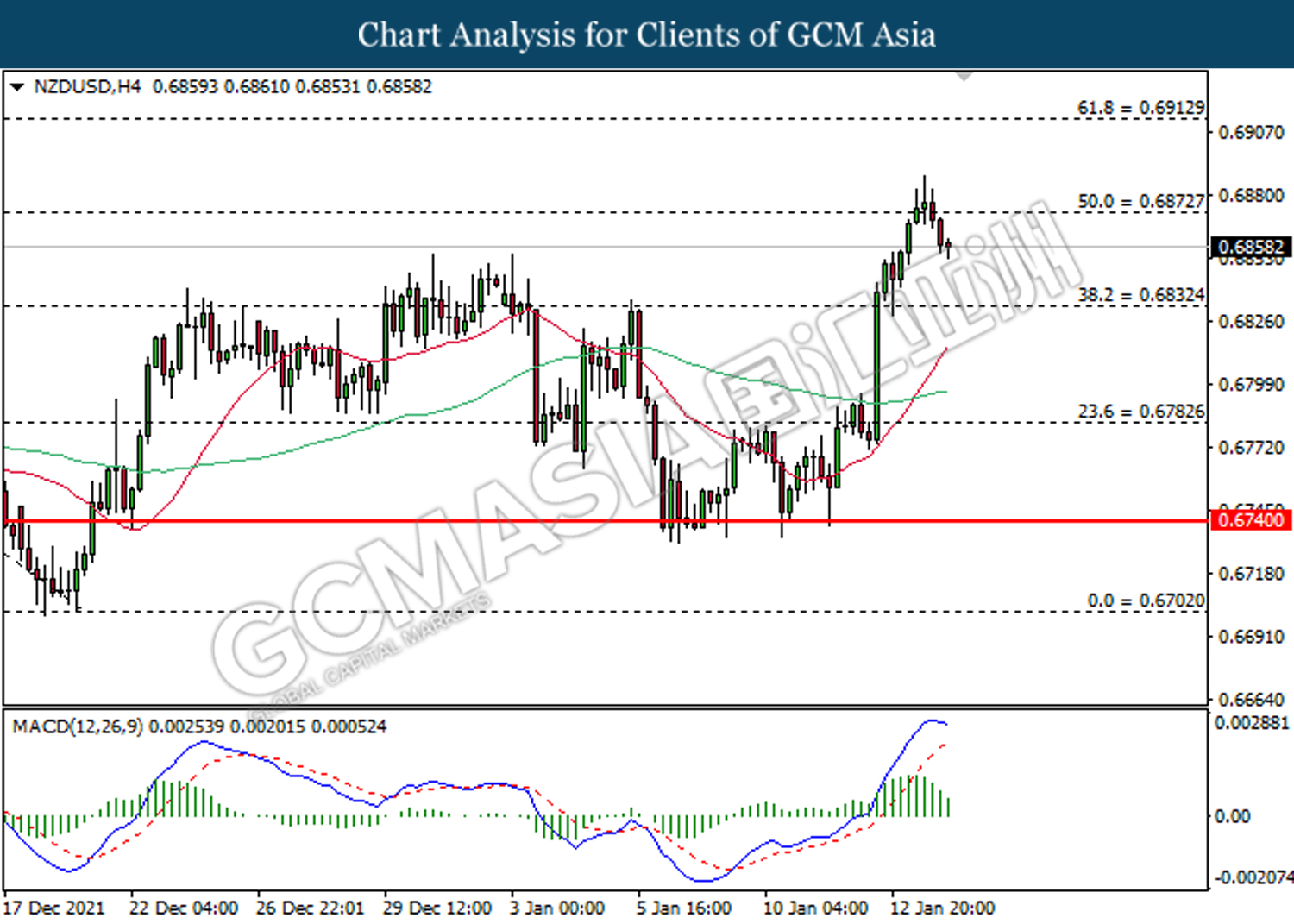

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate diminished upward momentum suggests the pair to be traded lower in short-term.

Resistance level: 0.6870, 0.6910

Support level: 0.6830, 0.6780

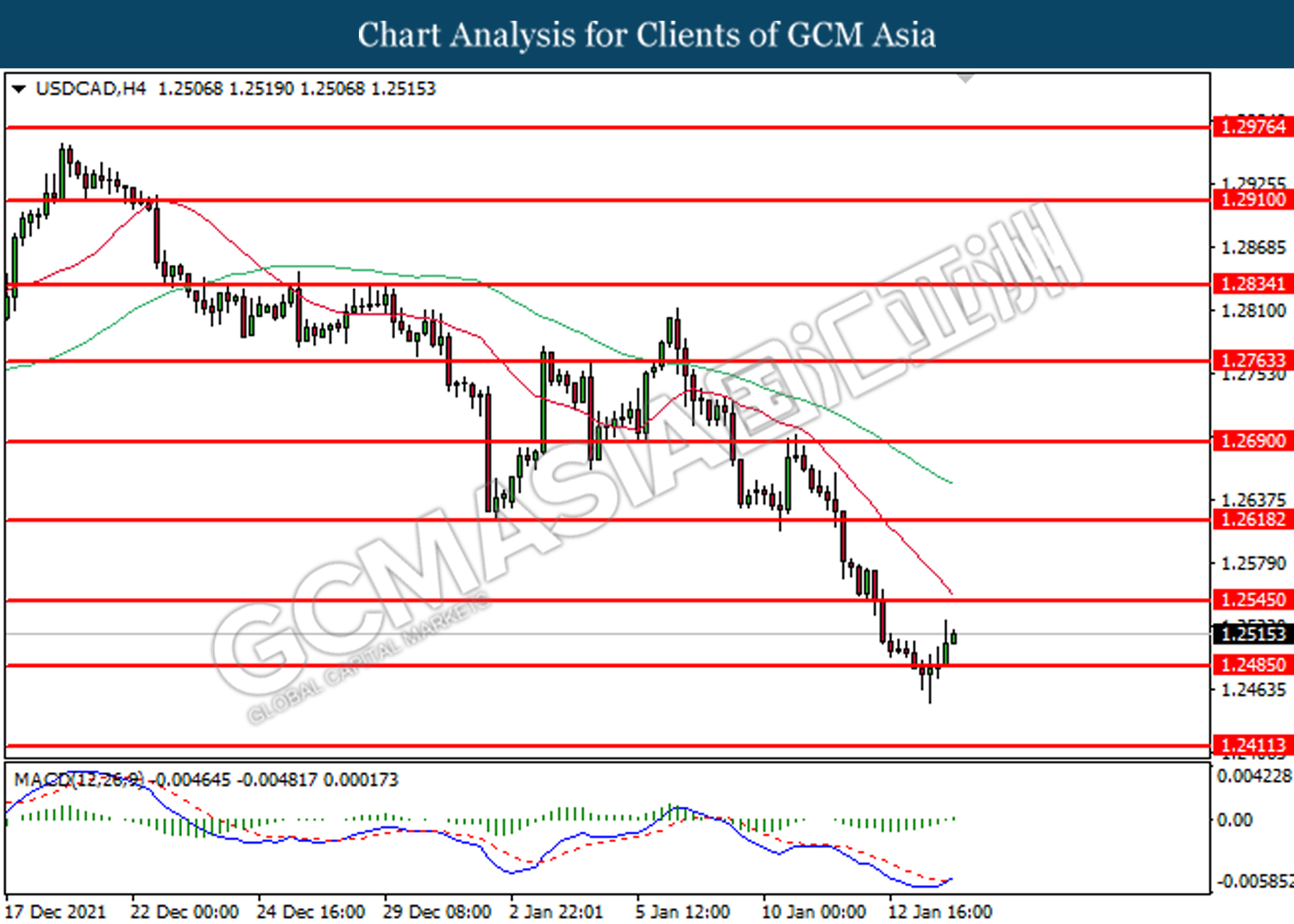

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.2545, 1.2620

Support level: 1.2485, 1.2410

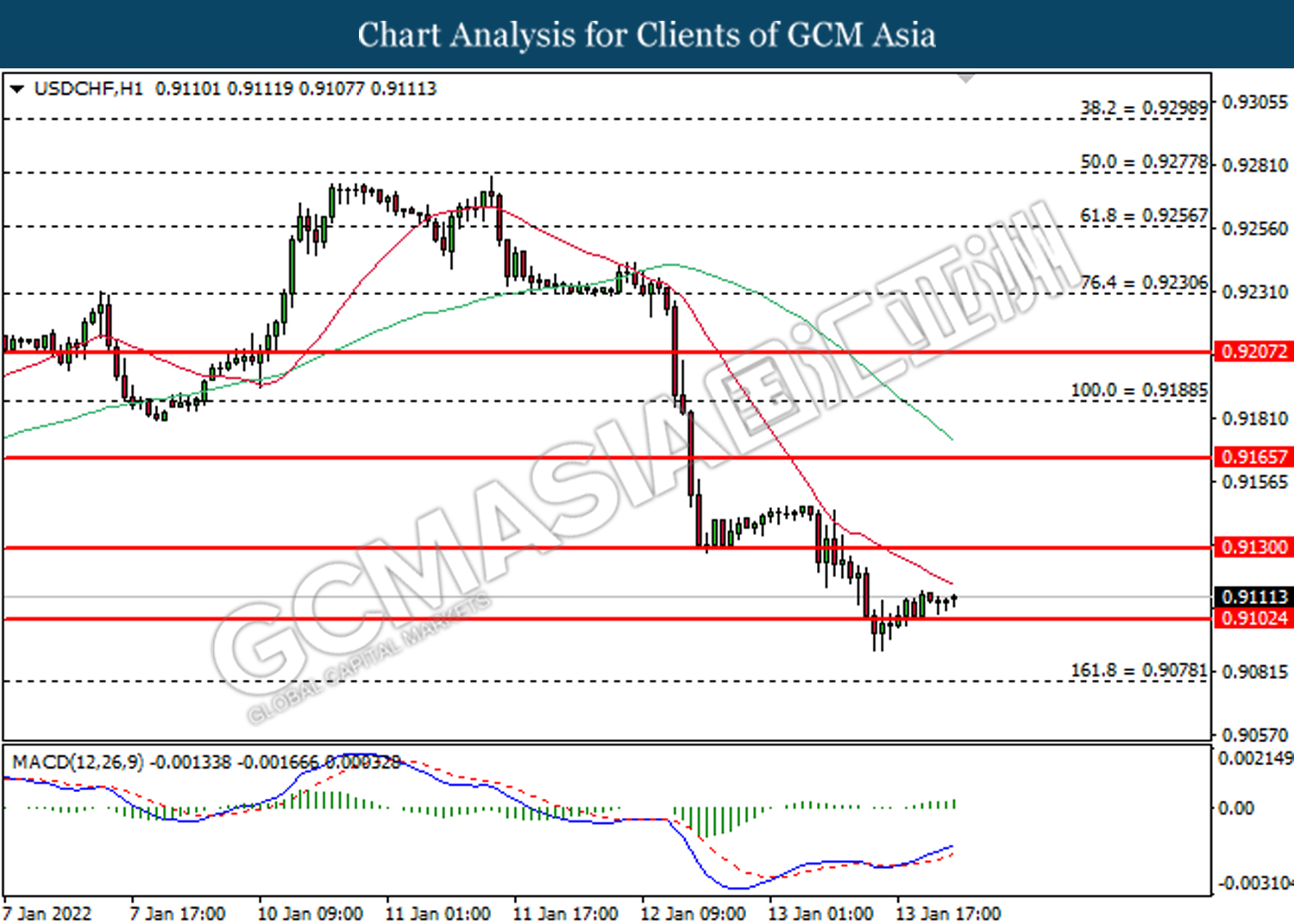

USDCHF, H1: USDCHF was traded higher following prior rebound from lower level. MACD which illustrate bullish divergence signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9130, 0.9165

Support level: 0.9100, 0.9080

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower in short-term.

Resistance level: 82.65, 84.60

Support level: 80.15, 77.35

GOLD_, H4: Gold price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower in short-term.

Resistance level: 1830.20, 1850.00

Support level: 1812.80, 1797.60